16 July 2021 Afternoon Session Analysis

Pound slips amid coronavirus woes.

The pound sterling which traded against the dollar and other currency pairs have slip following increasing new cases of coronavirus in the U.K. According to statistics from the British government, a total of 48,553 new Covid-19 cases has been recorded in the UK yesterday, an increase of 36.2% from the previous month. The U.K trade union said that due to the shortage of workers caused by coronavirus infection, the U.K government should tighten restrictions and implement lockdowns again. They also pointed out that due to lack of manpower, some companies had to pay up to three times the salary to make up for overtime. Although the number of cases in the UK has increased significantly, the U.K government insists that all social imprisonment standards will be relaxed on July 19 which have triggered further concern of another potential outbreak. At the time of writing, GBP/USD fell 0.04% to 1.3826.

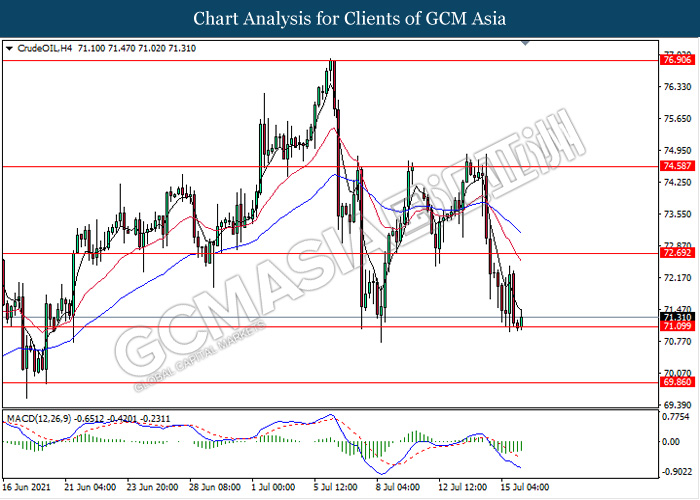

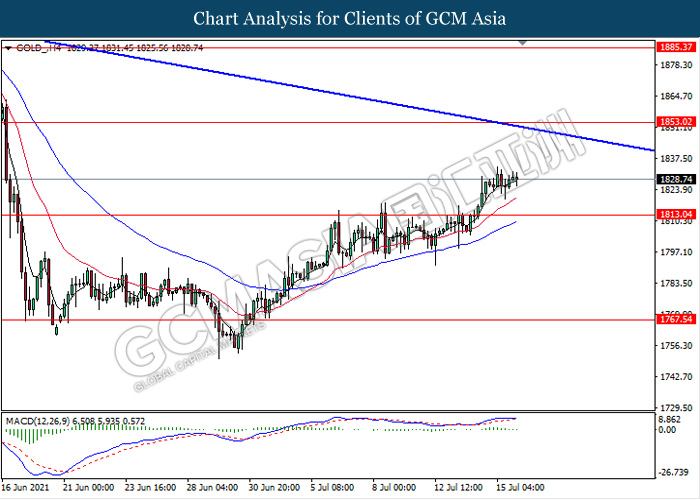

In the commodities market, crude oil price remains pressured and fell 0.11% to $71.30 per barrel as of writing following Delta coronavirus outbreak. The fast-spreading delta variant has swept across the globe, leading to renewed restrictions and crimping fuel demand. Southeast Asia’s largest economy, Indonesia have surpassed India in new daily cases this week, cementing its position as Asia’s new virus epicenter, while several of its neighbors are also seeing record case numbers. On the other hand, gold price retreat 0.06% to $1828.28 a troy ounce at the time of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

11:00 JPY BoJ Outlook Report (YoY)

11:00 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jun) | 1.90% | 1.90% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Jun) | -0.70% | 0.50% | – |

| 20:30 | USD – Retail Sales (MoM) (Jun) | -1.30% | -0.40% | – |

Technical Analysis

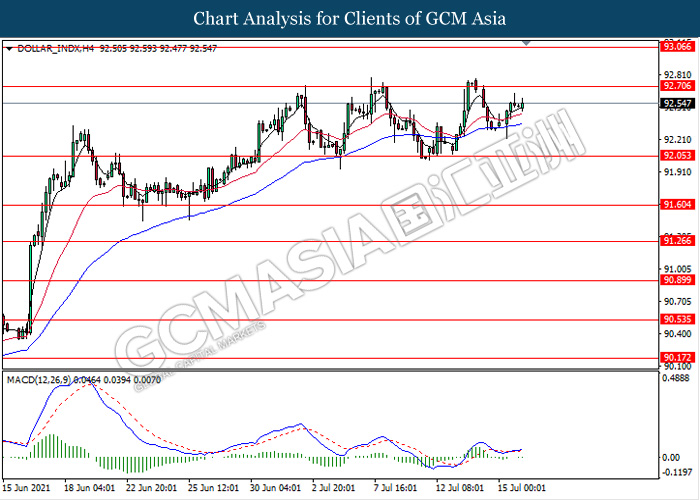

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near the resistance level 92.70. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the dollar to extend its gains after it breaks above the resistance level.

Resistance level: 92.70, 93.05

Support level: 92.05, 91.60

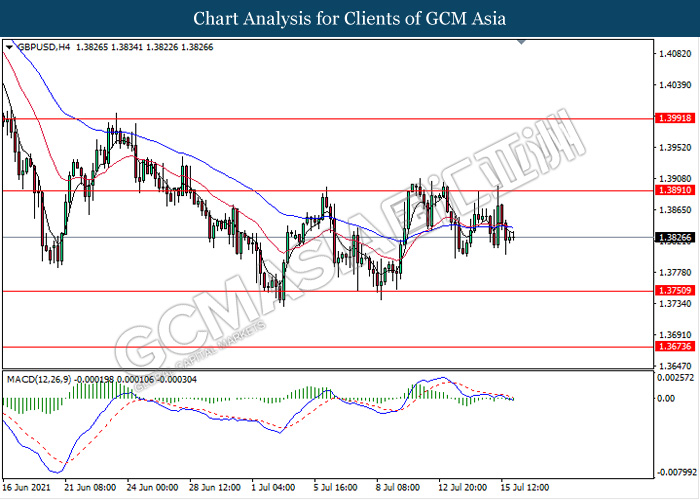

GBPUSD, H4: GBPUSD was traded lower following recent retracement from the resistance level 1.3890. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 1.3750.

Resistance level: 1.3890, 1.3990

Support level: 1.3750, 1.3675

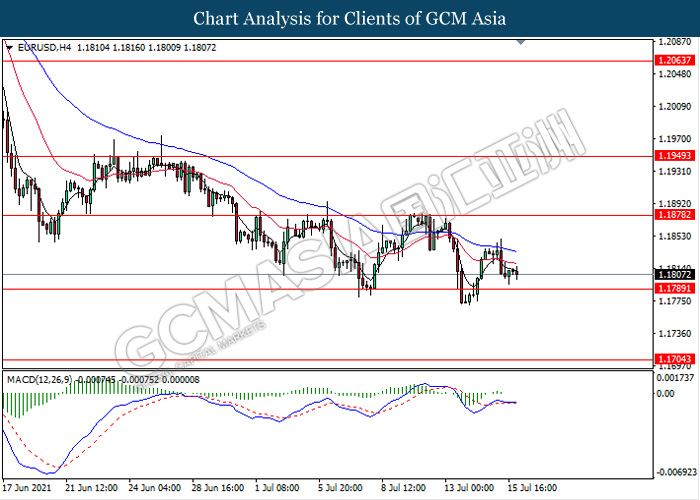

EURUSD, H4: EURUSD was traded lower while currently testing near the support level 1.1790. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1880, 1.1950

Support level: 1.1790, 1.1705

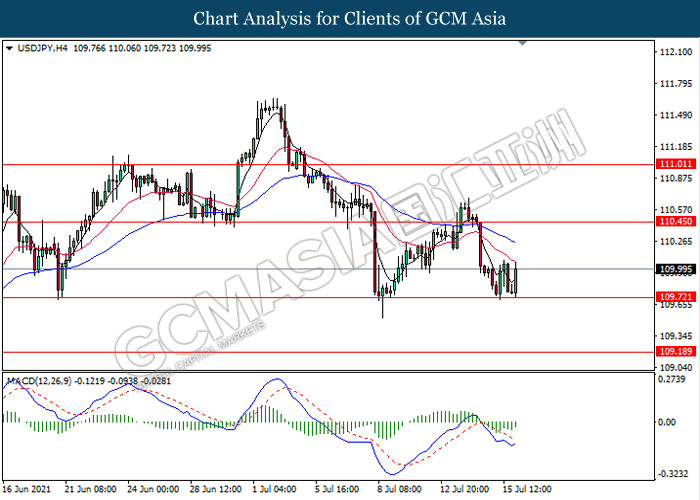

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 109.70. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 110.45.

Resistance level: 110.45, 111.00

Support level: 109.70, 109.20

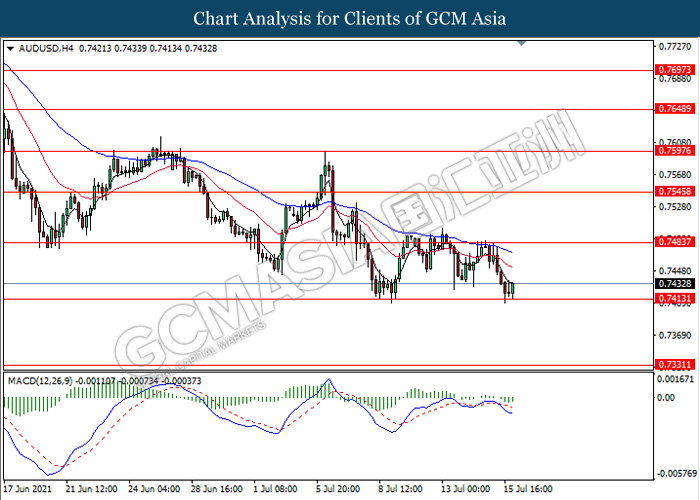

AUDUSD, H4: AUDUSD was traded lower while currently testing near the support level 0.7415. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7485, 0.7545

Support level: 0.7415, 0.7330

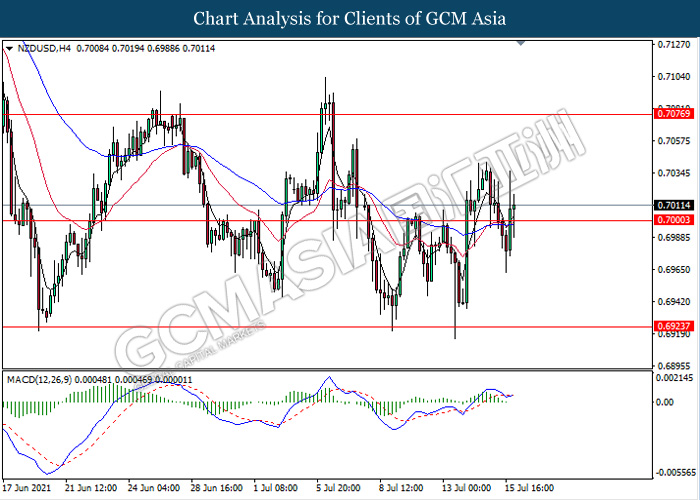

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the resistance level 0.7000. MACD which illustrate bullish bias signal suggest the pair to extend its gains towards the resistance level 0.7075.

Resistance level: 0.7075, 0.7135

Support level: 0.7005, 0.6925

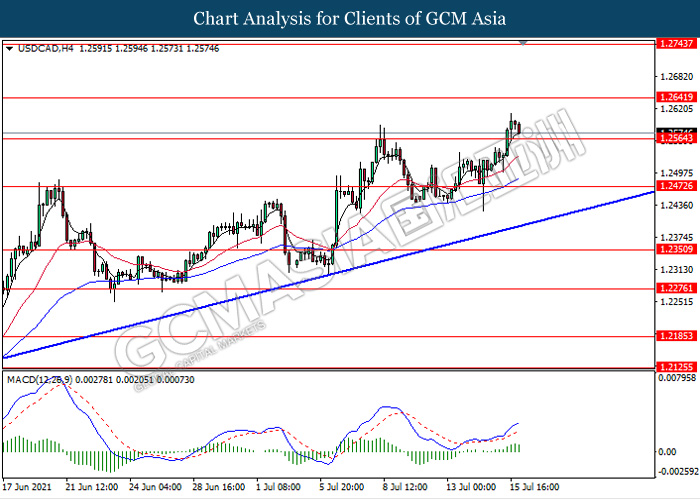

USDCAD, H4: USDCAD was traded lower while currently testing the support level 1.2565. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.2640, 1.2735

Support level: 1.2565, 1.2470

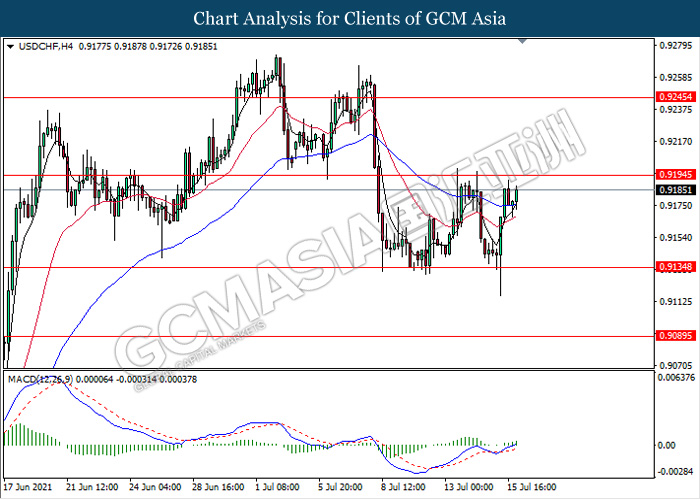

USDCHF, H4: USDCHF was traded higher while currently testing near the resistance level 0.9195. MACD which illustrate bullish bias signal suggest the pair to extend its gains after it breaks above the resistance level 0.9195.

Resistance level: 0.9195, 0.9245

Support level: 0.9135, 0.9090

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level 71.10. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 72.70, 74.60

Support level: 71.10, 69.85

GOLD_, H4: Gold price was traded higher following recent breakout above the previous resistance level 1813.05. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to be traded lower as a technical correction back towards the level 1813.05.

Resistance level: 1853.00, 1885.35

Support level: 1813.05, 1767.55.