15 January 2021 Afternoon Session Analysis

Euro bewildered following mixed ECB stance.

Euro took a slight hit during mid-Asian trading session after European Central Bank’s December meeting minutes shows mixed signals with regards to Euro zone economic recovery. In the meeting minutes, ECB President Christine Lagarde remains confident of Euro zone economic recovery for 2021 despite renewed virus curbs and challenging start to vaccination program. ECB forecasts remains “very plausible” and that “there is no reason to believe the forecast would be wrong at this point of time”. A resurgence of coronavirus cases across Europe has forced the enactment of tougher restriction that could dampen economic recovery at the start of the year. However, Lagarde cautioned that it would be a “concern” for the central bank if member states of EU extends their lockdown after the end of March. She added that some uncertainties continue to cloud over EU economic recovery which may require ECB to provide continuous support in terms of monetary stimulus. The stance portrayed by ECB shows that loose monetary policy setting would continue throughout 2021 in order to provide support to the economy. As of writing, pair of EUR/USD fell 0.07% to 1.2148.

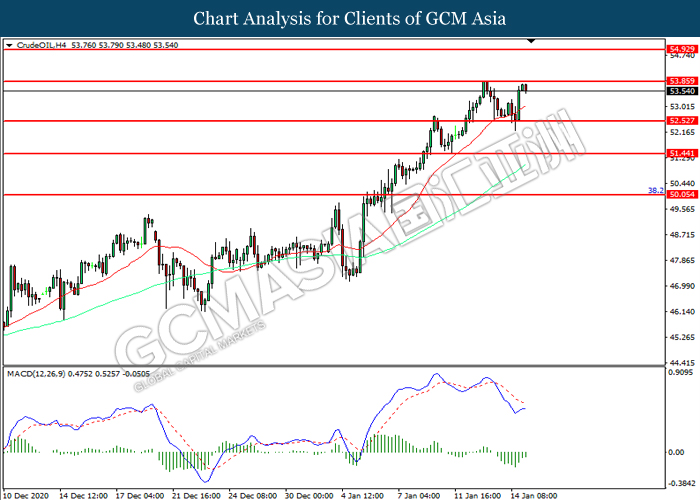

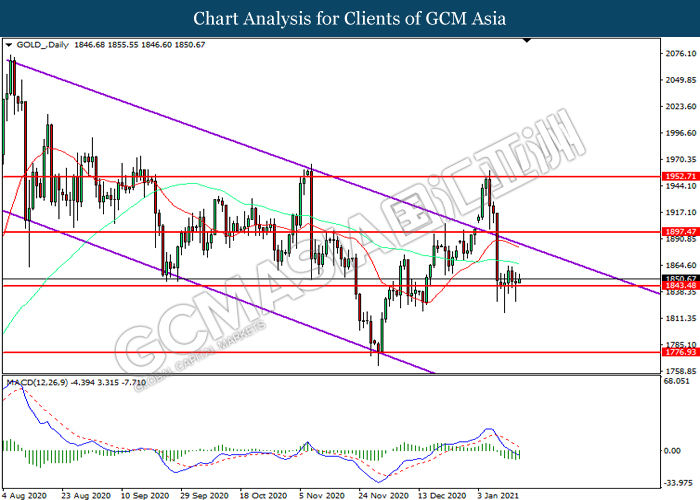

As for commodities, crude oil price was traded flat at around $53.56 per barrel. Investors will place their attention towards oil rig count data from the US in order to gauge the country’s oil production trend and level. On the other hand, gold price ticked down 0.03% to $1,851.98 a troy ounce following stronger greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.00 | GBP – GDP (MoM) | 0.4% | – | – |

| 15.00 | GBP – Manufacturing Production (MoM) (Nov) | 1.7% | 0.9% | – |

| 15.00 | GBP – Monthly GDP 3M/3M Change | 10.2% | – | – |

| 21.30 | USD – Core Retail Sales (MoM) (Dec) | -0.9% | -0.1% | – |

| 21.30 | USD – PPI (MoM) (Dec) | 0.1% | 0.4% | – |

| 21.30 | USD – Retail Sales (MoM) (Dec) | -1.1% | -0.2% | – |

Technical Analysis

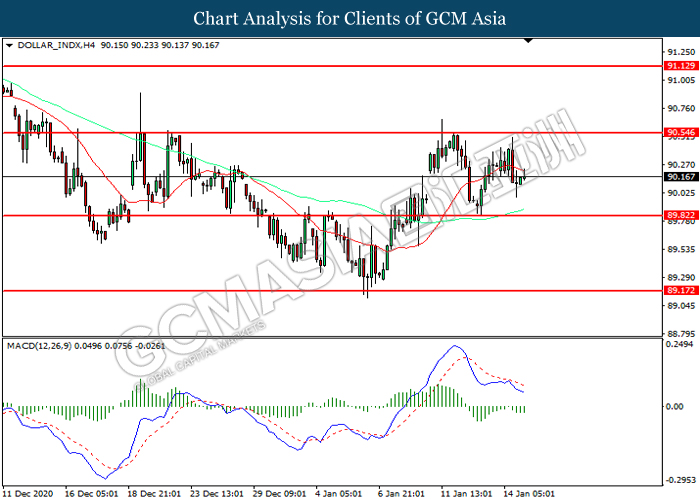

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 90.55. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 89.80.

Resistance level: 90.55, 91.15

Support level: 89.80, 89.15

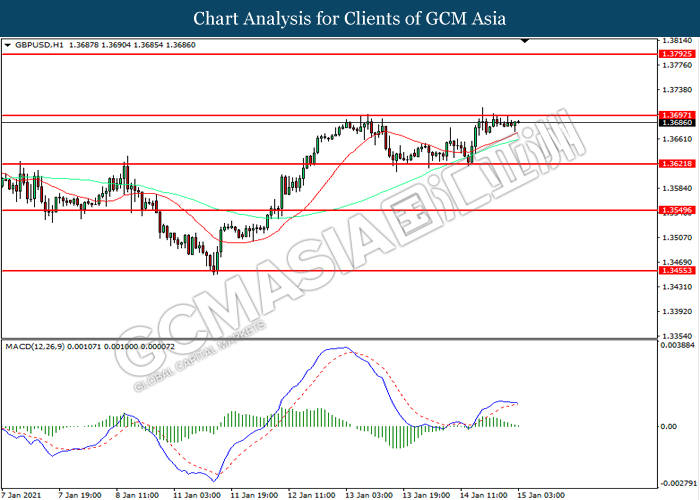

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.3695. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3695, 1.3795

Support level: 1.3620, 1.3450

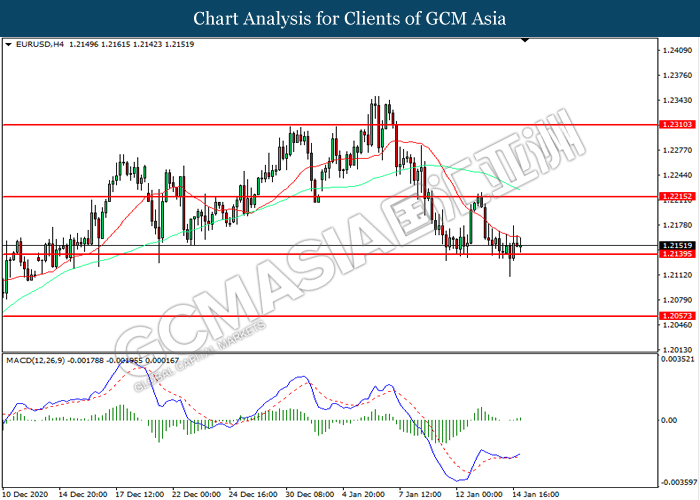

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.2140. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2215, 1.2310

Support level: 1.2140, 1.2055

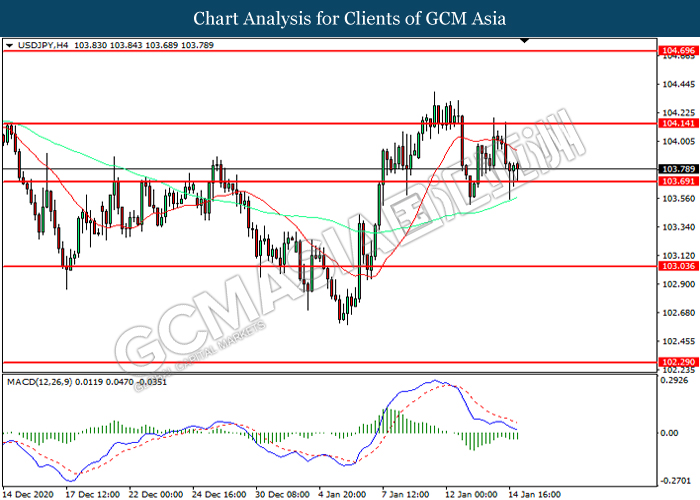

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 103.70. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 104.15, 104.70

Support level: 103.70, 103.05

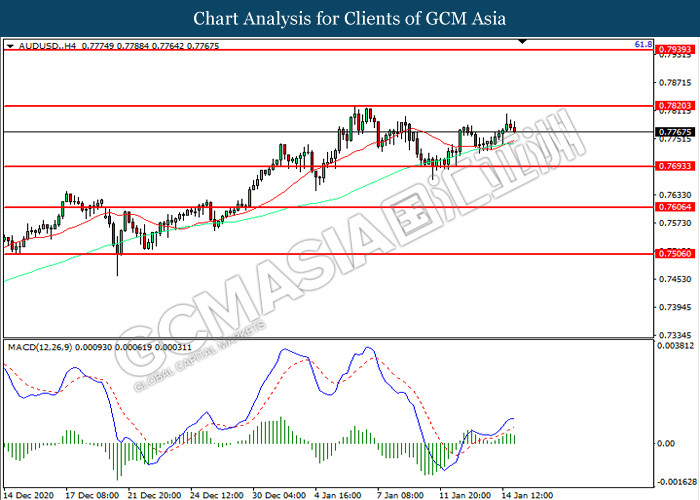

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7695. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7820, 0.7940

Support level: 0.7695, 0.7605

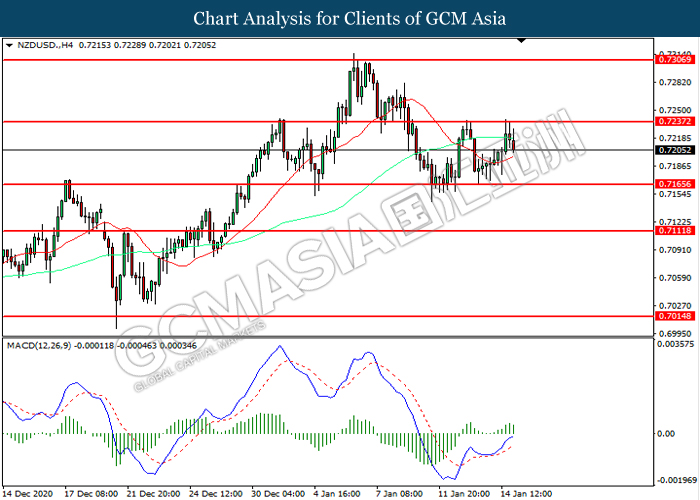

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.7235. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.7165.

Resistance level: 0.7235, 0.7305

Support level: 0.7165, 0.7115

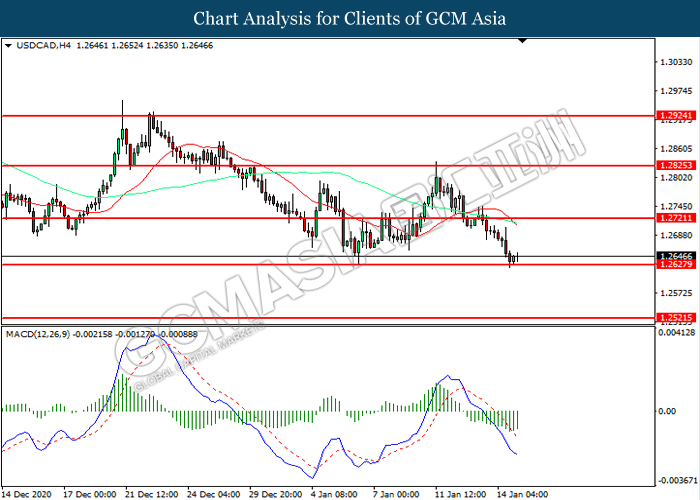

USDCAD, H1: USDCAD was traded lower while currently testing the support level at 1.2630. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2720, 1.2825

Support level: 1.2630, 1.2520

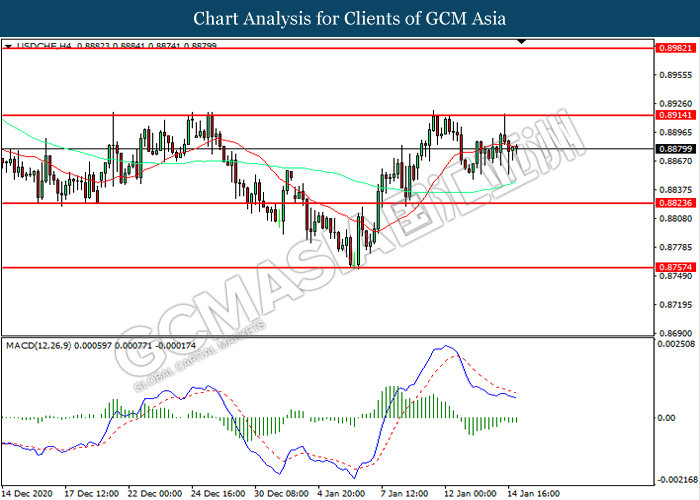

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.8915, 0.8980

Support level: 0.8825, 0.8755

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 53.85. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 53.85, 54.95

Support level: 52.55, 51.45

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1843.50. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1897.45, 1952.70

Support level: 1843.50, 1776.95