17 September 2020 Afternoon Session Analysis

Japanese Yen remains steady following revision from BoJ.

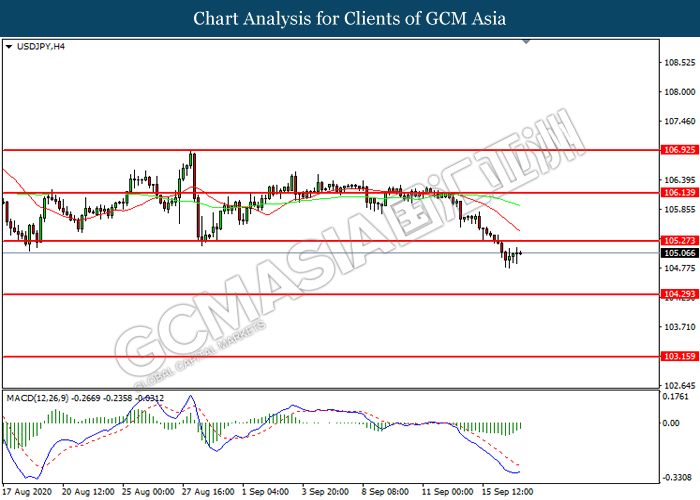

During late Asian session, the Japanese Yen which traded against the greenback and other currency pairs have gained as Bank of Japan’s decision to revise the economic assessment higher have manage to draw bid for the safe-haven currency. The central bank stated that the economy is in a severe state but also shows signs of life and could soon see higher output and exports. The statement added that consumption is gradually picking up; however, the consumer price index is likely to hover in the negative territory for the time being. Following BoJ’s positive comment on exports and output, the safe-haven Yen receive bid from the market. However, due to recent upbeat assessment from Fed, further potential gains may be limited. At the time of writing, USD/JPY slips 0.05% to 105.05.

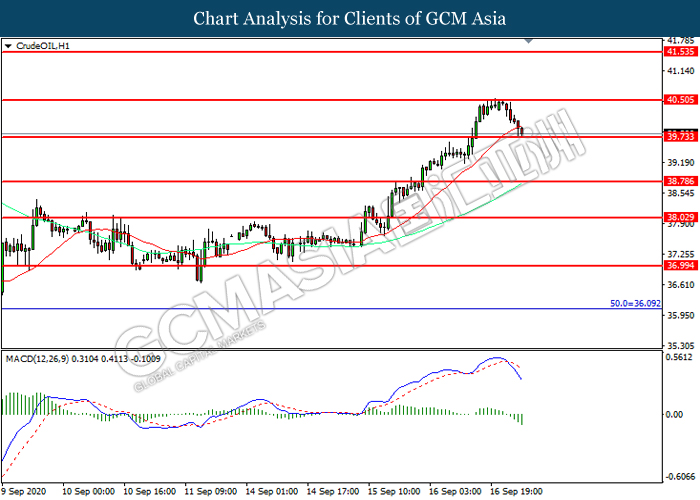

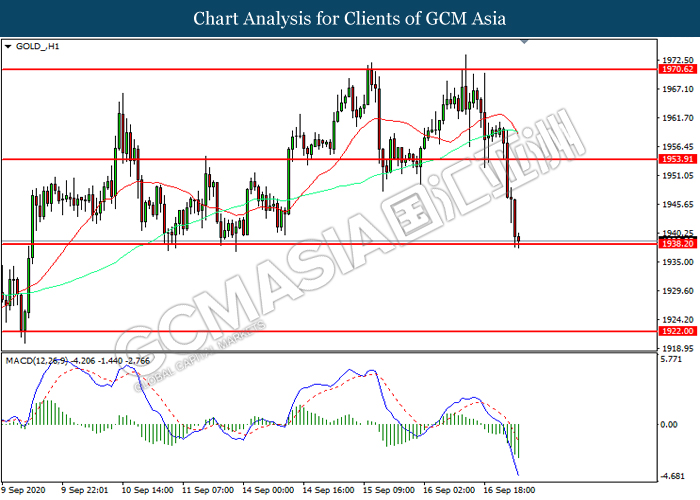

In the commodities market, crude oil price retreats 0.62% to $39.90 per barrel as of writing amid ongoing fuel demand concerns. Hurricane Sally, the second hurricane to hit the Gulf of Mexico area in less than a month, making landfall on Wednesday. After the storm, company crew are slowly returning to offshore oil platform but almost 500,000 barrels was shut down. At the same time, market concerns remain high over EIA report of increase in 3.461 million in stockpiles which is 6 times higher, thus exert some pressure for the commodity. On the other hand, gold price fell 0.99% to $1939.67 a troy ounce at the time of writing due to dollar strength boosted by positive Fed outlook.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 JPY BoJ Monetary Policy Statement

15:00 JPY BoJ Press Conference

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Aug) | – | -0.2% | -0.2% |

| 19:00 | GBP – BoE Interest Rate Decision (Sep) | – | 0.10% | 0.10% |

| 20:30 | USD – Building Permits (Aug) | – | 1.510M | 1.483M |

| 20:30 | USD – Initial Jobless Claims | – | 850K | 884K |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Sep) | – | 15.5 | 17.2 |

Technical Analysis

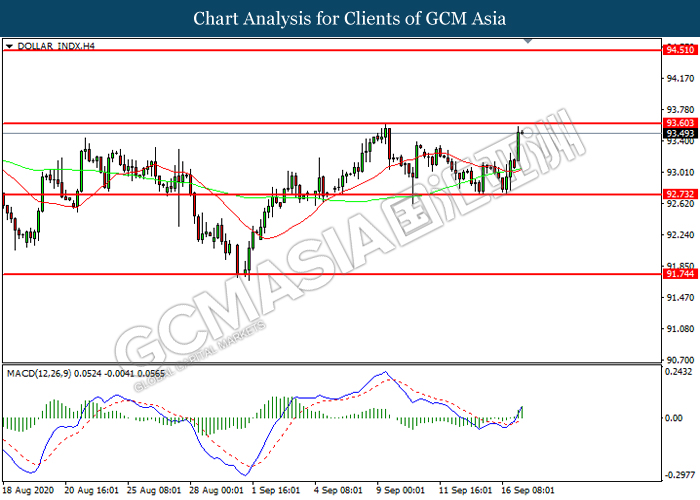

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 93.60. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.60, 94.50

Support level: 92.75, 91.75

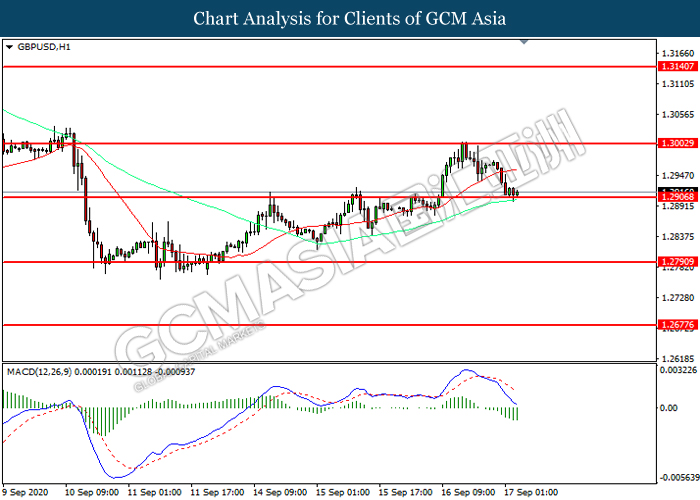

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level at 1.2905. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3005, 1.3140

Support level: 1.2790, 1.2675

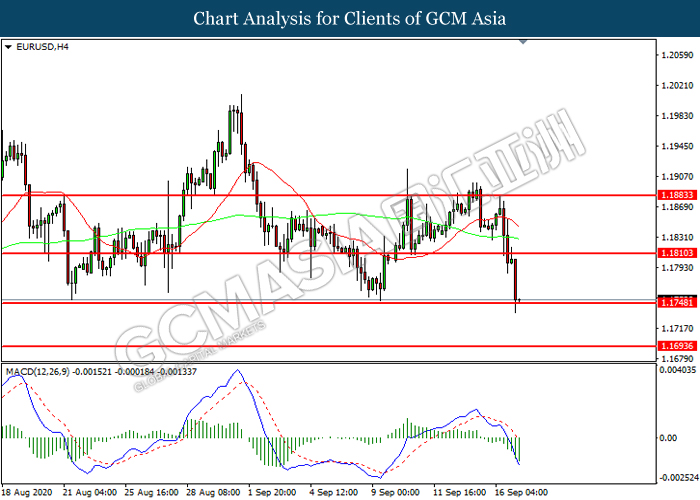

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1750. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1810, 1.1885

Support level: 1.1750, 1.1695

USDJPY, H4 : USDJPY was traded lower following prior breakout below the previous support level at 105.25. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 105.25, 106.15

Support level: 104.30, 103.15

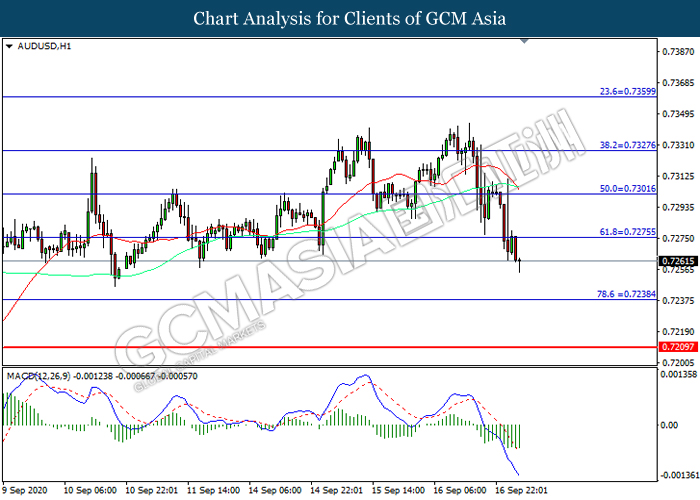

AUDUSD, H1: AUDUSD was traded lower following prior breakout below the previous support level at 0.7275. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7240.

Resistance level: 0.7275, 0.7300

Support level: 0.7240, 0.7210

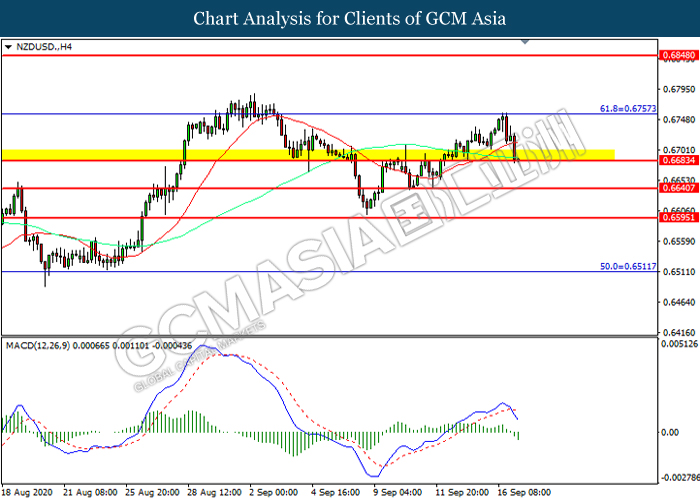

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6685. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6755, 0.6850

Support level: 0.6685, 0.6640

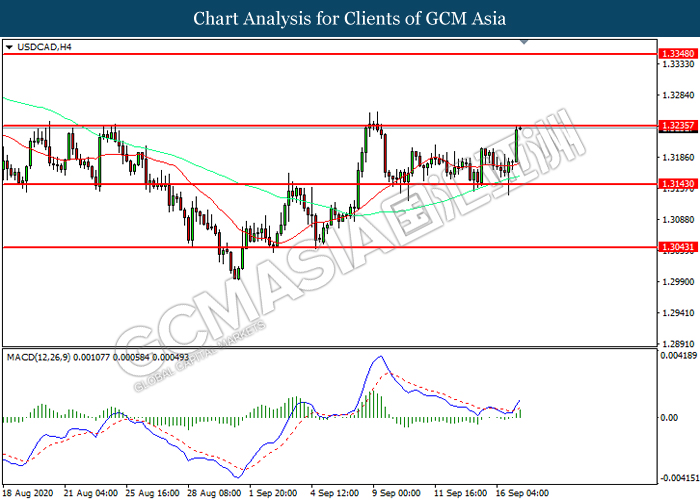

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3235. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3235, 1.3350

Support level: 1.3145, 1.3045

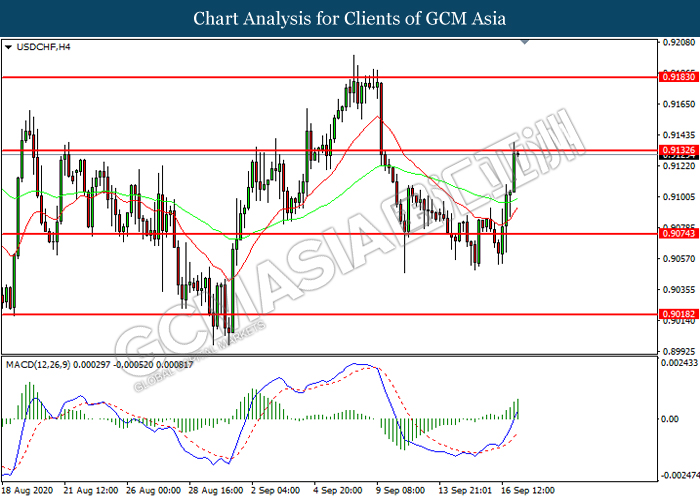

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9135. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9135, 0.9185

Support level: 0.9075, 0.9020

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 39.75. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 40.50, 41.55

Support level: 39.75, 38.80

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1938.20. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1953.90, 1970.60

Support level: 1938.20, 1922.00