18 July 2023 Afternoon Session Analysis

Dollar declined slightly as investors await on Fed’s interest decision.

The US dollar, which was traded against six other currencies, held steadily at a similar level as the investors were awaiting the Fed’s interest decision. According to the Federal Reserve Bank of New York, the U.S. New York Empire State Manufacturing Index reduced to 1.10 from 6.60 but exceeded the forecast which was polled by Reuters at -4.40. The NY Empire State Manufacturing Index is a monthly economic indicator that surveys 200 manufacturers from New York that measures the relative level of business conditions. A reading above zero represents that manufacturing activities are expanding, exerting upward pressures on the US dollar. Following the release of the positive data, the US dollar did not experience a huge spike due to investors waiting for the US Federal Reserve (Fed) meeting next week 26 – 27 July. The Federal Funds Rates (FFR) is expected to remain through 2023 at around the 5.25%-5.50% range, a survey shown by the CME FedWatch Tool. As of writing, the US dollar index slipped -0.02% to 99.45.

In the commodities market, crude oil prices rose by 0.23% to $74.20 per barrel due to OPEC+ agreeing to cut millions of barrels per day (bpd) in July and August, although China recently just released GDP data which is lower than the market forecast. Besides, gold prices rose 0.15% to $1958.85 per troy ounce due to the weakness of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Jun) | 0.1% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Jun) | 0.3% | 0.5% | – |

Technical Analysis

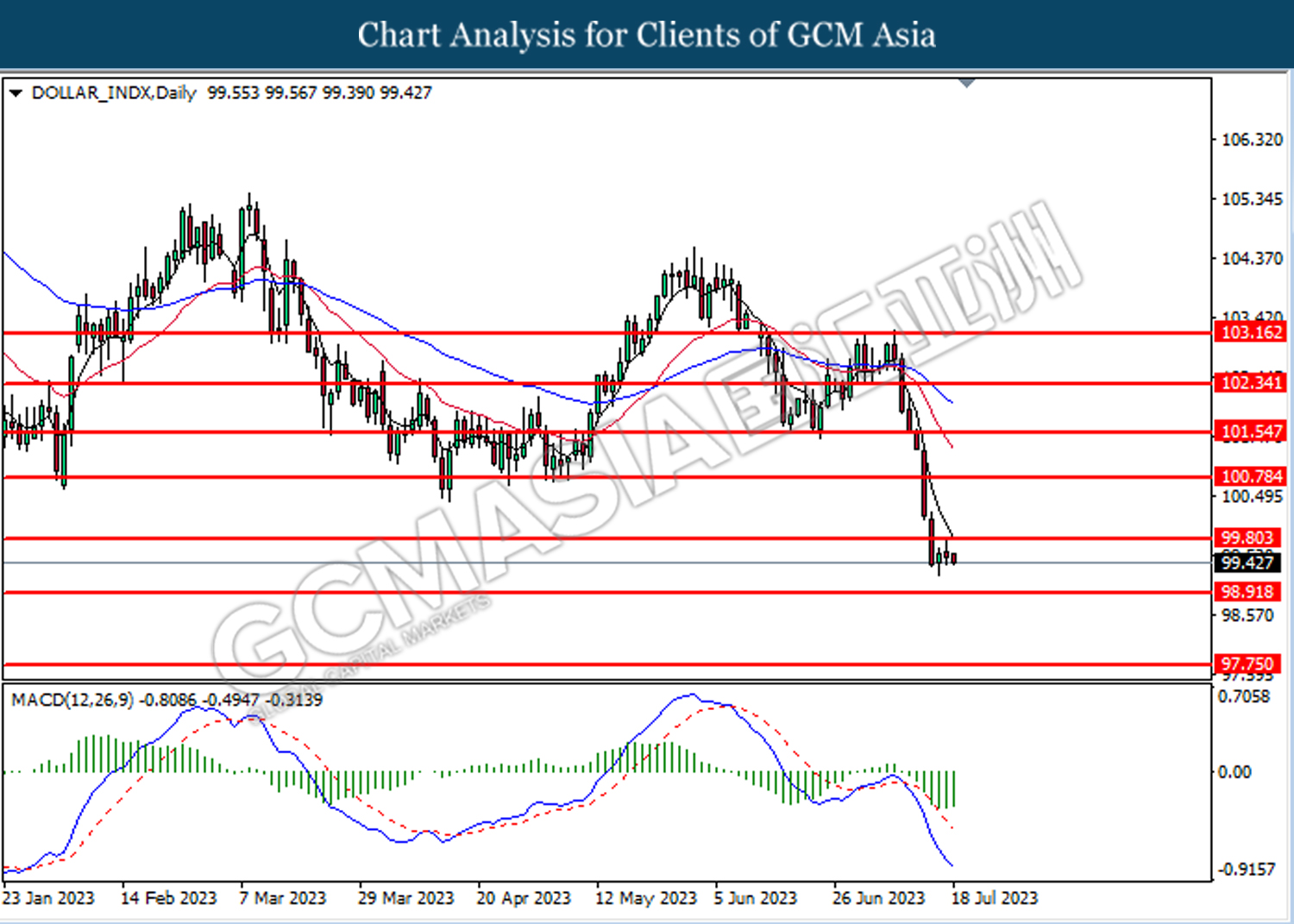

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 99.80. However, MACD which illustrated diminishing bearish momentum suggests the index undergoes technical correction in the short term.

Resistance level: 99.80, 100.80

Support level: 98.90, 97.75

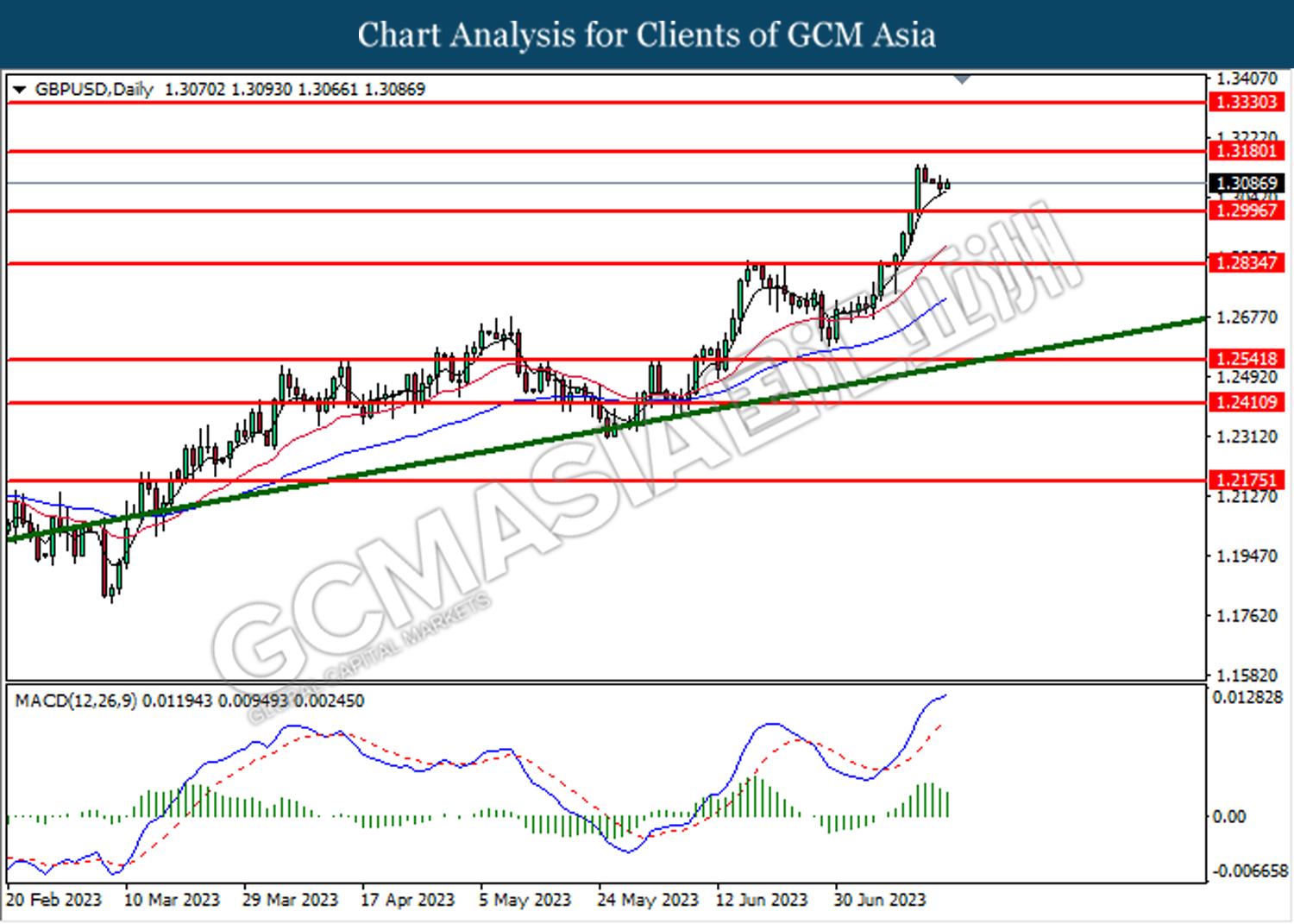

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.3000. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 1.3180, 1.3330

Support level: 1.3000, 1.2835

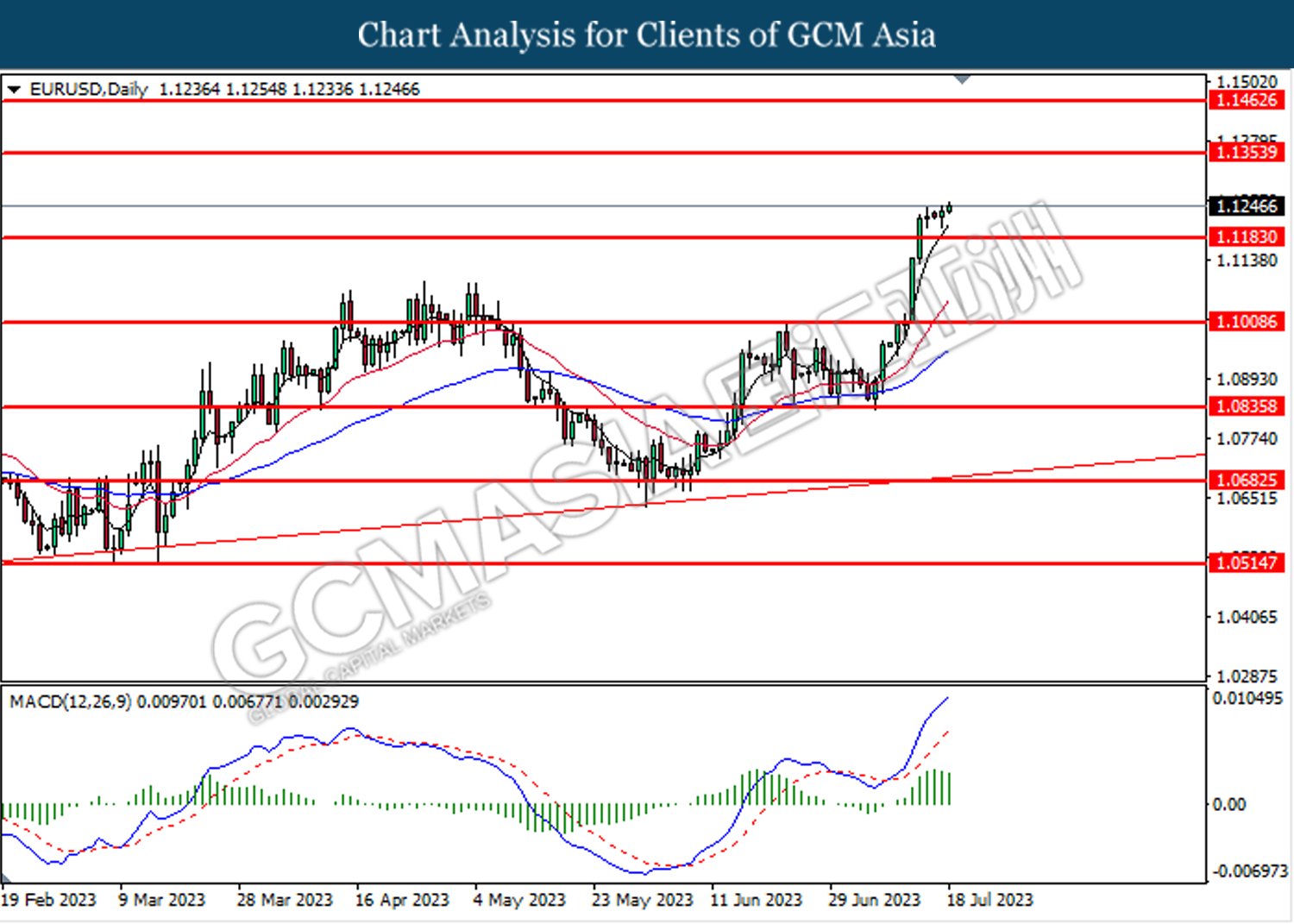

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.1185. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 1.1355, 1.1460

Support level: 1.1185, 1.1010

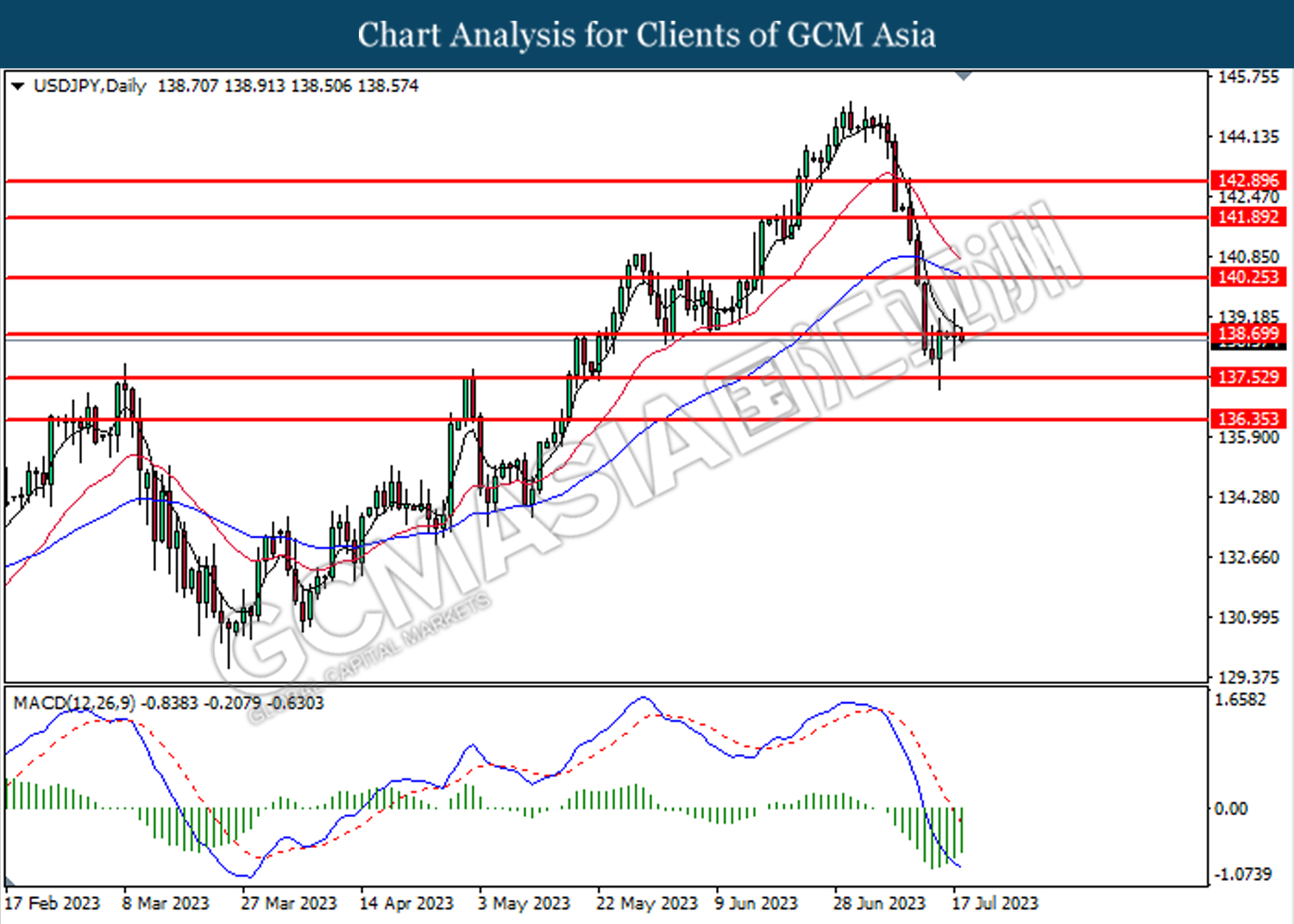

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 138.70. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it breakout to the resistance level.

Resistance level: 138.70, 140.25,

Support level: 137.50, 136.35

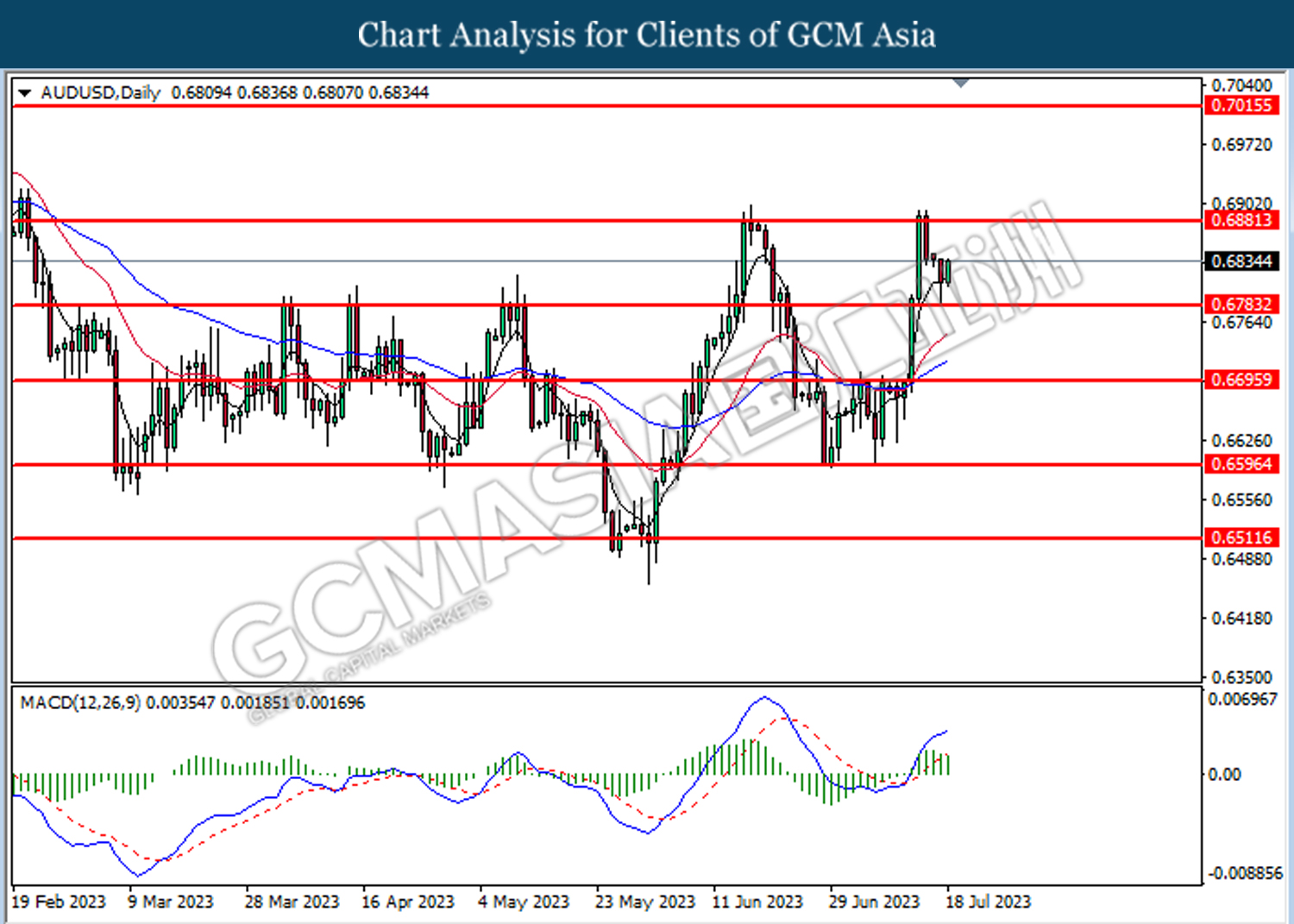

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6880, 0.7015

Support level: 0.6785, 0.6600

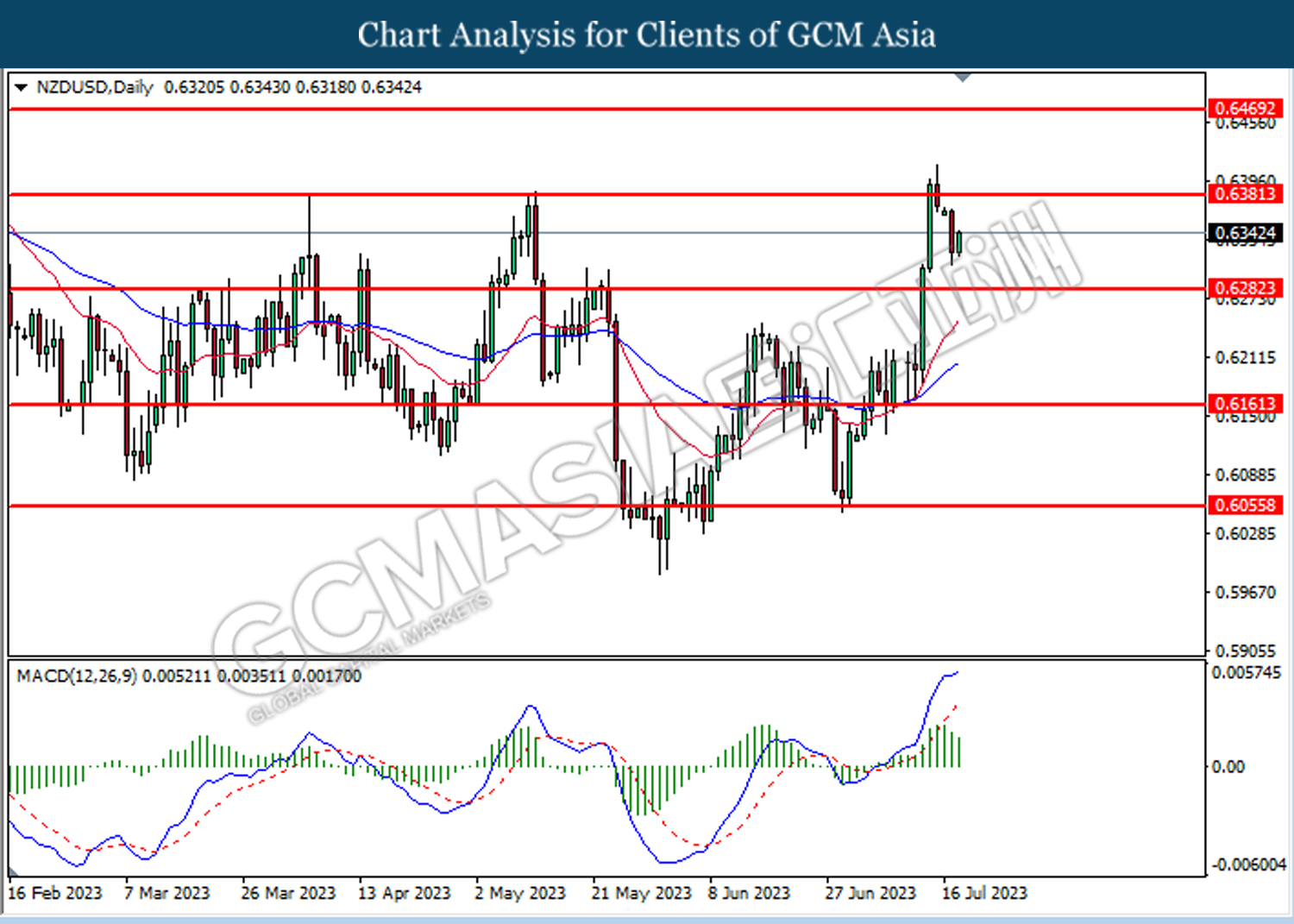

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6380. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6280.

Resistance level: 0.6380, 0.6470

Support level: 0.6280, 0.6160

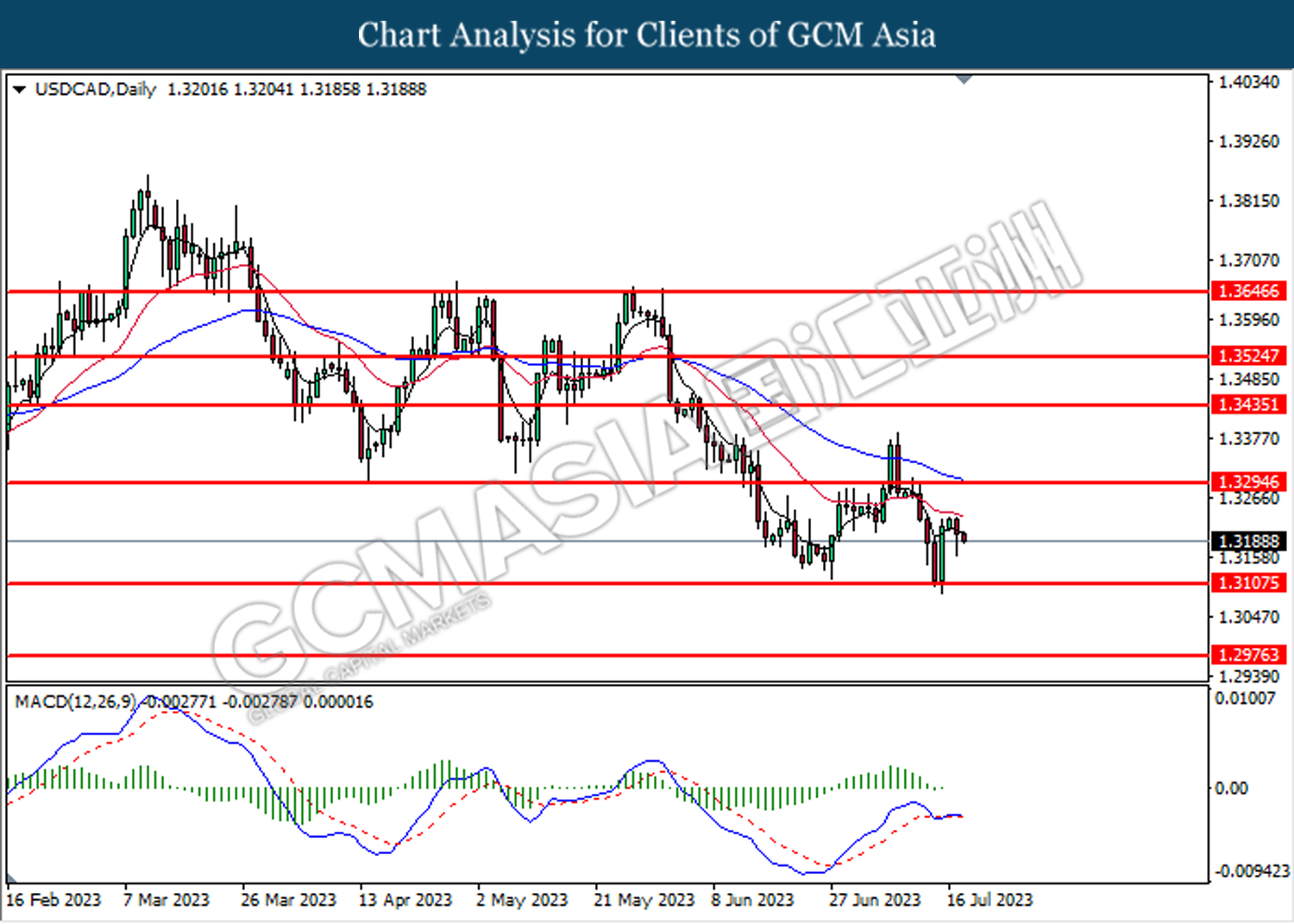

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3110. Due to the lack of signal from MACD, it is suggested to wait for further confirmation such as a breakout before entering the market.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

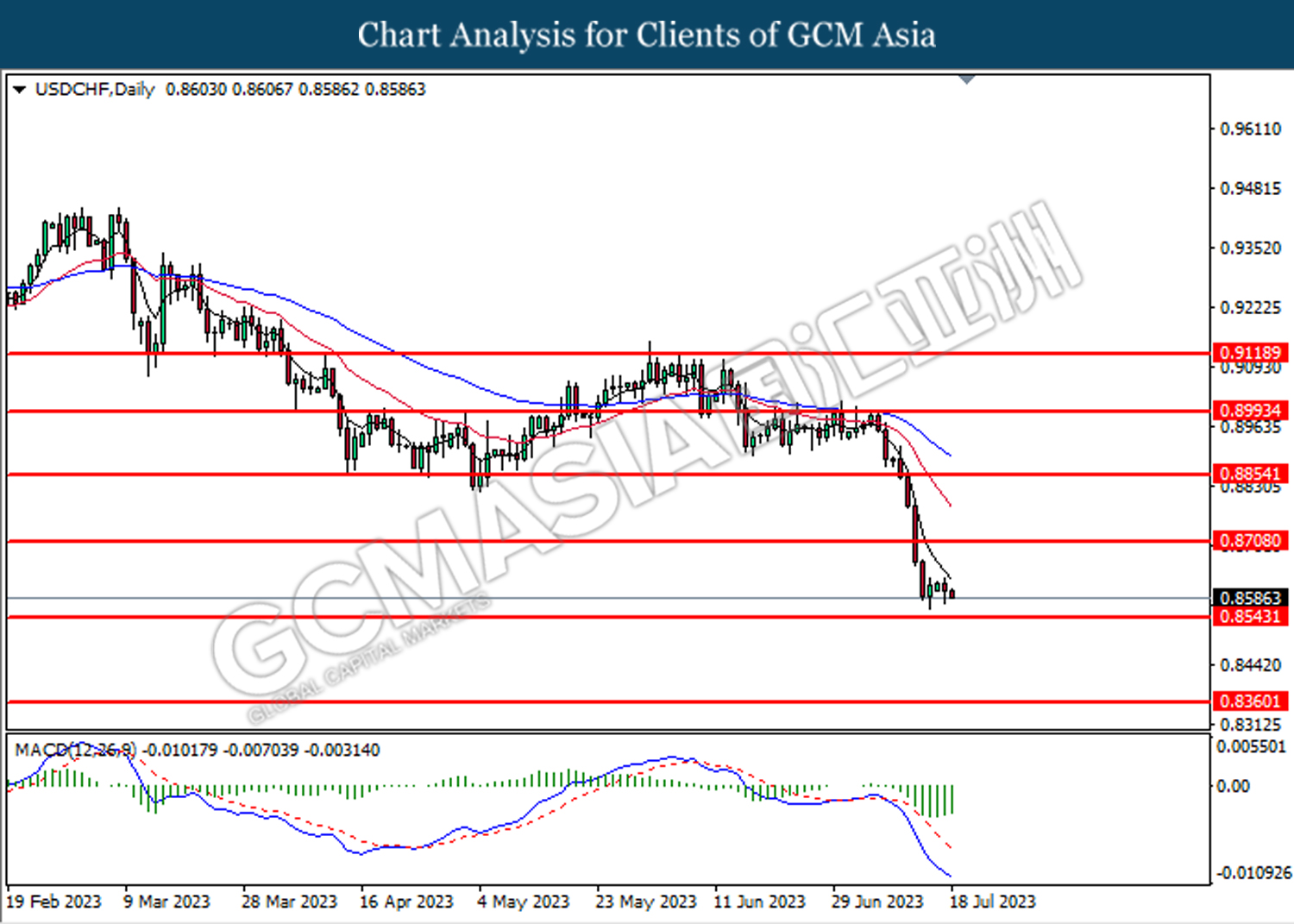

USDCHF, Daily: USDCHF was traded lower following the prior breakout from the previous support level at 0.8710. However, MACD which illustrated diminishing bearish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 0.8710, 0.8855

Support level: 0.8545, 0.8360

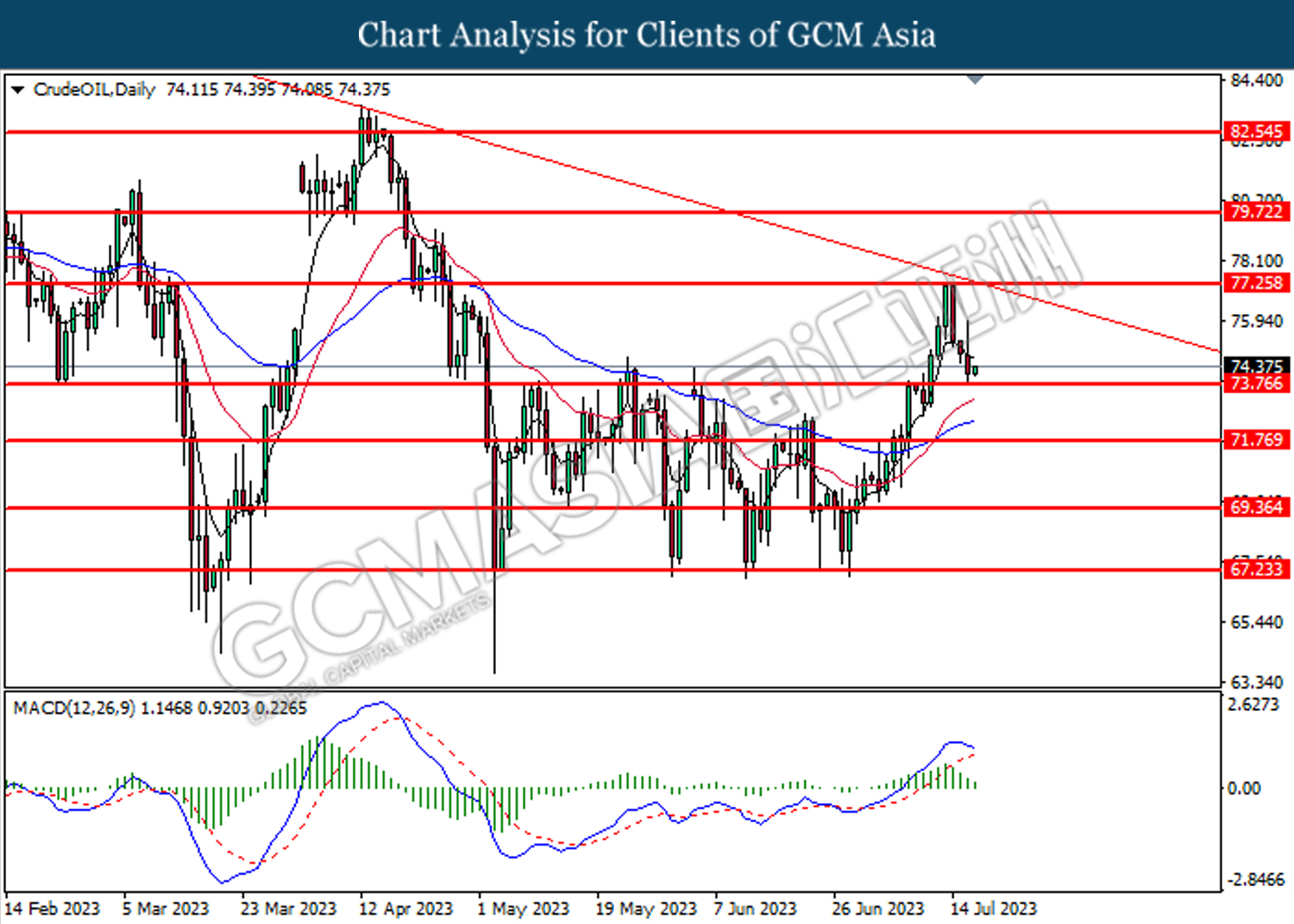

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 73.75. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes technical correction in the short term.

Resistance level: 77.25, 79.70

Support level: 73.75, 71.80

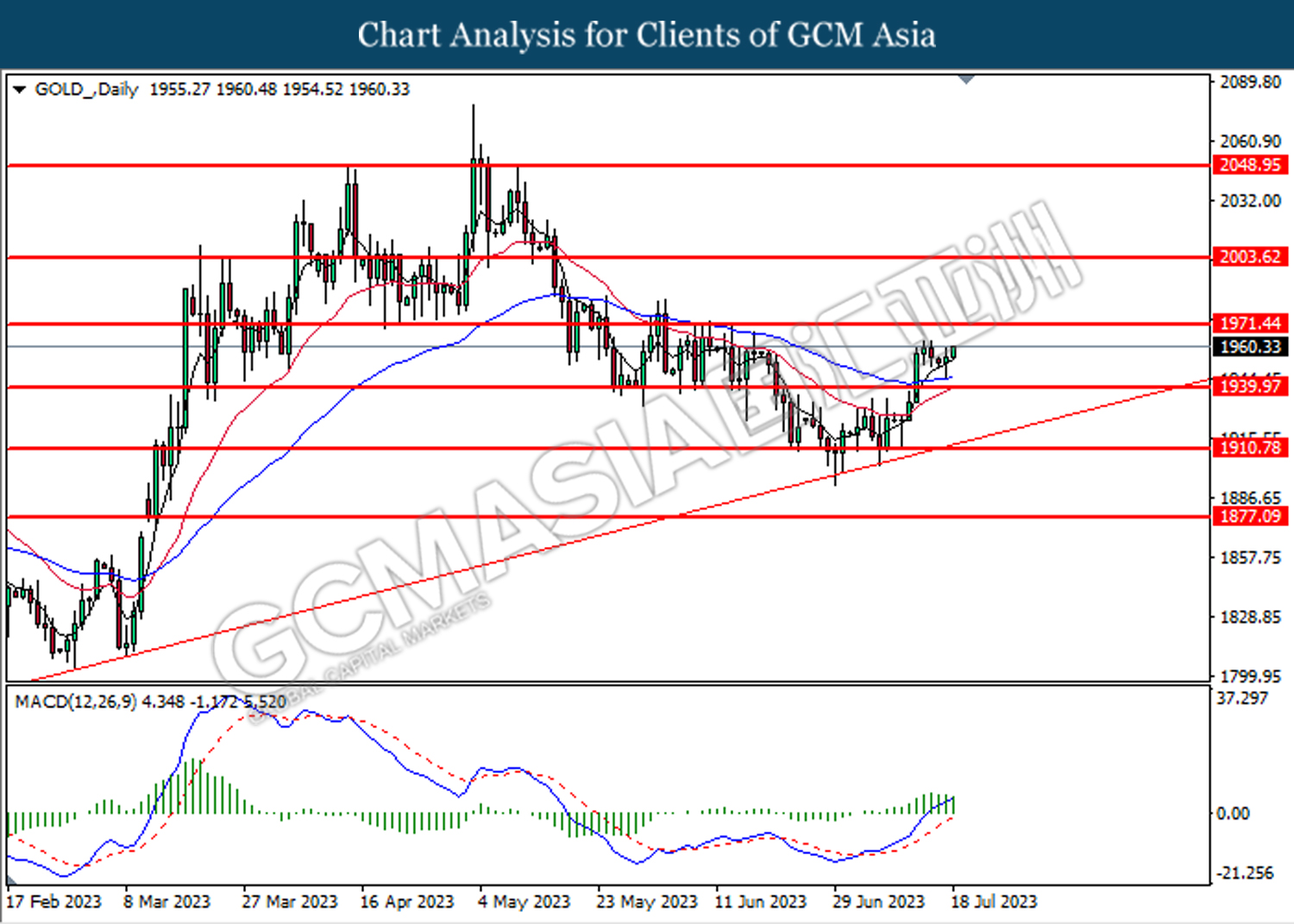

GOLD_, Daily: Gold price was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes technical correction in the short term.

Resistance level: 1971.40, 2003.60

Support level: 1940.00, 1910.80