18 July 2023 Morning Session Analysis

Greenback struggled amid growing bets of less hawkish Fed.

The dollar index, which was traded against a basket of six major currencies, managed to stop the bleeding from its wound in the yesterday trading session as there were no major factors influencing market direction. During this week, it is anticipated that the dollar will stabilize as investors await the upcoming Federal Reserve meeting, where a 25 basis point rate hike is expected. The substantial decrease in the dollar’s value last week was deemed somewhat unusual, and it is expected that the market will stabilize this week, potentially leading to a stronger dollar. The retail sales report for June, which has scheduled for release on Tuesday, will be the primary focus of the US economic landscape this week. Nevertheless, it is unlikely that this data will significantly impact monetary policy decisions. According to CME Fed Rate Monitor Tool, the probability of a rate hike in July is fully priced in by the market. Recent data indicating better-than-expected economic growth and a slower-than-anticipated increase in inflation have reduced the likelihood of a recession or a sharp economic slowdown. This has further fueled expectations of a less aggressive monetary policy stance by the Federal Reserve. As of writing, the dollar index dropped -0.03% to 99.88.

In the commodities market, crude oil prices depreciated by -1.22% to $74.00 per barrel as the weak Chinese data increased the market fears over the prospect of oil demand. Besides, gold prices ticked up 0.01% to $1955.15 per troy ounce as the US dollar rebounded slightly following a rejection near the recent low level.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Vice Chair for Supervision Barr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Jun) | 0.1% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Jun) | 0.3% | 0.5% | – |

Technical Analysis

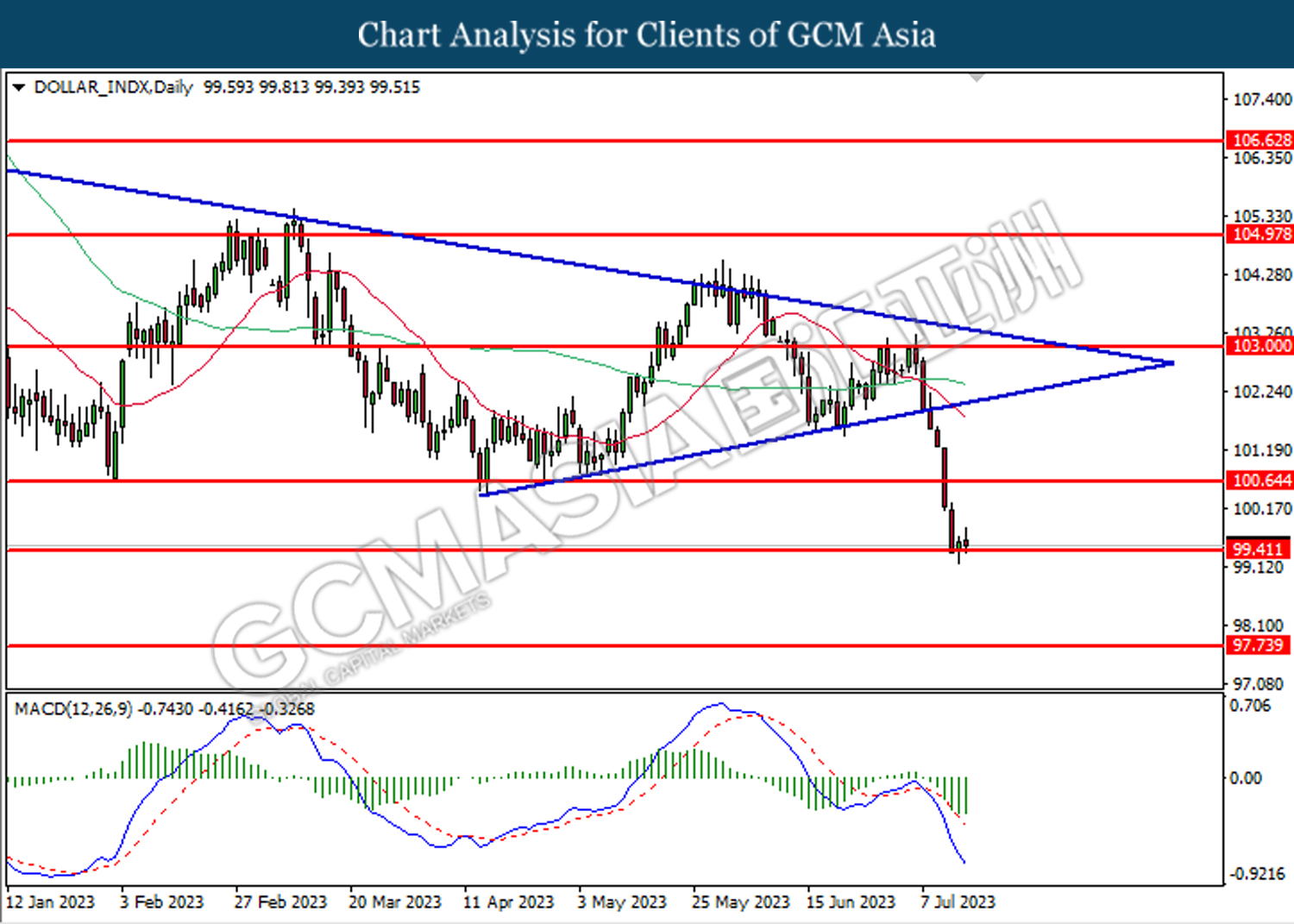

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 99.40. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level at 99.40.

Resistance level: 100.65, 103.00

Support level: 99.40, 97.75

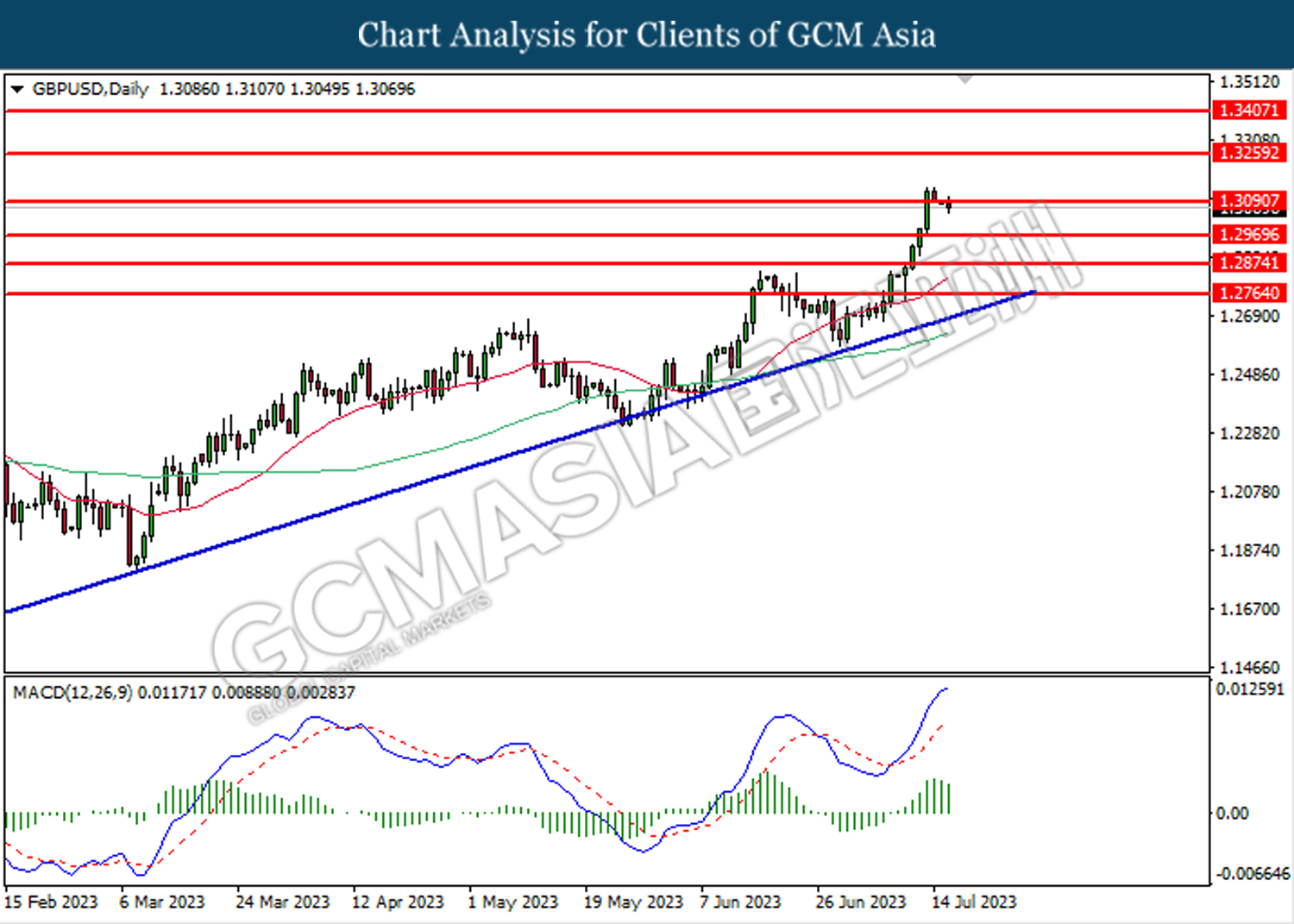

GBPUSD, Daily: GBPUSD was traded lower while currently retesting the support level at 1.3090. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3260, 1.3405

Support level: 1.3090, 1.2970

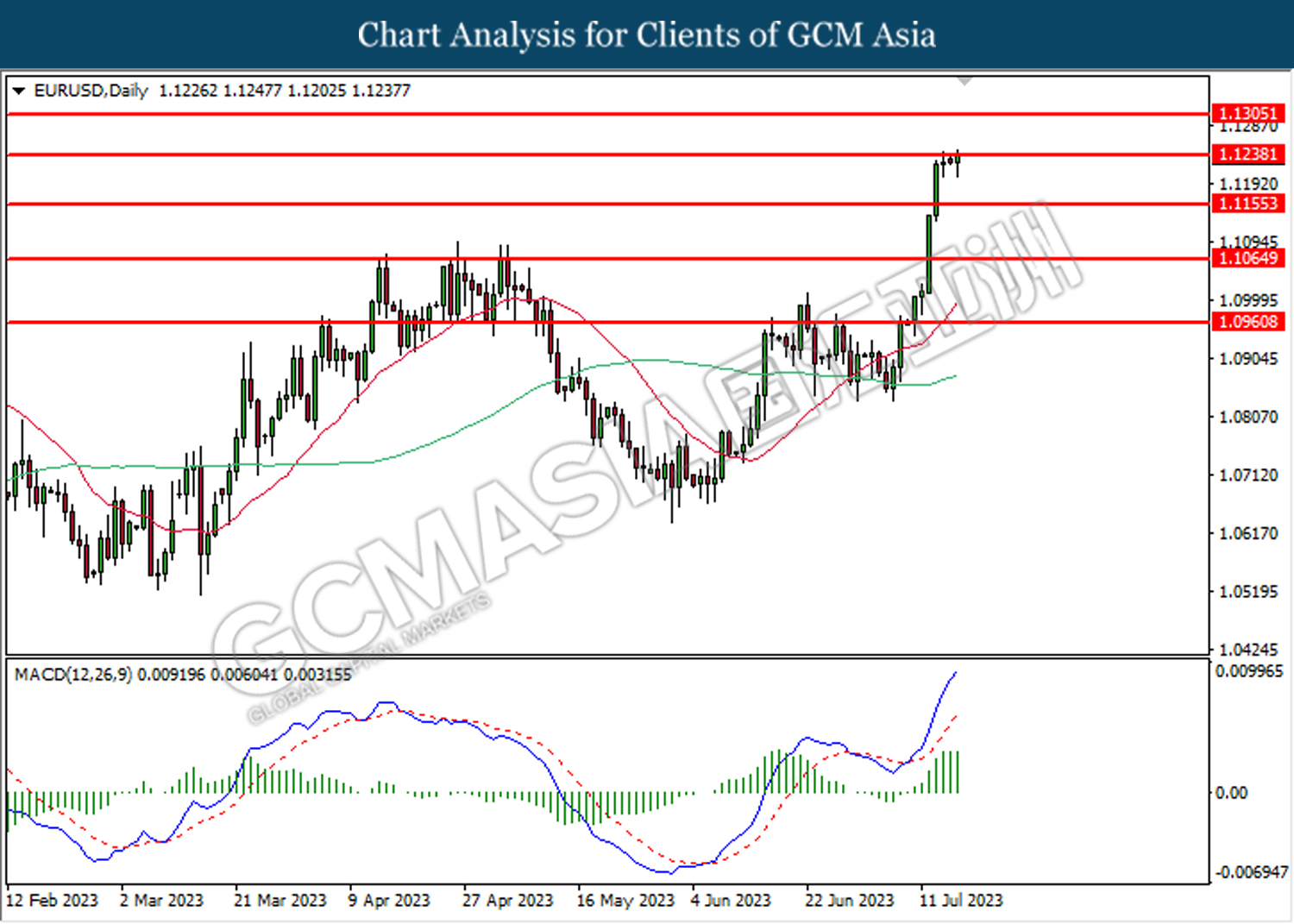

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1240. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1240, 1.1365

Support level: 1.1155, 1.1065

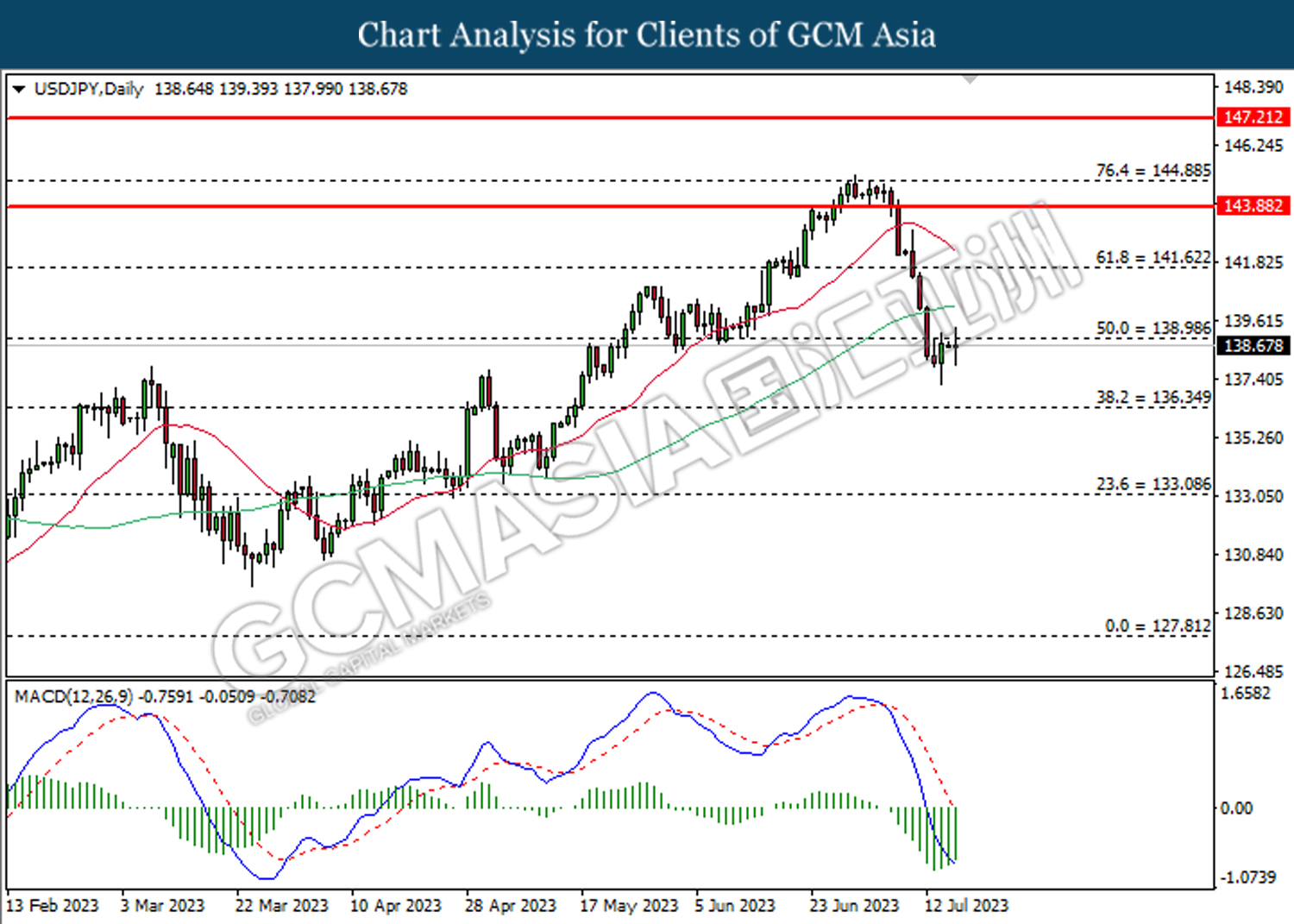

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 139.00. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 139.00, 141.60

Support level: 136.35, 133.10

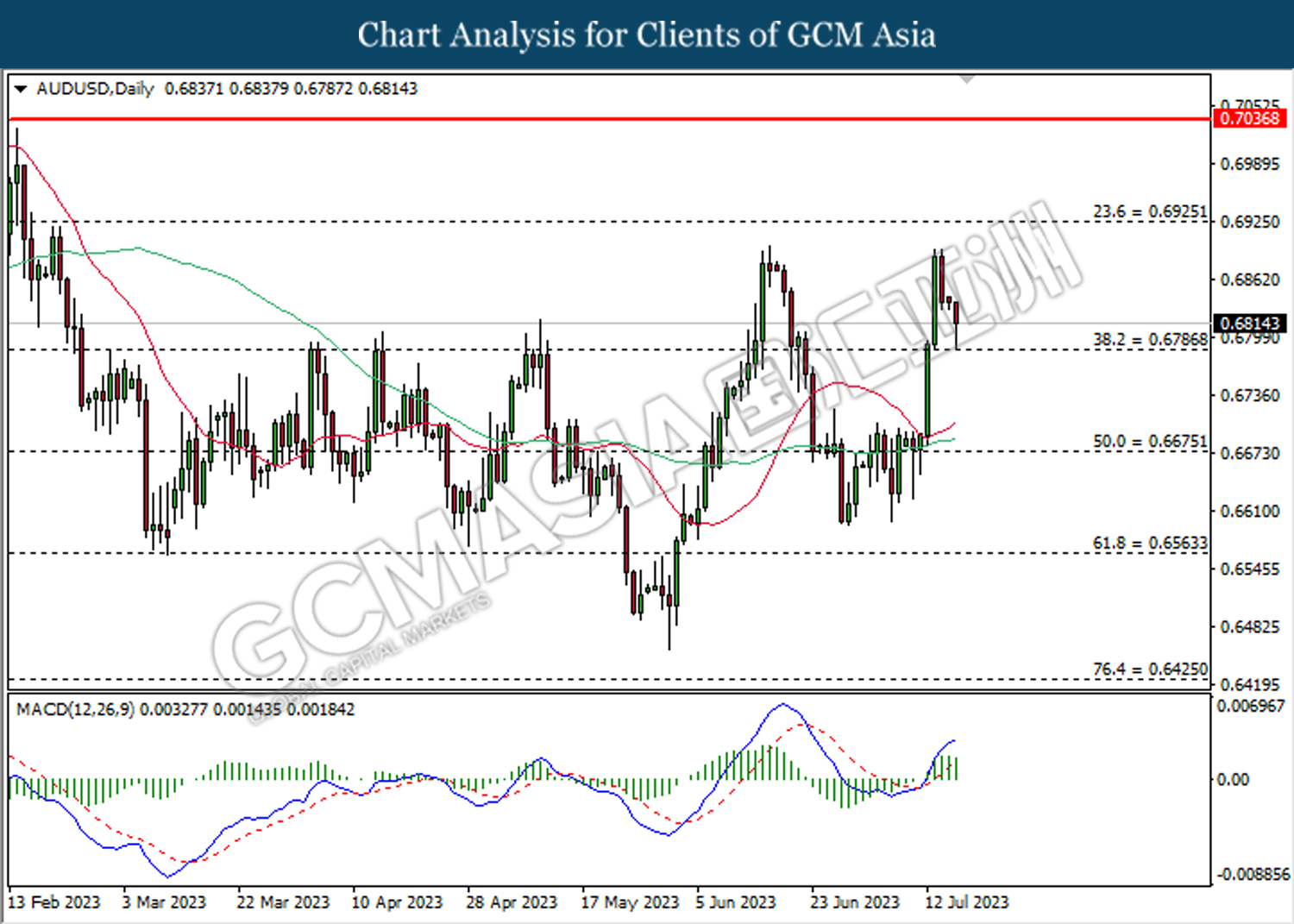

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

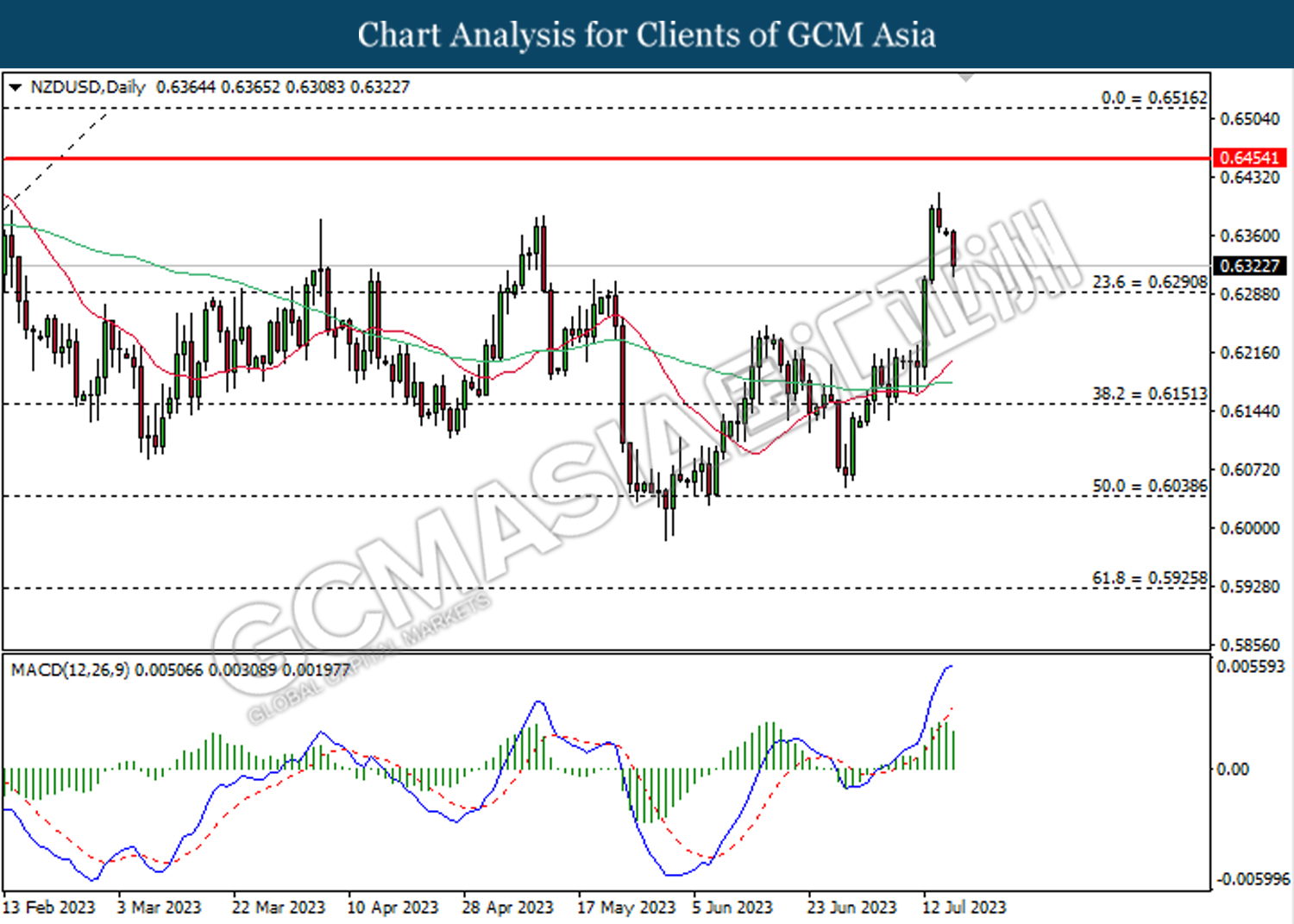

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6290.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

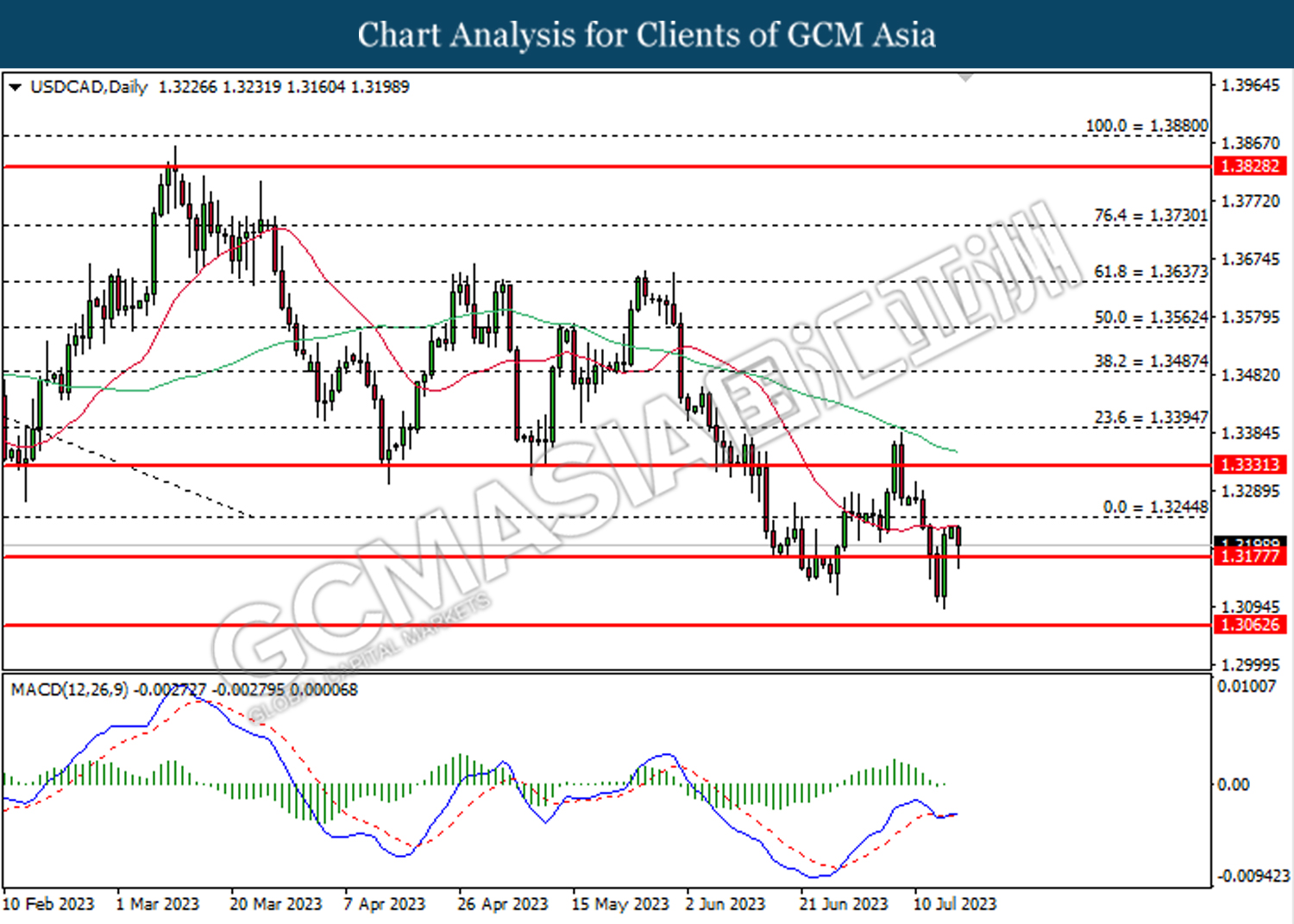

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3175. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3245.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

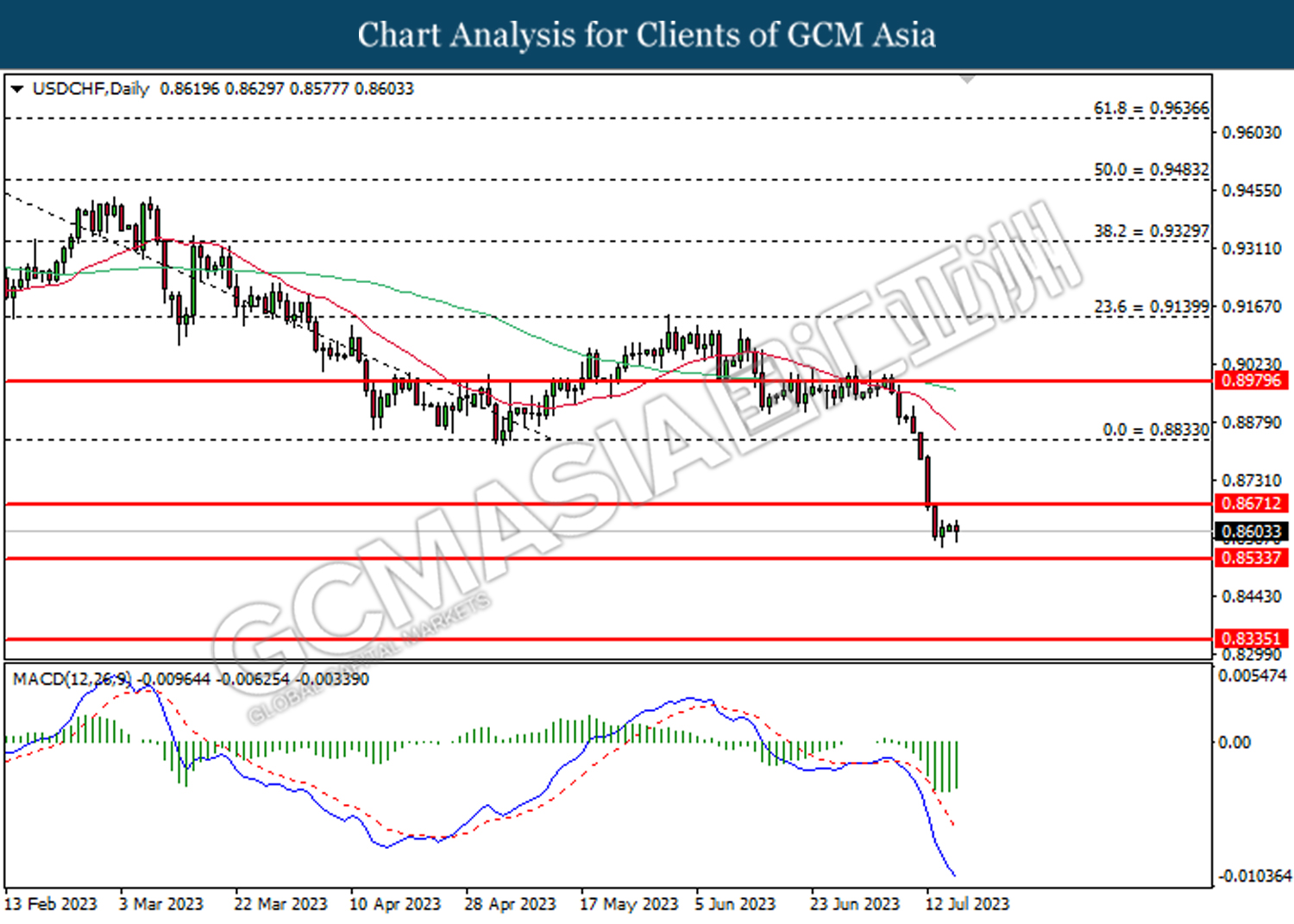

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8535.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 77.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 73.90.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

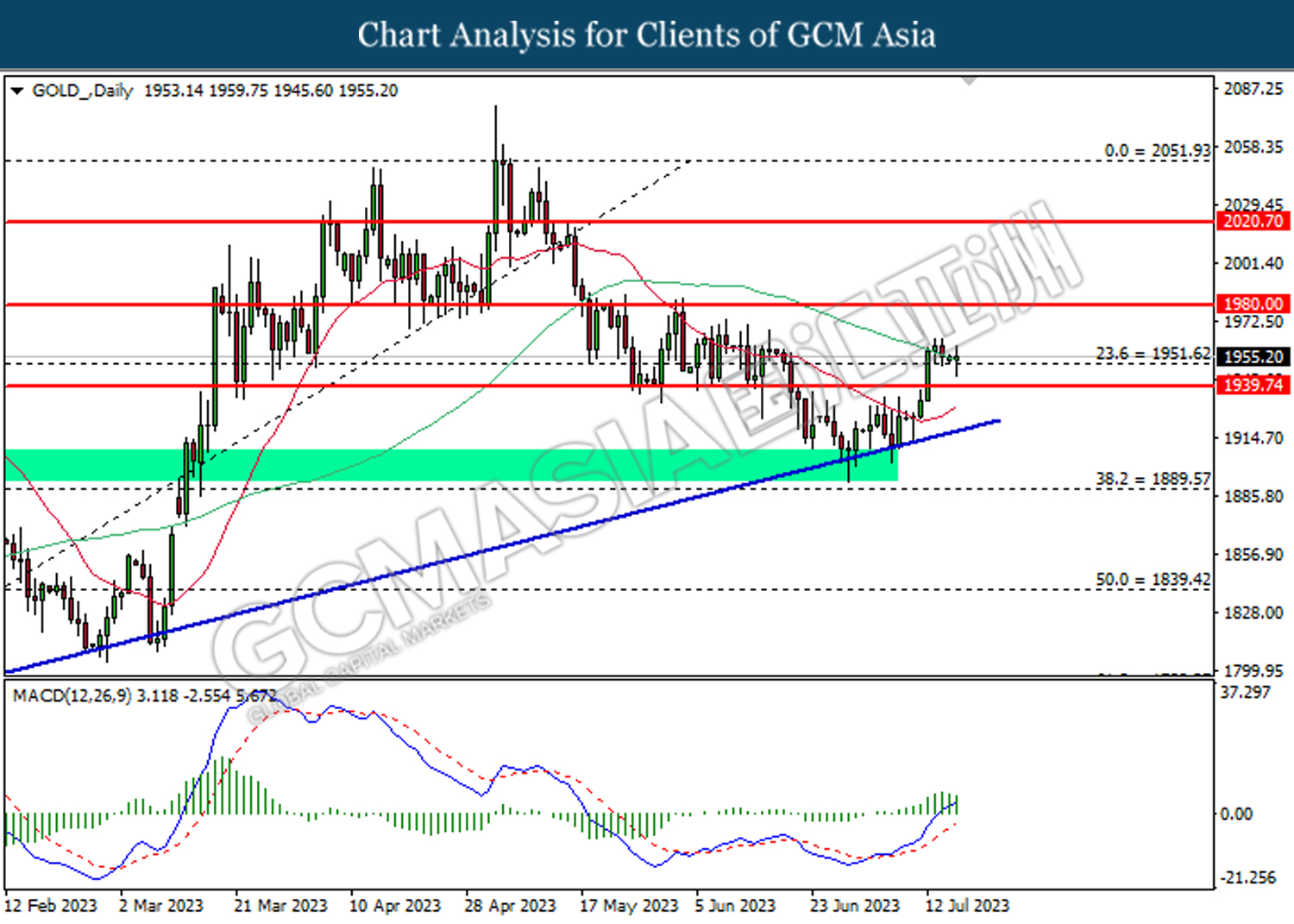

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75