15 July 2021 Morning Session Analysis

Dollar slumped following Fed maintained the dovish tone.

The Dollar Index which traded against a basket of six major currency pairs slumped following the Federal Reserve unleashed their dovish tone on yesterday, despite high inflation data was released. According to Reuters, Federal Reserve Chair Jerome Powell claimed that the U.S. economy was still a way offs from levels of the central bank’s goal before tapering its monetary support. Hence, market participants speculated that the Federal Reserve would continue to implement its expansionary monetary policy in longer-term basis to boost back the economic momentum. Such aggressive monetary policy would continue to increase the money circulation in financial market, which diminishing the appeal of the US Dollar. On the economic data front, U.S. Producer Price Index (PPI) had notched up significantly from the previous reading of 0.8% to 1.0%, exceeding the market forecast at 0.6%, according to U.S. Bureau of Labor Statistics. As of writing, the Dollar Index depreciated by 0.01% to 92.41.

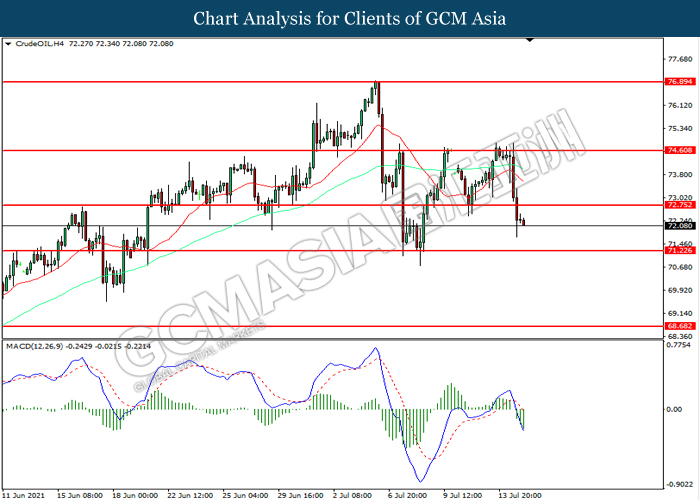

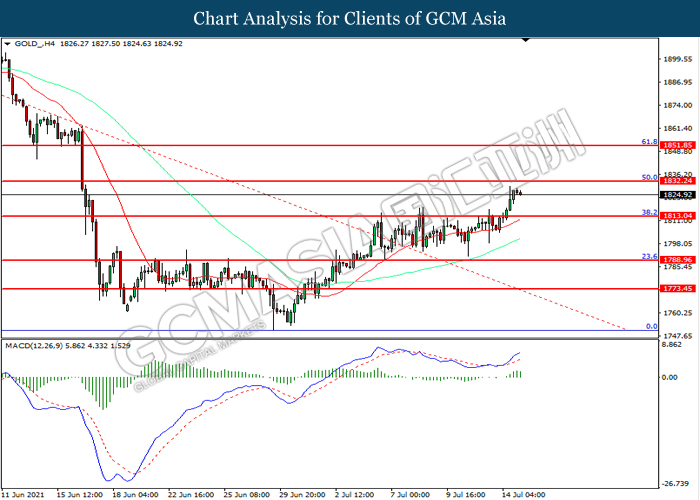

In the commodities market, the crude oil price depreciated by 0.38% to $72.75 per barrel as of writing. The oil market extends its losses following Saudi Arabia and the United Arab Emirates have reached a compromise over OPEC+ oil policy, giving the UAE a higher production baseline, according to OPEC+ source. On the other hand, the gold price surged 0.05% to $1826.00 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (May) | 5.60% | 7.20% | – |

| 14:00 | GBP – Claimant Count Change (Jun) | -92.6K | – | – |

| 20:30 | USD – Initial Jobless Claims | 373K | 360K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | 30.7 | 28.3 | – |

Technical Analysis

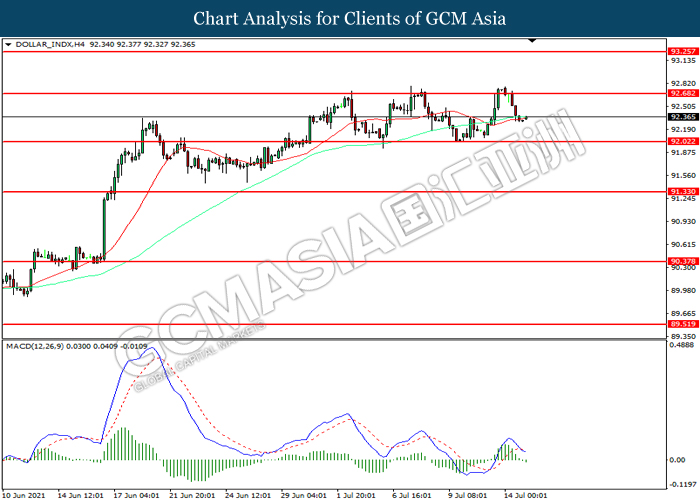

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 92.70. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 92.00.

Resistance level: 92.70, 93.25

Support level: 92.00, 91.35

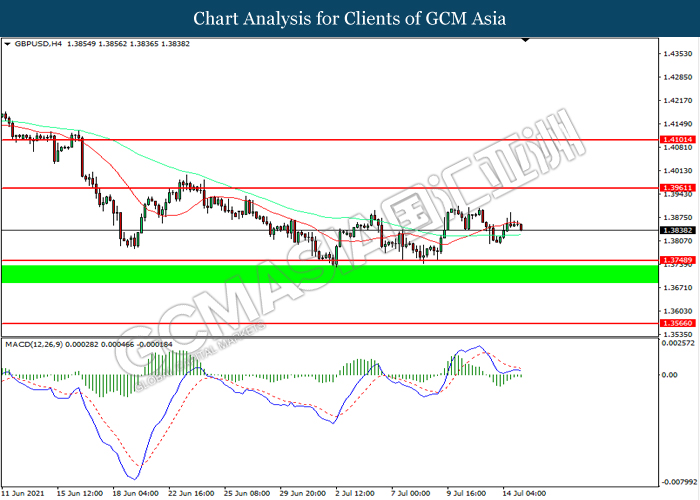

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3960. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3750.

Resistance level: 1.3960, 1.4100

Support level: 1.3750, 1.3565

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1850. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1850, 1.1955

Support level: 1.1725, 1.1635

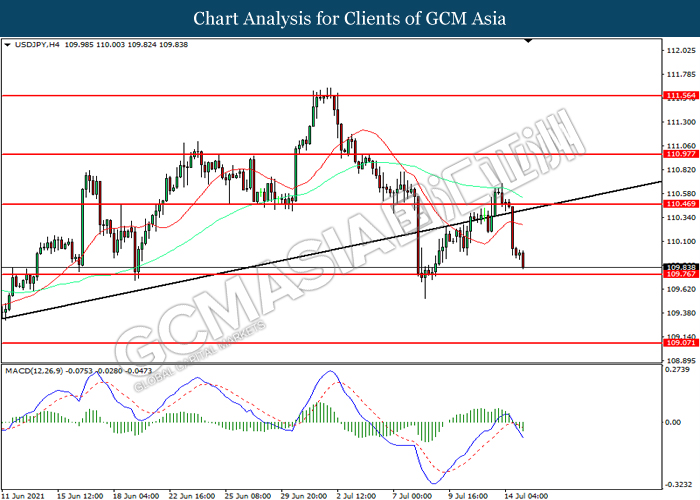

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 109.75. MACD which illustrated increasing bearish momentum suggest the pair to extend its loses after it successfully breakout below the support level.

Resistance level: 110.45, 110.95

Support level: 109.75, 109.05

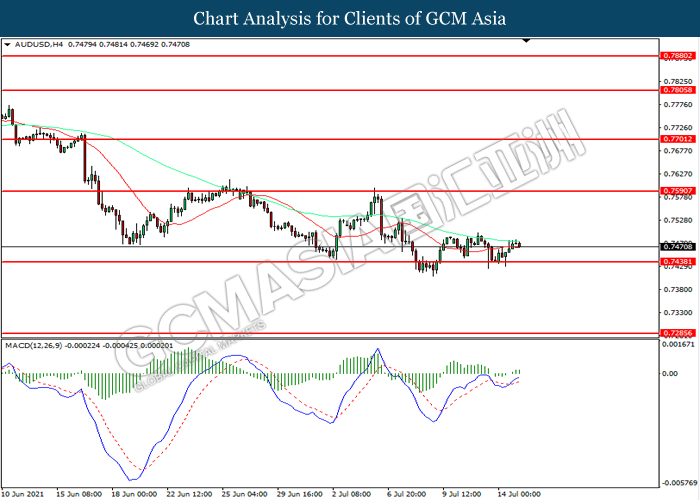

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7440. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7590.

Resistance level: 0.7590, 0.7700

Support level: 0.7440, 0.7285

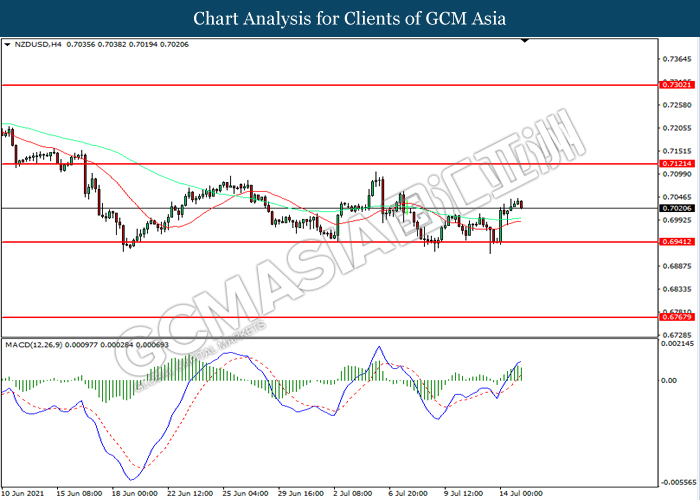

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6940. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7120.

Resistance level: 0.7120, 0.7305

Support level: 0.6940, 0.6770

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2440. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2585.

Resistance level: 1.2585, 1.2770

Support level: 1.2440, 1.2275

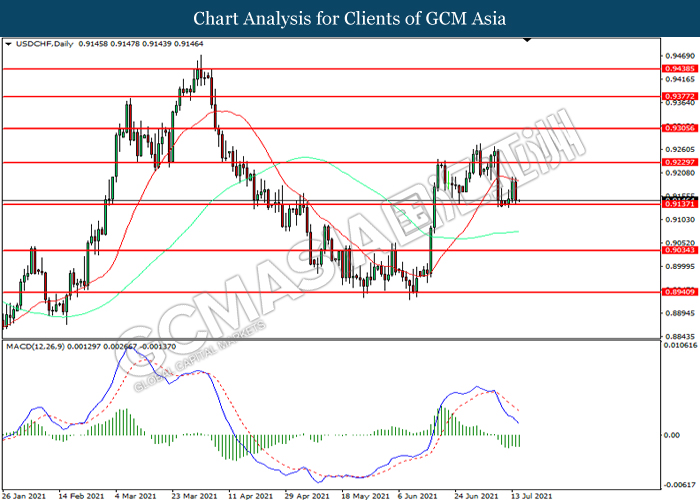

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9135. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9230, 0.9305

Support level: 0.9135, 0.9035

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 72.75. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 71.20.

Resistance level: 72.75, 74.60

Support level: 71.25, 68.70

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1832.25. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1832.25, 1851.85

Support level: 1813.05, 1788.95