18 January 2023 Morning Session Analysis

Greenback holds tight ahead of a series of data.

The dollar index, which traded against a basket of six major currencies, hovered near its 7 months low as the market participants are waiting for further economic data to be released, such as the Producer Price Index (PPI) and Retail Sales data. Yesterday, the dollar index was traded lower in choppy trading as the recent inflation figure improved gradually, getting far away from the peak of 9.1% while heading toward the Fed long term target’s 2.0%. Today, market attention has been put on the PPI data as it could provide further insight regarding the nation’s inflationary condition. Besides, the market participants are also eyeing on the announcement of BoJ Monetary Policy Statement. The expectation of a possible policy shift has been building up, whereby there is a high possibility could change or end its yield curve control policy. However, the likelihood of lifting the cash rate from -0.1% to the positive territory is unforeseen in this point of time, but a precursor of adopting tightening monetary policy is likely to be seen in the meeting. With that, the BoJ decision is likely to weigh on the FX market during the Asian trading session today, where the volatility will be amplified. As of writing, the pair of USD/JPY rose 0.07% to 128.25.

In the commodities market, crude oil prices edged up by 0.07% to $81.15 per barrel after the OPEC Secretary General Haitham Al-Ghais presented its optimistic view toward the recovery of the global economy, hinting the prospect of oil demand remains bright. Besides, gold prices edged down by -0.01% to $1908.35 per troy ounce following the rebound in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

11:00 JPY BoJ Outlook Report (YoY)

Tentative JPY BoJ Press Conference

03:00 USD Beige Book

(19th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Dec) | 10.7% | 10.6% | – |

| 18:00 | EUR – CPI (YoY) (Dec) | 9.2% | 9.2% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Dec) | -0.2% | -0.4% | – |

| 21:30 | USD – PPI (MoM) (Dec) | 0.3% | -0.1% | – |

| 21:30 | USD – Retail Sales (MoM) (Dec) | -0.6% | -0.8% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

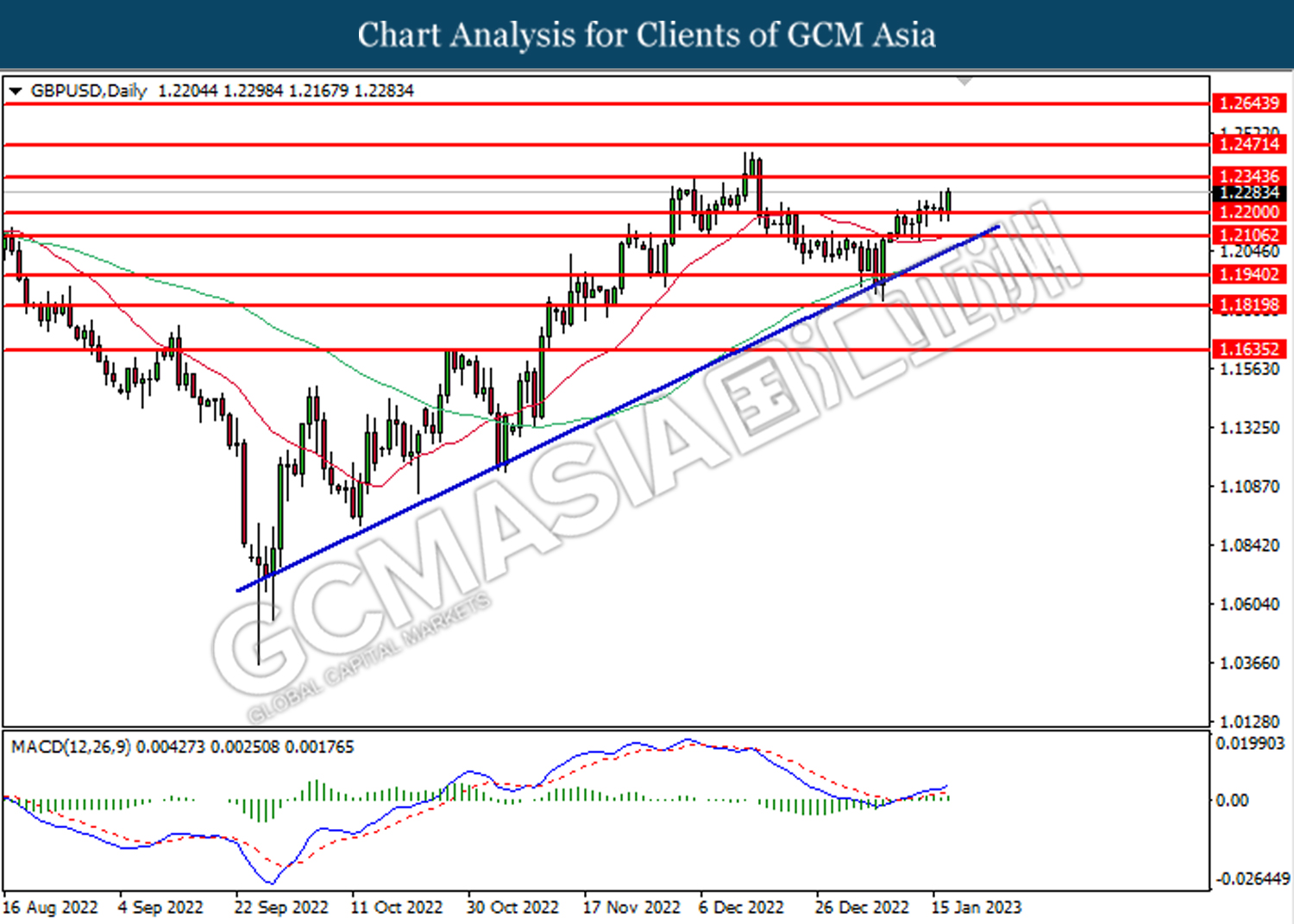

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

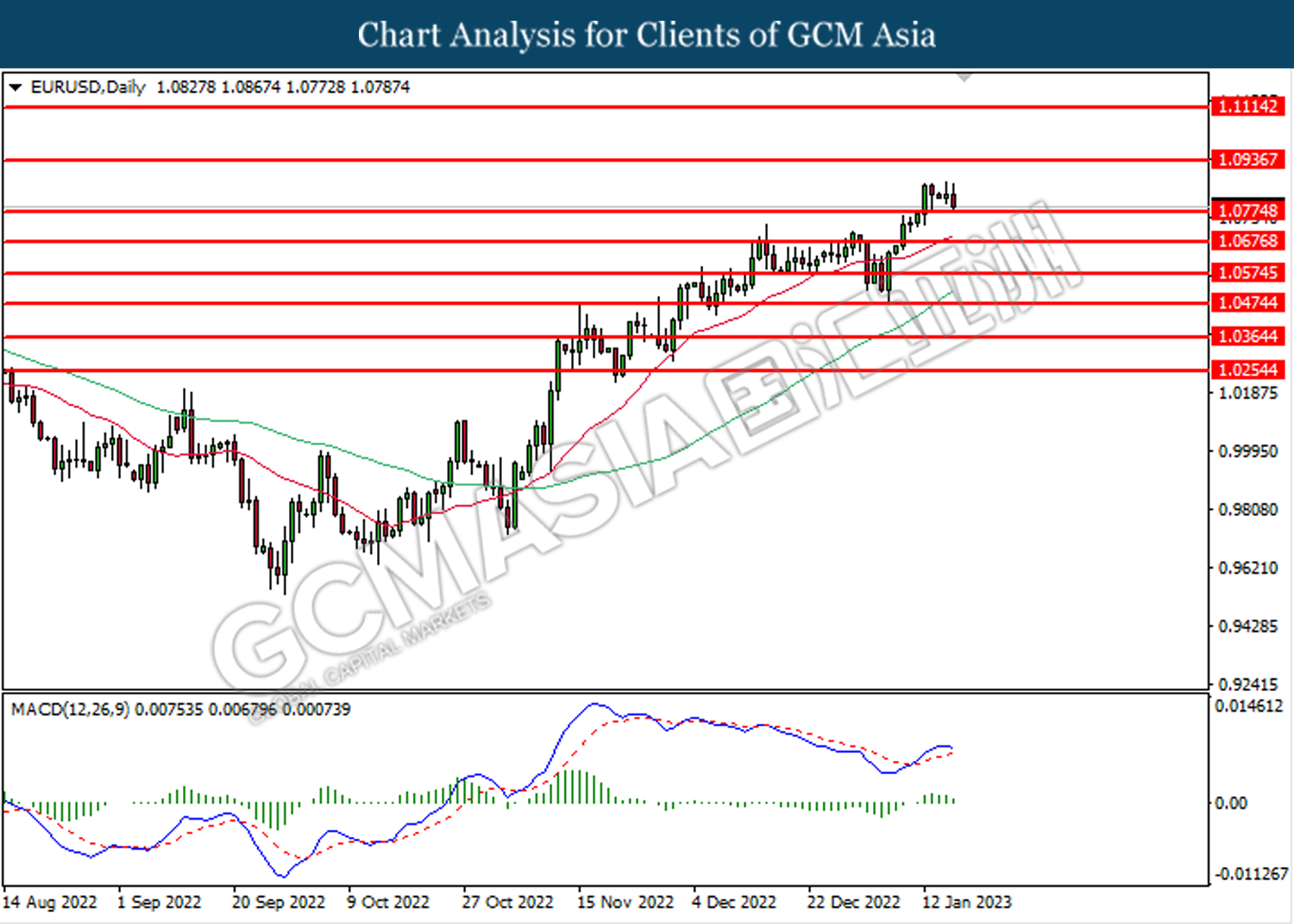

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0775. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0935, 1.1115

Support level: 1.0775, 1.0675

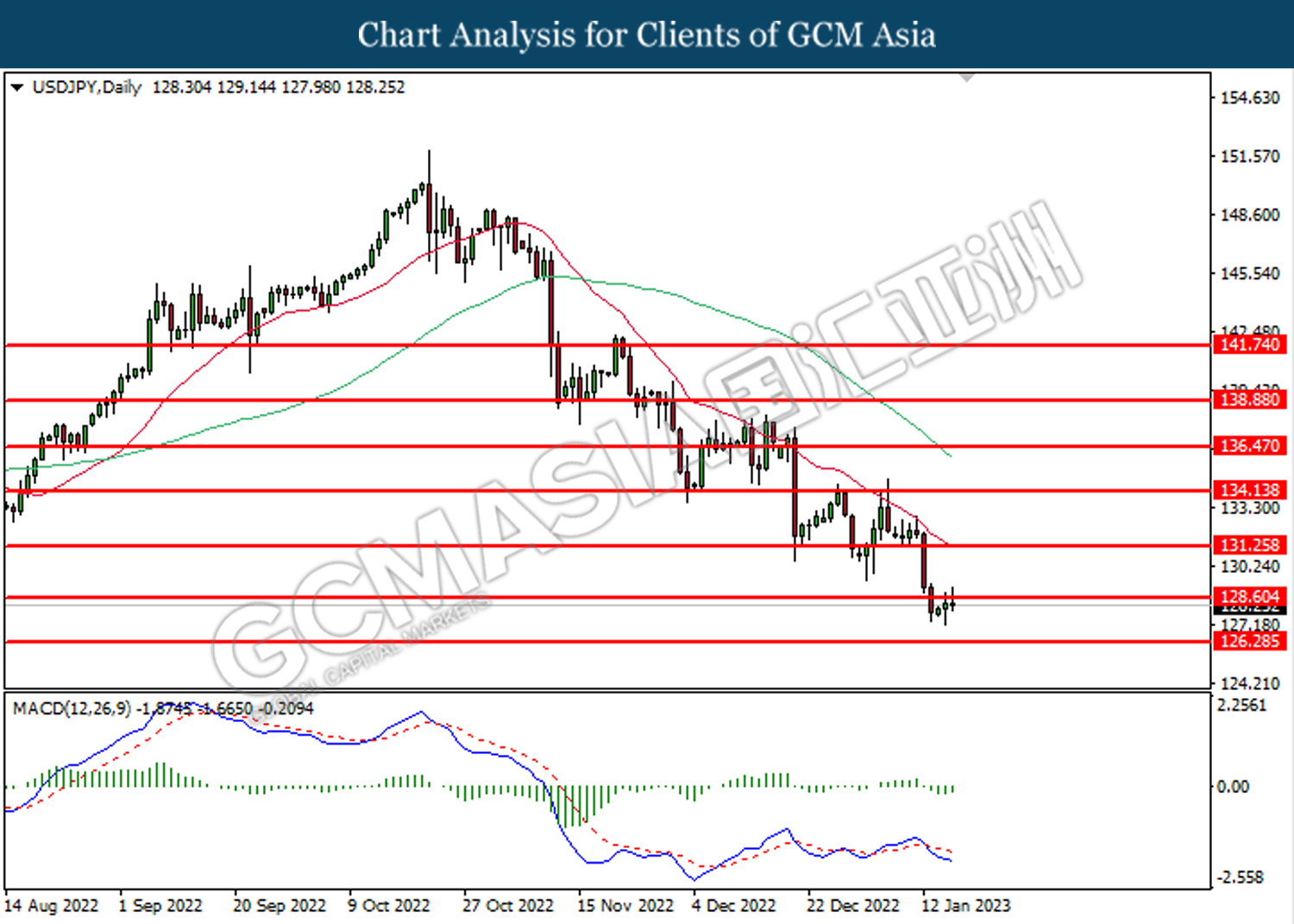

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 128.60. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 128.60.

Resistance level: 128.60, 131.25

Support level: 126.30, 123.75

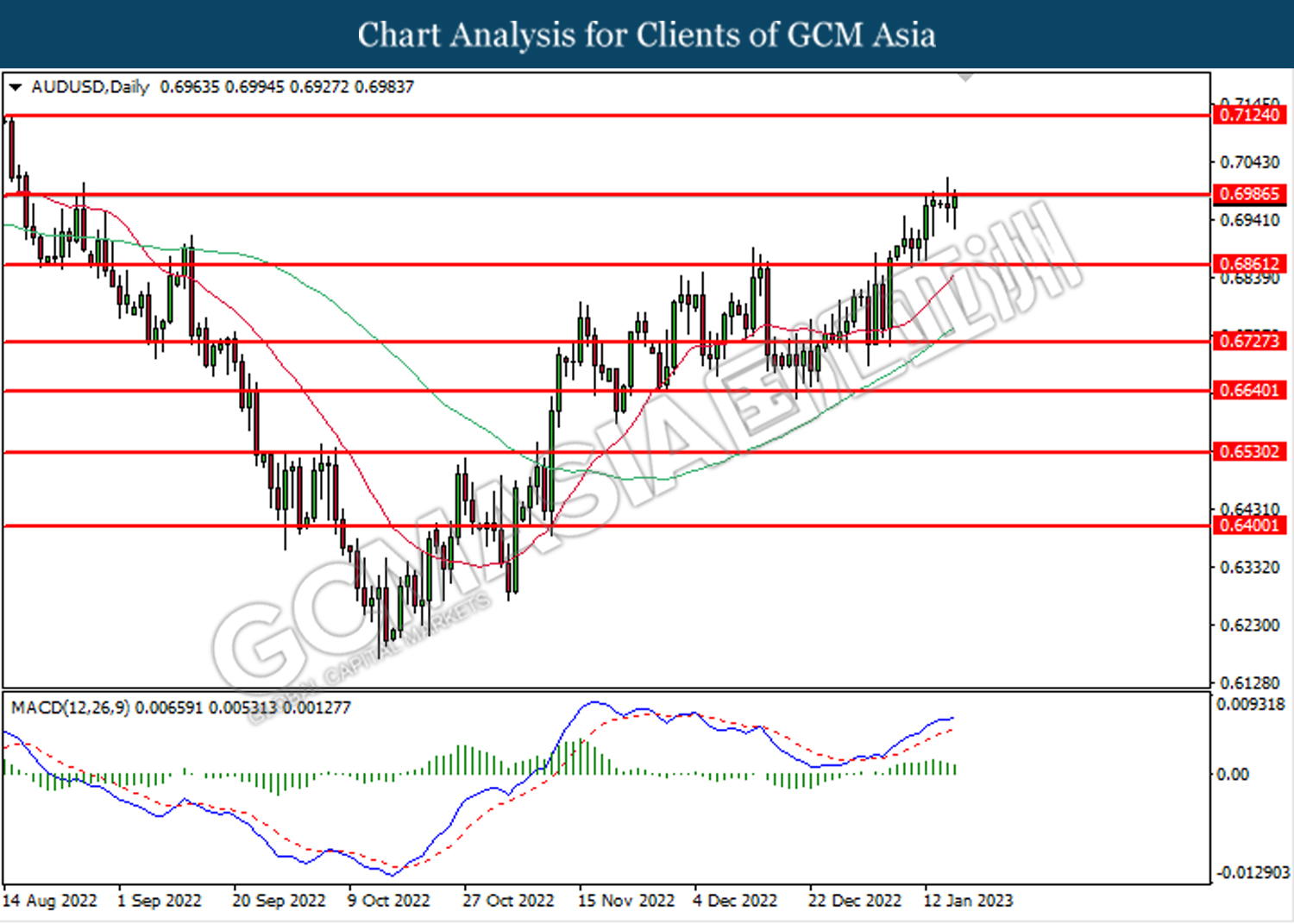

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

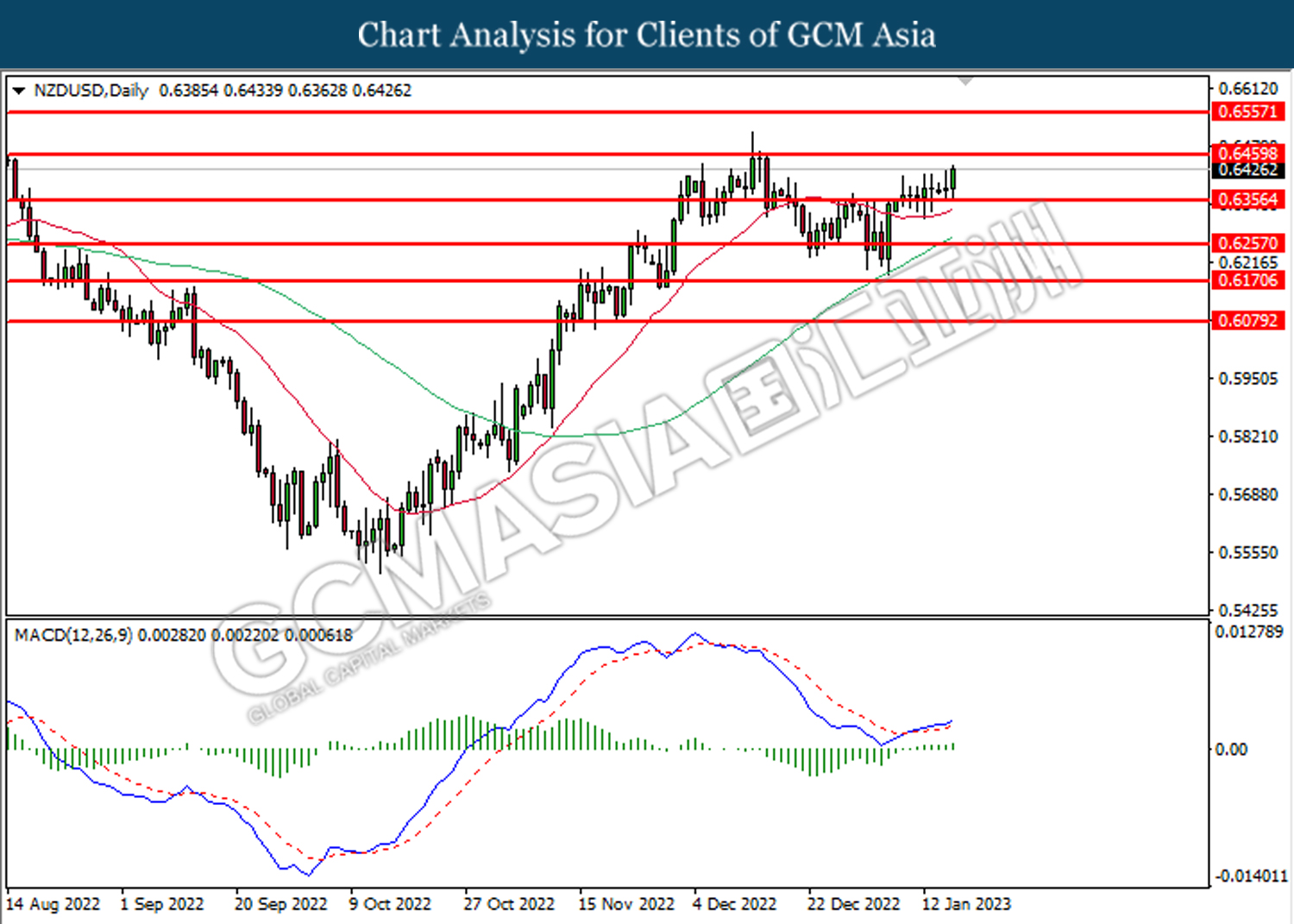

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

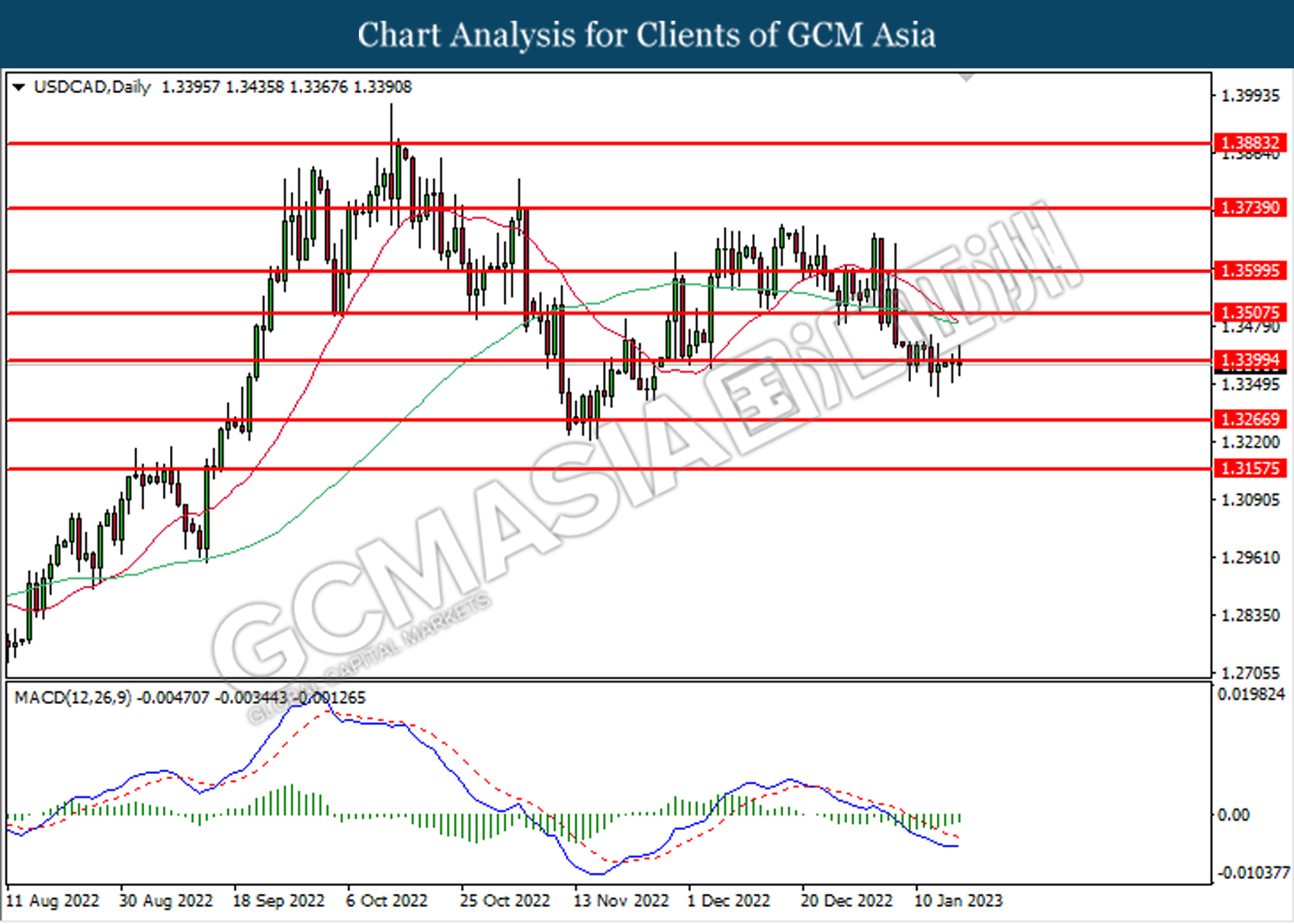

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3400. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

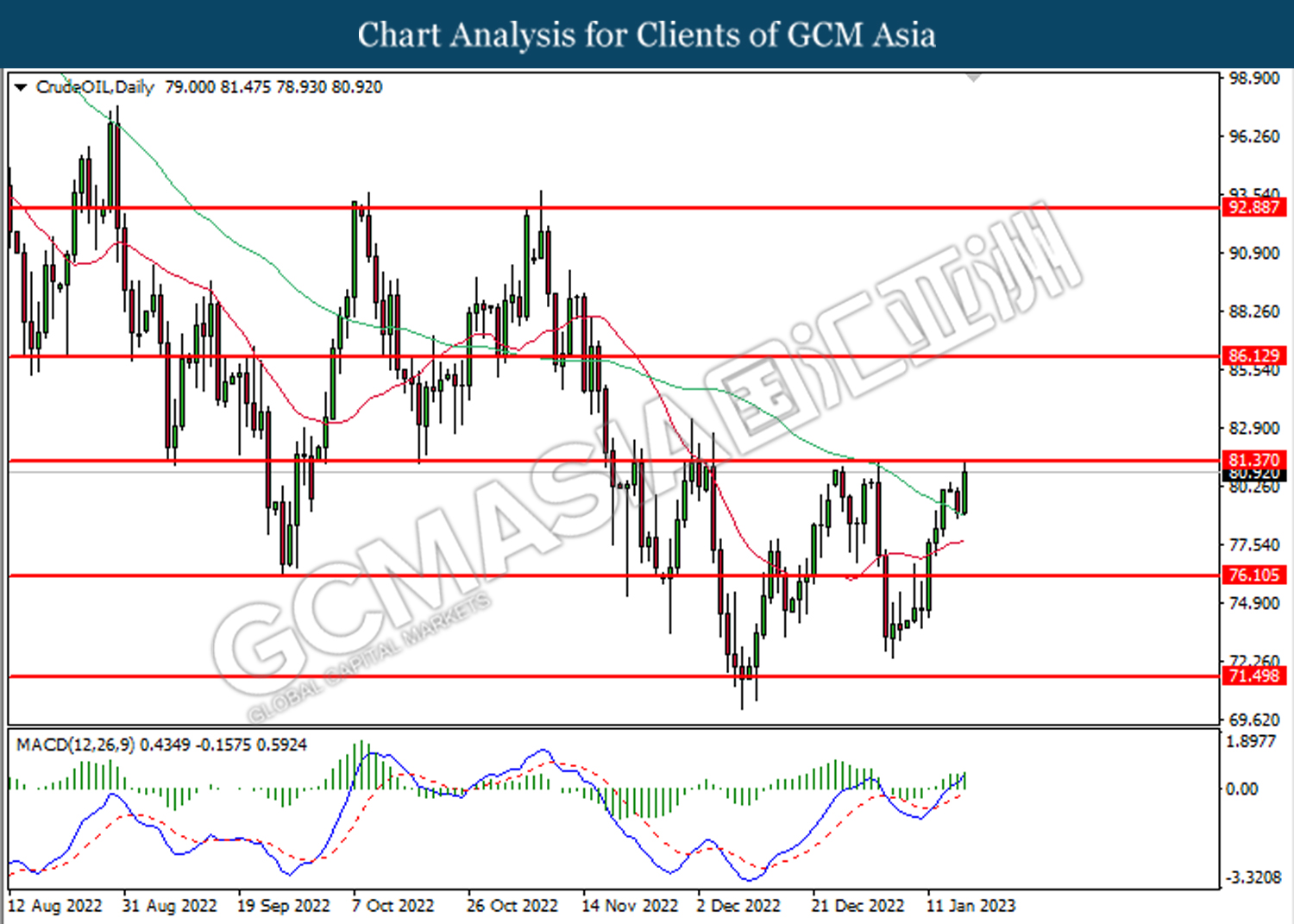

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.35. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 81.35.

Resistance level: 81.35, 86.15

Support level: 76.10, 71.50

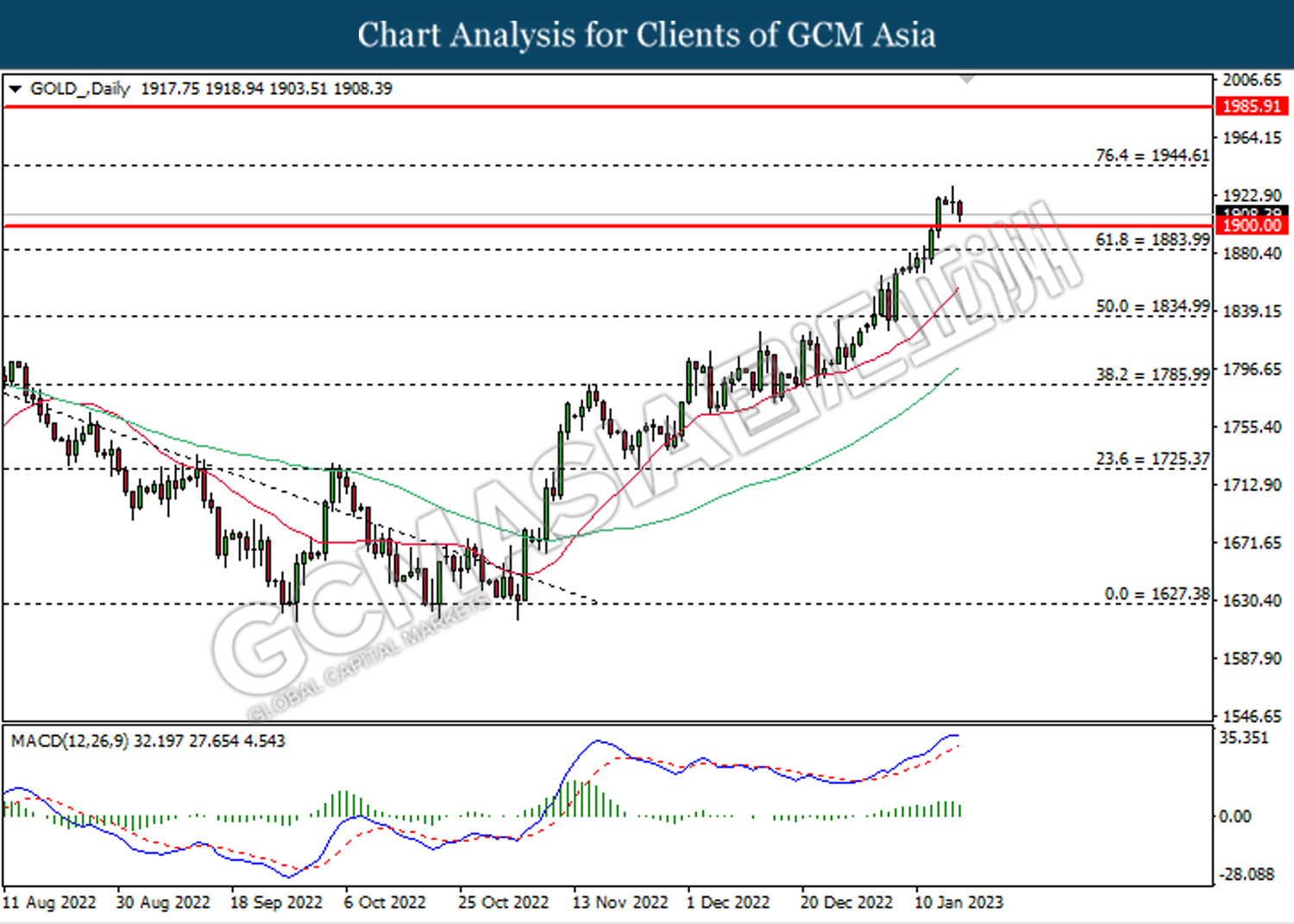

GOLD_, Daily: Gold price was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1900.00.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00