18 January 2021 Morning Session Analysis

Pound sterling slumped amid recession risk heightened.

Pound sterling which act as one of the major currencies that being traded in the FX market retraced from the highest level in 2.5 years as ongoing lockdown restriction tampered the pound’s appeal. Earlier of the month, UK Prime Minister Boris Johnson decided to re-implement lockdown measure across entire UK as the total confirmed cases had proved that UK virus outbreak was out of control. The economy took a hit badly from restrictions put in place in order to curb the pandemic, as huge part of economic activities was being forced to stall. On data front, UK GDP data came in at -2.6%, marking the worst fall since last year’s June, while economist expecting a further decline could be seen in the first three months of 2021 amid ongoing renewed lockdown measure, which would put the UK back in recession. Besides, UK manufacturing data has recorded a reading of 0.7%, weaker than economist expectation at 0.9%, indicating a dwindling recovery within the billow of virus. During Asian early trading session, the pair of GBP/USD depreciated by 0.01% to 1.3586.

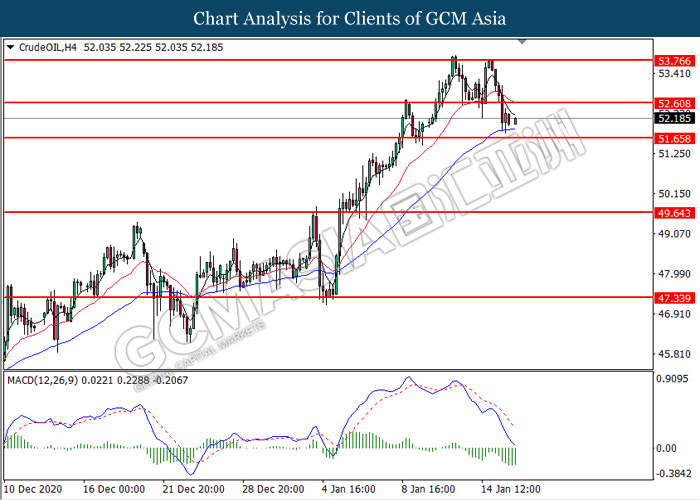

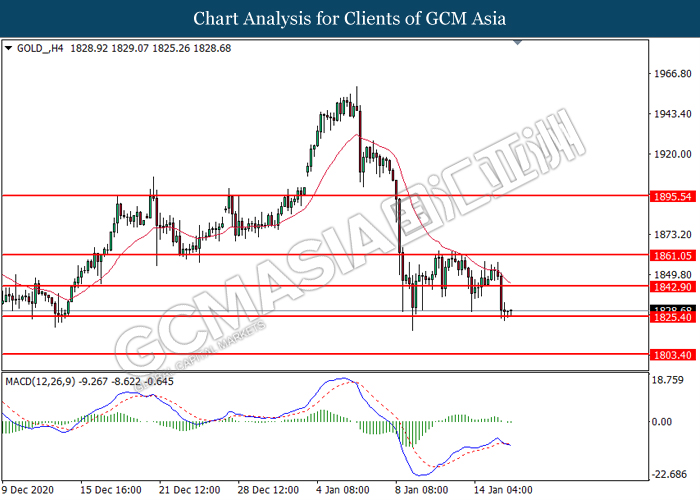

In the commodities market, the crude oil price rebounded by 0.23% to $52.14 per barrel as of writing. In the last trading session, oil price slumped significantly amid US oil rig count increased for the eight consecutive weeks. According to the Baker Hughes, US Oil Rig Count data came in at 287, showing an increase of 13 oil rig while comparing to the previous reading of 275. Besides, gold price dropped 0.09% to $1827.00 a troy ounce as surging of US 10 years treasury yield lifted up the appeal of dollar, pressing down the gold price.

Today’s Holiday Market Close

Time Market Event

All Day USD Martin Luther King, Jr. Day

Today’s Highlight Events

Time Market Event

21:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 10:00 | CNY – GDP (QoQ)(Q4) | 4.9% | 6.1% | – |

| 10:00 | CNY – Industrial Production (YoY)(Dec) | 7.0% | 6.9% | – |

Technical Analysis

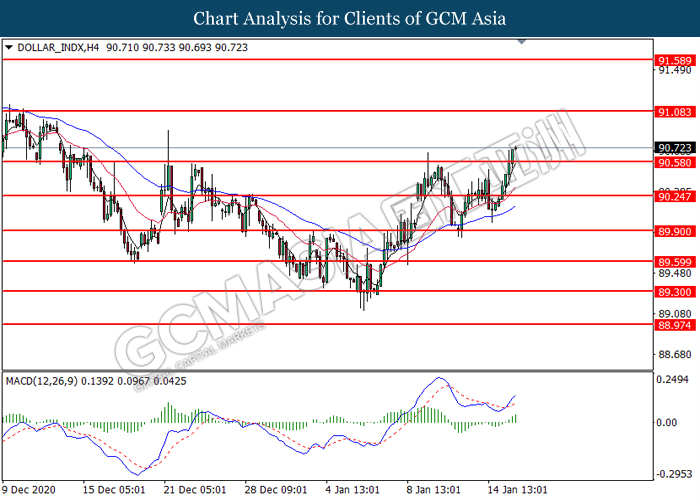

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 90.60. MACD which illustrated bullish momentum suggest the index to extend its gains toward the resistance level at 91.10.

Resistance level: 91.10, 91.60

Support level: 90.60, 90.25

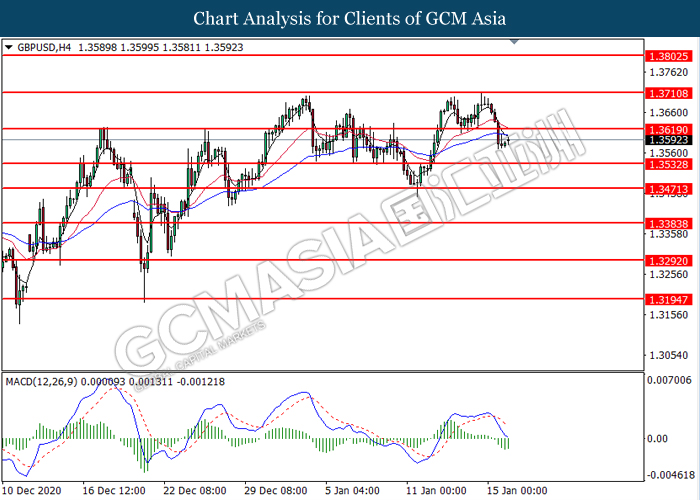

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3620.

Resistance level: 1.3620, 1.3710

Support level: 1.3535, 1.3470

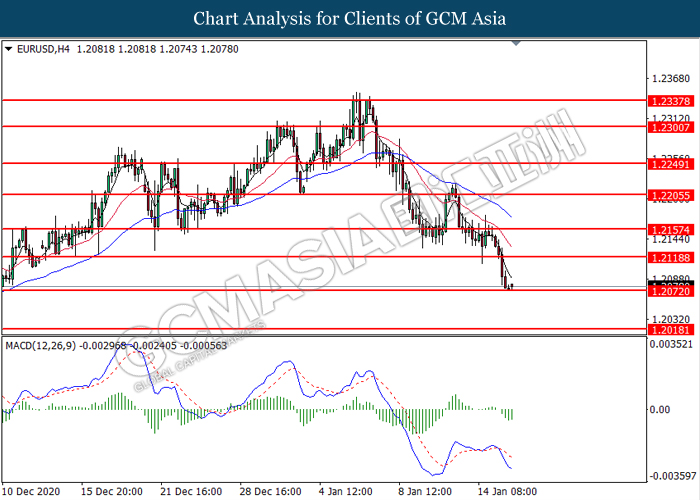

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2070. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2120.

Resistance level: 1.2120, 1.2155

Support level: 1.2070, 1.2020

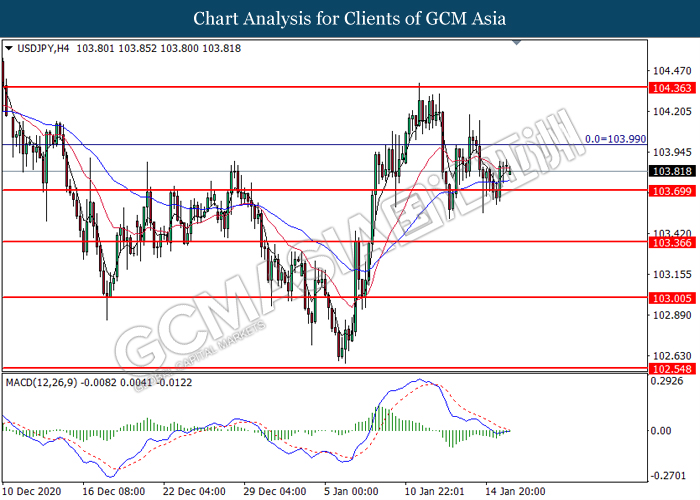

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 103.70. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 104.00.

Resistance level: 104.00, 104.35

Support level: 103.70, 103.35

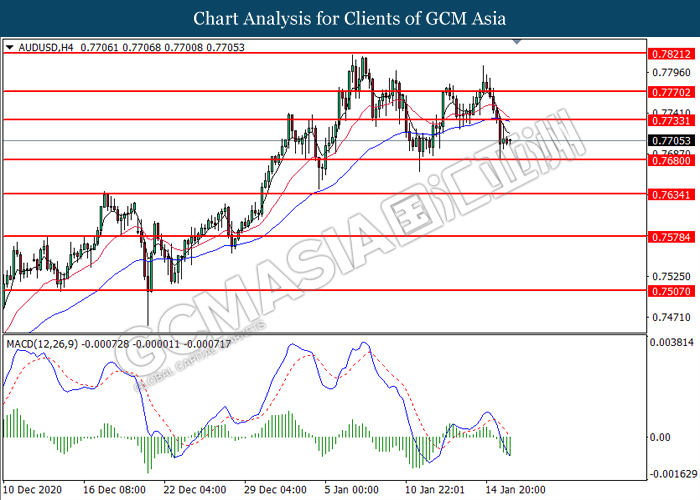

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7735. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.7680.

Resistance level: 0.7735, 0.7770

Support level: 0.7680, 0.7635

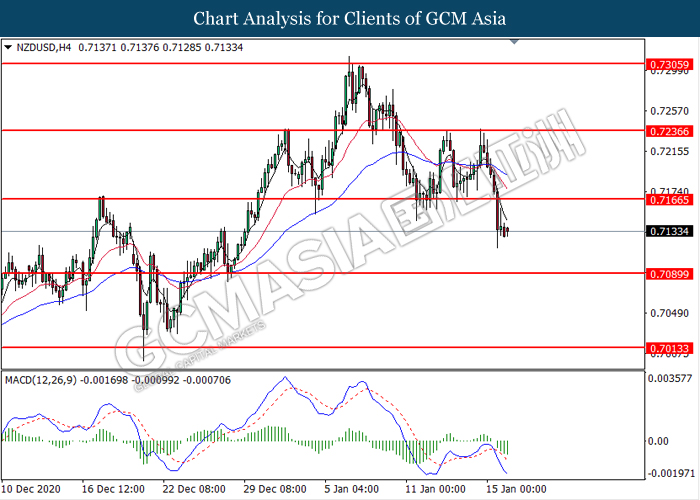

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level at 0.7165. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.7090.

Resistance level: 0.7165, 0.7235

Support level: 0.7090, 0.7015

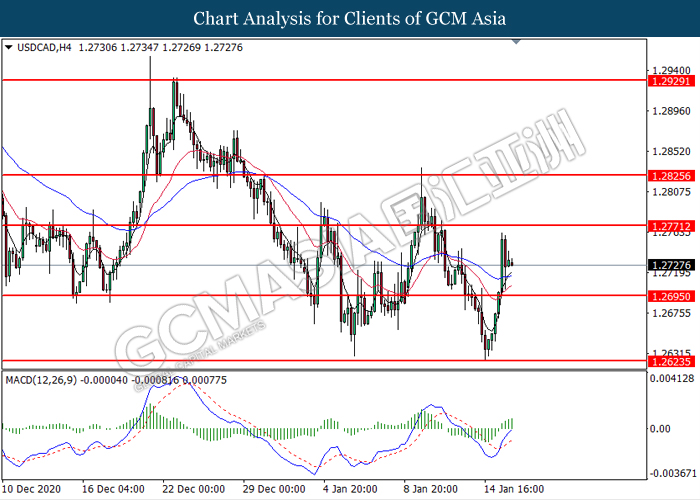

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.2770. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2695.

Resistance level: 1.2770, 1.2825

Support level: 1.2695, 1.2625

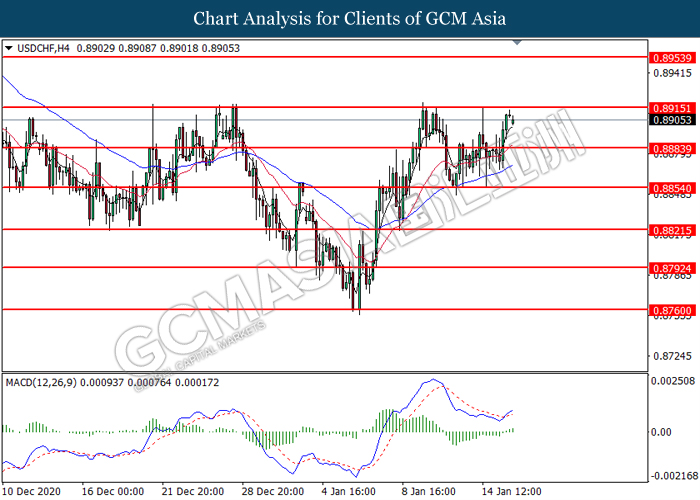

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term toward the higher level.

Resistance level: 0.8915, 0.8955

Support level: 0.8885, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 52.60.

Resistance level: 52.60, 53.75

Support level: 51.65, 49.65

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1825.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1842.90, 1861.05

Support level: 1825.40, 1803.40