17 July 2023 Morning Session Analysis

US dollar edged higher as market pessimism was priced in.

The dollar index, which was traded against a basket of six major currencies, managed to regain its luster after hitting the 15-month low, as the market participants started to take profit on their short sell position. The dollar index experienced a sharp decline last week due to inflation data, which fell short of expectations. The Consumer Price Index (CPI) on Wednesday and Producer Price Index on Thursday contributed to this trend, suggesting that the Federal Reserve is approaching the end of its cycle of interest rate increases. With the inflation has been steadily slowing down in the recent months, it has fostered a sense of optimism among Americans about the future. According to a survey that released on Frida’s night, the US consumer sentiment, as measured by the University of Michigan, increased by 13% in July. This marks the second consecutive month of improvement and represents the largest month-to-month gain since 2006. The index has reached its highest level since September 2021. Based on the survey result from the University of Michigan, the US Consumer Confidence Index rose to 72.6 from 64.4 in June. This reading came in better than the market expectation of 65.5. As a result, the dollar index regurgitated its previous losses and rebounded slightly before the end of Friday’s trading session. As of writing, the dollar index rose 0.04% to 99.95.

In the commodities market, crude oil prices were down by -0.49% to $74.90 per barrel as the US dollar strengthened and oil traders booked profits from a strong rally. Besides, gold prices ticked down by -0.08% to $1954.00 per troy ounce as the investors took profit following the huge rally last week.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – NY Empire State Manufacturing Index (Jul) | 6.0 | 0.0 | – |

Technical Analysis

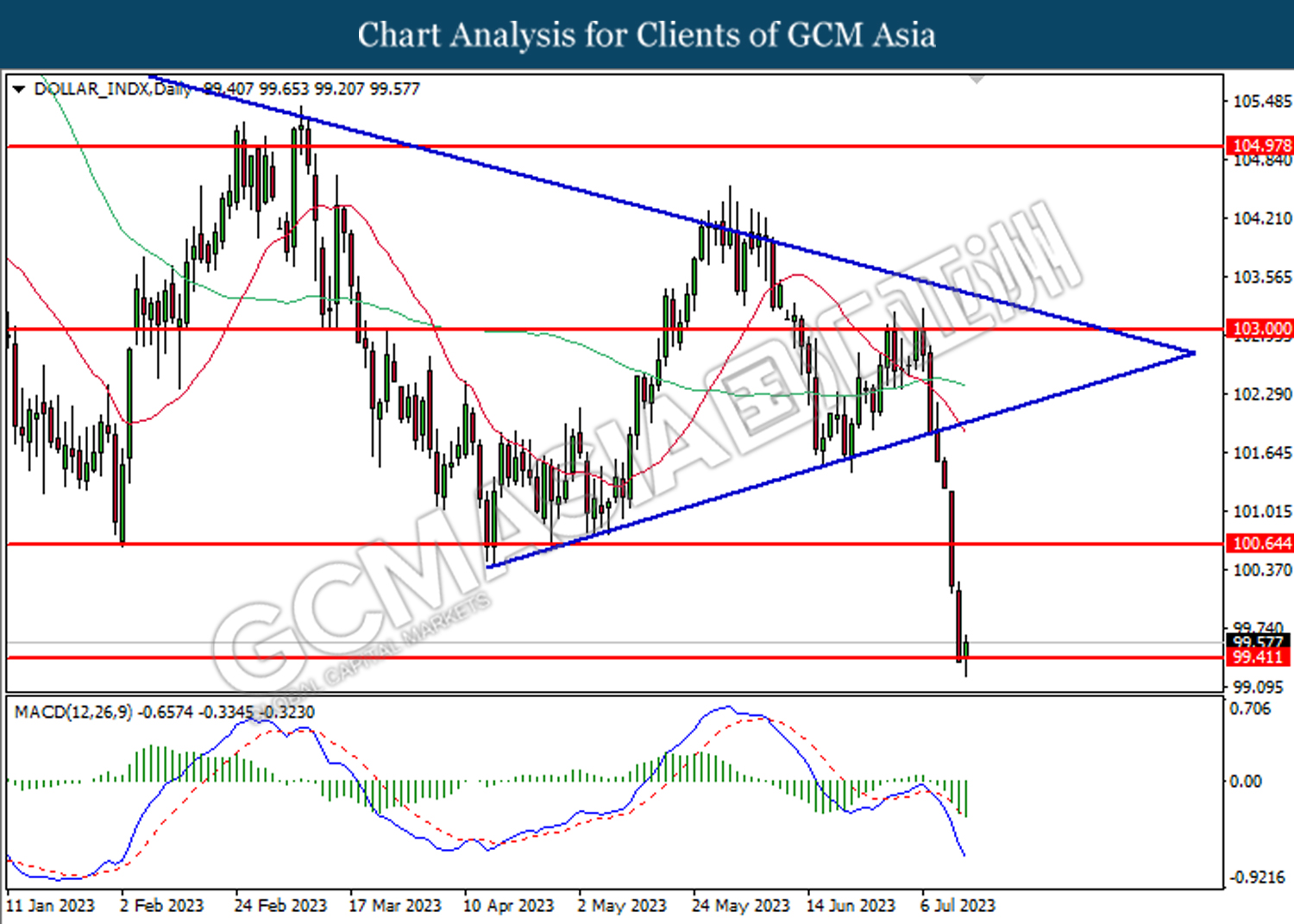

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 99.40. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level at 99.40.

Resistance level: 100.65, 103.00

Support level: 99.40, 97.75

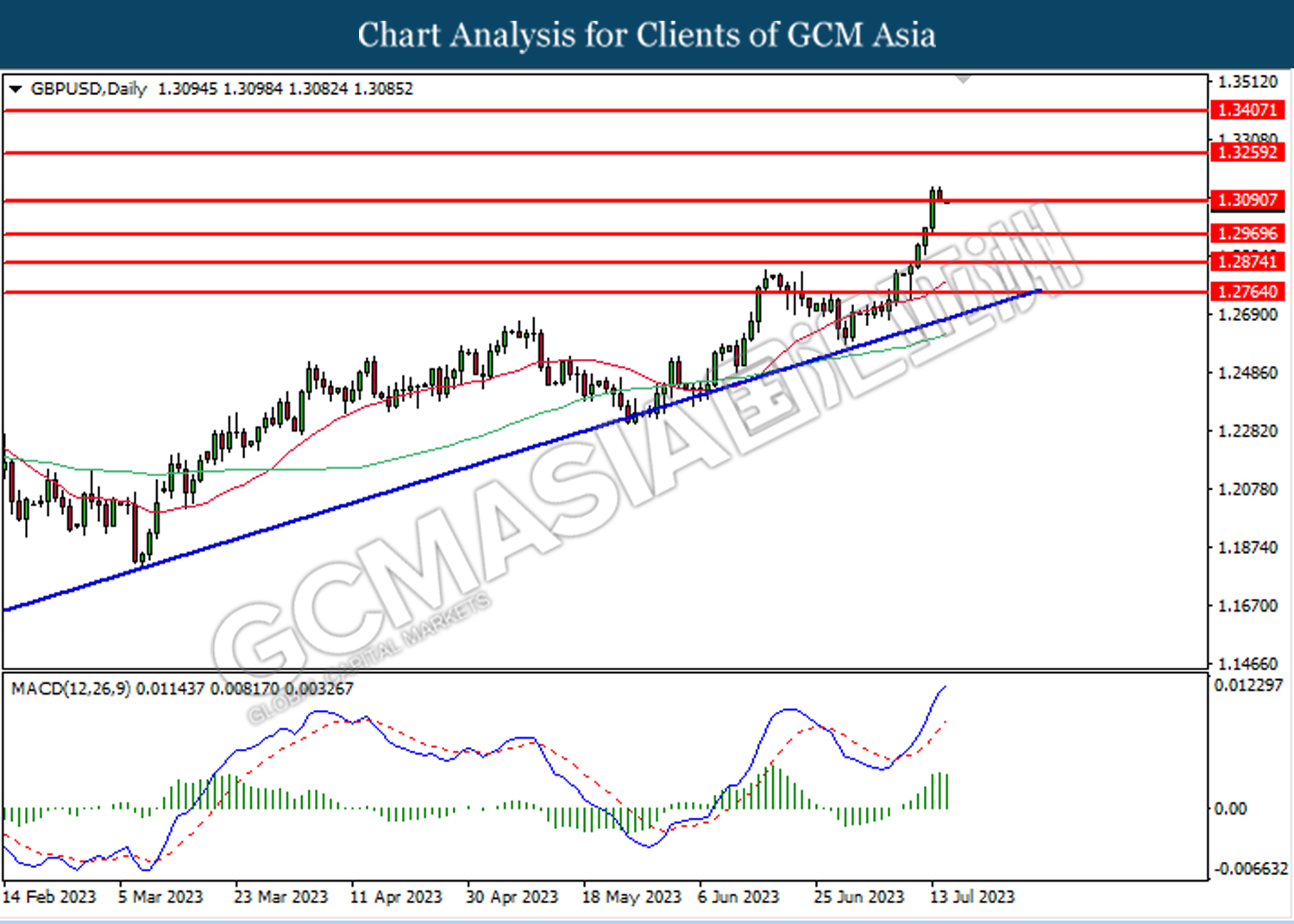

GBPUSD, Daily: GBPUSD was traded lower while currently retesting the support level at 1.3090. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3260, 1.3405

Support level: 1.3090, 1.2970

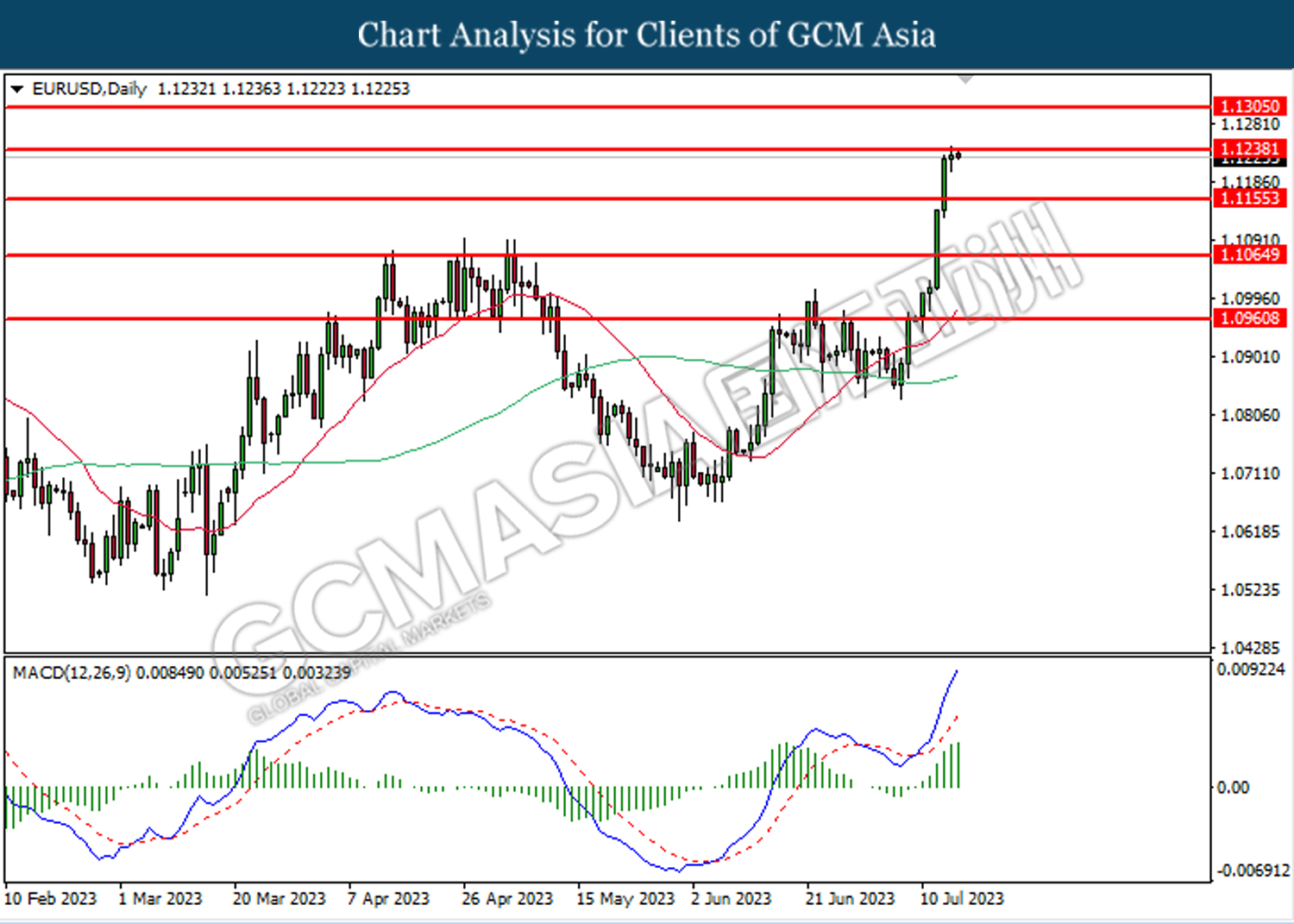

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.1155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1240.

Resistance level: 1.1240, 1.1365

Support level: 1.1155, 1.1065

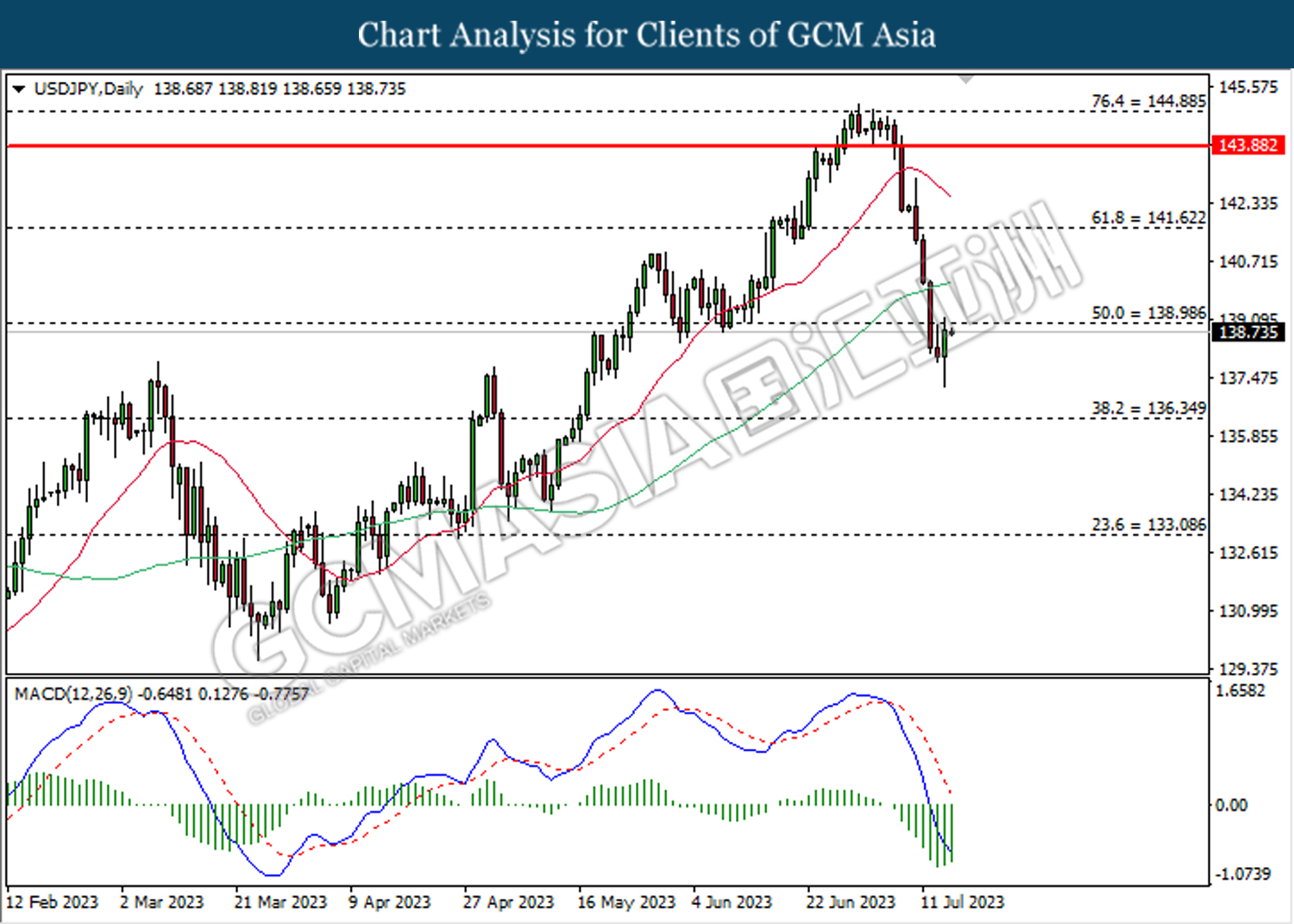

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 139.00. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 139.00, 141.60

Support level: 136.35, 133.10

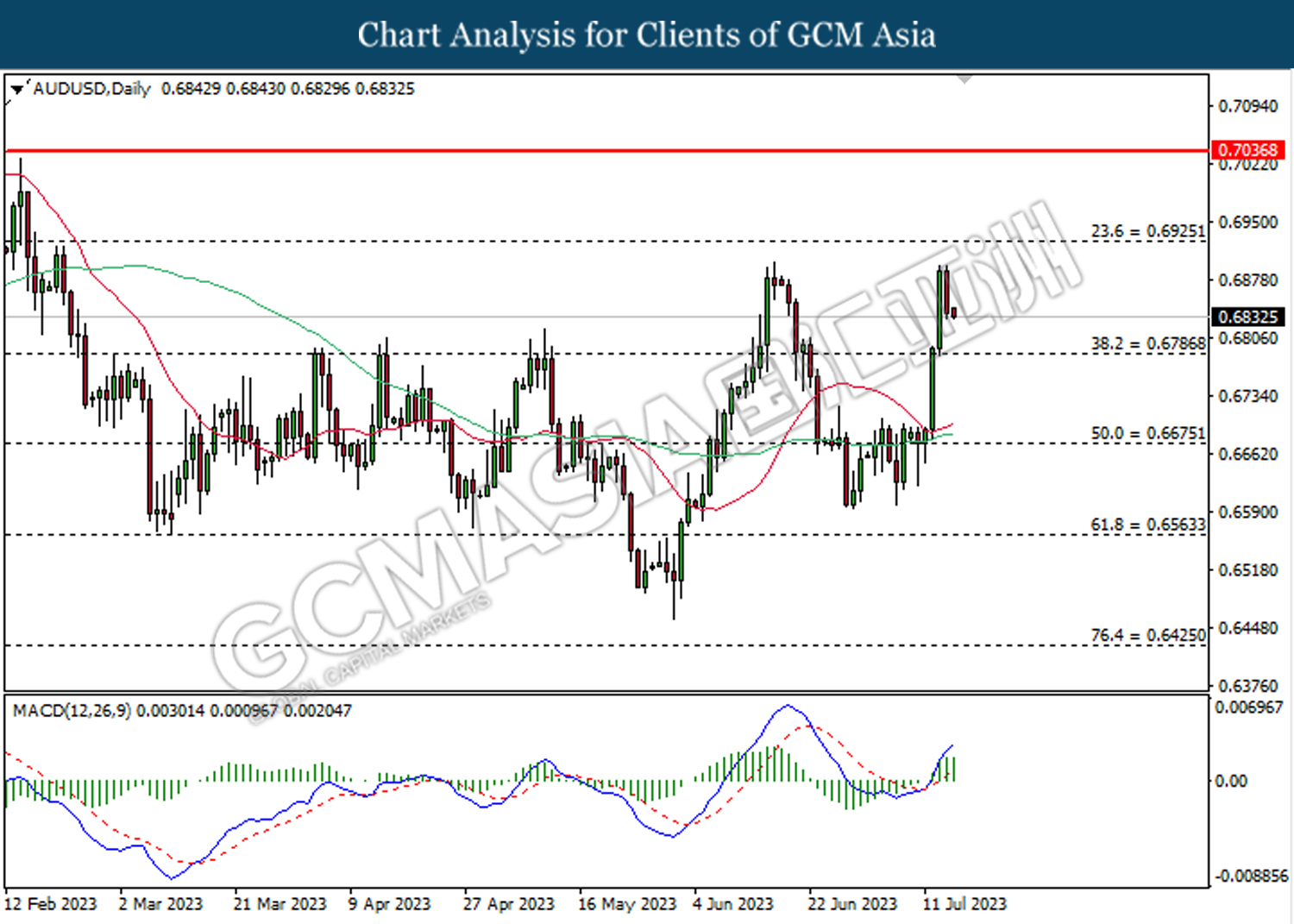

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

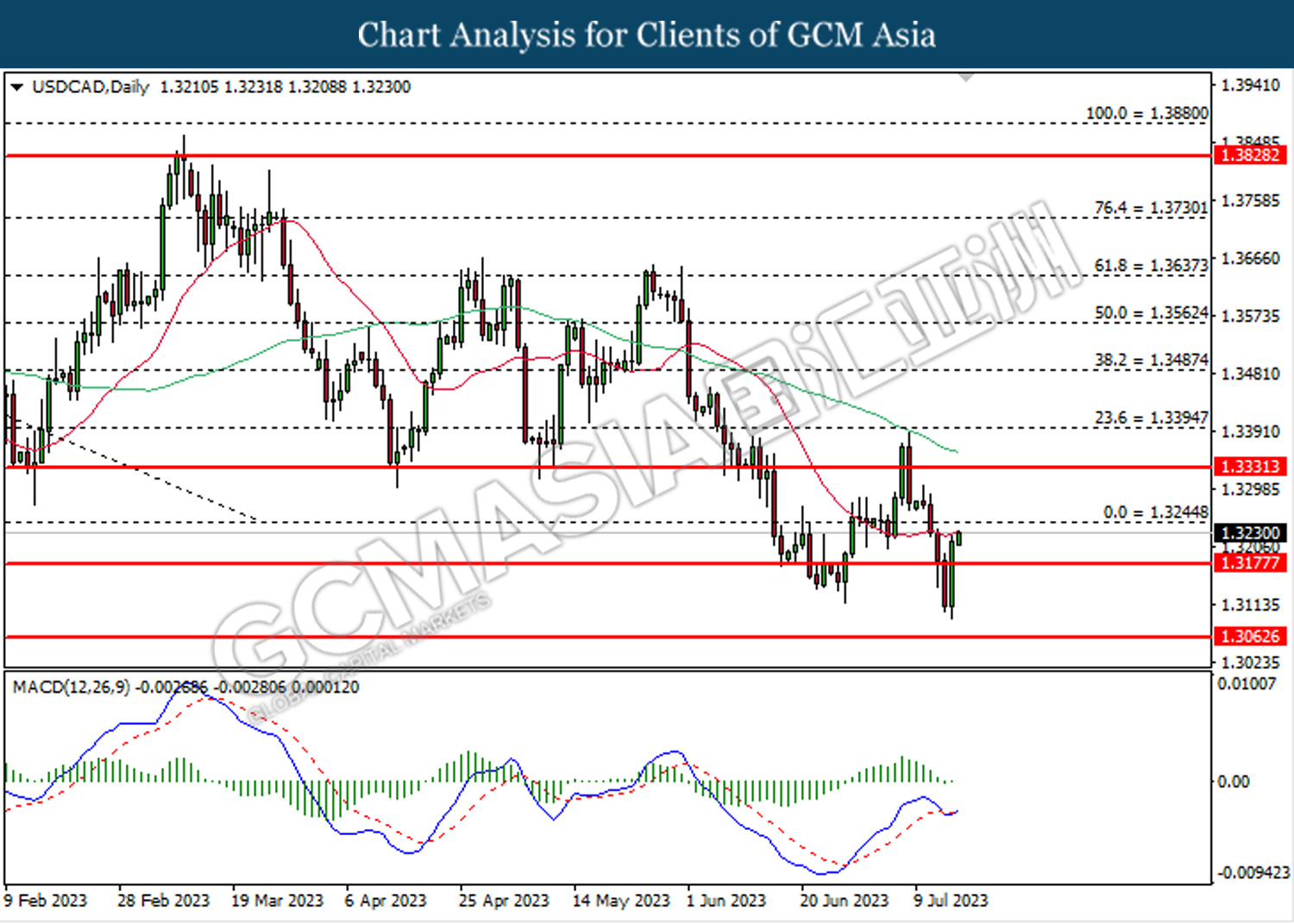

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3175. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3245.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

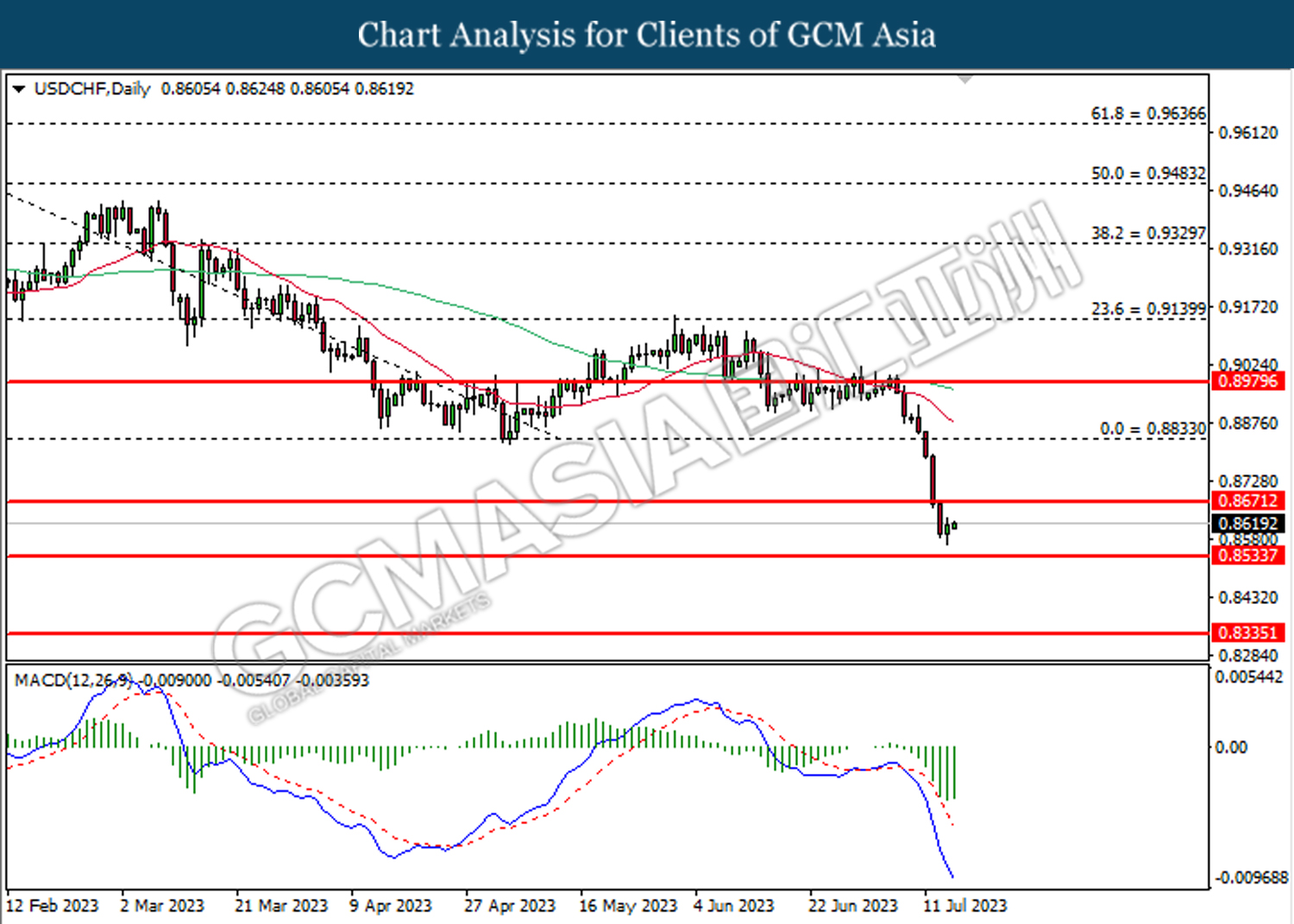

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8535.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

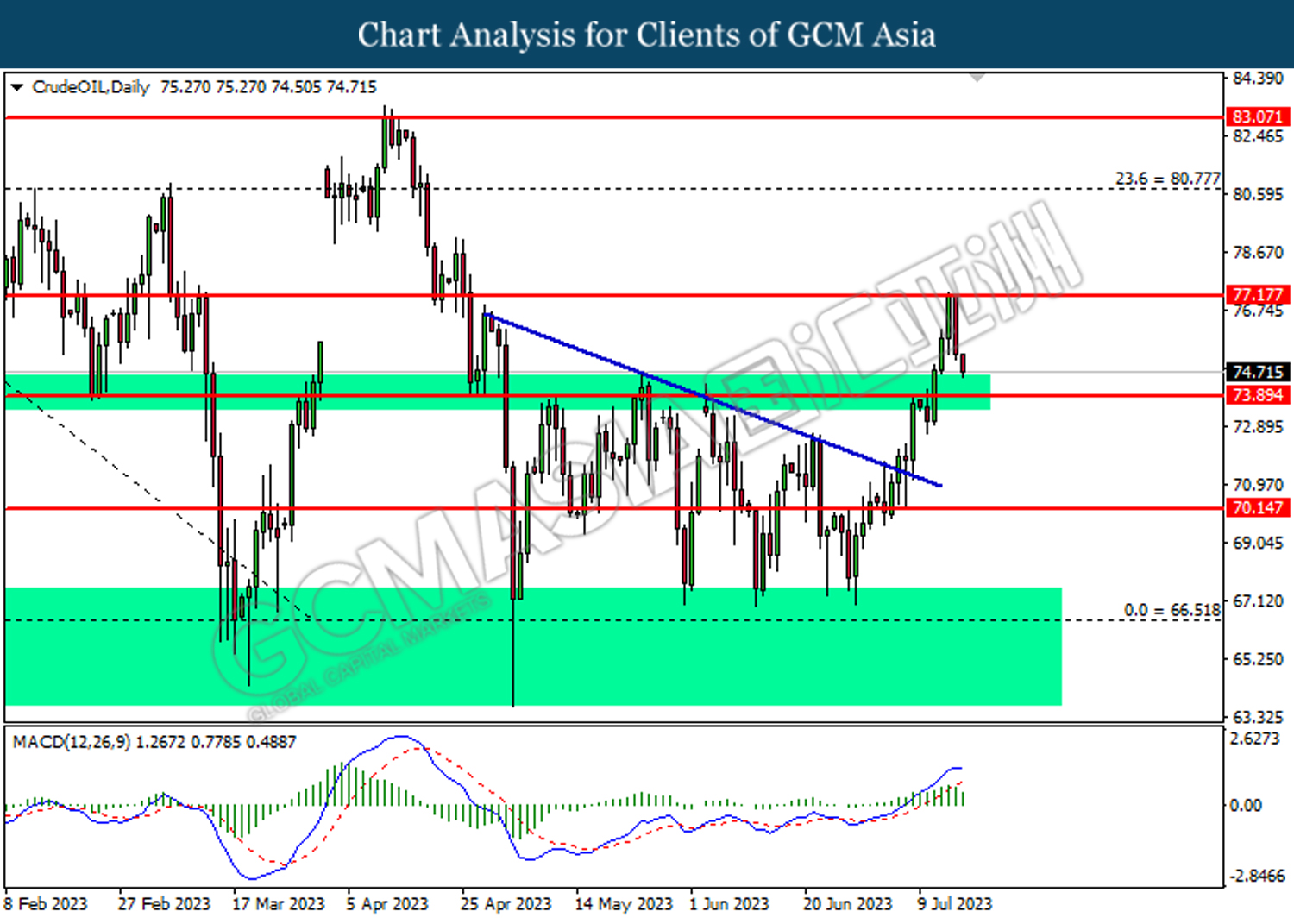

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 77.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 73.90.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

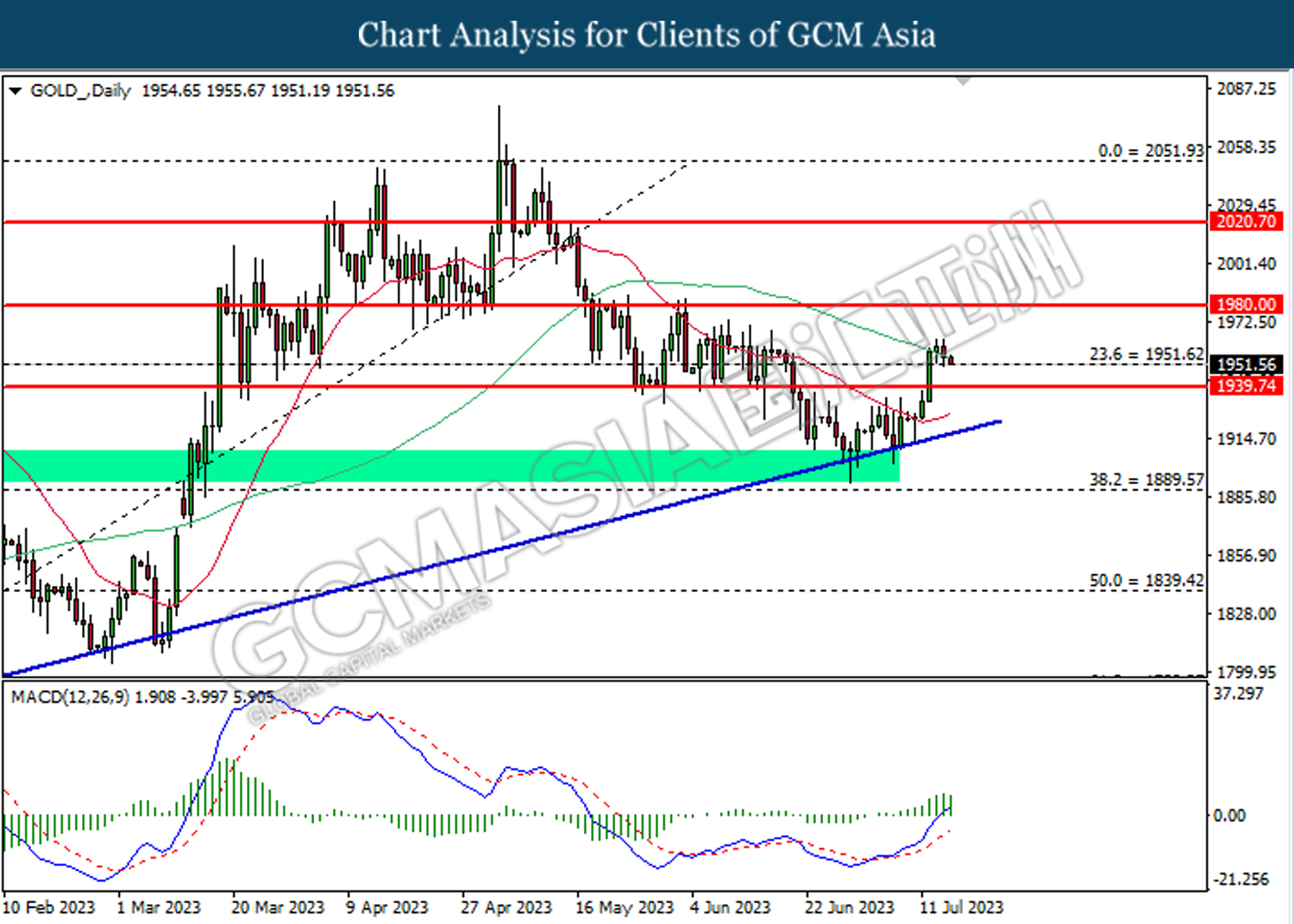

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75