19 January 2023 Afternoon Session Analysis

Euro plunged as inflationary risk eased.

The EUR/USD, which traded widely by global investors dived on yesterday following the easing of inflationary risk in Eurozone. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY has notched down from the previous reading of 10.1% to 9.2%. In details, the CPI in Europe countries had slide for the second month in a row month, while it indicated that the aggressive rate hike move from ECB has received significant impact on spiking inflation. With that, the ECB members might start planning for a slower hikes. Prior to that, the ECB’s policymakers was considering a less aggressive rate hike in the upcoming meeting, says 25 basis point increase. Such statement has dialed down the appeal of Euro. On the other hand, the AUD/USD dropped significantly after the downbeat employment data has been announced. The Australia Employment Change has declined from the prior figures of 58.3K to -14.6K, missing the consensus forecast of 22.5K. The negative data has shown that the labor market in Australia remained fragile, which brought negative prospects toward economic progression in the Australia. As of writing, the EUR/USD edged up by 0.02% to 1.0795, as well as AUD/USD dropped by 0.51% to 0.6905.

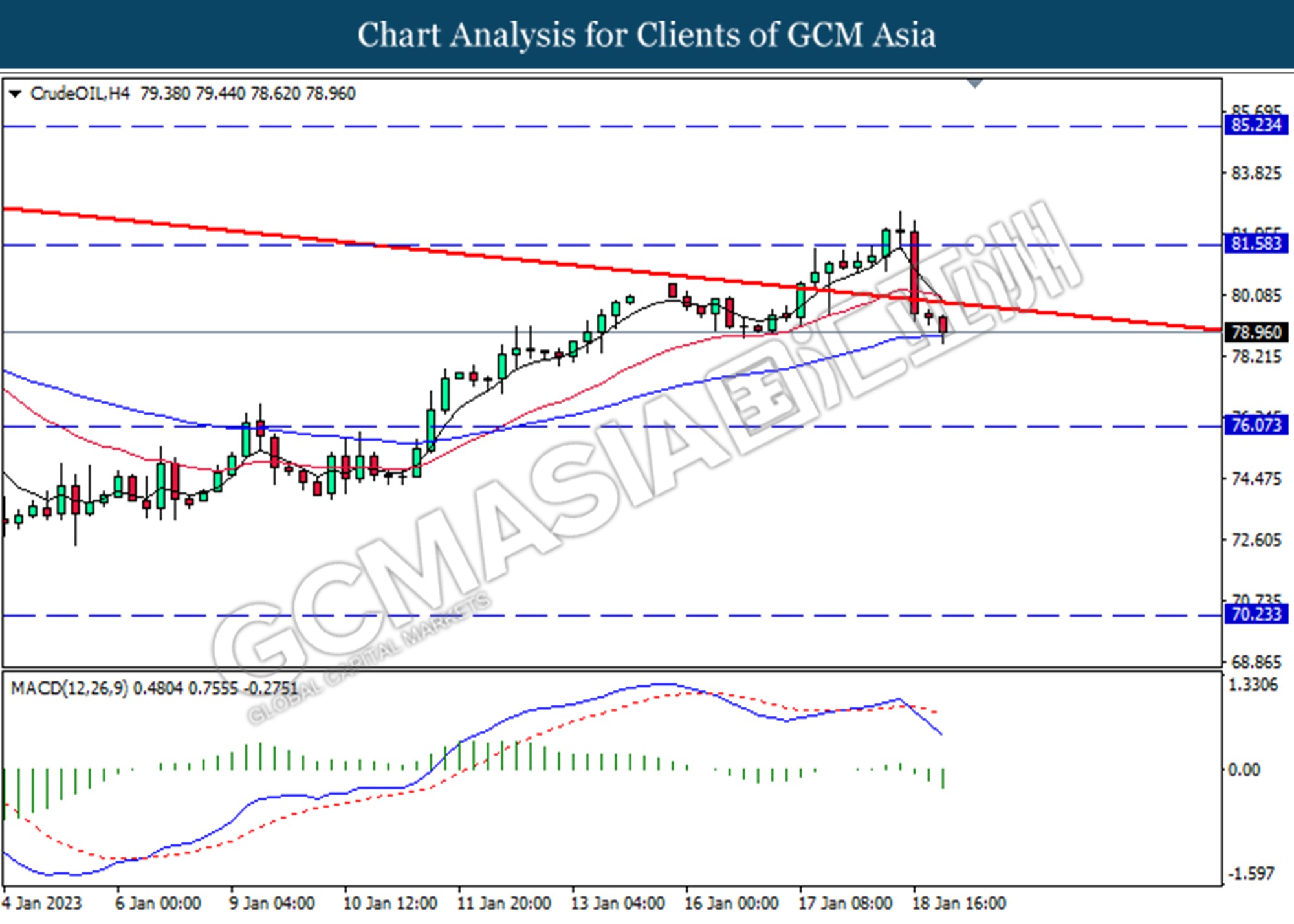

In the commodities market, the crude oil price slumped by 1.17% to $78.84 per barrel as of writing following the API Weekly Crude Oil Stock shows stockpiles over past week. In addition, the gold price appreciated by 0.09% to $1906.78 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:30 EUR ECB President Lagarde Speaks

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Dec) | 1.351M | 1.370M | – |

| 21:30 | USD – Initial Jobless Claims | 205K | 212K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Jan) | -13.8 | -11.0 | – |

Technical Analysis

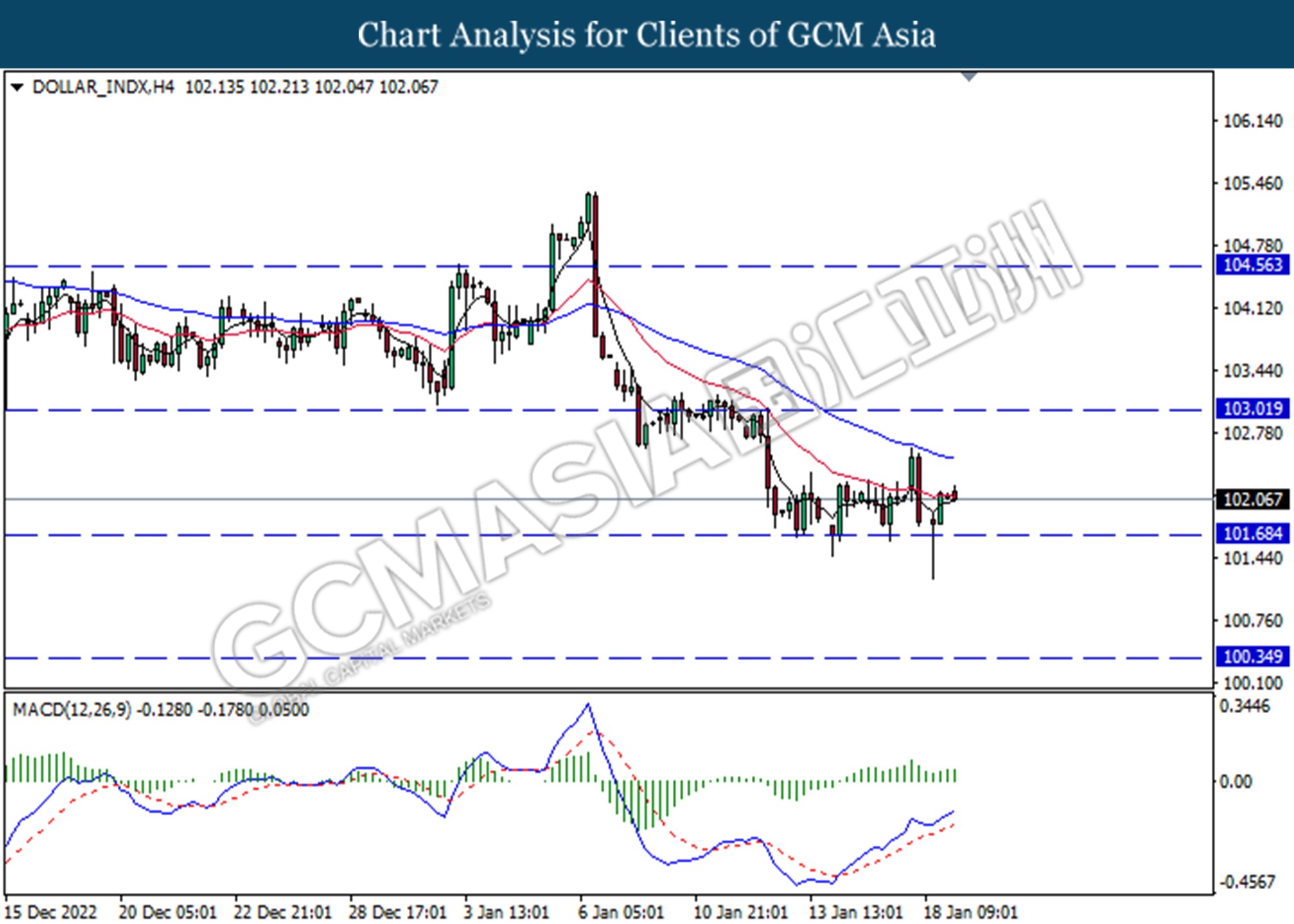

DOLLAR_INDX, H4: Dollar index was traded higher following rebound from the support level at 101.70. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level at 103.00

Resistance level: 103.00, 104.55

Support level: 101.70, 100.35

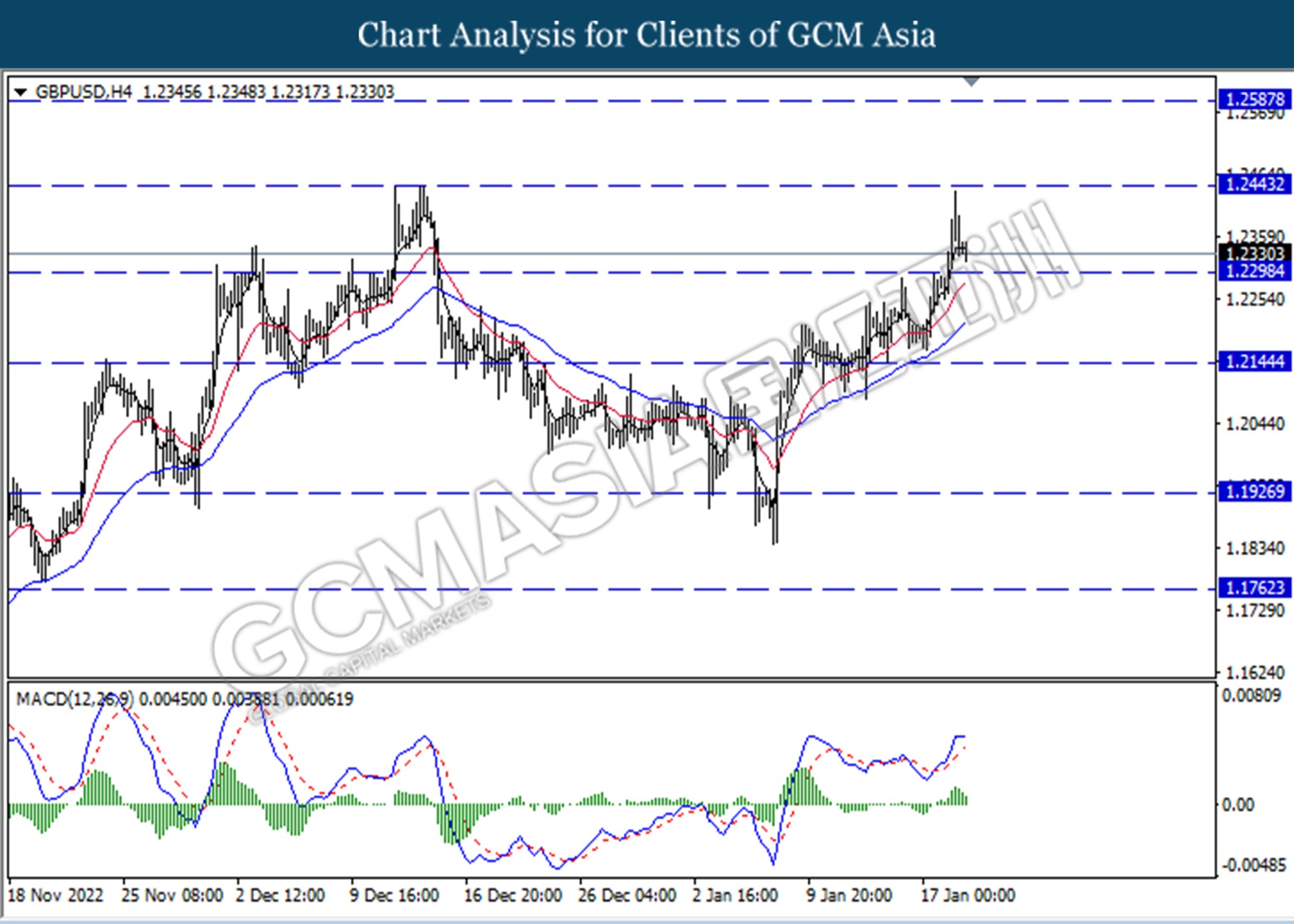

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from resistance level at 1.2450. MACD which illustrated diminishing bullish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2450, 1.2590

Support level: 1.2300, 1.3150

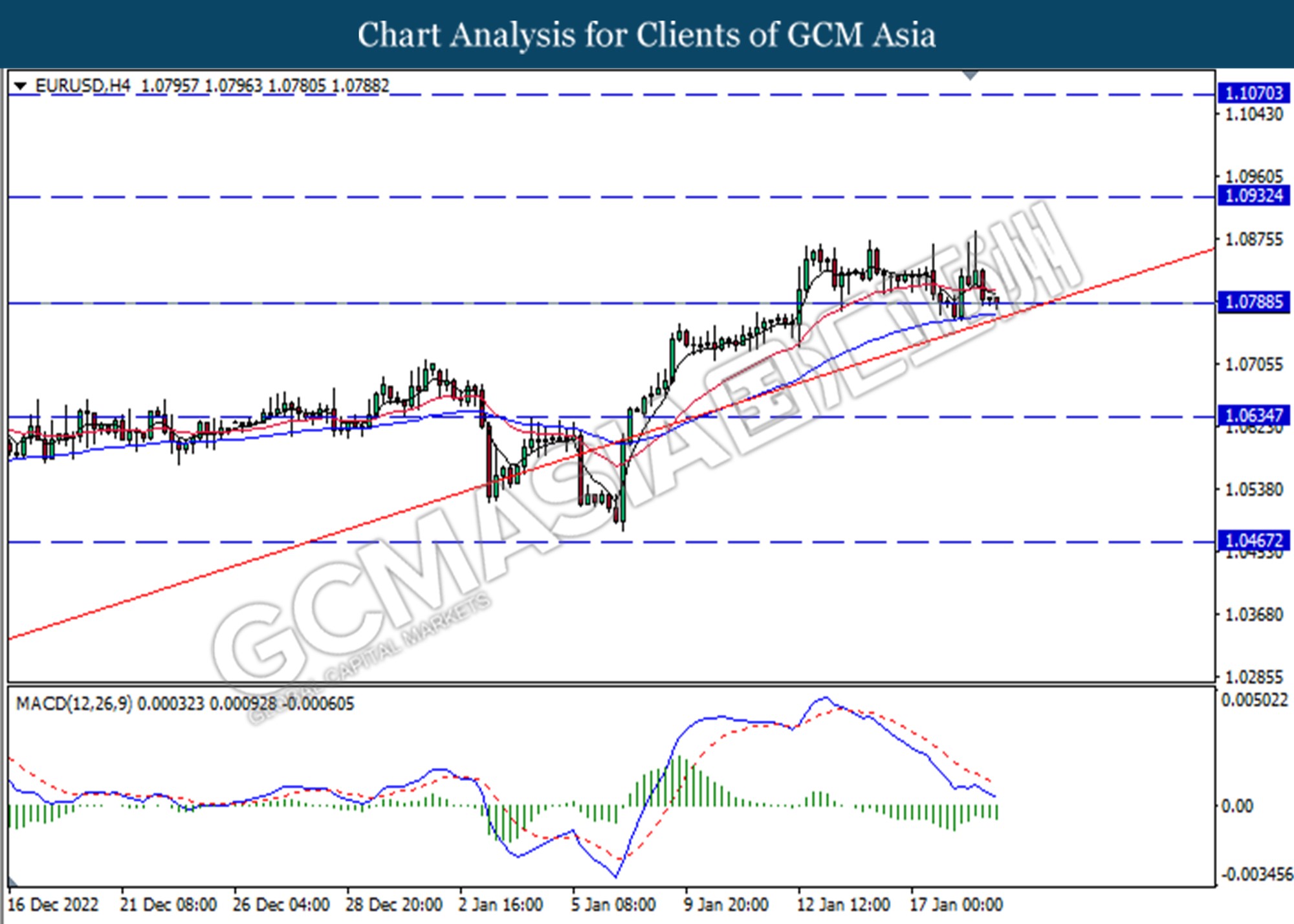

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0790. MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term

Resistance level: 1.0930, 1.1070

Support level: 1.0635, 1.0470

USDJPY, H4: USDJPY was traded lower following a prior breakout below the previous support level at 130.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout above the support level at 128.00

Resistance level: 130.25, 132.30

Support level: 128.00, 126.50

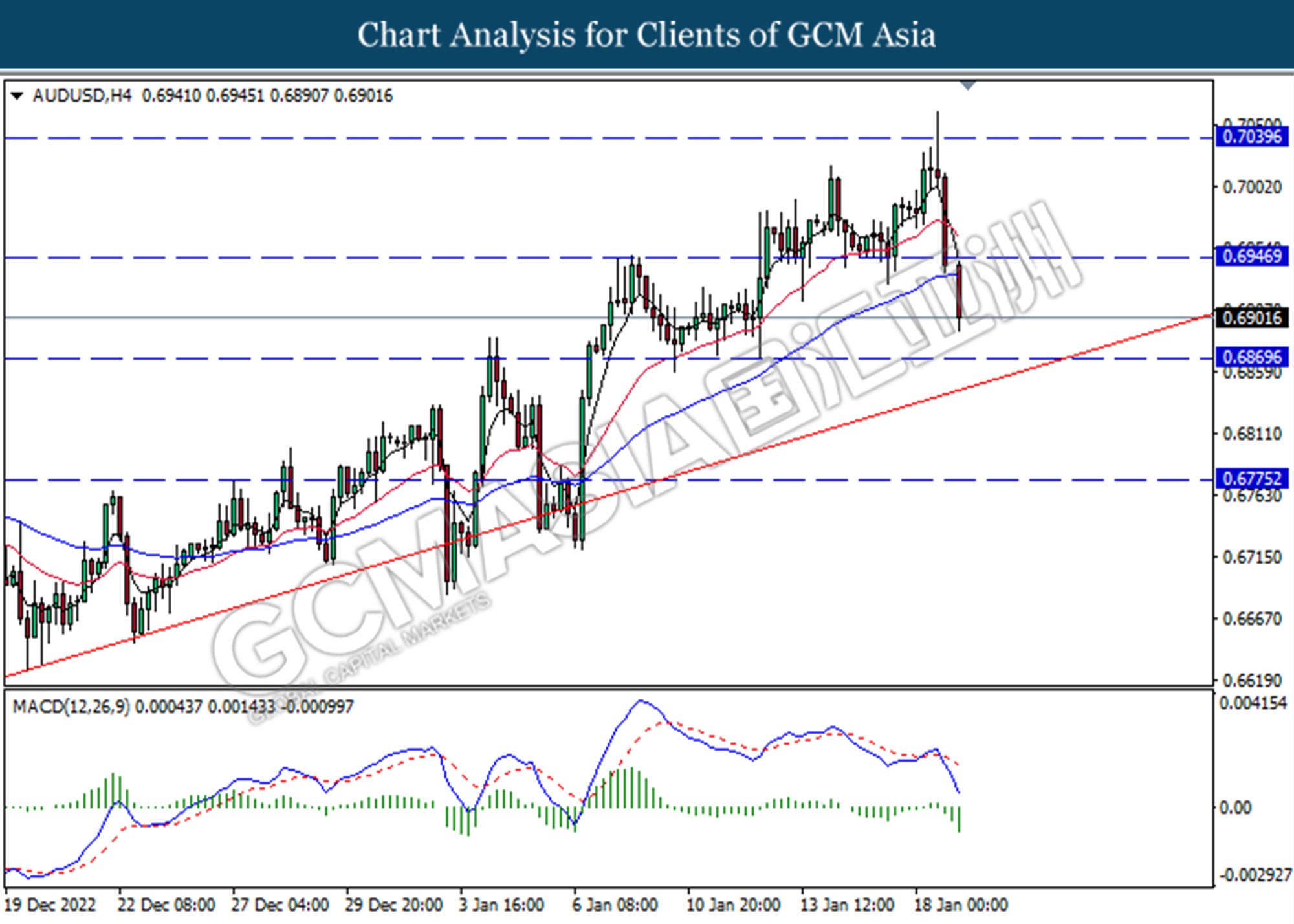

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below from the previous support level at 0.6945. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 0.6870.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

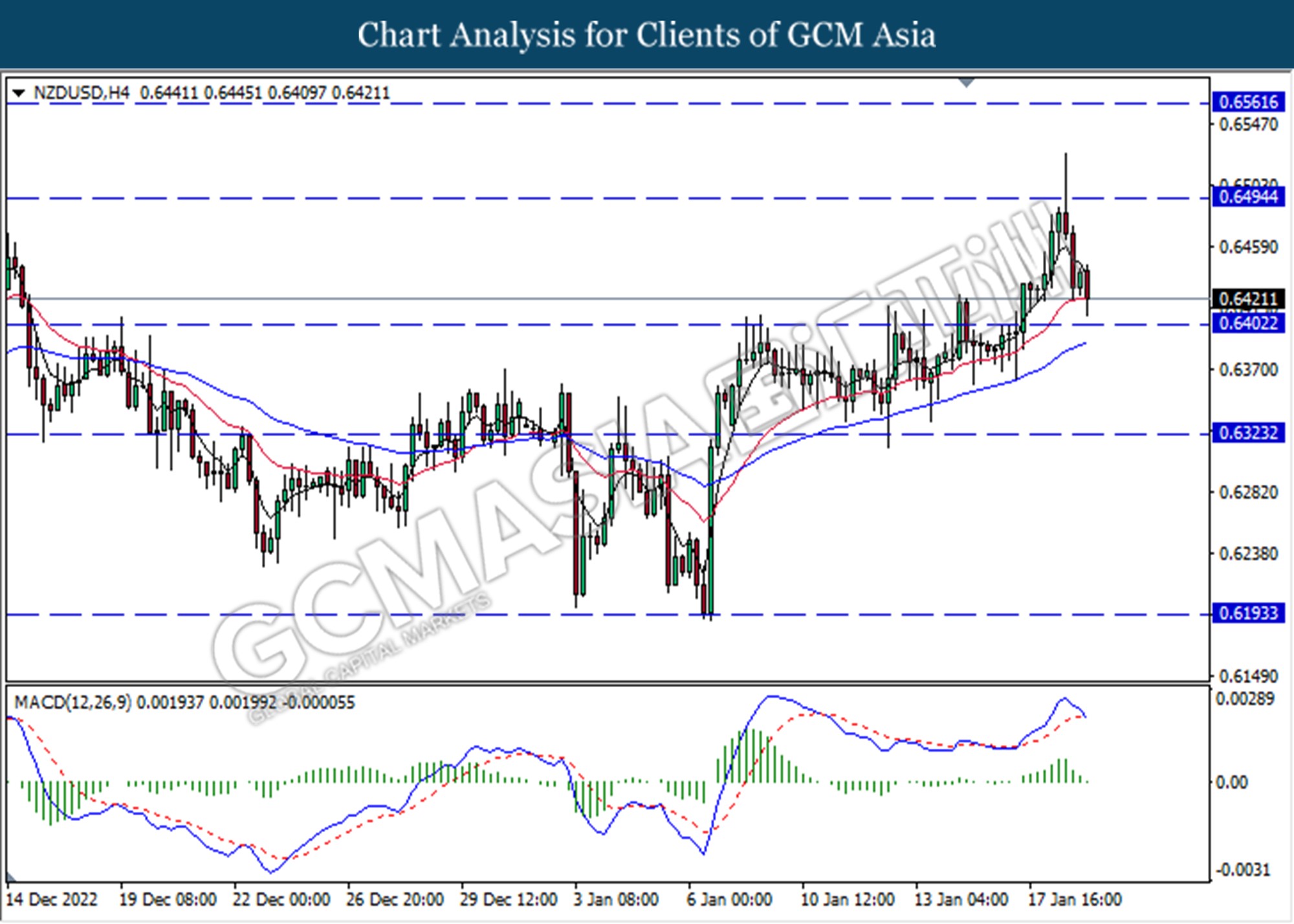

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from the resistance level at 0.6495. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6400.

Resistance level: 0.6495, 0.6560

Support level: 0.6400, 0.6325

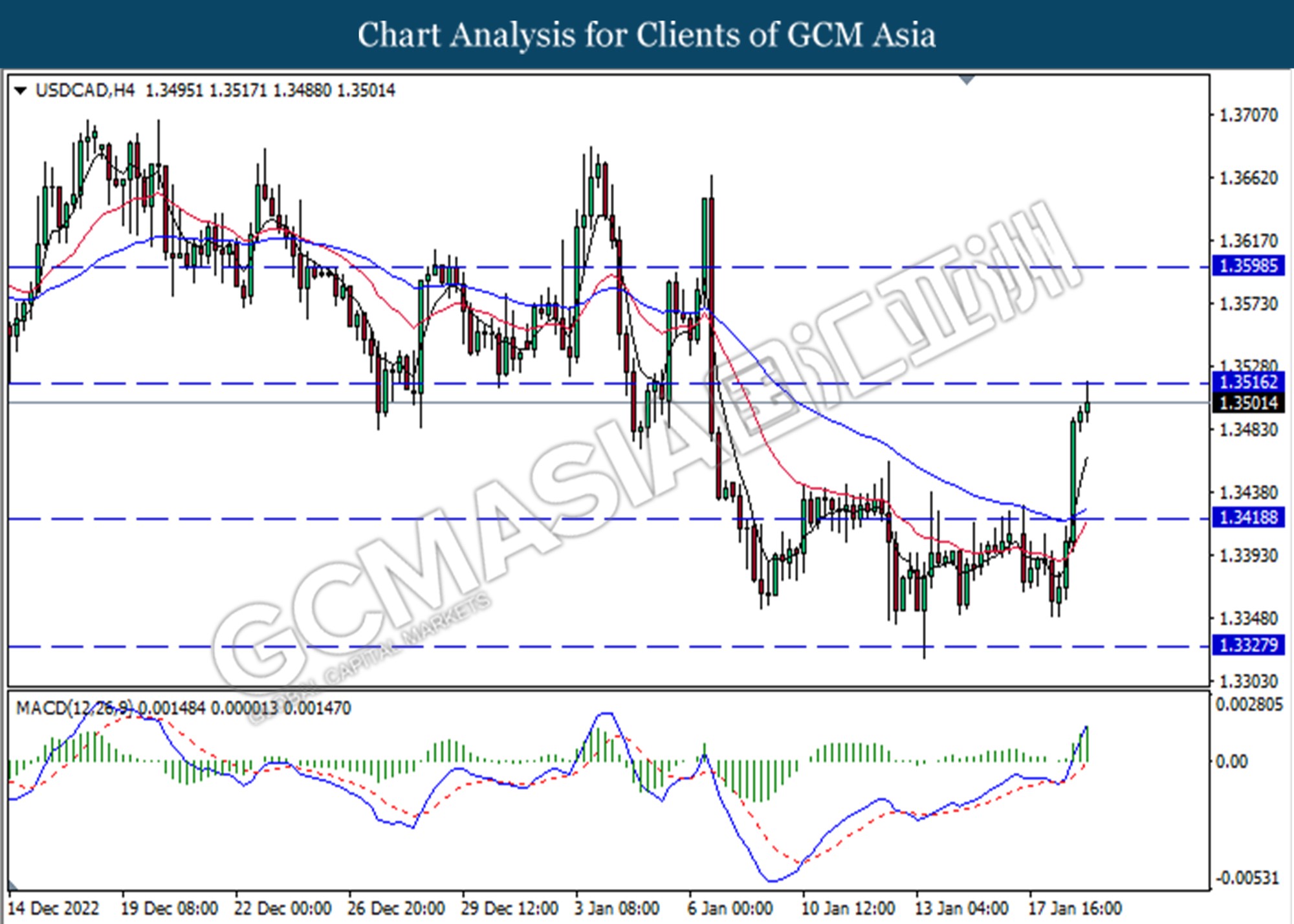

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3515. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

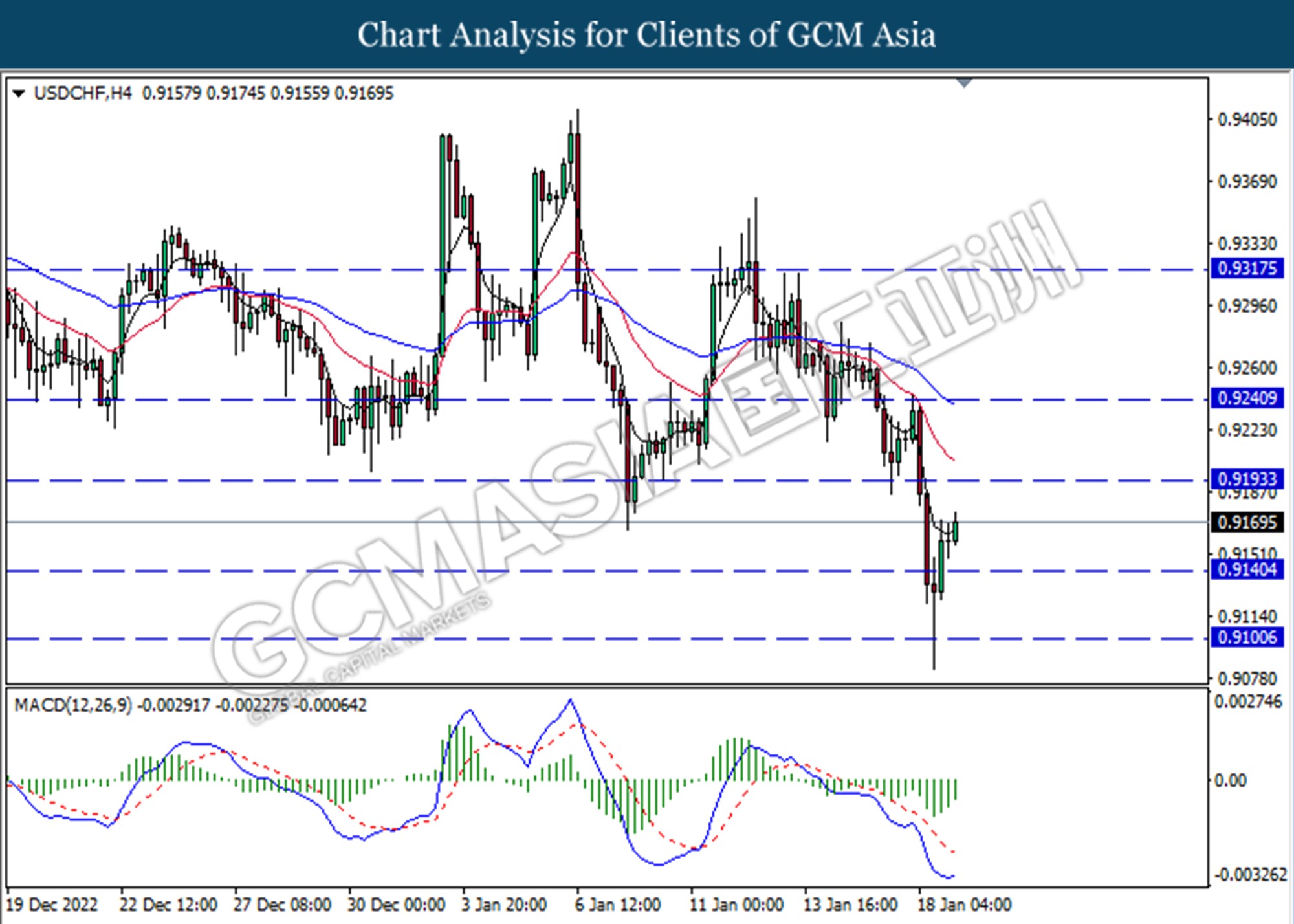

USDCHF, H4: USDCHF was traded higher following a prior rebound from the support level at 0.9140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.9195

Resistance level: 0.9195, 0.9240

Support level: 0.9140, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following the prior breakout below from the previous support level at 81.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 76.05.

Resistance level: 81.60, 85.25

Support level: 76.05, 70.25

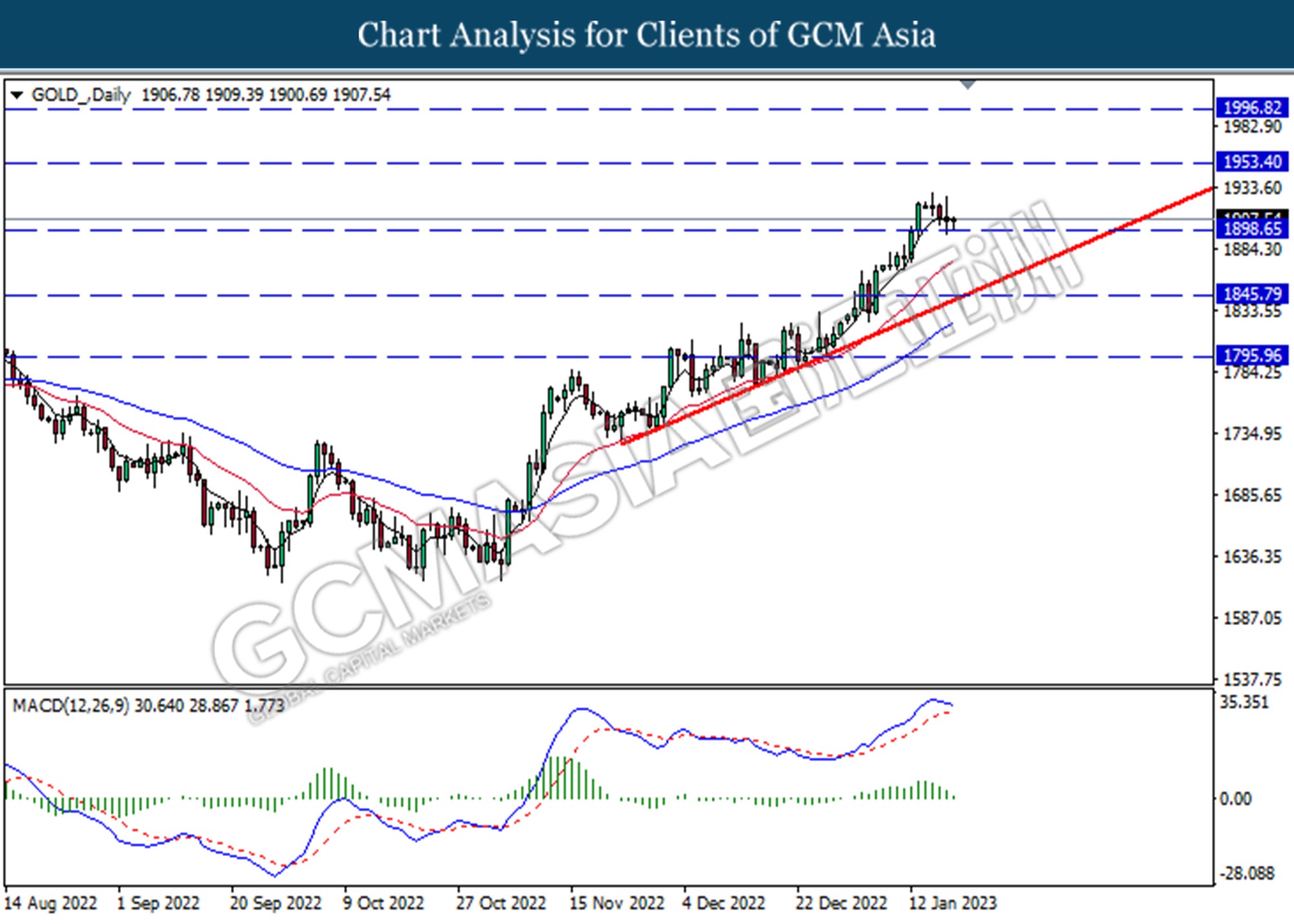

GOLD_, Daily: Gold price was traded lower currently testing the support level at 1898.65. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward if successfully break below the support level.

Resistance level: 1953.40, 1996.90

Support level: 1898.65, 1845.80