18 January 2022 Morning Session Analysis

Is Brexit beneficial to UK?

Pound sterling droops further as investors reassess the possible outcome from recent Brexit talks in between UK and EU. While UK and EU kickstarted their new rounds of talk this week with Foreign Minister Liz Truss heading the team, investors digest a recent report that laid out woes among UK business owners. According to a survey conducted by One World Express, 73% of entrepreneurs says that their business has seen zero benefits from UK’s departure from EU. A quarter of UK business owners was significantly impacted by Brexit last year where one in three business experienced difficulties to secure working visas for EU based employees in 2021. In addition, 43% of UK business faced supply chain issues as EU tightens up their custom checks which may require extensive paperwork and longer hours of processing. If recent talks in between UK and EU failed to garner any positive outcome, UK businesses may face greater hurdles ahead that may eventually jeopardize UK’s economic momentum. During Asian trading session, pair of GBP/USD was down by 0.01% to 1.3643.

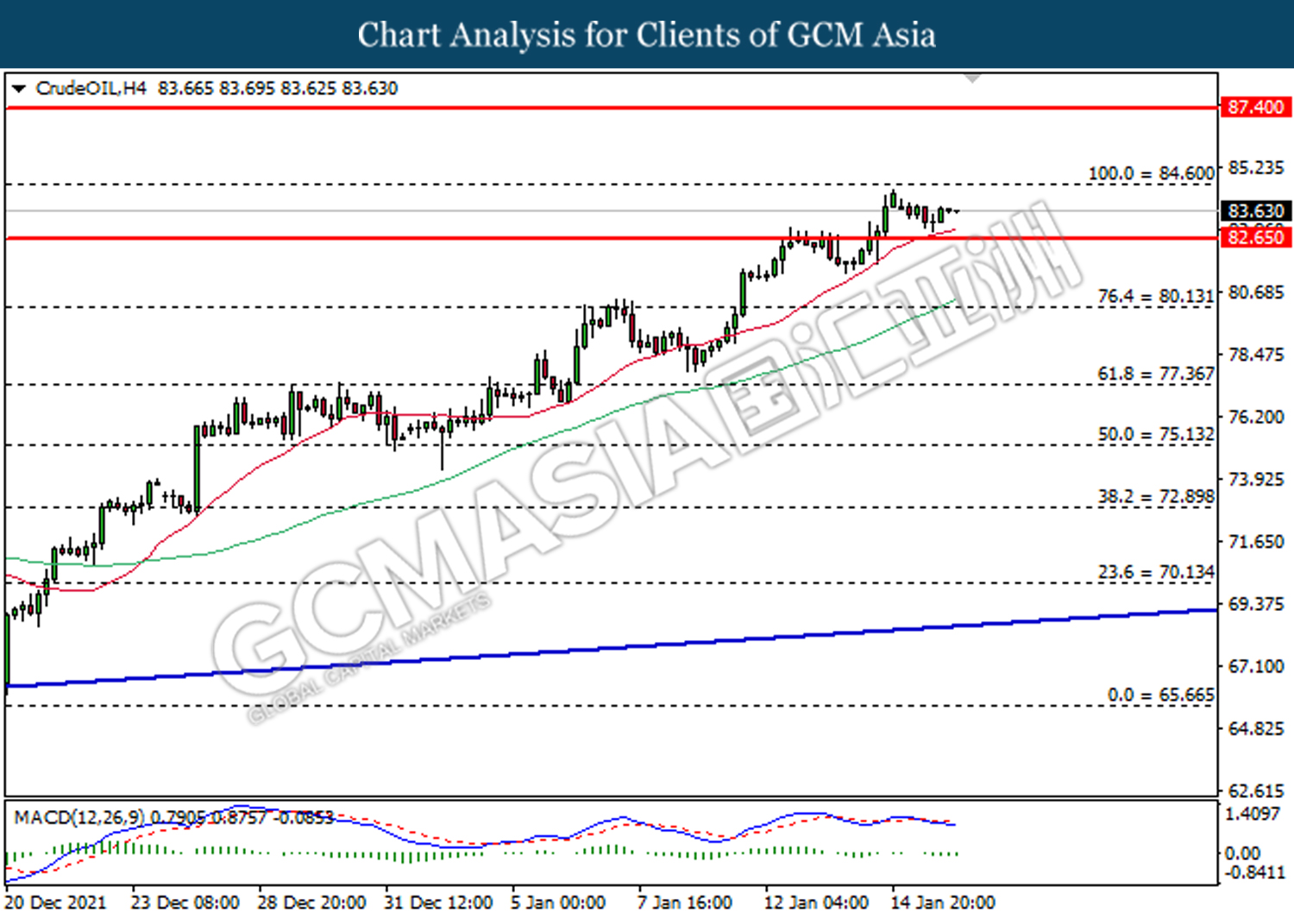

As for commodities, crude oil price was up 0.06% to $83.66 per barrel as OPEC-nations struggles to increase their oil production due to infrastructure and capacity limitations. Otherwise, gold price was down 0.01% to $1,818.45 a troy ounce as investors expects more than 90% chance for an interest rate hike from Federal Reserve during March’s policy meeting.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative JPY BoJ Monetary Policy Statement

Tentative JPY BoJ Outlook Report

Tentative JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Nov) | 4.90% | 4.20% | – |

| 15:00 | GBP – Claimant Count Change (Dec) | -49.8K | -38.6K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Jan) | 29.9 | 32.7 | – |

Technical Analysis

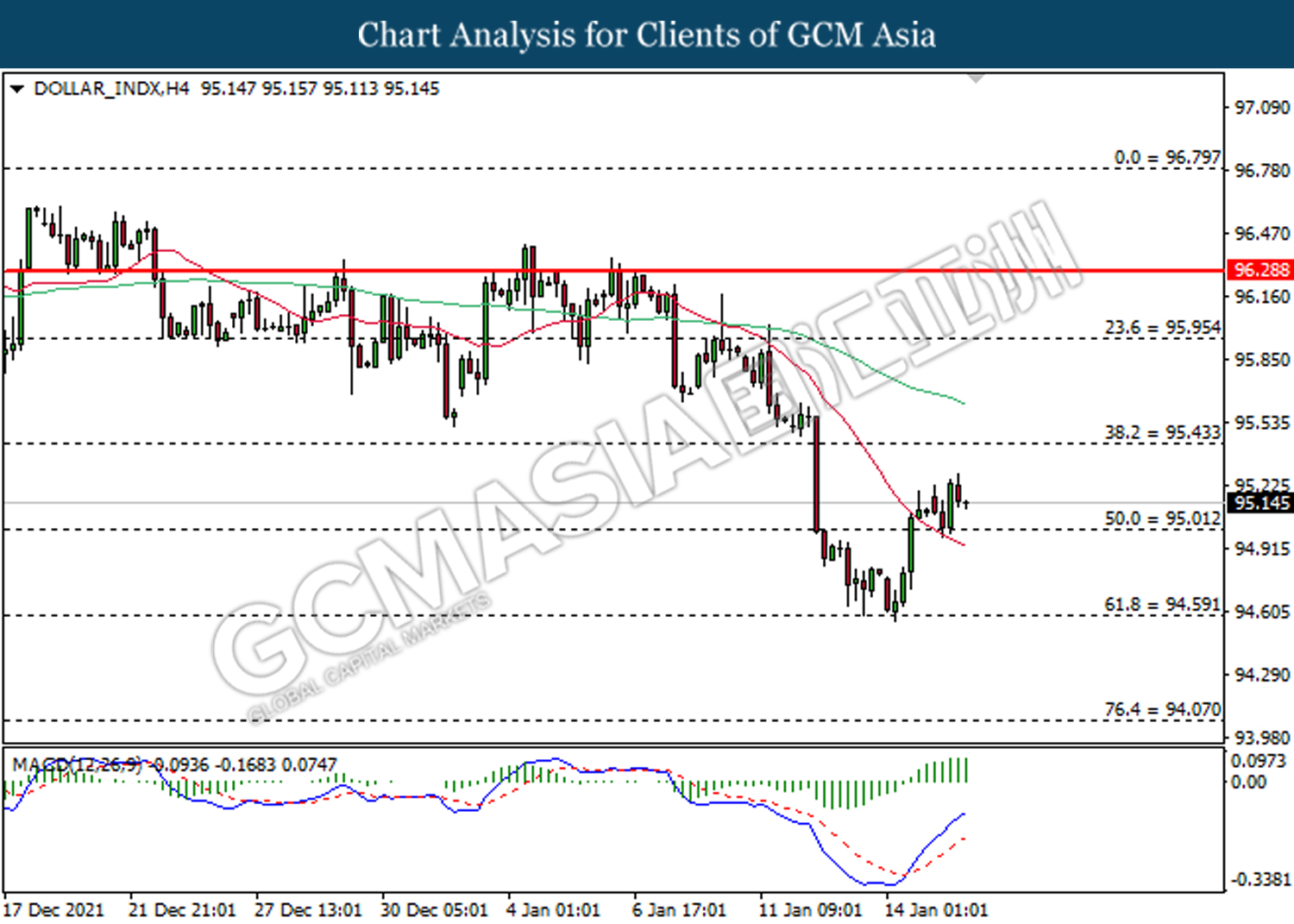

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 95.45, 95.95

Support level: 95.00, 94.60

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the upward trendline.

Resistance level: 1.3690, 1.3745

Support level: 1.3630, 1.3570

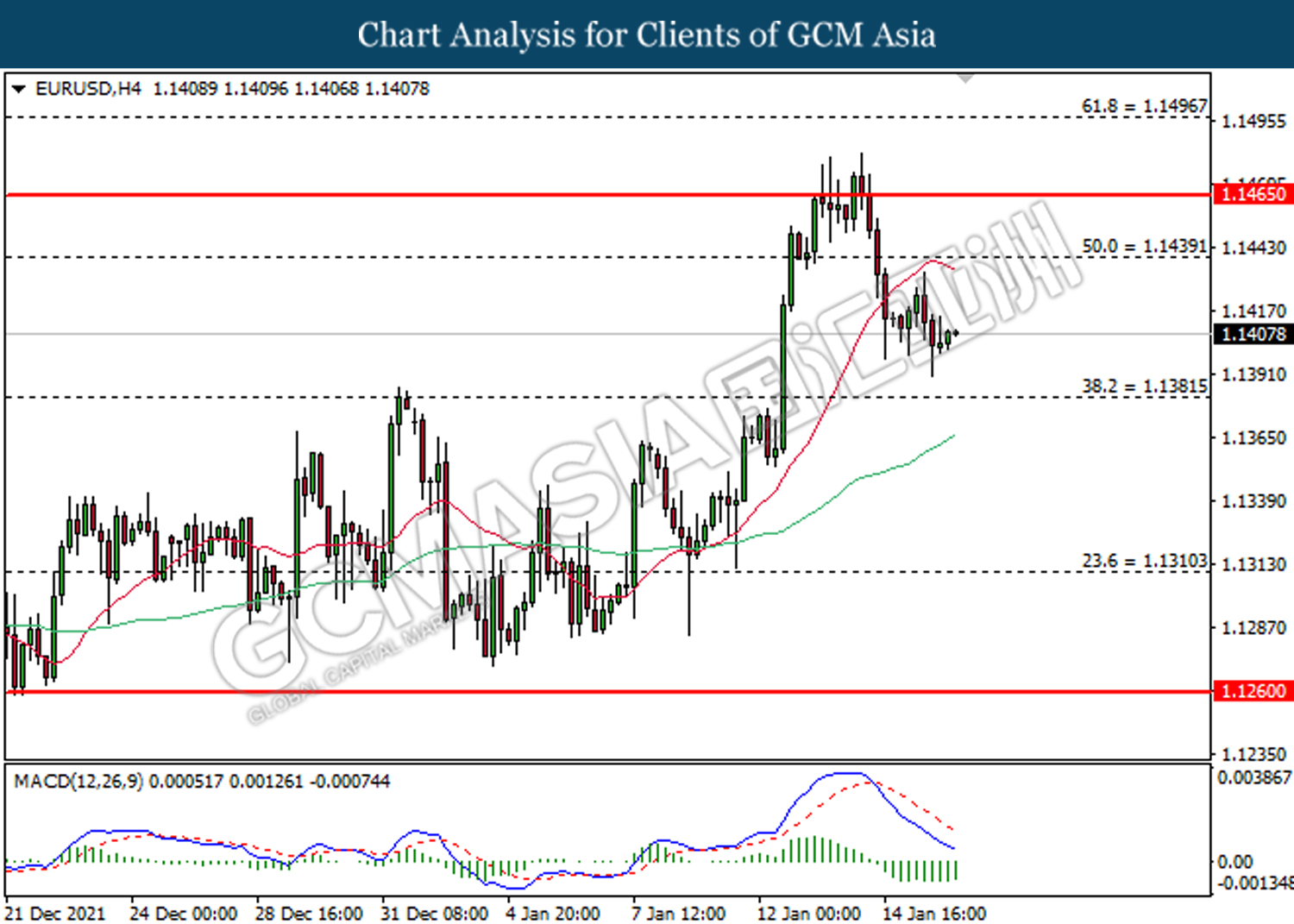

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1440, 1.1465

Support level: 1.1380, 1.1310

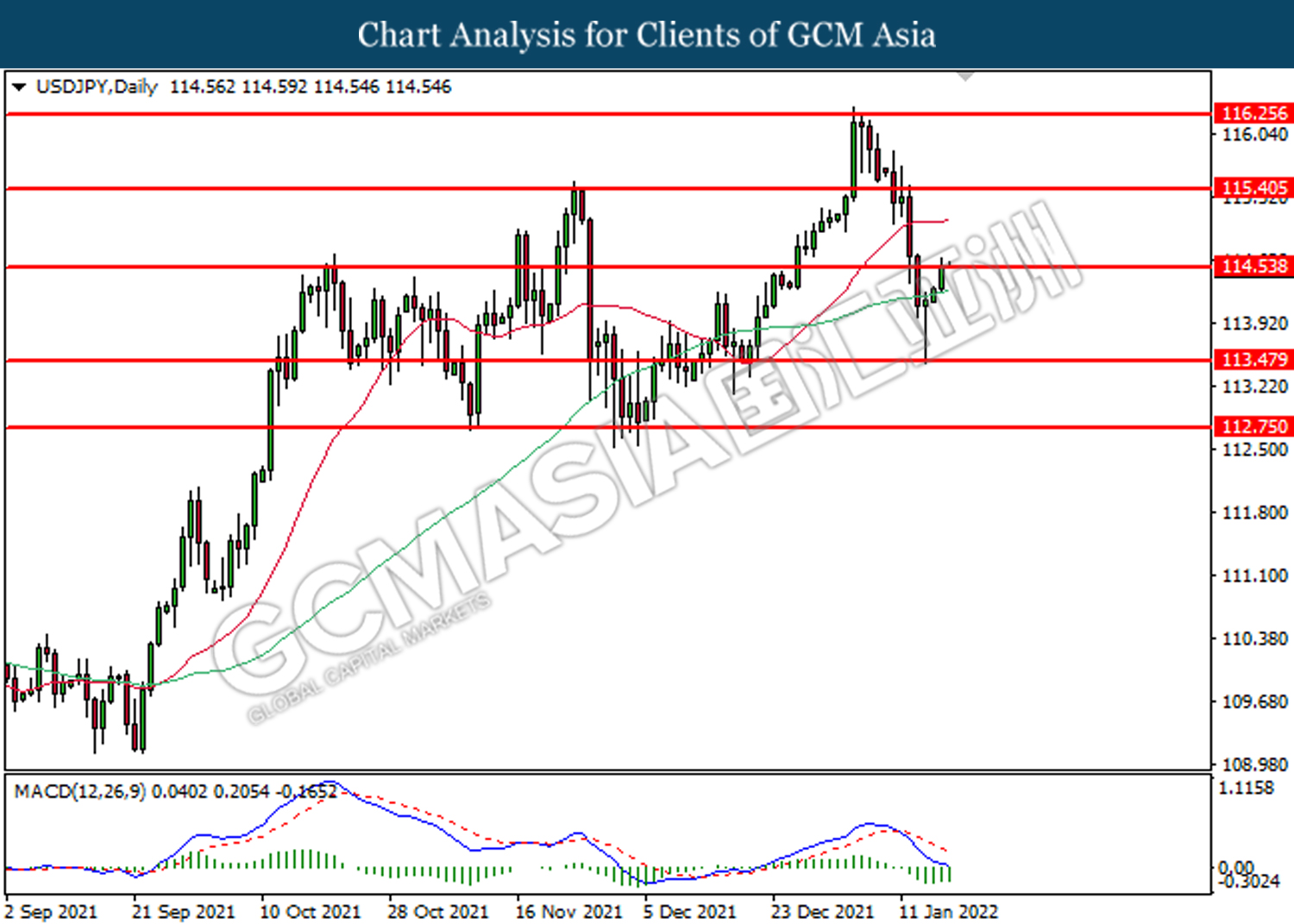

USDJPY, Daily: USDJPY was traded higher following rebound from 113.50. MACD which illustrate diminished bearish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 114.55, 115.40

Support level: 113.50, 112.75

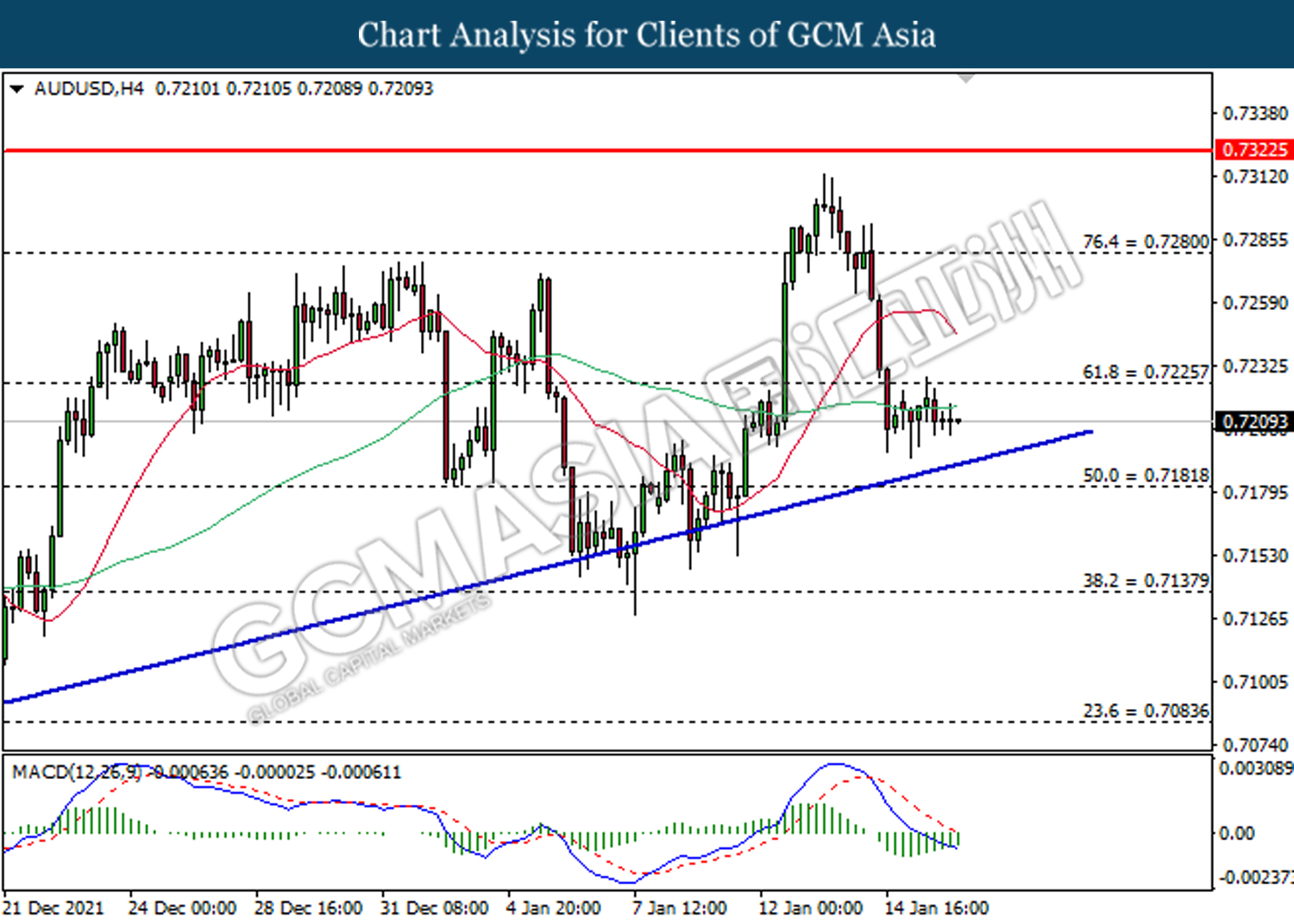

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower short-term.

Resistance level: 0.7225, 0.7280

Support level: 0.7180, 0.7140

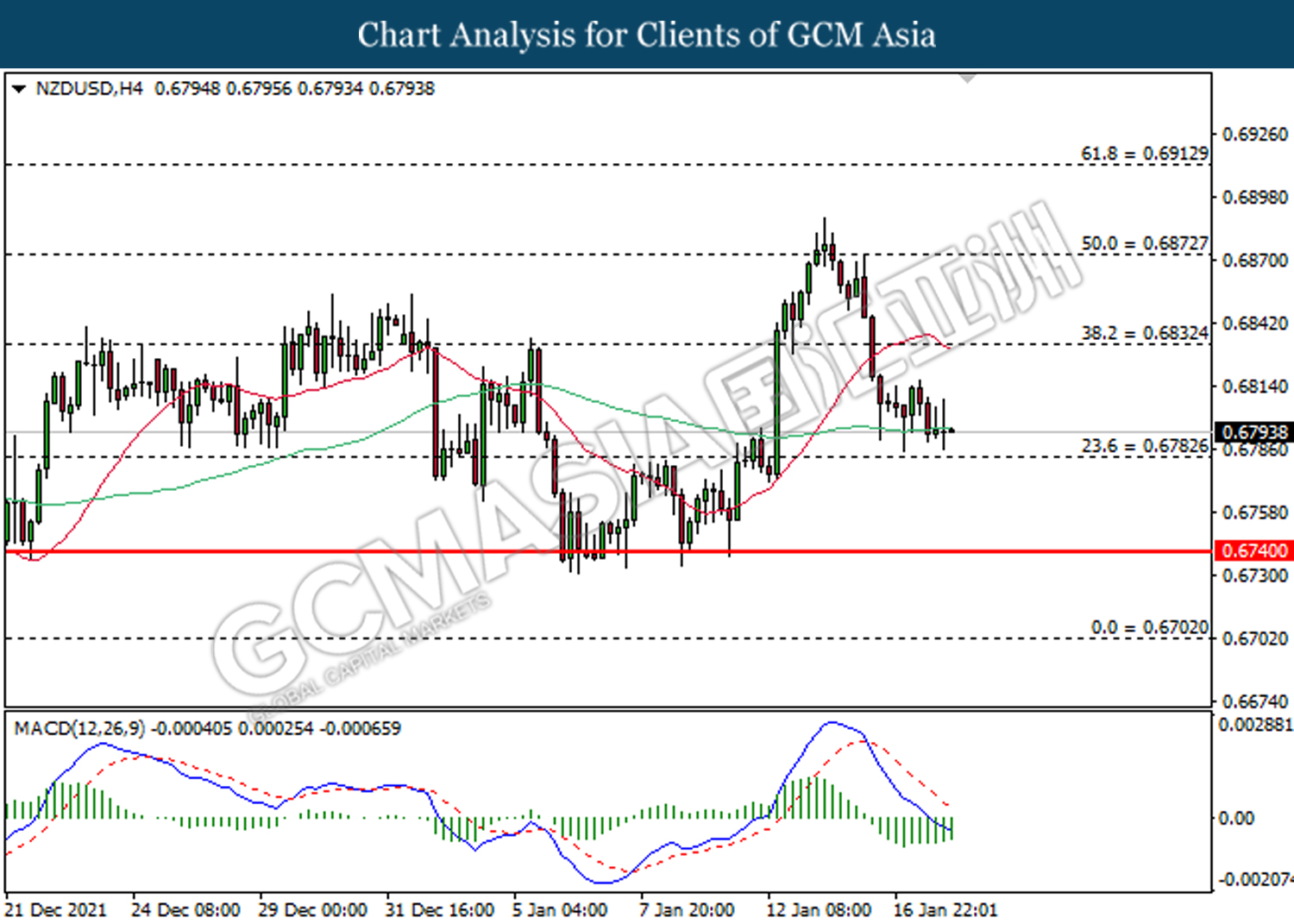

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.6830, 0.6870

Support level: 0.6780, 0.6740

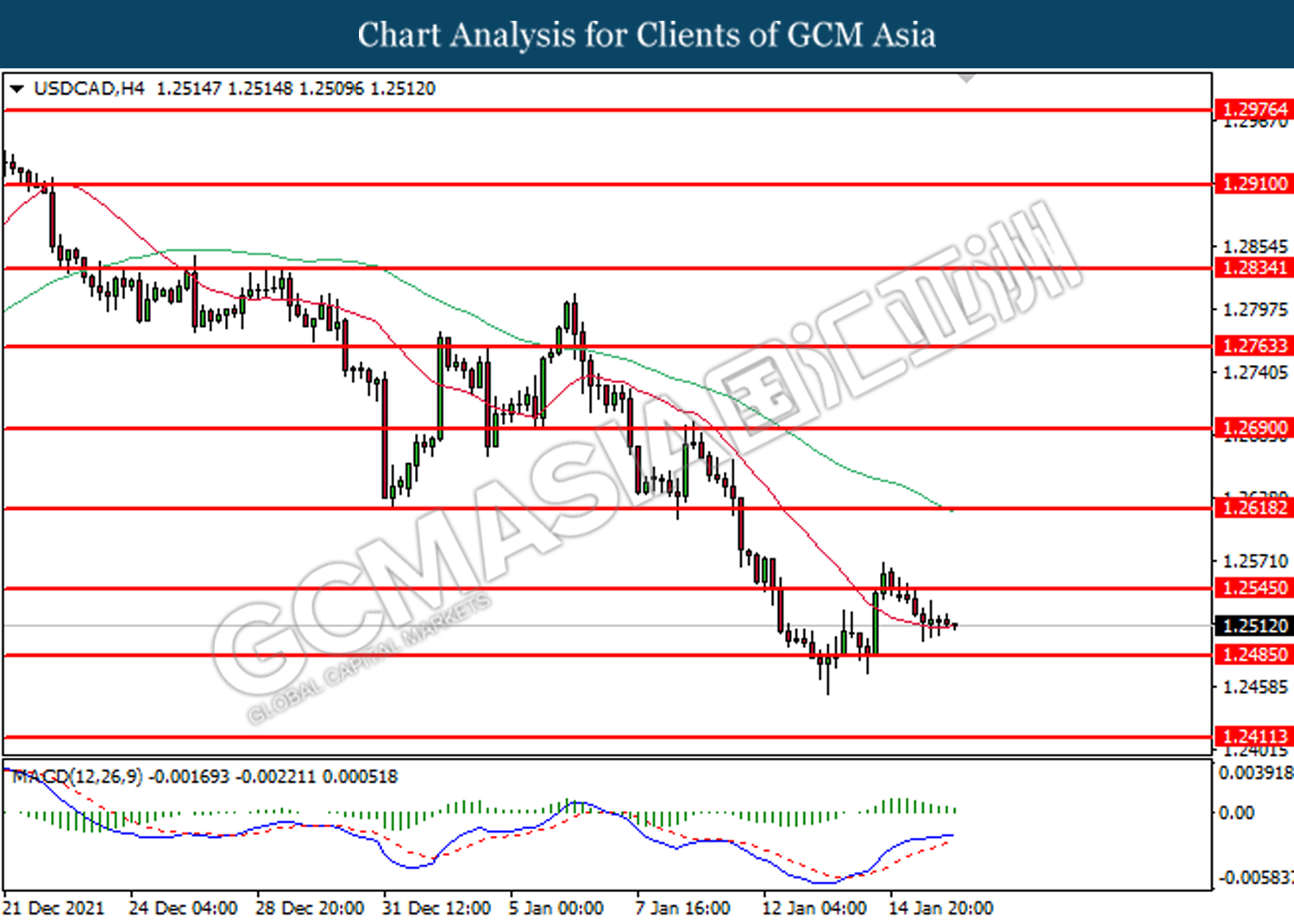

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after closing below 1.2485.

Resistance level: 1.2545, 1.2620

Support level: 1.2485, 1.2410

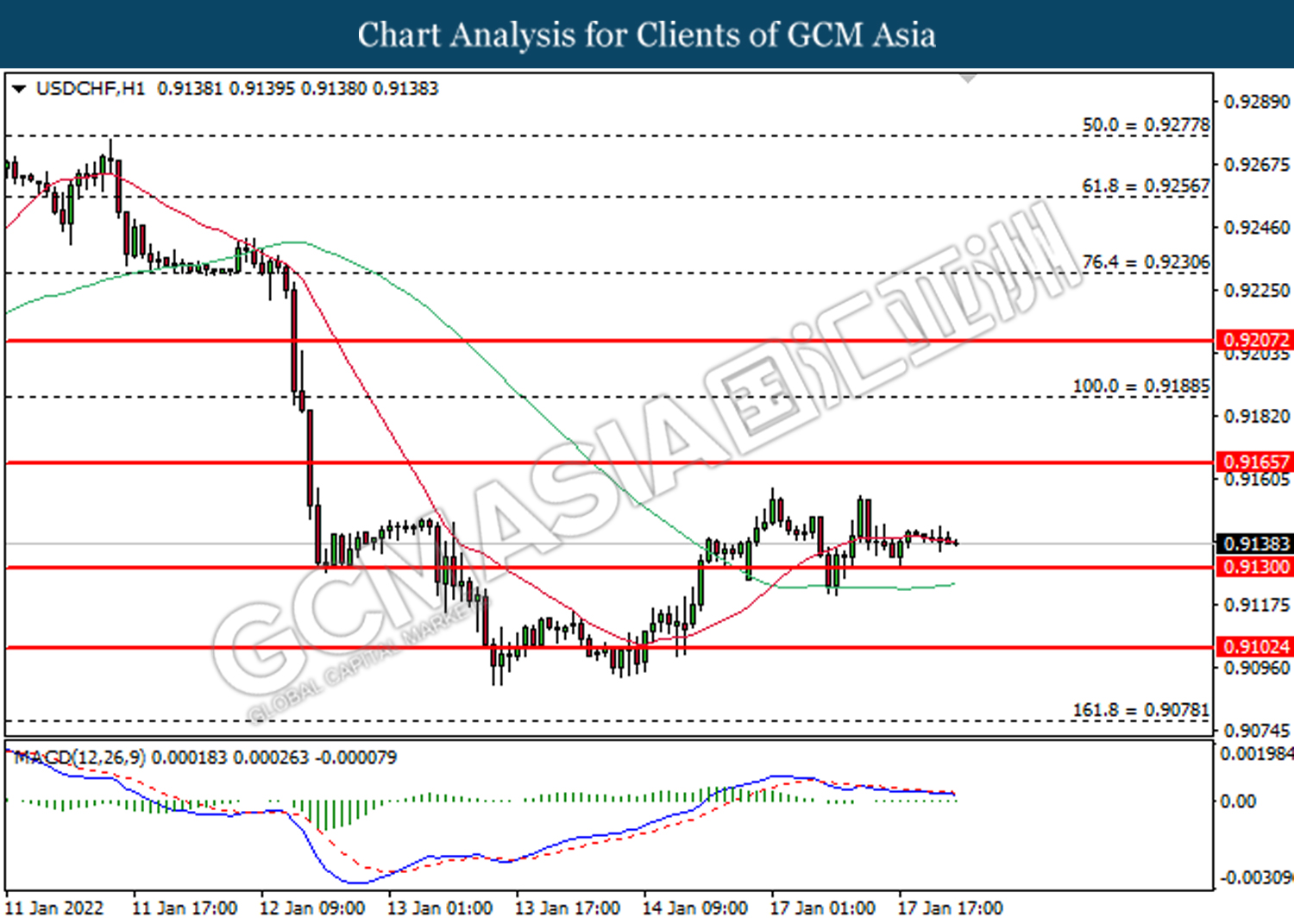

USDCHF, H1: USDCHF was traded flat within the range of 0.9130 and 0.9165. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.9165, 0.9190

Support level: 0.9130, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 84.60, 87.40

Support level: 82.65, 80.15

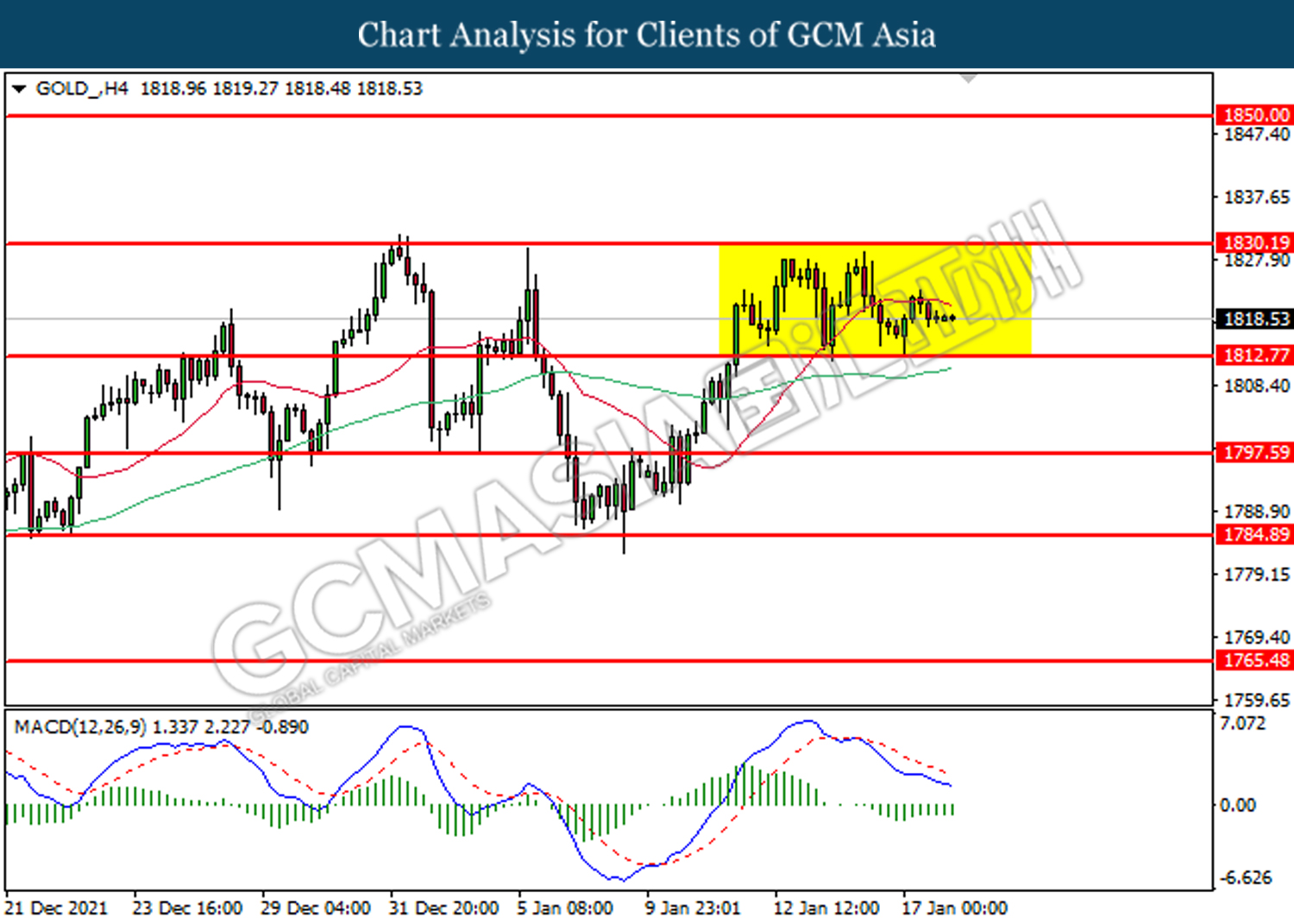

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60