14 July 2023 Afternoon Session Analysis

Pound Sterling lifted despite fragile UK economic conditions.

The Pound Sterling which traded against the dollar index, lifted despite the UK economic output revealed by Official Nasional Statistics (ONS) showed a shrink in May. The monthly Gross Domestic Product (GDP) was reduced to -0.1% from 0.2%, while the economists expect the economic output in May will shrink to -0.3%. Separate economic data such as industrial production and manufacturing Purchasing Managers Index (PMI) was revealed by ONS on Thursday. The monthly reading of UK industrial production in May was reduced to -0.6% from -0.2%, higher than market expectation. According to the report, the decline was due to the fall in three of four main segments with electricity and gas being the largest contributor to the result. While the manufacturing production recorded -0.2% from -0.1%, lower than expectations of -0.5%. Since economists widely forecast the UK will enter into recession due to high inflation and high-interest rate, the better-than-expected GDP data for June would put the UK economy on track to avoid contraction. The pair of GBPUSD edged up as investors expressed optimism about the UK economy. Meanwhile, investors eye next week’s Consumer Price Index (CPI) for Jun to determine whether the Bank of England (BoE) will raise the rate by another half percentage of a quarter-point hike. As of writing the GBPUSD traded up by 0.06% to 1.3140.

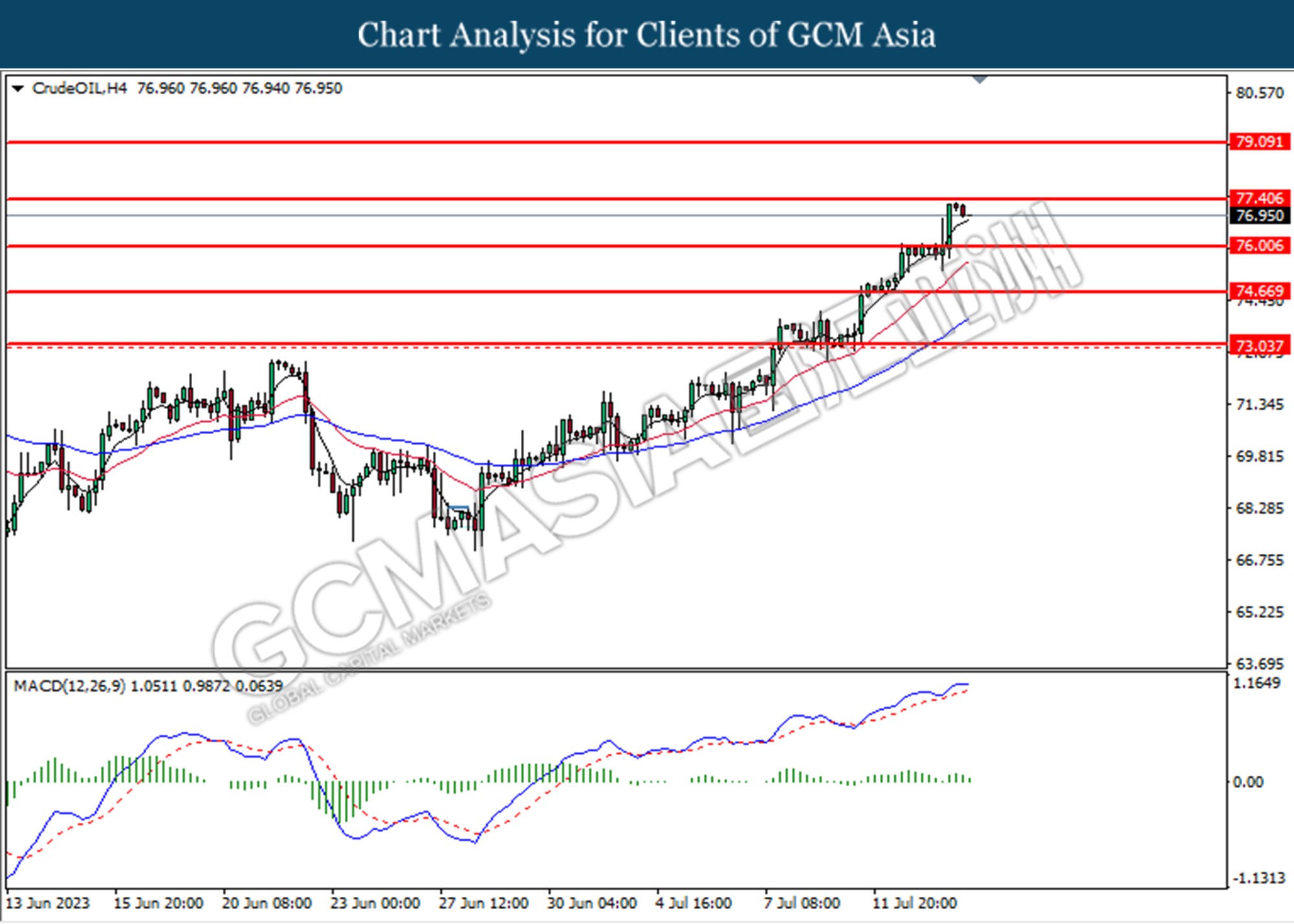

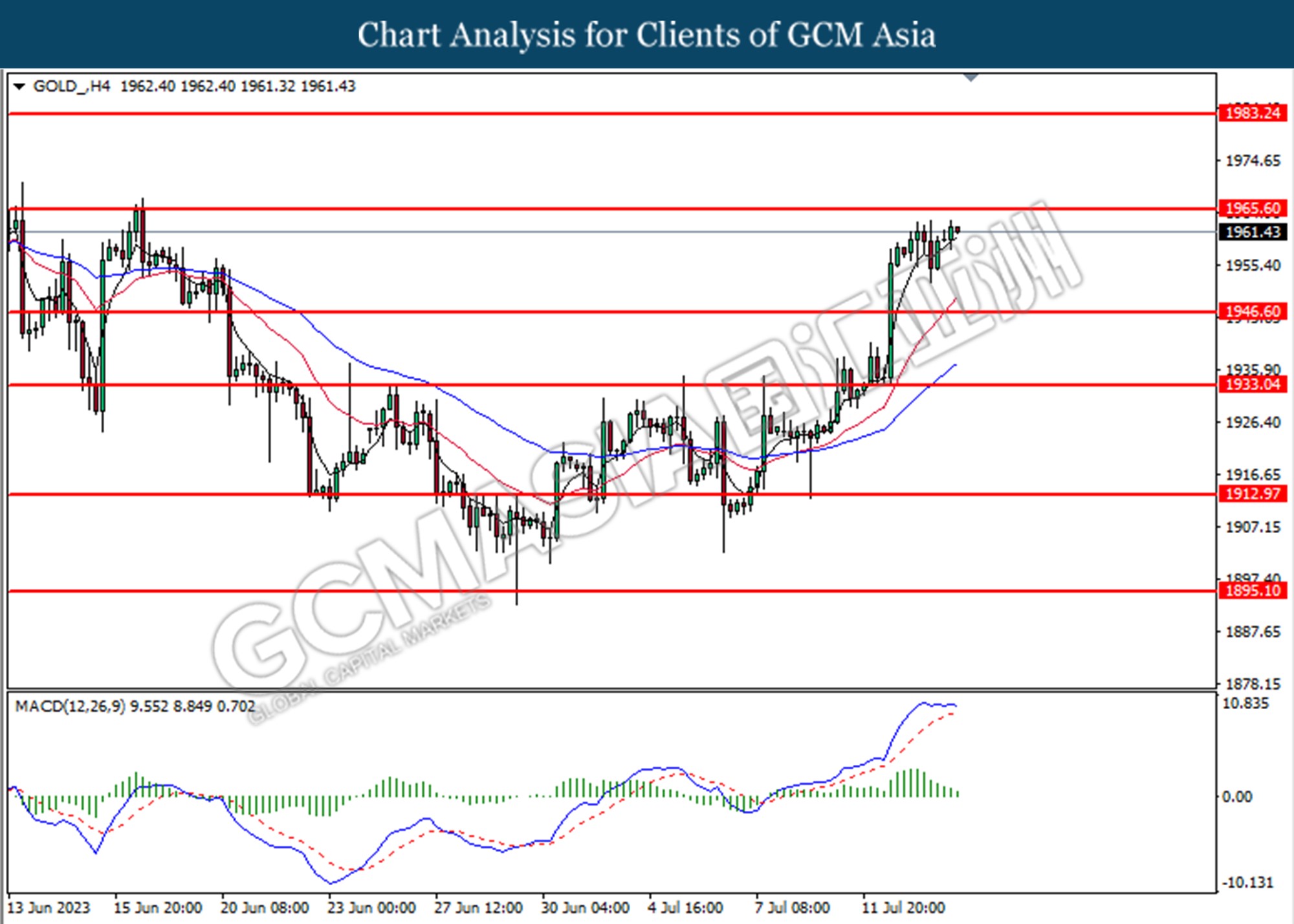

In the commodities market, crude oil prices slipped by -0.29% to $76.91 per barrel as traders profited from taking on the previous trading session. On the other hand, the price of gold rose by 0.12% to 1962.78 after the dollar weakened due to lower inflation data announced yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (Jul) | 65.5 | 64.4 | – |

Technical Analysis

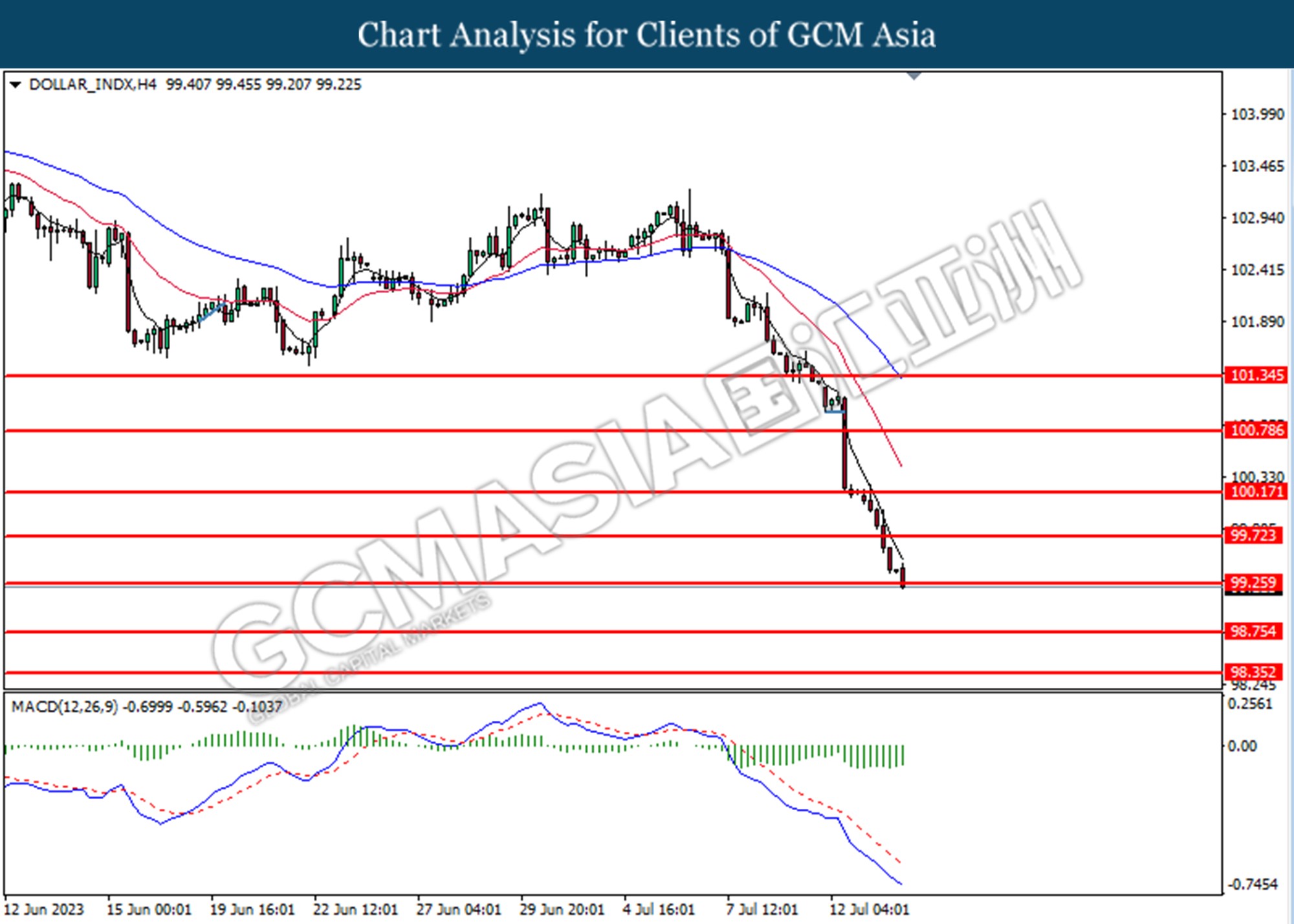

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks below for the previous support level at 99.25. However, MACD which illustrated diminishing bearish momentum suggests the index undergoes a technical correction in a short term.

Resistance level: 99.25, 99.70

Support level: 98.75, 98.35

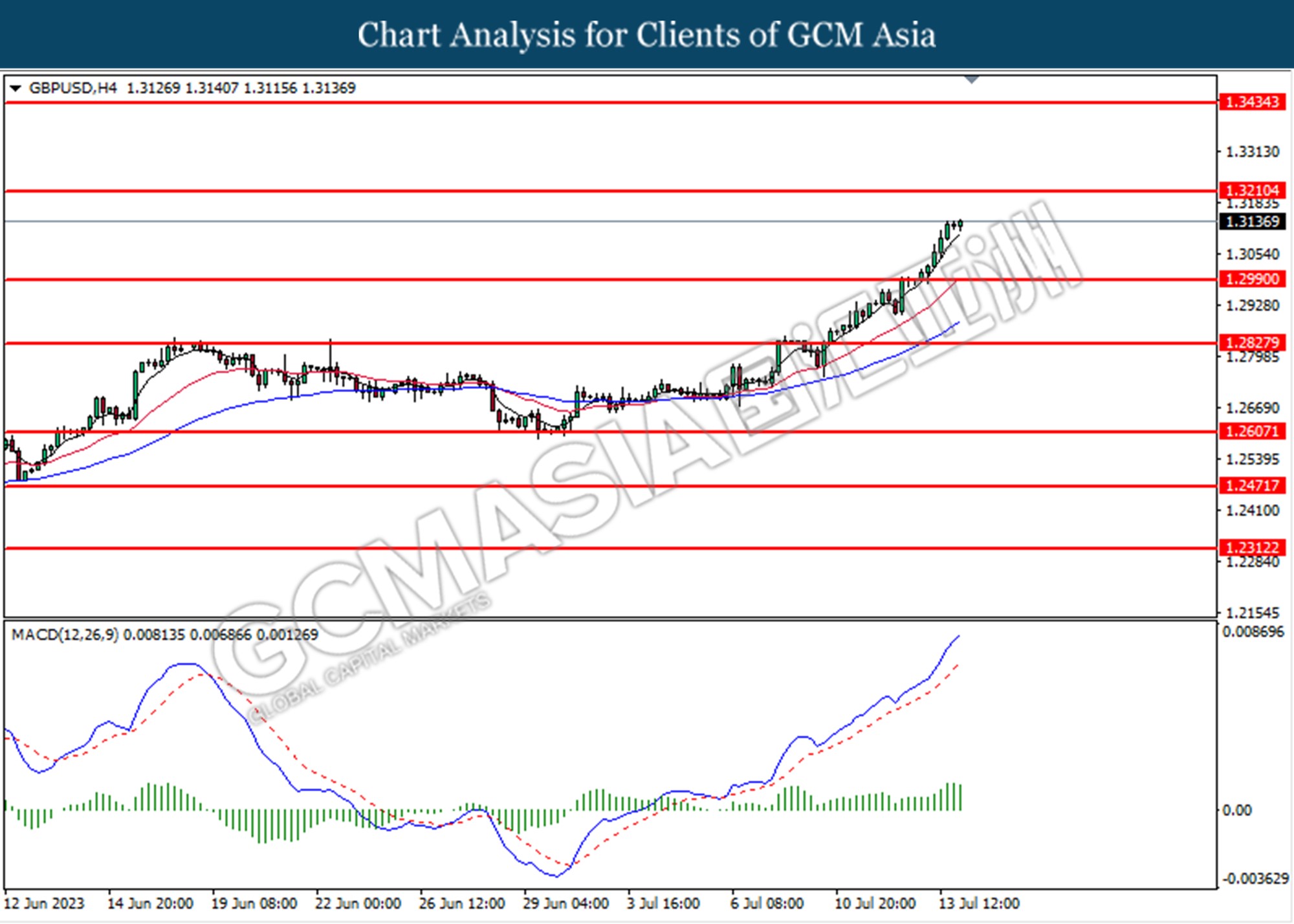

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2990. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3210, 1.3435

Support level: 1.2990, 1.2830

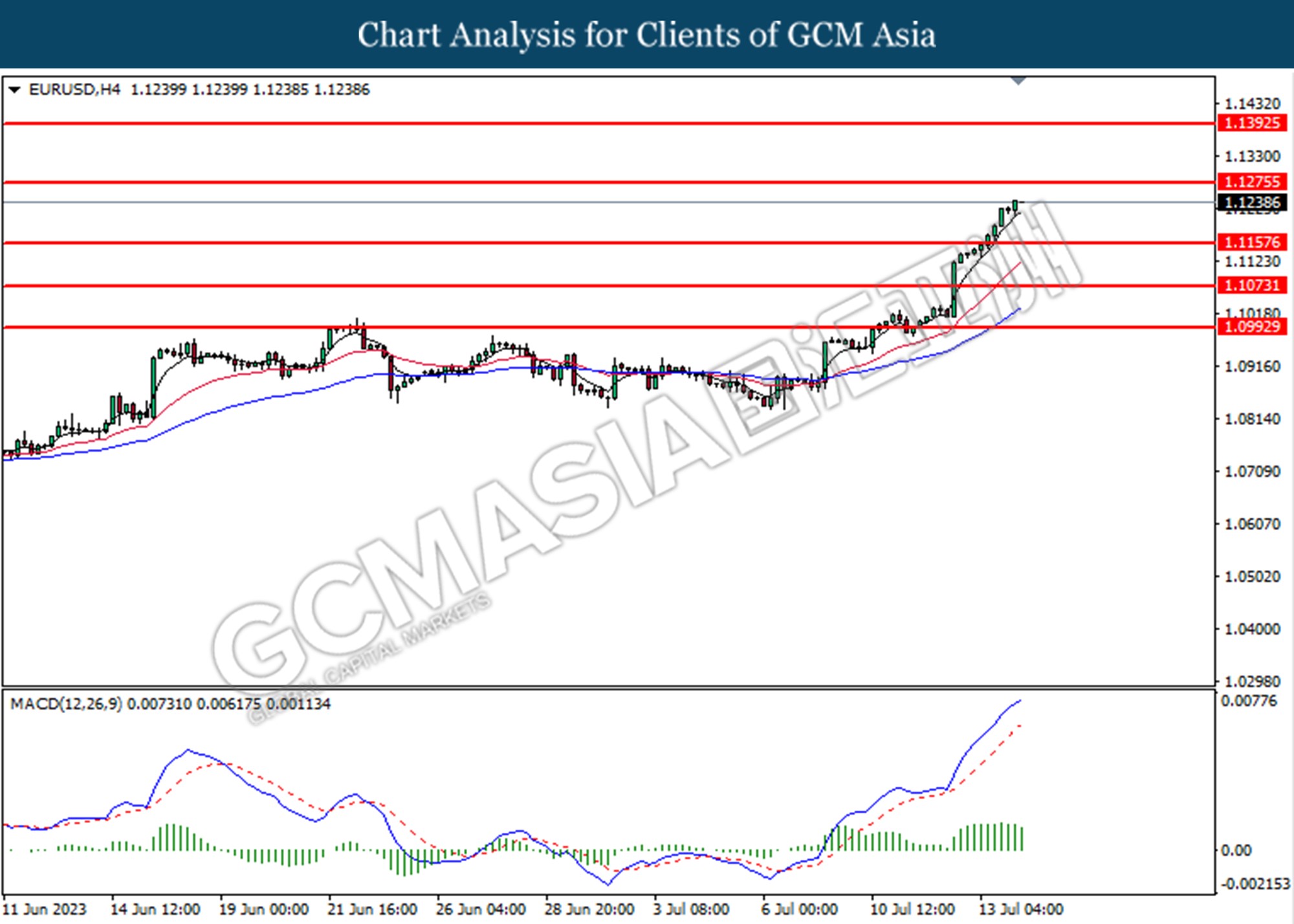

EURUSD, H4: EURUSD was traded higher following the prior breaks above the previous resistance level at 1.1075. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.1275, 1.1390

Support level: 1.1160, 1.1075

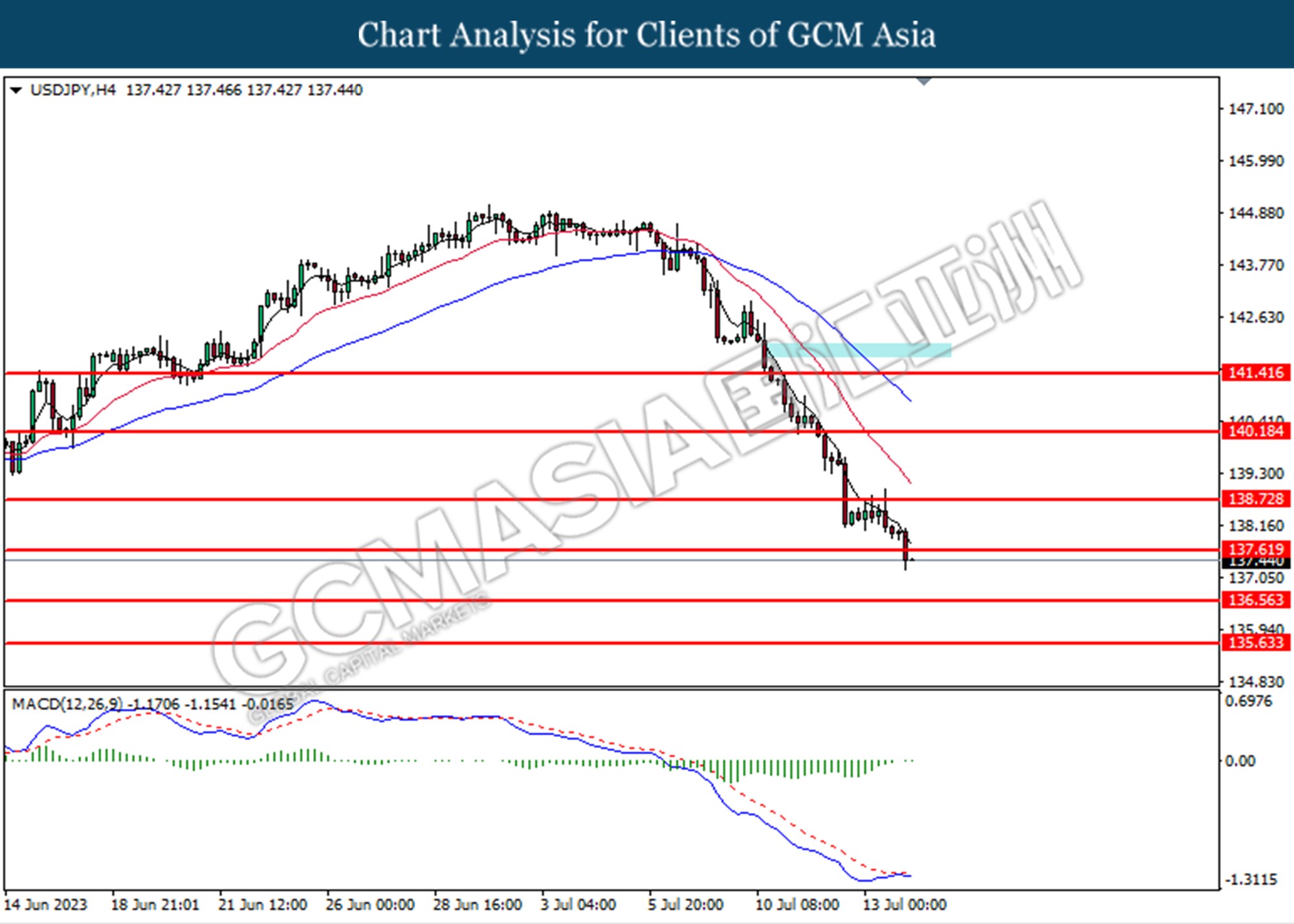

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 137.60. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 137.60, 138.70

Support level: 136.55, 136.65

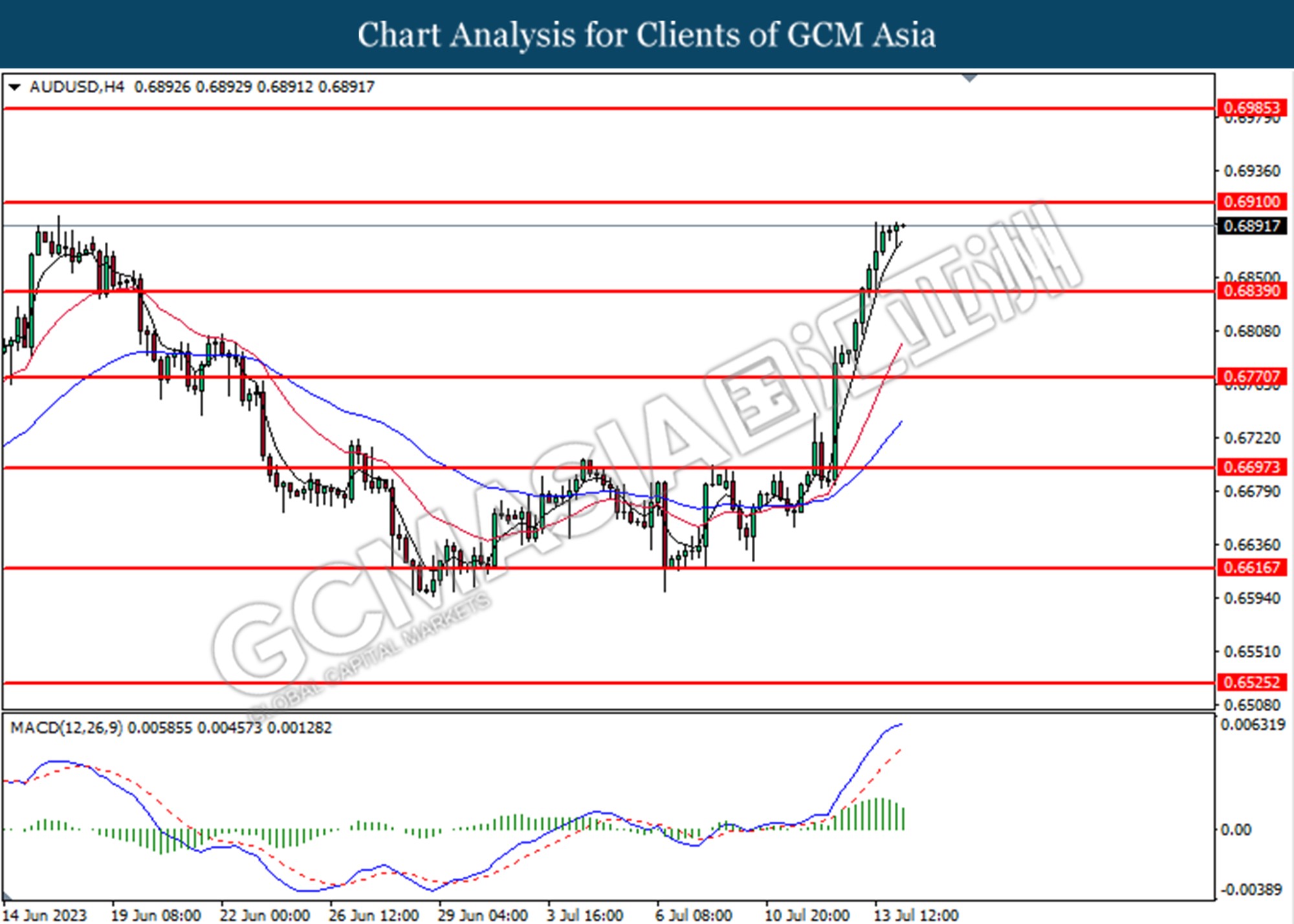

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above the prior resistance level at 0.6840. However. MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

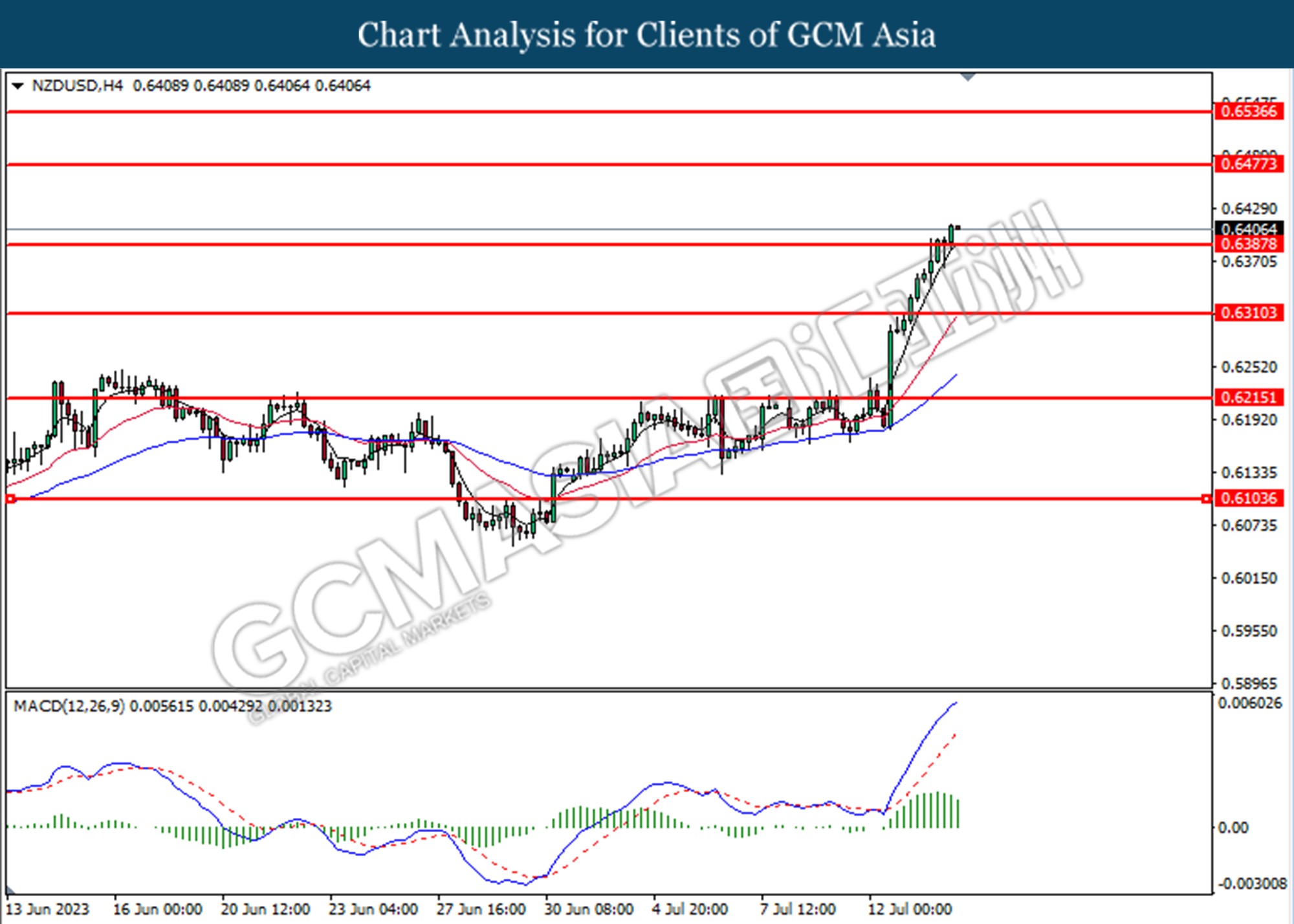

NZDUSD, H4: NZDUSD was traded higher following the prior breaks above the previous resistance level at 0.6390. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6480, 0.6535

Support level: 0.6390, 0.6310

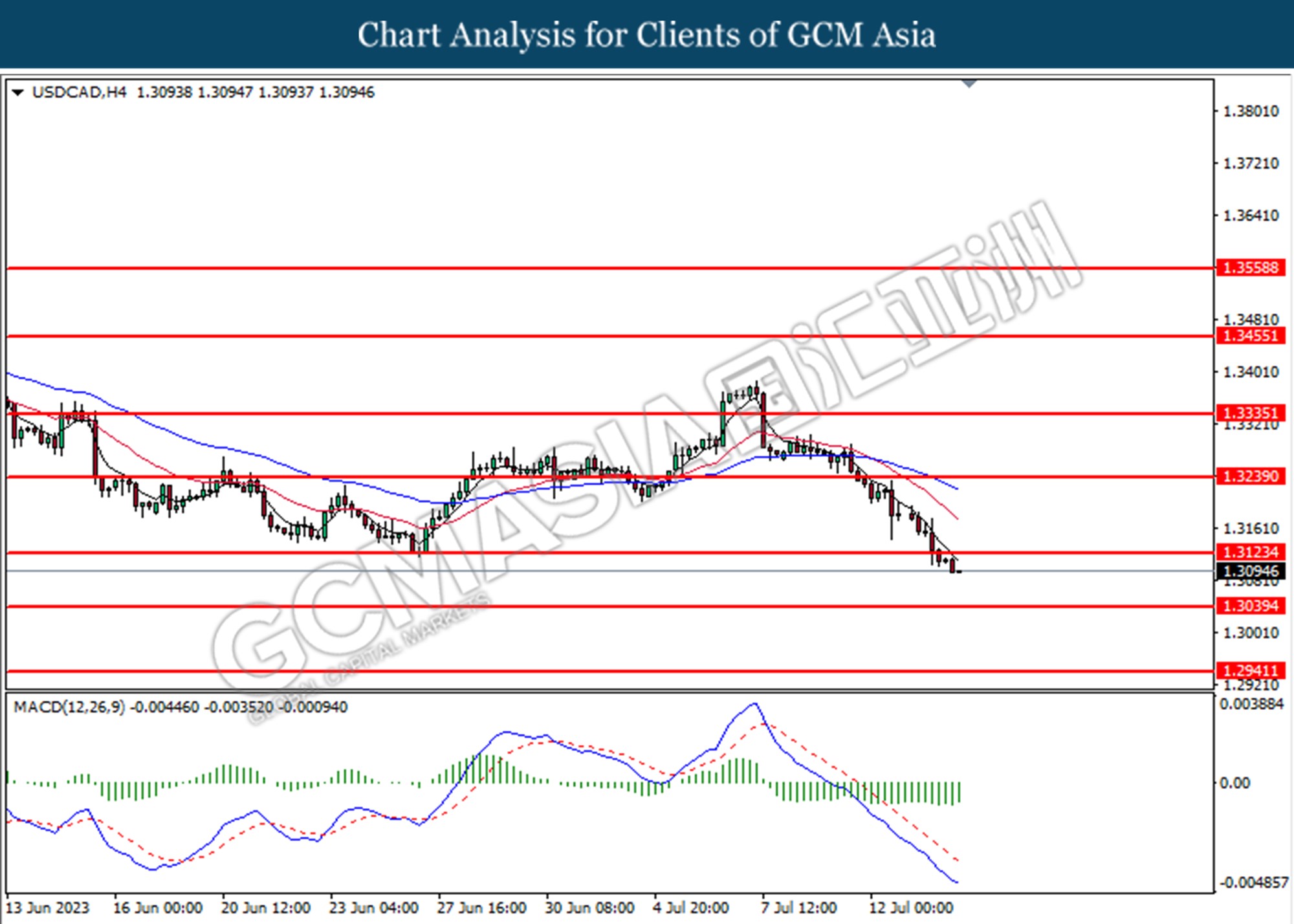

USDCAD, H4: USDCAD was traded lower following the prior breaks below the previous support level at 1.3125. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3140, 1.3240

Support level: 1.3040, 1.2940

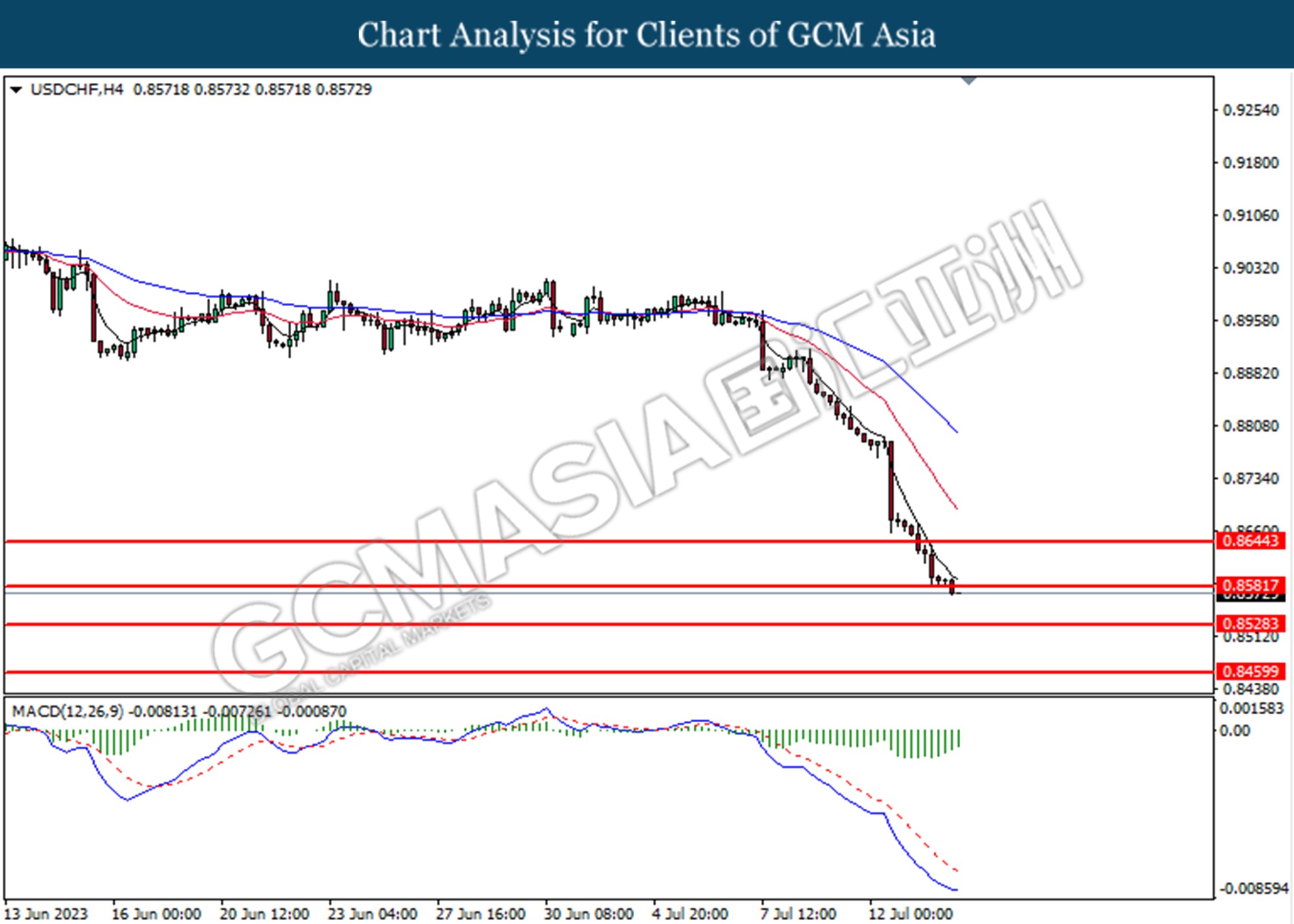

USDCHF, H4: USDCHF was traded lower following the prior breaks below from the previous support level at 0.8580. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.8580, 0.8645

Support level: 0.8530, 0.8460

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 77.40. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward support level.

Resistance level: 77.40, 79.10

Support level: 76.00, 74.65

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 1965.60, 1983.25

Support level: 1946.60, 1933.05