14 July 2023 Morning Session Analysis

The dollar fell as PPI showed further signs of slowing inflation.

The dollar index, which was traded against a basket of six major currencies, continued to weaken as the US inflationary pressures showed further sign of easing. In June, U.S. producer prices index saw minimal growth, indicating a further decline in inflationary pressures and providing additional evidence of the economy’s transition into a disinflation phase. According to the Labor Department’s report on Thursday, the producer price index for final demand increased by a mere 0.1% during the previous month. Over the 12 months leading up to June, the PPI experienced a meager 0.1% gain. This marks the smallest year-on-year increase since August 2020 and follows a 0.9% rise in May. These findings align with recent data from Wednesday, which revealed a slight increase in consumer prices for June. The overall trend suggests that inflation is subsiding as supply chain bottlenecks gradually dissipate and demand for goods slows down in response to higher interest rates. However, the losses of the dollar index were limited by the upbeat initial jobless claims. According to the Department of Labor, the number of American who filed for unemployment claims only rose by 237K, lower than the market expectation at 250K, showing that the US labor market remained tight. As of writing, the dollar index dropped -0.76% to 99.75.

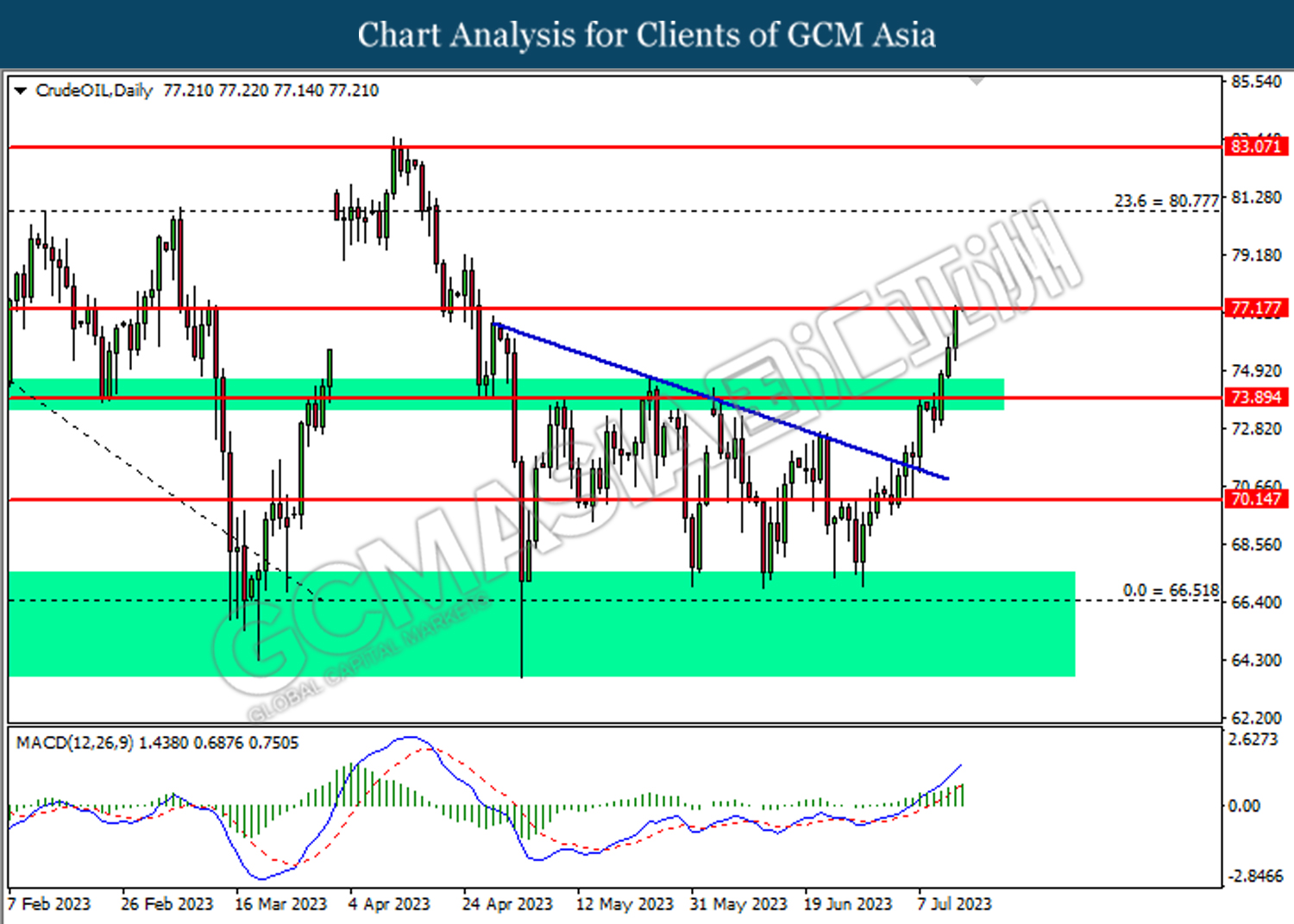

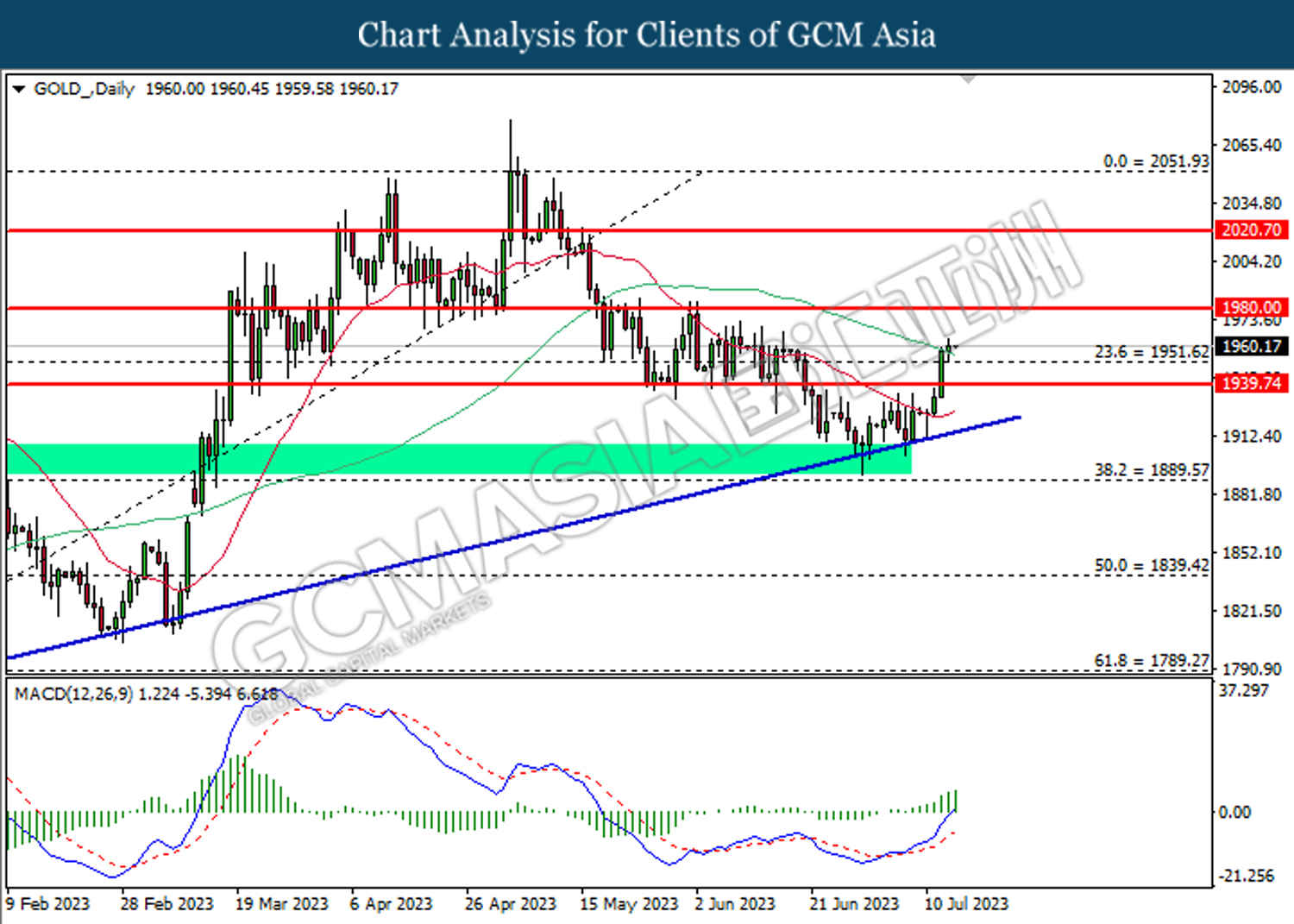

In the commodities market, crude oil prices edged up by 1.73% to $77.15 per barrel, buoyed by a significant decline in the value of the U.S. dollar against major currencies. Besides, gold prices ticked up 0.03% to $1960.00 per troy ounce as the US PPI data showed further signs of easing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (Jul) | 65.5 | 64.4 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 99.40. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level at 99.40.

Resistance level: 100.65, 103.00

Support level: 99.40, 97.75

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.3090. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.3090.

Resistance level: 1.3090, 1.3260

Support level: 1.2970, 1.2875

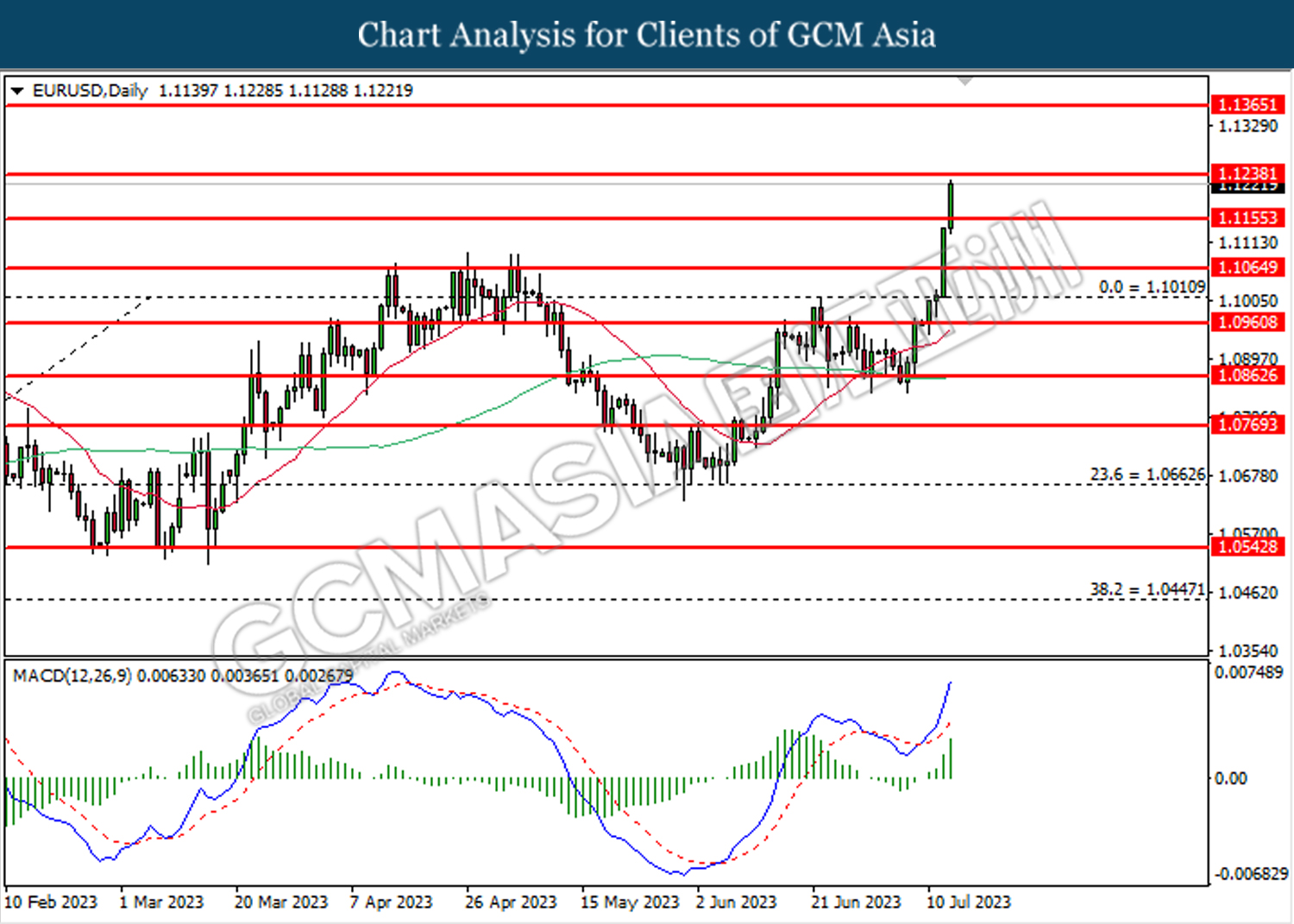

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.1155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1240.

Resistance level: 1.1240, 1.1365

Support level: 1.1155, 1.1065

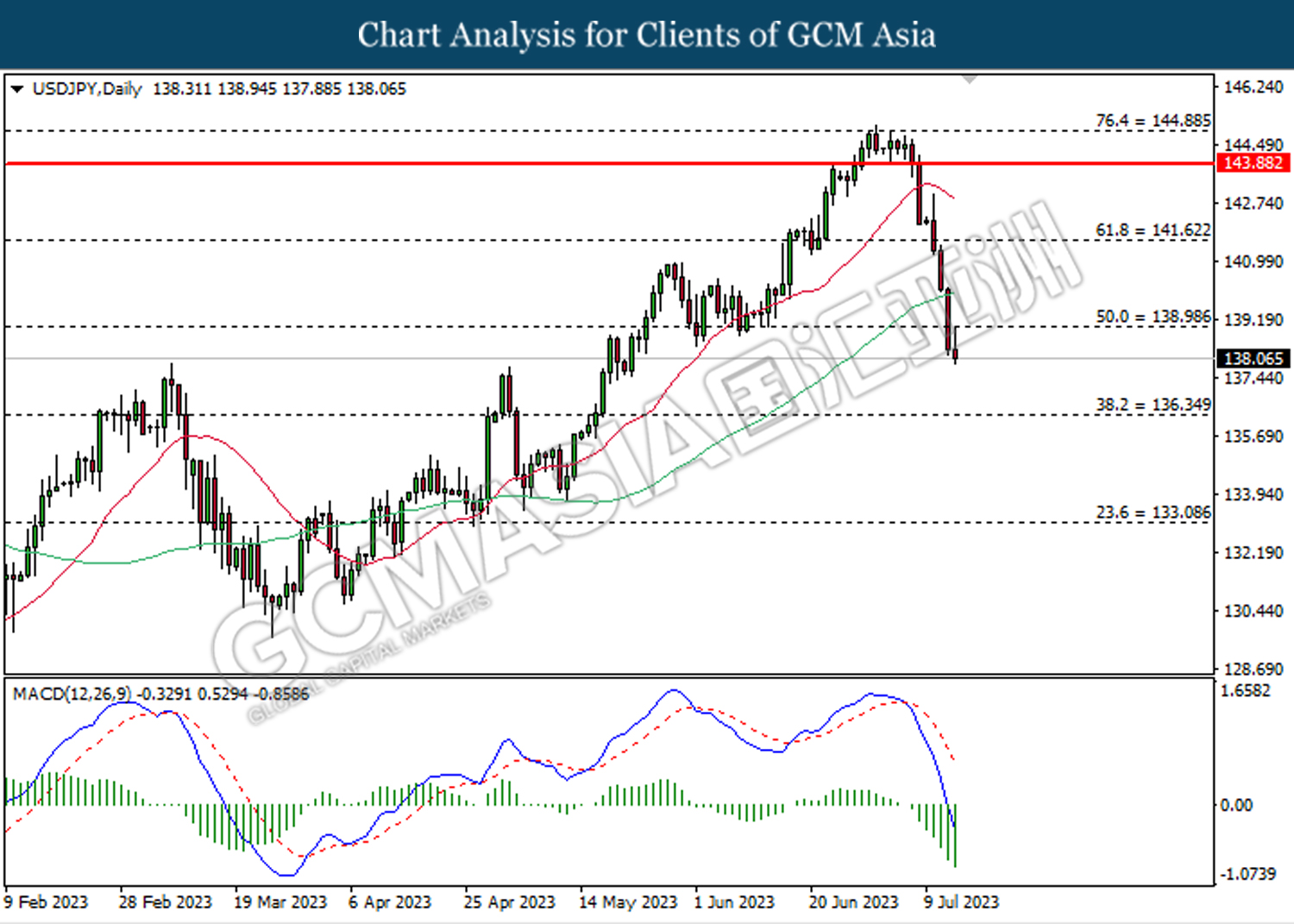

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 139.00. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 139.00, 141.60

Support level: 136.35, 133.10

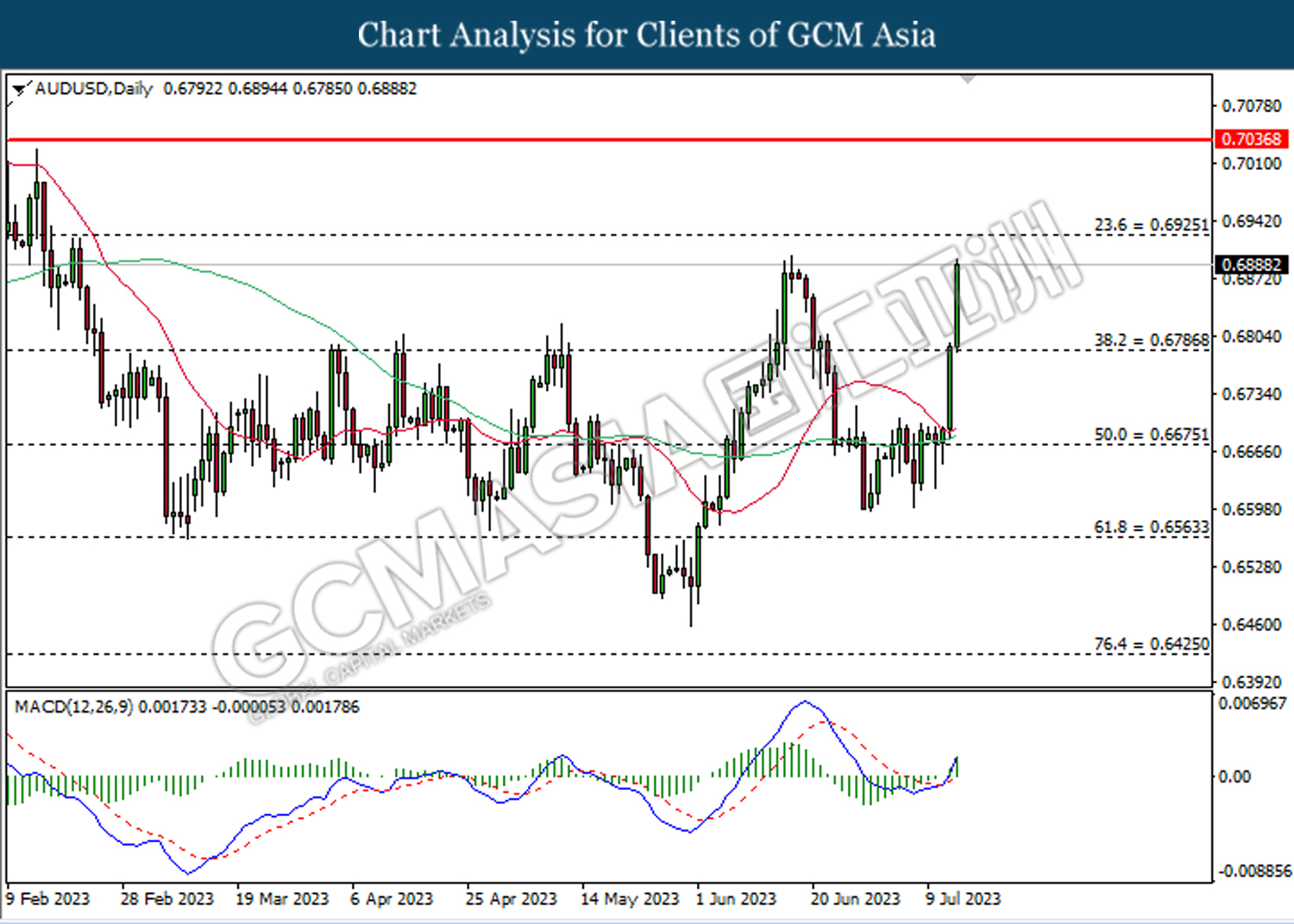

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

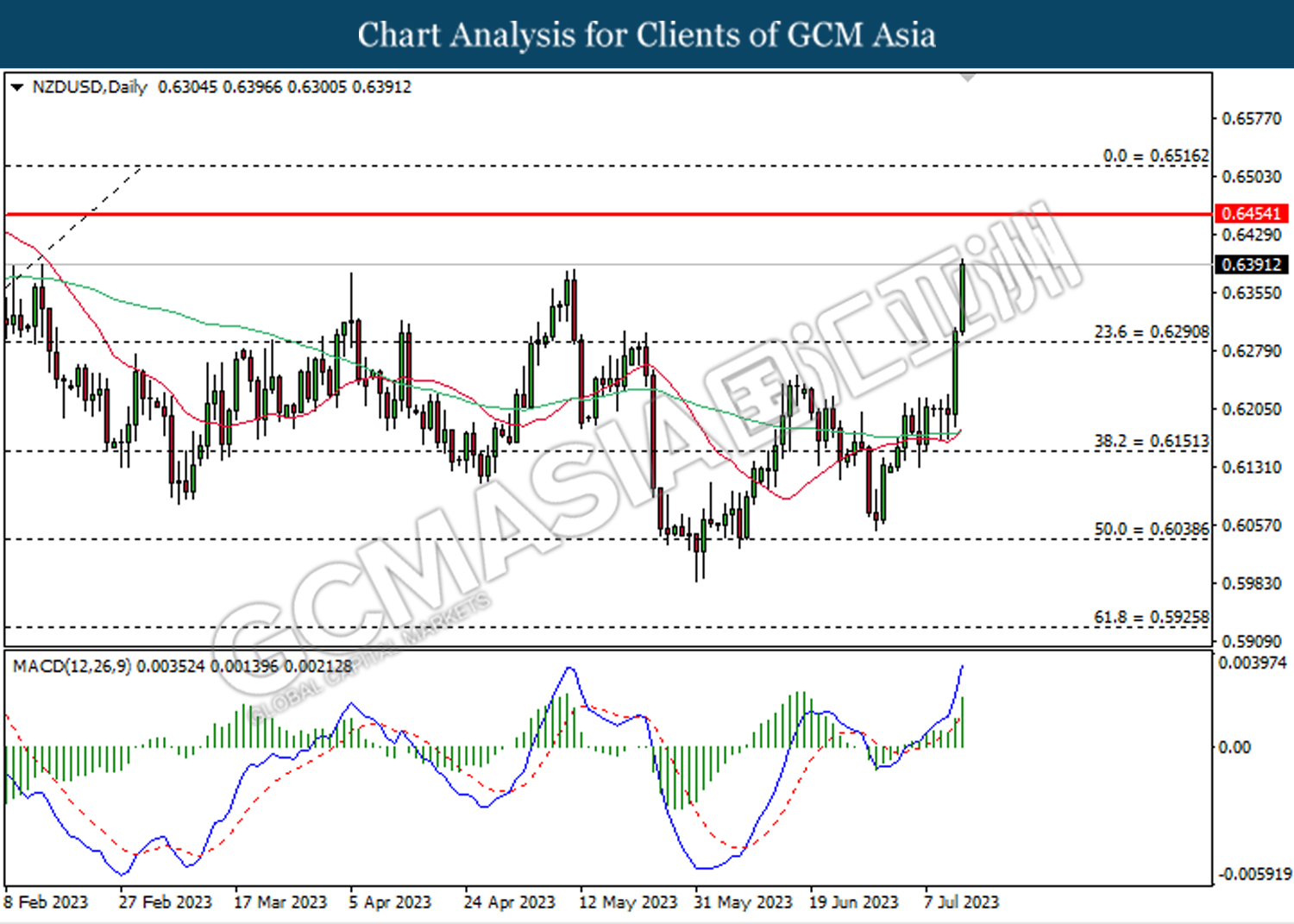

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3175. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3065.

Resistance level: 1.3175, 1.3245

Support level: 1.3065, 1.2930

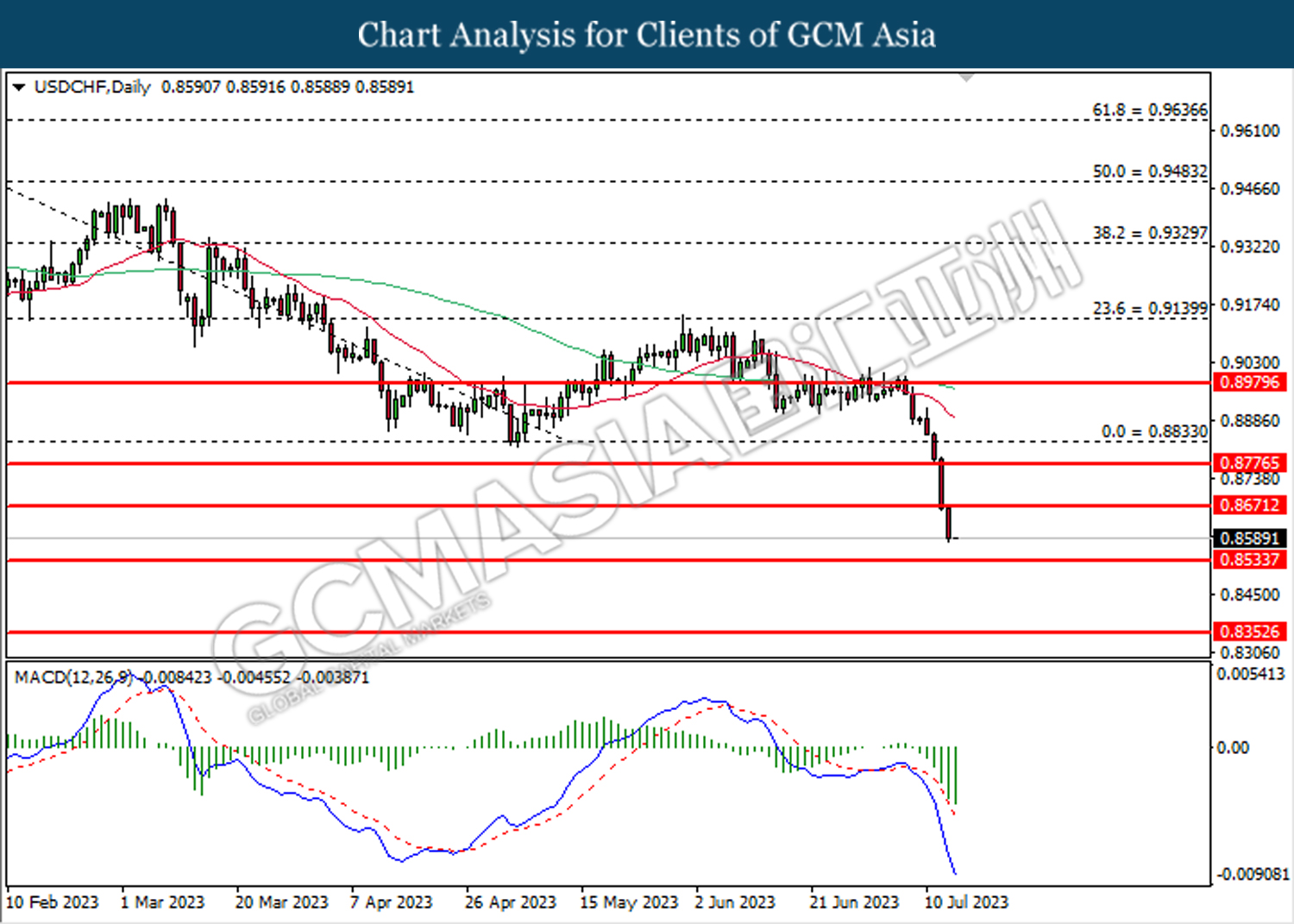

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8535.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 77.15.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75