16 November 2020 Afternoon Session Analysis

Pound surged after Dominic Cummings resigns.

Pound sterling which acts as one of the major currency that being traded in the FX market managed to continue ride on its bullish trend after UK PM’s chief adviser Dominic Cummings decided to resign. He was a key member of the Vote Leave team that followed Johnson into Downing Street in 2019 and successfully campaigned for UK voters to reject EU membership in the 2016 Brexit referendum. Besides, he was also an aggressive member in handling and advising issues which related to Brexit. Therefore, the resignation of Dominic Cummings may urges the Brexit negotiator from UK side to be more tolerate and compromise in negotiating with EU party. However, market participants still eyeing on the renewed talks between EU and UK in this weeks which aiming at the major problem including fisheries and level of playing field. In this week, Britain chief negotiator David Frost will heading back to Brussels for more discussion with EU’s Michel Barnier. However, UK has hinted that Brexit talks could extend beyond this week as two sides are still struggling in breaking the barriers to reach a trade deal. During Asian trading session, the pair of GBP/USD rose 0.34% to 1.3230.

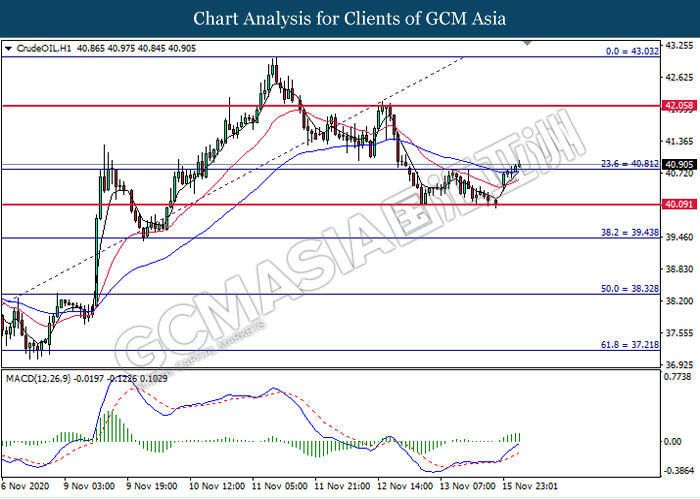

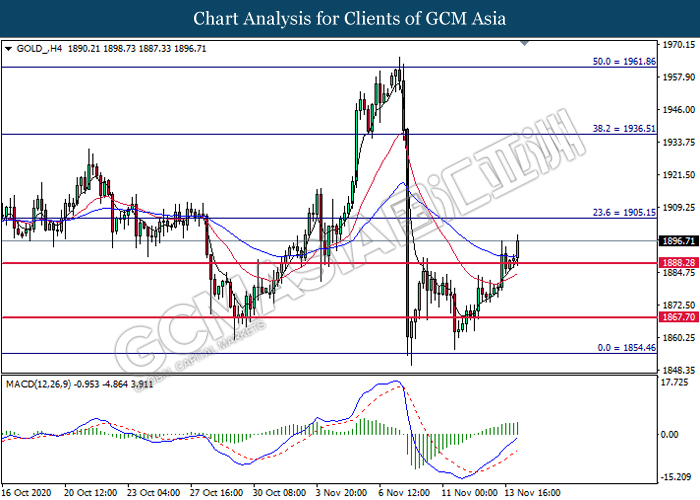

In the commodities market, the crude oil price ticked up by 1.39% to $40.95 per barrel amid OPEC and its allies have complied 101% with the oil production cuts in October. As of now, OPEC+ will have a crucial meetings over the next two weeks, which will decide if OPEC+ will extend their oil cut production in January 2021. Besides, gold price appreciated 0.42% to $1897.35 amid weakening of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

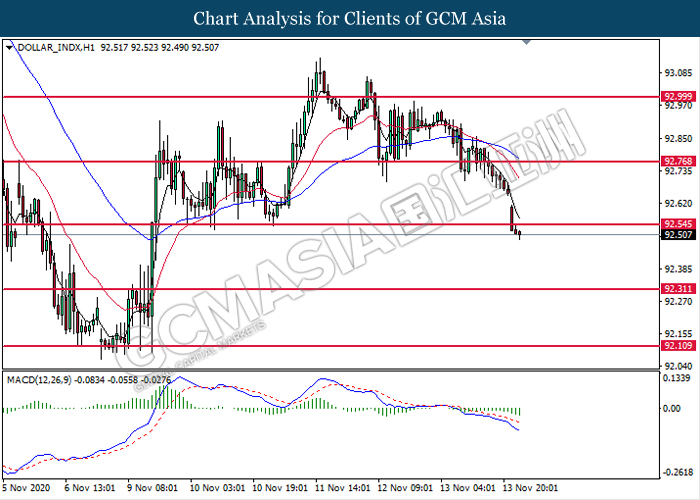

DOLLAR_INDX, H1: Dollar index was traded lower following prior breakout below the previous support level at 92.55. MACD which illustrate bearish bias momentum signal suggest the dollar to extend its losses toward the support level at 92.30.

Resistance level: 92.55, 92.75

Support level: 92.30, 92.10

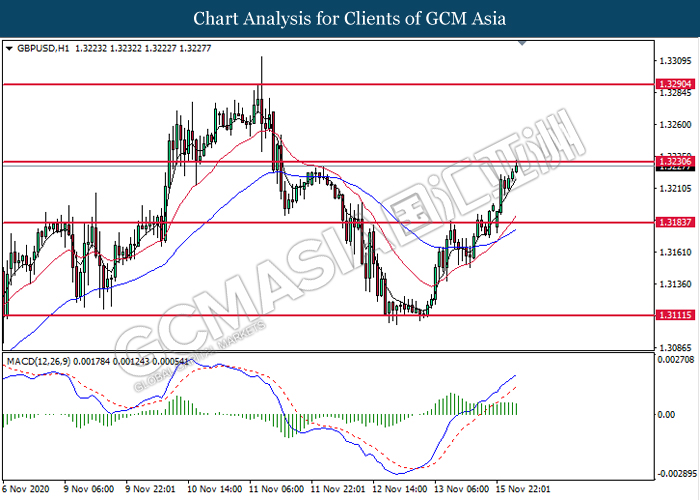

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.3230. MACD which illustrates bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.3230.

Resistance level: 1.3230, 1.3290

Support level: 1.3185, 1.3110

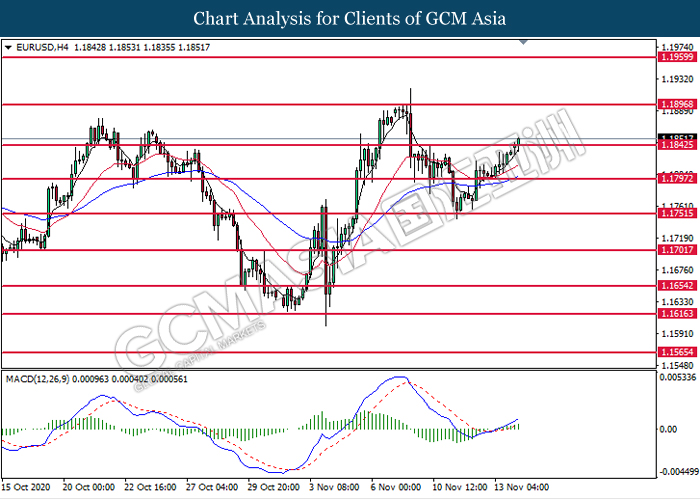

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1845. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 1.1895.

Resistance level: 1.1895, 1.1960

Support level: 1.1845, 1.1795

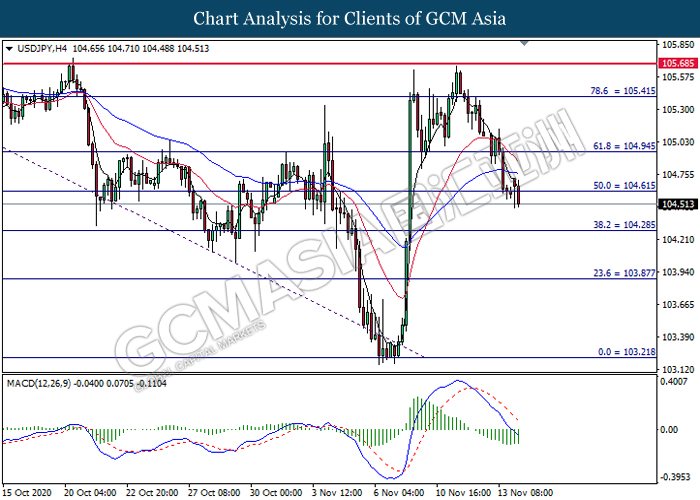

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 104.60. MACD which illustrate bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 104.95, 105.40

Support level: 104.60, 104.30

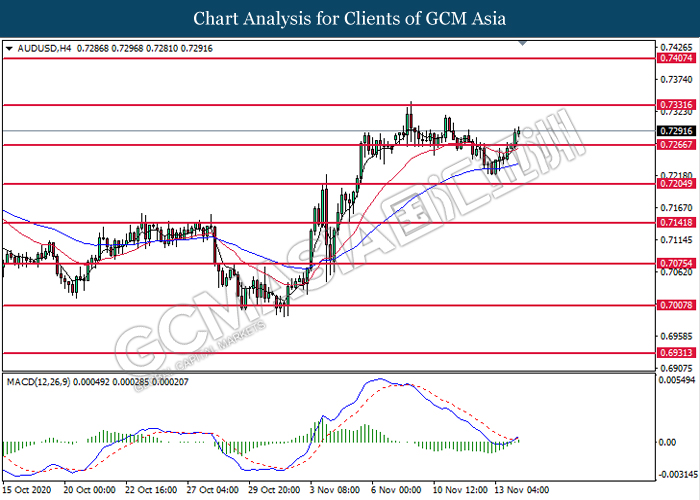

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the resistance level at 0.7265. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7330.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

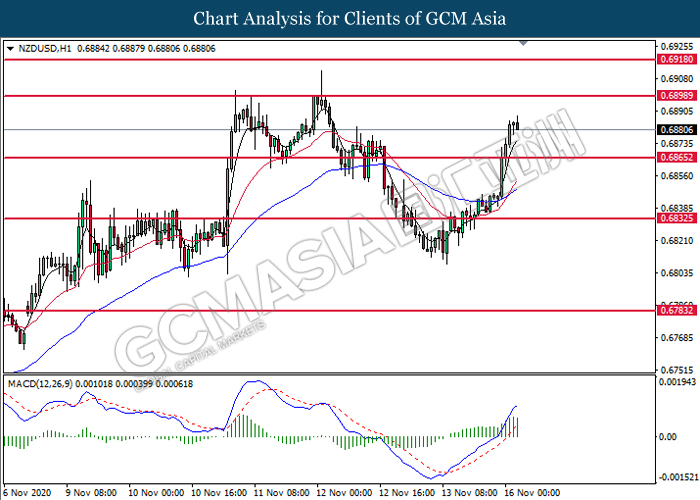

NZDUSD, H1: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6865. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 0.6900.

Resistance level: 0.6900, 0.6920

Support level: 0.6865, 0.6835

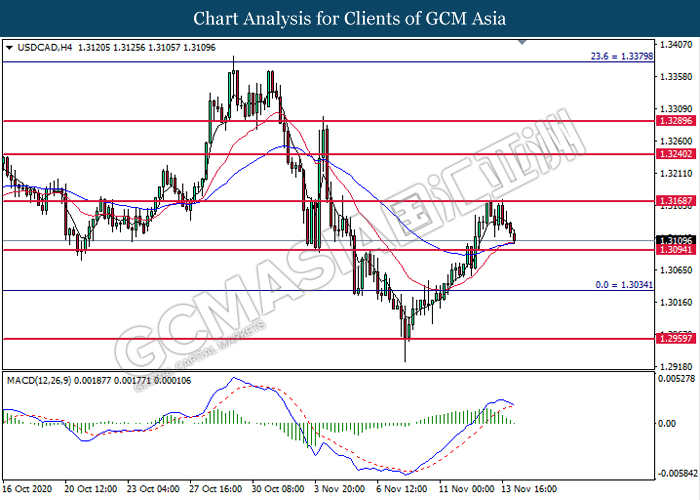

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3170. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 1.3095.

Resistance level: 1.3170, 1.3240

Support level: 1.3095, 1.3035

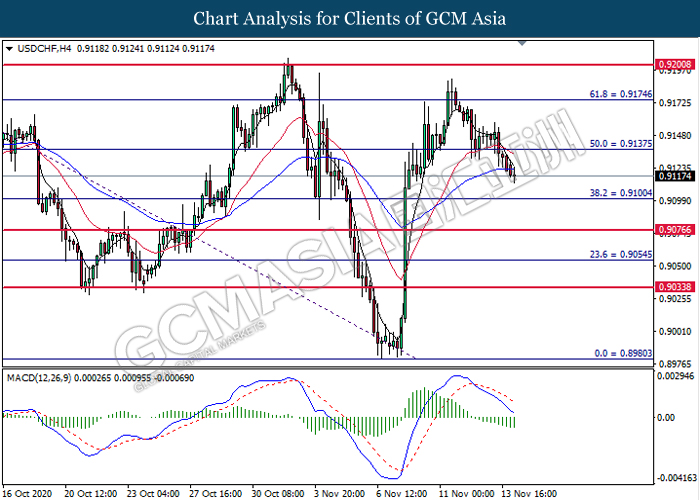

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9135. MACD which display bearish bias momentum signal suggest the pair to extend its losses toward the support level at 0.9100.

Resistance level: 0.9135, 0.9175

Support level: 0.9100, 0.9075

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level at 40.80. MACD which illustrate bullish bias momentum signal suggest the commodity to extend its gains toward the resistance level at 42.05.

Resistance level: 40.80, 42.05

Support level: 40.10, 39.45

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1888.30. MACD which illustrate bullish bias momentum signal suggest the commodity to extend its gains toward the resistance level at 1905.15.

Resistance level: 1905.15, 1936.50

Support level: 1888.30, 1867.70.