16 September 2020 Morning Session Analysis

WTO: US violated global trade rules with tariffs on China.

US dollar was traded flat around 93.06 while investors continue to digest the latest verdict from World Trade Organization (WTO) upon the United States. According to WTO, US has violated global trade rules after it imposed tariffs upon Chinese goods in 2018. Prior, Washington has imposed levies of more than $400 billion goods worth of exports from China due to allegations upon intellectual property. According to the extensive evidence submitted by the US, Washington accuses China of intellectual property theft and forced transfer of technology access for US firms whom wishes to operate in the market. On the other hand, China claimed that the tariffs enacted has violated WTO’s treatment provision as the measures failed to provide the same treatment for all member countries of WTO. Likewise, China also alleged that the duties broke key dispute-settlement rule that requires all countries to first seek recourse from WTO before imposing retaliatory measures. While the verdict sided towards Beijing, Washington can effectively veto the decision by lodging an appeal any point in the next 60 days. Such verdict from the WTO has little impact upon US enacted tariffs upon China but it could substantially increase the tension between both countries.

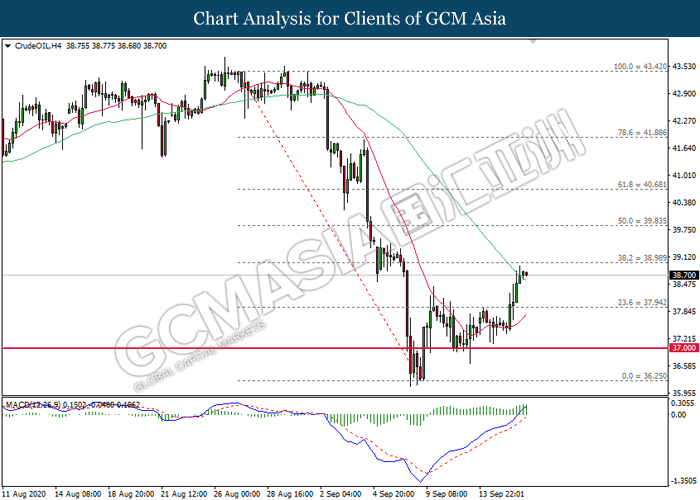

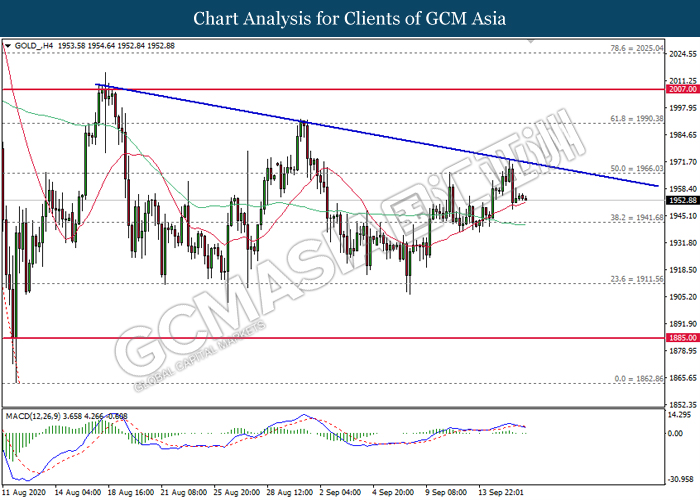

As for commodities market, crude oil price rose 0.26% to $38.38 following bullish data from this morning. According to American Petroleum Institute, crude oil stocks for last week was down by -9.517 million barrels. For the time being, investors will wait for official data from Energy Information Administration bound to be released by tonight for more market signal. On the other hand, gold price was traded flat around $1,953.89 a troy ounce while market participants wait for more signals from the global market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 (16th) USD FOMC Economic Projections

02:00 USD FOMC Statement

02:30 USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | GBP – CPI (YoY) (Aug) | – | 0.1% | 1.0% |

| 20:30 | USD – Core Retail Sales (MoM) (Aug) | – | 0.8% | 1.9% |

| 20:30 | USD – Retail Sales (MoM) (Aug) | – | 1.0% | 1.2% |

| 20:30 | CAD – Core CPI (MoM) (Aug) | – | – | -0.1% |

| 22:30 | CrudeOIL – Crude Oil Inventories | – | 1.271M | 2.032M |

| 02:00

(16th) |

USD – Fed Interest Rate Decision | – | 0.25% | 0.25% |

Technical Analysis

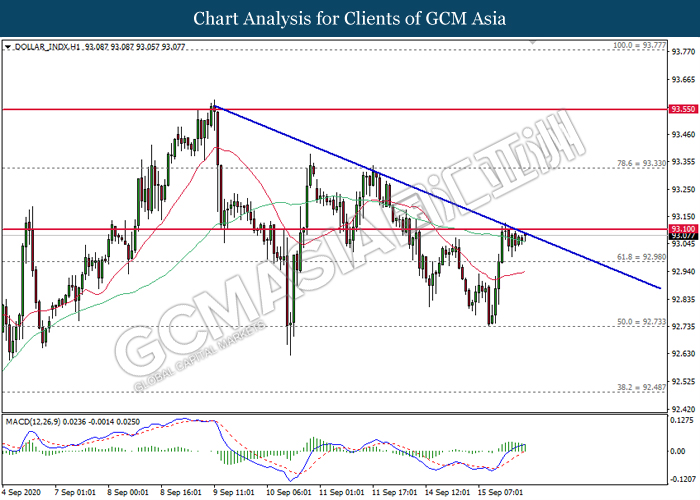

DOLLAR_INDX, H1: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrate bullish signal suggests the index to extend its gains after breaking the downward trendline.

Resistance level: 93.10, 93.35

Support level: 93.00, 92.75

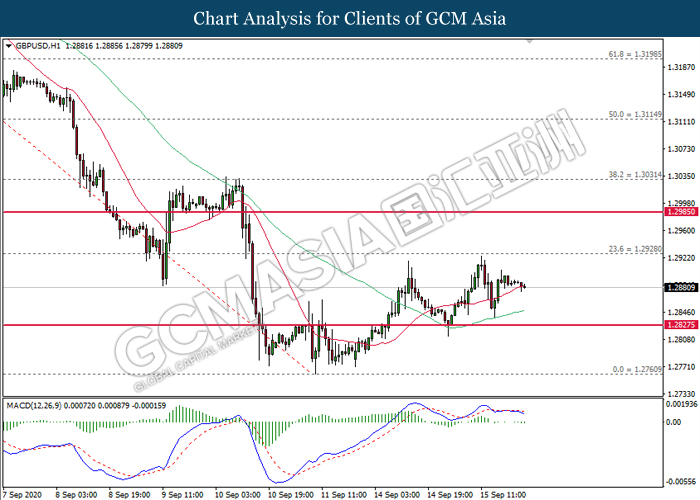

GBPUSD, H1: GBPUSD was traded lower following prior retrace from its higher level. MACD which illustrate negative divergence signal suggests the pair to be traded lower in short-term.

Resistance level: 1.2930, 1.2985

Support level: 1.2830, 1.2760

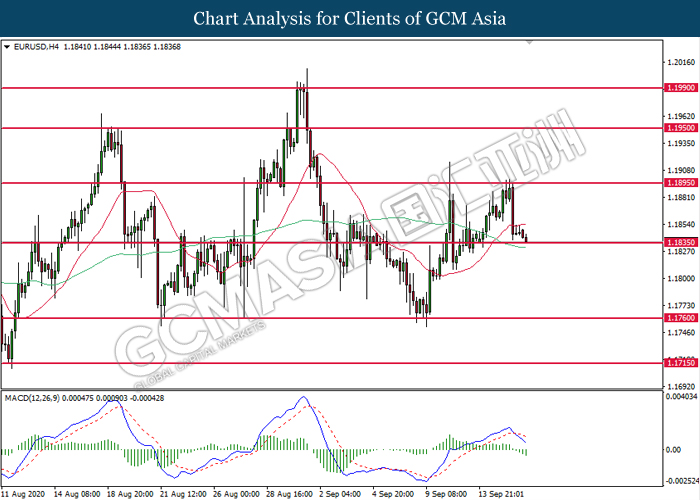

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrate bearish signal suggests the pair to extend its losses after closing below 1.1835.

Resistance level: 1.1895, 1.1950

Support level: 1.1835, 1.1760

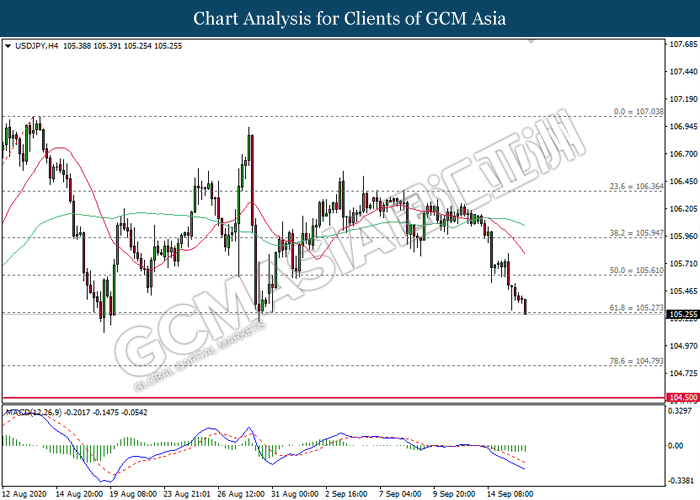

USDJPY, H4: USDJPY was traded lower while currently testing 105.30. MACD which illustrate bearish signal suggest the pair to extend its losses after closing below the support level.

Resistance level: 105.60, 105.95

Support level: 105.30, 104.80

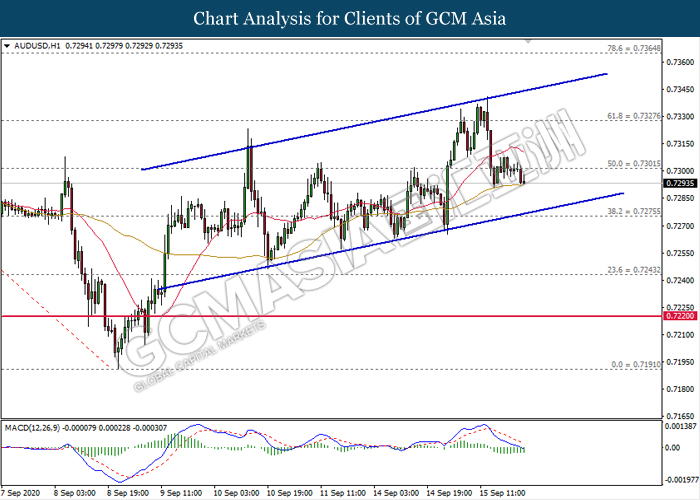

AUDUSD, H1: AUDUSD was traded lower following prior retrace from the top level of upward channel. MACD which illustrate bearish signal suggest the pair to be traded lower in short-term.

Resistance level: 0.7300, 0.7330

Support level: 0.7275, 0.7240

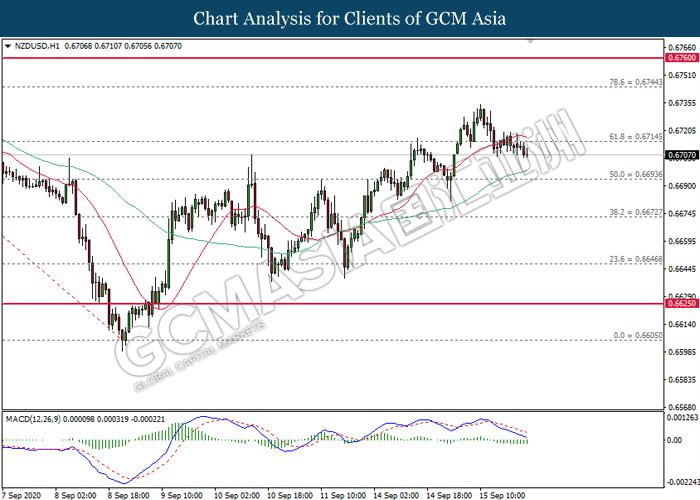

NZDUSD, H1: NZDUSD was traded lower following prior retrace from the higher level. MACD which illustrate bearish signal suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6715, 0.6745

Support level: 0.6695, 0.6670

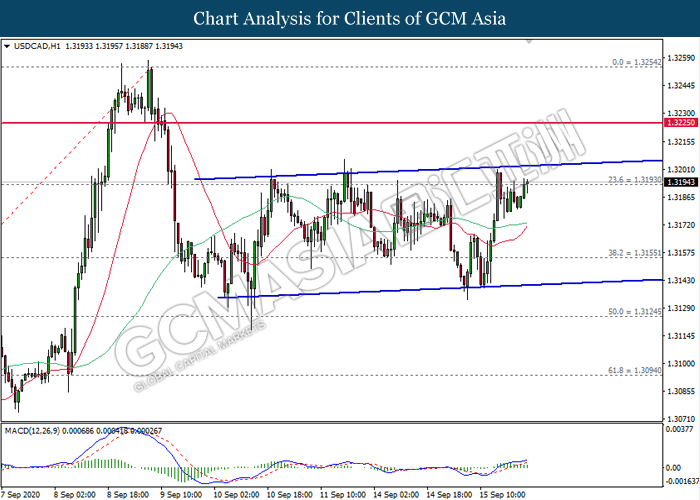

USDCAD, H1: USDCAD was traded higher following prior rebound from the lower level. MACD which illustrate bullish signal suggests the pair to extend its gains after breaking the top level of upward channel.

Resistance level: 1.3195, 1.3225

Support level: 1.3155, 1.3125

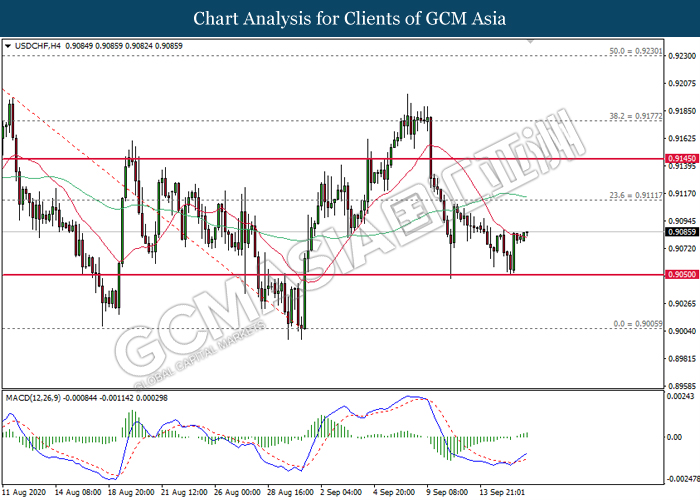

USDCHF, H4: USDCHF was traded higher following prior rebound from the lower level. MACD which illustrate bullish signal suggest the pair to be traded higher in short-term.

Resistance level: 0.9110, 0.9145

Support level: 0.9050, 0.9005

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the lower level. MACD which illustrate bullish signal suggests its price to extend upwards after closing above 39.00.

Resistance level: 39.00, 39.85

Support level: 37.95, 37.00

GOLD_, H4: Gold price was traded lower following prior retrace from the downward trendline. MACD which illustrate bearish signal suggests its price to extend further downwards in short-term.

Resistance level: 1966.00, 1990.40

Support level: 1941.70, 1911.55