17 March 2023 Afternoon Session Analysis

Euro jumped in the aftermath of ECB hikes rate.

The Euro, which is acted as the major currency in European Union, jumped aftermath of the ECB hikes rate by 50 basis points, as expected to 3.50%. Recently, the swift closure of Silicon Valley Bank, followed by the Signature bank rattled investors’ confidence and raised concern over the global tightening path. Following that, investors took a bet on a 25bps rate hike by the ECB rather than a 50bps of increment. However, the council decided to increase the interest rate by 50 points in order to return inflation to the ECB’s medium-term 2% target. In the press conference held by the president of the ECB, Christine Lagarde mentioned the inflation pressure in the Eurozone remains stubbornly high and strengthen the wage pressures. Elevated inflation has prompted the ECB to remain aggressive in its upcoming tightening monetary decisions. At the same time, investors are highly concerned about the upcoming inflation data for more signals from the ECB. As of writing, the EUR/USD gained 0.40% to $1.0647.

In the commodities market, crude oil prices settled up by 0.13% to $68.42 per barrel as Saudi-Russian assurances on production cuts stabled the oil prices. Besides, gold prices appreciated by 0.65% to $1935.65 per troy ounce as bank sector jitters spurred the market’s safe-haven demand.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR- CPI (YoY) (Feb) | 8.5% | 8.5% | |

| 22:00 | USD – Michigan Consumer Sentiment (Mar) | 67.0 | 67.0 |

Technical Analysis

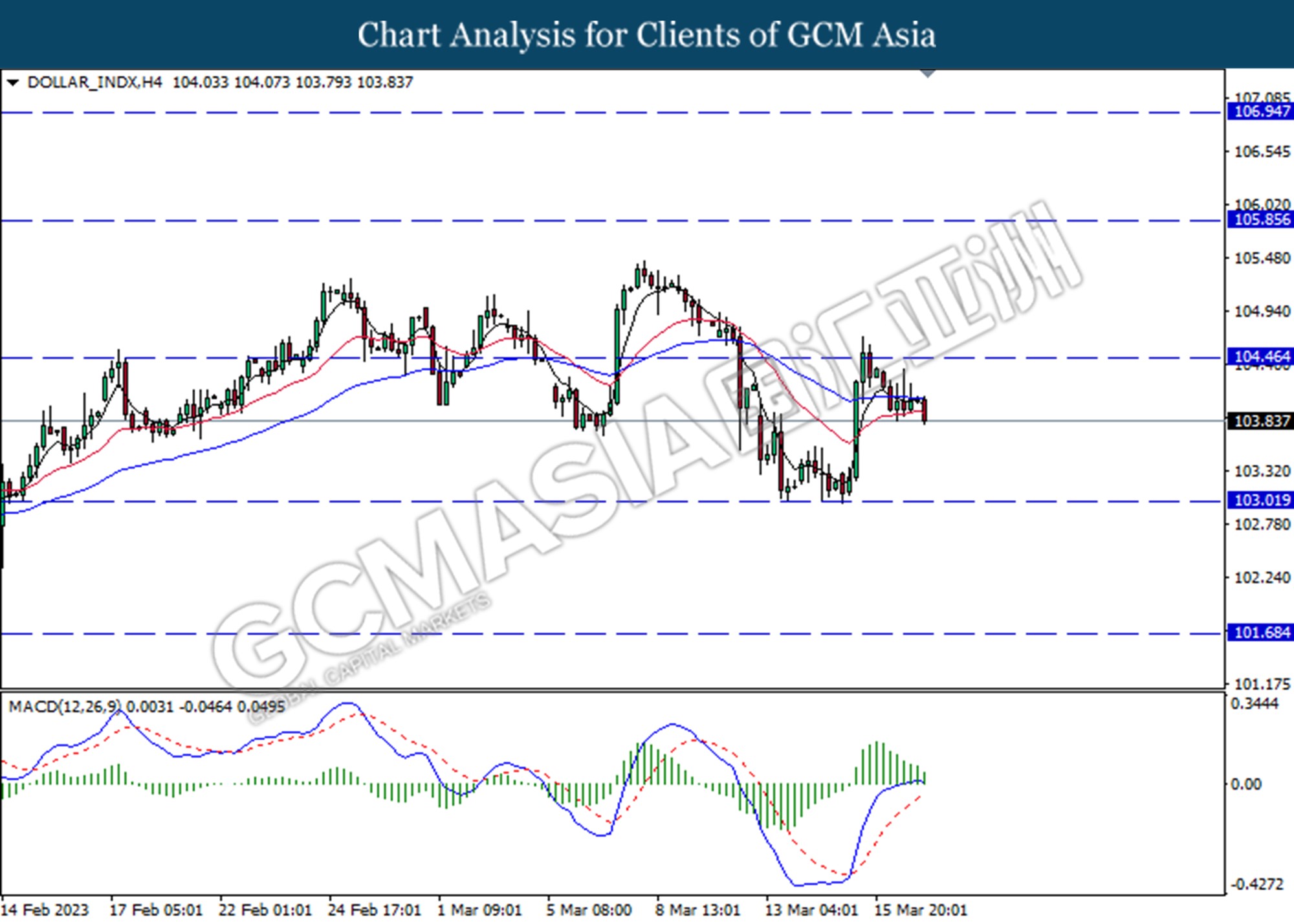

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

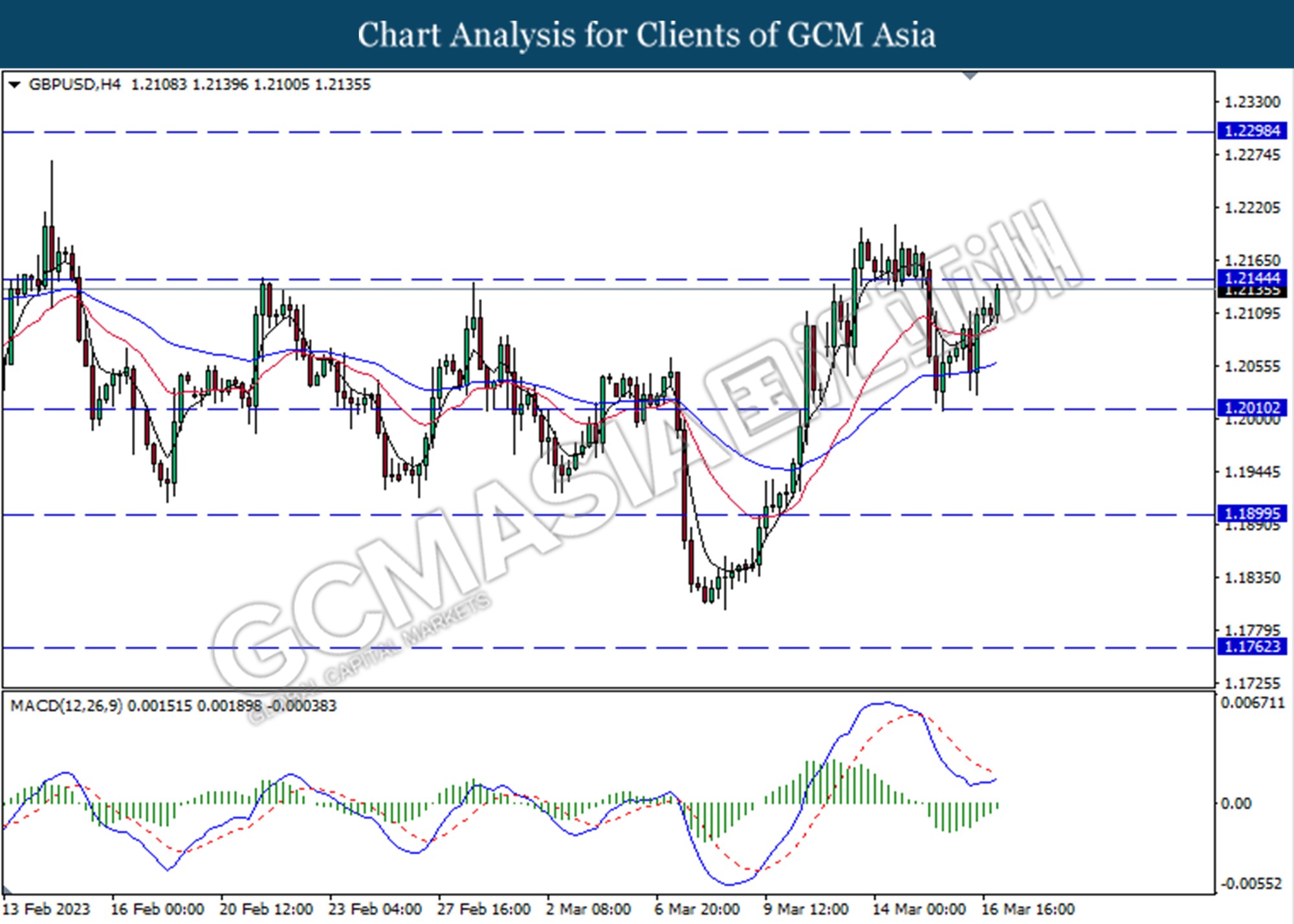

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2145

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

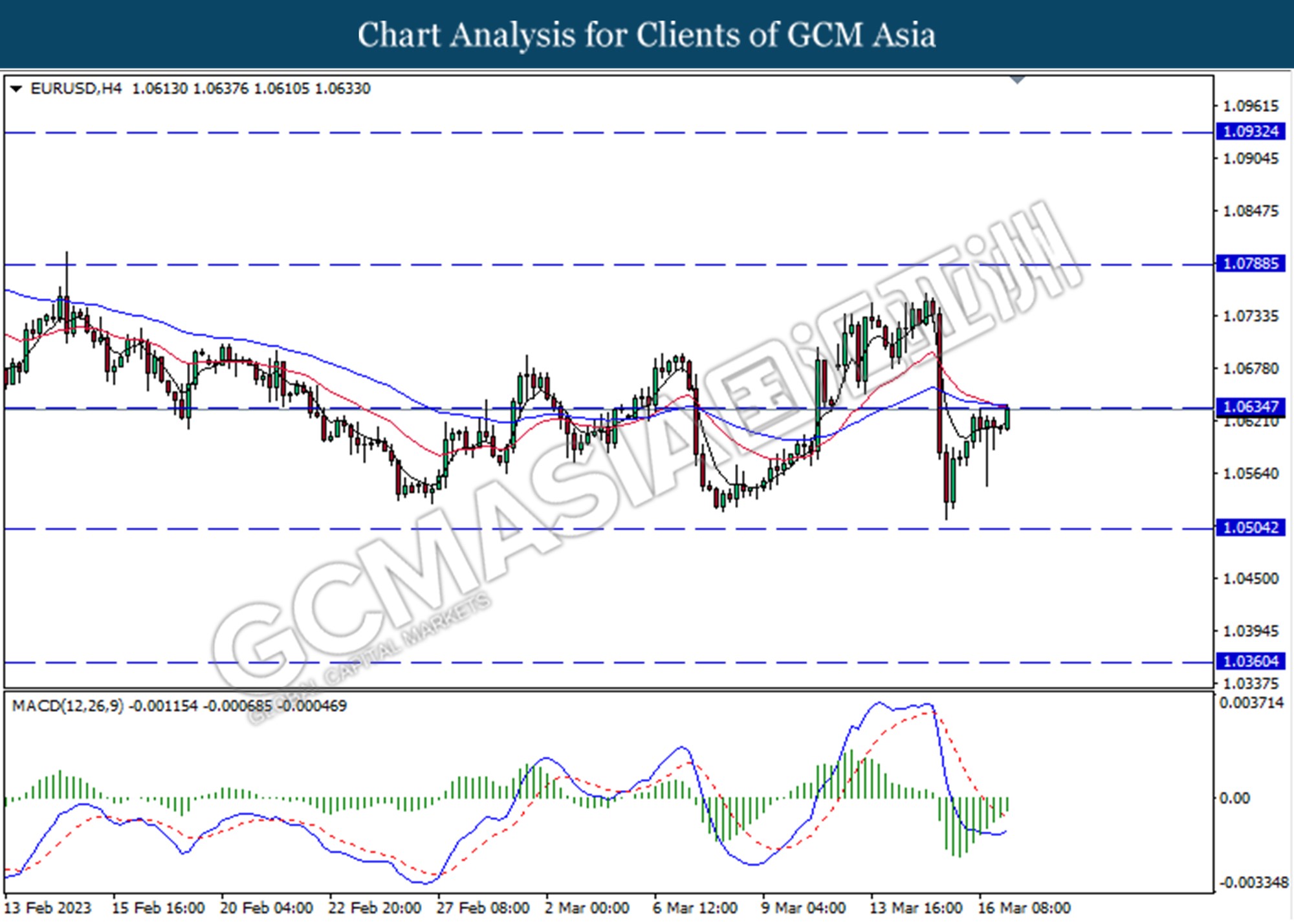

EURUSD, H4: EURUSD was traded higher while currently testing for the resistance level at 1.0635. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level at 1.0635.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

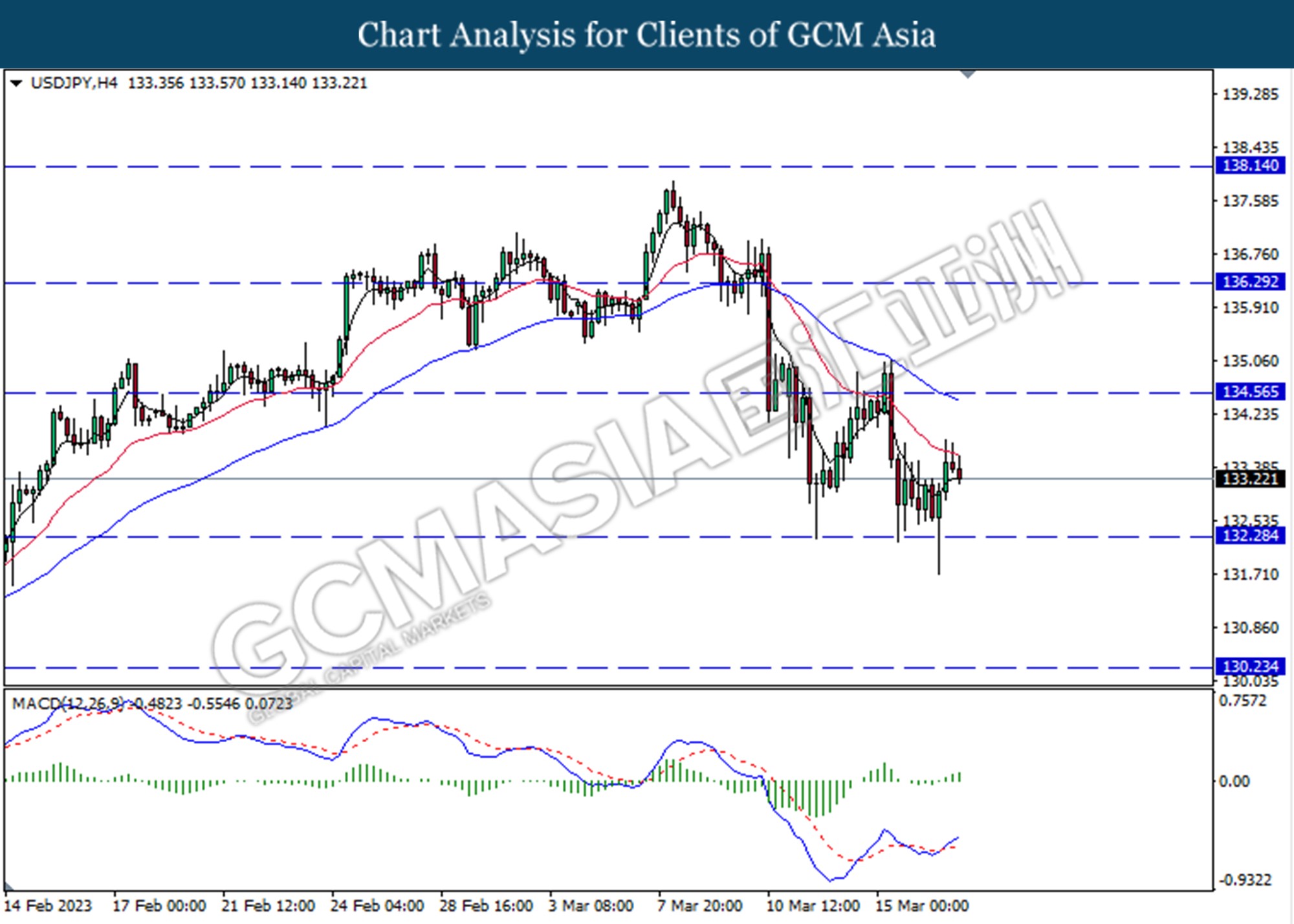

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 134.60, 136.30

Support level: 132.30, 130.25

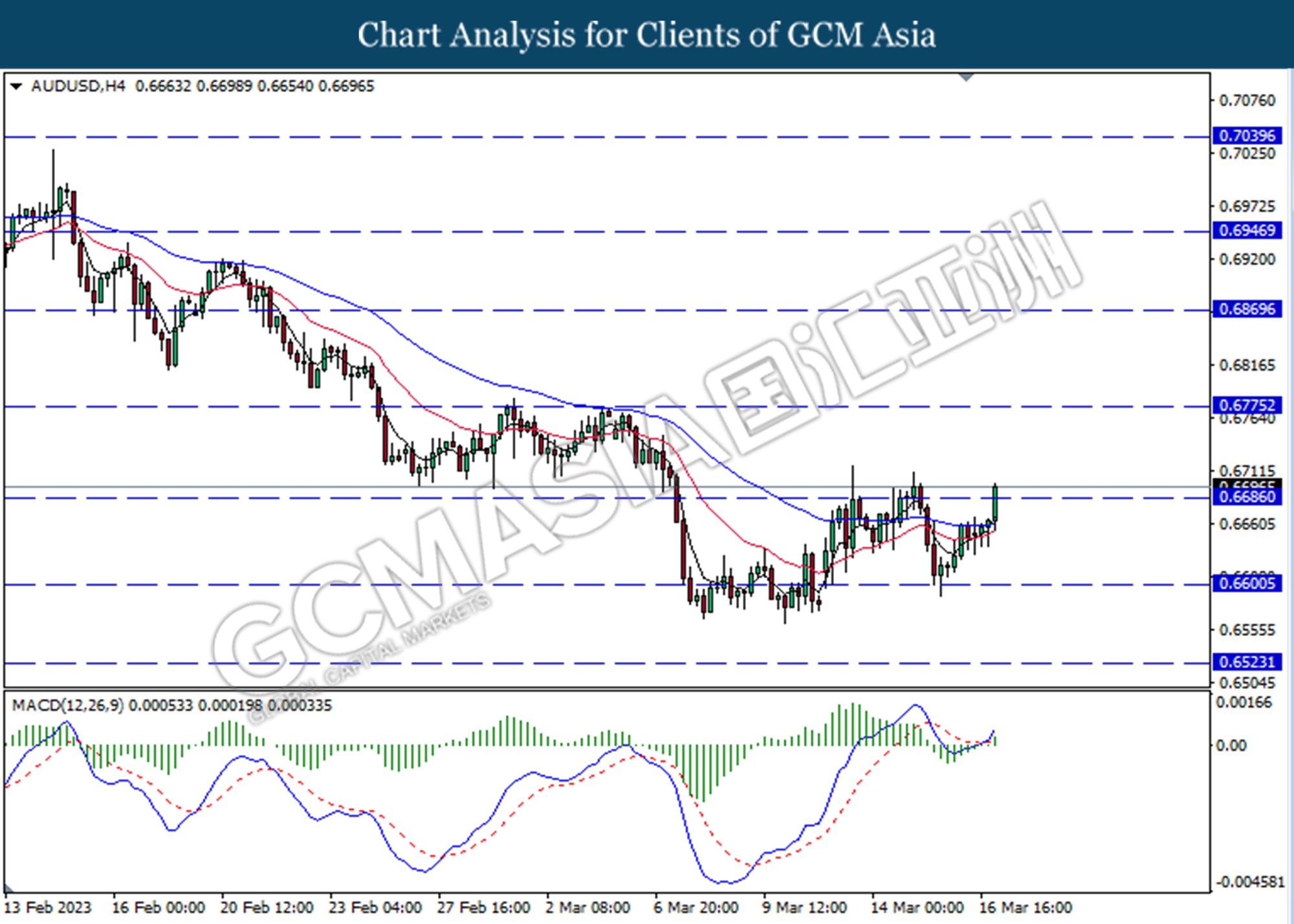

AUDUSD, H4: AUDUSD was traded higher following a prior break above the resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

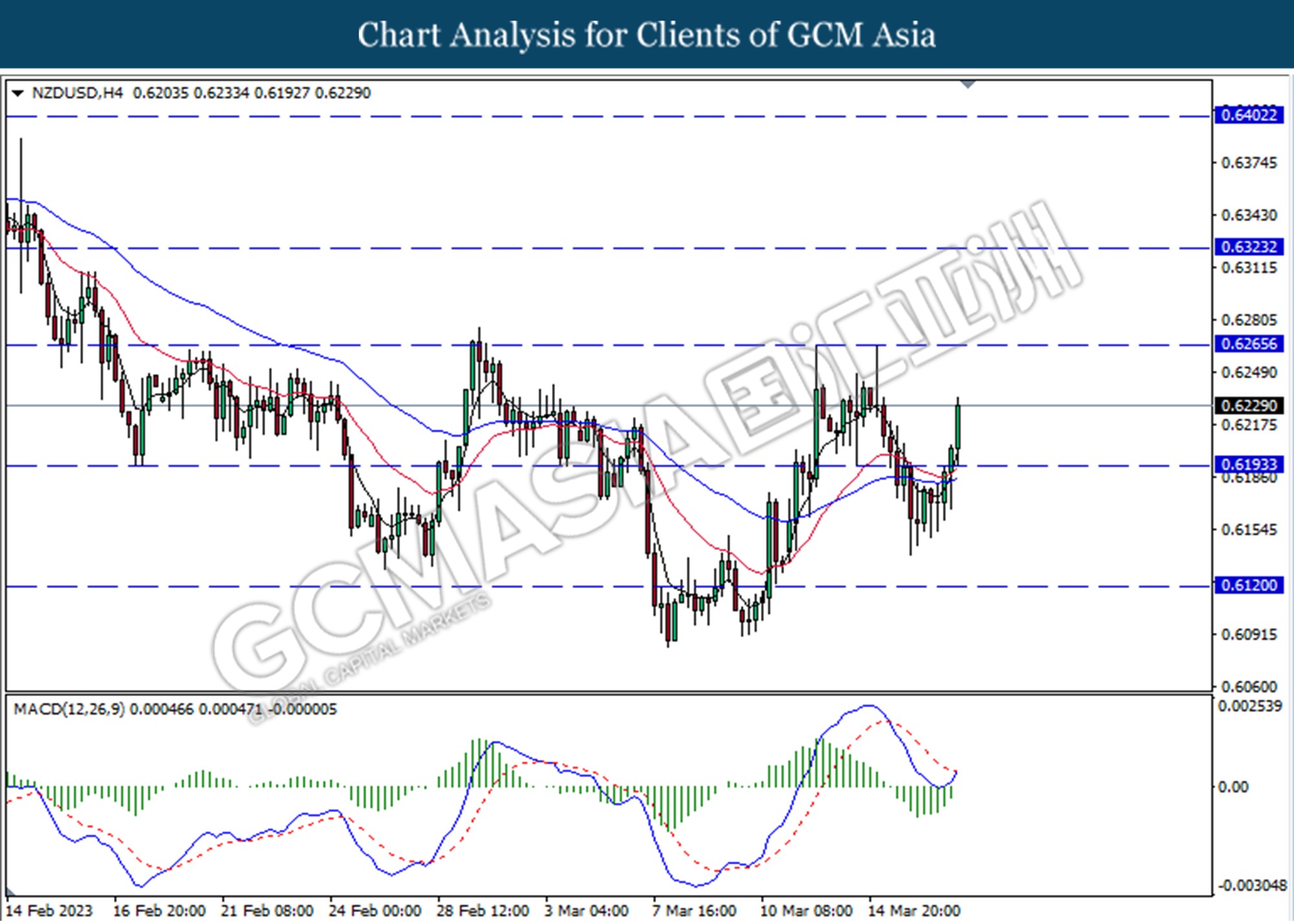

NZDUSD, H4: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6195. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

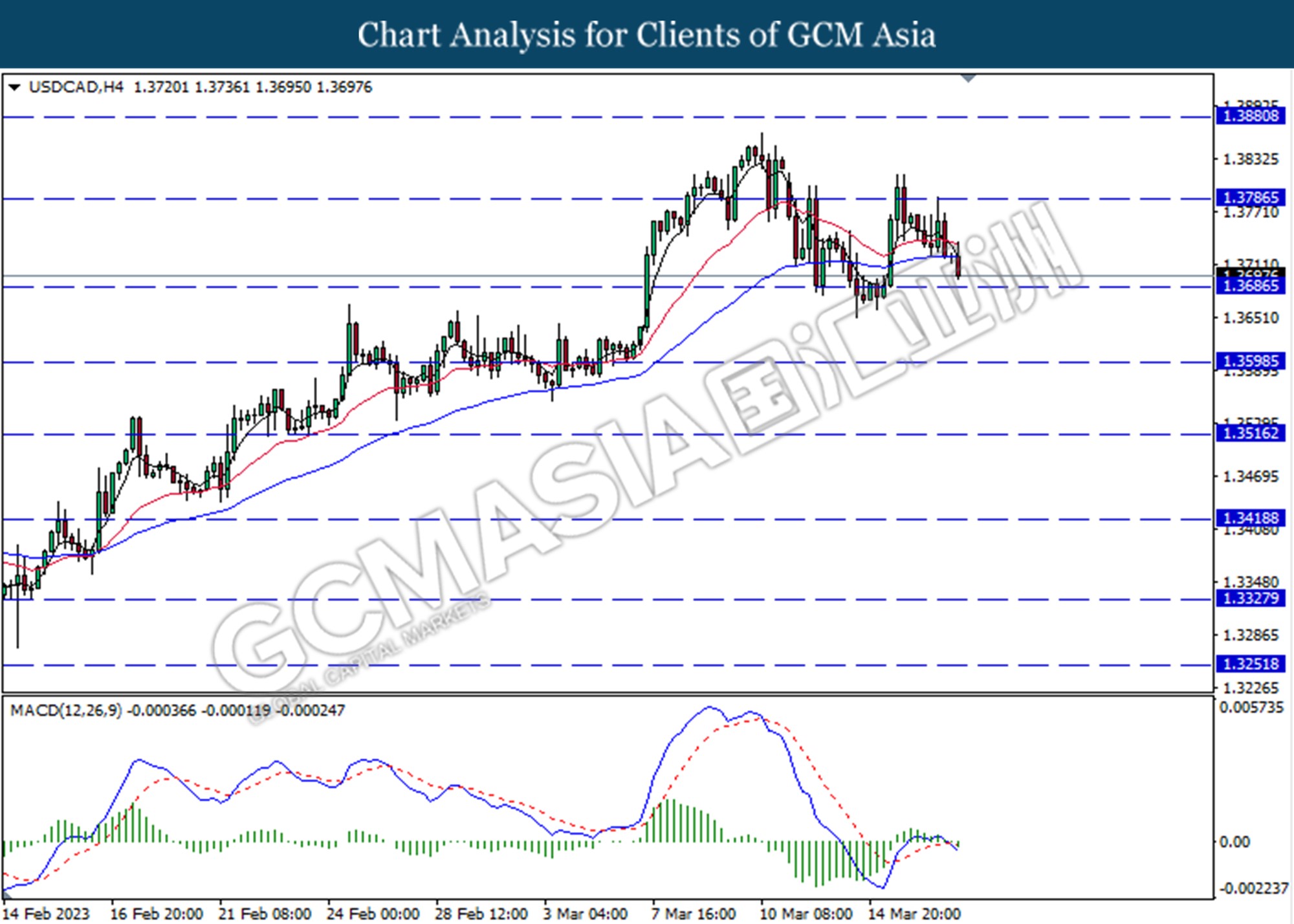

USDCAD, H4: USDCAD was traded following a prior retracement from the resistance level at 1.3785. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3685.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

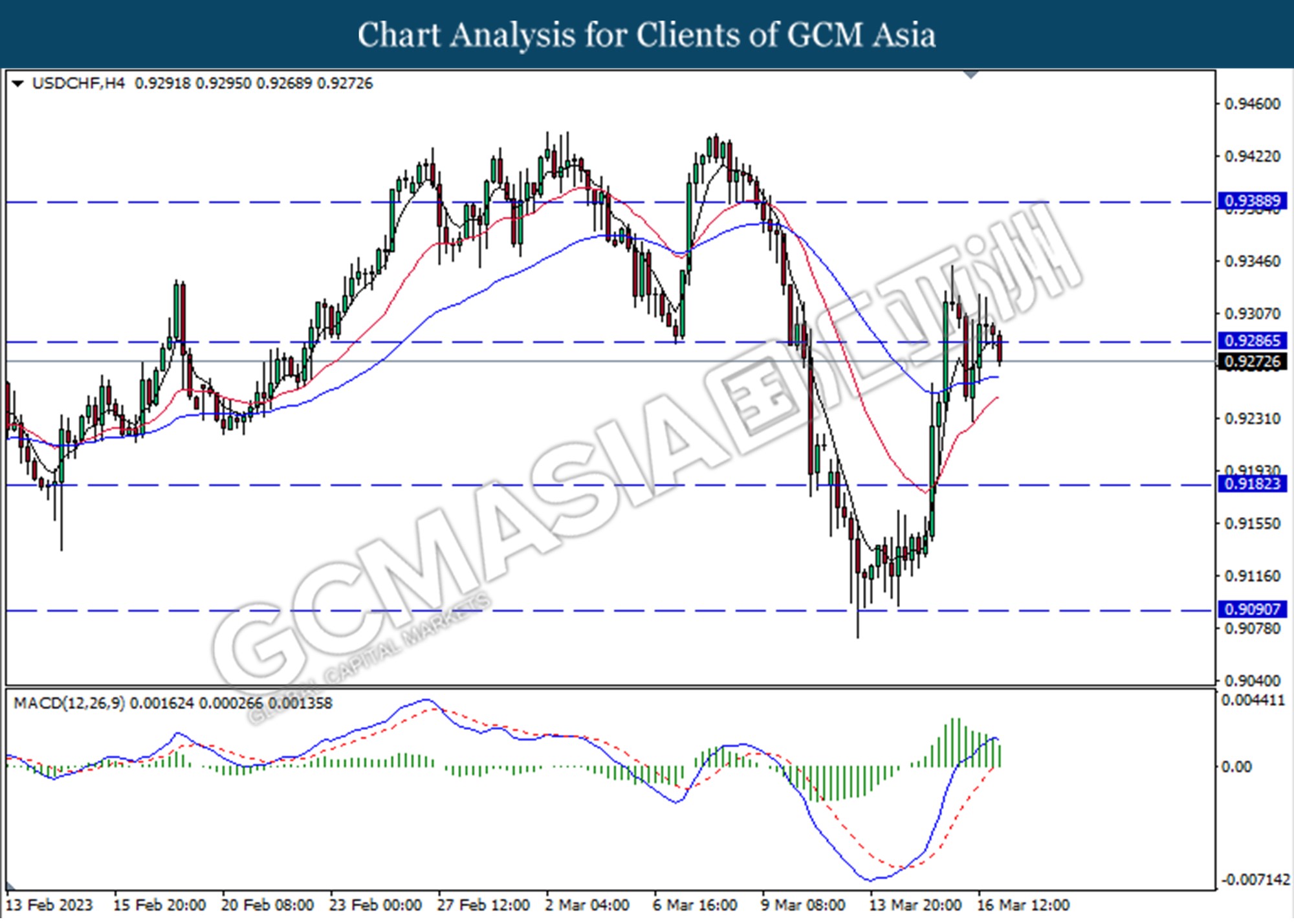

USDCHF, H4: USDCHF was traded lower following a prior break below the previous support level at 0.9285. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 0.9180.

Resistance level: 0.9390, 0.9285

Support level: 0.9180, 0.9090

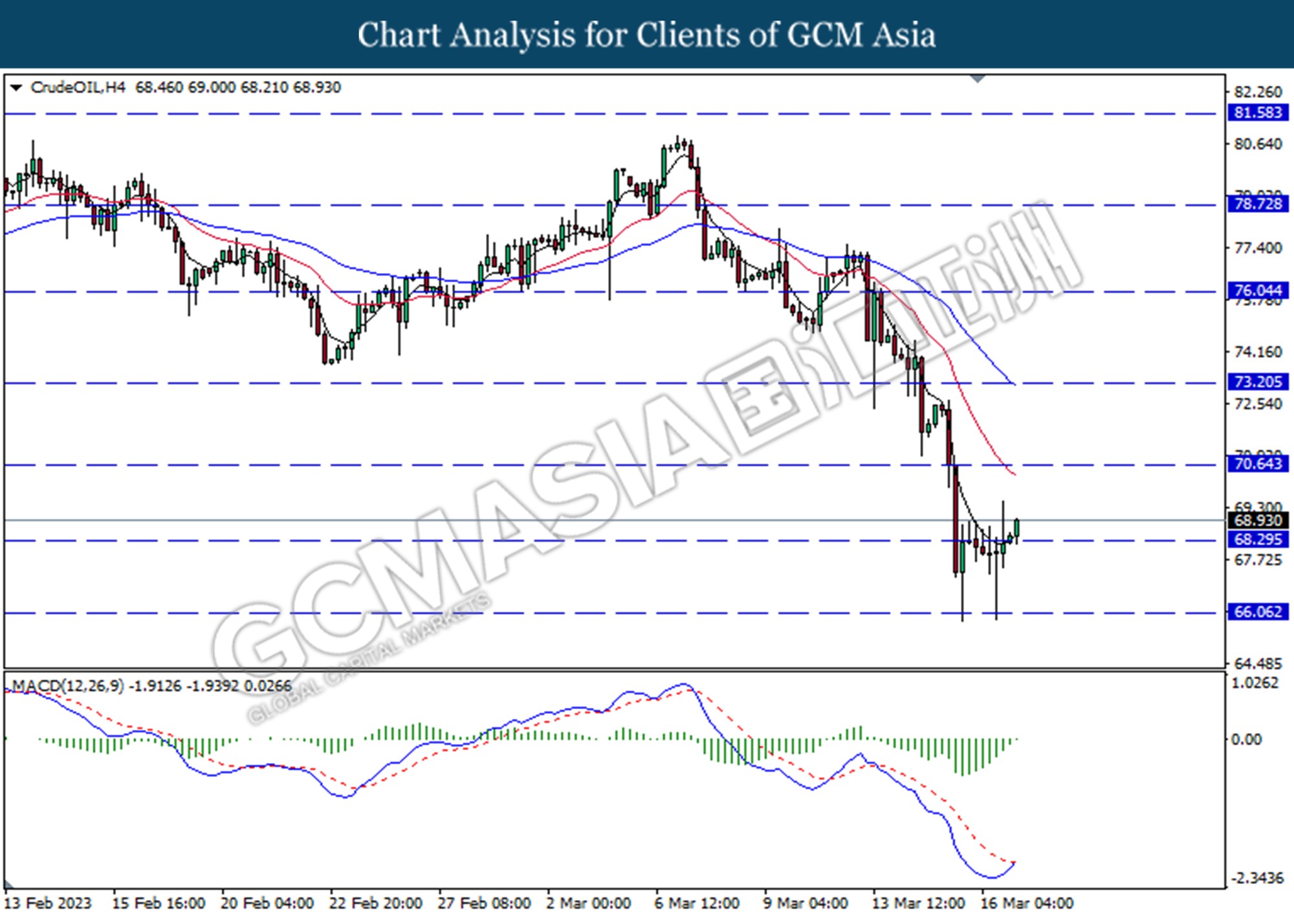

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 68.30. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains toward the resistance level at 70.65.

Resistance level: 70.65, 73.20

Support level: 68.30, 66.05

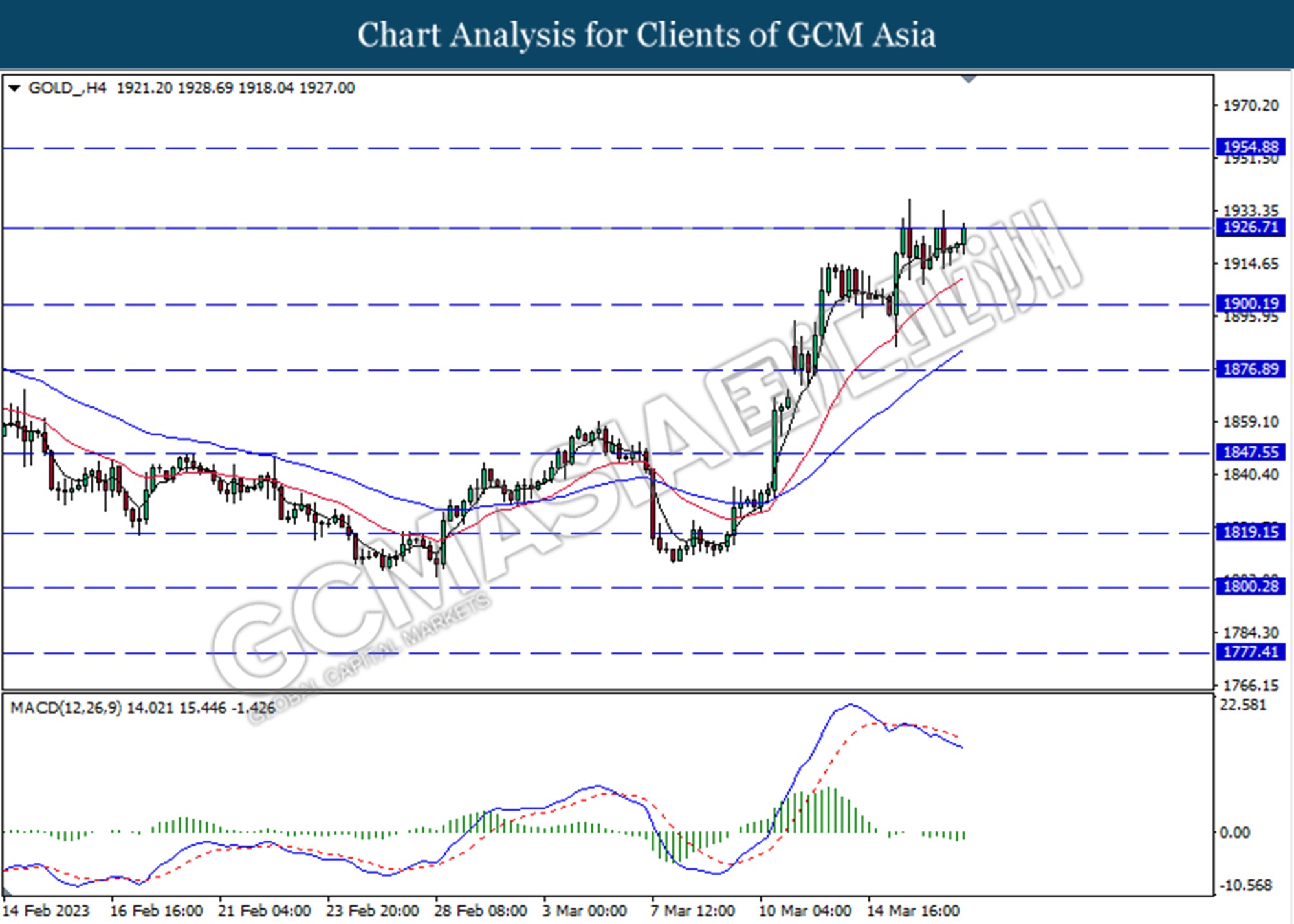

GOLD_, H4: Gold price was traded higher while currently testing for the resistance level at 1926.75 MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains if successfully break above the resistance level.

Resistance level: 1926.75, 1954.90

Support level: 1900.20, 1876.90