17 January 2022 Afternoon Session Analysis

NZD was traded flat amid mixed China data.

The China-proxy currency New Zealand Dollar was traded flat over the backdrop of mixed economic from China. According to National Bureau of Statistics, China Gross Domestic Product (GDP) year-over-year came in at 4.0%, exceeding the market forecast at 3.6%. Besides, China Industrial Production notched up significantly from the previous reading of 3.8% to 4.3%, which also fared better than the market forecast at 3.6%. Since China is New Zealand’s largest trading partner, with two-way trade exceeding NZ$33 billion, the upbeat economic data from China would be dialing up the market optimism toward the economic progression in New Zealand. Nonetheless, the gains experienced by the New Zealand Dollar was limited by negative retail data. China Retail Sales declined significantly from the previous reading of 3.9% to 1.7%, missing the market forecast at 3.7%. As of writing, NZD/USD appreciated by 0.06% to 0.6800.

In the commodities market, the crude oil price surged 0.05% to $84.15 per barrel as of writing. The oil market extends its gains amid market participants remained optimism that the rapid Covid-19 vaccination rollout around the world would able to increase the market demand for crude oil in future, spurring bullish momentum for this black-commodity. On the other hand, the gold price slumped 0.04% to $1818.70 per barrel as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD Martin Luther King Jr. Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently near the resistance level at 95.50. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.50, 96.80

Support level: 94.50, 93.25

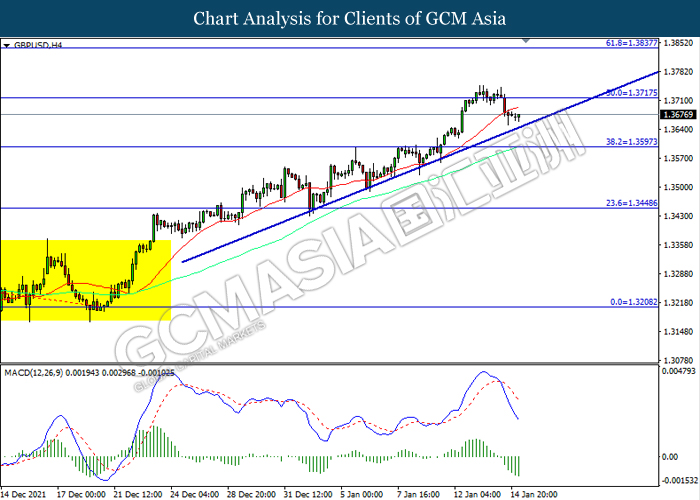

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3715. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3595.

Resistance level: 1.3715, 1.3840

Support level: 1.3595, 1.3450

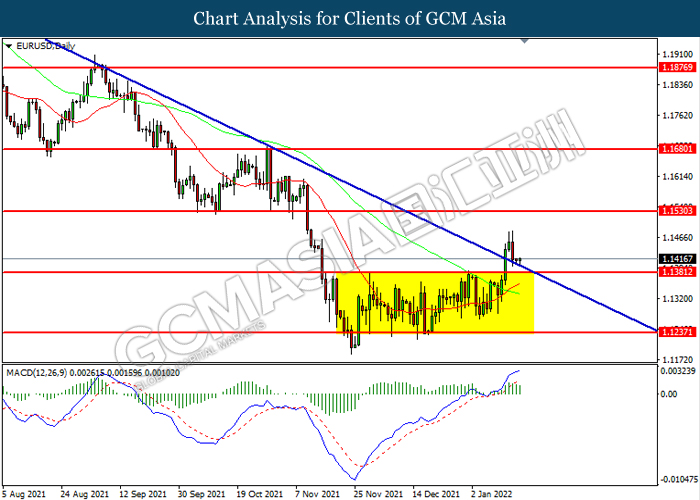

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1380. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1530, 1.1680

Support level: 1.1380, 1.1235

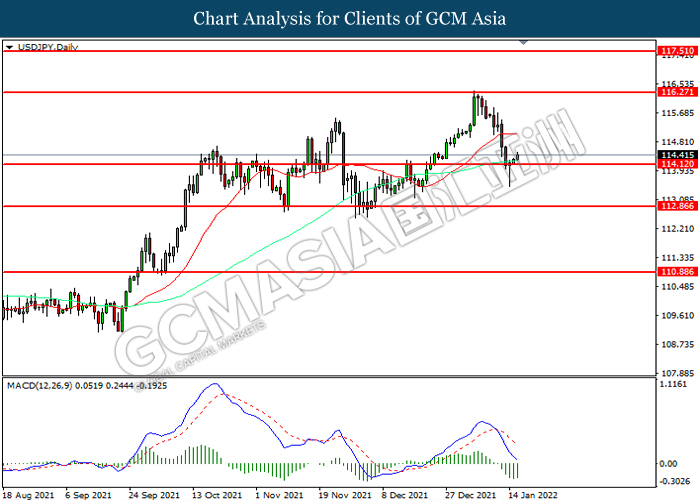

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 114.10. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 116.25, 117.50

Support level: 114.10, 112.85

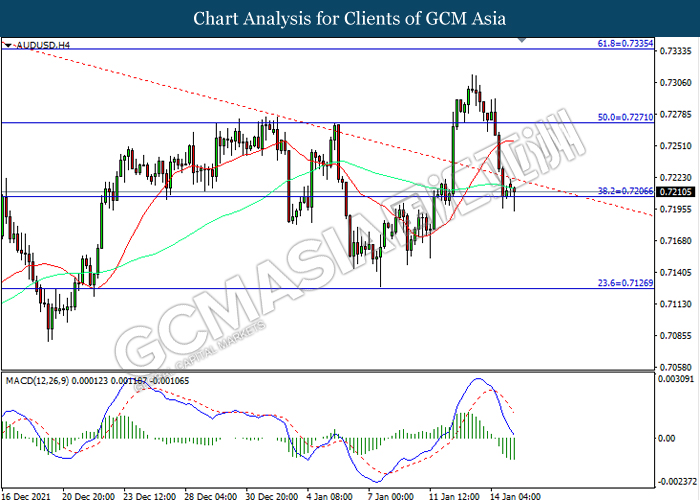

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

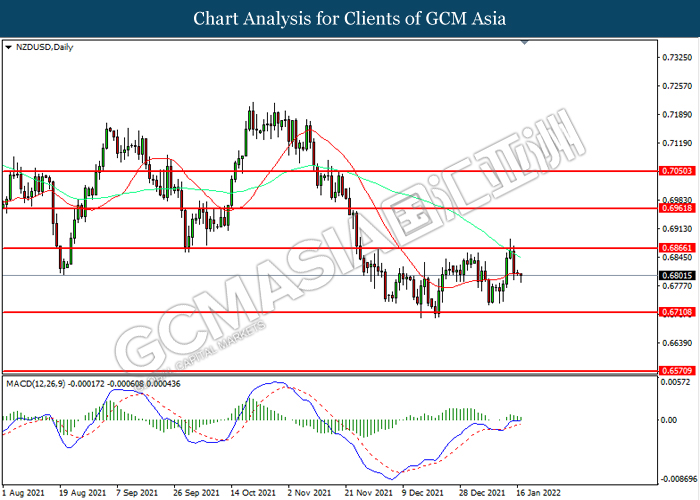

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6710.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

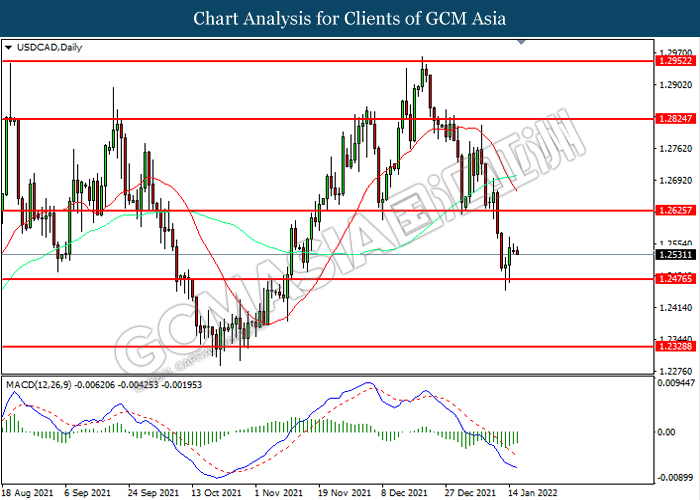

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2475. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2625.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9095. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9095, 0.9035

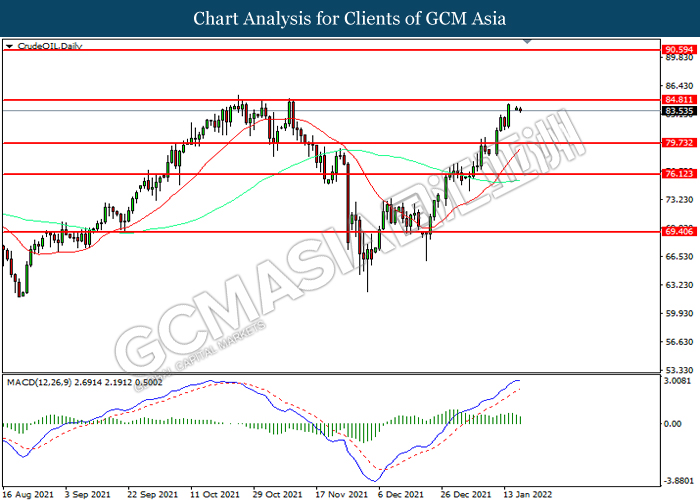

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 84.80. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 84,80, 90.60

Support level: 79.75, 76.10

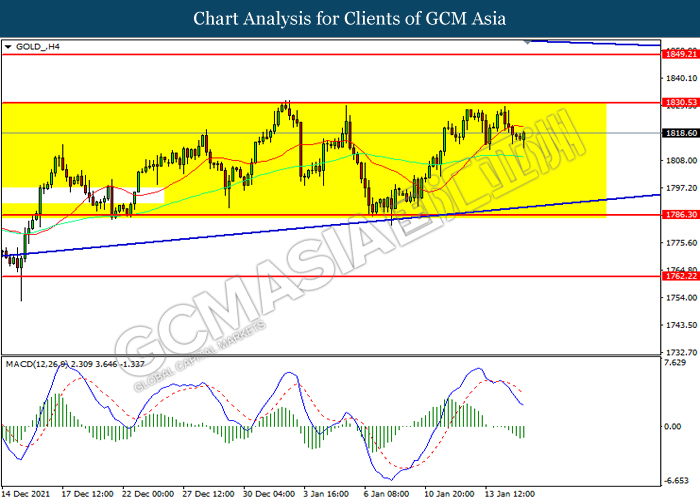

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1830.55. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1786.30.

Resistance level: 1830.55, 1849.20

Support level: 1786.30, 1762.20