17 March 2023 Morning Session Analysis

US dollar was traded mixed following a series of economic data.

The dollar index, which traded against a basket of six major currencies, hovered near a similar level after a series of economic data were released. Last night, the US Department of Labor posted the Initial Jobless Claims at 192K, significantly lower than both the consensus forecast and the previous week’s reading at 205K and 212K respectively. The stronger-than-expected labor data showed that the US labor market remains resilient despite the recent banking turmoil. However, the US Philadelphia Fed Manufacturing Index was reported at -23.2, weaker than the consensus expectation of -15.6, suggesting continued declines for the region’s manufacturing sector. Following that, the US dollar was traded mixed by the investors while the market participants are weighing on the possibility of a rate pause and the fallout of the banking sector in the US. On the other hand, the European Central Bank agreed to increase its interest rate by 50 bps in yesterday’s meeting, as widely expected. With that, it triggered another round of sell-off in the US dollar market, pushing the pair of EUR/USD slightly above the recent low. As of writing, the US dollar dropped 0.19% to 104.45.

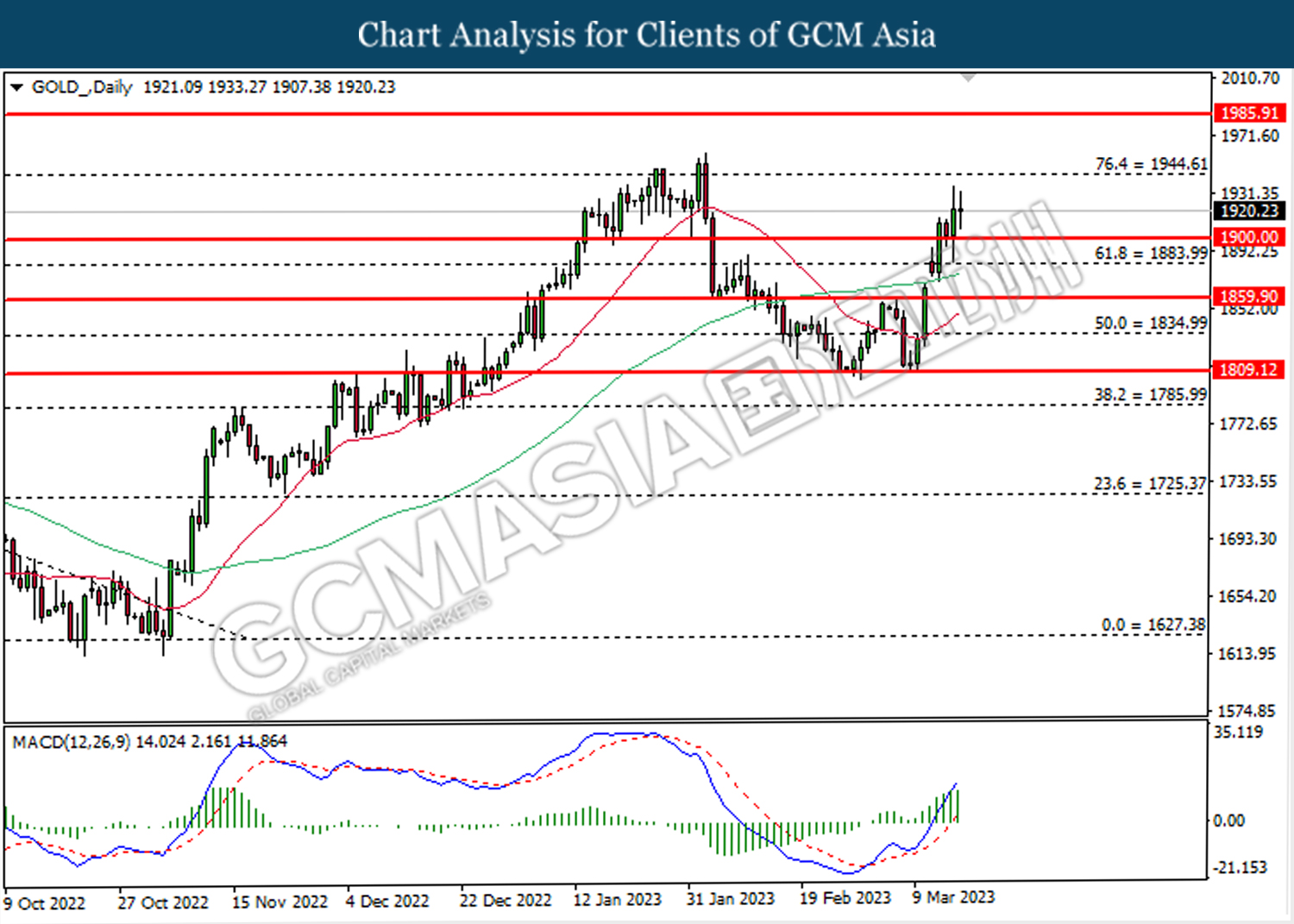

In the commodities market, crude oil prices were down by -0.05% to $68.75 per barrel as the continued banking turmoil in Europe and US weighed on the oil demand’s prospect. Besides, gold prices ticked up by 0.02% to $1919.50 per troy ounce as market risk-off sentiment remains high.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Feb) | 8.5% | 8.5% | – |

| 22:00 | USD – Michigan Consumer Sentiment | 67.0 | 67.0 | – |

Technical Analysis

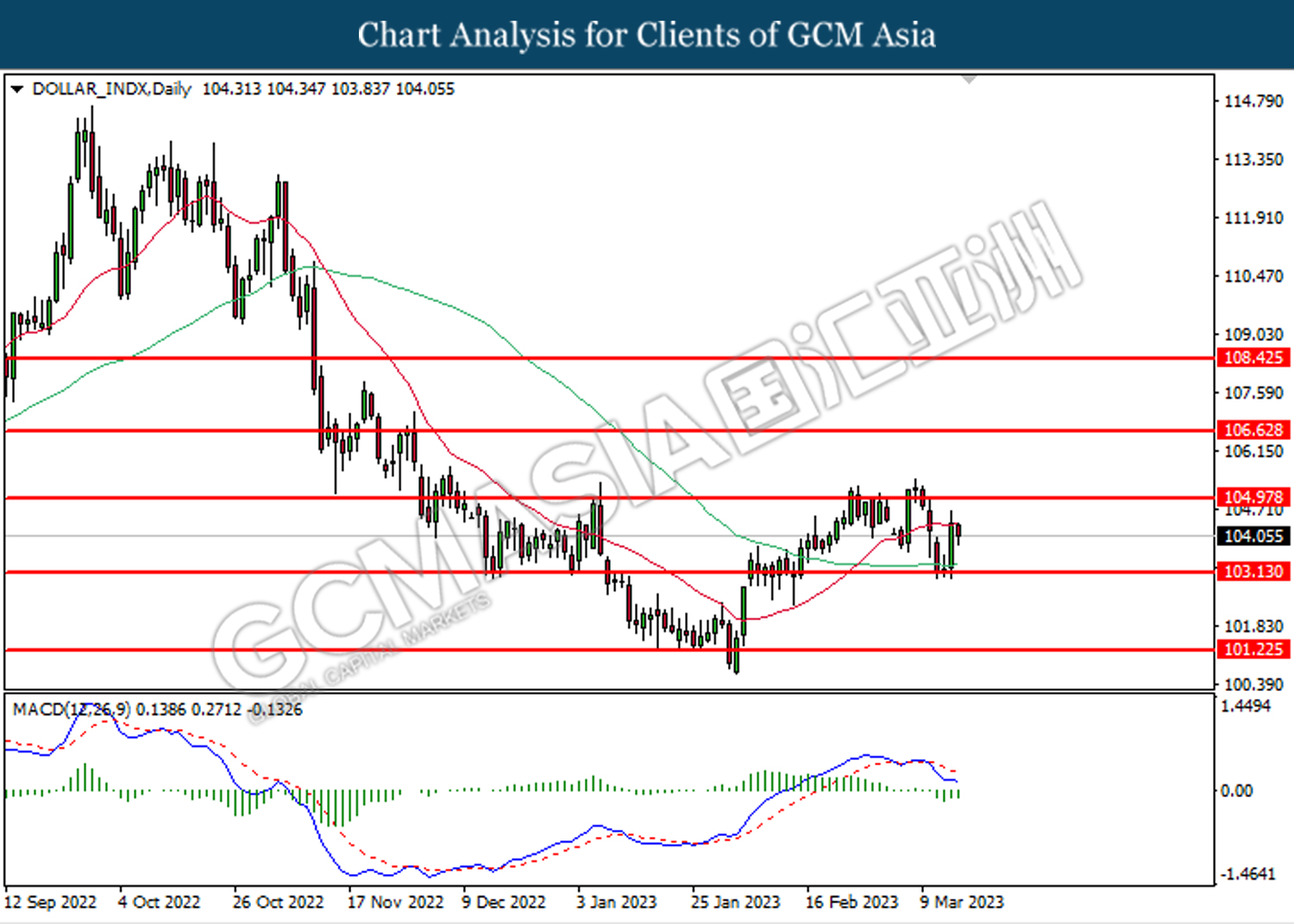

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 103.15. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

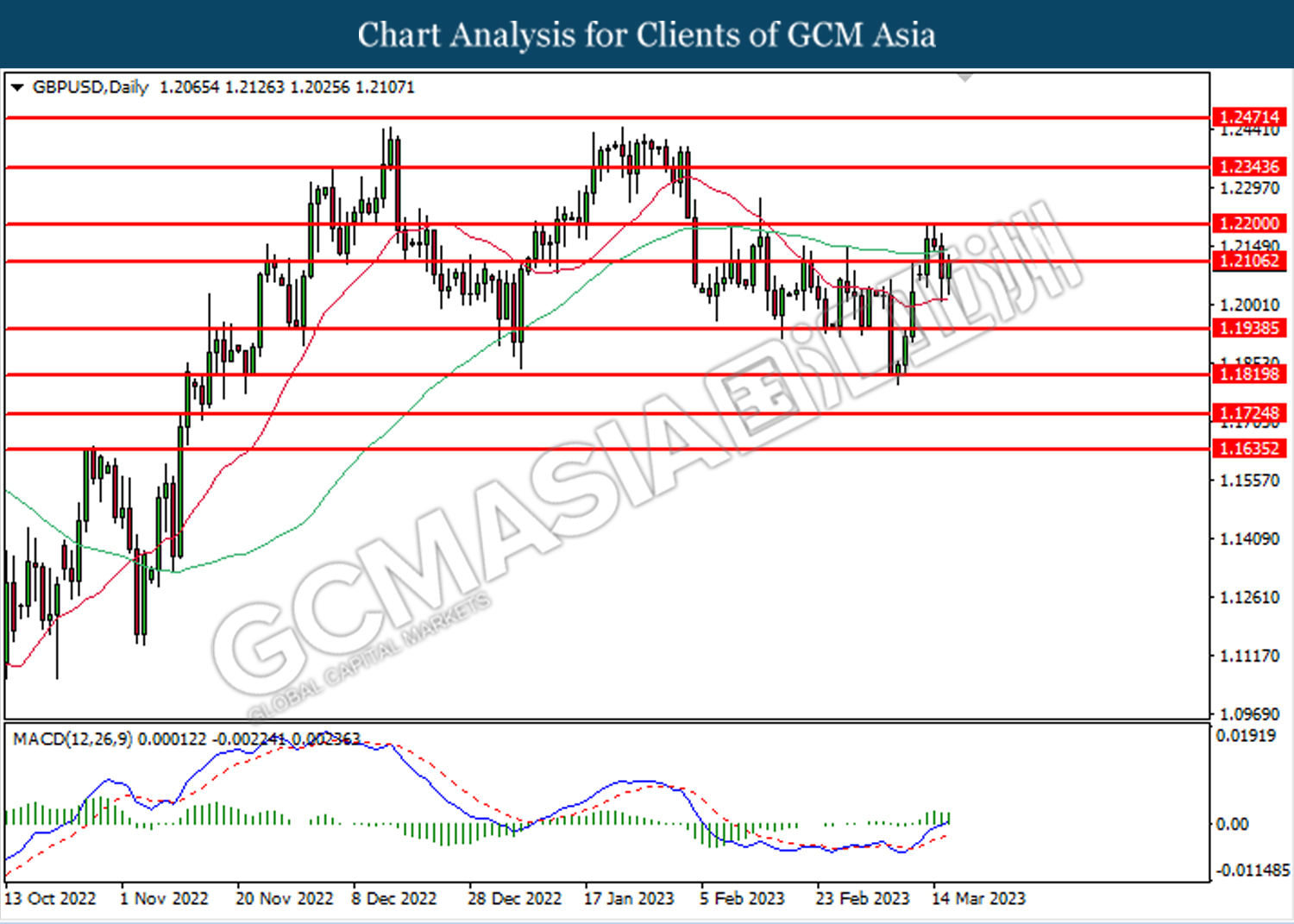

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0665, 1.0770

Support level: 1.0575, 1.0445

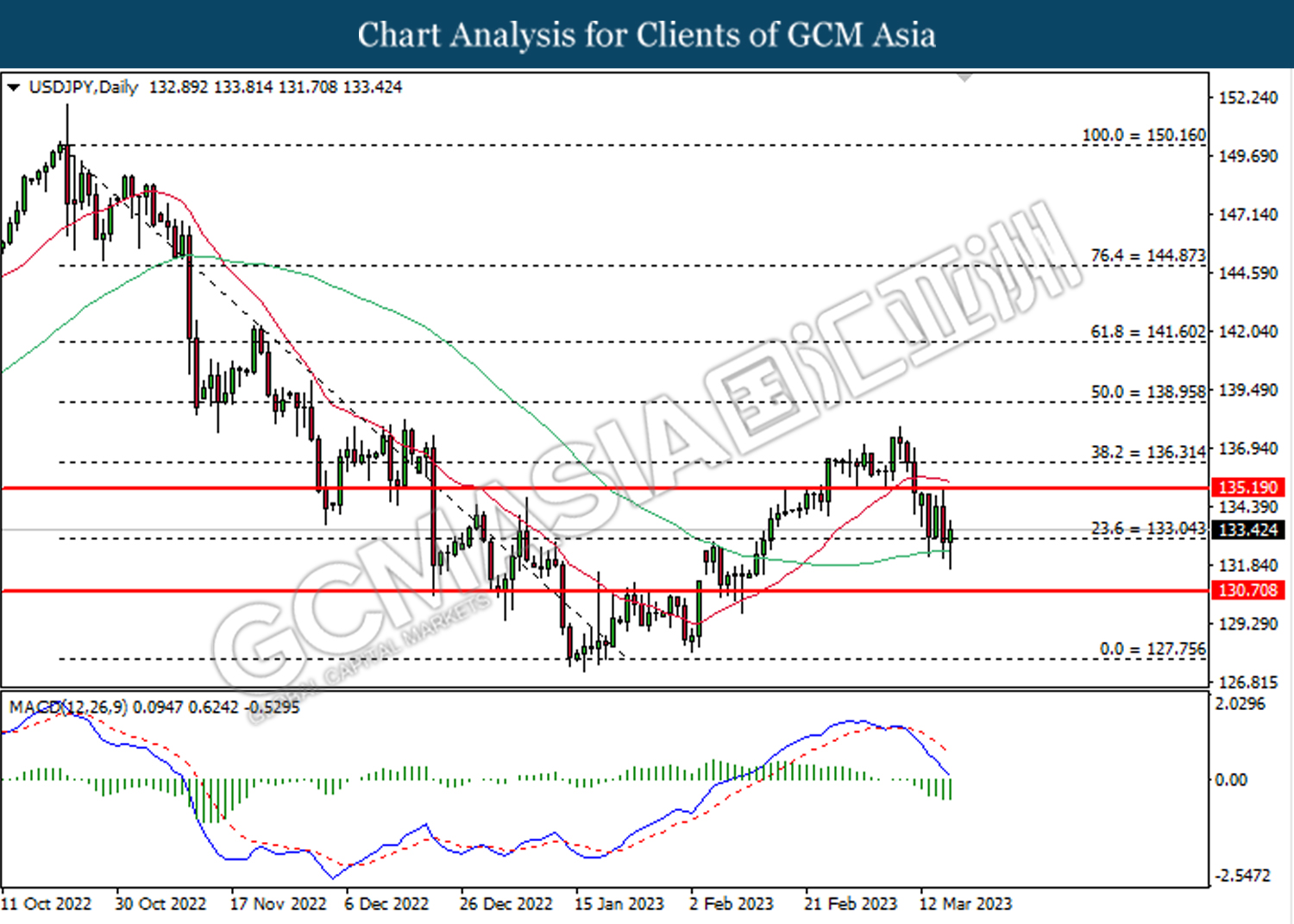

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.05. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

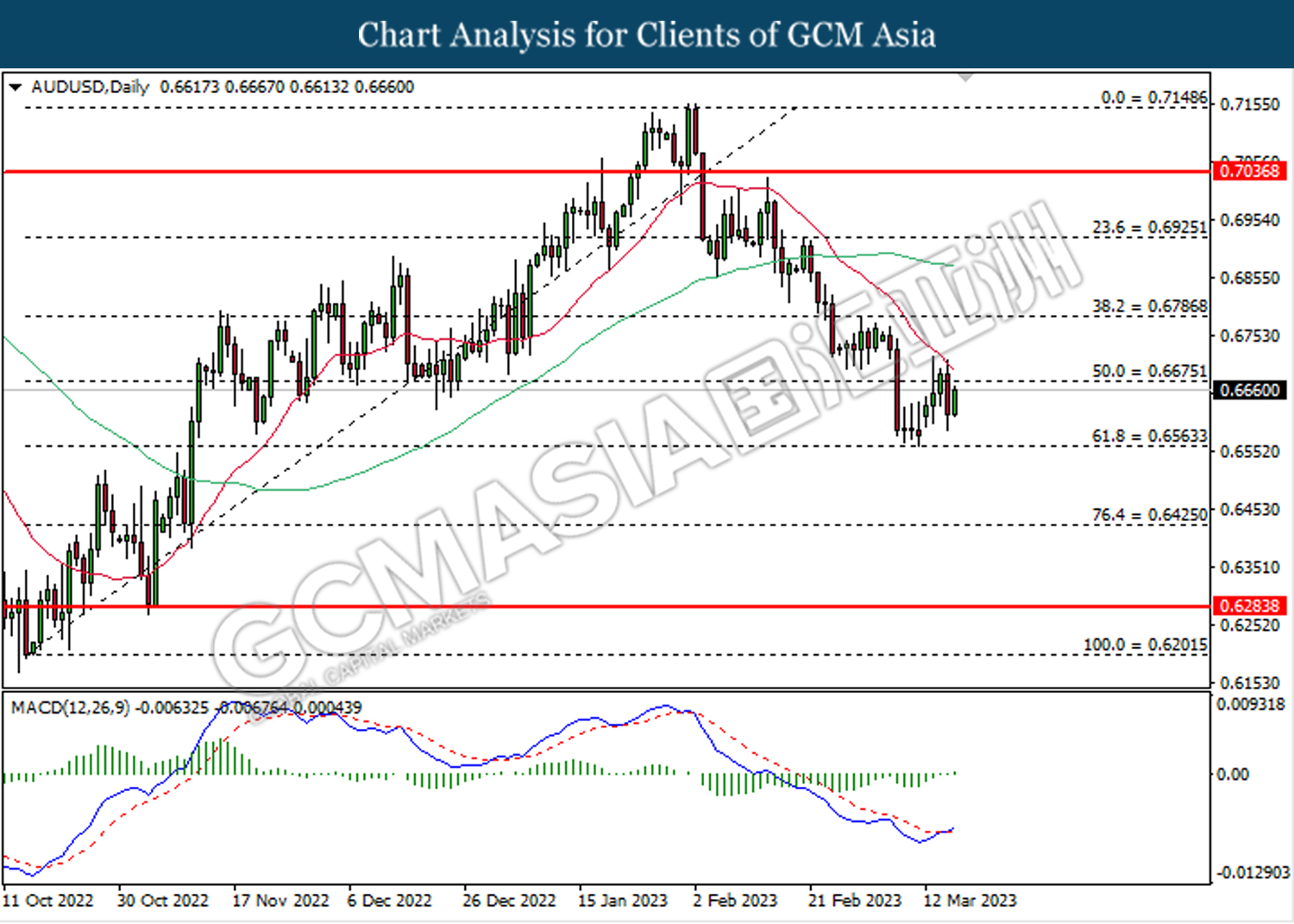

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

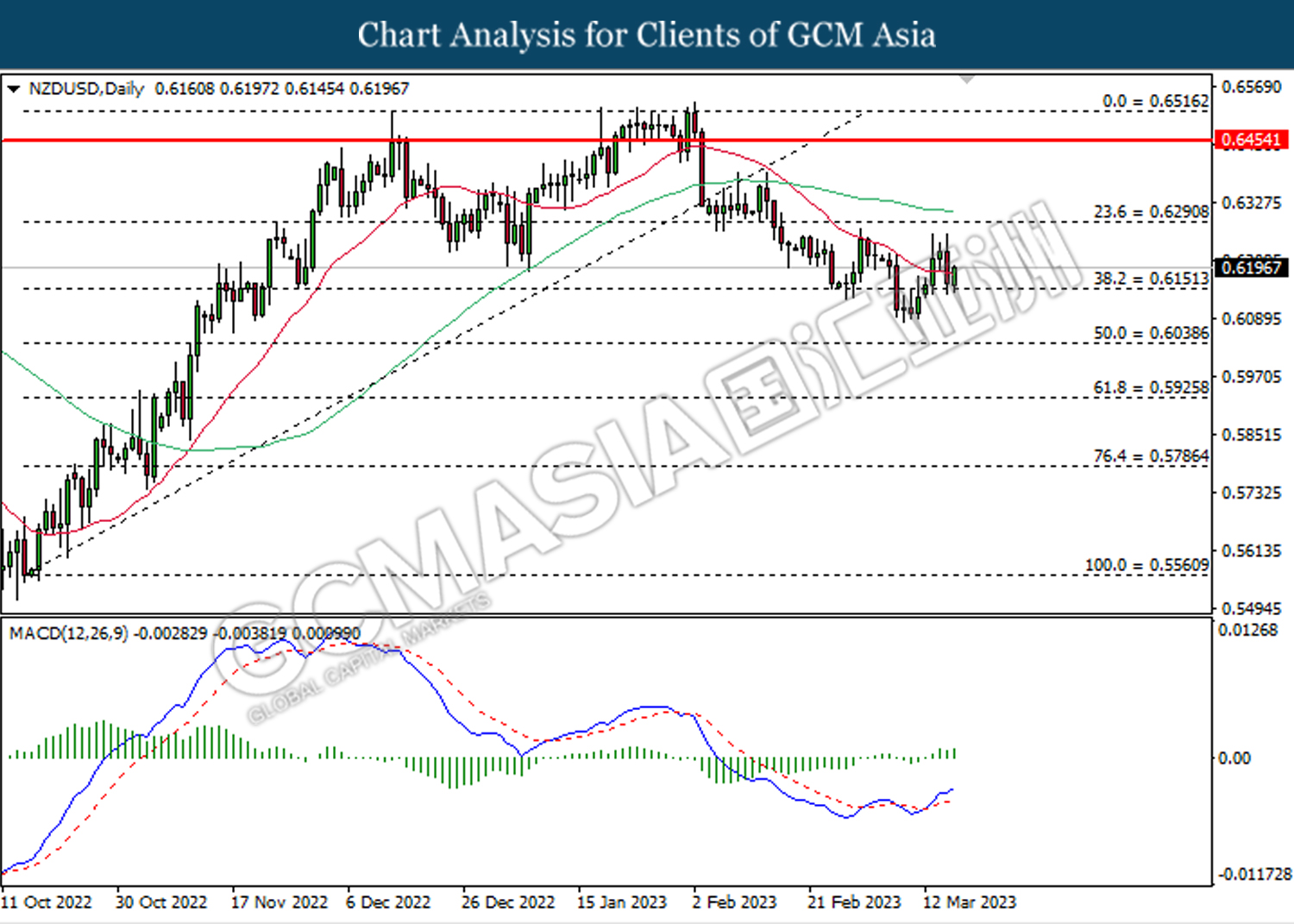

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

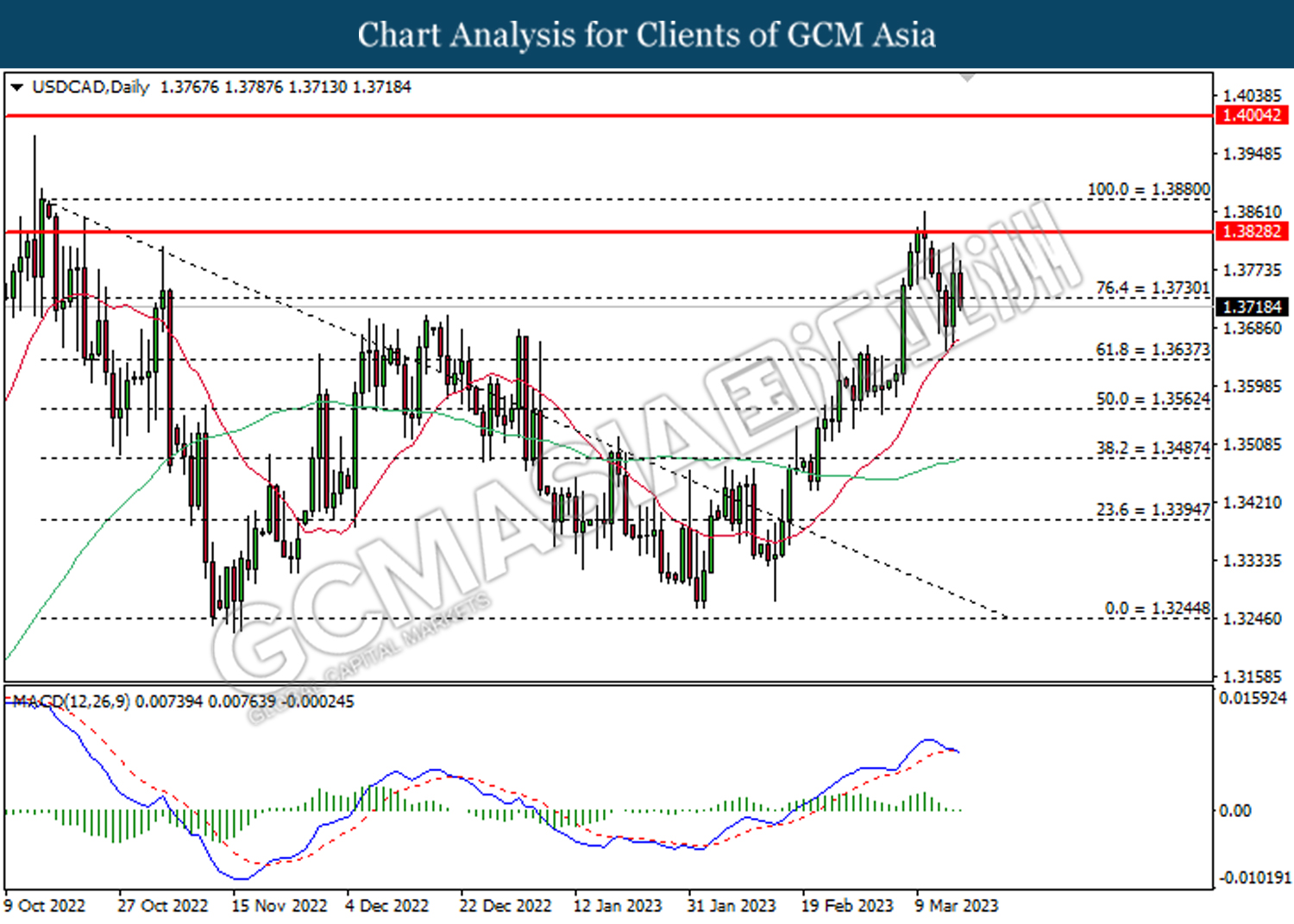

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3730. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3830, 1.3880

Support level: 1.3730, 1.3635

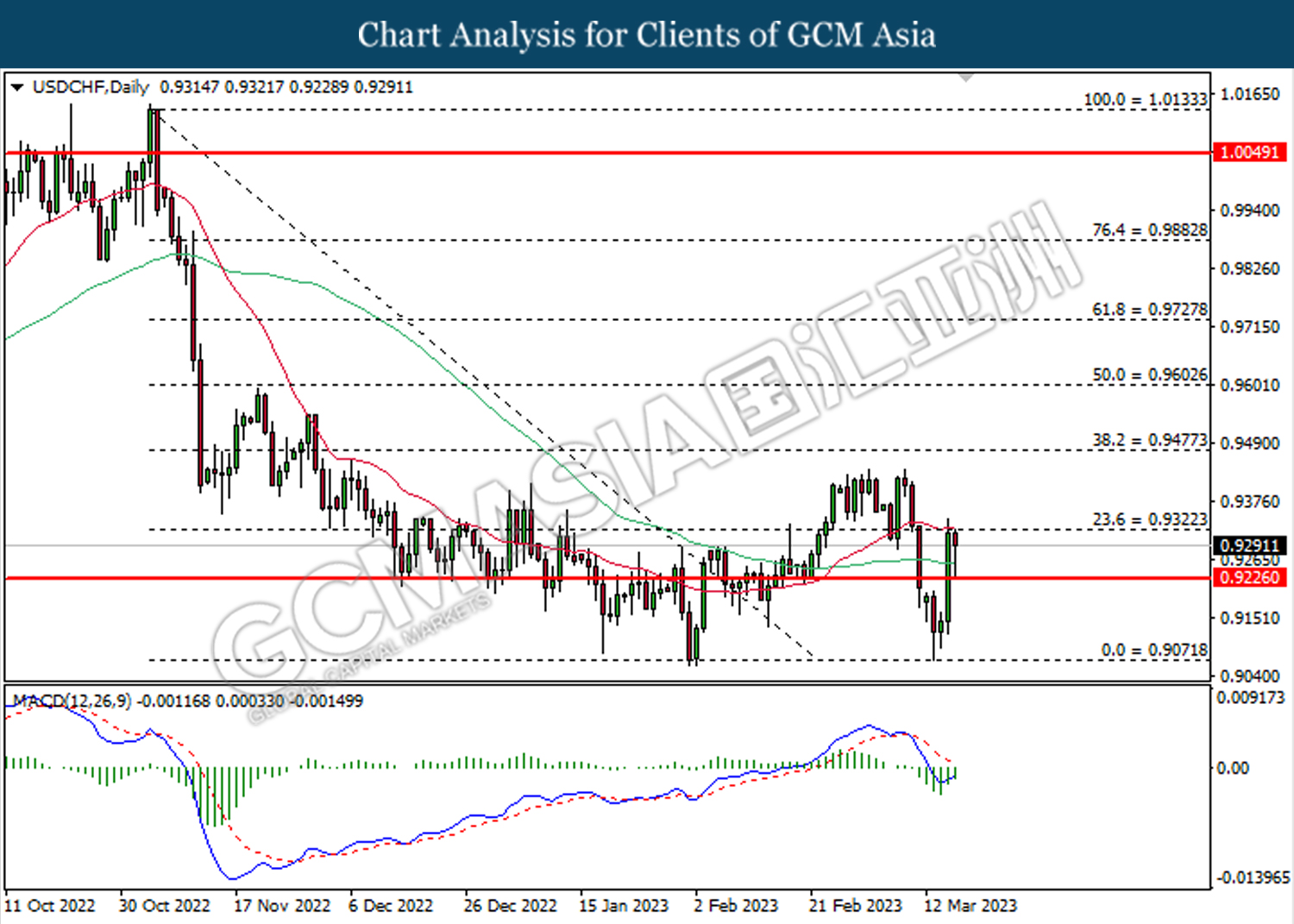

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9325. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1900.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00