15 June 2017 Daily Analysis

Conflicting signals, investors muddled.

US dollar nurses some losses on Thursday as weak US inflation data left investors wondering if the Federal Reserve would follow up its rate hike stance later in the year. Overnight, the Federal Reserve increased its key interest rate by 25 basis point to a range of 1.00% – 1.25% while maintaining its view that a total of three rate hikes in 2017 would be appropriate. Although the rate hike was widely expected, investors are agitated by recent slowdown in economic activity which may derail expectation for a total of three rate hikes. The central bank remained obstinate that economic growth is progressing moderately while inflation is expected to rise above bank’s 2% target in the medium term. However, the greenback received some bearish pressure as political turmoil in Washington continues to deepen, with Washington Post reporting that US President Donald Trump is being investigated by special counsel Robert Mueller for possible obstruction of justice. “There is a lot to digest, and even some apparently conflicting signals, such as the fact that inflation outlook was revised slightly lower by the Fed but maintaining its intention to raise rates again this year,” said Mitsuo Imaizumi, chief forex strategist. The dollar index ticked down 0.05% and last quoted at 96.80. Against other major peers, EUR/USD was up 0.07% to $1.1227 while pound sterling rose 0.10% to $1.2757.

Peering into the commodities, crude oil price hovers near one-month low after depreciating 0.22% to $44.63 per barrel. Its prices received broad pressure due to high global inventories and rising doubts over OPEC’s ability to implement production cuts. On the other hand, gold price gained 0.2% to $1,265.47 following deepening political turmoil that surrounds Trump administration in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 CHF SNB Monetary Policy Assessment

15:30 CHF SNB Press Conference

19:00 GBP BoE MPC Meeting Minutes

04:00 GBP BoE Gov Carney Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 06:45 | NZD – GDP (QoQ) (Q1) | 0.4% | 0.7% | 0.5% |

| 09:30 | AUD – Employment Change (May) | 37.4K | 10.0K | 42.0K |

| 15:30 | CHF – SNB Interest Rate Decision | -0.75% | -0.75% | – |

| 16:30 | GBP – Retail Sales (MoM) (May) | 2.3% | -0.8% | – |

| 19:00 | GBP – BoE Interest Rate Decision (June) | 0.25% | 0.25% | – |

| 20:30 | USD – Initial Jobless Claims | 245K | 242K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (June) | 38.8 | 24.0 | – |

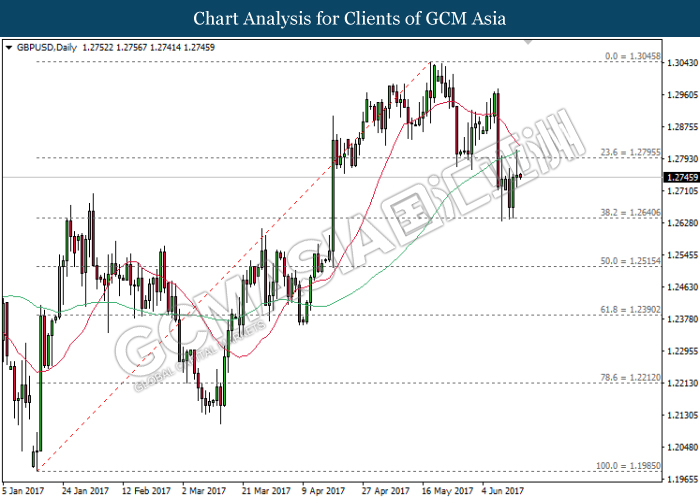

GBPUSD

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the strong resistance level of 1.2795. Both MA lines which continues to narrow downwards suggests further downside bias for GBPUSD to move towards the support level of 1.2640.

Resistance level: 1.2795, 1.3045

Support level: 1.2640, 1.2515

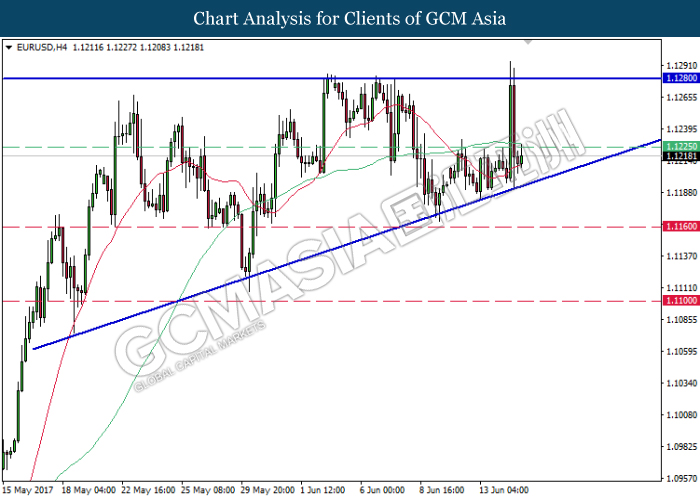

EURUSD

EURUSD, H4: EURUSD remained traded within an ascending triangle following prior retracement from the top level at 1.1280. A successful closure above the resistance level of 1.1225 would suggest EURUSD to extend its gains towards the upper level of the triangle.

Resistance level: 1.1225, 1.1280

Support level: 1.1160, 1.1100

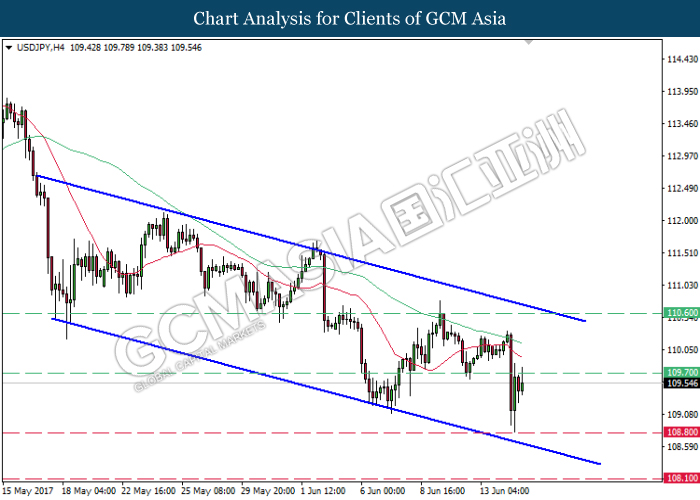

USDJPY

USDJPY, H4: USDJPY remains traded within a downward channel while recently retraced from the resistance level of 109.70. Such retracement suggests USDJPY to extend its downward momentum towards the first target at 108.80.

Resistance level: 109.70, 110.60

Support level: 108.80, 108.10

CrudeOIL

CrudeOIL, H4: Crude oil price remained traded within a downward channel following prior retracement from the 20-moving average line (red). As MACD continues to hover inside downward momentum, crude oil price is suggested to extend its losses towards the support level of 44.00.

Resistance level: 45.30, 46.70

Support level: 44.00, 43.00

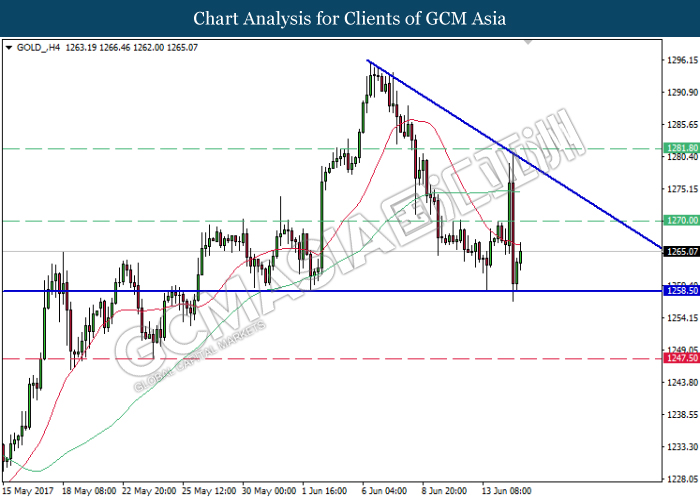

GOLD

GOLD_, H4: Gold price remained traded within a descending triangle following prior rebound from the bottom level at 1258.50. Recent rebound suggests gold price to extend its retracements towards the first target at 1270.00.

Resistance level: 1270.00, 1281.80

Support level: 1258.50, 1247.50