15 July 2021 Afternoon Session Analysis

Aussie slips following mixed Australian jobs data.

The Australian dollar which traded against the greenback and other currency pairs have fell due to unclear signals of Australia employment report for June. According to Australian Bureau of Statistics, the Unemployment Rate improved to 4.9%, better than market expectation of 5.5%. However, Australia’s headline Employment Change have dropped below market expectation of 30.0k and previous reading of 115.2K to 29.1K while Participation Rate also came in at 66.2%, weaker than market expectation of 66.3%. On top of that, worsening COVID-19 conditions in Australia also continue to exert pressure for the Aussie. Recently, Aussie PM Scott Morrison stated that the vaccine rollout is two months behind. On the same line, World Bank Group President David Malpass stated that many countries in East Asia and Pacific may not fully vaccinate population until 2024 even as new variants emerge due to vaccine shortages. At the time of writing, AUD/USD fell 0.33% to 0.7461.

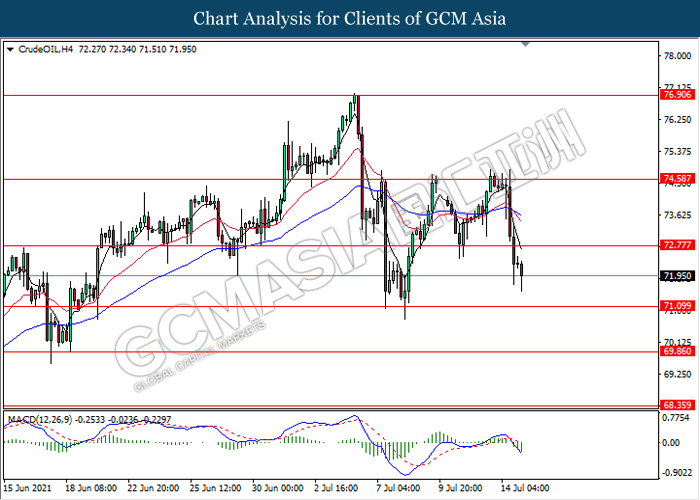

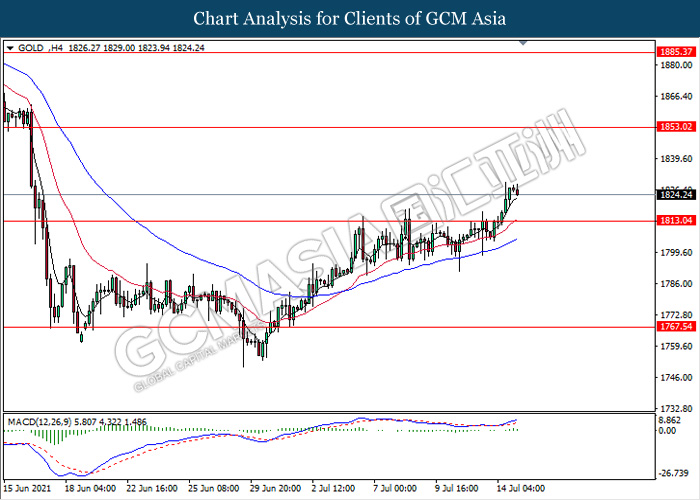

In the commodities market, crude oil price plunged 0.78% to $72.44 per barrel at the time of writing amid rising fuel stocks and potential OPEC agreement. On data front, both gasoline and distillate inventories rose last week, according to a U.S. government report. Besides that, Saudi Arabia and the United Arab Emirates were said to resolve the standoff where the latest proposal involves a higher output quota for the UAE. On the other hand, gold price rose 0.09% to $1824.58 a troy ounce as of writing amid dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (May) | 5.60% | 7.20% | – |

| 14:00 | GBP – Claimant Count Change (Jun) | -92.6K | – | – |

| 20:30 | USD – Initial Jobless Claims | 373K | 360K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | 30.7 | 28.3 | – |

Technical Analysis

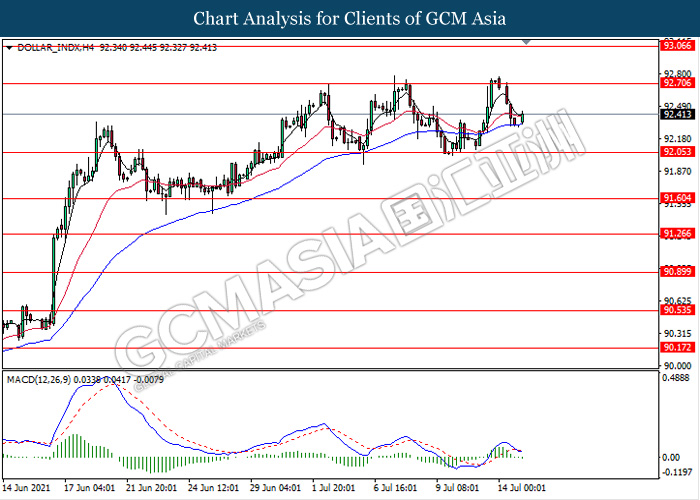

DOLLAR_INDX, H4: Dollar index was traded lower following recent retracement from the resistance level 92.70. MACD which illustrate bearish momentum signal with the formation of death cross suggest the dollar to extend its losses towards the support level 92.05.

Resistance level: 92.70, 93.05

Support level: 92.05, 91.60

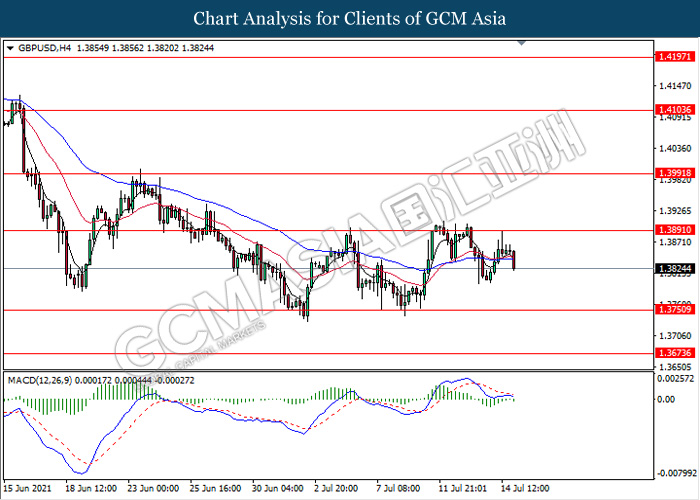

GBPUSD, H4: GBPUSD was traded lower following recent retracement from the resistance level 1.3890. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 1.3750.

Resistance level: 1.3890, 1.3990

Support level: 1.3750, 1.3675

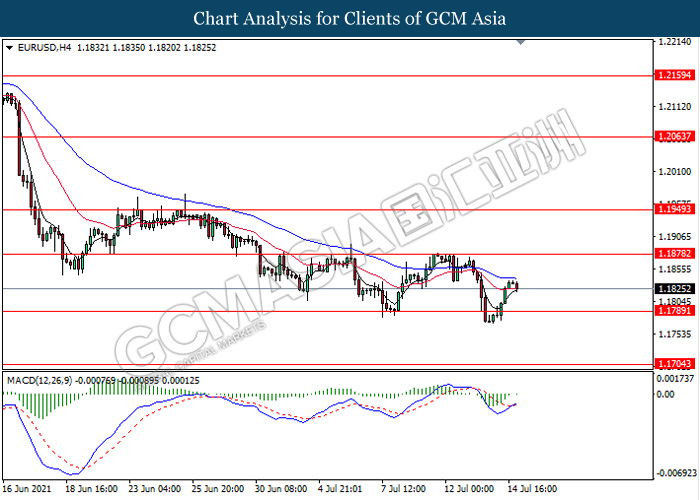

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.1790. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its rebound to resistance level 1.1880.

Resistance level: 1.1880, 1.1950

Support level: 1.1790, 1.1705

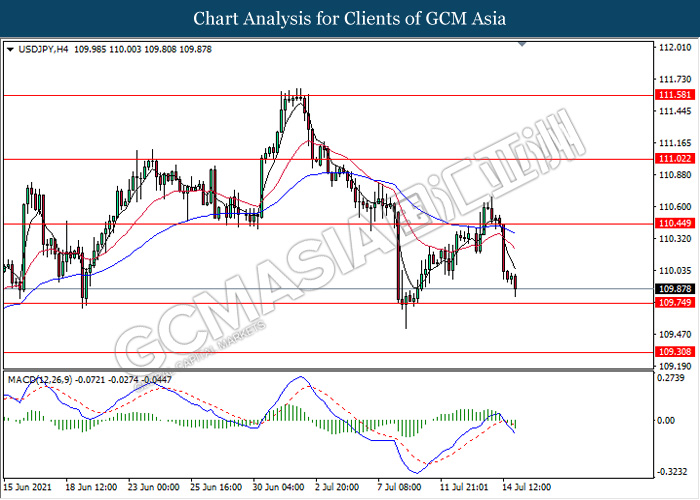

USDJPY, H4: USDJPY was traded lower while currently testing near the support level 109.75. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 110.45, 111.00

Support level: 109.75, 109.30

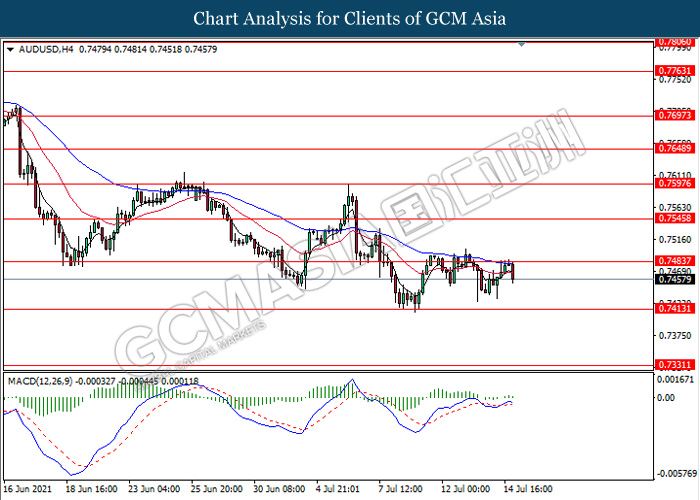

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7485. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 0.7415.

Resistance level: 0.7485, 0.7545

Support level: 0.7415, 0.7330

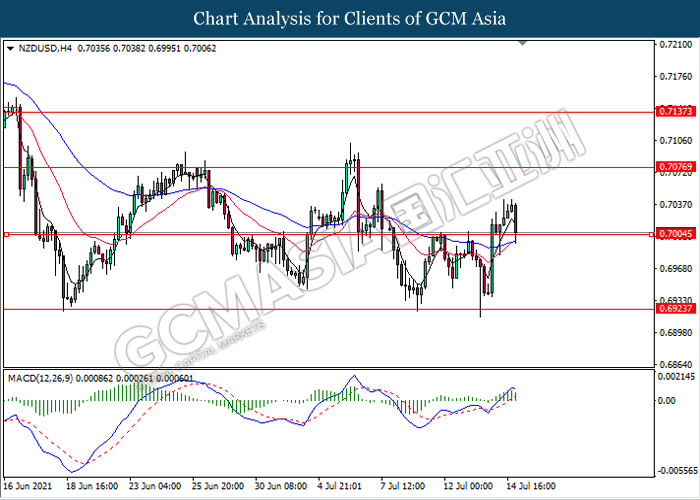

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.7005. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7075, 0.7135

Support level: 0.7005, 0.6925

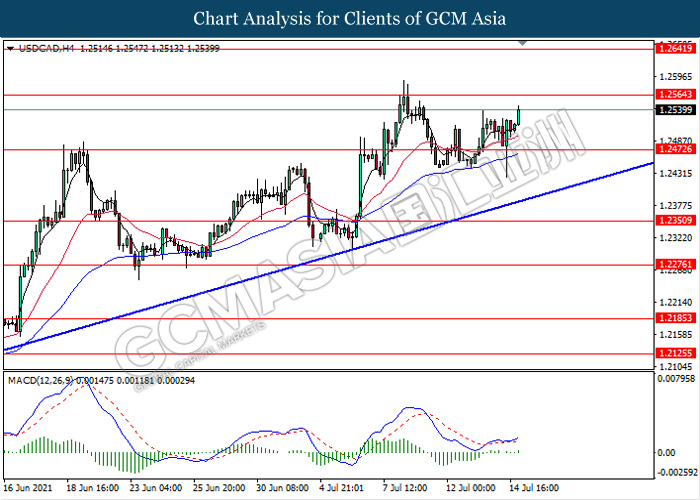

USDCAD, H4: USDCAD was traded higher while currently testing near the resistance level 1.2565. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 1.2565, 1.2640

Support level: 1.2470, 1.2350

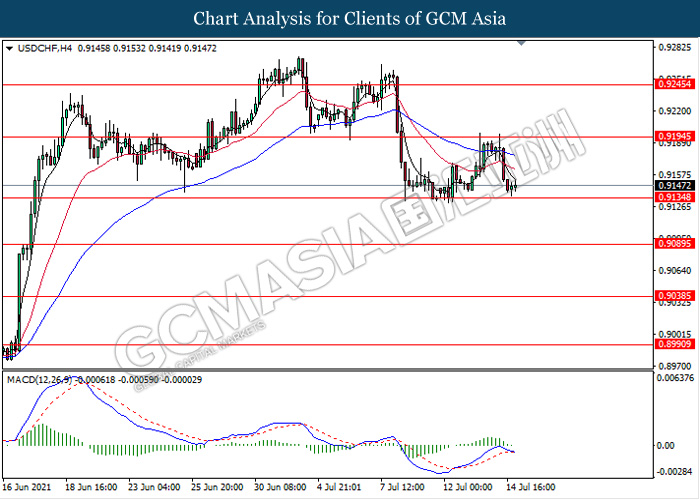

USDCHF, H4: USDCHF was traded lower while currently testing near the support level 0.9135. MACD which illustrate diminishing bullish momentum signal with the starting formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.9195, 0.9245

Support level: 0.9135, 0.9090

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level 72.75. MACD which illustrate bearish momentum signal suggest the commodity to extend its losses towards the support level 71.10.

Resistance level: 72.75, 74.60

Support level: 71.10, 69.85

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1853.00. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the commodity to extend its gains towards the resistance level 1853.00.

Resistance level: 1853.00, 1885.35

Support level: 1813.05, 1767.55.