17 January 2022 Morning Session Analysis

Fed extended its rebound.

US dollar successfully extended its rebound last Friday as a few Federal Reserve officials grumbles over high inflation in the US. According to Fed official John Williams, he expects Omicron to lengthen supply chain issues which in return could drive up the costs of goods and raw materials. However, Williams emphasized that Fed may reduce accommodative monetary policy substantially in order to curb rising inflation in the near-term. He also expects inflation to subside periodically and hovers near their target of 2% in the mid-term. On the other hand, Fed official Mary Daly emphasize the importance to control rising inflation in order to achieve stability and equilibrium in between market supply and demand. Daly reiterates the call to initiate further monetary policy tightening although doing so may jeopardize economic momentum slightly. As of writing, the dollar index ticks up 0.01% to 95.09.

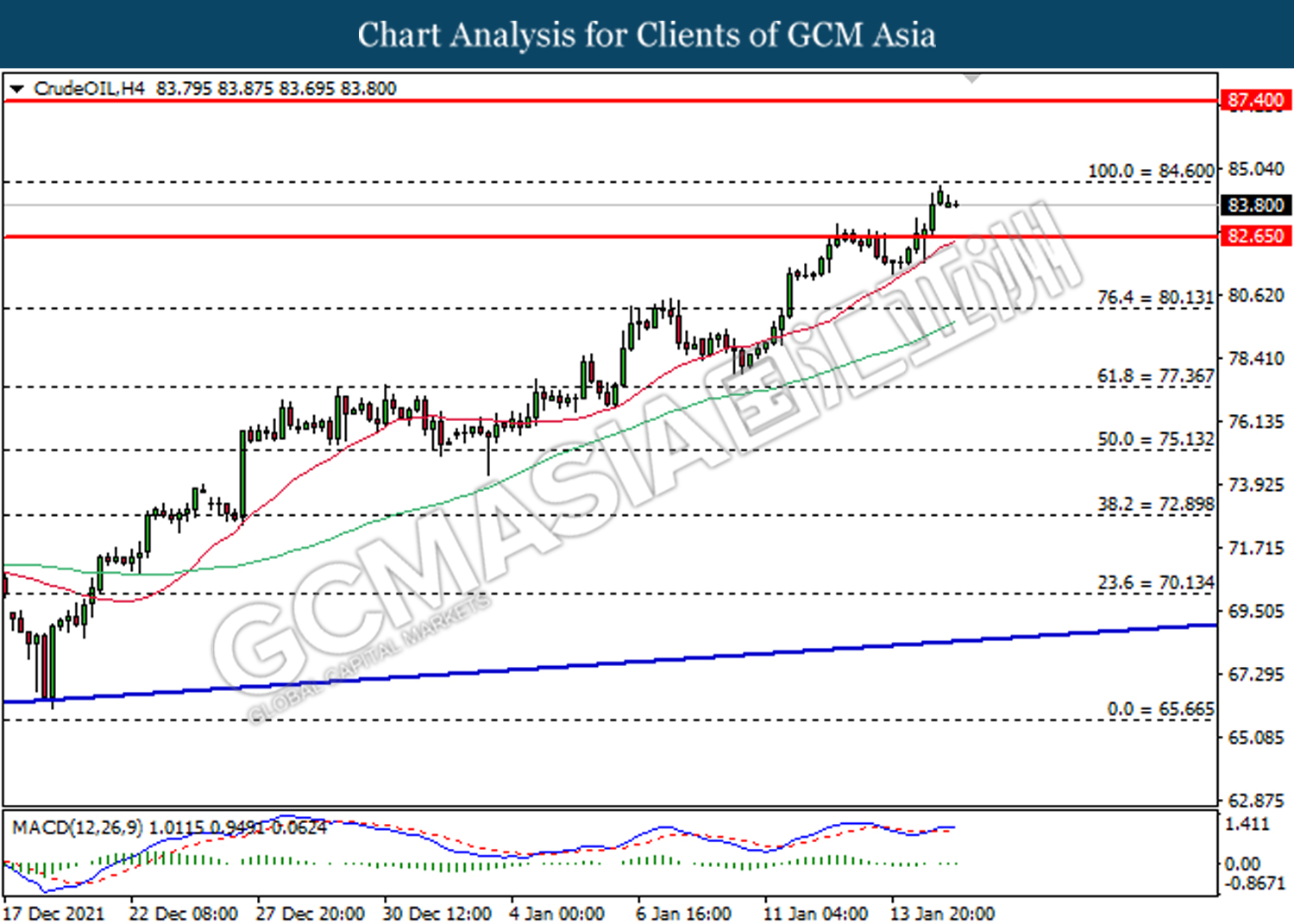

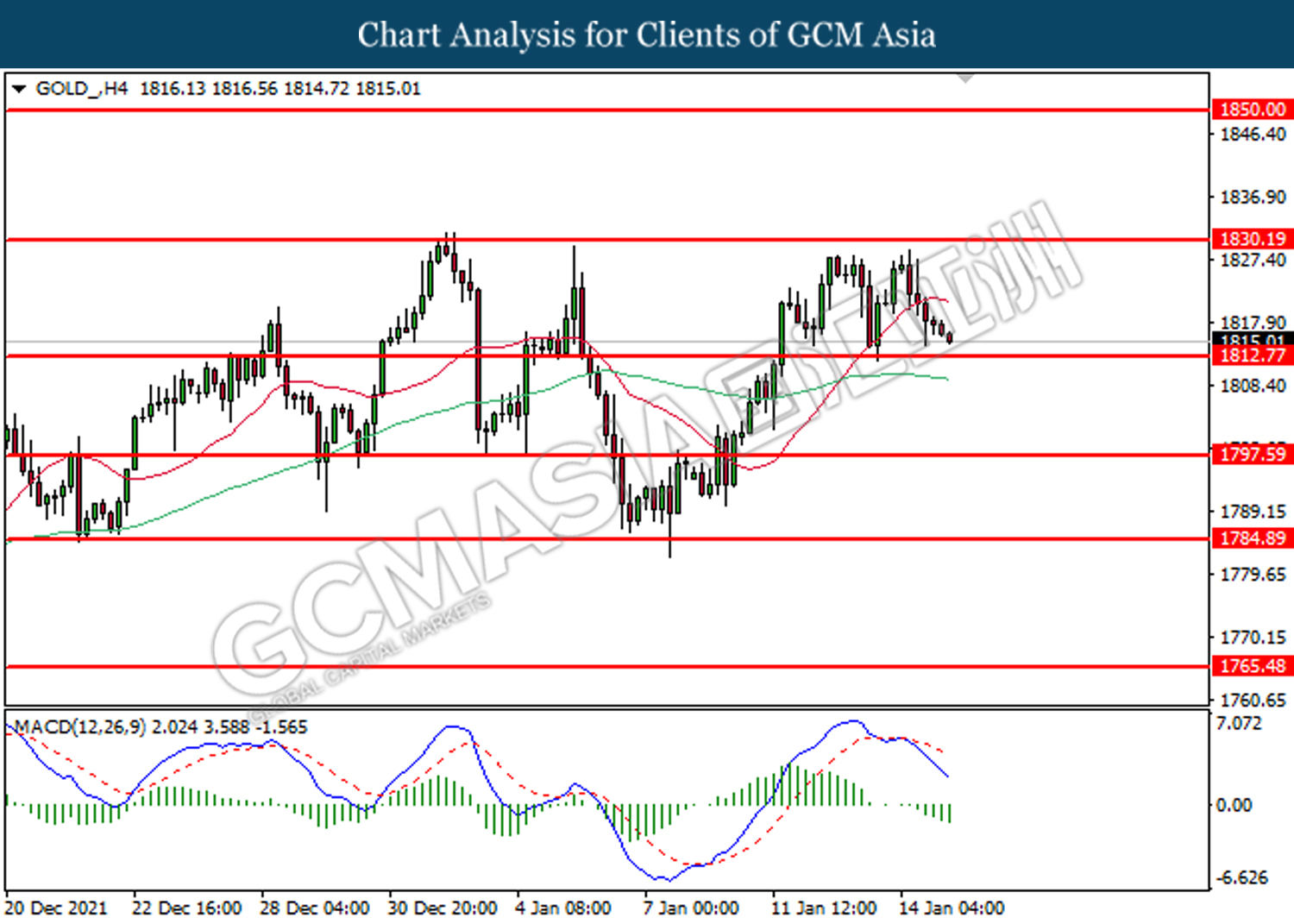

In the commodities market, crude oil price rose 0.21% to $83.80 per barrel. Rising geopolitical tension in between Russia and Ukraine has sparked speculation over possible oil supply interruption from the region. On the other hand, gold price notched down 0.08% to $1,817.65 a troy ounce as US dollar extends its bullish momentum.

Today’s Holiday Market Close

Time Market Event

All Day USD Martin Luther King Jr. Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

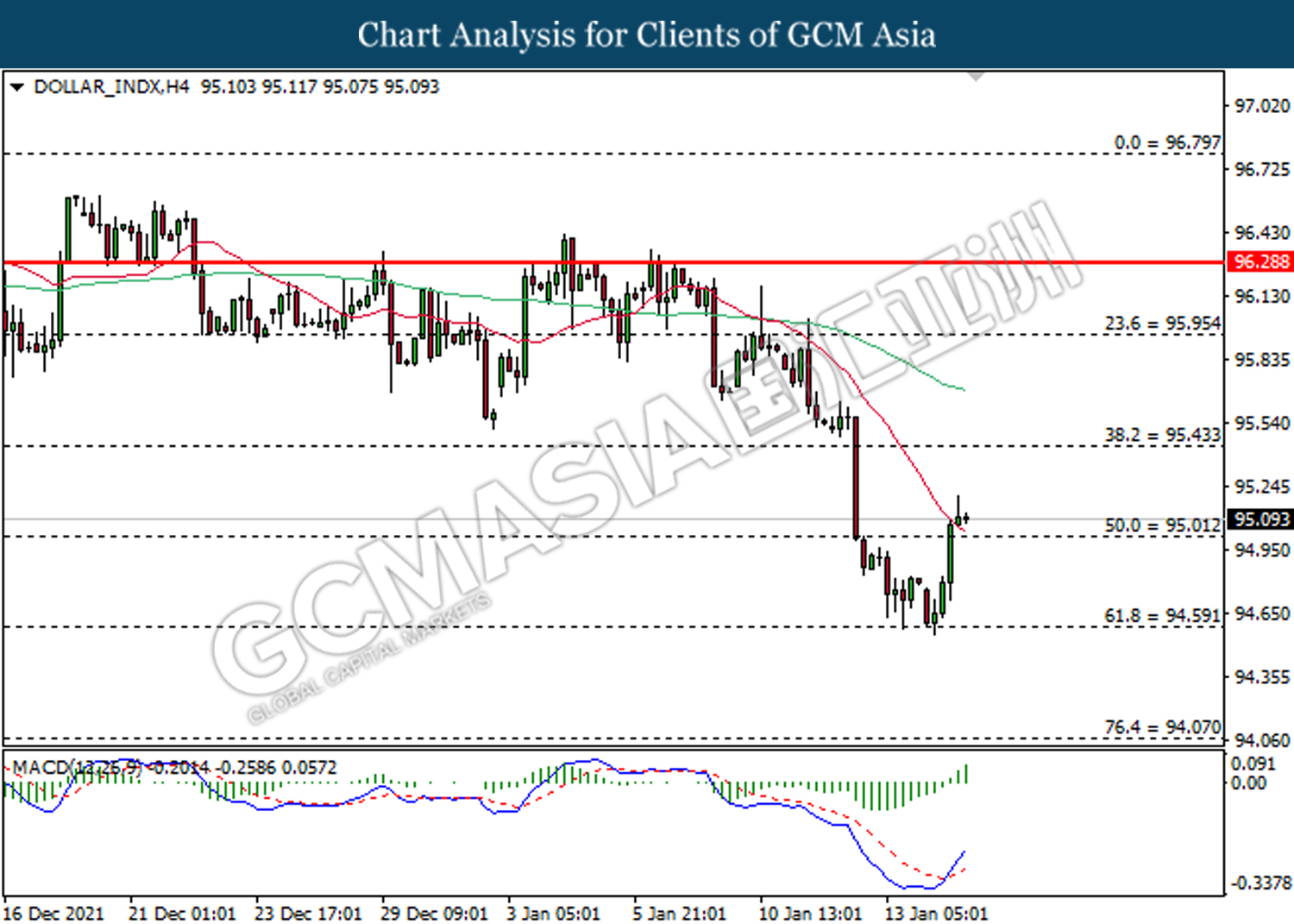

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 95.45, 95.95

Support level: 95.00, 94.1060

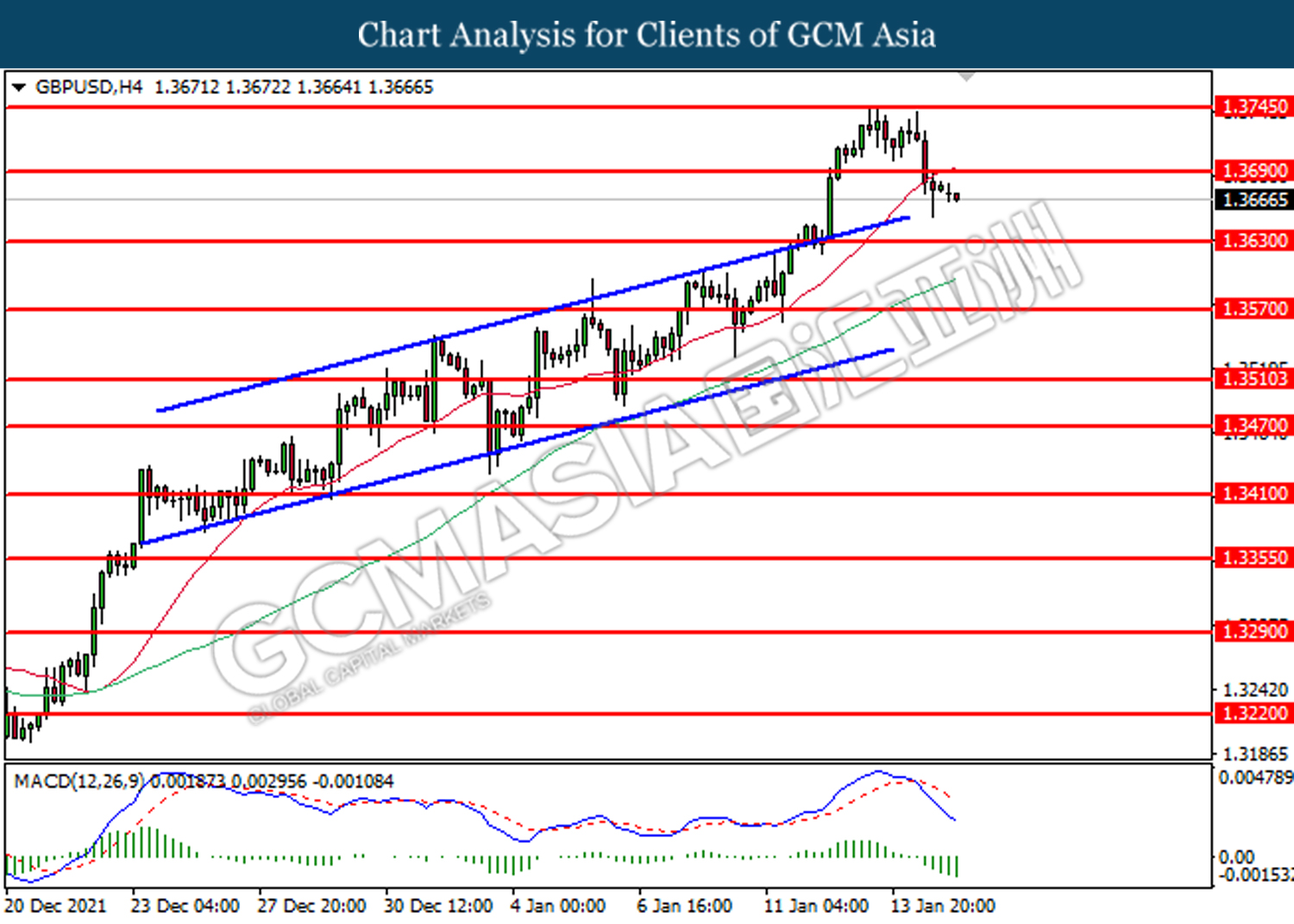

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3690, 1.3745

Support level: 1.3630, 1.3570

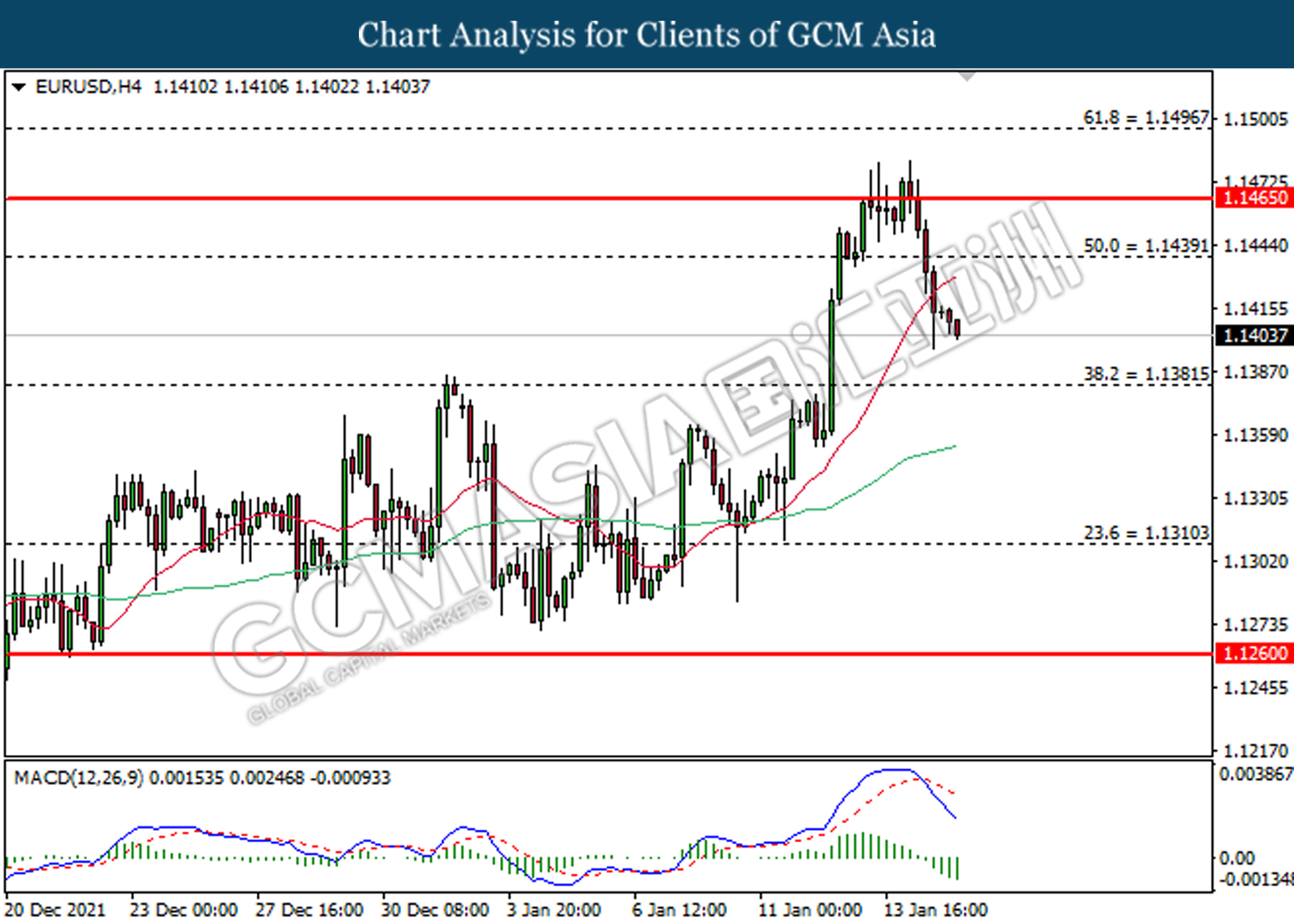

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1440, 1.1465

Support level: 1.1380, 1.1310

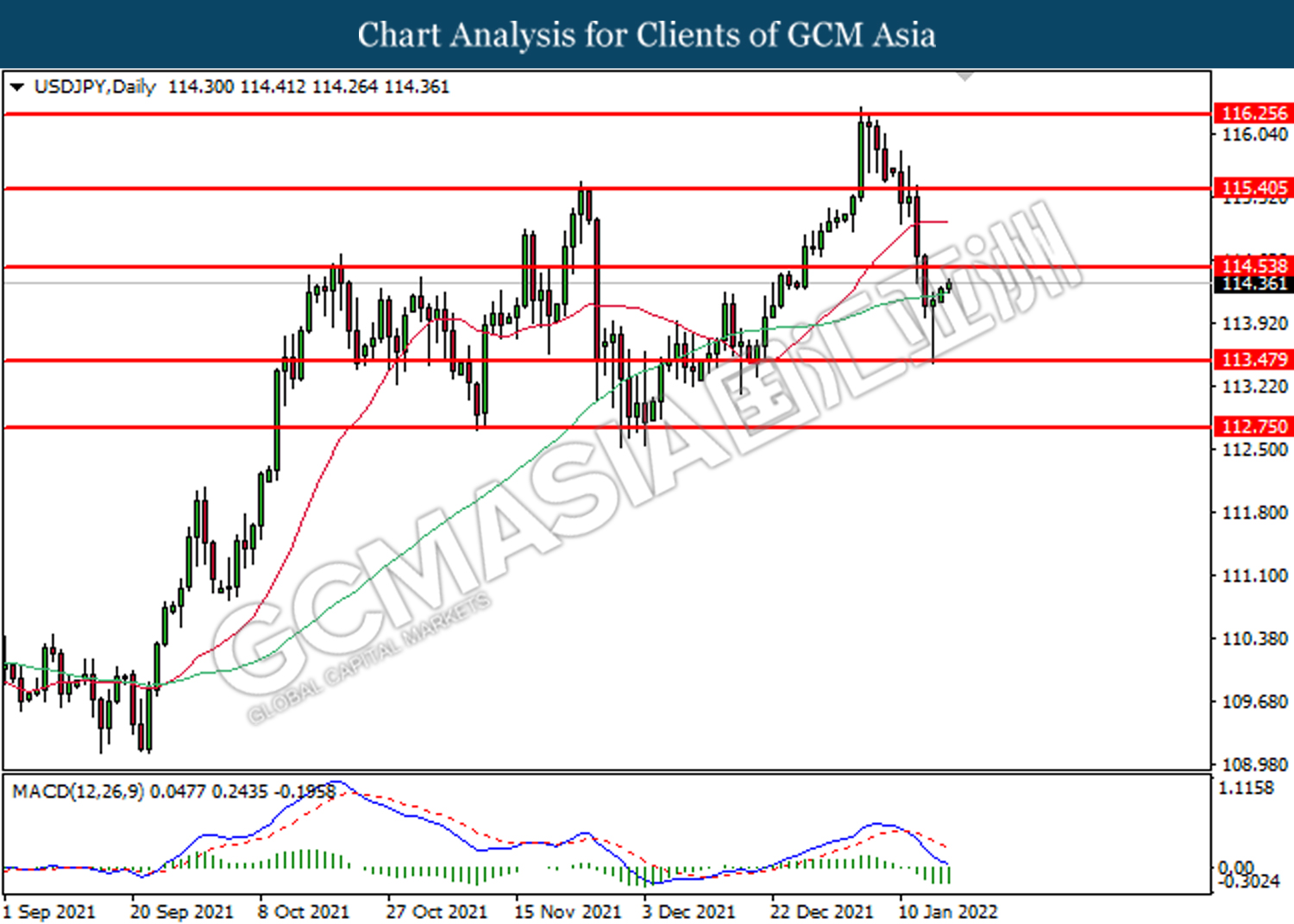

USDJPY, Daily: USDJPY was traded higher following rebound from 113.50. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 114.55, 115.40

Support level: 113.50, 112.75

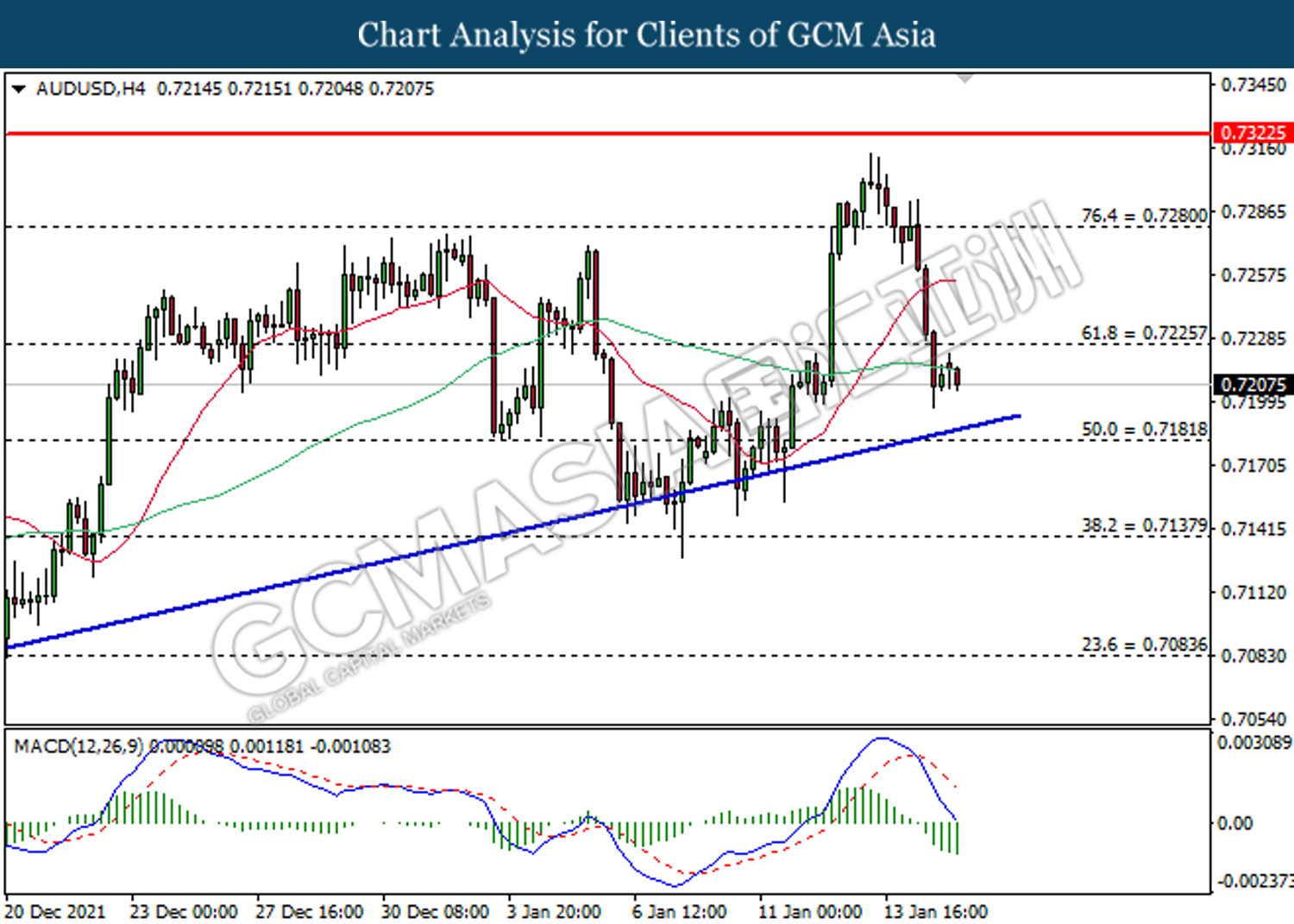

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower short-term.

Resistance level: 0.7225, 0.7280

Support level: 0.7180, 0.7140

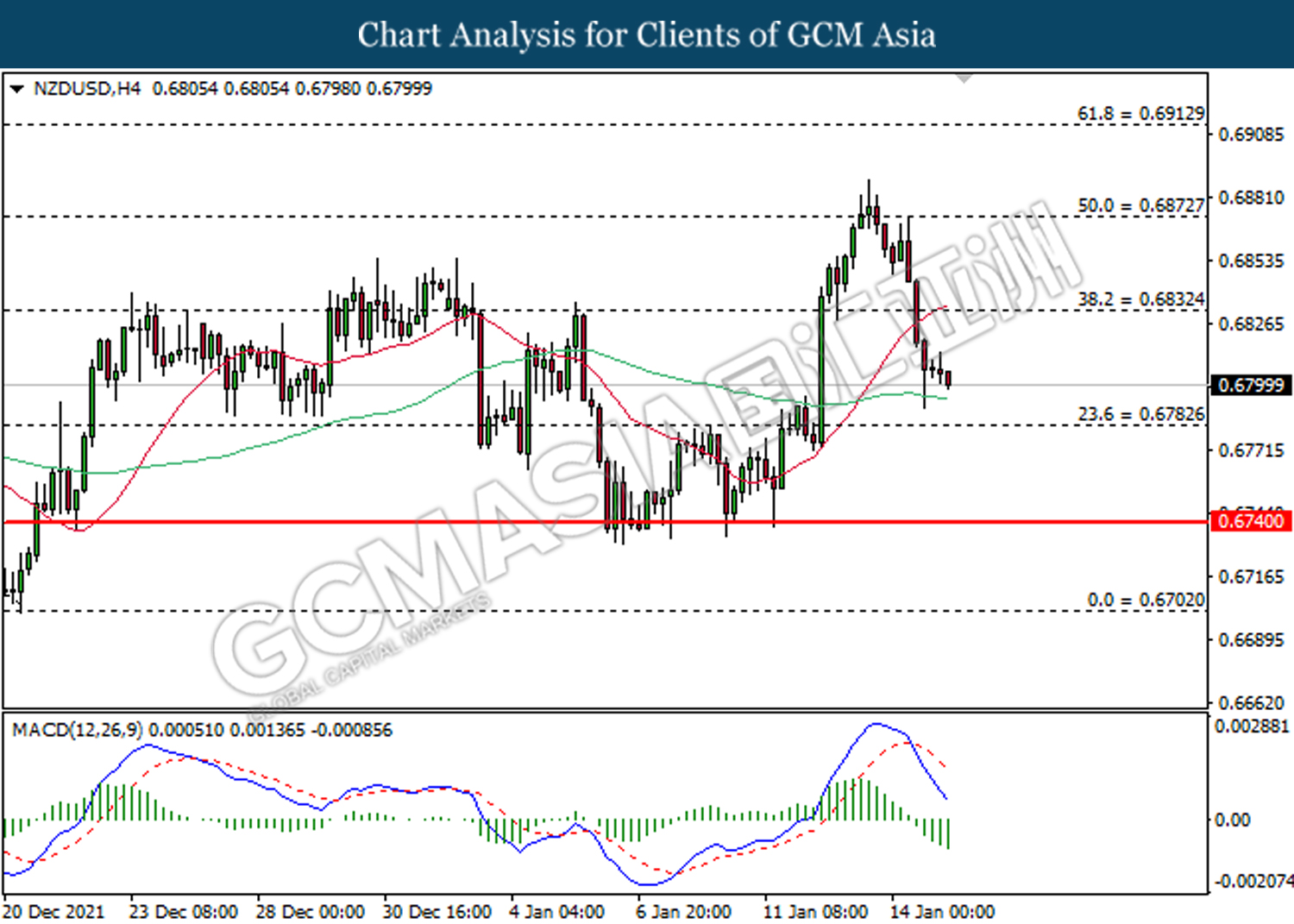

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6830, 0.6870

Support level: 0.6780, 0.6740

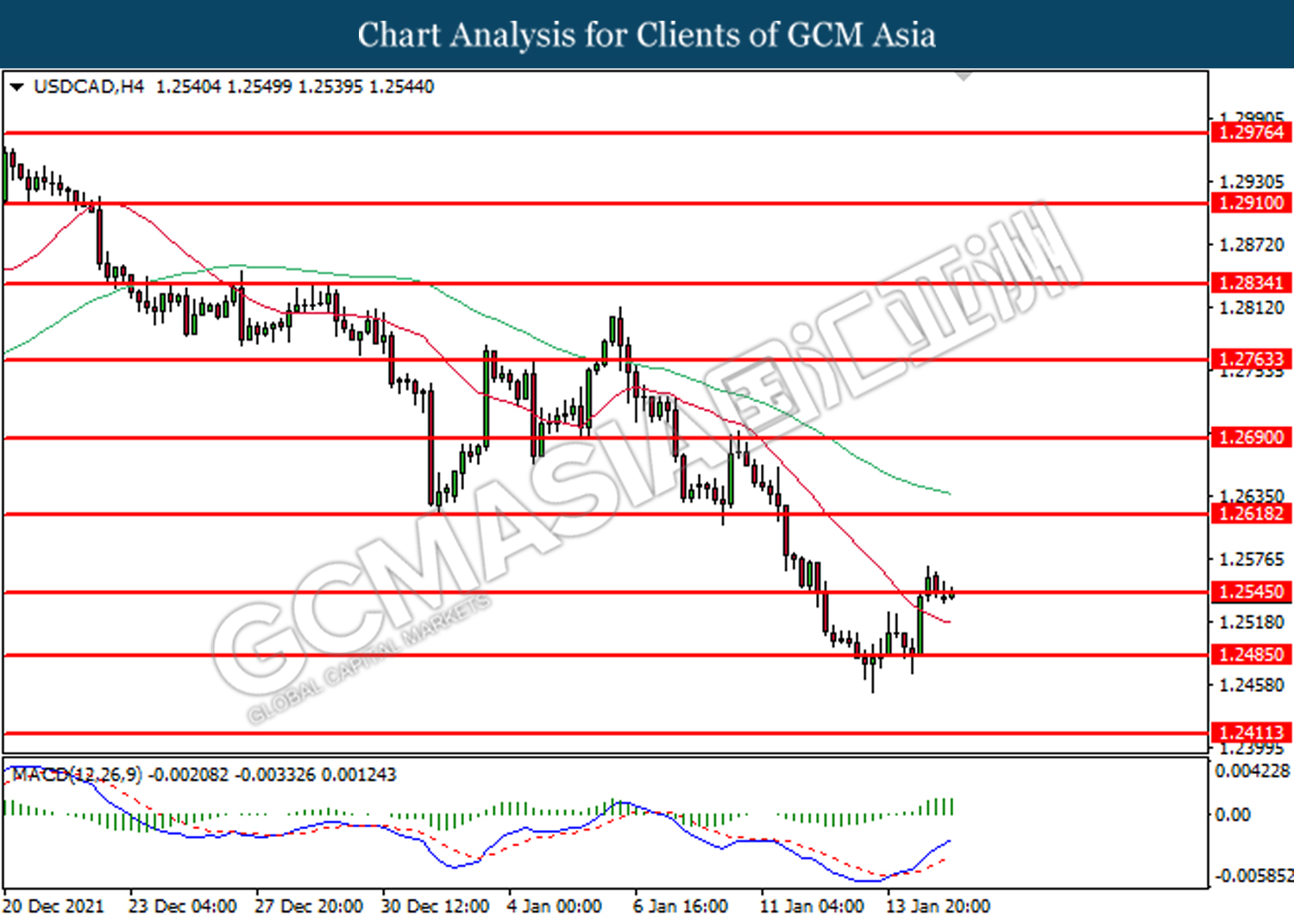

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish suggests the pair to be traded higher after closing above 1.2545.

Resistance level: 1.2545, 1.2620

Support level: 1.2485, 1.2410

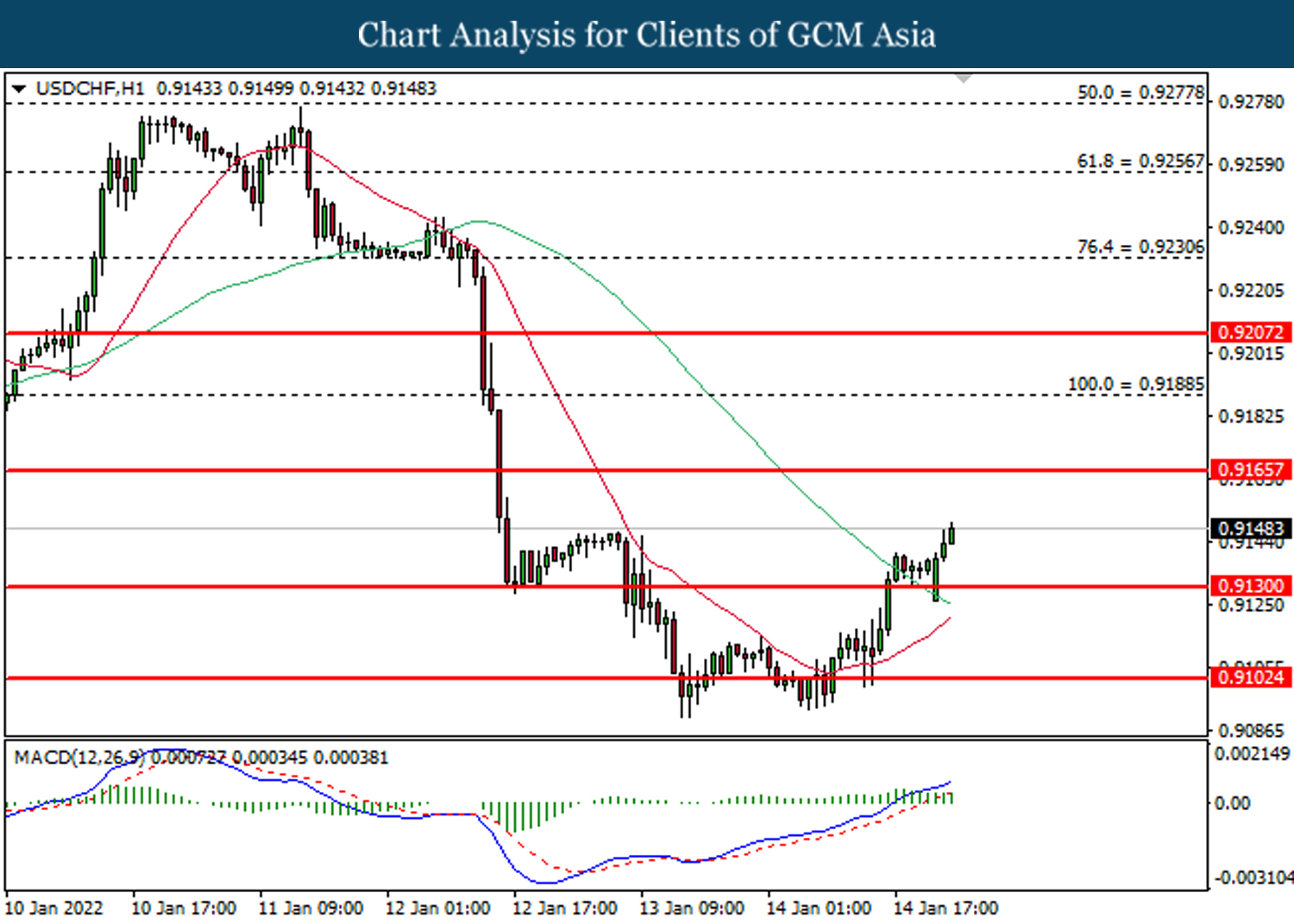

USDCHF, H1: USDCHF was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9165, 0.9190

Support level: 0.9130, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests its price to be traded lower in short-term.

Resistance level: 84.60, 87.40

Support level: 82.65, 80.15

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after closing below 1812.80.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60