15 September 2020 Afternoon Session Analysis

Dollar soft on vaccine hopes and deal.

The dollar index which traded against a basket of six major currency pairs have dipped following hopes for vaccine and deals from big corporate help improve market appetite. Following latest development on vaccine, AstraZeneca have resumes its COVID-19 vaccine clinical trials in U.K which is currency one of the most advanced in development. Besides that, other pharmaceutical company such Pfizer Inc and BioNTech Se also proposed to expand their Phase 3 COVID-19 vaccine trials. On top of that, market confidence also lifted by several multi-billion deals from major companies such as Nvidia. Nvidia is reported to acquire the UK-based computer chip designer Arm Holdings with the deal worth $40 billion while China’s ByteDance Tik Tok also purchased by Oracle. At the time of writing, dollar index slips 0.06% to 92.92.

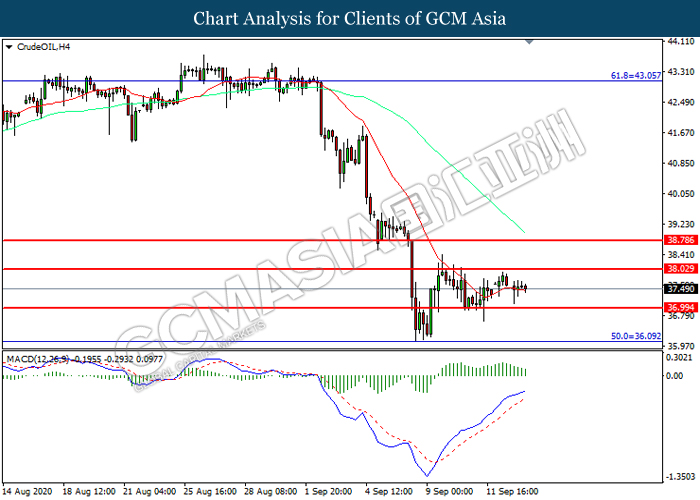

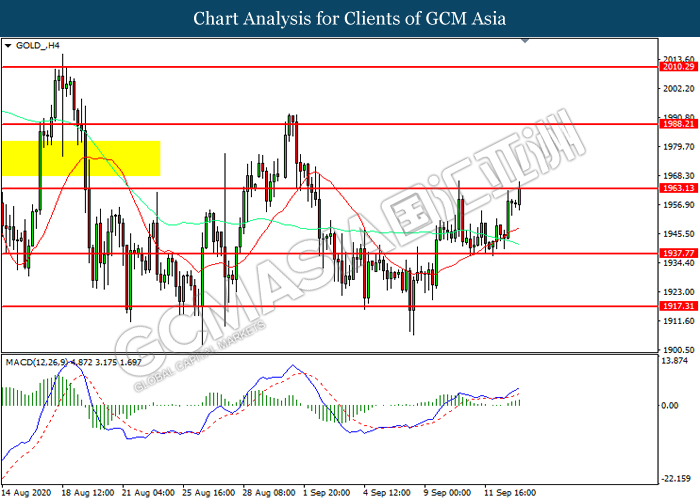

In the commodities market, crude oil price remains weak and inched lower 0.07% to $37.57 per barrel as of writing amid bleak demand outlook. Following latest report, major oil industry producers and traders are now forecasting a bleak future for global fuel demand due to ongoing coronavirus. Meanwhile, OPEC also downgrading its oil demand forecast on Monday. On the other hand, gold price slow regain its value and rose 0.41% to $1964.62 a troy ounce at the time of writing amid weakening dollar spurred demand for the commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index + Bonus (Jul) | -1.2% | -1.3% | – |

| 14:00 | GBP – Claimant Count Change (Aug) | 94.4K | 100.0K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Sep) | 71.5 | 69.8 | – |

| 04:30

(16th) |

CrudeOIL – API Weekly Crude Oil Stock | 2.9700M | – | – |

Technical Analysis

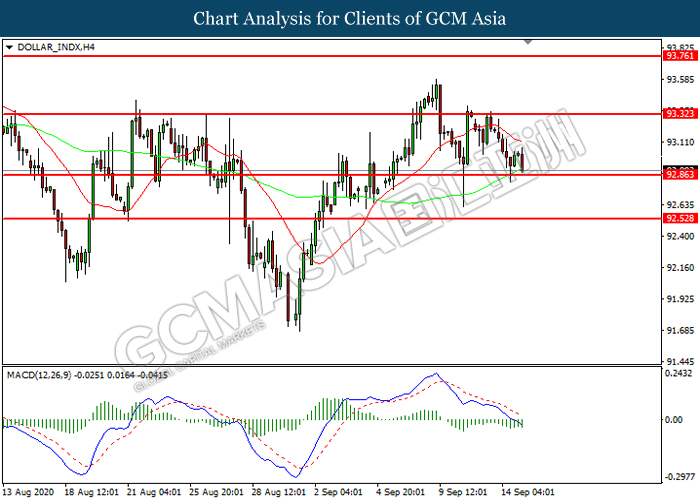

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 92.85. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 93.30, 93.75

Support level: 92.85, 92.55

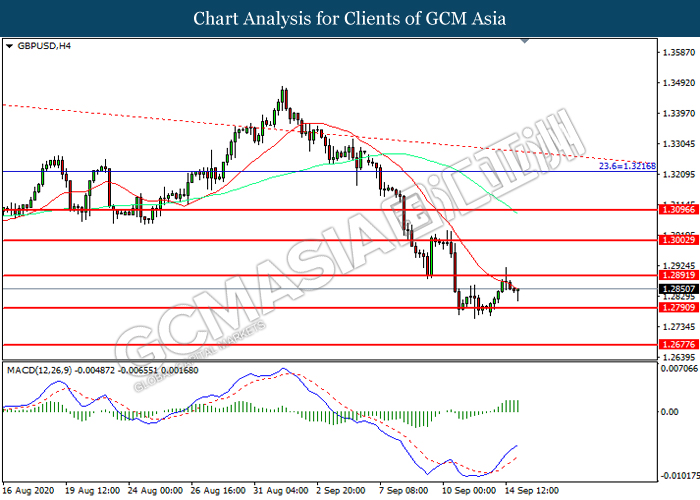

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2890. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2890, 1.3005

Support level: 1.2790, 1.2675

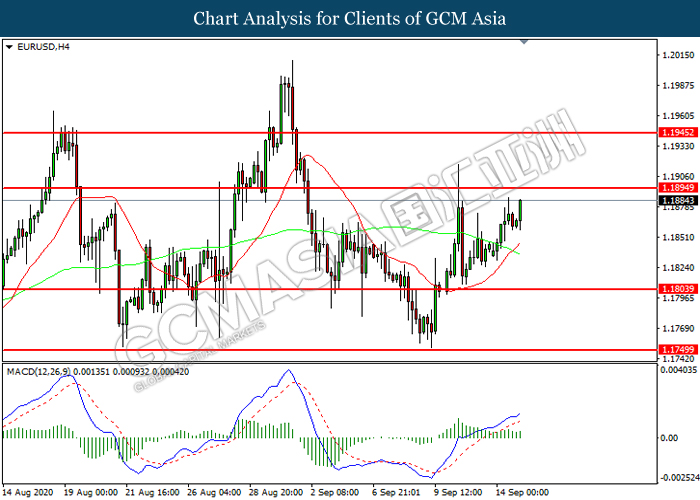

EURUSD, H4: EURUSD was traded higher while currently near the resistance level at 1.1895. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1895, 1.1945

Support level: 1.1805, 1.1750

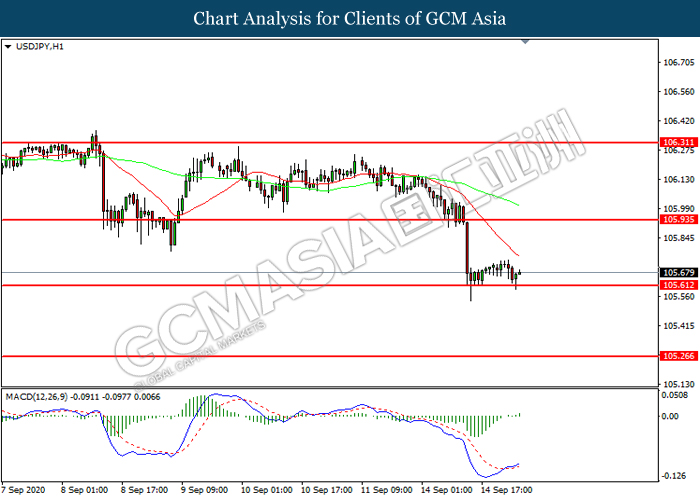

USDJPY, H1: USDJPY was traded lower while currently testing the support level at 105.60. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 105.95, 106.30

Support level: 106.60, 105.25

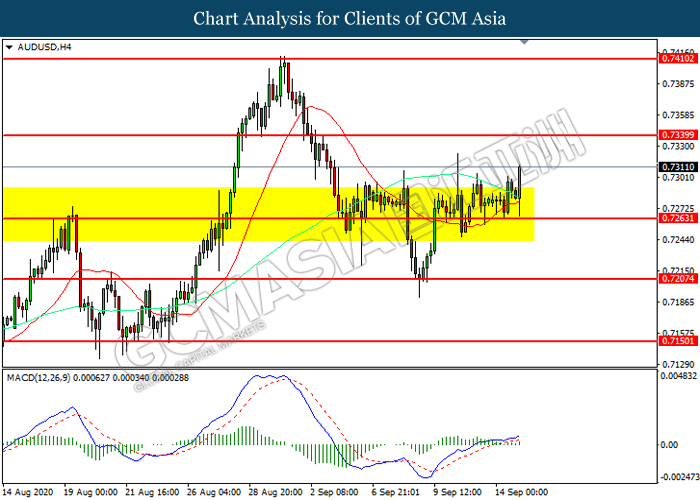

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7265. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7340.

Resistance level: 0.7340, 0.7410

Support level: 0.7265, 0.7205

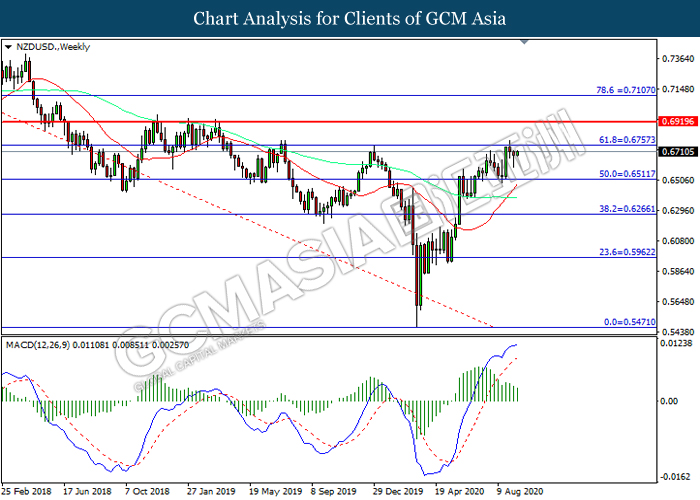

NZDUSD, Weekly: NZDUSD was traded higher while currently testing the resistance level at 0.6755. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6755, 0.6920

Support level: 0.6510, 0.6265

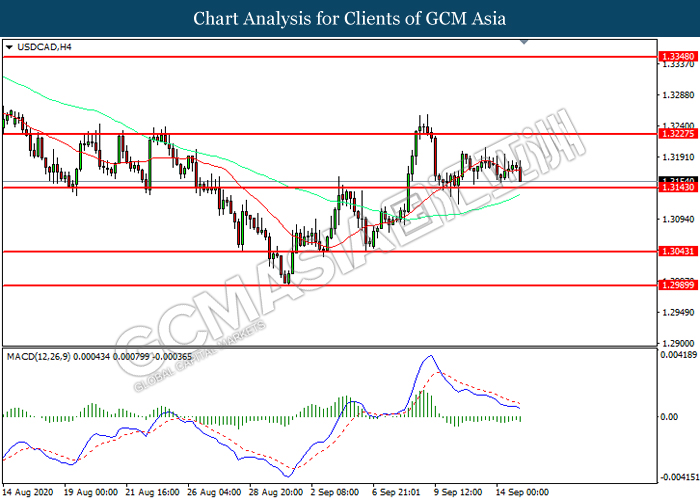

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3145. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3225, 1.3350

Support level: 1.3145, 1.3045

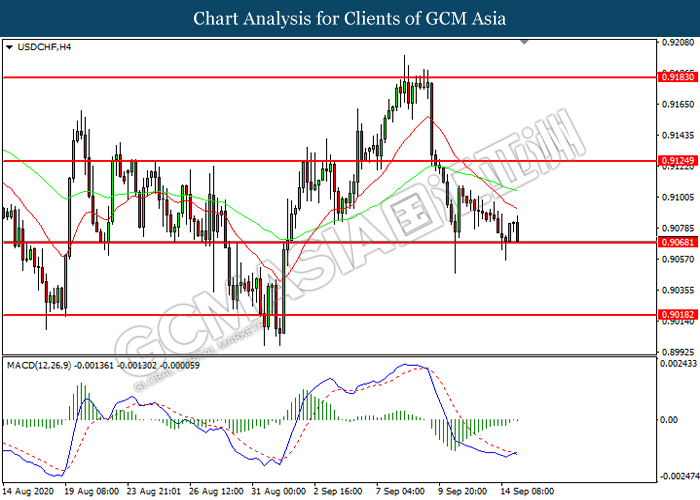

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9070. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9125, 0.9185

Support level: 0.9070, 0.9020

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 38.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 37.00.

Resistance level: 38.05, 38.80

Support level: 37.00, 36.10

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1963.15. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1963.15, 1988.20

Support level: 1937.75, 1917.30