17 January 2023 Afternoon Session Analysis

Aussie edged up following the optimistic GDP.

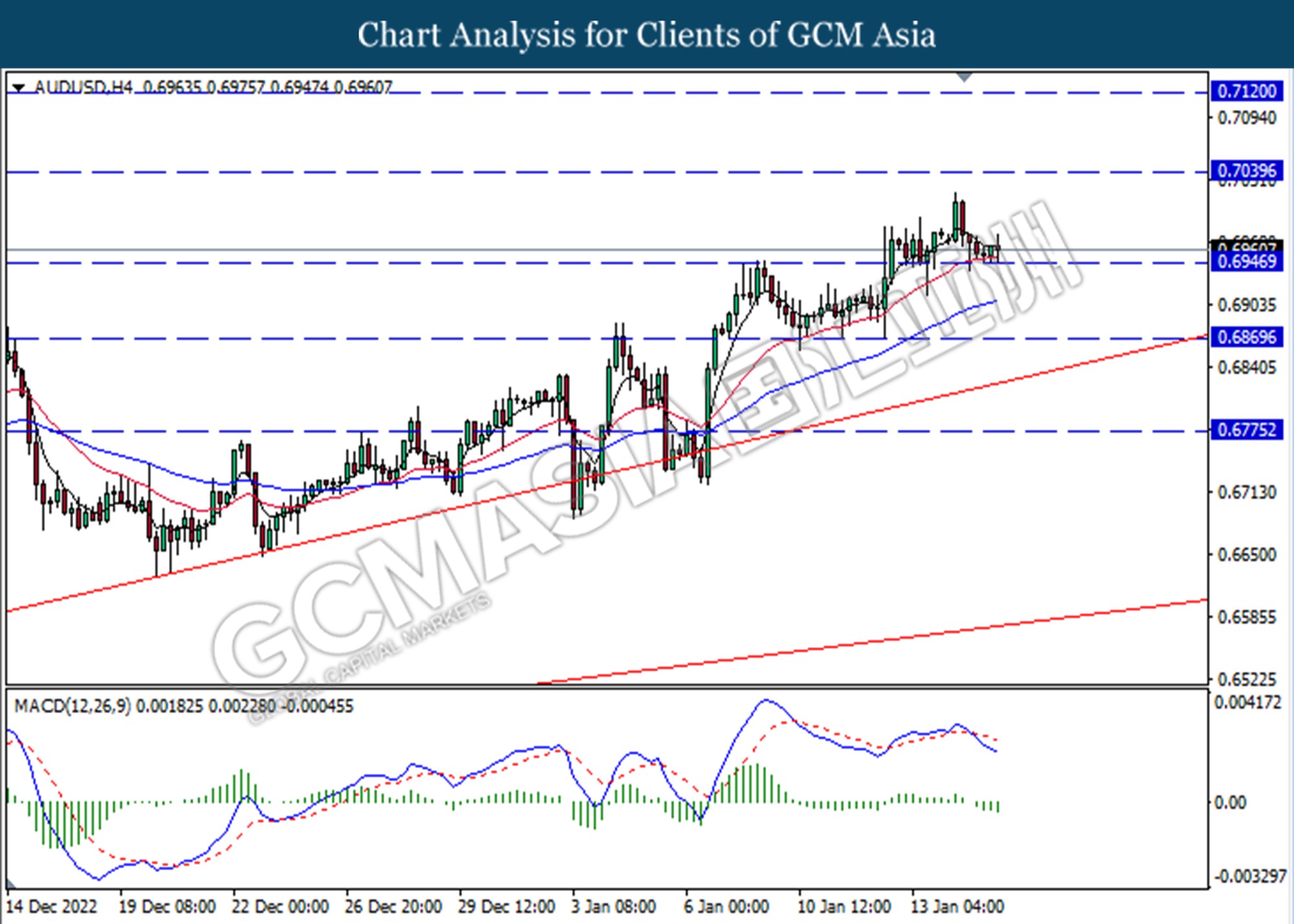

The AUD/USD, which traded widely by global investors received some bullish momentum on Tuesday after the upbeat economic data has been unleashed. According to National Bureau of Statistics of China, the China Gross Domestic Product (GDP) YoY came in at the reading of 2.9%, exceeding the market forecast of 1.8%. Besides, the China Industrial Production YoY also surprised market participants by a better-than-expected figures, which indicating that the manufacturing sector in China has started to recover. Thus, Aussie, one of the China-proxy currency has catch the eyes of investors. Though, the gains of Aussie was limited following the pandemic Covid-19 issue still lingering in China. According to Reuters, China citizens laden with luggage flocked to rail stations in China’s megacities on Monday, heading to their hometowns for holidays. However, China may be on the verge of another outbreak of COVID-19 amid the background of loosening ‘zero-Covid’ policy. As of writing, the AUD/USD appreciated by 0.22% to 0.6969.

In the commodities market, the crude oil price eased by 0.62% to $79.60 per barrel as of writing as investors are awaiting for the OPEC monthly report which will be released tonight. On the other hand, the gold price depreciated by 0.42% to $1910.25 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Nov) | 6.1% | 6.1% | – |

| 15:00 | GBP – Claimant Count Change (Dec) | 30.5K | 19.8K | – |

| 15:00 | EUR – German CPI (YoY) (Dec) | 8.6% | 8.6% | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Jan) | -23.3 | -15.0 | – |

| 21:30 | CAD – Core CPI (MoM) (Dec) | – | – | – |

Technical Analysis

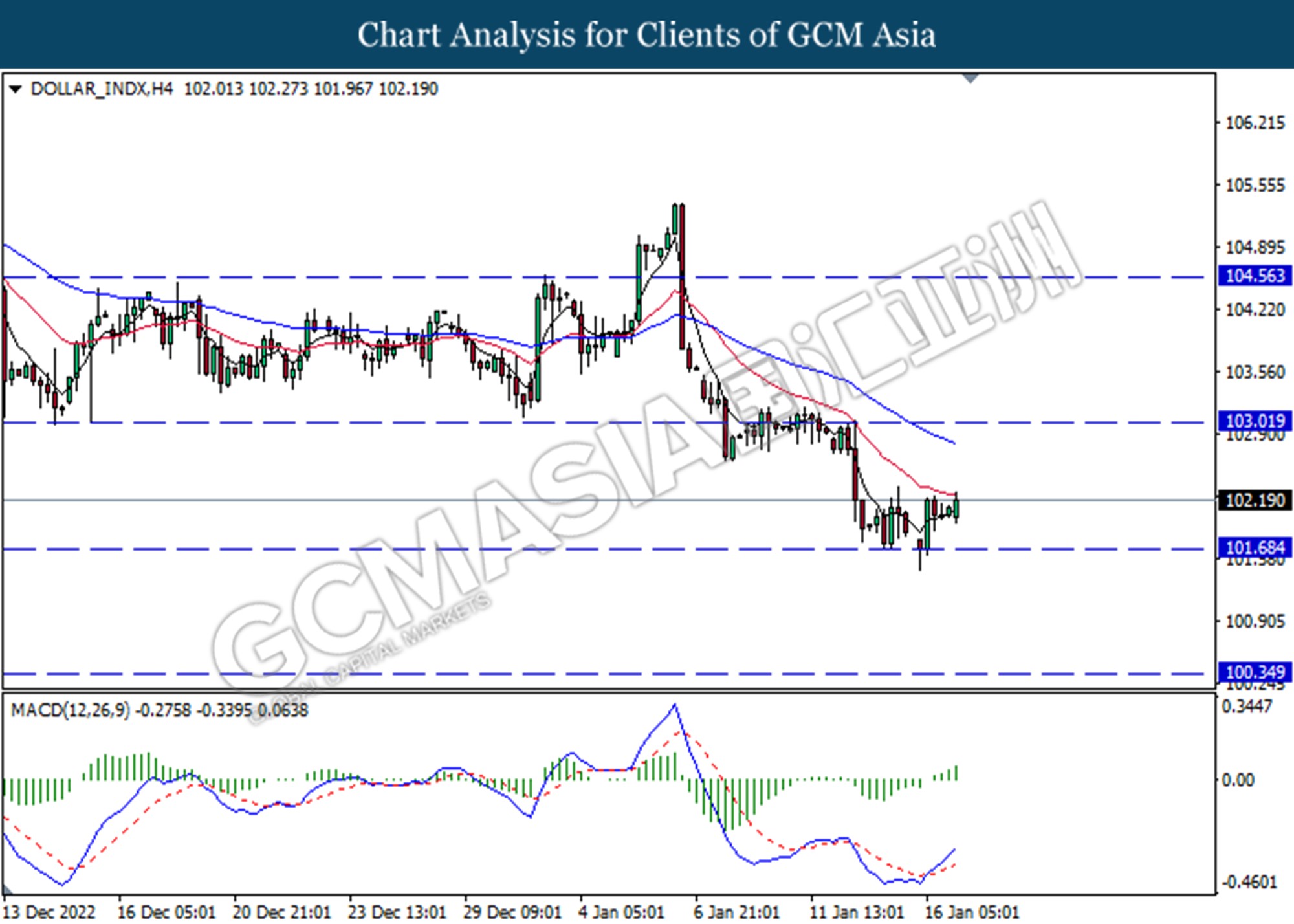

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index extend its gains towards resistance at 101.65.

Resistance level: 103.00, 104.55

Support level: 101.65, 100.35

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggested the pair extend its gains towards support level at 1.2145

Resistance level: 1.2300, 1.2450

Support level: 1.2145, 1.1925

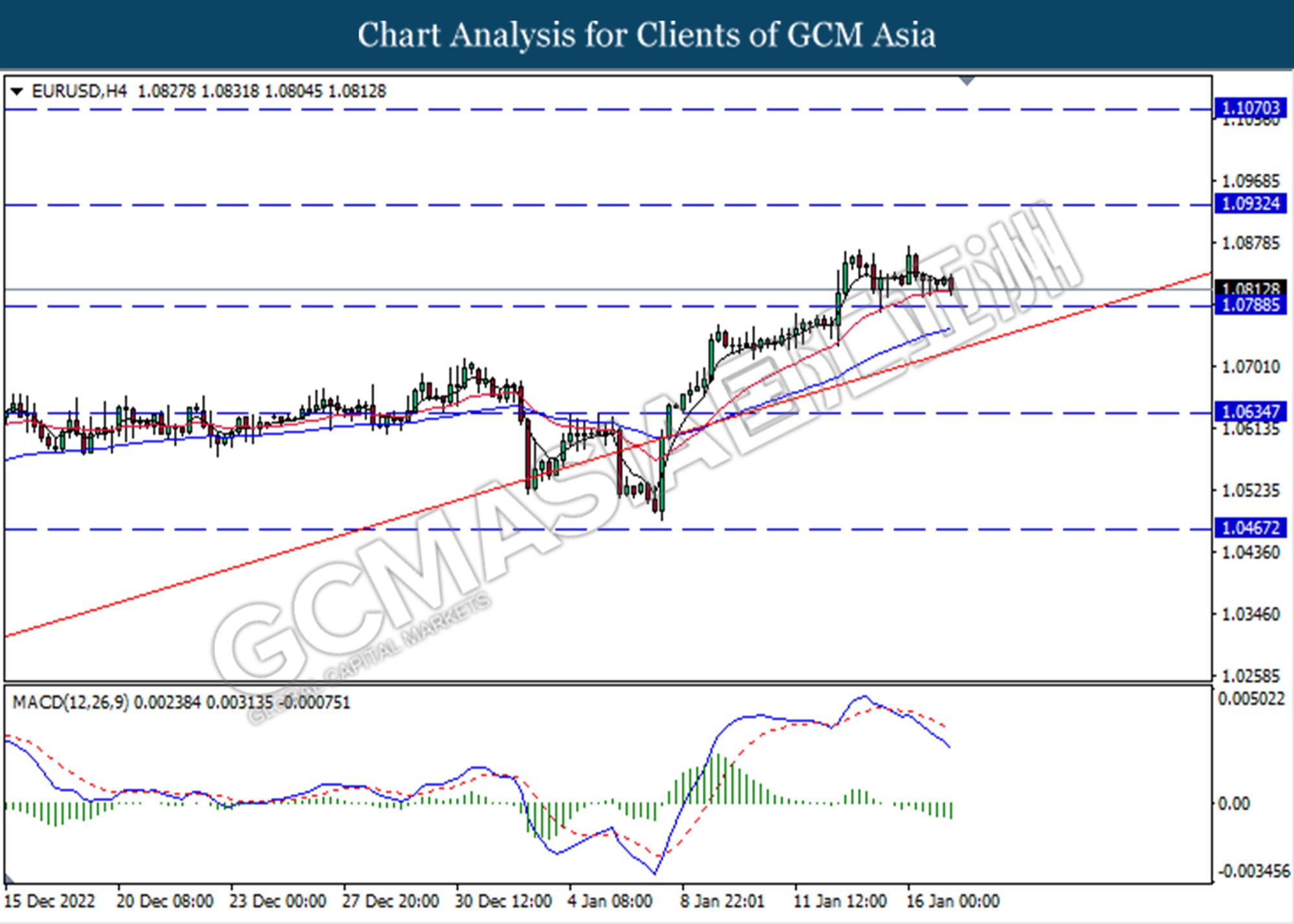

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggested the pair extend its losses towards support level at 1.0635

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0470

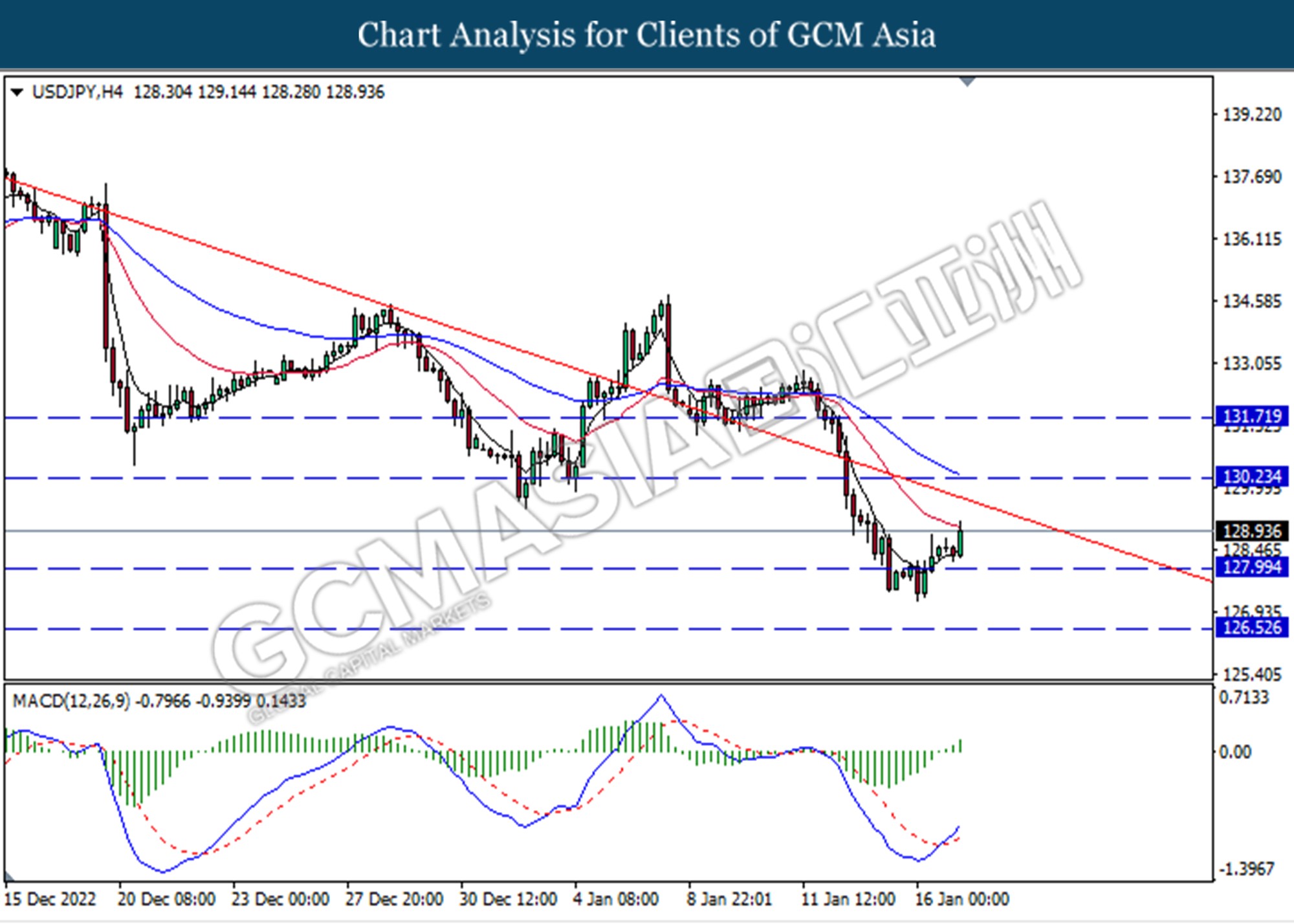

USDJPY, H4: USDJPY was traded higher following a prior break above the previous resistance level. MACD which illustrated increasing bullish momentum suggested the pair will extend its gains towards 130.25.

Resistance level: 130.25, 131.70

Support level: 128.00, 126.50

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggested the pair will extend it losses if successfully break below the support level at 0.6870

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

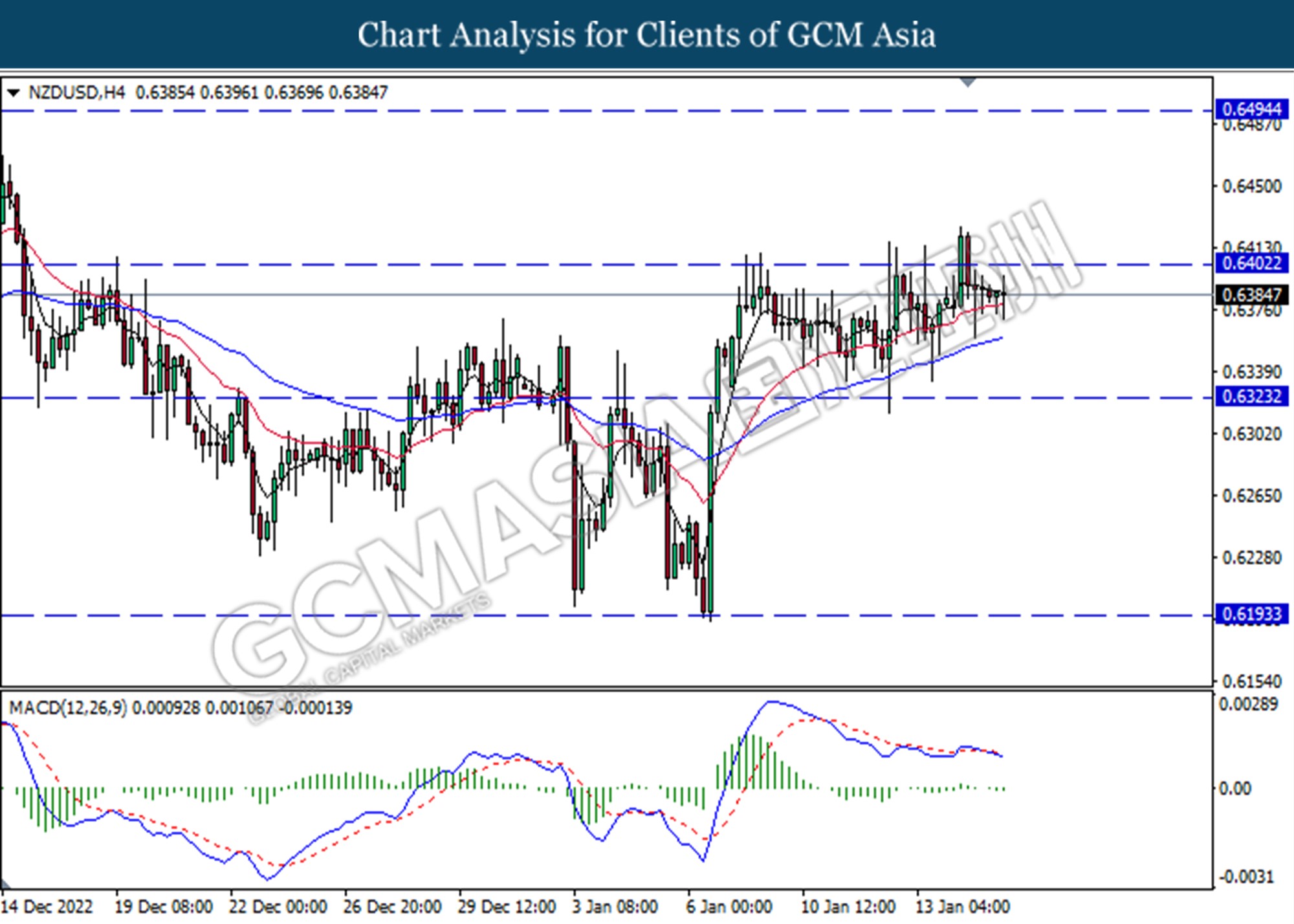

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level. MACD which illustrated bearish bias momentum suggested the pair will extend its losses towards support level at 0.6325

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6195

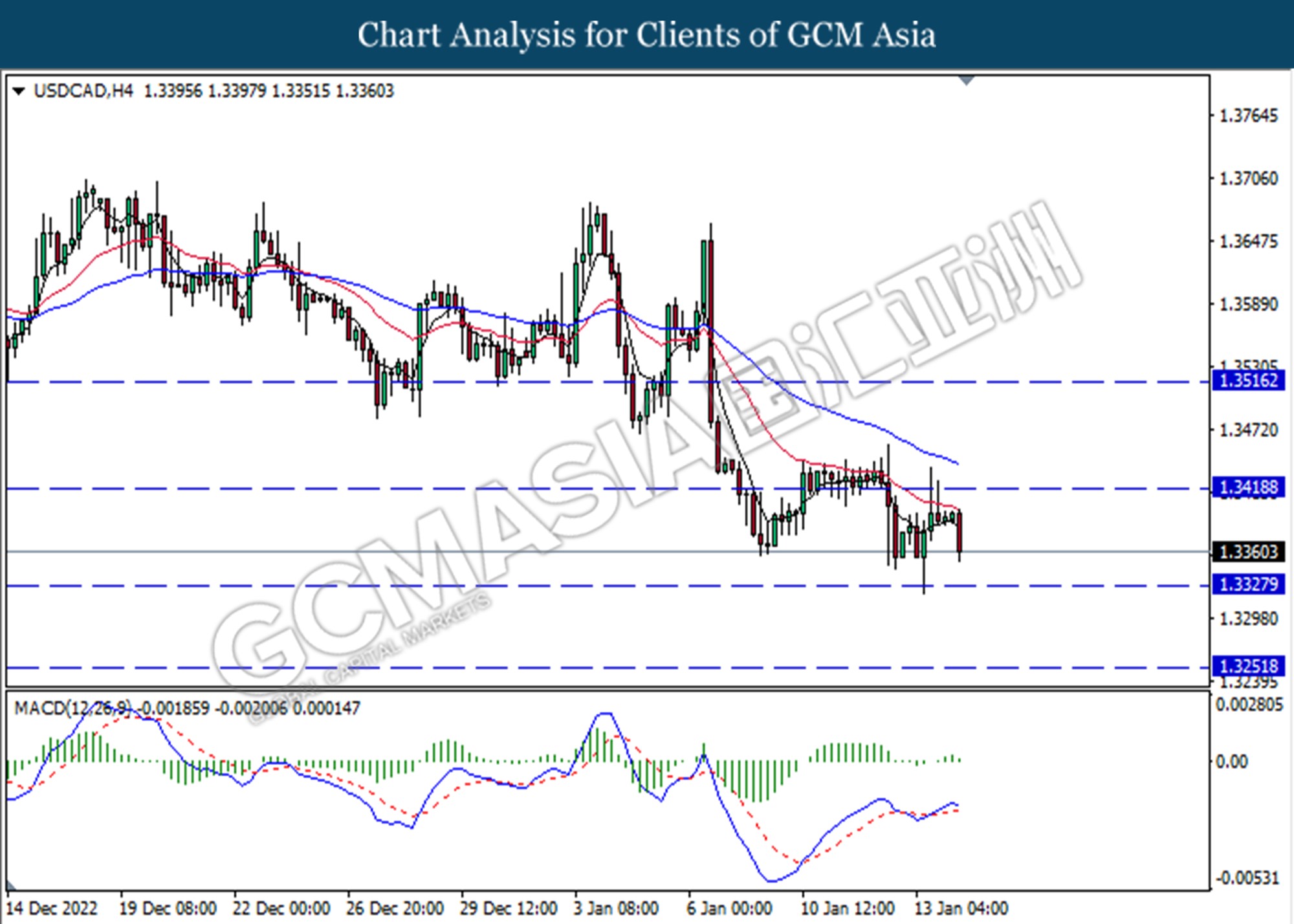

USDCAD, H4: USDCAD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish bias momentum suggested the pair will traded lower towards support level at 1.3330.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggested the pair will extend its gains towards resistance level at 0.9310.

Resistance level: 0.9310, 0.9365

Support level: 0.9240, 0.9195

CrudeOIL, Daily: CrudeOIL was traded lower following a prior retracement from the trend level. MACD which illustrated bullish bias momentum suggested the commodity will undergo a technical correction in short-term.

Resistance level: 81.60, 89.00

Support level: 76.05, 70.25

GOLD, Daily: GOLD was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggested the commodity will extend its losses if the commodity break below the support level at 1898.65.

Resistance level: 1953.40, 1996.80

Support level: 1898.65, 1845.80