14 September 2020 Morning Session Analysis

Pound slumped over the Brexit chaos.

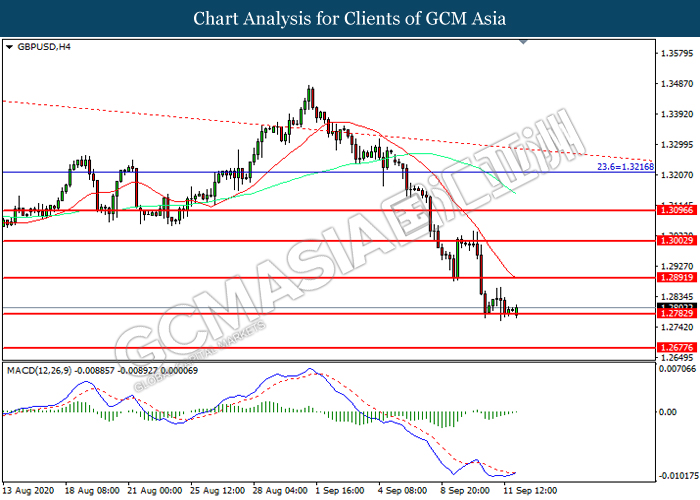

Pound Sterling slumped over the backdrop of the bleak economic data from the United Kingdom last Friday. According to Office for National Statistics, the U.K. Gross Domestic Product (GDP) for last month came in at only 6.6%, worse than the market forecast for a reading up to 6.7%, which dialled down the market optimism toward the economic progression from the UK region. Besides that, the Pound Sterling extend its losses amid the rising tensions between the European Union and UK over the Brexit issues. Lack of progress over the meeting between EU and UK on last week has left scant hopes on soft-Brexit. Indeed, major European Countries has stepped up planning for a “no-deal” Brexit after the Brexit transition period end on 31st December 2020. Nonetheless, the losses experienced by the Pound Sterling was limited following the UK Manufacturing Production had shown some improvement on last month. The Office for National Statistics reported that the reading for the U.K. Manufacturing Production came in at 6.3%, fared better than the economist forecast at 5.0%. As of writing, GBP/USD appreciated by 0.05% to 1.2795.

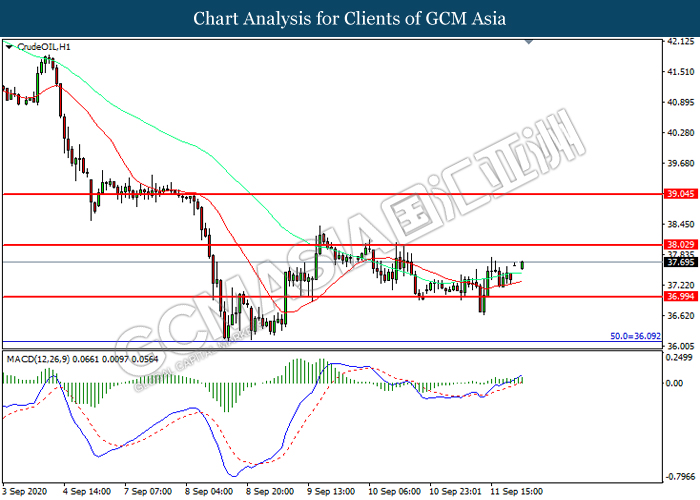

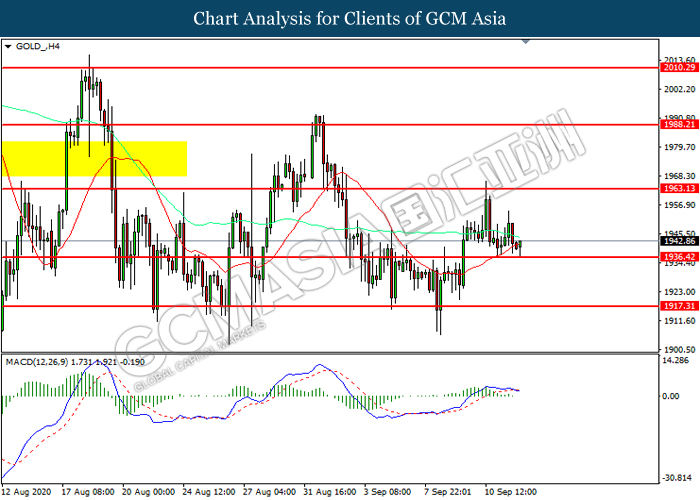

In the commodities market, the crude oil price surged 1.25% to $37.65 per barrel as of writing. The oil market edged higher on last week following the U.S energy firms reduced the number of oil and natural gas rigs operating. The U.S. Baker Hughes Oil Rig Count, an early indicator of future oil output had fell by 2 to 254 in last week, according to Baker Hughes Co. On the other hand, the gold price appreciated by 0.09% to $1941.75 per troy ounces amid the fears over the coronavirus pandemic had spurred risk-off sentiment in the FX market while insinuating demand for the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

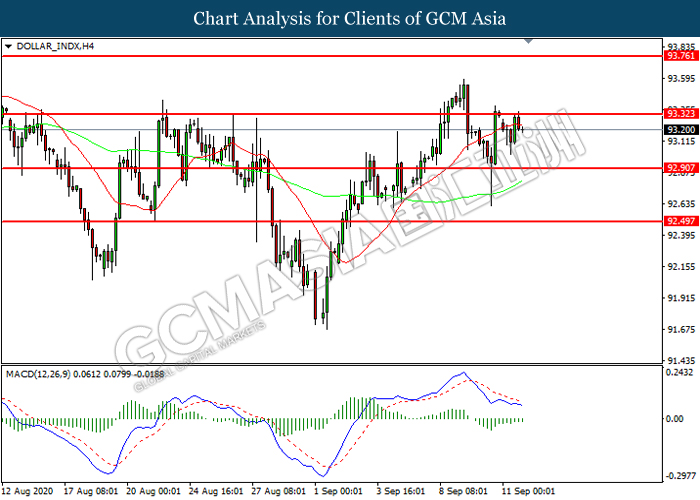

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 93.30. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.30, 93.75

Support level: 92.90, 92.50

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2785. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2890, 1.3005

Support level: 1.2785, 1.2675

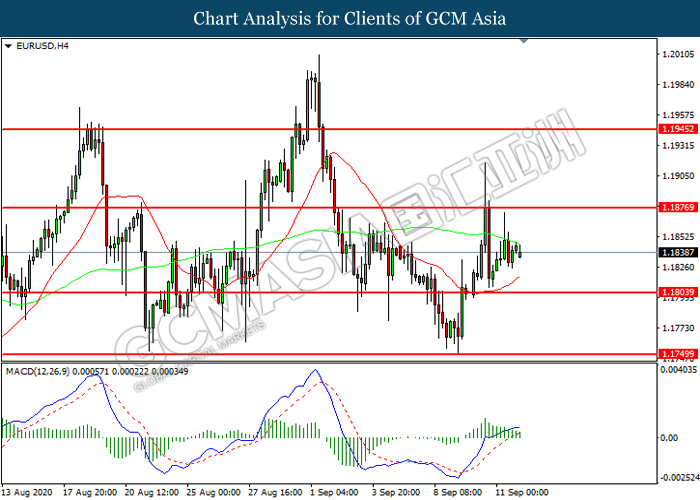

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1805. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1875, 1.1945

Support level: 1.1805, 1.1750

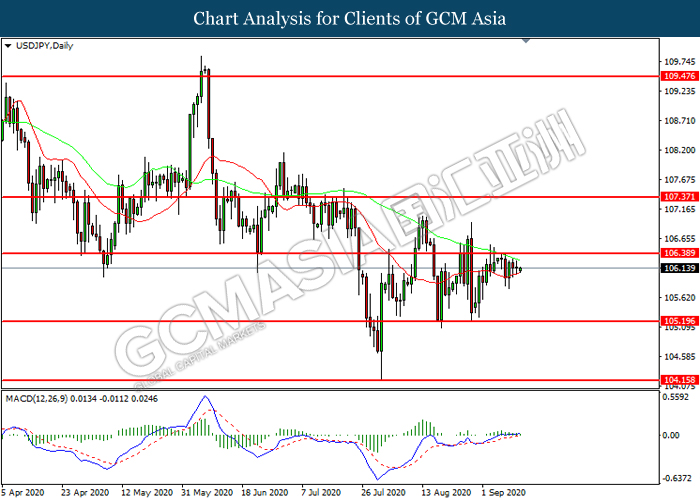

USDJPY, Daily : USDJPY was traded higher while currently testing the resistance level at 106.40. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 106.40, 107.35

Support level: 105.20, 104.15

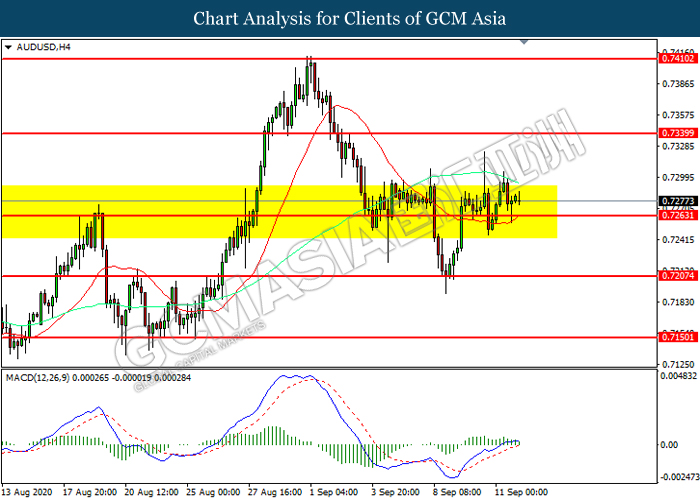

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7265. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7340, 0.7410

Support level: 0.7265, 0.7205

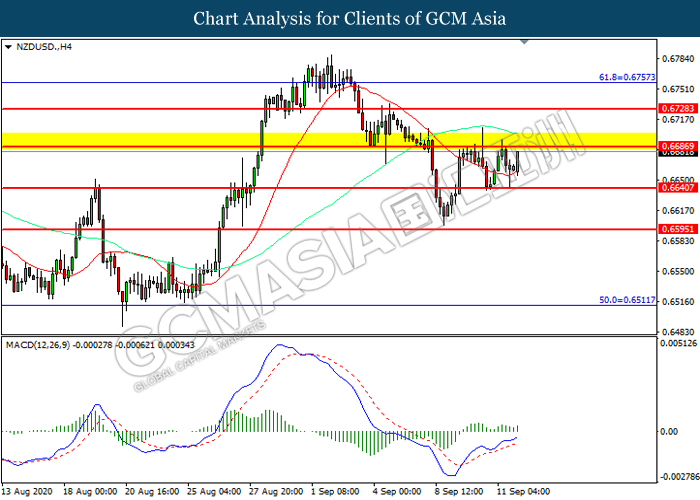

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6685, 0.6730

Support level: 0.6640, 0.6595

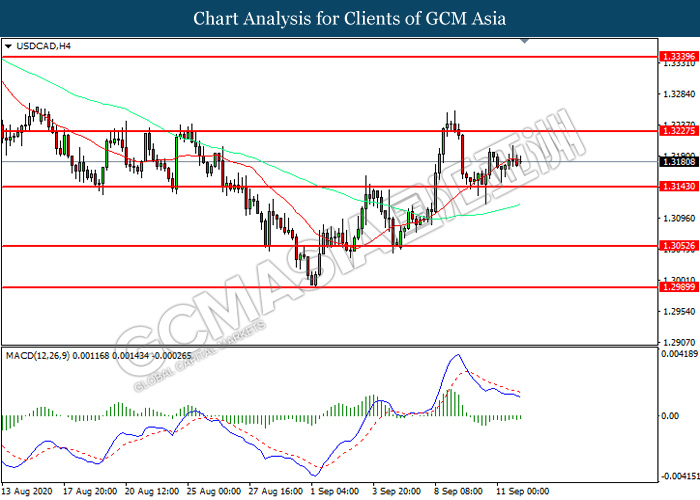

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3145. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3225.

Resistance level: 1.3225, 1.3340

Support level: 1.3145, 1.3055

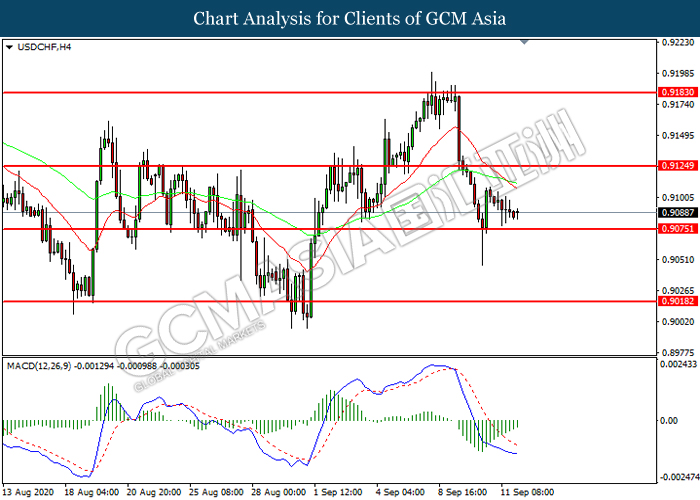

USDCHF, H4: USDCHF was traded lower while currently near the support level at 0.9075. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9125, 0.9185

Support level: 0.9075, 0.9020

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 37.00. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 38.05.

Resistance level: 38.05, 39.05

Support level: 37.00, 36.10

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1936.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1963.15, 1988.20

Support level: 1936.40, 1917.30