18 January 2021 Afternoon Session Analysis

Aussie traded flat amid mixed economic data from China.

The Australian Dollar was traded within a range over the backdrop of mixed economic data from China on Monday. According to National Bureau of Statistics of China, the China Gross Domestic Product (GDP) had notched up significantly from the previous reading of 4.9% to 6.5%, exceeding the market forecast at 6.1%. Meanwhile, the China Industrial Production had also increased significantly from the preliminary reading of 7.0% to 7.3%, which also fared better than the market expectation at 6.9%. Since the Australian economic growth relies heavily on China, any slowdown in the economy of China will affect the demand for Australian’s exportation, which having a strong impact on Australia Dollar. Hence, as both crucial economic data from China region had fared better than expectation, which dialled up the market optimism toward the economic progression in the Australia. Nonetheless, the gains experienced by the Aussie was limited following the negative Chinese’s retail sales data was released. According to latest statistics, the China Retail Sales came in at 4.6%, worse than the market forecast at 5.5%. As of writing, AUD/USD appreciated by 0.01% to 0.7702.

In the commodities market, the crude oil price depreciated by 0.08% to $52.00 per barrel as of writing. The crude oil price extends its losses as investors remained concern over the spiking numbers of Covid-19 cases in the world, which spurring negative prospect for the oil demand in future. On the other hand, the gold price appreciated by 0.05% to $1828.80 per troy ounce as of writing amid rising trade tensions between Canada and US following U.S. President-elect Joe Biden claimed that the he is planning to cancel the keystone XL Pipeline Permit on his 1st day in office.

Today’s Holiday Market Close

Time Market Event

All Day USD Martin Luther King, Jr. Day

Today’s Highlight Events

Time Market Event

21:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

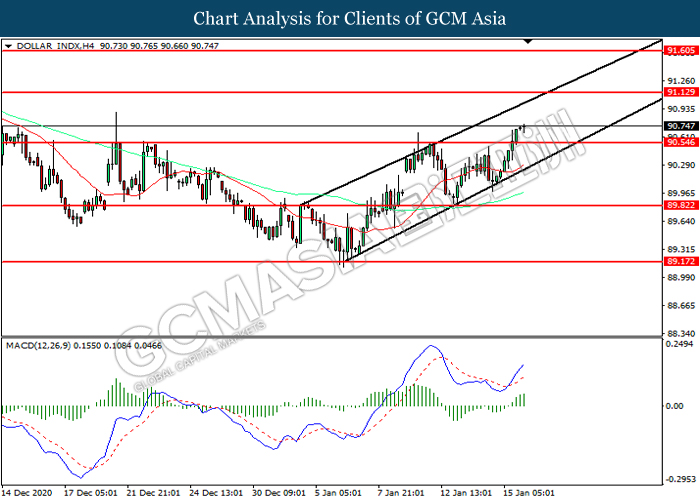

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 90.55. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 91.15.

Resistance level: 91.15, 91.60

Support level: 90.55, 89.80

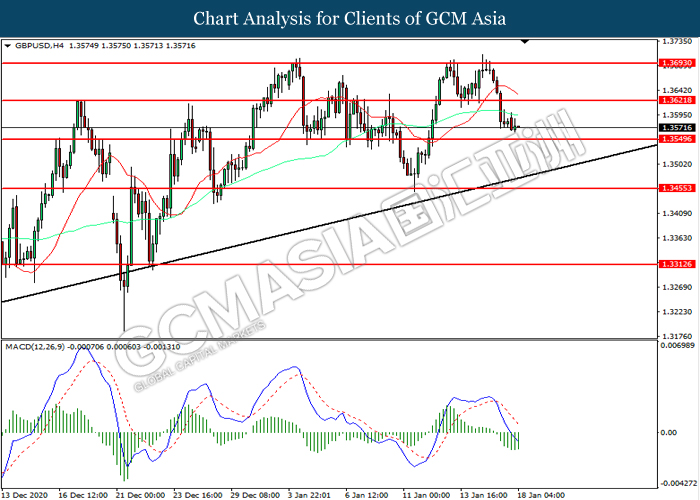

GBPUSD, H4: GBPUSD was traded lower while currently near the support level at 1.3550. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3620, 1.3695

Support level: 1.3550, 1.3455

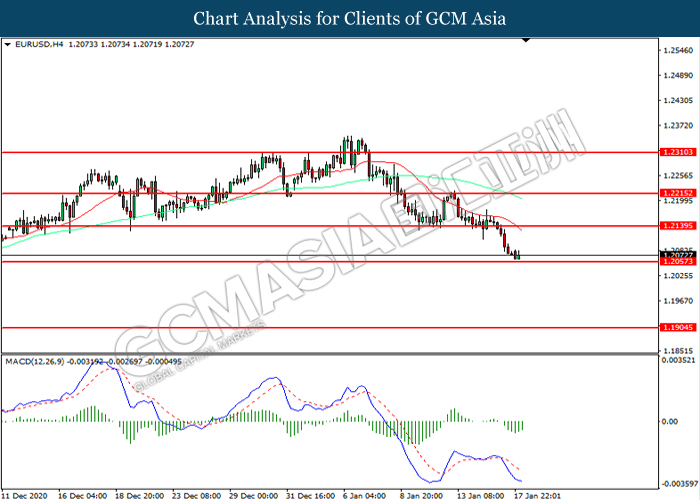

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.2160. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2140, 1.2215

Support level: 1.2055, 1.1905

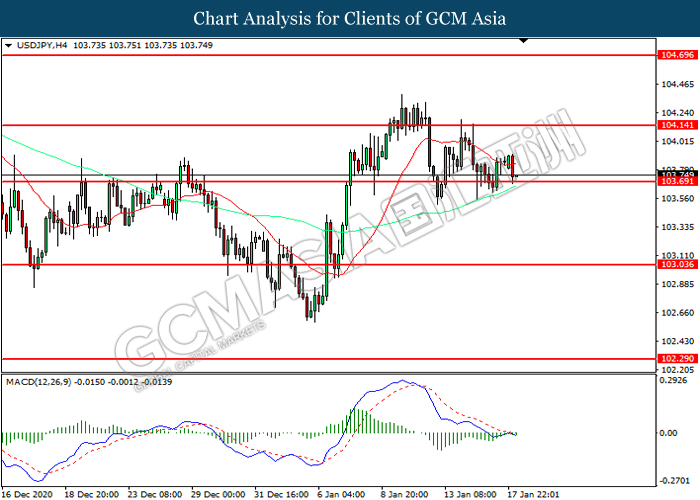

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 103.70. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 104.15, 104.70

Support level: 103.70, 103.05

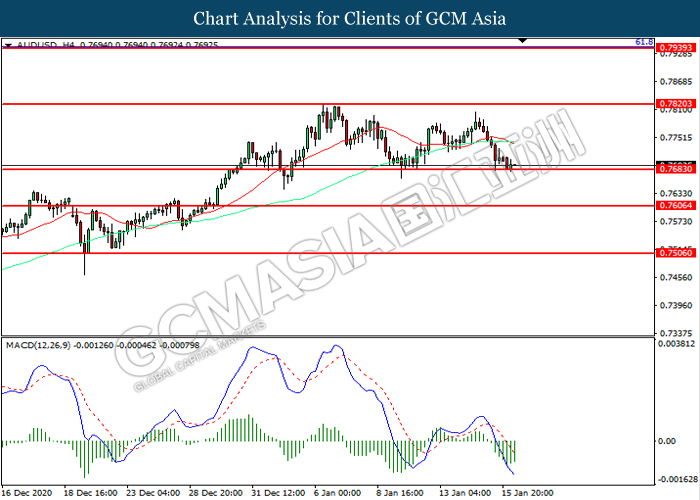

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7685. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7820, 0.7940

Support level: 0.7685, 0.7605

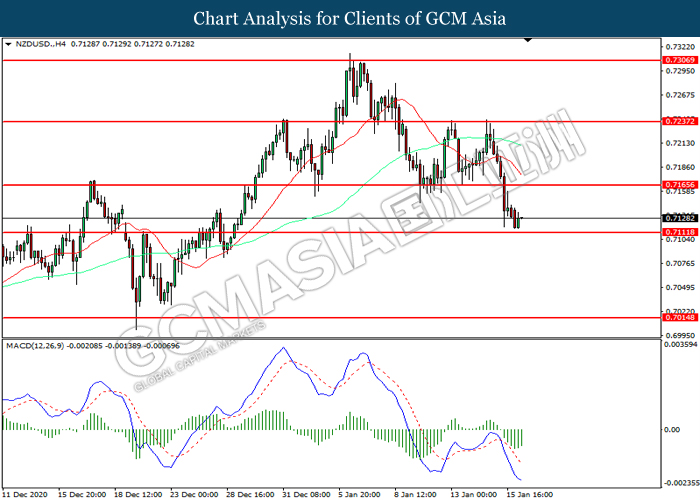

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.7110. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7165, 0.7235

Support level: 0.7110, 0.7015

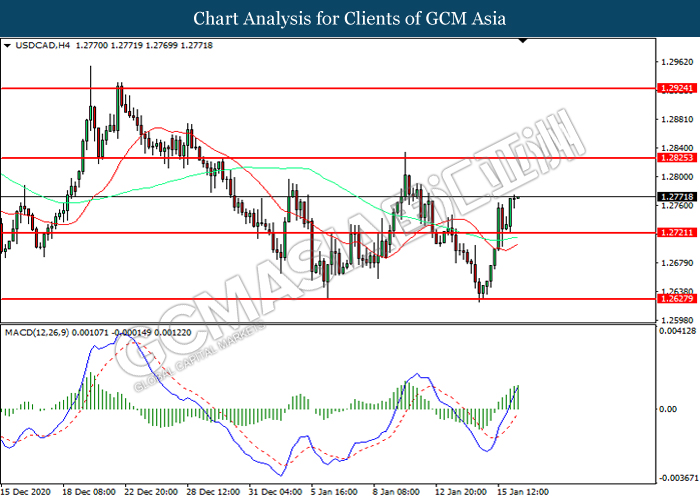

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2720. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2825.

Resistance level: 1.2825, 1.2925

Support level: 1.2720, 1.2630

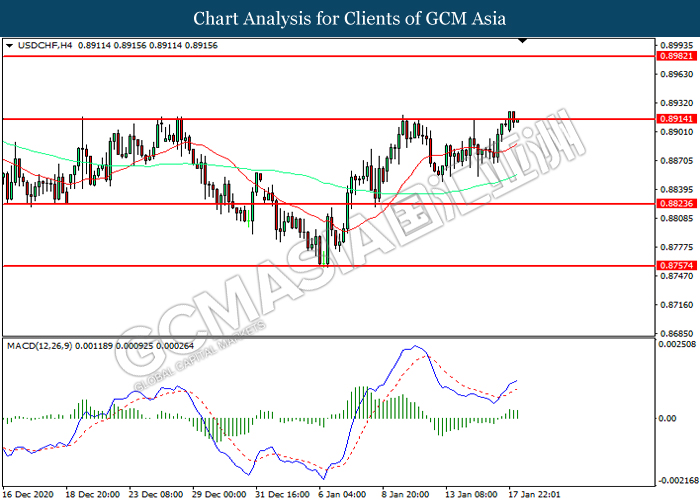

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.8915. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8915, 0.8980

Support level: 0.8825, 0.8755

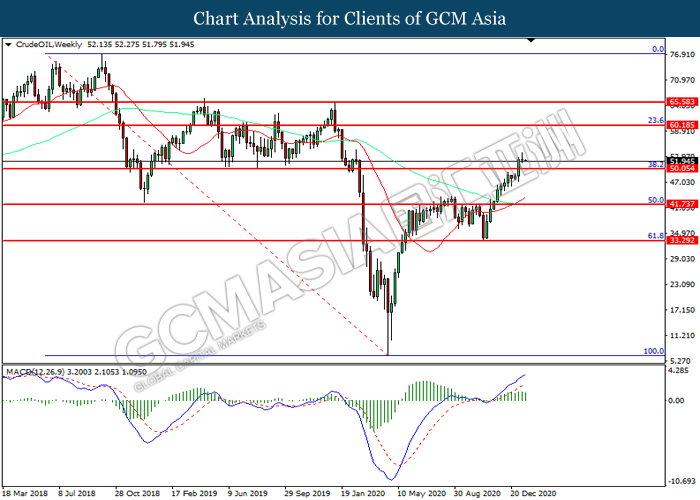

CrudeOIL, Weekly: Crude oil price was traded higher following prior breakout above the previous resistance level at 50.05. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 60.20, 65.60

Support level: 50.05, 41.75

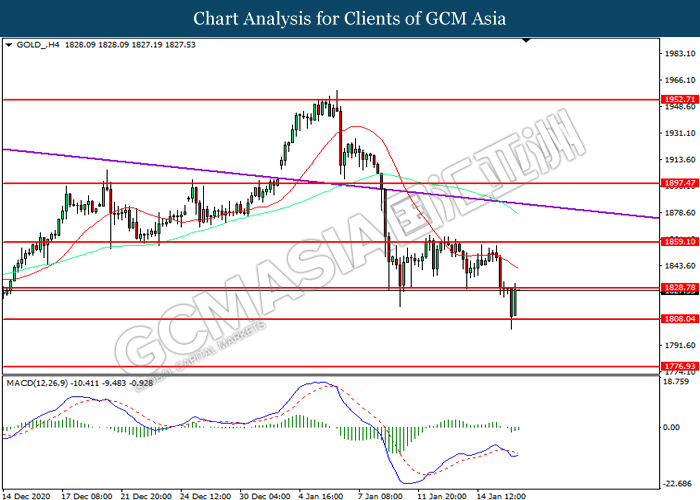

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1828.80. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1859.10, 1897.45

Support level: 1808.05, 1776.95