18 January 2022 Afternoon Session Analysis

Dollar surged amid rising US yield.

The Dollar Index which traded against a basket of six major currency pairs remains bullish amid investors continue to speculate the higher odds for the Federal Reserve to tighten the monetary policy. Contractionary monetary policy would reduce the money circulation in the US market, which diminishing the inflation risk in future while spurring bullish momentum for the US Dollar. On the other hand, the EUR/USD was traded flat amid lack of major economic data for euro zone this week. Though, investors would remain their focus toward the European Central Bank’s meeting minutes on Thursday to gauge the likelihood monetary policy decision in future. Earlier, European Central Bank President Christine Lagarde claimed that they bank is ready to take any measures necessary to stabilize its inflation toward their 2% target. As of writing, the Dollar Index surged 0.05% to 95.20 while the pair of EUR/USD surged 0.11% to 1.1420.

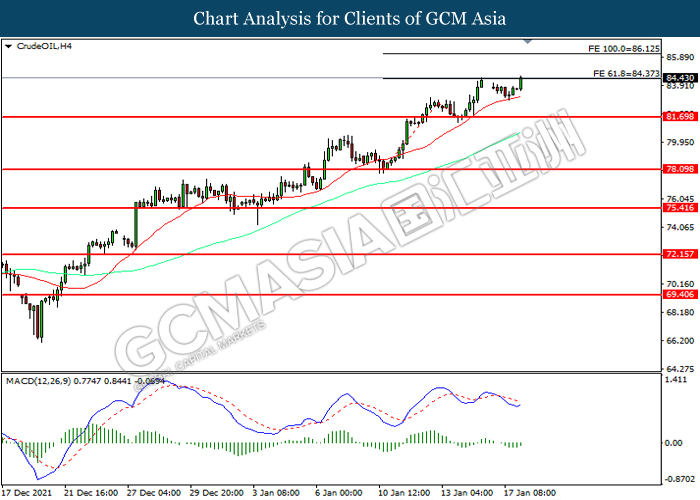

In the commodities market, the crude oil price appreciated by 0.98% to $85.20 per barrel as of writing. The oil market extend is gains amid worries about possible supply disruption following Yemen’s Houthi group attacked the United Arab Emirates, escalating geopolitics tensions between the Iran-aligned group and Saudi Arabian-led coalition. On the other hand, the gold price depreciated by 0.10% to $1,822.50 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative JPY BoJ Monetary Policy Statement

Tentative JPY BoJ Outlook Report

Tentative JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Nov) | 4.90% | 4.20% | – |

| 15:00 | GBP – Claimant Count Change (Dec) | -49.8K | -38.6K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Jan) | 29.9 | 32.7 | – |

Technical Analysis

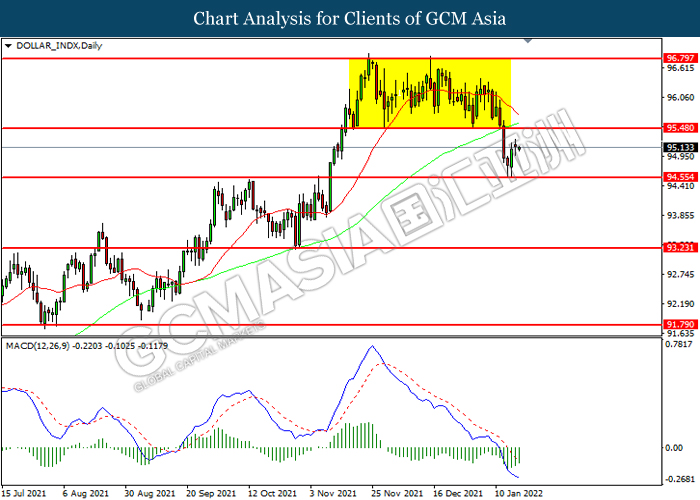

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 94.55. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level at 95.50.

Resistance level: 95.50, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3715. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3595.

Resistance level: 1.3715, 1.3840

Support level: 1.3595, 1.3450

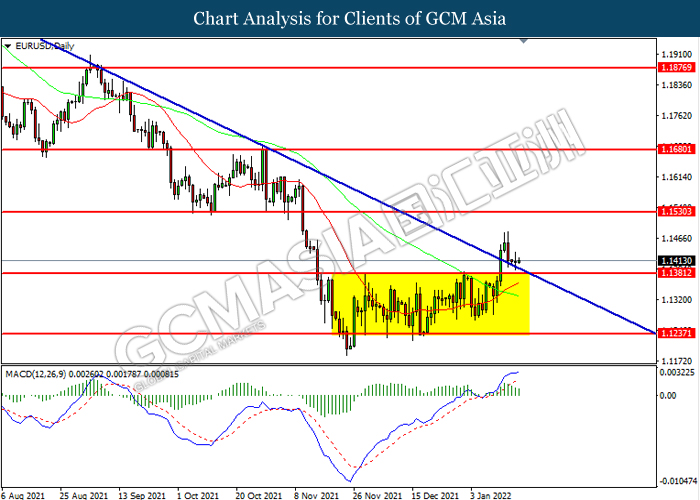

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1380. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1530, 1.1680

Support level: 1.1380, 1.1235

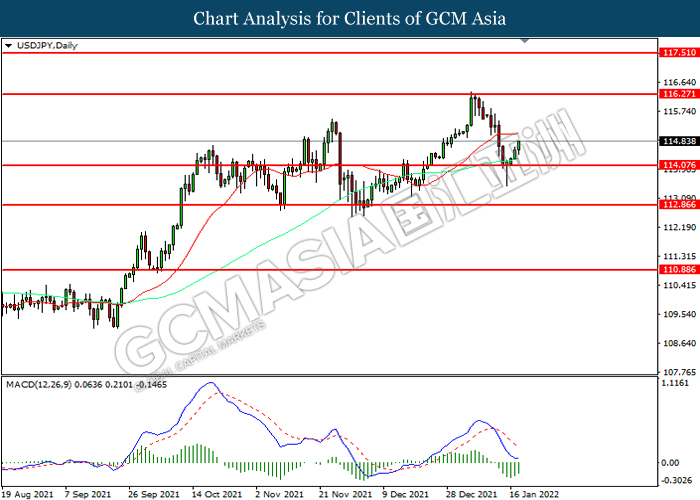

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 114.10. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 116.25.

Resistance level: 116.25, 117.50

Support level: 114.10, 112.85

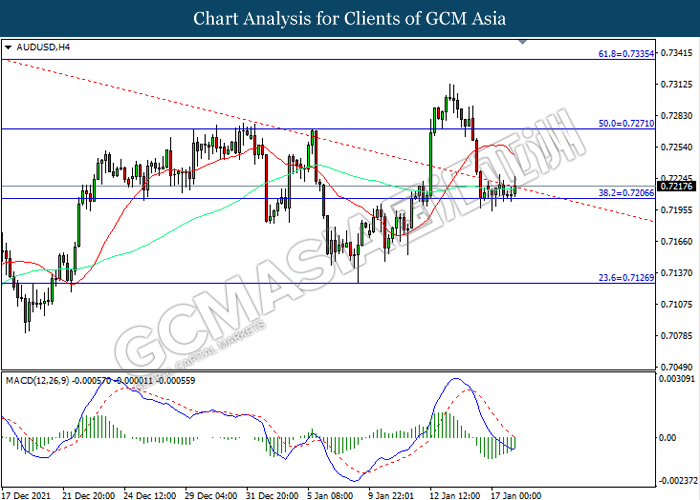

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7205. However, MACD which illustrated diminishing suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

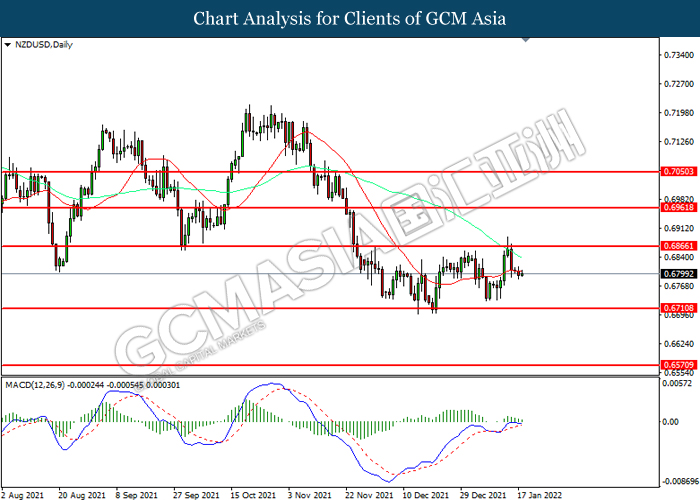

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6710.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

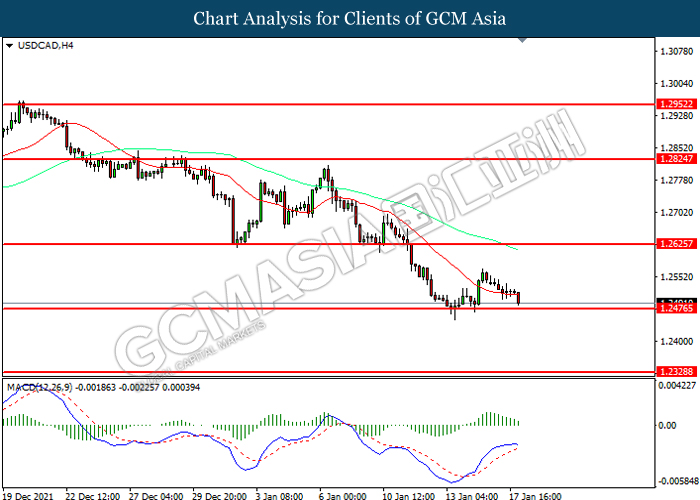

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2475. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

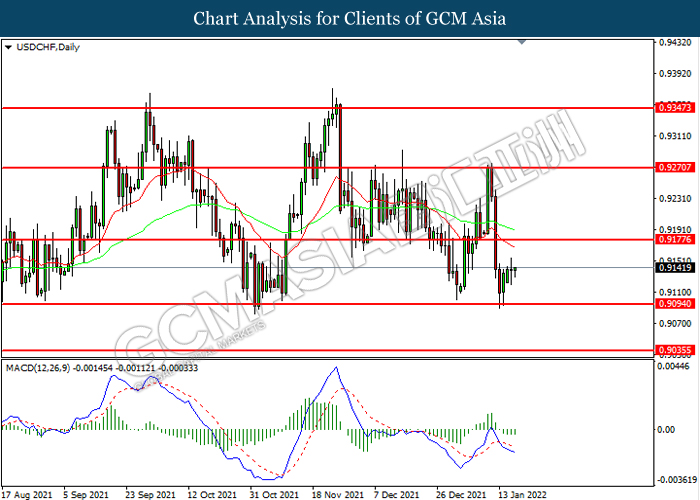

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9095. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 84.40. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 84,80, 86.15

Support level: 81.70, 78.10

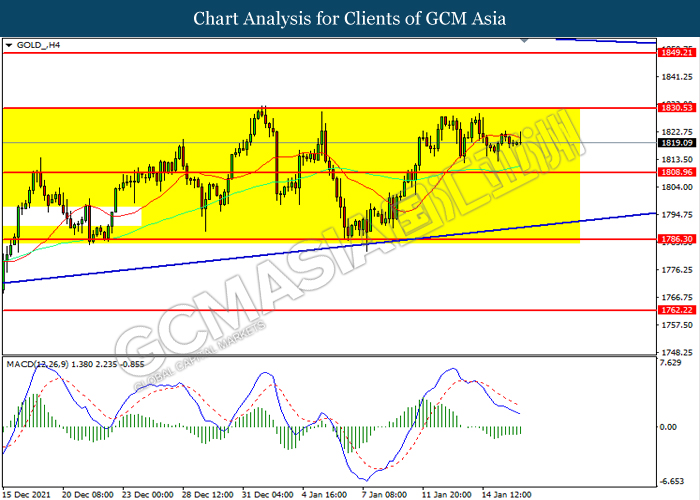

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1830.55. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1830.55, 1849.20

Support level: 1808.95, 1786.30