19 January 2021 Morning Session Analysis

Euro wobbles amid pessimistic eurozone outlook.

The single currency in European Union was having mixed pattern yesterday while hovering near the lowest level in six weeks as ongoing pandemic continue overshadowed the EU economy performance. Amidst another wave of covid-19 crisis, several EU countries were forced to reimplement lockdown measure to combat and limit the fast-spreading virus. With more nations under lockdowns and restrictions, majority of the economic activity in EU halted which subsequently exerted huge pressure on Europe’s recovery and constituting a clear deterioration of economic outlook. Furthermore, German Chancellor Angela Merkel also revealed that she wanted to unleash a “mega-lockdown” after a spike in death toll and confirmed virus cases in Germany last week. Over such a backdrop, investors are eyeing on the upcoming ECB meeting which scheduled on Thursday’s night in order to gauge the further direction of Euro. As Covid-19 crisis was making EU economic imbalances worse, it hinted that ECB may step in by easing their monetary policy or vowing EU government to unveil further fiscal support in order to boost up the recovery pace of economy. As of writing, the pair of EUR/USD dropped 0.01% to 1.2075.

In the commodities market, the crude oil price depreciated by 0.05% to $52.10 per barrel as of writing amid market concern over the possibility of further lockdown in Europe may damper the oil market future demand outlook. Besides, gold price rose 0.01% to $1837.40 a troy ounce amid worsening of pandemic covid-19 sharpen the market safe-haven behaviour.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – German ZEW Economic Sentiment (Jan) | 55.0 | 60.0 | – |

Technical Analysis

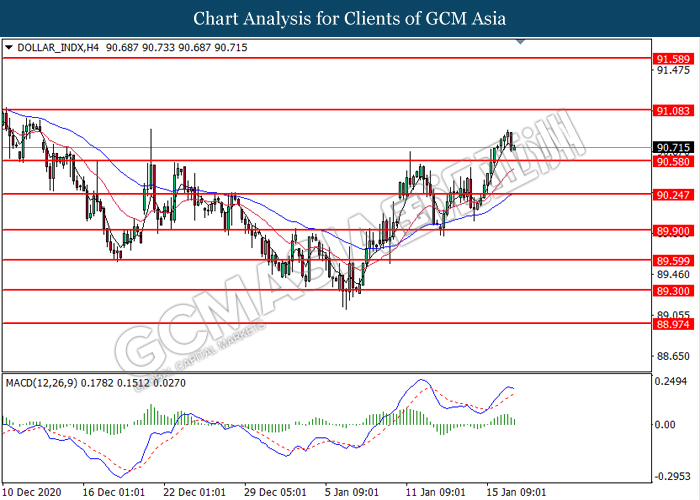

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward the support level at 90.60.

Resistance level: 91.10, 91.60

Support level: 90.60, 90.25

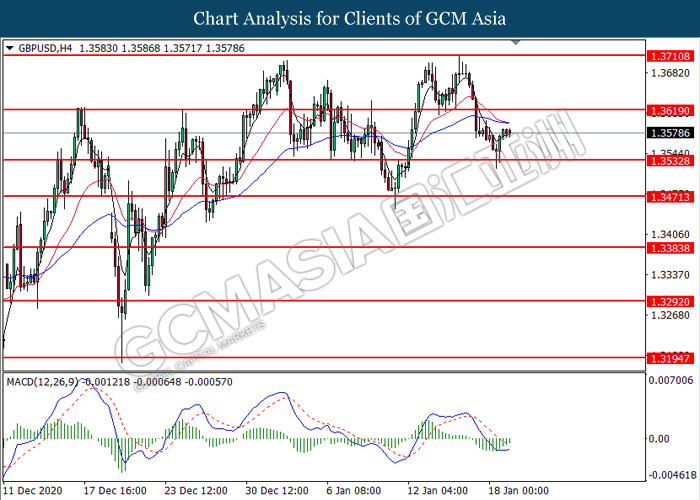

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3620.

Resistance level: 1.3620, 1.3710

Support level: 1.3535, 1.3470

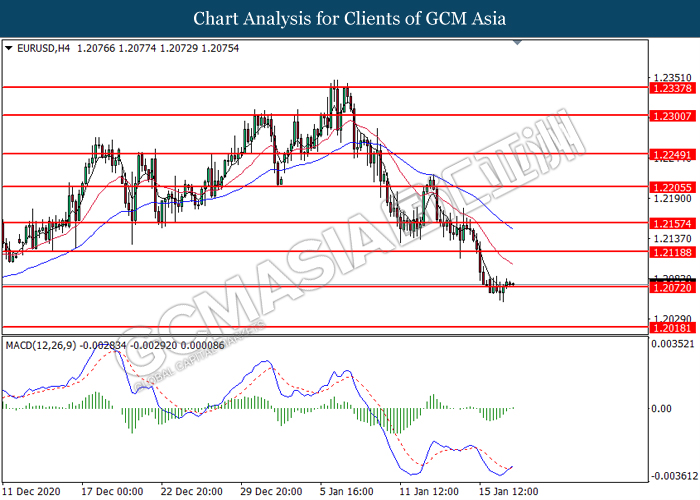

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2070. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2120.

Resistance level: 1.2120, 1.2155

Support level: 1.2070, 1.2020

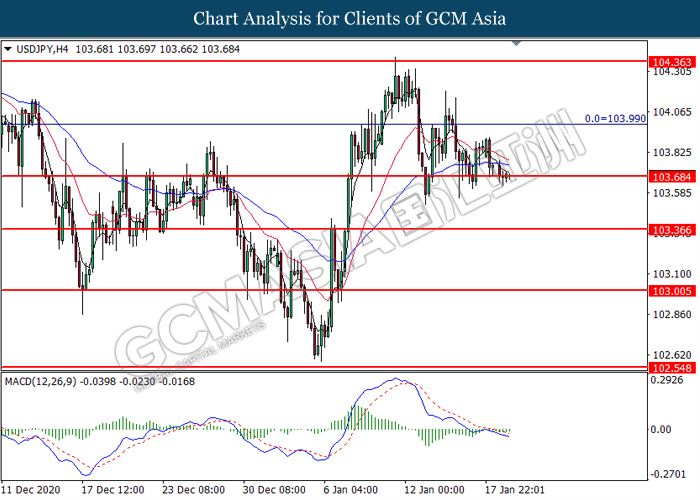

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 103.70. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 104.00, 104.35

Support level: 103.70, 103.35

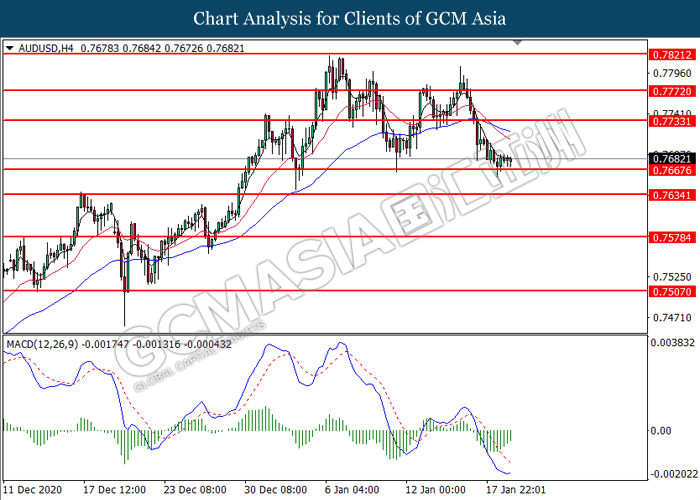

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7735.

Resistance level: 0.7735, 0.7770

Support level: 0.7670, 0.7635

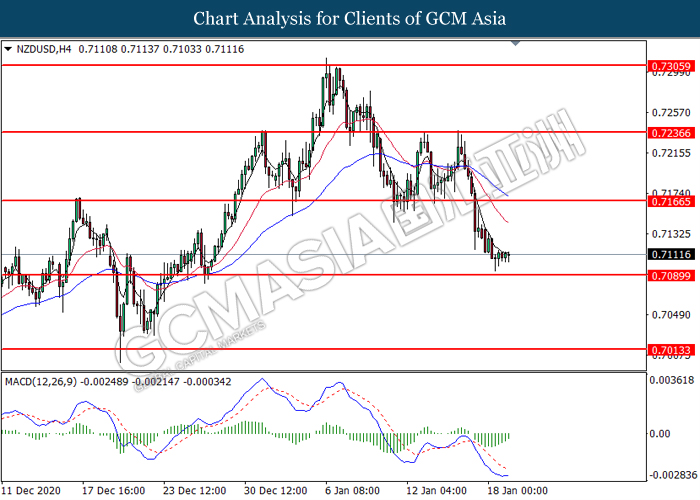

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7165.

Resistance level: 0.7165, 0.7235

Support level: 0.7090, 0.7015

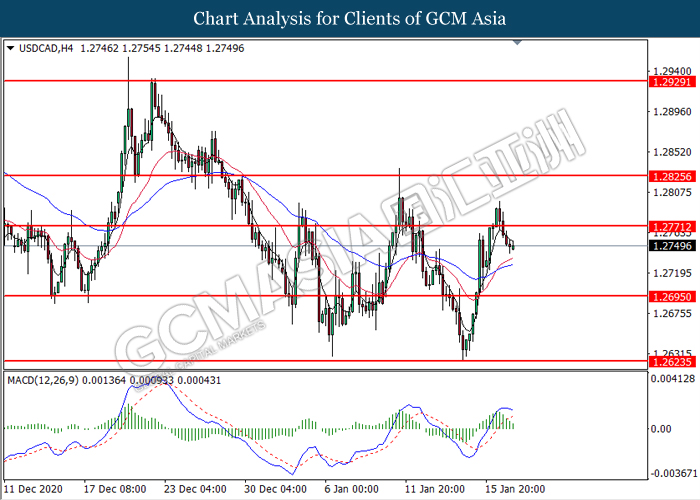

USDCAD, H4: USDCAD was traded lower following prior retracement near the resistance level at 1.2770. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2695.

Resistance level: 1.2770, 1.2825

Support level: 1.2695, 1.2625

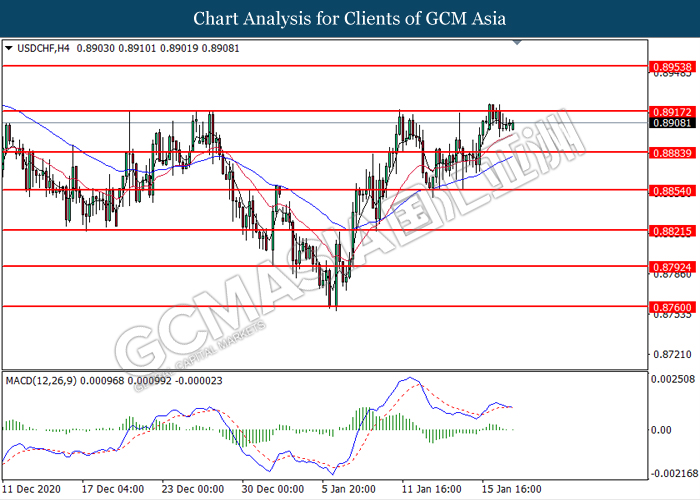

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.8885.

Resistance level: 0.8915, 0.8955

Support level: 0.8885, 0.8855

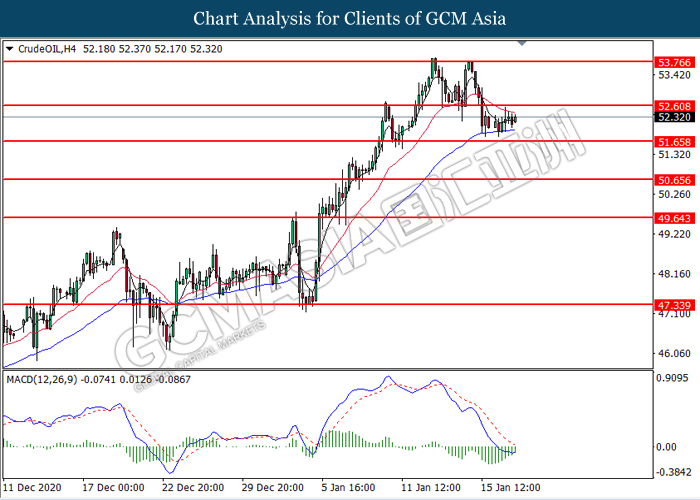

CrudeOIL, H4: Crude oil price was traded higher following prior rebound near the support level at 51.65. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 52.60.

Resistance level: 52.60, 53.75

Support level: 51.65, 50.65

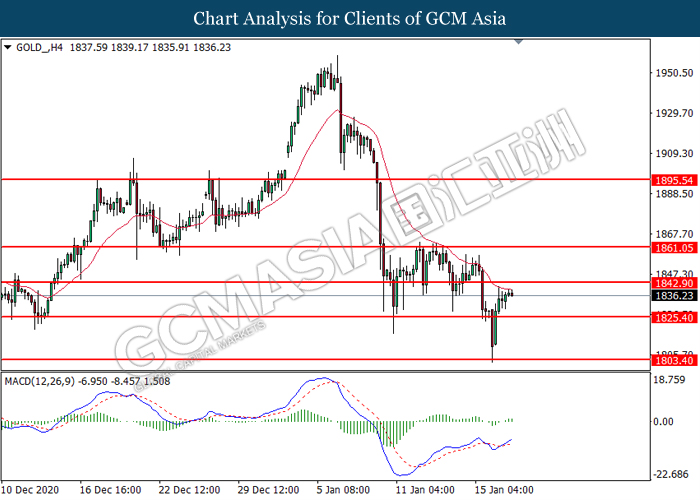

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1825.40. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1842.90.

Resistance level: 1842.90, 1861.05

Support level: 1825.40, 1803.40