15 January 2021 Morning Session Analysis

Dollar up on further stimulus expectation.

During early Asian session, the dollar index which traded against a basket of six major currency pairs remains steady and rose as expectation of a further substantial stimulus measure continue to support the demand for the greenback. According to CNN, President-elect Joe Biden will look to outline plans later Thursday of a fiscal stimulus package of around $2 trillion. Due to the prospect of higher stimulus plans, government borrowing also expected to increase which weighed on the U.S government bonds and caused the benchmark rate to soars above 1% for the first time since March. On top of that, another that factor that supported the dollar is concerns that the Fed could reduce its monetary support sooner than expected following economic recovery. At the time of writing, dollar index edge higher 0.11% to 90.16.

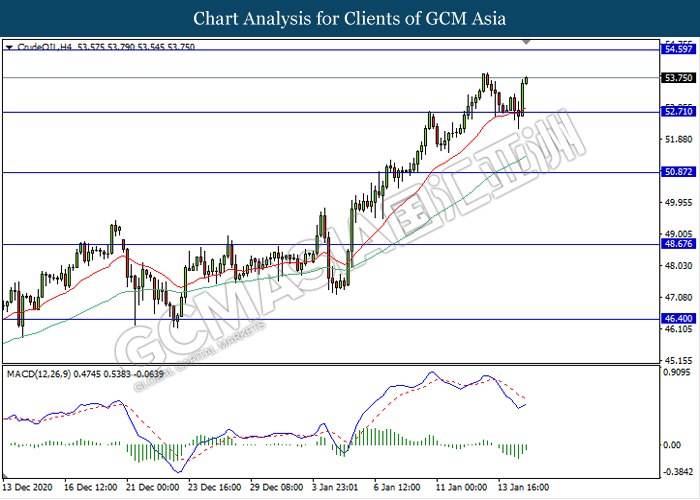

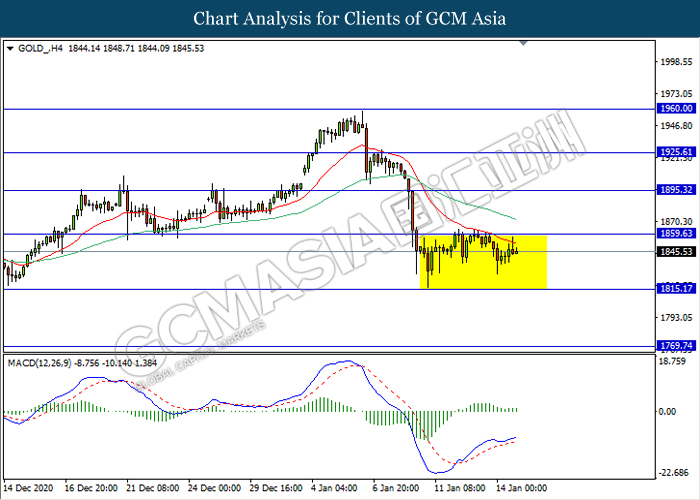

In the commodities market, crude oil price rose 0.15% to $53.72 per barrel as of writing following OPEC revision on demand growth and prospect of further stimulus. According to its report, global world economic growth was revised marginally higher from last month’s report and estimated to contract by 4.1%, compared to the previous month’s forecast of -4.2%. At the same time, hope that the incoming Biden administration will quickly push through yet another round of stimulus payment in the amount of $1400 per person also help bolstering the commodity price. On the other hand, gold price slips 0.08% to $1846.90 a troy ounce at the time of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.00 | GBP – GDP (MoM) | 0.4% | – | – |

| 15.00 | GBP – Manufacturing Production (MoM) (Nov) | 1.7% | 0.9% | – |

| 15.00 | GBP – Monthly GDP 3M/3M Change | 10.2% | – | – |

| 21.30 | USD – Core Retail Sales (MoM) (Dec) | -0.9% | -0.1% | – |

| 21.30 | USD – PPI (MoM) (Dec) | 0.1% | 0.4% | – |

| 21.30 | USD – Retail Sales (MoM) (Dec) | -1.1% | -0.2% | – |

Technical Analysis

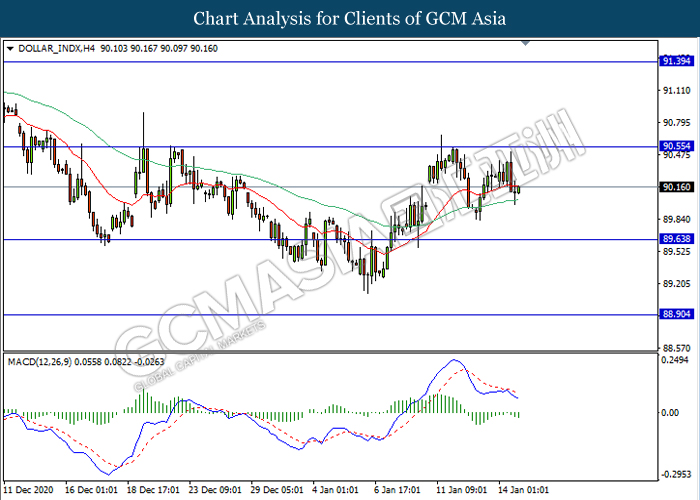

DOLLAR_INDX, H4: Dollar index was traded lower following recent retracement from the resistance level 90.55. MACD which illustrate bearish bias signal suggest the dollar to extend its retracement towards the support level 89.65.

Resistance level: 90.55, 91.40

Support level: 89.65, 88.90

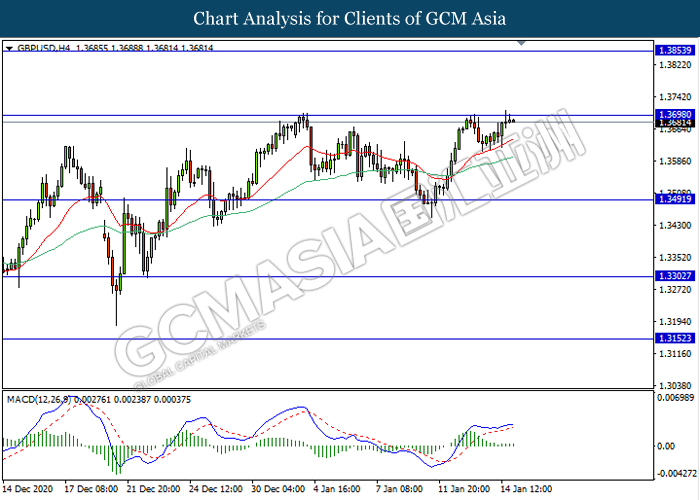

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level 1.3700. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction towards the support level 1.3490.

Resistance level: 1.3700, 1.3855

Support level: 1.3490, 1.3300

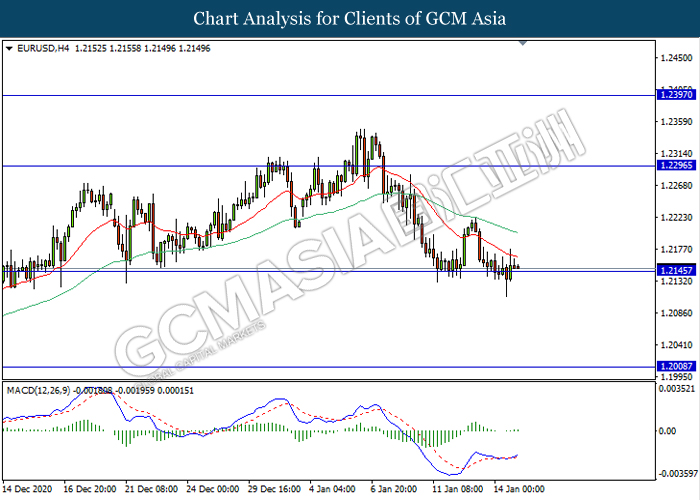

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.2145. However, MACD which illustrate bullish momentum signal suggest the pair to be traded higher as a technical correction towards the resistance level 1.2295.

Resistance level: 1.2295, 1.2395

Support level: 1.2145, 1.2010

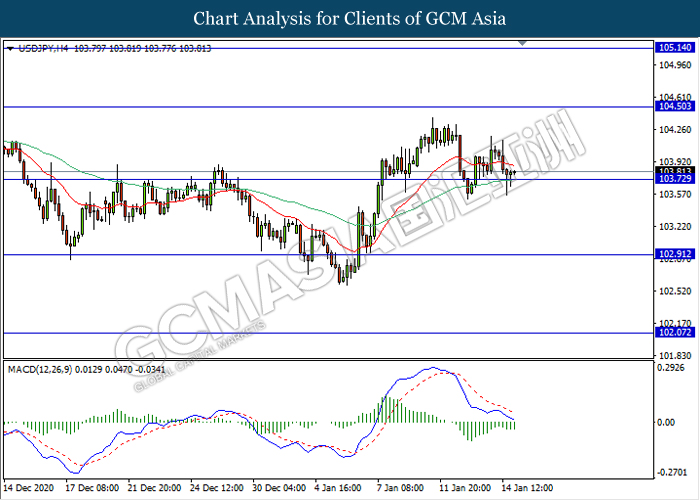

USDJPY, H4: USDJPY was traded lower while currently testing the support level 103.70. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 104.50, 105.15

Support level: 103.70, 102.90

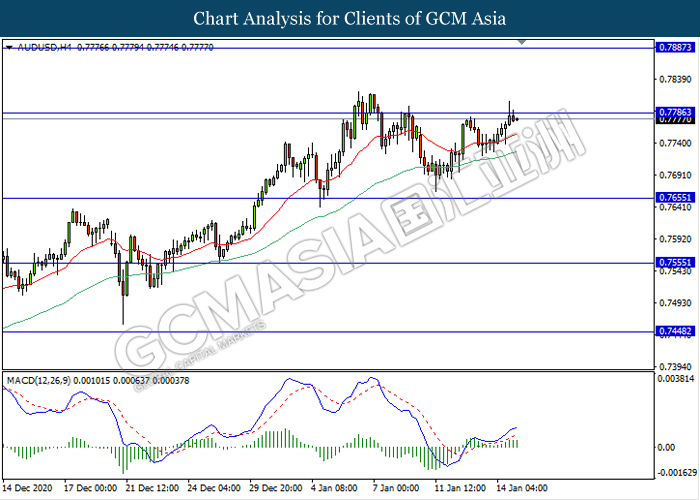

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level 0.7785. MACD which illustrate ongoing bullish bias signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.7785, 0.7885

Support level: 0.7655, 0.7555

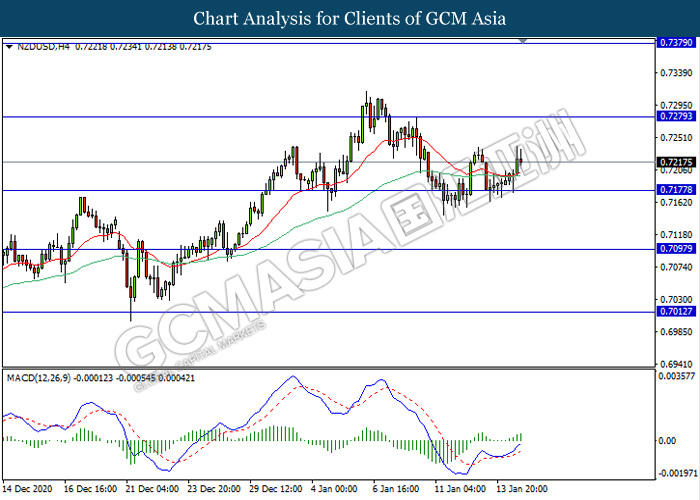

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.7175. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 0.7280.

Resistance level: 0.7280, 0.7380

Support level: 0.7175, 0.7095

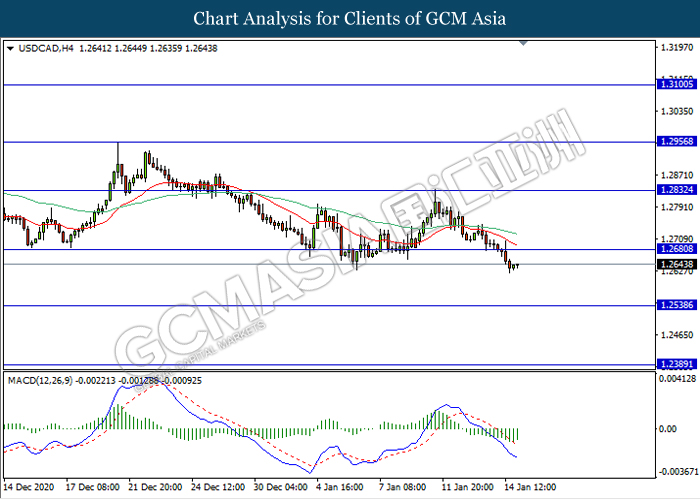

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level 1.2680. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses towards the support level 1.2540.

Resistance level: 1.2680, 1.2830

Support level: 1.2540, 1.2390

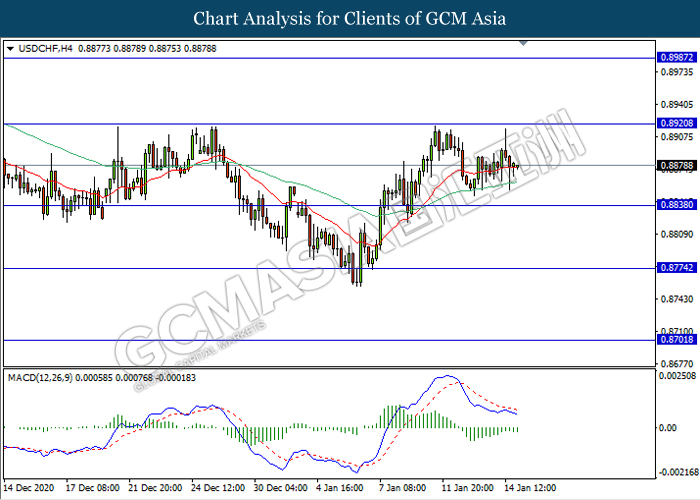

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.8920. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its retracement in short term towards the support level 0.8840

Resistance level: 0.8920, 0.8985

Support level: 0.8840, 0.8775

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 52.70. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its rebound towards the resistance level 54.60.

Resistance level: 54.60, 57.30

Support level: 52.70, 50.85

GOLD_, H4: Gold price remain traded in a sideway channel. However, MACD which illustrate bearish bias signal suggest the commodity to be traded lower in short term towards the support level 1815.15.

Resistance level: 1859.65, 1895.30