16 September 2020 Afternoon Session Analysis

Pound surged amid upbeat data.

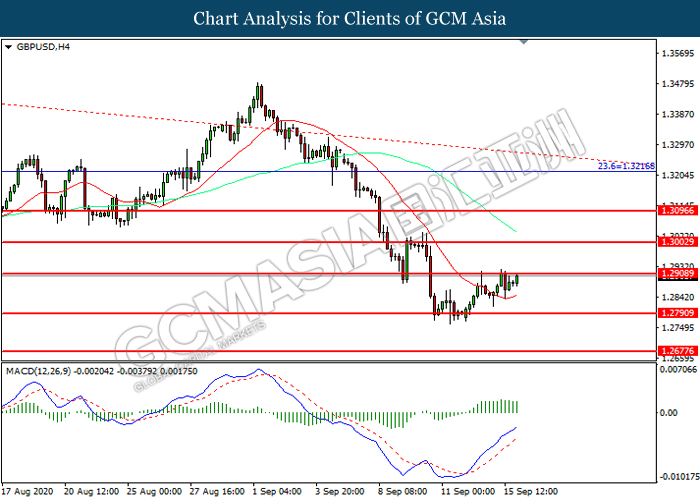

Pound Sterling surged over the backdrop of the upbeat economic data from the UK region yesterday. According to Office for National Statistics, the U.K. Average Earning index + Bonus increased from the previous reading of -1.2% to -1.0%, confounding market forecast for a reading of up to -1.3%. Similarly, the U.K. Claimant Count Change came in at 73.7, which fared better than the economist forecast at 100.0K. As both data fared better than expectation, which dialled up the market optimism toward the strong pace economic recovery in the United Kingdom while insinuating market demand on the Pound Sterling. Nonetheless, the gains experienced by the Pound Sterling was limited amid uncertainty over the Brexit issues continue to linger in the UK financial market. If both parties failed to achieve consensus with regards of the post-Brexit deal, UK will automatically drop out of the EU’s main trading arrangements. In fact, tariffs and border checks would be applied to UK goods travelling to EU, which spurring negative prospect toward the economic progression in UK. Nonetheless, as for now investors would continue to scrutinize the latest development with regards of the Brexit issues in order to gauge the likelihood movement for the currency. As of writing, GBP/USD appreciated by 0.14% to 1.2901.

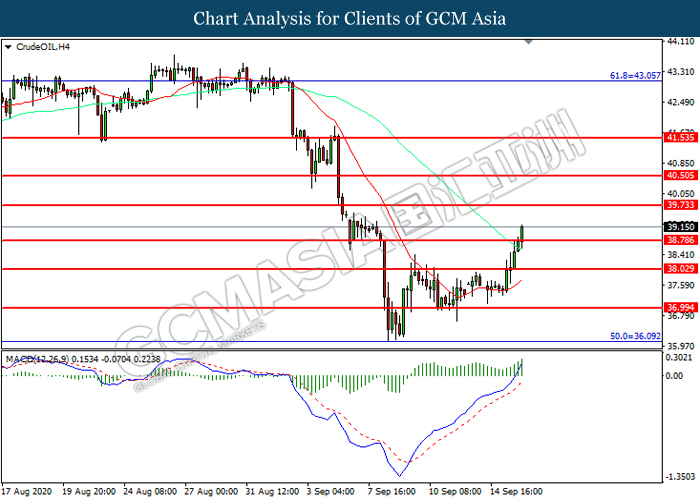

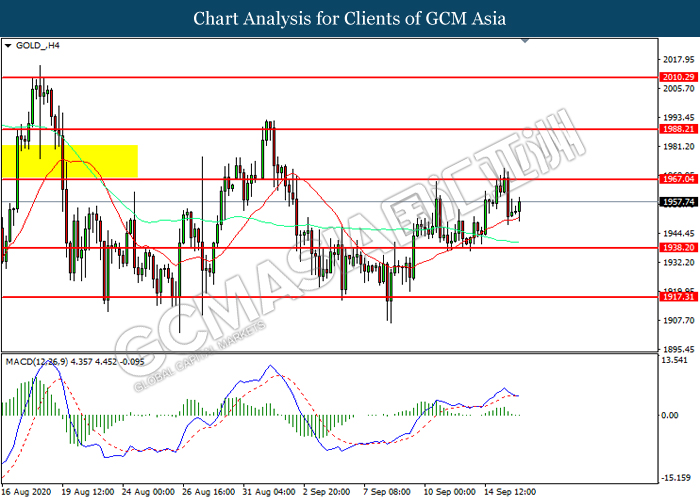

In the commodities market, the crude oil price surged 1.15% to $39.05 per troy ounces as of writing. The oil market edged higher as a hurricane had continue to disrupt the U.S. offshore oil and gas production on yesterday. More than 25% of U.S. offshore oil and gas output was shut on Tuesday as Hurricane Sally sat just off the U.S. Gulf Coast. On the other hand, the gold price surged 0.20% to $1957.50 per troy ounces while market participants would focus on the FOMC meeting tonight in order to receive further trading signals.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 (16th) USD FOMC Economic Projections

02:00 USD FOMC Statement

02:30 USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | GBP – CPI (YoY) (Aug) | – | 0.1% | 1.0% |

| 20:30 | USD – Core Retail Sales (MoM) (Aug) | – | 0.8% | 1.9% |

| 20:30 | USD – Retail Sales (MoM) (Aug) | – | 1.0% | 1.2% |

| 20:30 | CAD – Core CPI (MoM) (Aug) | – | – | -0.1% |

| 22:30 | CrudeOIL – Crude Oil Inventories | – | 1.271M | 2.032M |

| 02:00

(16th) |

USD – Fed Interest Rate Decision | – | 0.25% | 0.25% |

Technical Analysis

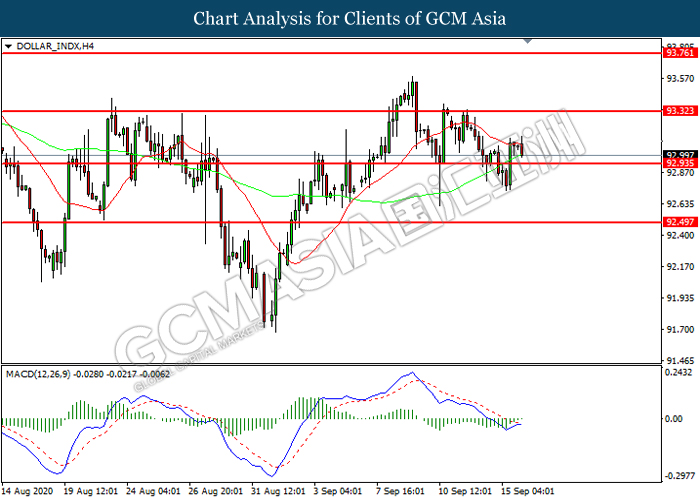

DOLLAR_INDX, H4: Dollar index was traded lower currently near the support level at 92.95. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 93.30, 93.75

Support level: 92.95, 92.50

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2910. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2910, 1.3005

Support level: 1.2790, 1.2675

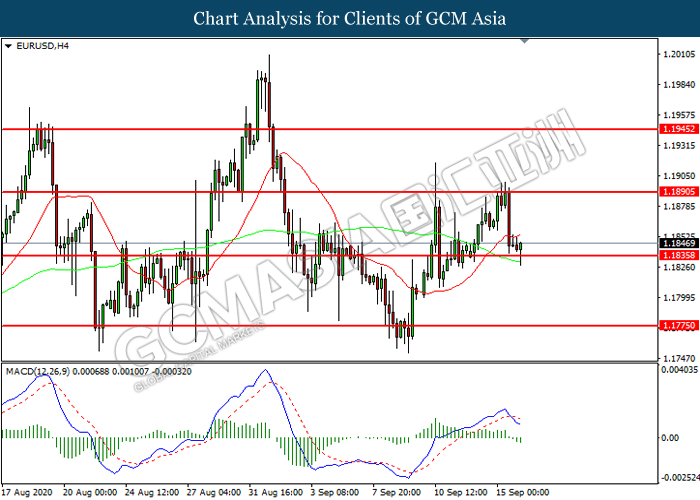

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1835. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1890, 1.1945

Support level: 1.1835, 1.1775

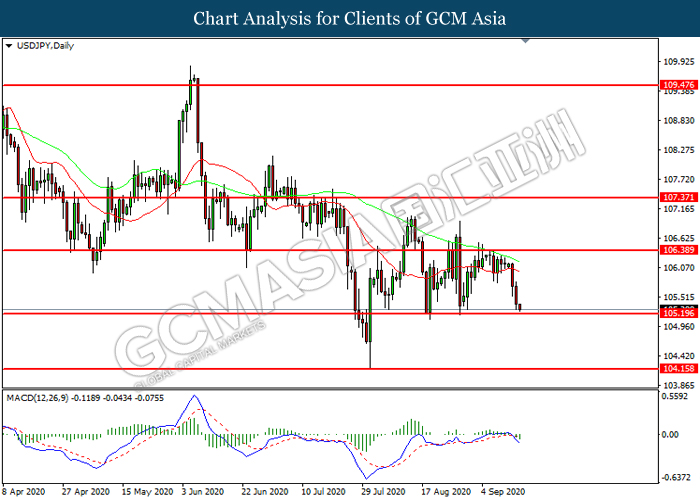

USDJPY, Daily : USDJPY was traded lower while currently testing the support level at 105.20. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 106.40, 107.35

Support level: 105.20, 104.15

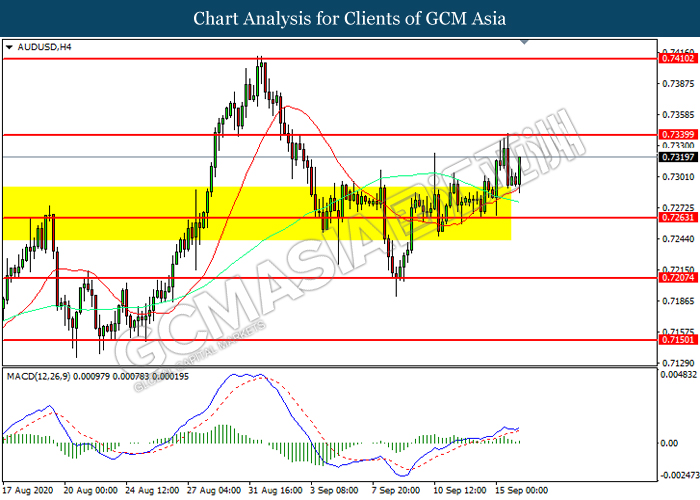

AUDUSD, H4: AUDUSD was traded higher while currently near the resistance level at 0.7340. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7340, 0.7410

Support level: 0.7265, 0.7205

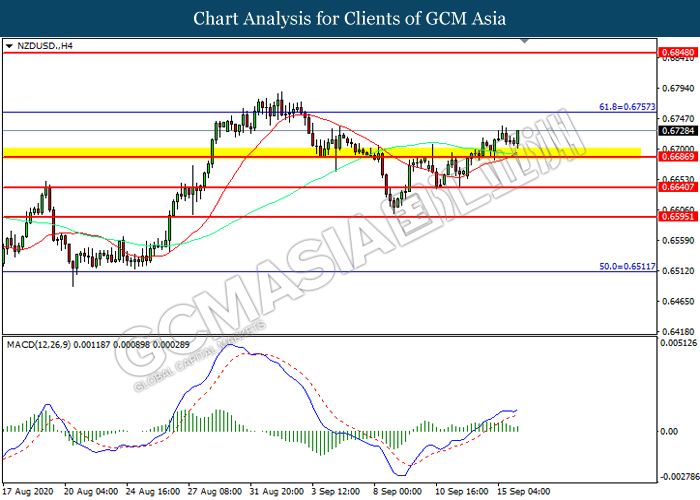

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6685. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6755.

Resistance level: 0.6755, 0.6850

Support level: 0.6685, 0.6640

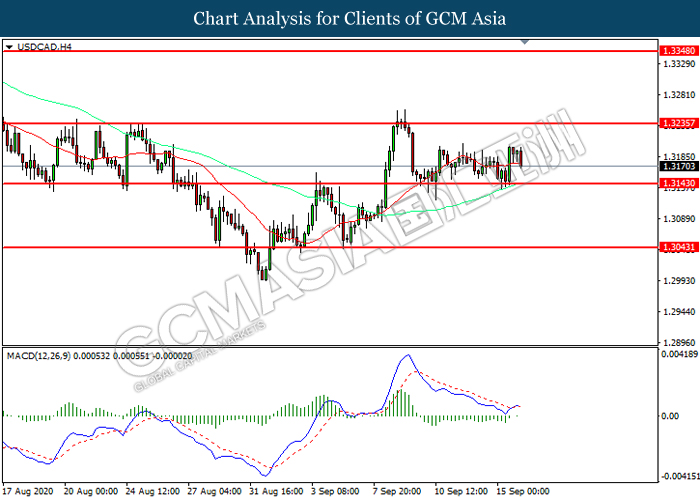

USDCAD, H4: USDCAD was traded lower while currently near the support level at 1.3145. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3235, 1.3350

Support level: 1.3145, 1.3045

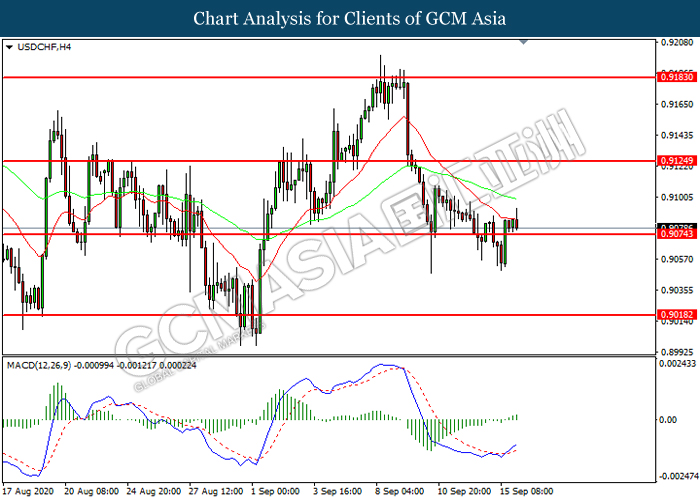

USDCHF, H4: USDCHF was traded within a range while currently testing the support level at 0.9075. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9125, 0.9185

Support level: 0.9075, 0.9020

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the resistance level at 39.75. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 39.75.

Resistance level: 39.75, 40.50

Support level: 38.80, 38.05

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level t 1967.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 1938.20.

Resistance level: 1967.05, 1988.20

Support level: 1938.20, 1917.30