17 July 2023 Afternoon Session Analysis

Aussie tumbles on China’s fragile economy.

The Aussie dollar, which traded against the dollar index slipped after China released its second quarter Gross Domestic Product (GDP). China, as the largest trading partner of Australia, second-quarter annual basis GDP rose to 6.3% from 4.5%, but slightly lower than analysts polled by Reuters had predicted a 7.3% increase in the second quarter. On a monthly basis, Q2 GDP slipped to 0.8% from 2.2%, but higher than the market anticipated of 0.5%. it caused the pair of AUDUSD to decline as major trading partners weakened in economic conditions. Meanwhile, the unemployment rate in line with market expectations of 5.2%, stood at the same readings as the previous month. A statement from the National Bureau of China showed that the unemployment rate among the younger group aged between 16 to 24 was up to 21.3, a new record. National Bureau of China spokesperson noted that China faces a complex geopolitical and economic international environment but he predicts that China can still achieve 5% in full-year growth target. As of writing, the AUDUSD ticked down by -0.42% to 0.6807.

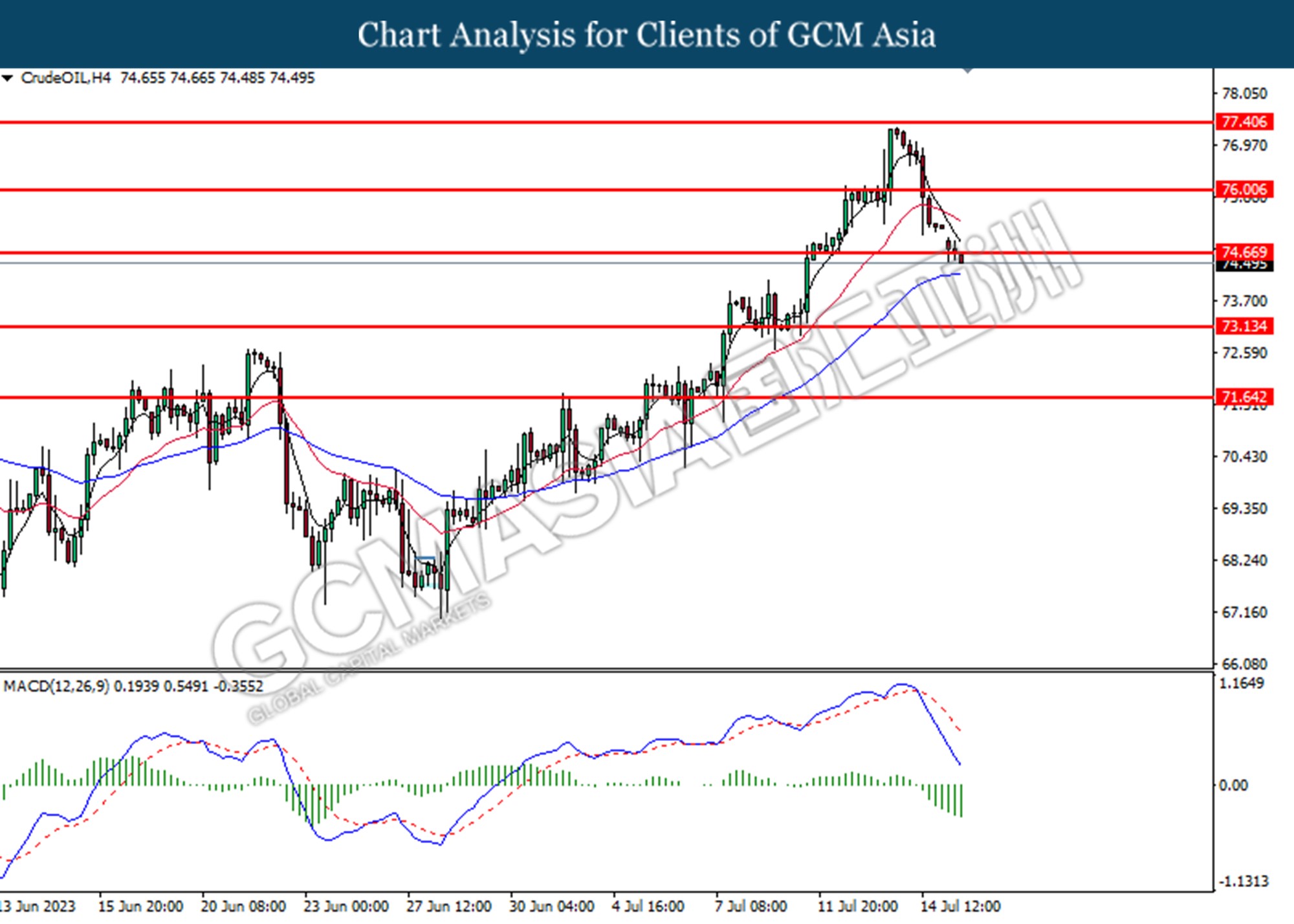

In the commodities market, crude oil prices slipped by -0.70% to $74.74 per barrel as China’s GDP was announced lower than expected. On the other hand, the price of gold rose by 0.12% to 1962.78 after the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – NY Empire State Manufacturing Index (Jul) | 6.0 | 0.0 | – |

Technical Analysis

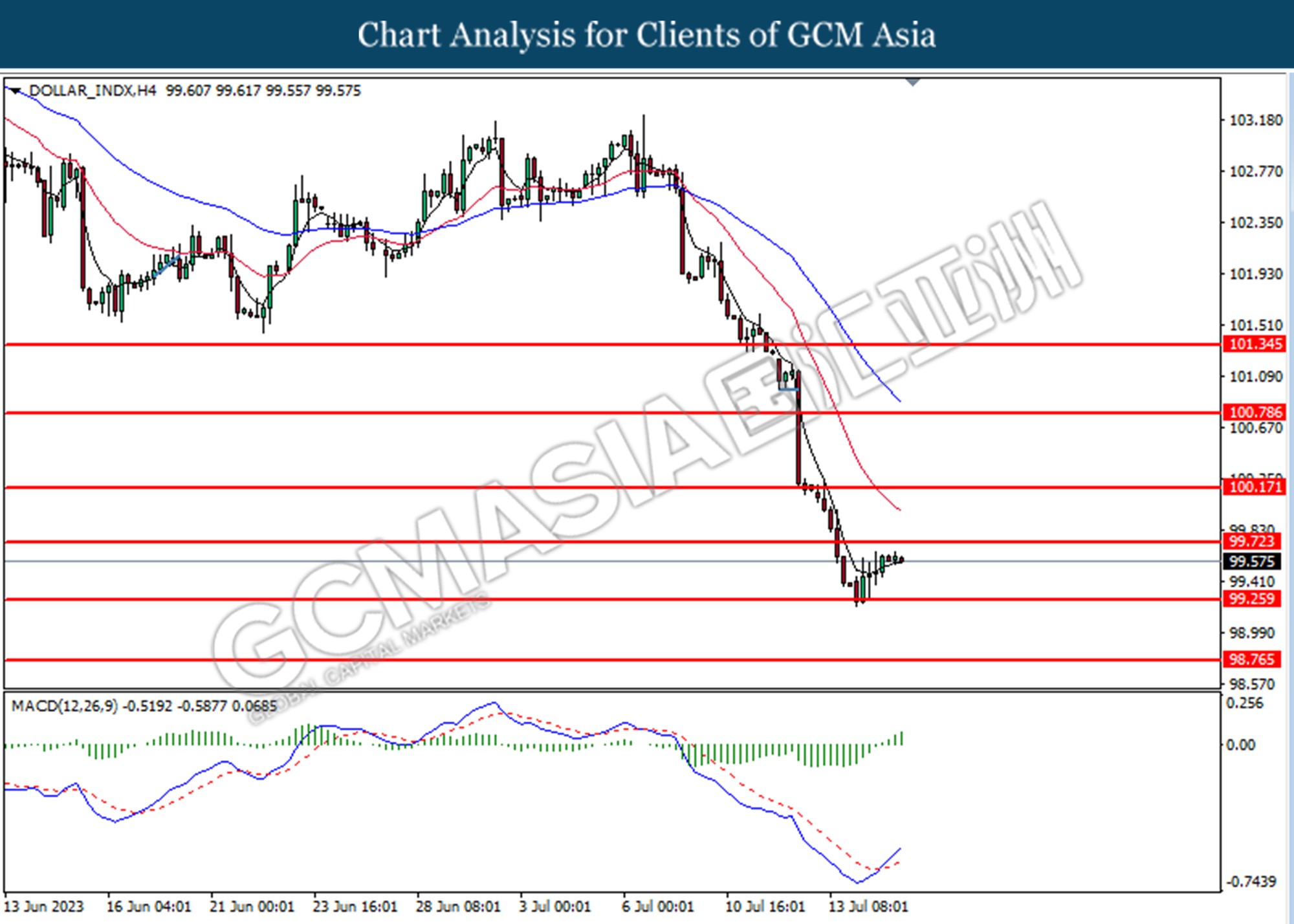

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the support level at 99.25. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level at 99.75.

Resistance level: 99.70, 100.20

Support level: 99.25, 98.75

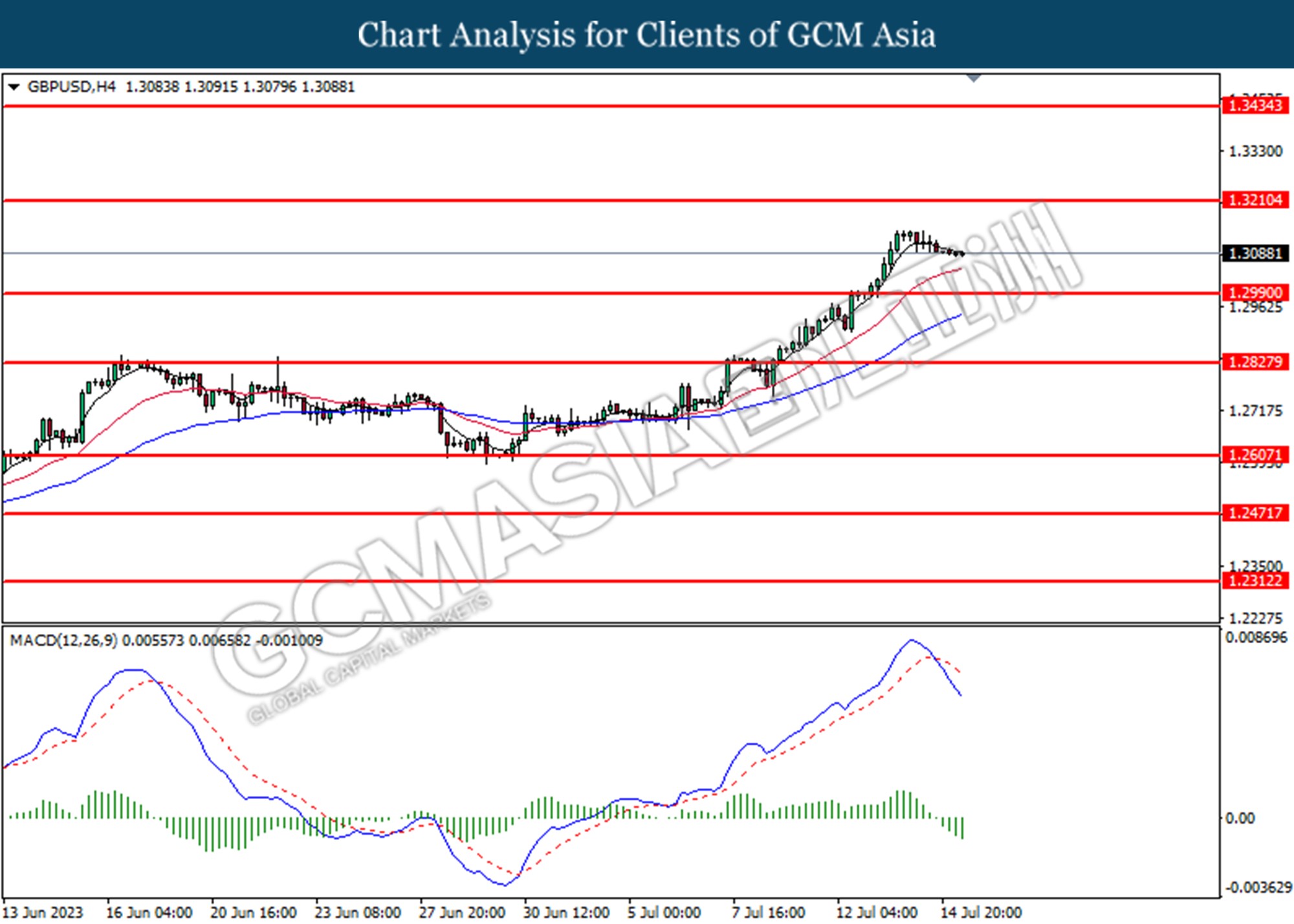

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2990.

Resistance level: 1.3210, 1.3435

Support level: 1.2990, 1.2830

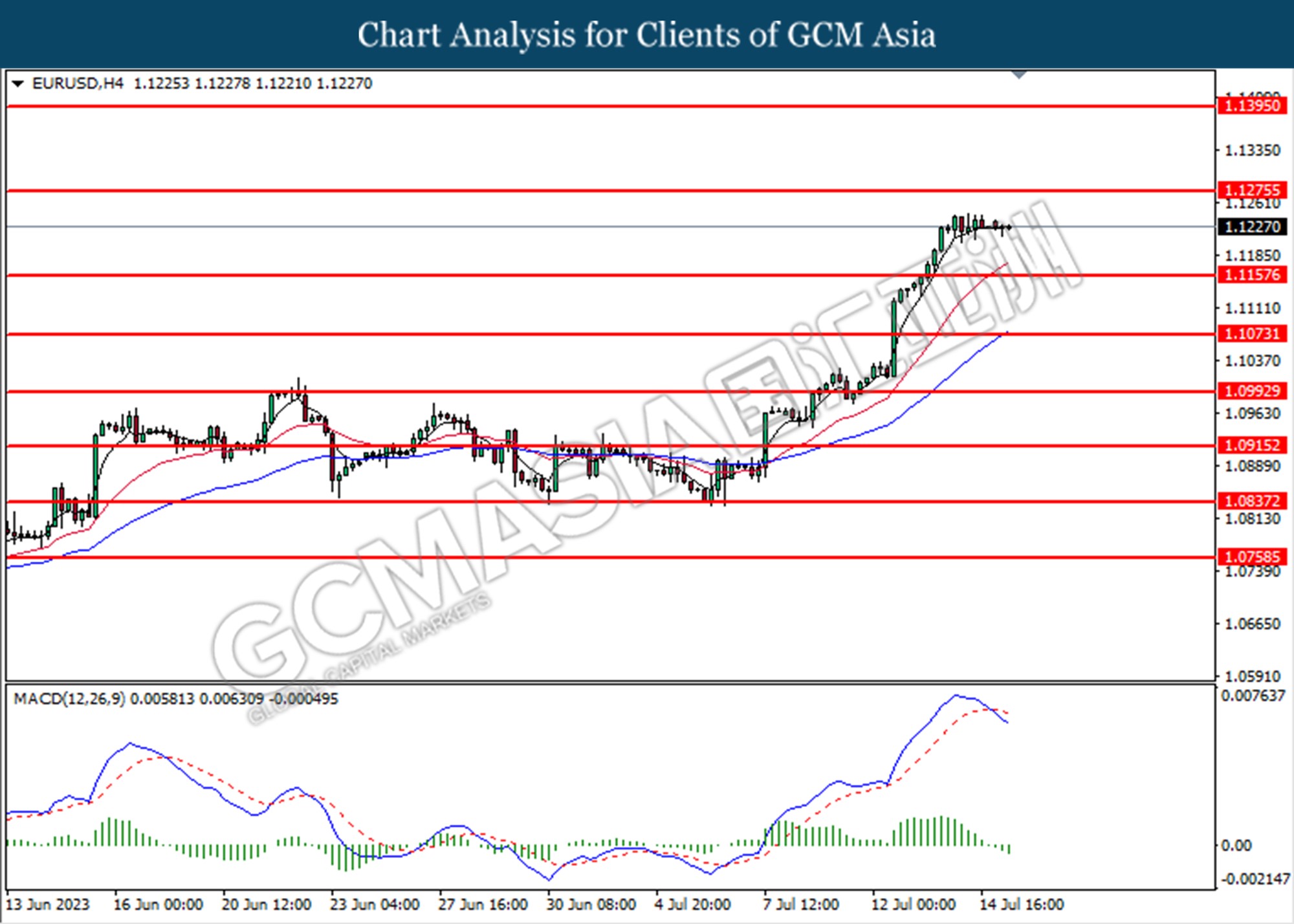

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.1160.

Resistance level: 1.1275, 1.1395

Support level: 1.1160, 1.1075

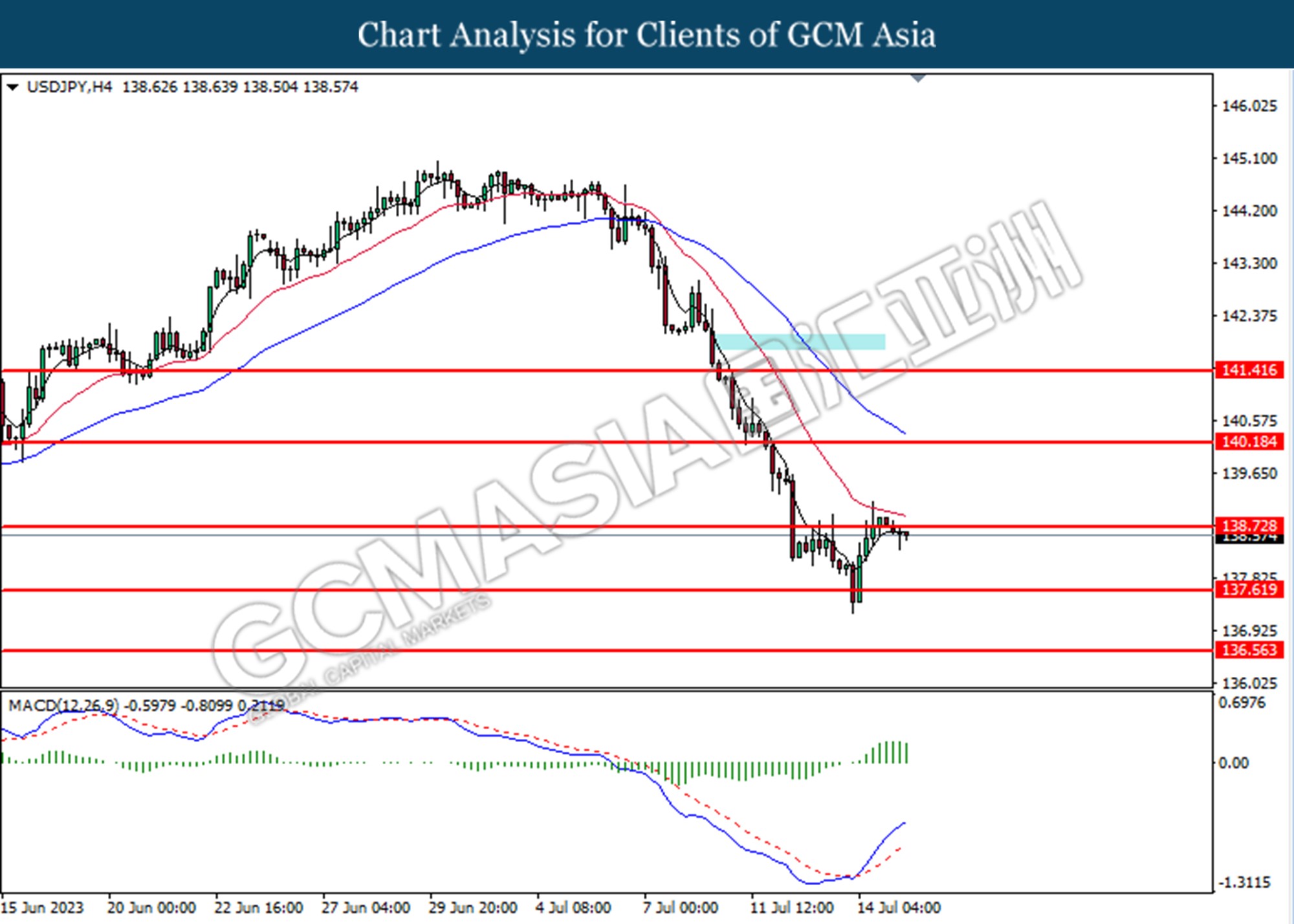

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 138.70. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 138.70, 140.20

Support level: 137.60, 136.55

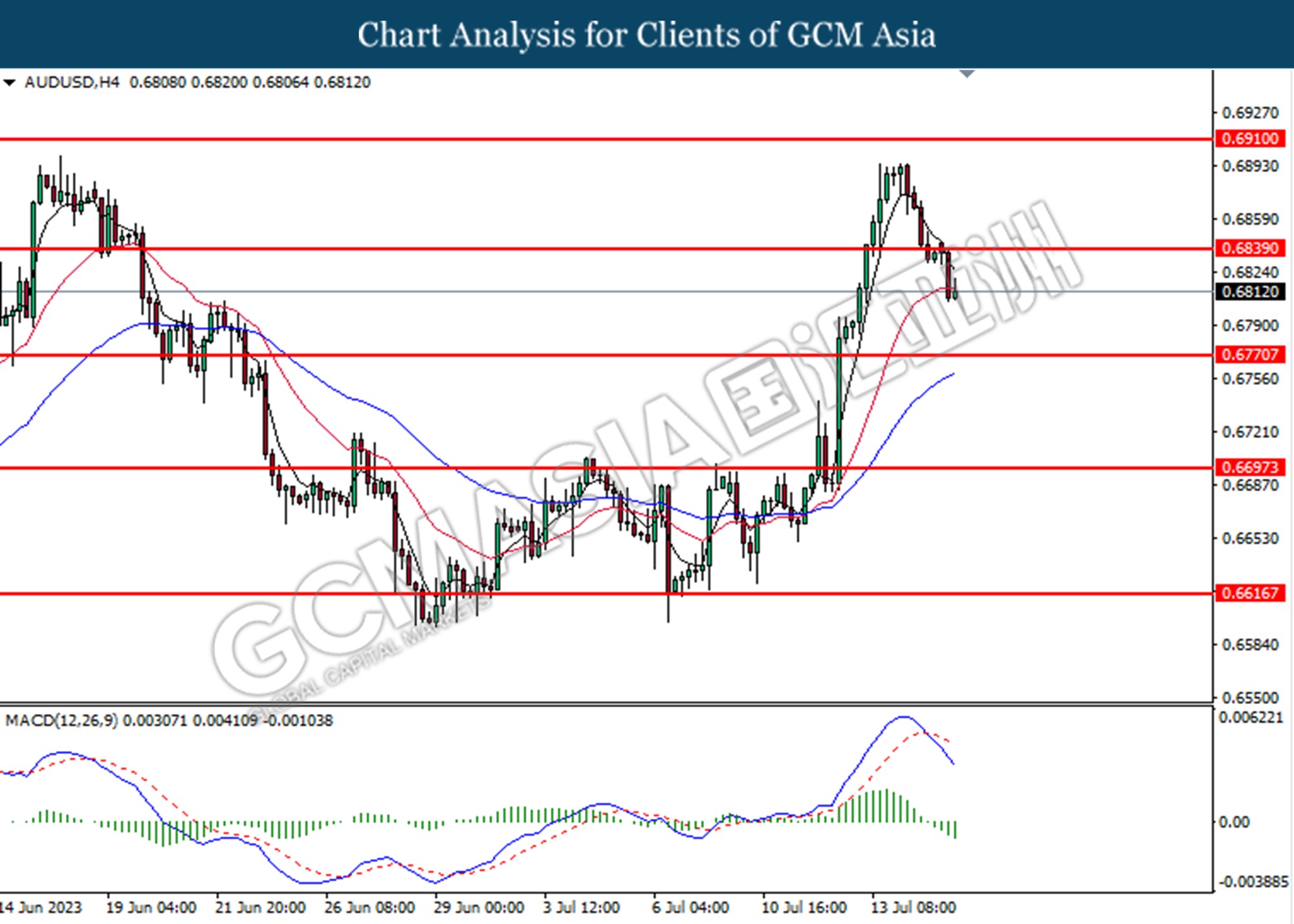

AUDUSD, H4: AUDUSD was traded lower following the prior breaks above the prior support level at 0.6840. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6770.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

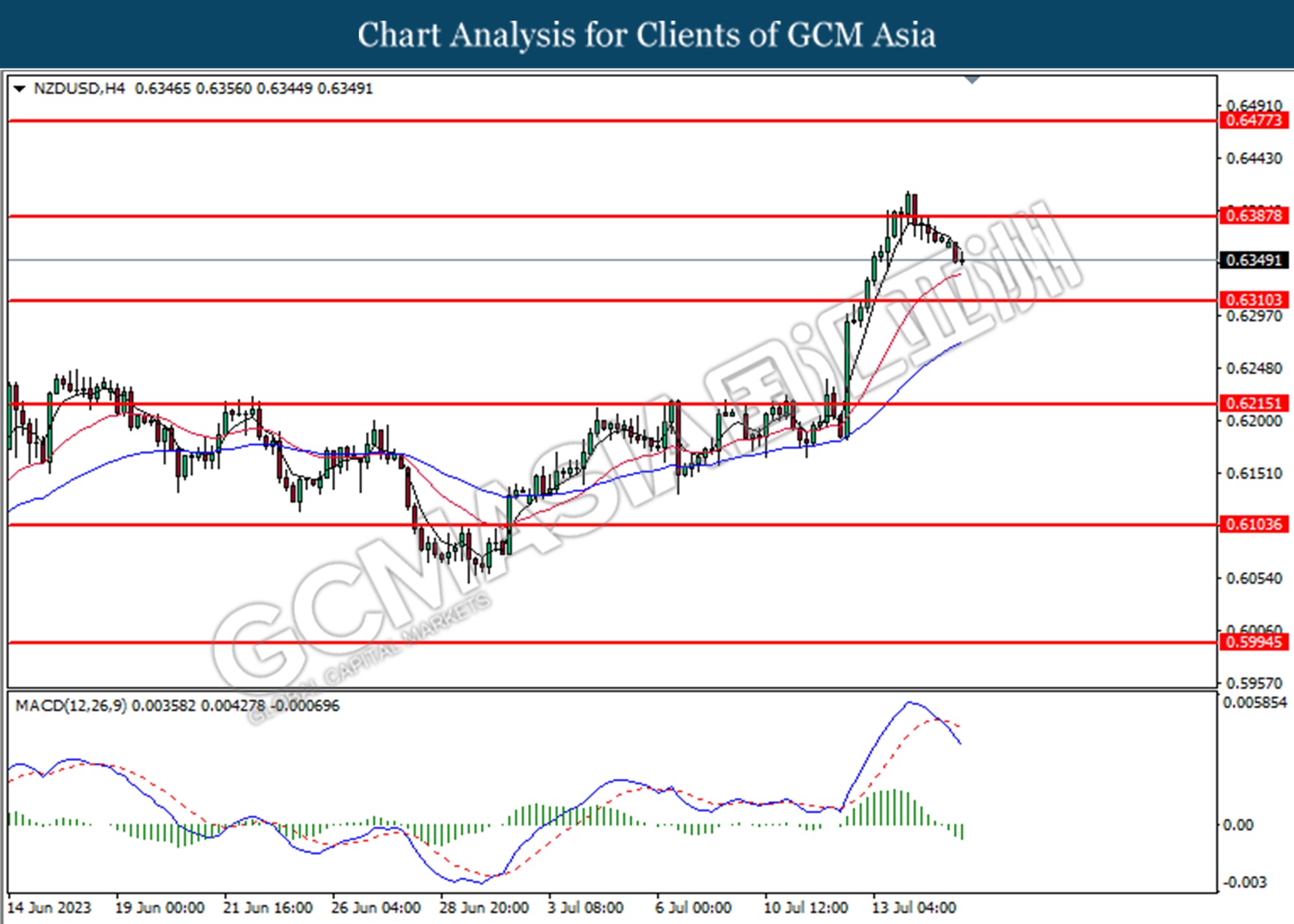

NZDUSD, H4: NZDUSD was traded lower following the prior breaks above the prior support level at 0.6390. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6770.

Resistance level: 0.6390, 0.6480

Support level: 0.6310, 0.6215

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

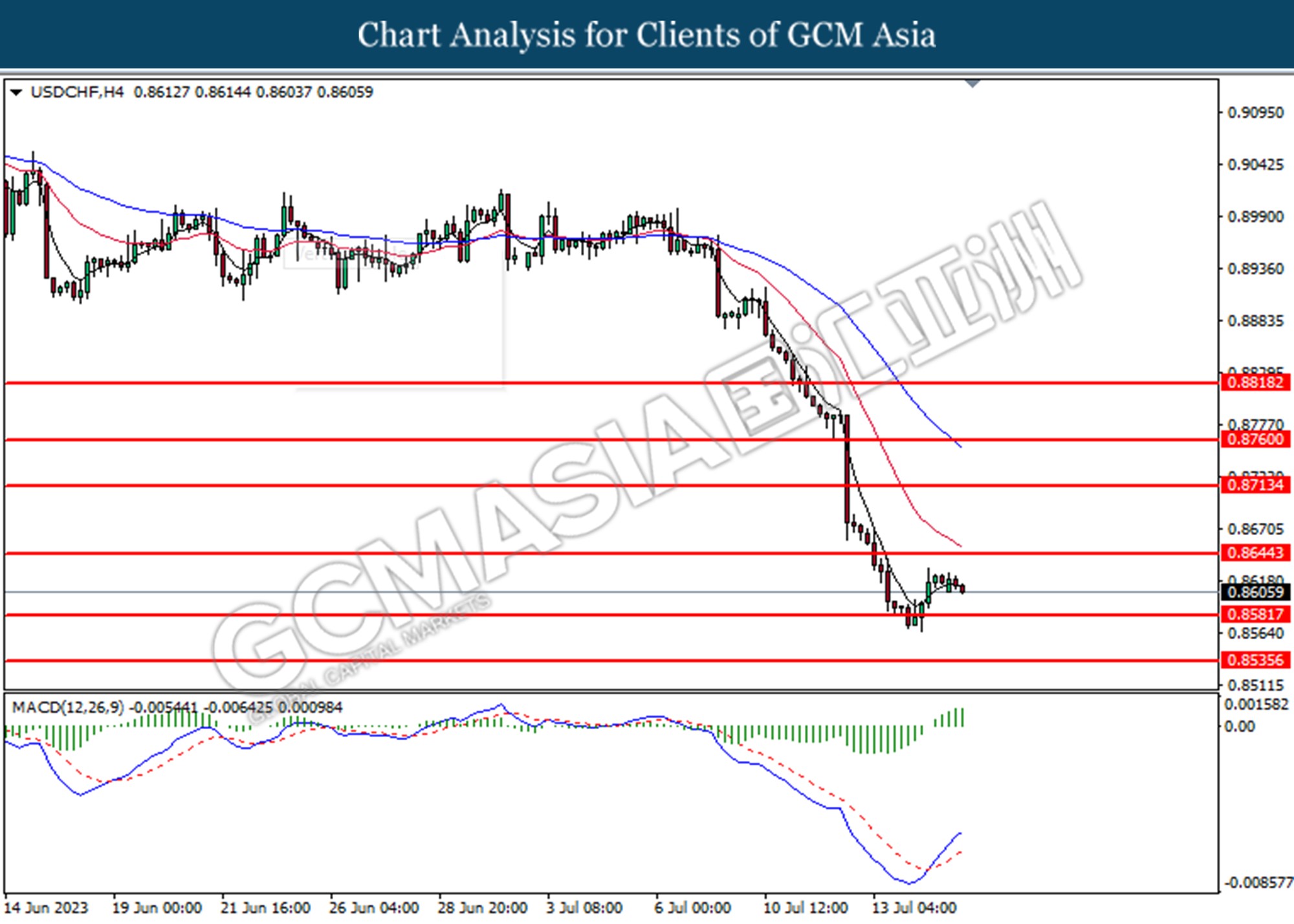

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.8645, 0.8715

Support level: 0.8580, 0.8535

CrudeOIL, H4: Crude oil price was traded lower following the prior breaks below the previous support level at 74.65. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the next support level.

Resistance level: 74.65, 76.00

Support level: 73.15, 71.65

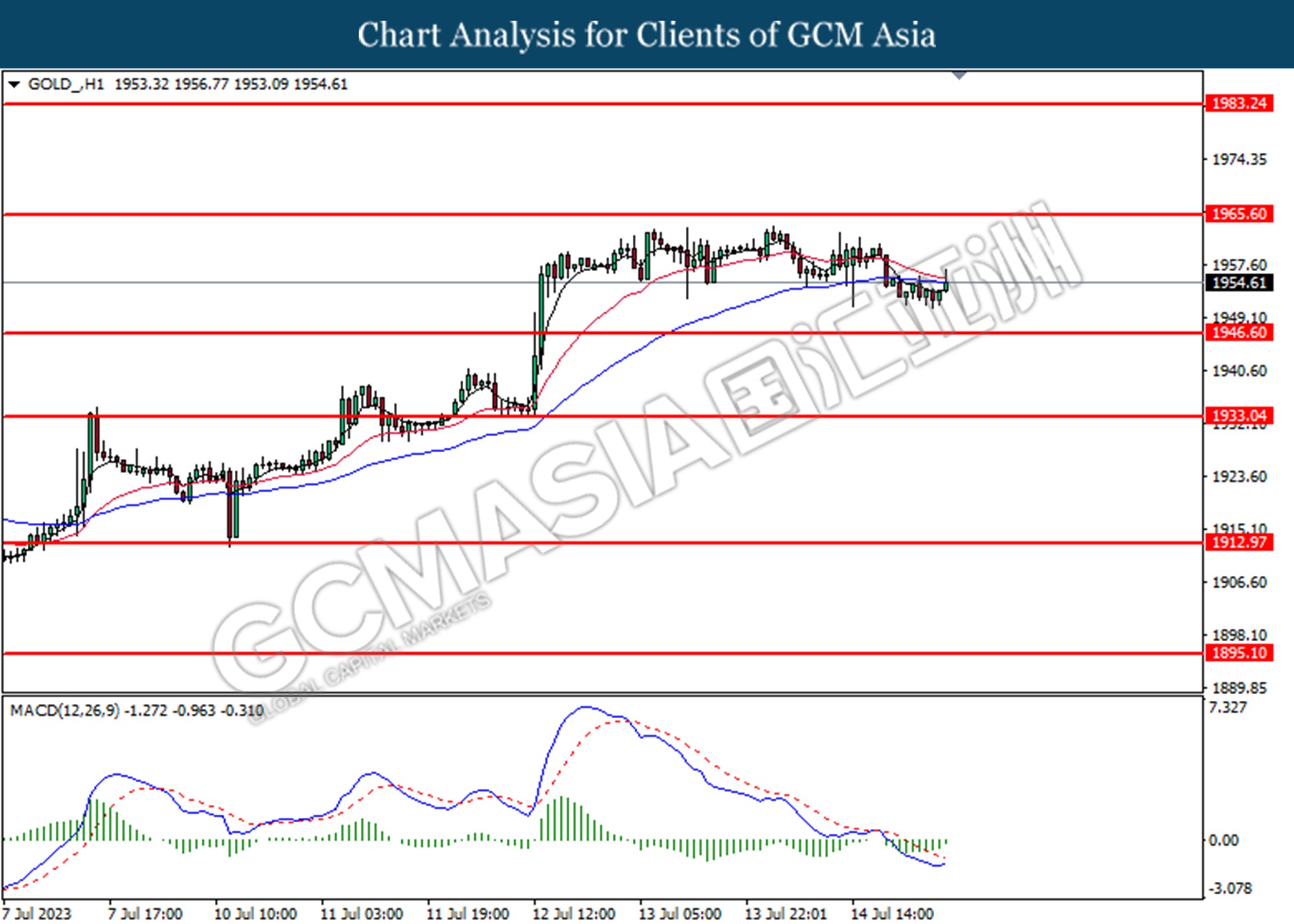

GOLD_, H1: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains towards the resistance level.

Resistance level: 1965.60, 1983.25

Support level: 1946.60, 1933.05