17 January 2023 Morning Session Analysis

US Dollar steadied amid Martin Luther King Day.

The dollar index, which traded against a basket of six major currencies, was traded thinly during Martin Luther King Day, but still managed to find it foots at the recent low level. The FX market was in thin trade yesterday as the major stock market was closed for Martin Luther King Jr. Day. Before that, the US dollar was sold off massively by the market participants as the US inflation figure for December was in line with the consensus forecast, whereby the inflation is on the retreat. With such a backdrop, it further confirmed the market standpoint where the Fed is getting closer to the end of its rate hike plan, and no massive rate hike moving forward. This week, the market participants will continue to eye on the crucial economic data, such as Retail Sales and PPI, to further assess the next move of the Federal Reserve. As of writing, the dollar index rose by 0.17% to 102.35.

In the commodities market, crude oil prices dropped by -1.47% to $78.95 per barrel as the rebound of the US dollar pushed the cost of oil higher for non-US buyers. Besides, gold prices edged down by -0.25% to $1915.35 per troy ounce following the rebound in the Greenback market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Nov) | 6.1% | 6.1% | – |

| 15:00 | GBP – Claimant Count Change (Dec) | 30.5K | 19.8K | – |

| 15:00 | EUR – German CPI (YoY) (Dec) | 8.6% | 8.6% | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Jan) | -23.3 | -15.0 | – |

| 21:30 | CAD – Core CPI (MoM) (Dec) | – | – | – |

Technical Analysis

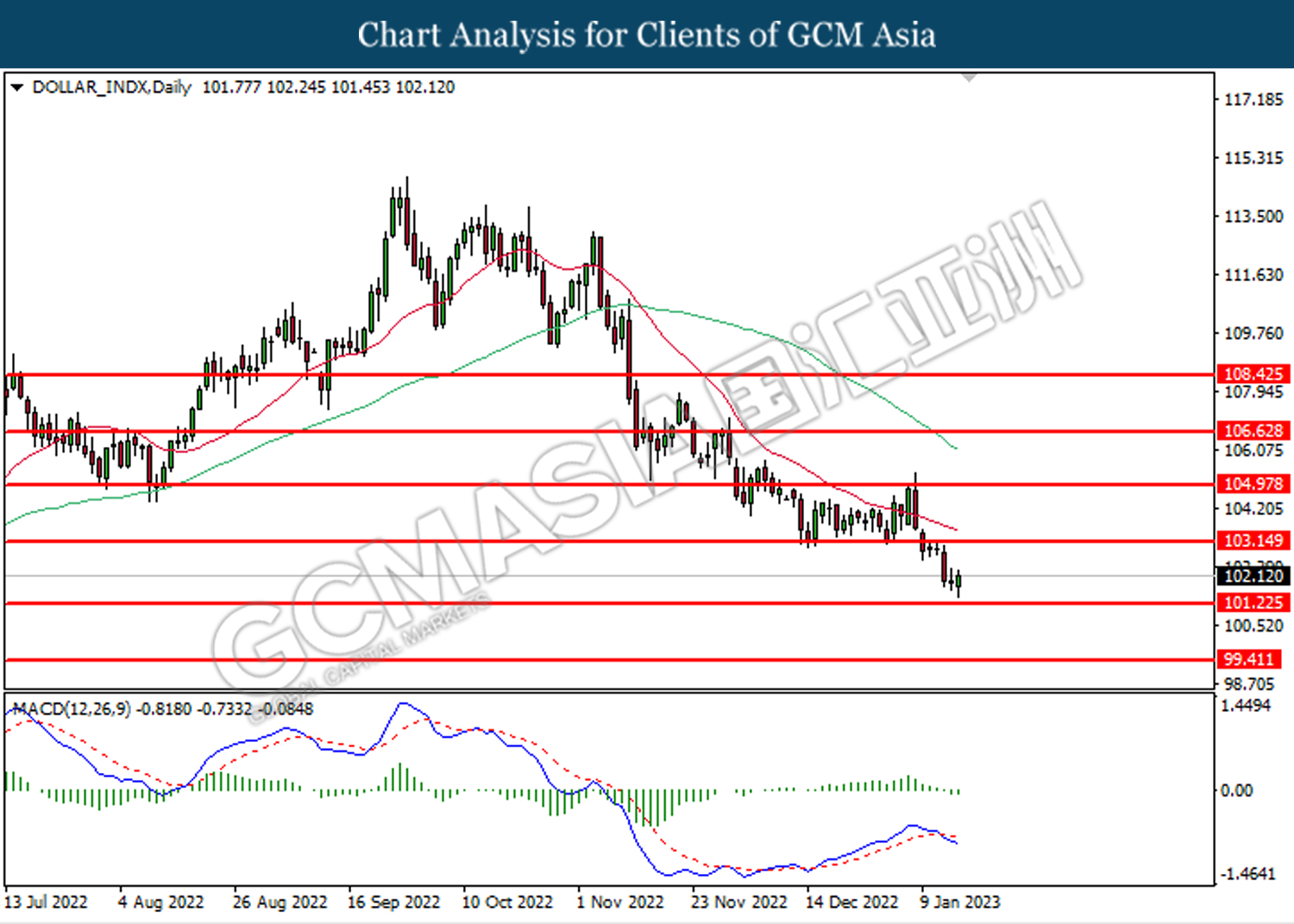

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

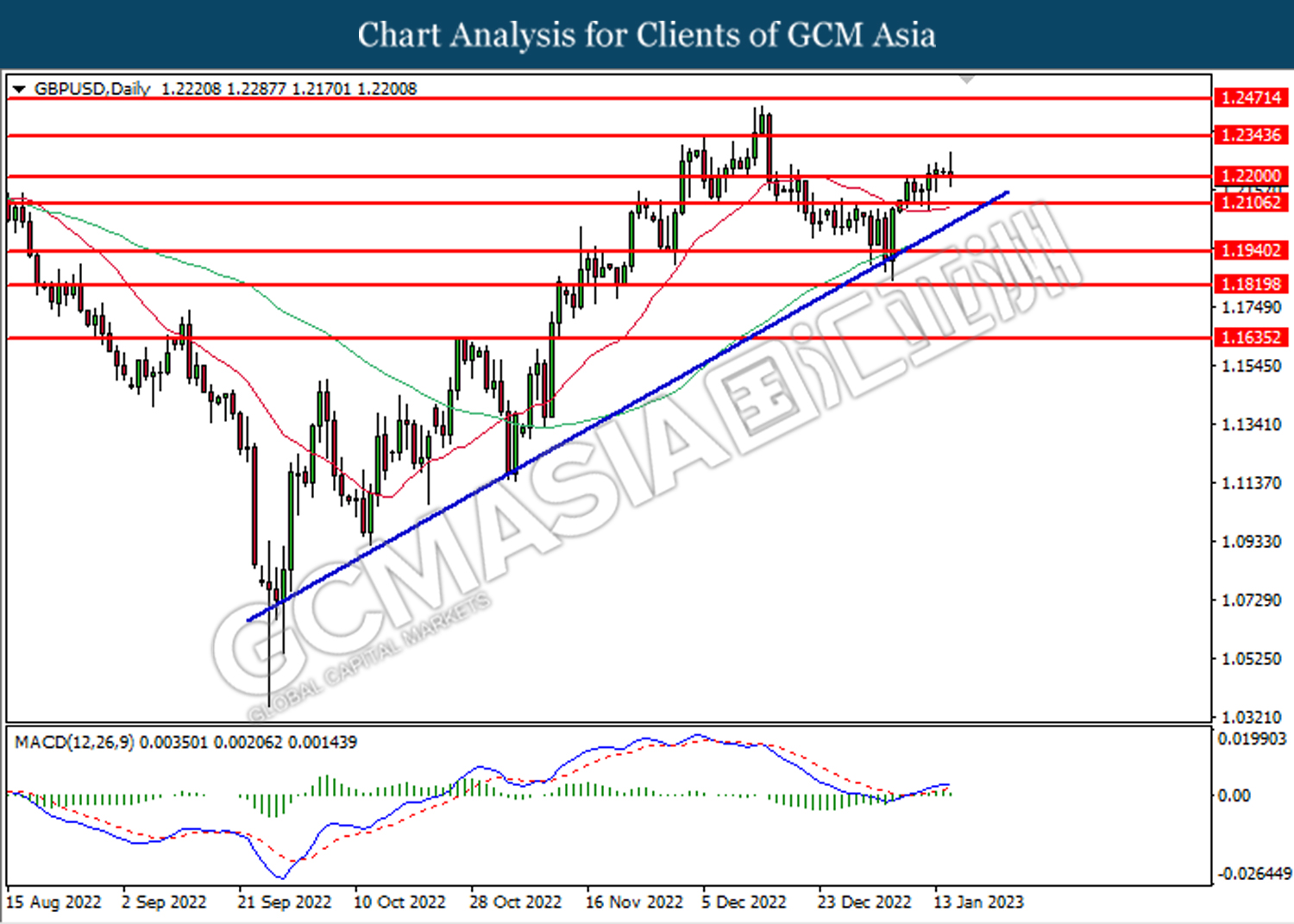

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

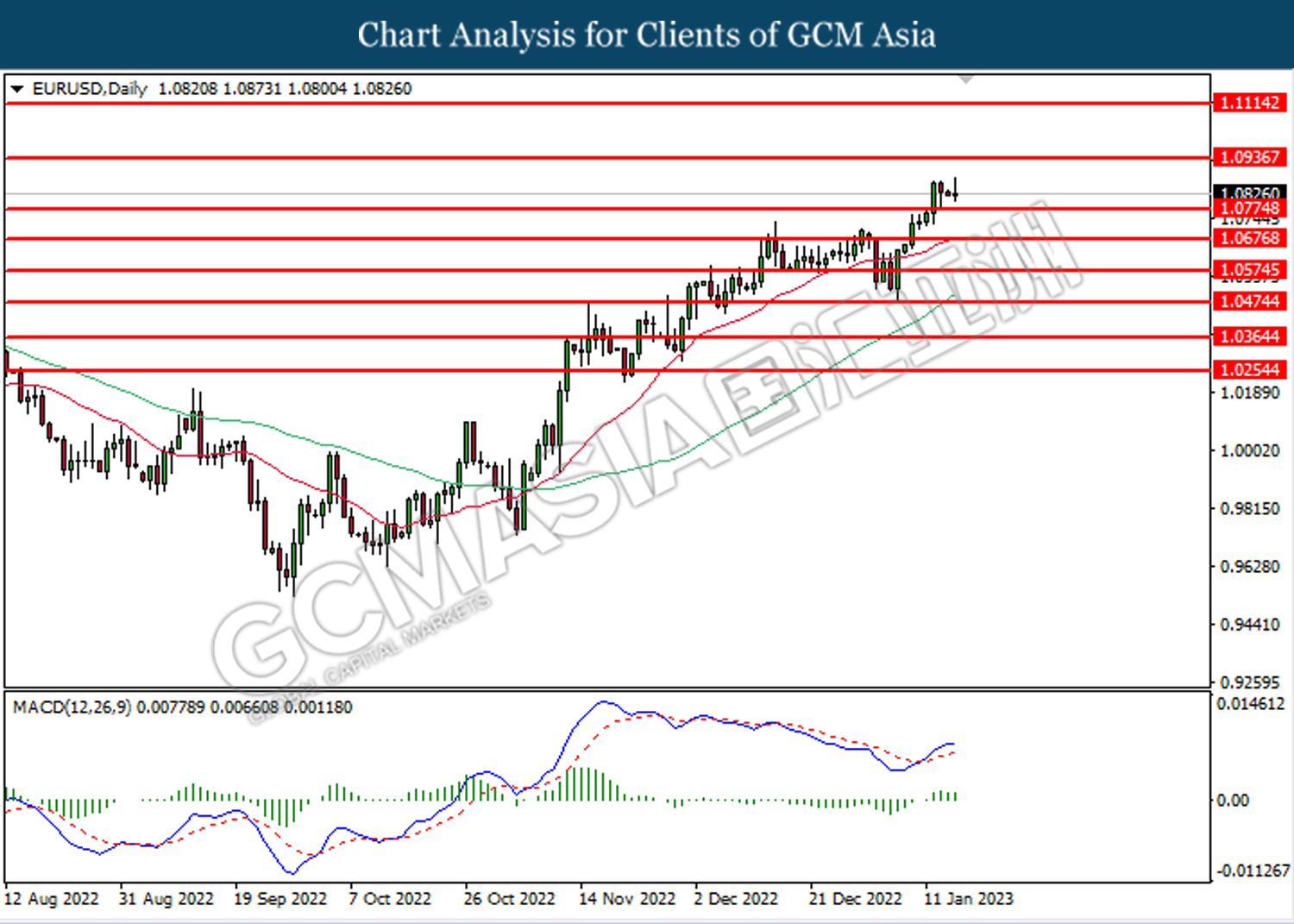

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0775. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0935.

Resistance level: 1.0935, 1.1115

Support level: 1.0775, 1.0675

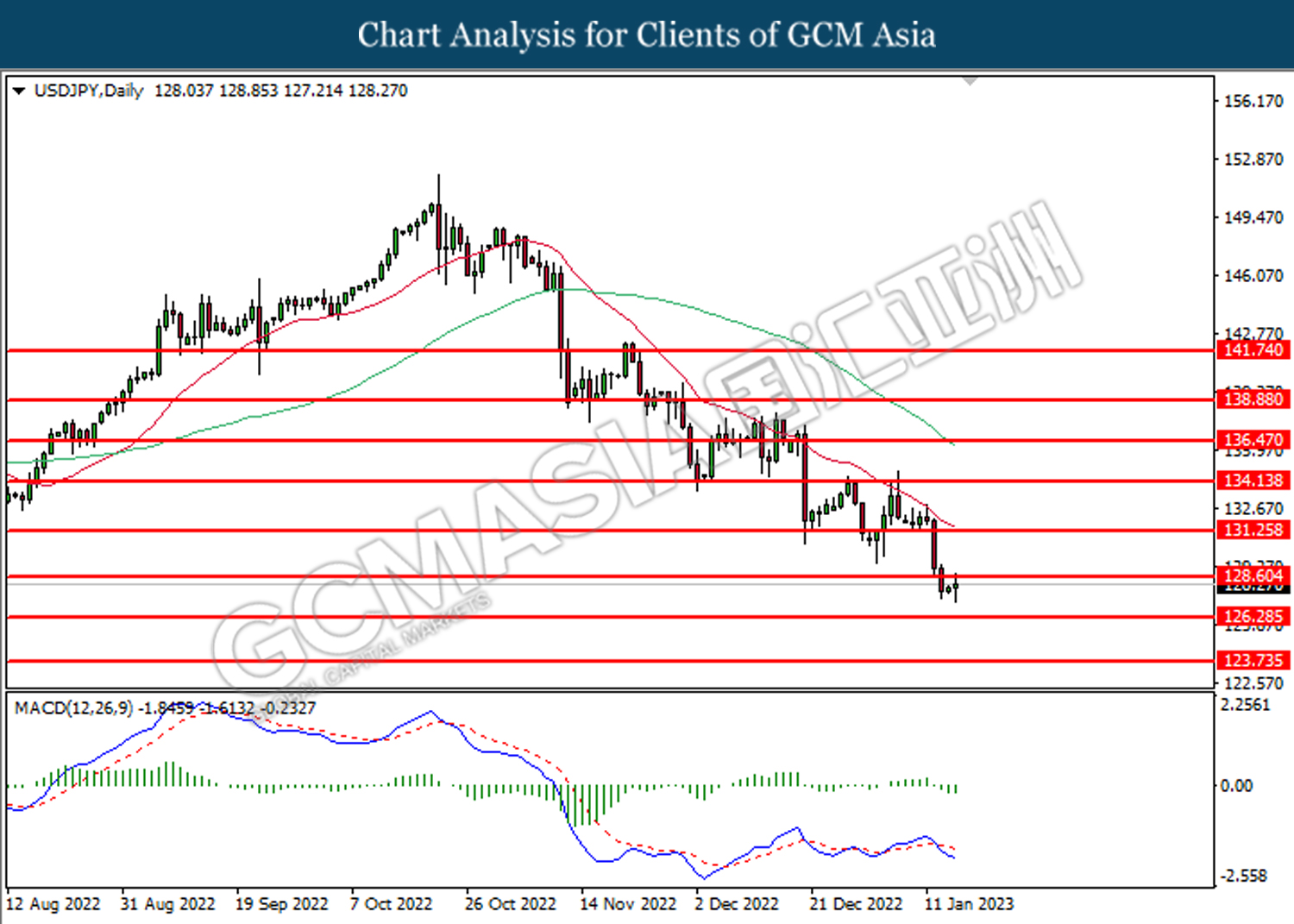

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the support level at 128.60. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 126.30.

Resistance level: 128.60, 131.25

Support level: 126.30, 123.75

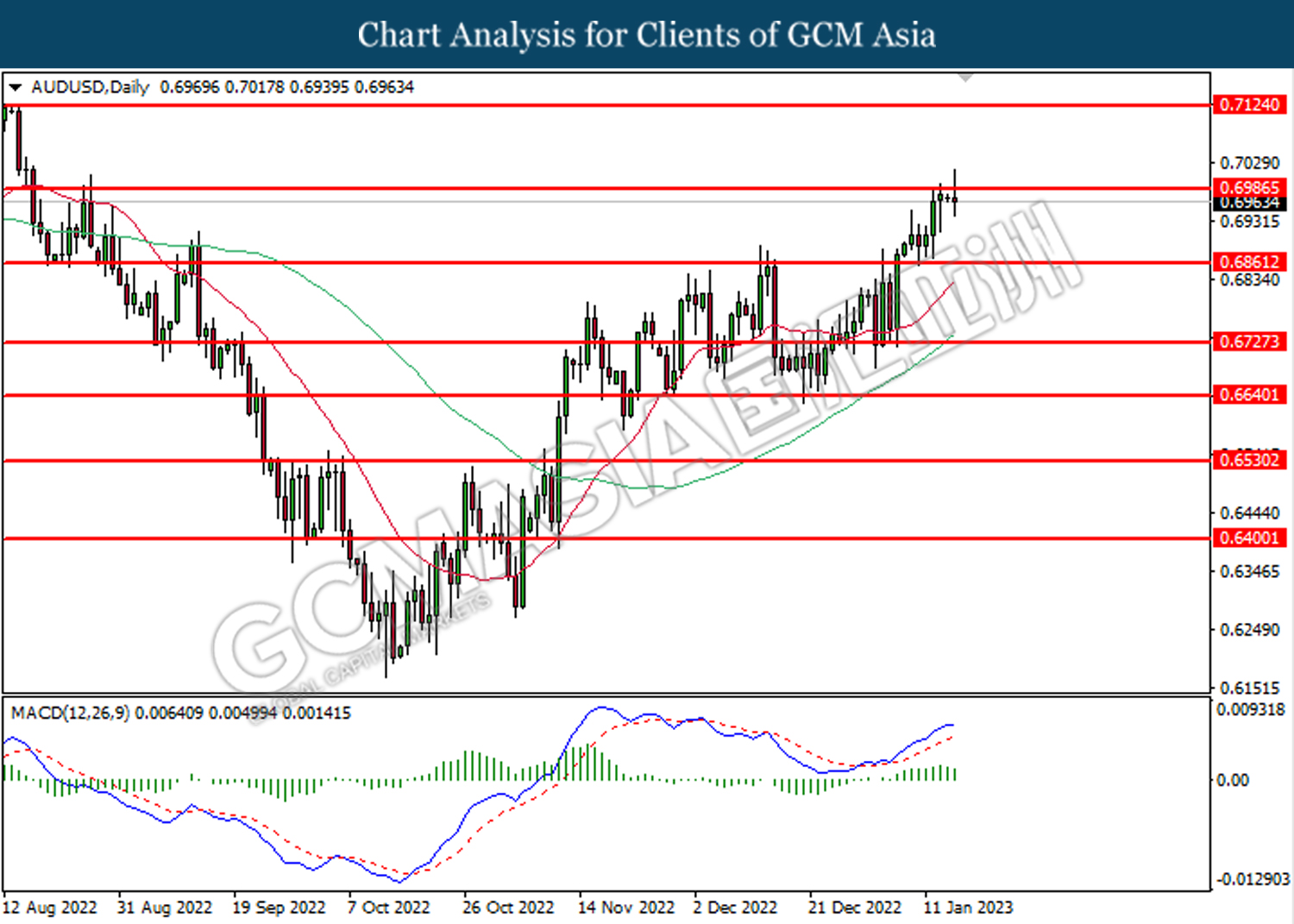

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

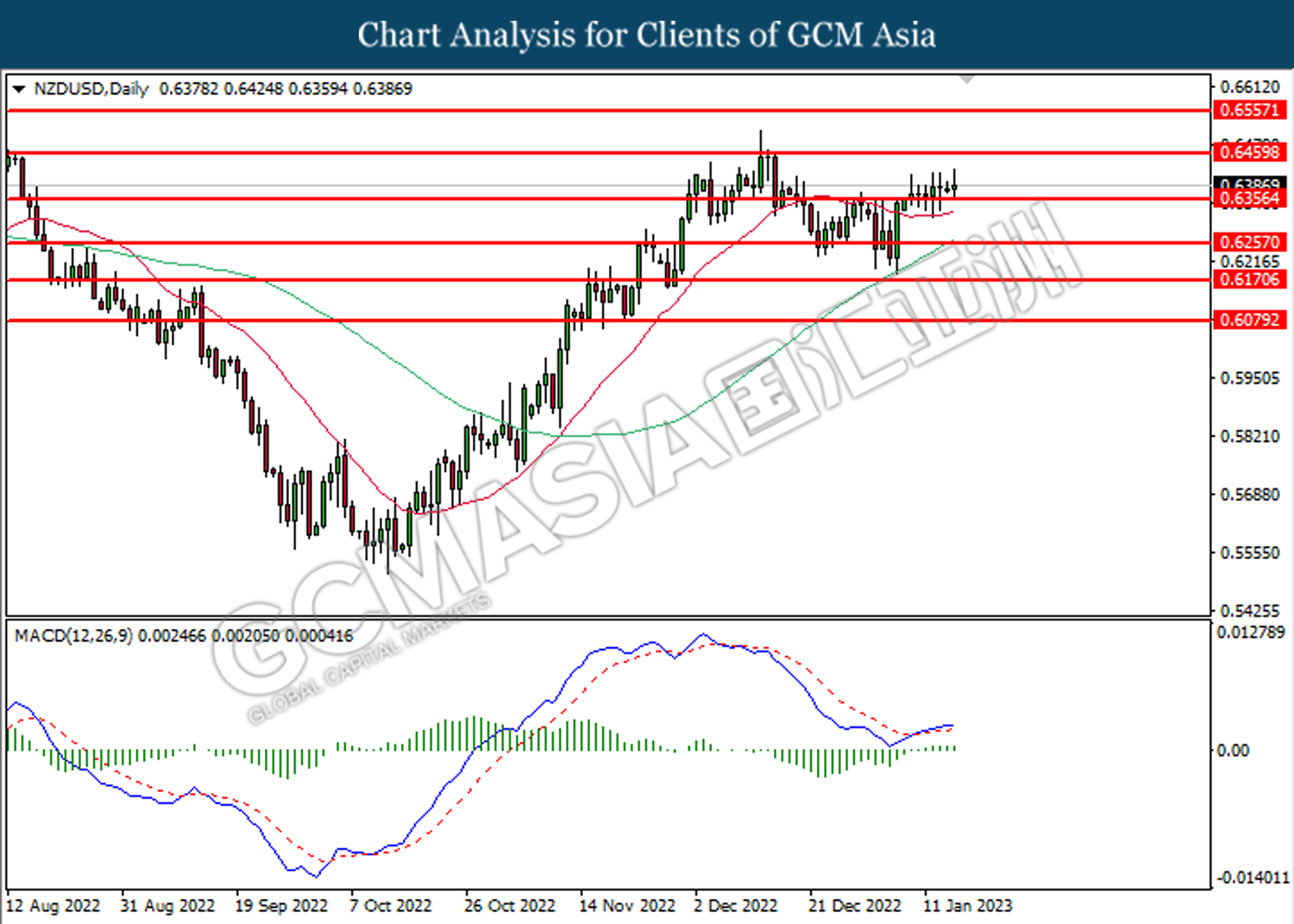

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3400. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

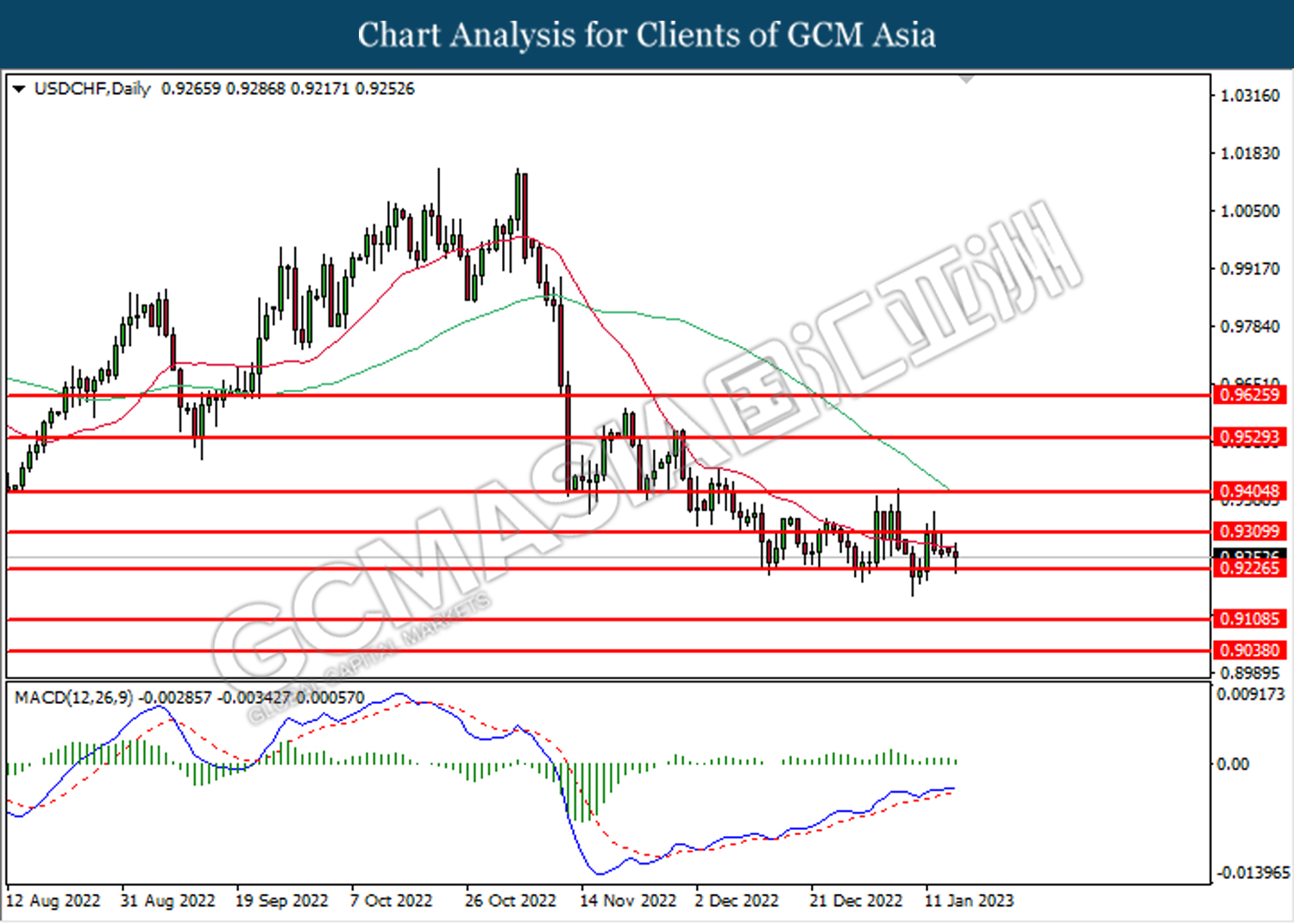

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9310. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

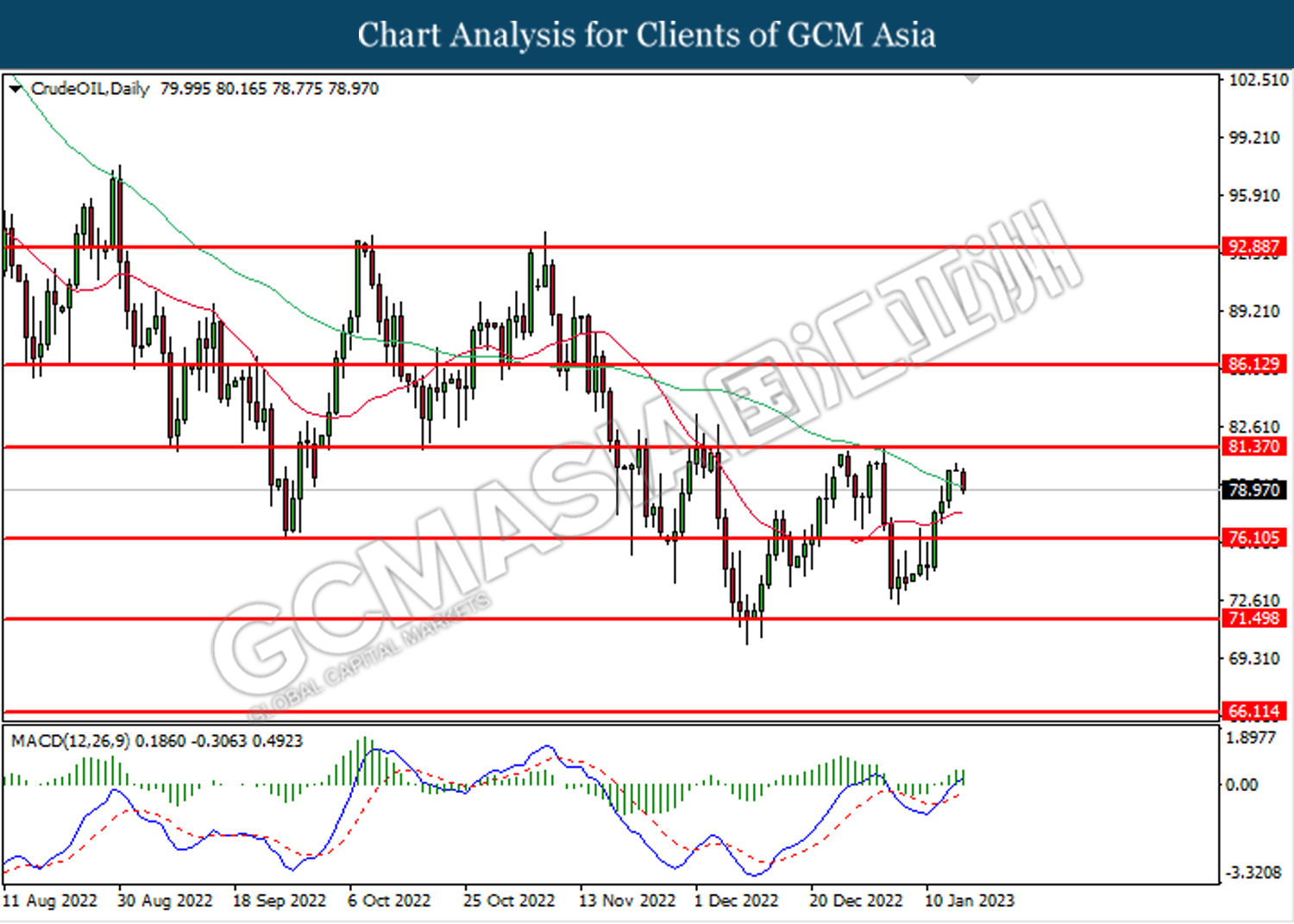

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement near the resistance level at 81.35. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 81.35, 86.15

Support level: 76.10, 71.50

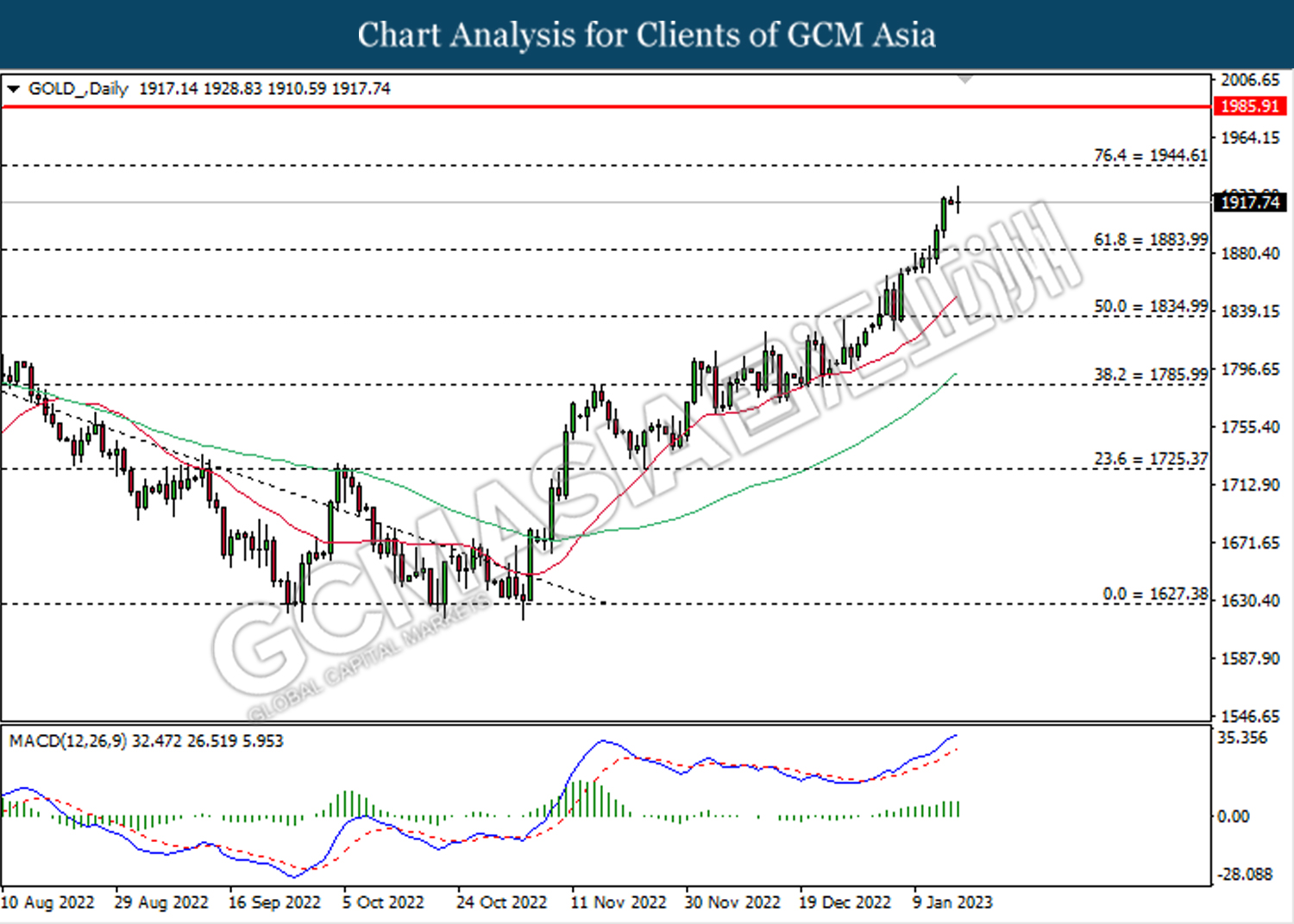

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1884.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1884.00, 1835.00