16 January 2023 Afternoon Session Analysis

Pound Sterling surged despite of economy recession problems.

The GBP/USD, which traded widely by global investors rose significantly on Friday although the UK economy still face some challenges of recession. According to Office for National Statistics, the UK Gross Domestic Product (GDP) YoY has notched down from the previous reading of 1.5% to 0.2%, which lower than the consensus forecast of 0.3%. Besides that, the UK Manufacturing Production MoM also declined in November, whereas indicating that a contraction in the manufacturers output. However, Pound Sterling has found favour with investors over the slump of US Dollar. Last week, the US inflation rate has decreased by -0.1% in December, while it sparked the hopes of lower rate hikes by Fed in the February meeting. On the other hand, the overall trend of EUR/USD remained upward following the hawkish statement from European Central Bank member. According to Reuters, ECB policymaker Pablo Hernandez de Cos claimed on last week that the ECB would likely to continue hiking its interest rate aggressively to cool down inflation to the 2% target over the medium term. As of writing, the GBP/USD appreciated by 0.37% to 1.2274, as well as EUR/USD rallied by 0.31% to 1.0862.

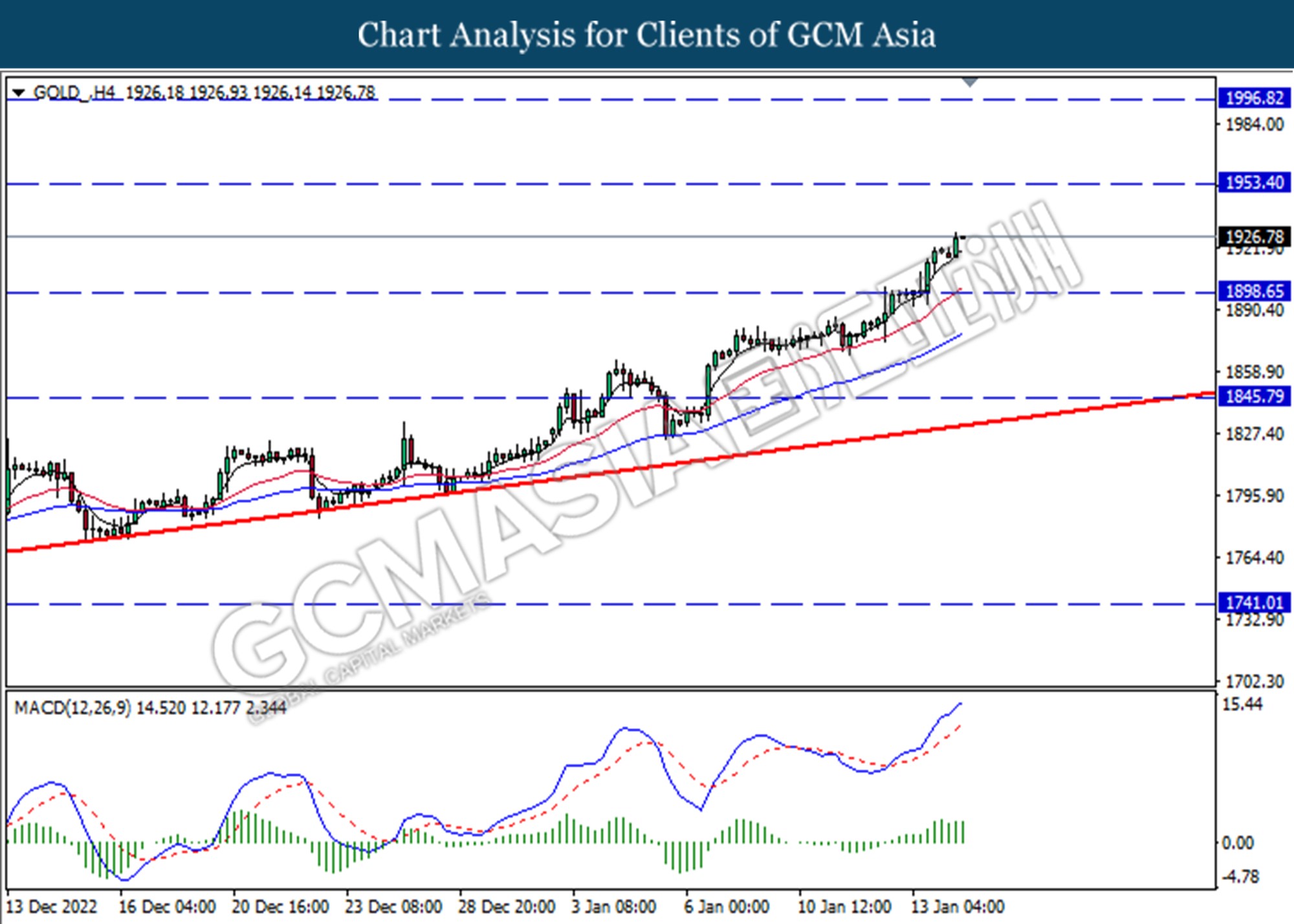

In the commodities market, the crude oil price dropped by 0.76% to $79.50 per barrel as of writing as traders stay cautions against the OPEC monthly forecast report. In addition, the gold price jumped by 0.32% to $1924.99 per troy ounce as of writing amid the depreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD Martin Luther King, Jr. Day

Today’s Highlight Events

Time Market Event

23:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – German ZEW Economic Sentiment (Jan) | -23.3 | -15.5 | – |

Technical Analysis

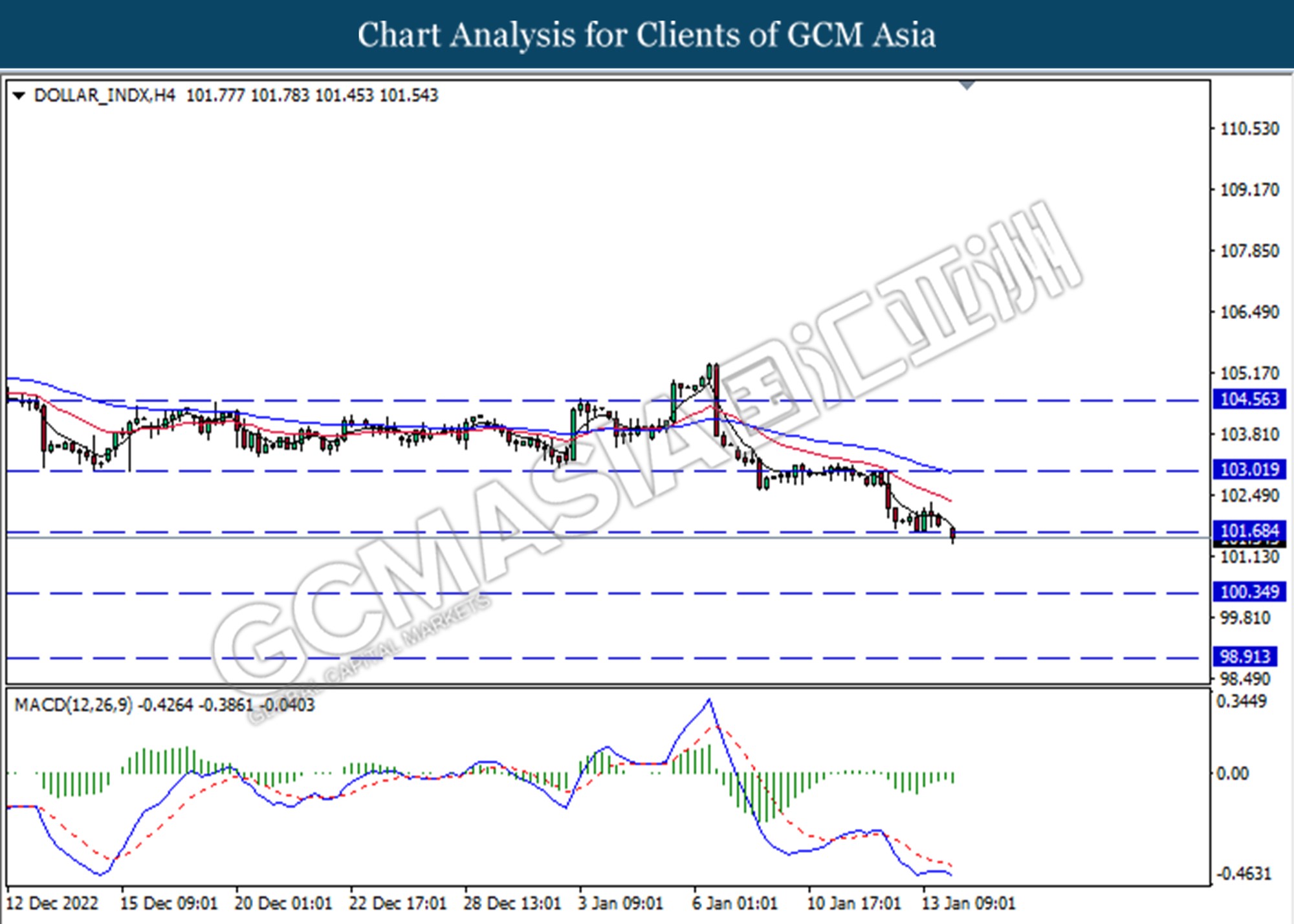

DOLLAR_INDX, H4: Dollar index was traded lower following a prior breakout below the support level at 101.65. MACD which illustrated increasing in bearish momentum suggested the index will extend it losses toward support at 100.35.

Resistance level: 101.65, 103.00

Support level : 100.35, 98.90

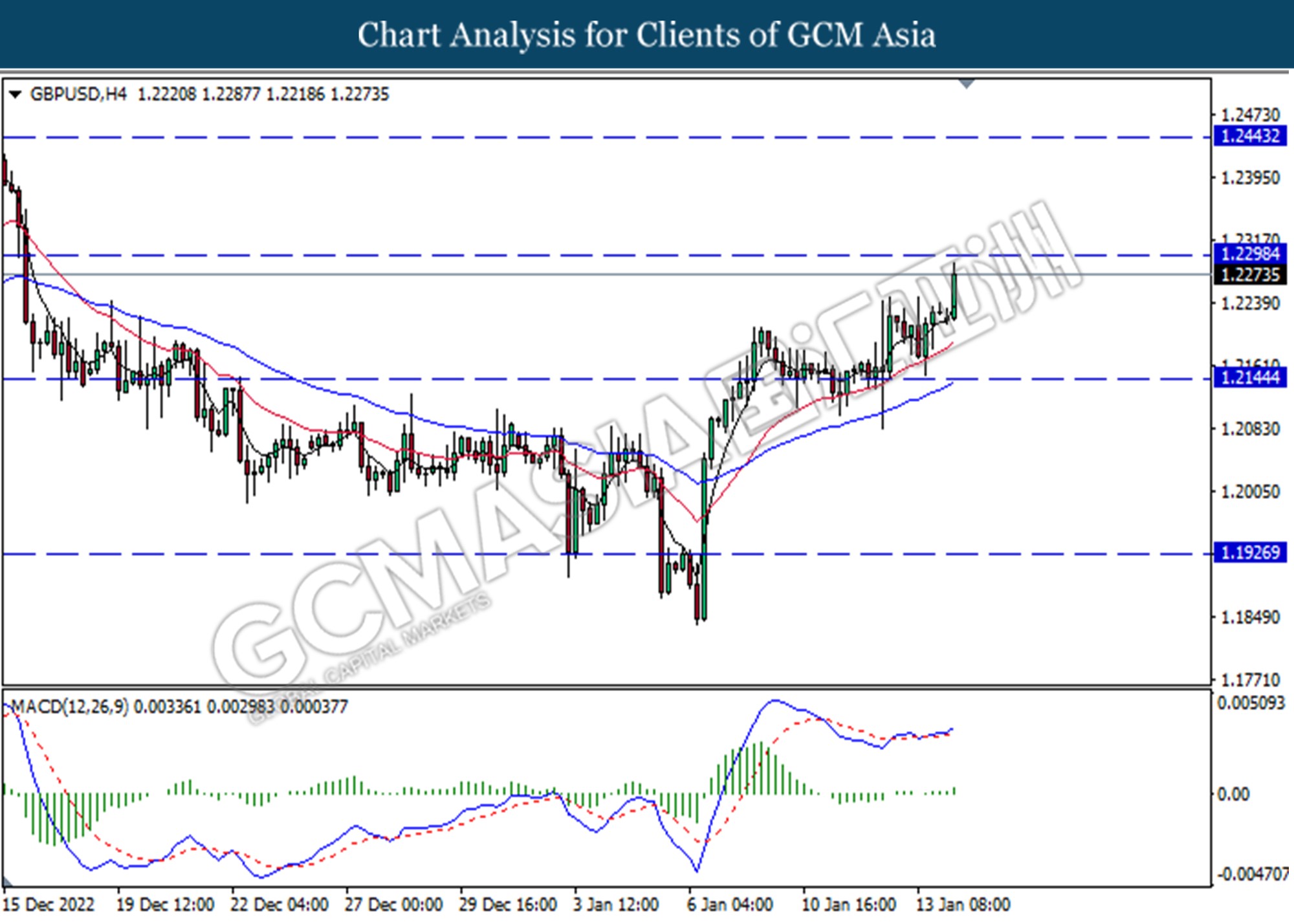

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the support level, MACD which illustrated increasing in bullish momentum suggested the pair will extend its gain toward resistance level at 1.2300.

Resistance level: 1.2300, 1.2445

Support level : 1.2145, 1.1925

EURUSD, H4: EURUSD was traded higher following a prior rebound from support level. MACD which illustrated diminishing in bearish momentum suggested the pairs extend its goal toward resistance at 1.0935.

Resistance level: 1.0935, 1.1070

Support level : 1.0785, 1.0635

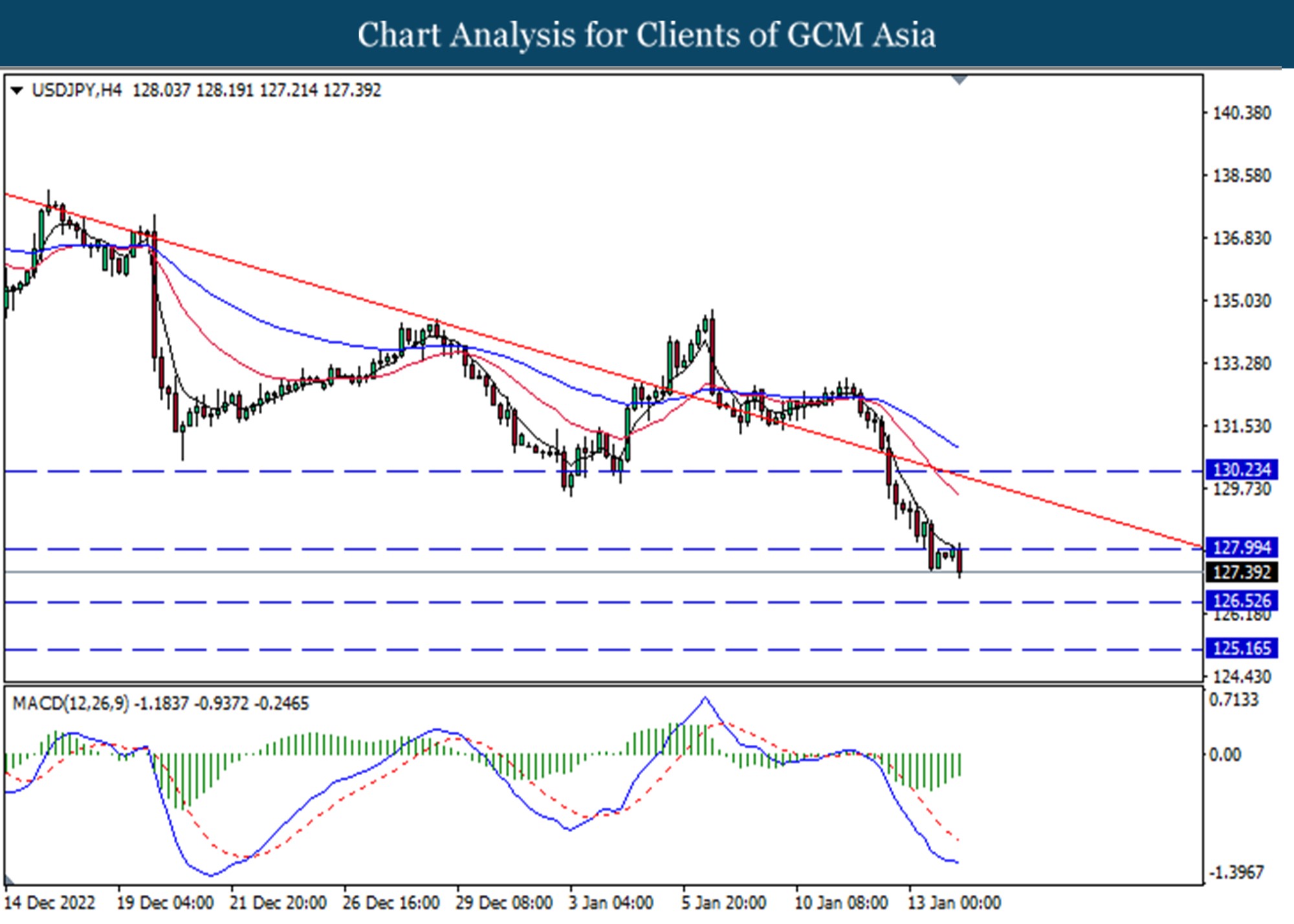

USDJPY, H4: USDJPY was traded lower following a prior break below the previous support level. However, MACD which illustrated reducing in bearish momentum suggested the pairs undergo a technical correction in short term.

Resistance level: 128.00, 130.25

Support Level: 126.50, 125.15

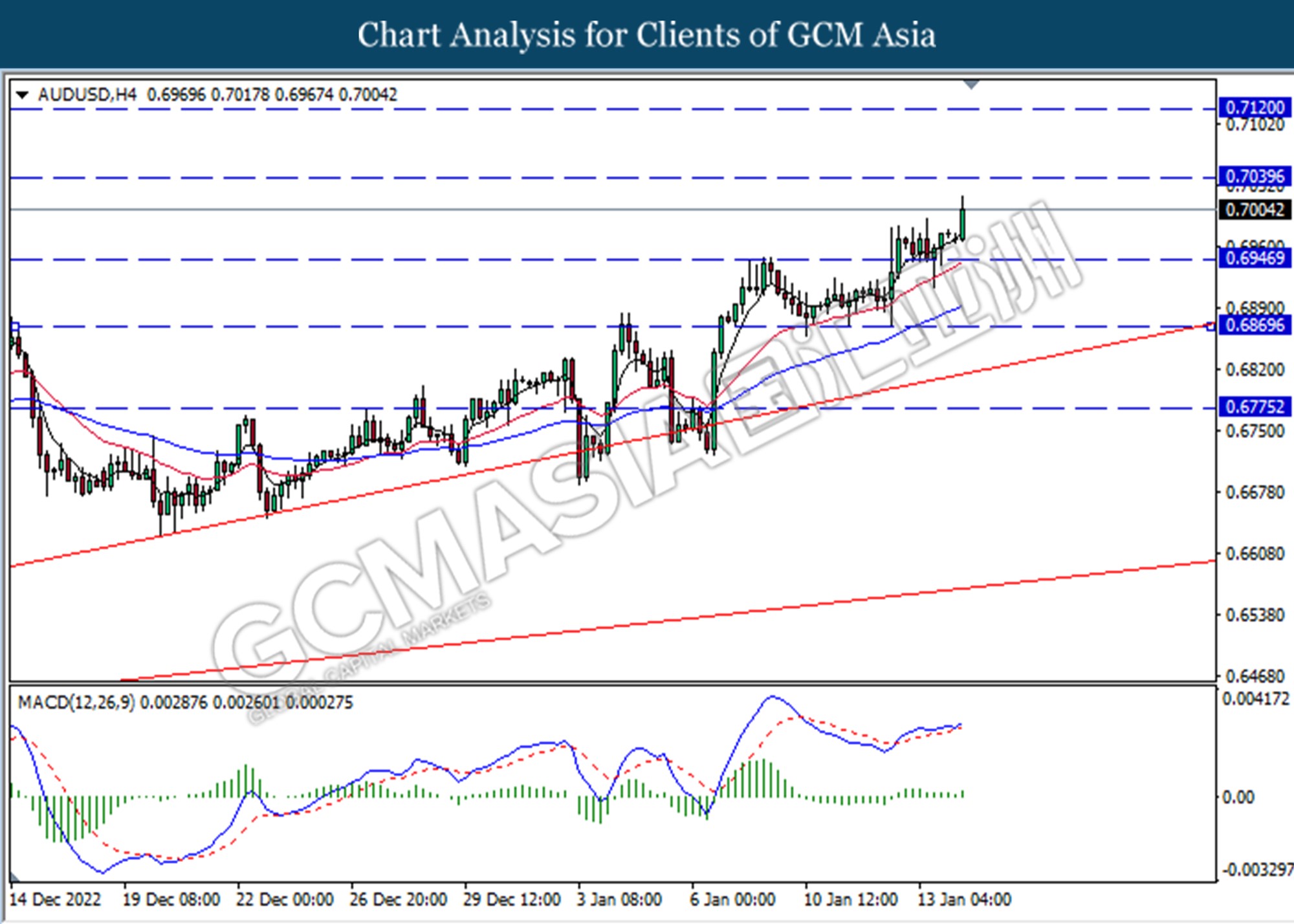

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the support level. MACDH which illustrated increasing in bullish momentum suggested the pair will extend its gain toward resistance level at 0.7035

Resistance level: 0.7035, 0.7120

Support level : 0.6945, 0.6870

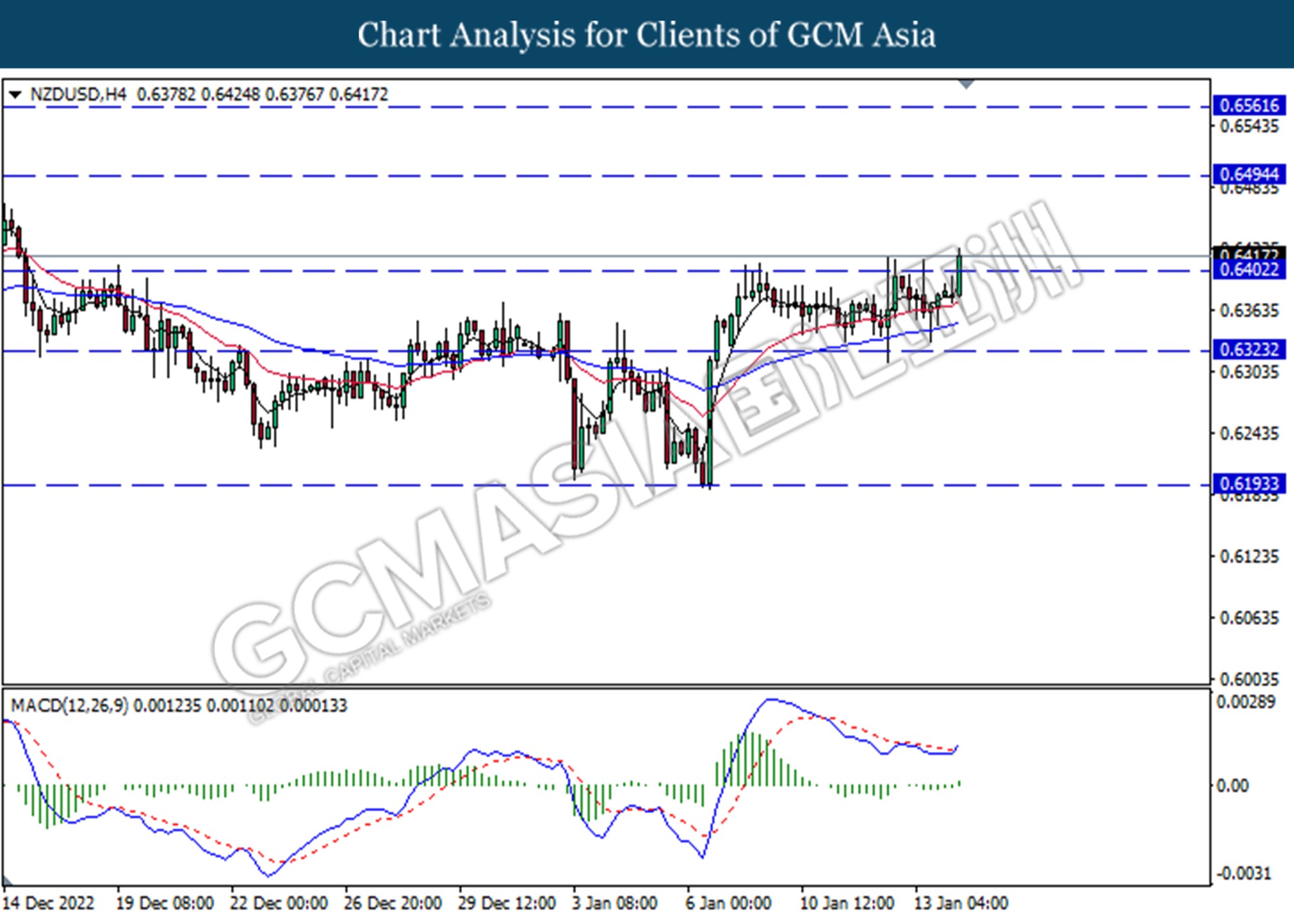

NZDUSD, H4: NZDUSD was traded higher following a prior break above the previous resistance level at 0.6495. MACD which illustrated increasing in bullish momentum suggested the pairs will extend its gain toward resistance level at 0.6495.

Resistance level: 0.6495, 0.6560

Support level : 0.6400, 0.6320

USDCAD, H4: USDCAD was traded lower following retracement from resistance level. MACD which illustrated decreasing in bullish momentum suggested the pair will extend its losses toward support level at 1.3325

Resistance level: 1.3420, 1.3515

Support level : 1.3325, 1.3250

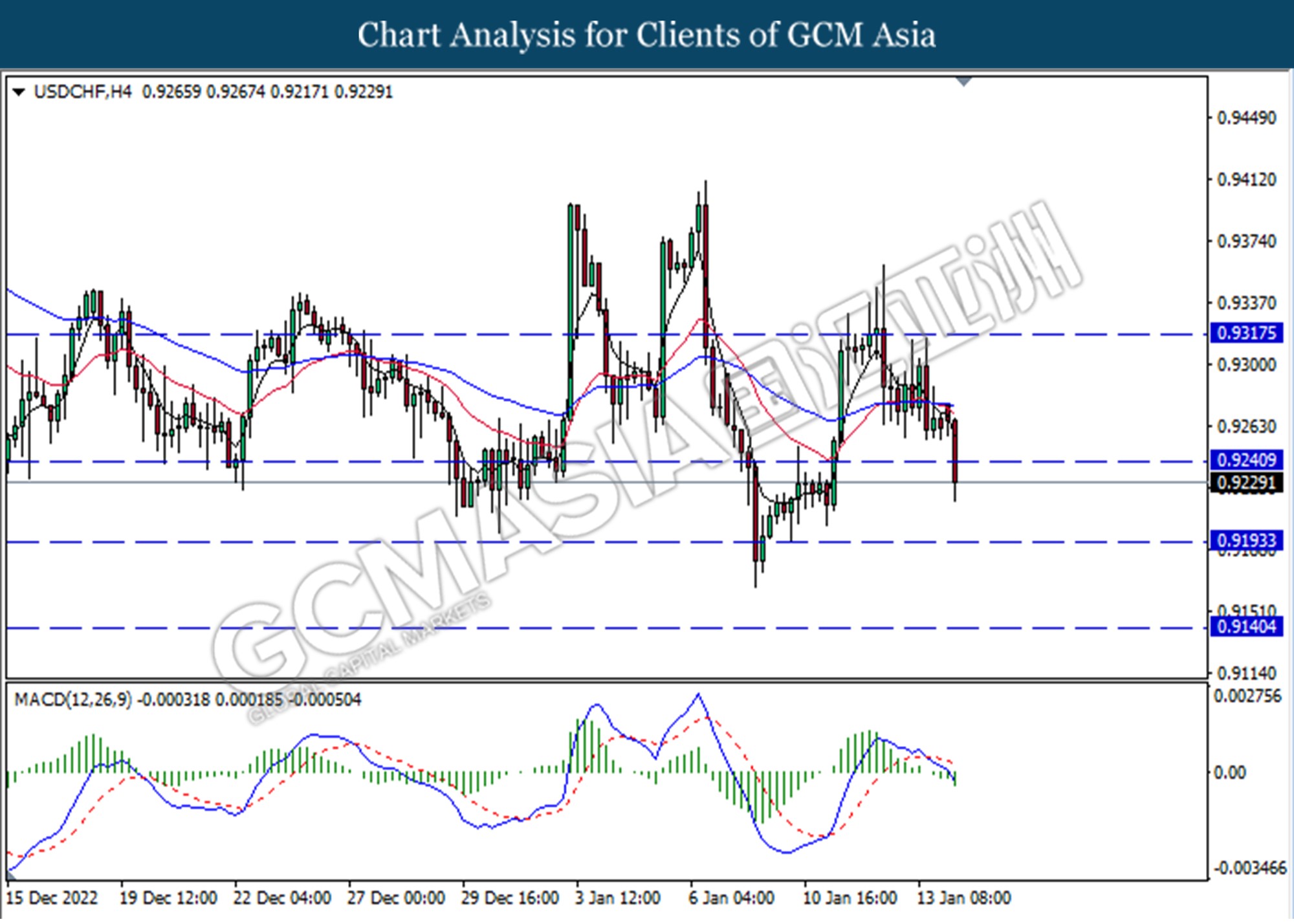

USDCHF, H4: USDCHF was traded lower following a prior break below the support level. MACD which illustrated increasing in bearish momentum suggested the pair extend its losses toward support level at 0.9120

Resistance level: 0.9240, 0.9315

Support level: 0.9195, 0.9140

CrudeOIL, Daily: Crude oil was traded lower following a prior retracement from the downward trend line. MACD which illustrated bullish bias momentum suggested the commodity undergo technical correction in short term.

Resistance level: 81.60, 89.00

Support level : 76.05, 70.25

GOLD_ ,H4: Gold was traded higher following a prior break above the previous resistance level. MACD which illustrated bullish bias momentum suggested the commodity will extend its gains toward the resistance level at 1953.40.

Resistance level: 1953.40, 1996.80

Support level: 1898.65, 1845.80