19 January 2021 Afternoon Session Analysis

Aussie rose on upbeat data, risk-on mood.

During late Asian session, the Australian dollar which traded against the greenback and other currency pairs have jumped as the pair benefited from positive data and risk-on mood in the market. On data front, Australia’s ANZ Roy Morgan Weekly Consumer Confidence eases to 108.7 from 108.9. Even so, the confidence was higher than last year with the sentiment in January 2020 was impacted by the bushfires. Besides that, HIA New Home Sales also reached remarkable heights with the reading of 32.5%, almost double compared to previous reading in November. It was also the second strongest month in 20 years of survey. On top of that, the momentum was further lifted by positive development on coronavirus cases. According to ABC News, there was zero new coronavirus (COVID-19) cases from the Australian Capital Territory (ACT) and Victoria. At the time of writing, AUD/USD rose 0.37% to 0.7707.

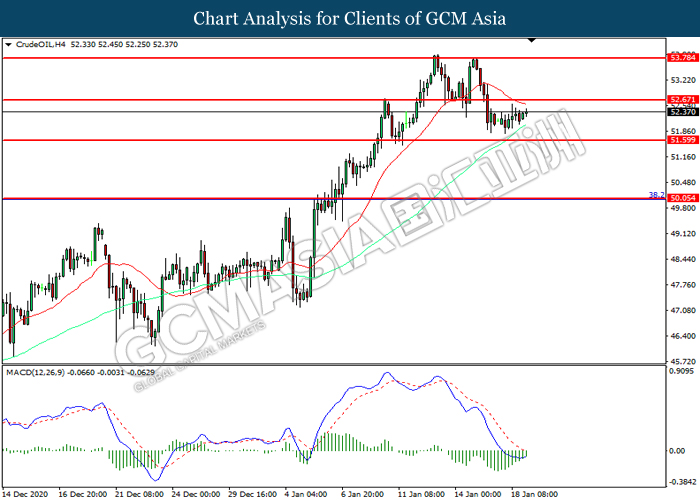

In the commodities market, crude oil price remains mixed in overall and edge higher 0.42% to $52.31 per barrel as of writing with investors weighing optimism of further stimulus measure against increasing fears for fuel demand and COVID-19. Positive economic data from China, the top crude oil importer globally, helped boost sentiment and showed that refinery output rose 3% to a new record in 2020. However, the positivity was offset by the growing number of COVID-19 cases globally and the restrictive measures that affect fuel demand. Market currently waits for more catalyst to determine further direction for the commodity. On the other hand, gold price rose 0.03% to $1837.98 a troy ounce following dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – German ZEW Economic Sentiment (Jan) | 55.0 | 60.0 | – |

Technical Analysis

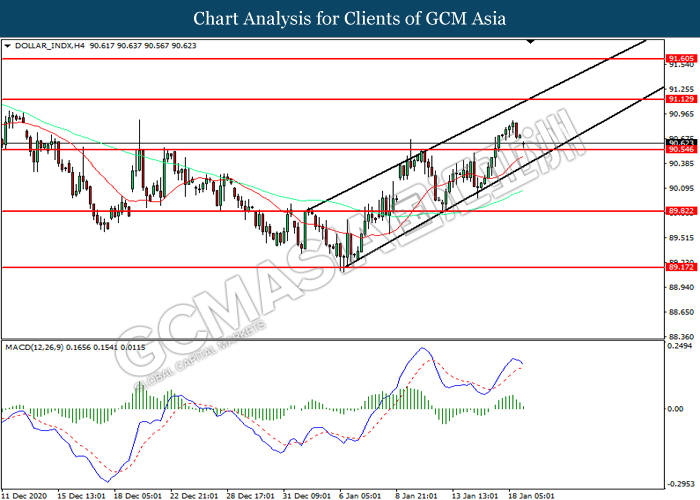

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 90.55. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 91.15, 91.60

Support level: 90.55, 89.80

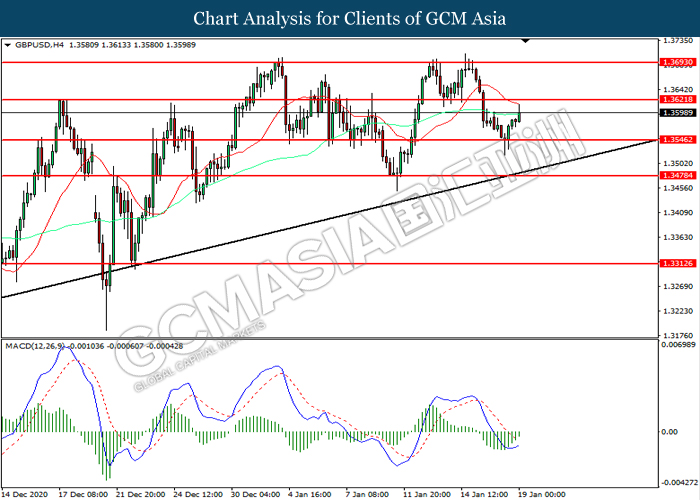

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3620. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3620, 1.3695

Support level: 1.3545, 1.3480

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2075. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2140.

Resistance level: 1.2140, 1.2215

Support level: 1.2055, 1.1905

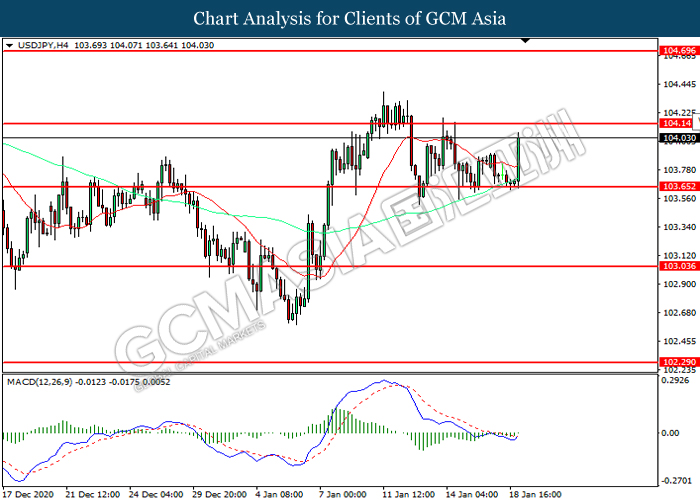

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 103.65. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 104.15.

Resistance level: 104.15, 104.70

Support level: 103.70, 103.05

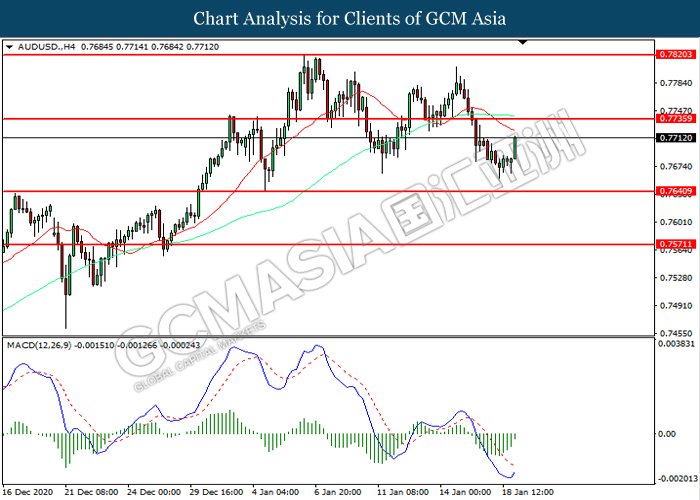

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7640. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.7735.

Resistance level: 0.7735, 0.7820

Support level: 0.7640, 0.7570

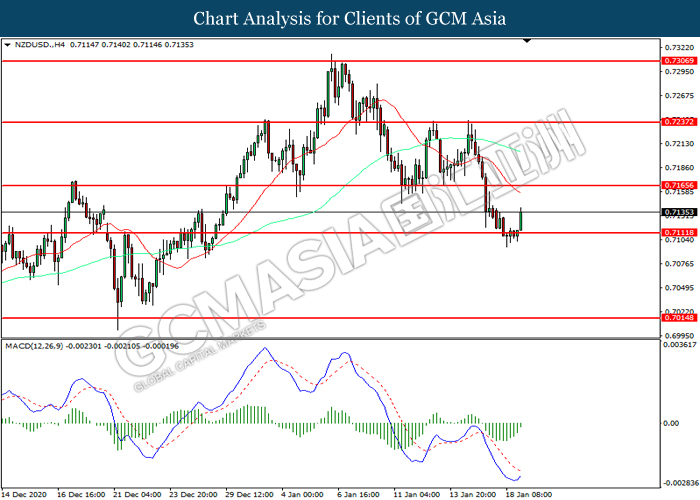

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.7110. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.7165.

Resistance level: 0.7165, 0.7235

Support level: 0.7110, 0.7015

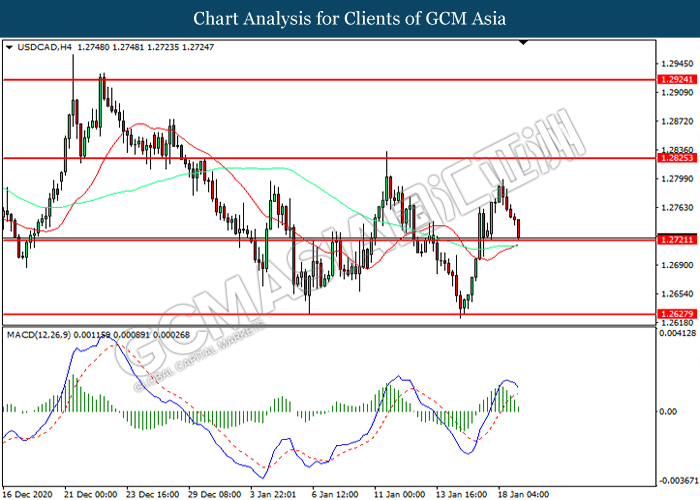

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2720. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2925

Support level: 1.2720, 1.2630

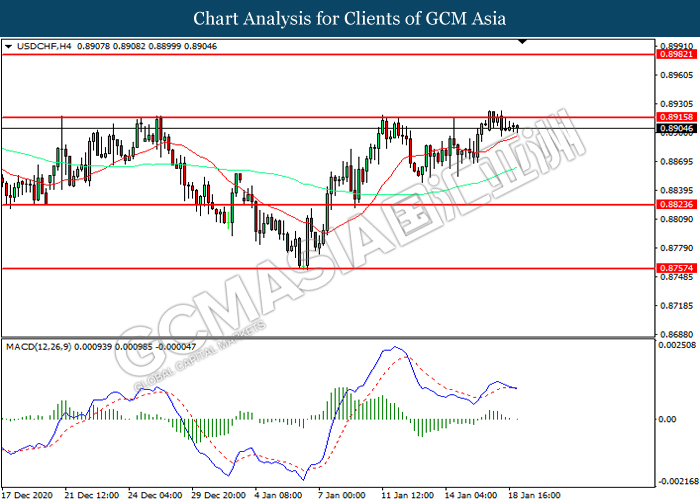

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.8825.

Resistance level: 0.8915, 0.8980

Support level: 0.8825, 0.8755

CrudeOIL, H4: Crude oil price was traded higher while currently near the resistance level at 52.65. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 52.65, 53.80

Support level: 51.60, 50.05

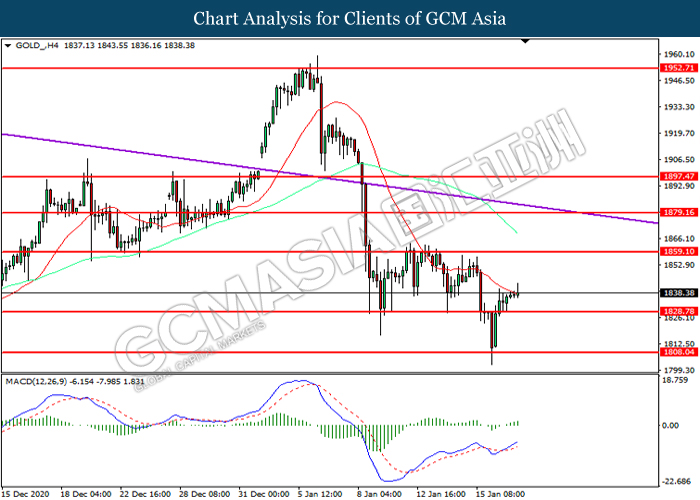

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1828.80. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1859.10.

Resistance level: 1859.10, 1897.45

Support level: 1828.80, 1808.05