16 July 2021 Morning Session Analysis

Dollar surged amid upbeat job data.

The Dollar Index which traded against a basket of six major currency pairs surged over the backdrop of upbeat job data from United States yesterday, which spurring positive prospect toward the economic momentum in United States while increasing market demand on the US Dollar. According to Department of Labor, the U.S. Initial Jobless Claims had declined significantly from the previous reading of 386K to 360K, indicating that the numbers of Americans filing new claims for unemployment benefits had declined as labor market in United States recovered. Nonetheless, the gains experienced by the US Dollar was limited following negative manufacturing data was released. According to Federal Reserve Bank of Philadelphia, U.S. Philadelphia Fed Manufacturing Index declined significantly from the previous reading of 30.7 to 21.9, worse than the market forecast at 28.0. As of writing, the Dollar Index appreciated by 0.04% to 92.55.

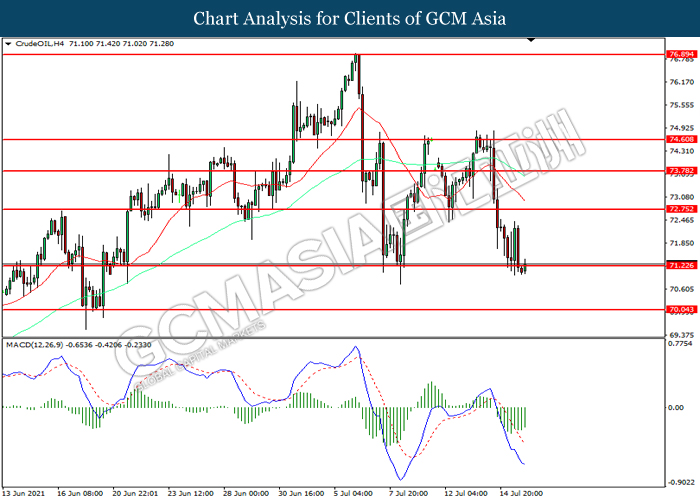

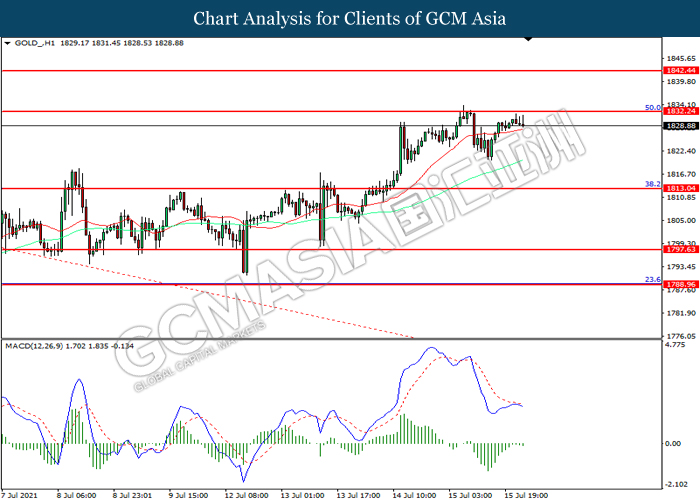

In the commodities market, the crude oil price slumped 0.05% to $72.20 per barrel as of writing amid spiking numbers of Delta variant in the world had diminished the market demand on this black commodity. Nonetheless, investors would continue to scrutinize the latest updates with regards of Covid-19 development in order to gauge the likelihood movement for the crude oil. On the other hand, the gold price slumped 0.04% to $1829.85 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

11:00 JPY BoJ Outlook Report (YoY)

11:00 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jun) | 1.90% | 1.90% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Jun) | -0.70% | 0.50% | – |

| 20:30 | USD – Retail Sales (MoM) (Jun) | -1.30% | -0.40% | – |

Technical Analysis

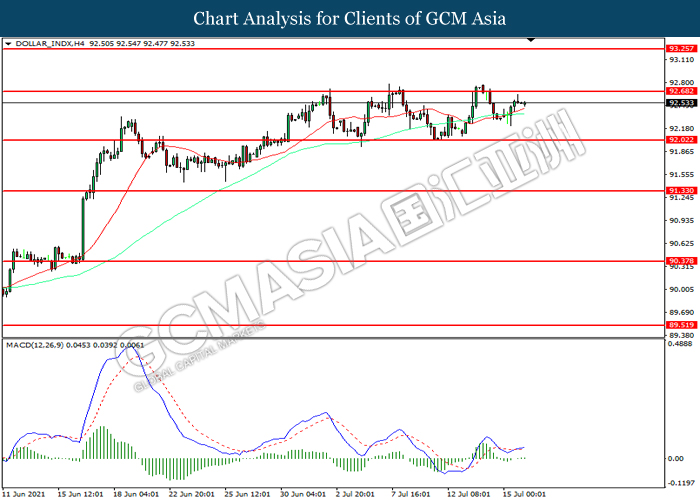

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 92.70. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 92.70, 93.25

Support level: 92.00, 91.35

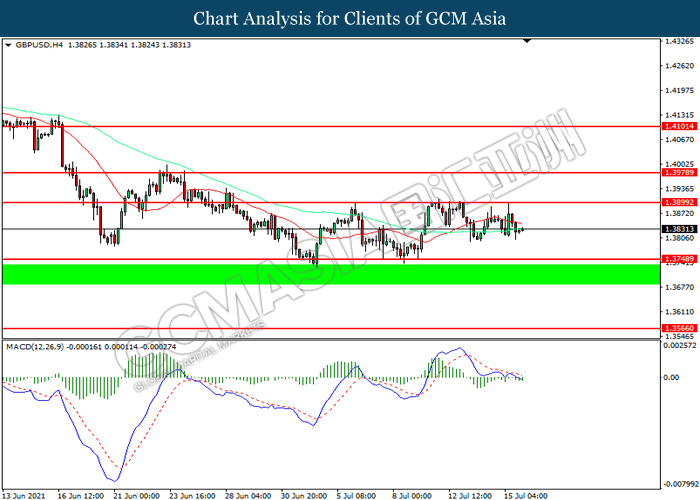

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3900. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3750.

Resistance level: 1.3900, 1.3980

Support level: 1.3750, 1.3565

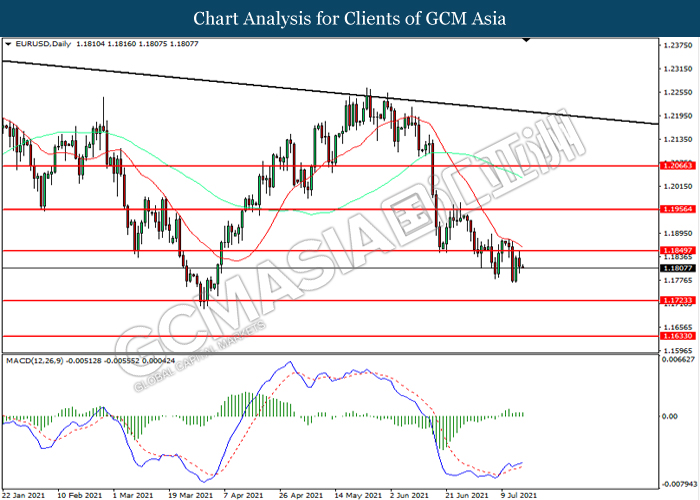

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1850. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1850, 1.1955

Support level: 1.1725, 1.1635

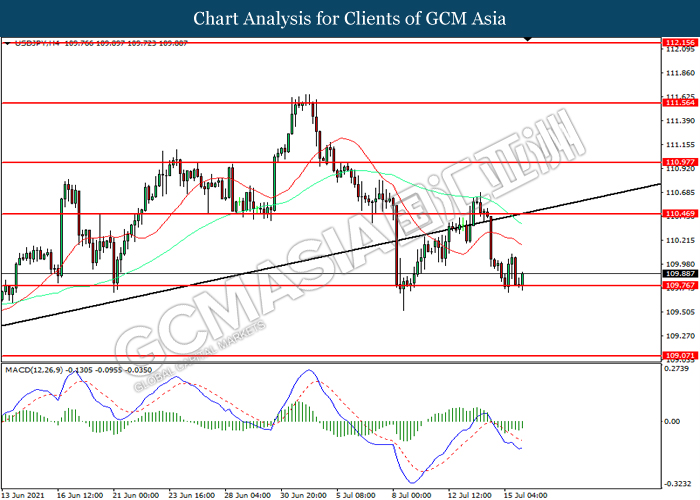

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 109.75. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 110.45, 110.95

Support level: 109.75, 109.05

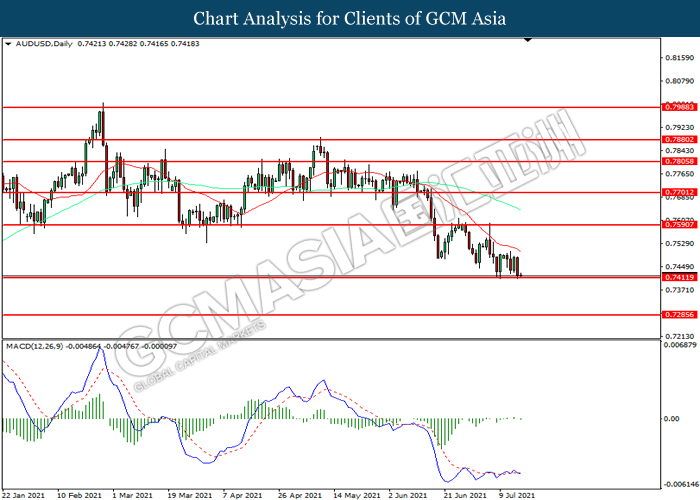

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.7410. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7590, 0.7700

Support level: 0.7410, 0.7285

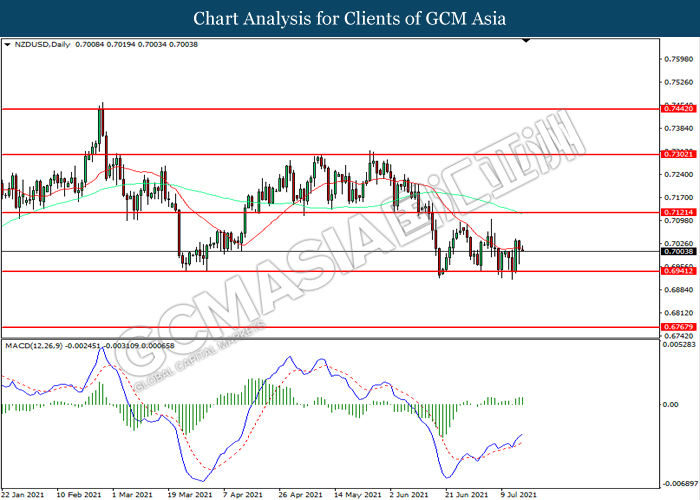

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6940. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7120.

Resistance level: 0.7120, 0.7305

Support level: 0.6940, 0.6770

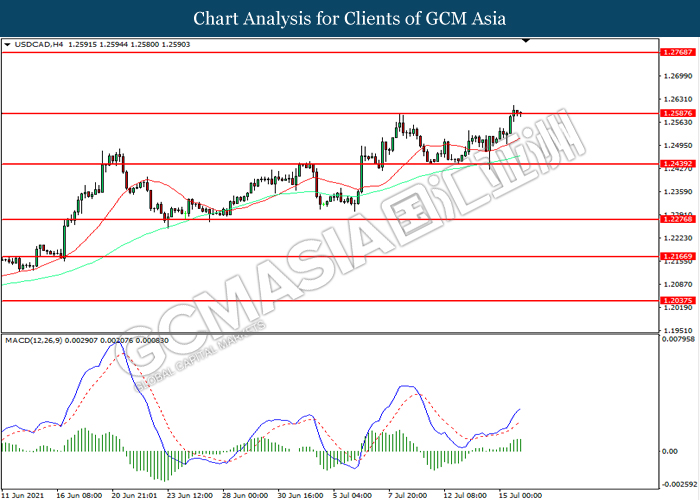

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2585. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2585, 1.2770

Support level: 1.2440, 1.2275

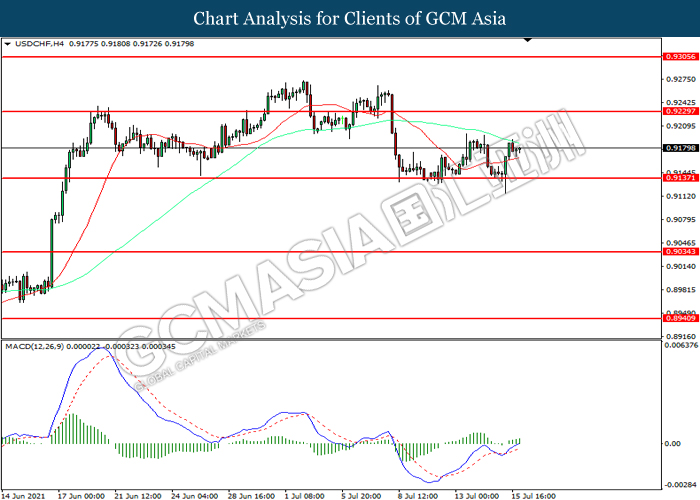

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9135. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9230.

Resistance level: 0.9230, 0.9305

Support level: 0.9135, 0.9035

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 71.25. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 72.75, 73.80

Support level: 71.25, 70.05

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1832.25. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1832.25, 1842.45

Support level: 1813.05, 1797.65