18 September 2020 Afternoon Session Analysis

Yen retreats following CPI data.

During late Asian session, the safe-haven Yen which traded against the dollar and other currency pairs have retreat from its gains following downbeat Japan CPI. According to the Statistics Bureau of Japan, Japan’s National CPI have fell to 0.2%, lower than market expectation. Following the weak data, the Japanese Yen have since gave up some of its gains. However, due to another recent batch of weak data from the U.S and policy decision from Fed, further losses for the safe-haven Yen may be limited. At Wednesday’s policy meeting, the Fed pledged to keep rates near zero until the labor market reaches “maximum employment” and inflation is on track to “moderately exceed” the 2% target, with most policymakers seeing rates on hold through at least 2023. On data front, U.S. jobless claims remained elevated at 860,000, while both housing starts and the Philadelphia Fed business index fell. At the time of writing, USD/JPY rose 0.09% to 104.83.

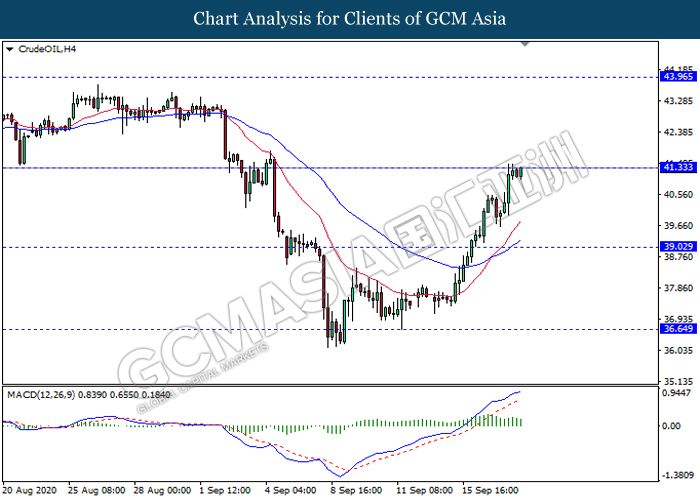

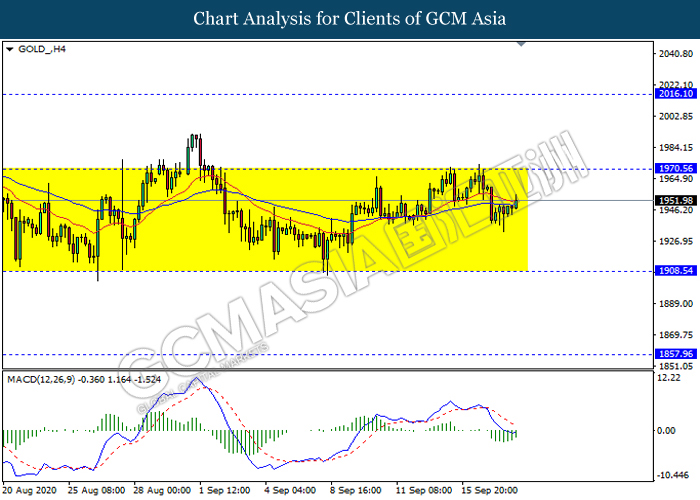

In the commodities market, crude oil price extend gains and rose 0.06% to $41.21 per barrel as of writing following Saudi Minister warned traders not to gamble against the alliance. Prince Abdulaziz bin Salman who decides on the energy policy of the world’s most influential oil producing country stated that he will make the oil market jumpy and warned to whoever gamble on the oil market will experience pain. On top of that, Prince Salman also sought to assure that all members within the OPEC will make up for production quotas. On the other hand, gold price gains 0.39% a troy ounce to $1951.30 at the time of writing amid weakening dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (Aug) | – | 0.7% | 3.6% |

| 20:30 | CAD – Core Retail Sales (MoM) (Jul) | – | 0.5% | 15.7% |

Technical Analysis

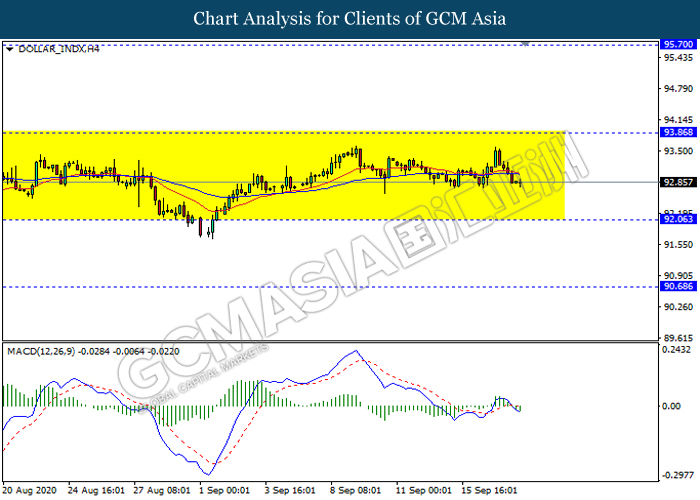

DOLLAR_INDX, H4: Dollar index remain traded in a sideway channel. However, MACD which illustrate bearish momentum suggest the dollar to be traded lower in short term towards the support level 92.05.

Resistance level: 93.85, 95.70

Support level: 92.05, 90.70

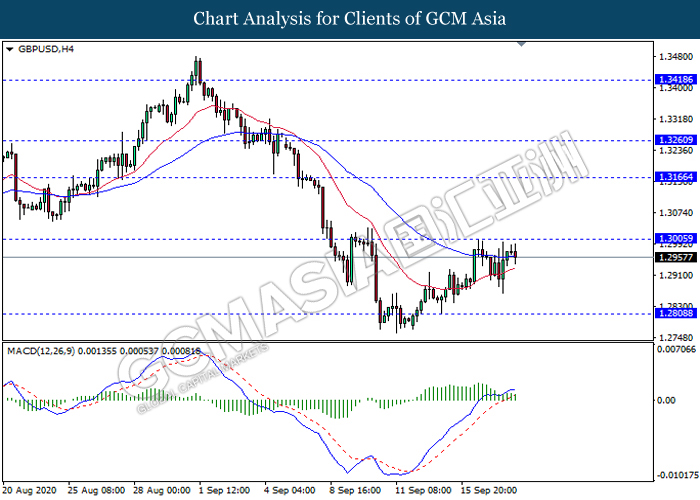

GBPUSD, H4: GBPUSD was traded higher while currently testing near the resistance level 1.3005. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a short term technical correction towards the support level 1.2810.

Resistance level: 1.3005, 1.3165

Support level: 1.2810, 1.2660

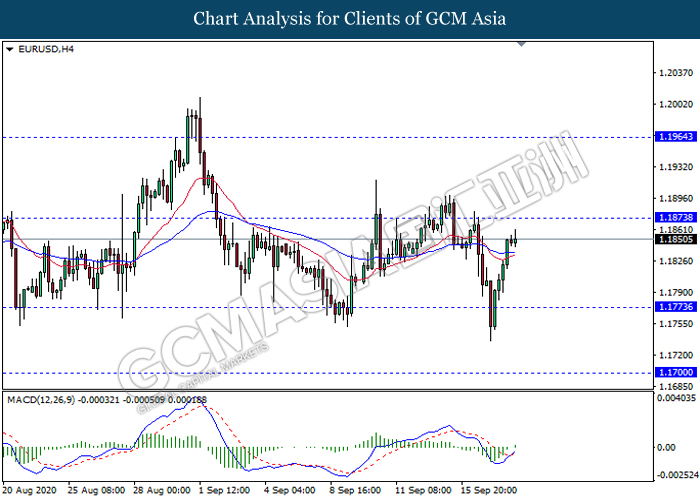

EURUSD, H4: EURUSD was traded higher while currently testing near the resistance level 1.1875. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level 1.1875.

Resistance level: 1.1875, 1.1965

Support level: 1.1775, 1.1700

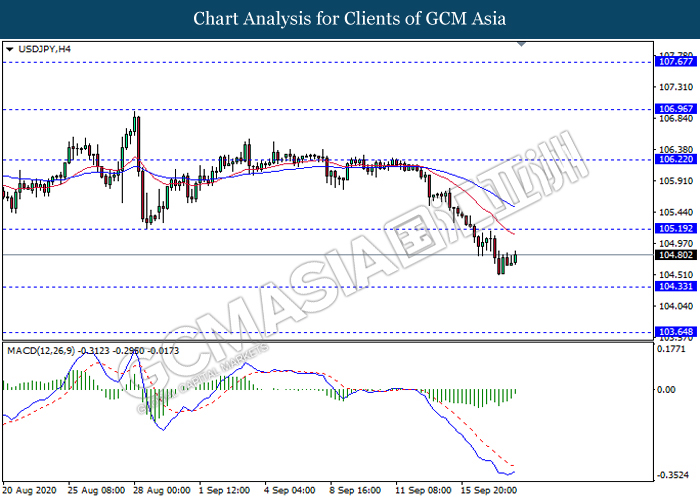

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 104.35.. MACD which illustrate diminishing bearish momentum signal with the starting formation of golden cross suggest the pair to extend its rebound towards the resistance level 105.20.

Resistance level: 105.20, 106.20

Support level: 104.35, 103.65

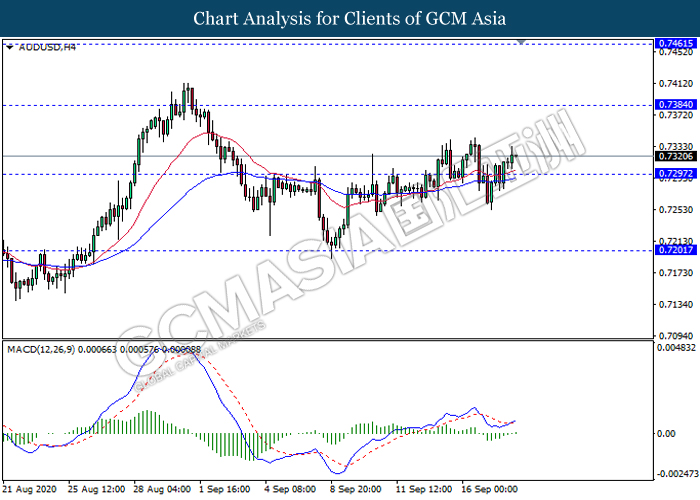

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7295. MACD which illustrate bullish bias signal with the starting formation of golden cross suggest the pair to extend its rebound towards the resistance level 0.7385.

Resistance level: 0.7385, 0.7460

Support level: 0.7295, 0.7200

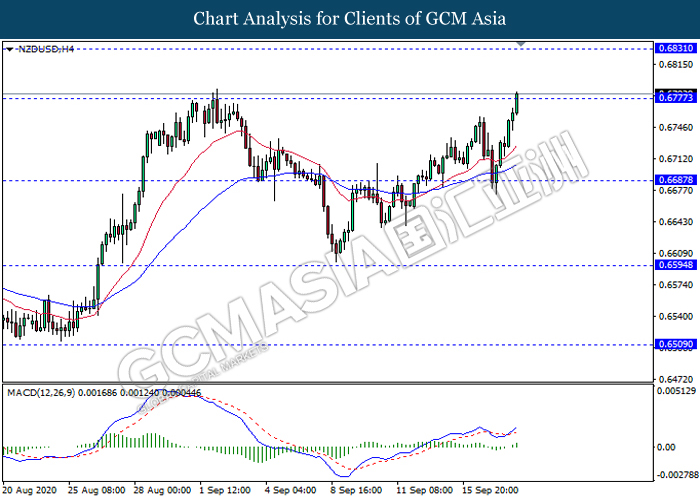

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6775. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level 0.6775.

Resistance level: 0.6775, 0.6830

Support level: 0.6685, 0.6595

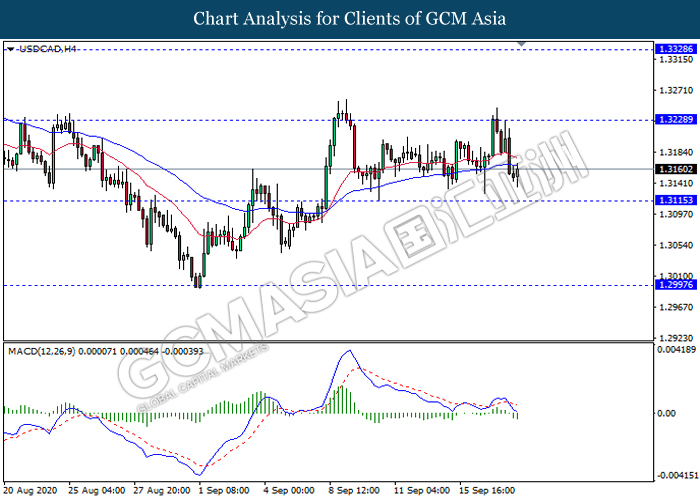

USDCAD, H4: USDCAD was traded lower following recent retracement from the resistance level 1.3230. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 1.3115.

Resistance level: 1.3230, 1.3330

Support level: 1.3115, 1.2995

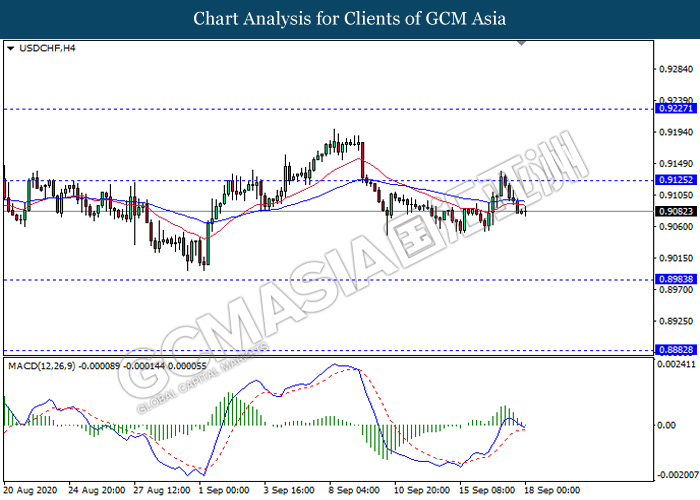

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.9125. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement towards the support level 0.8985.

Resistance level: 0.9125, 0.9225

Support level: 0.8985, 0.8880

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 41.35. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to be traded lower as a technical correction towards the support level 39.00.

Resistance level: 41.35, 43.95

Support level: 39.00, 36.65

GOLD_, H4: Gold price remain traded in a sideway channel. However, MACD which illustrate bullish momentum signal suggest the commodity to be traded higher towards the resistance level 1970.55.

Resistance level: 1970.55, 2016.10

Support level: 1908.55, 1857.95