14 September 2020 Afternoon Session Analysis

Yen held steady following risk-off mood.

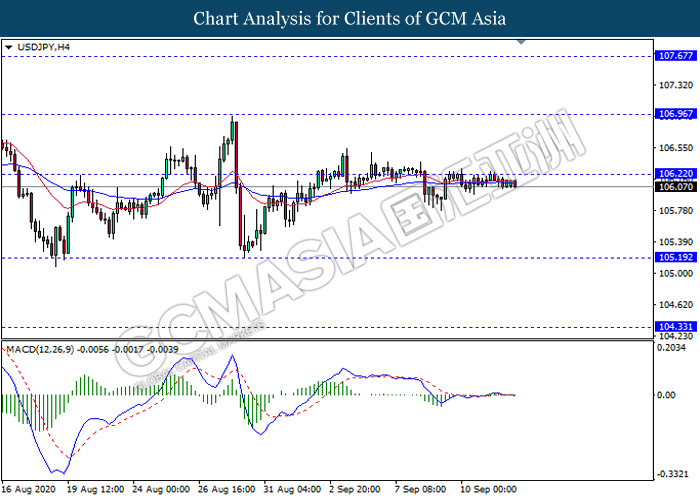

During late Asian session, the Japanese Yen which traded against the dollar and other currency pairs continue to maintain its ground and remain stable as worsening coronavirus and various geopolitical tension continue to weigh on the risk sentiment. On coronavirus front, the number of global coronavirus cases continue to skyrocket as WHO reported a total one-day increase of 307,930 in 24 hours. Some of the biggest increases were from India, U.S and Brazil. As the virus show no signs of easing, market fears remain high even with news of AstraZeneca restart its coronavirus vaccine trials was unable to support the market. On top of that, reports of Iran plotting to kill U.S ambassador also diminished further risk appetite in the market. According to reports from Politico, Iranian government is plotting an assassination attempt against the U.S ambassador to South Africa. The plot could dramatically increase the tension between U.S and Iran and triggered enormous pressure on Donald Trump to fight back. At the time of writing, USD/JPY slips 0.04% to 106.12.

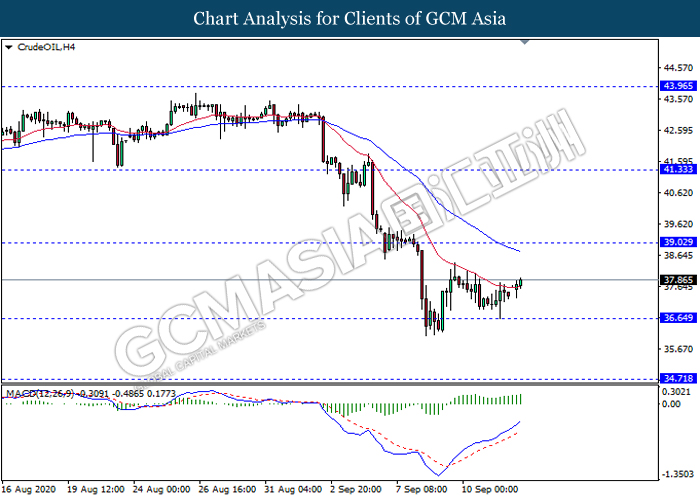

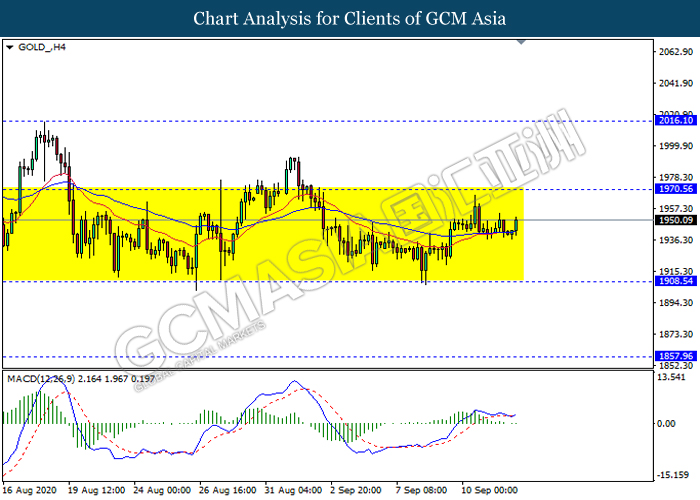

In the commodities market, crude oil price rose 1.85% to $37.85 per barrel as of writing following news of another storm may disrupt production. According to reports, Tropical Storm Sally is gaining strength in the area and is forecasted to be a category 2 hurricane. The storm is expected to reach on Tuesday and may once again disrupt oil production. On the other hand, gold price soars 0.48% to $1949.53 a troy ounce at the time of writing amid geopolitical issues and coronavirus causing investors to shift their portfolio into safe-haven markets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

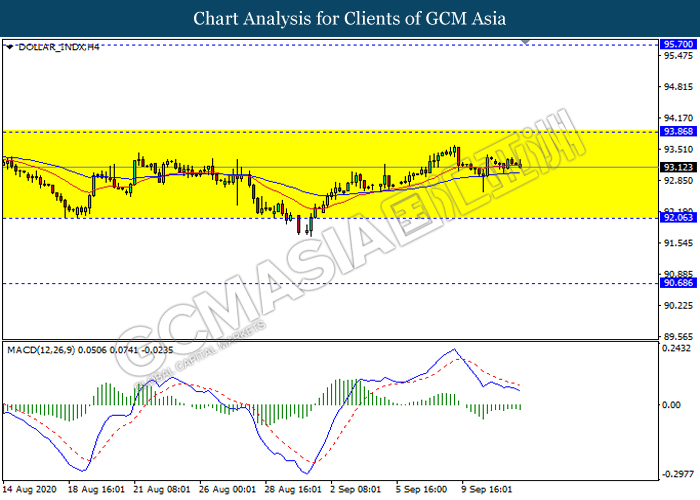

DOLLAR_INDX, H4: Dollar index remain traded in a sideway channel. However, MACD which illustrate bearish momentum suggest the dollar to be traded lower in short term towards the support level 92.05.

Resistance level: 94.00, 95.70

Support level: 92.05, 90.70

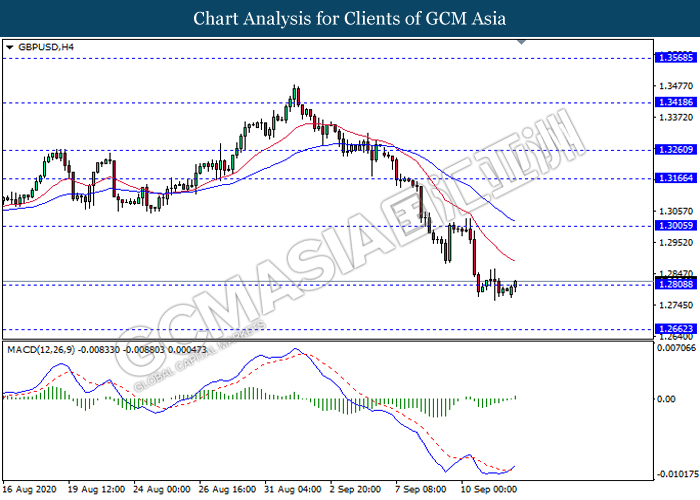

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.2810. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to experience a technical correction towards the resistance level 1.3005.

Resistance level: 1.3005, 1.3165

Support level: 1.2810, 1.2660

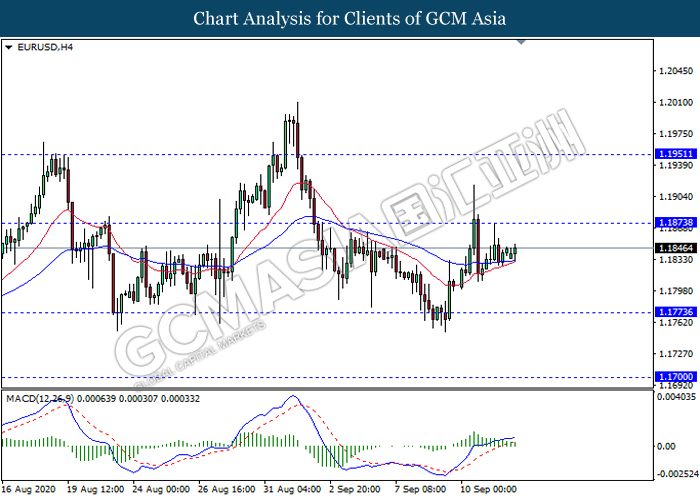

EURUSD, H4: EURUSD was traded flat near the MA lines. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower in short term towards the support level 1.1775.

Resistance level: 1.1875, 1.1950

Support level: 1.1775, 1.1700

USDJPY, H4: USDJPY was traded flat while currently testing the resistance level 106.20. However, due to lack of momentum and clear direction from MACD, it is suggested to wait until further signal appear before entering this market.

Resistance level: 106.20, 106.95

Support level: 105.20, 104.35

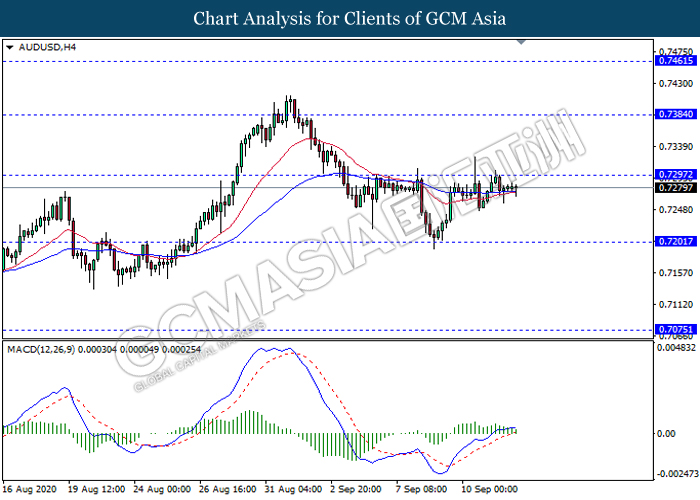

AUDUSD, H4: AUDUSD was traded flat while currently testing near the resistance level 0.7295. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower towards the support level 0.7200.

Resistance level: 0.7295, 0.7385

Support level: 0.7200, 0.7075

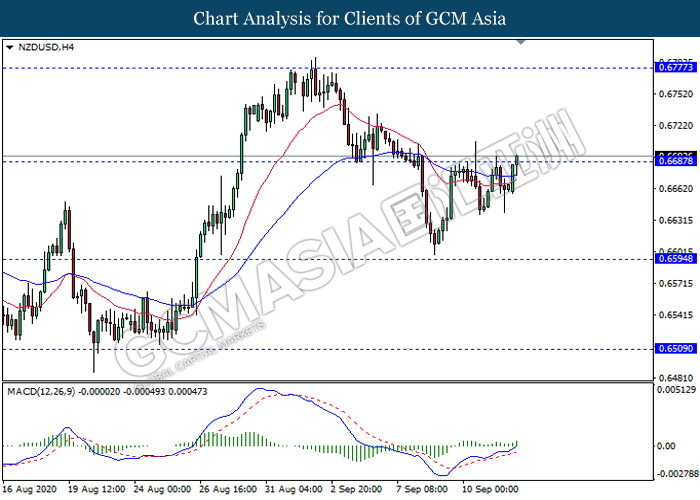

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6685. MACD which illustrate bullish bias signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6595, 0.6510

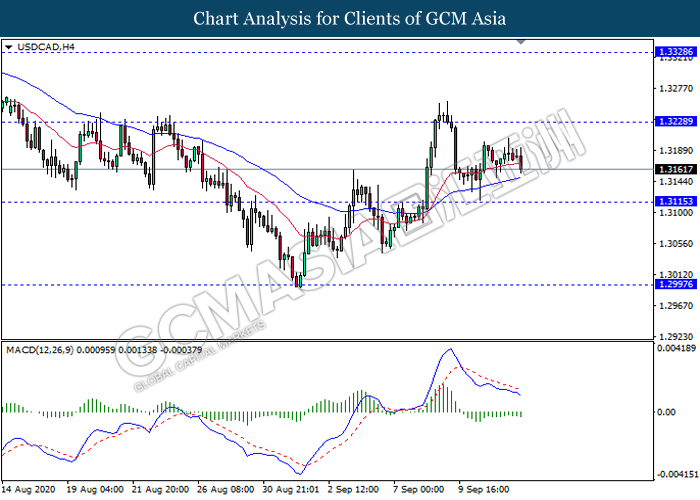

USDCAD, H4: USDCAD was traded lower following prior retracement from its high level. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 1.3115.

Resistance level: 1.3230, 1.3330

Support level: 1.3115, 1.2995

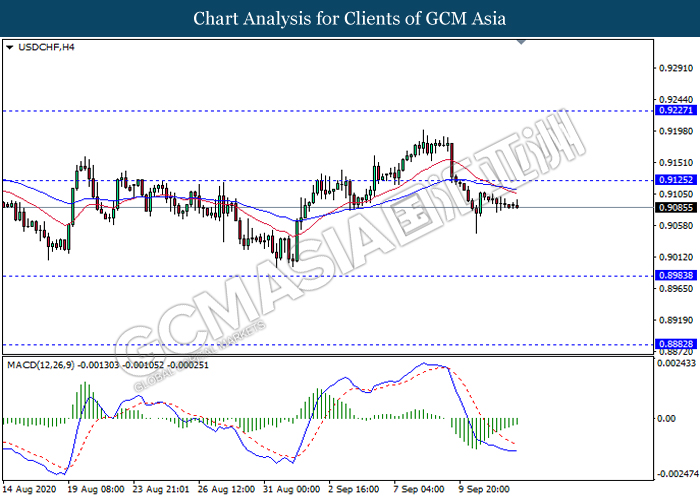

USDCHF, H4: USDCHF was traded flat near the MA lines. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher in short term towards the resistance level 0.9125.

Resistance level: 0.9125, 0.9225

Support level: 0.8985, 0.8880

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 36.65. MACD which illustrate bullish momentum suggested the commodity to extend its gains towards the resistance level 39.05.

Resistance level: 39.00, 41.35

Support level: 36.65, 34.70

GOLD_, H4: Gold price remain traded in a sideway channel. However, MACD which illustrate bullish bias signal suggest the commodity to be traded higher in short term towards the resistance level 1970.55.

Resistance level: 1970.55, 2016.10

Support level: 1908.55, 1857.95