15 September 2020 Morning Session Analysis

Pound steadied following Johnson won in the key Brexit vote.

Pound sterling which acts as the a major currency in FX market managed to hold its ground after UK Prime Minister won an initial Parliamentary vote to violate the Brexit deal with European Union. Earlier today, the plan of Boris Johnson to breach the Brexit treaty was supported by the majority of the parliamentary members with 340 against 263 votes. This so called Johnson’s bill is perceived as a threat by EU, where it might collapse the trade talks and urge a messy Brexit at the end. However, Boris Johnson disagreed with EU statement while emphasizing that the bill was essential to counter the unfair treatment from EU such as trade barrier between Britain and Northern Ireland and imposed a food blockade. In order to strive for a better future, UK have to remain its hard stance in negotiating the deal with EU, while showing no tolerance toward the EU party. Prior to now, both parties reiterated that they must achieve a deal before the month of October and that if not, no deal Brexit will has the highest probability to be faced by UK. As of writing, the pair of GBP/USD rose 0.04% to 1.2849.

In the commodities market, crude oil price rebounded by 0.30% to $37.35 per barrel after falling for more than 3% yesterday amid OPEC’s bearish outlook toward the future outlook of this black commodity market. According to CNBC, OPEC has slashed the forecast of oil demand growth for this year by 400K bpd as compare to the previous month’s estimate. Besides, gold price surged by 0.05% to $1956.50 per troy ounce amid resurgence of Covid-19 lifted up the favourability of safe haven asset such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index + Bonus (Jul) | -1.2% | -1.3% | – |

| 14:00 | GBP – Claimant Count Change (Aug) | 94.4K | 100.0K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Sep) | 71.5 | 69.8 | – |

| 04:30

(16th) |

CrudeOIL – API Weekly Crude Oil Stock | 2.9700M | – | – |

Technical Analysis

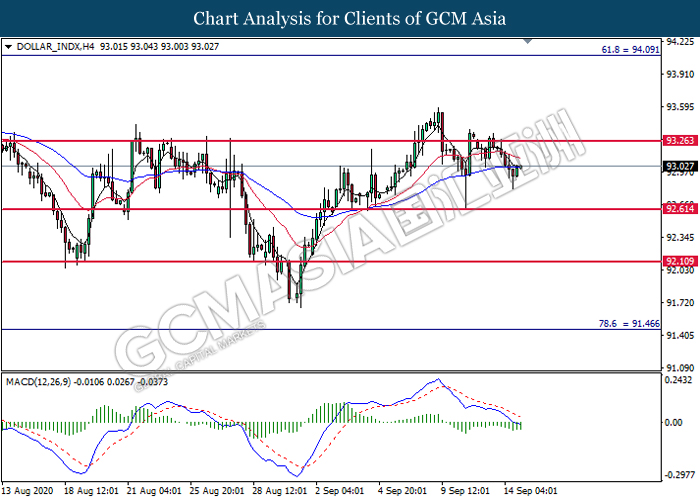

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 93.25. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 92.60.

Resistance level: 93.25, 94.10

Support level: 92.60, 92.10

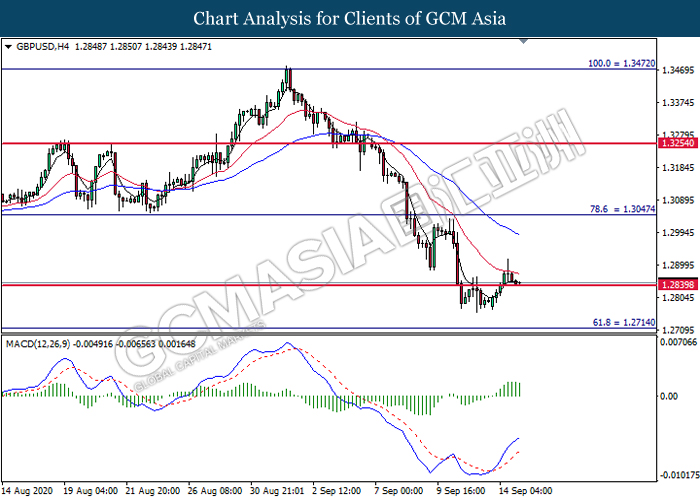

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2840. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2840.

Resistance level: 1.3045, 1.3255

Support level: 1.2840, 1.2715

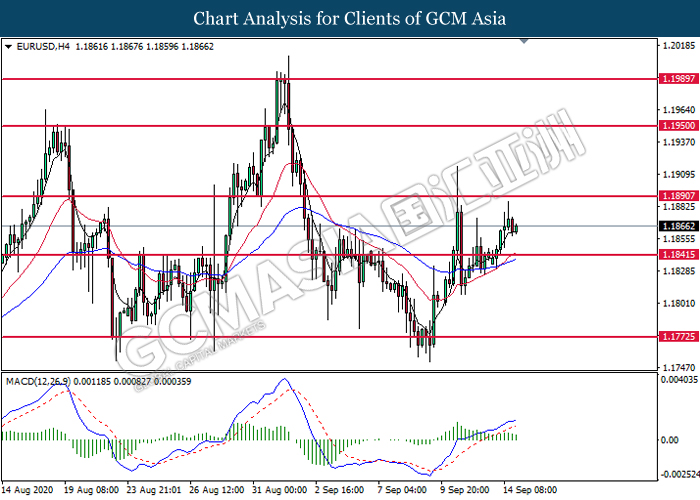

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1840. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.1890.

Resistance level: 1.1890, 1.1950

Support level: 1.1840, 1.1775

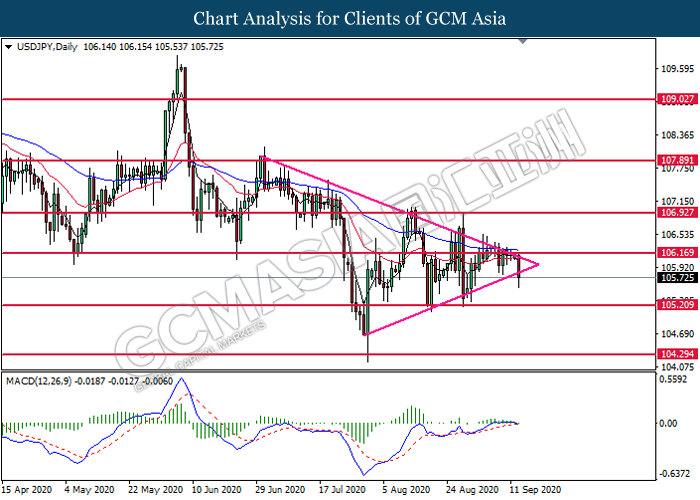

USDJPY, Daily: USDJPY was traded lower while currently testing the bottom level of the triangle. MACD which illustrates diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the triangle’s bottom level.

Resistance level: 106.15, 106.95

Support level: 105.20, 104.30

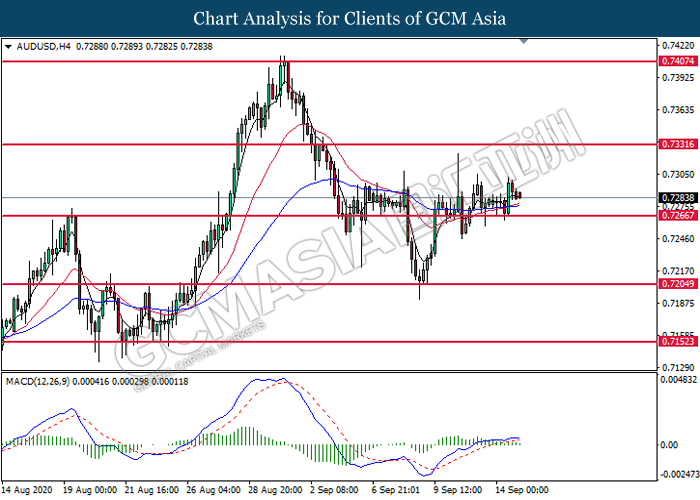

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.7265.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

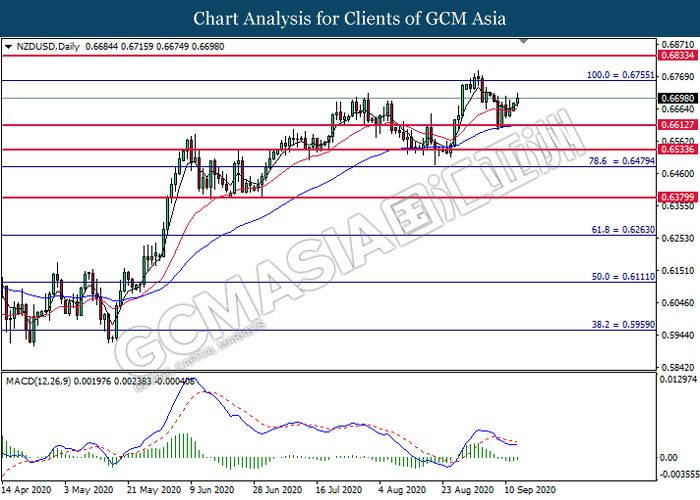

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6615. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6755.

Resistance level: 0.6755, 0.6835

Support level: 0.6615, 0.6535

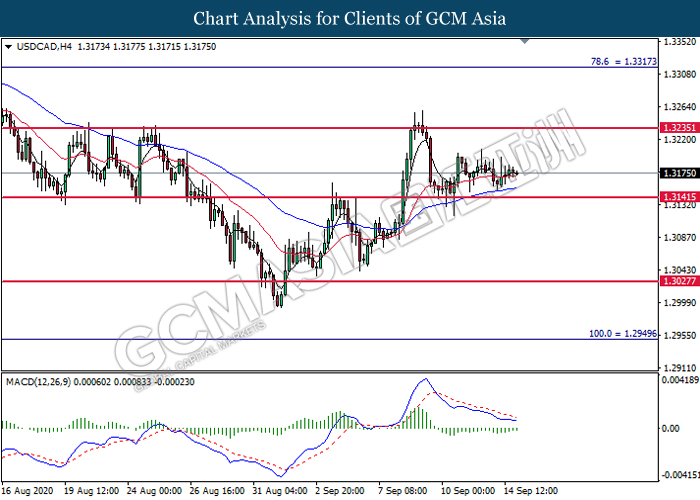

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3140. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3235.

Resistance level: 1.3235, 1.3315

Support level: 1.3140, 1.3030

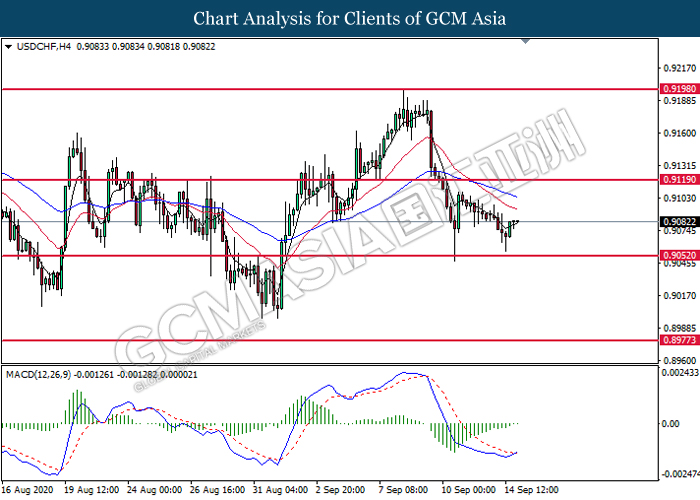

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9050. MACD which illustrates diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9120.

Resistance level: 0.9120, 0.9200

Support level: 0.9050, 0.8970

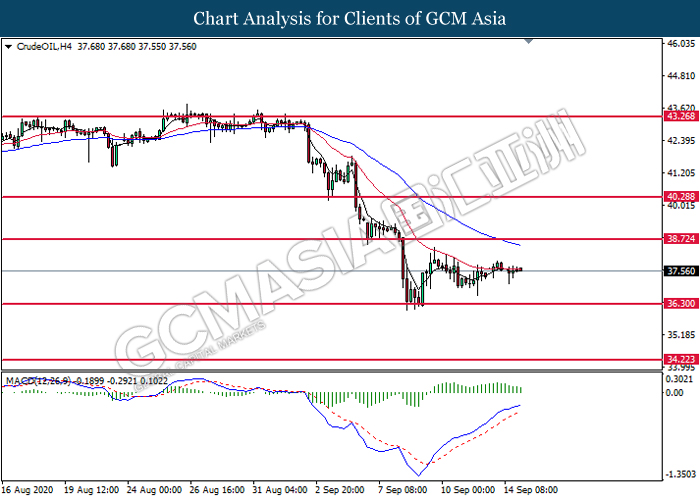

CrudeOIL, H4: Crude oil price was traded flat near the 20 moving average line (Red). MACD which illustrate diminishing bullish momentum suggest the commodity to undergo technical correction toward the support level at 36.30.

Resistance level: 38.70, 40.30

Support level: 36.30, 34.20

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1926.40. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 2069.75.

Resistance level: 2069.75, 2147.50

Support level: 1926.40, 1761.65