19 January 2023 Morning Session Analysis

US Dollar plummeted amid downbeat economic data.

The dollar index, which traded against a basket of six major currencies, slumped as a series of downbeat economic data further diminished the luster of the currency. According to the US Bureau of Labor Statistic, the Producer Price Index (PPI) data dropped from 0.2% to -0.5%, missing the expectation of -0.1%, mirroring the further sign of inflation was receding. The sharp drop in the data was mainly attributed to the decline in the costs of energy products and food. On the other side, the dollar index dropped further after the US Retail Sales data printed the biggest drop since a year ago. The relative data came in at -1.1%, weaker than the consensus forecast at -0.8%, pointing a slower pace of economic growth in US heading into 2023. However, the gains were limited by the hawkish comments from the Fed’s members. Yesterday, St. Louis Fed President James Bullard reiterated that cash rate should be lifted up above 5.0% as soon as possible in order curb the still-high inflation in the nation. As of writing, the dollar index edged up 0.01% to 102.40.

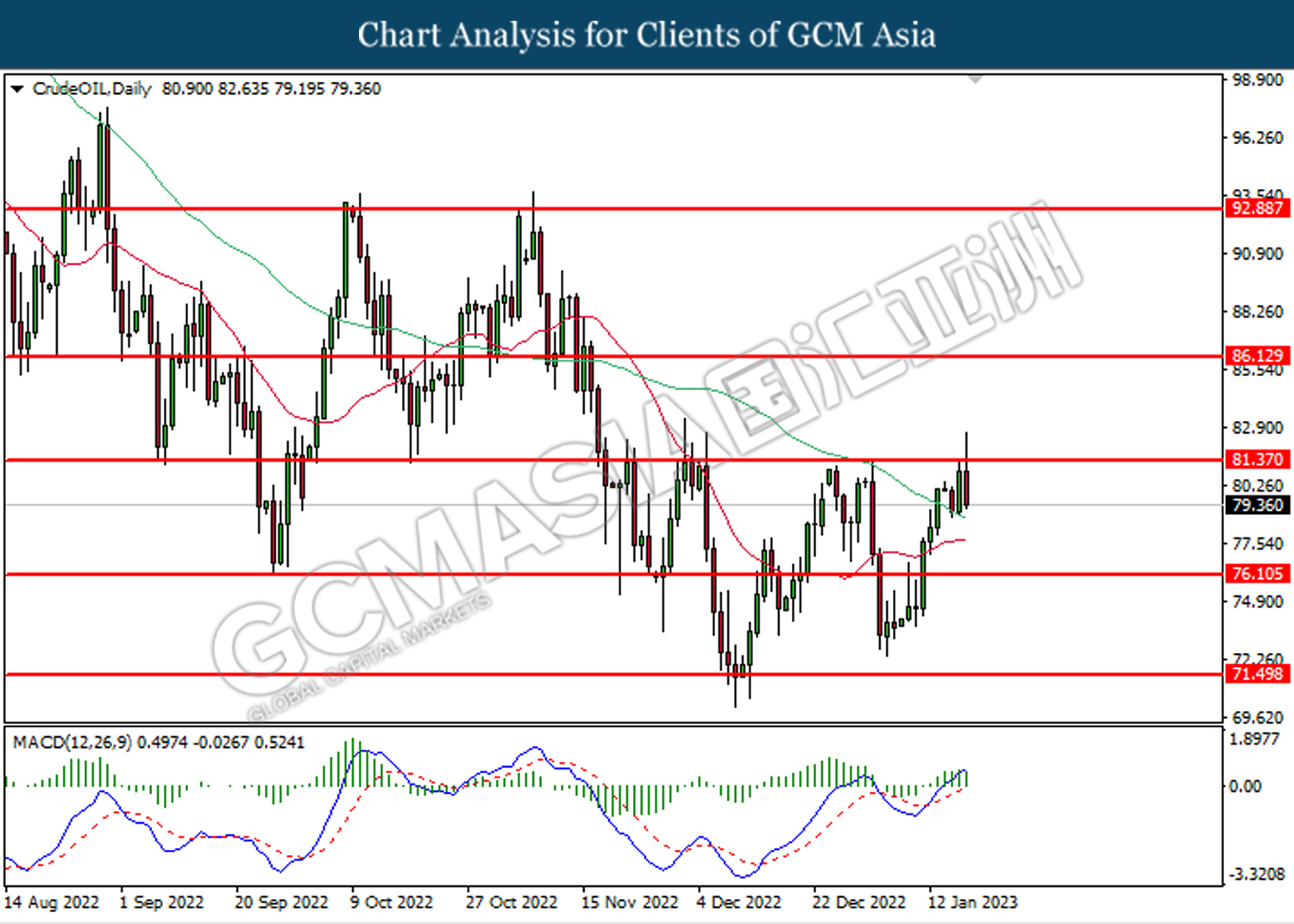

In the commodities market, crude oil prices dived -2.27% to $79.40 per barrel as the hawkish comment from the Fed’s member sparked worries about a possible recession in the US, dampening the prospect of oil market. Besides, gold prices edged down by -0.22% to $1904.35 per troy ounce following the rebound in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:30 EUR ECB President Lagarde Speaks

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Dec) | 1.351M | 1.370M | – |

| 21:30 | USD – Initial Jobless Claims | 205K | 212K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Jan) | -13.8 | -11.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

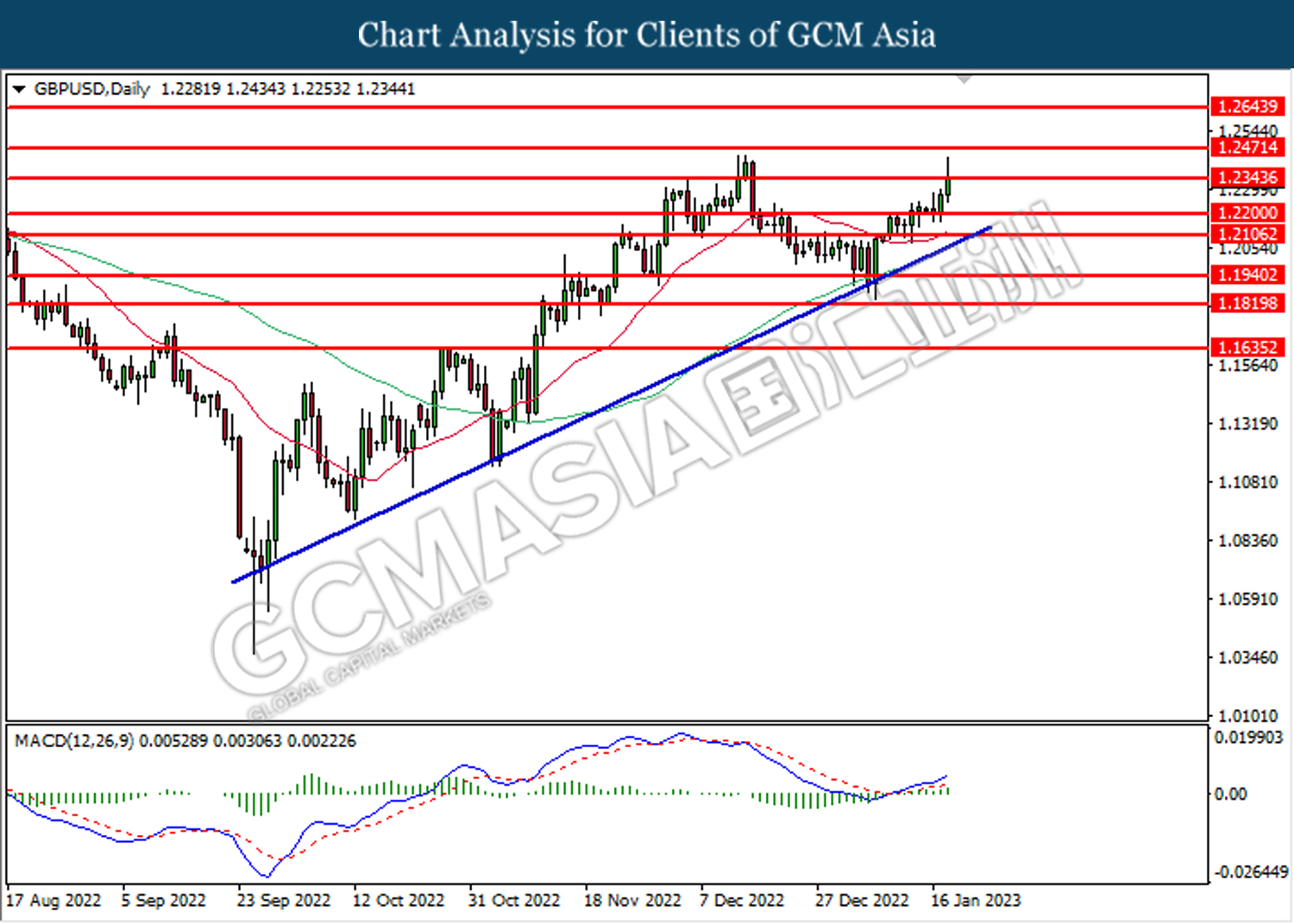

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2345. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

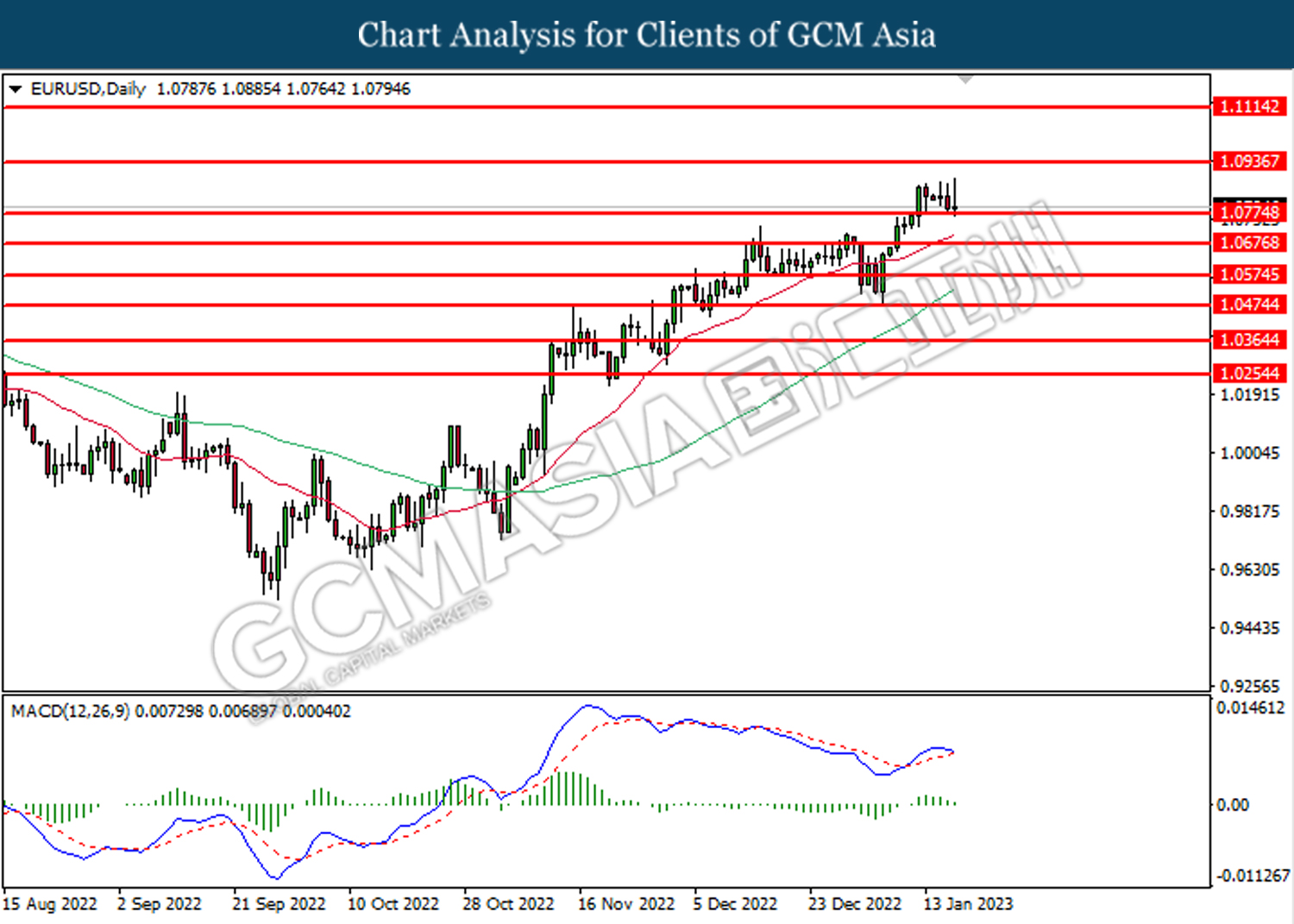

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0775. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0935, 1.1115

Support level: 1.0775, 1.0675

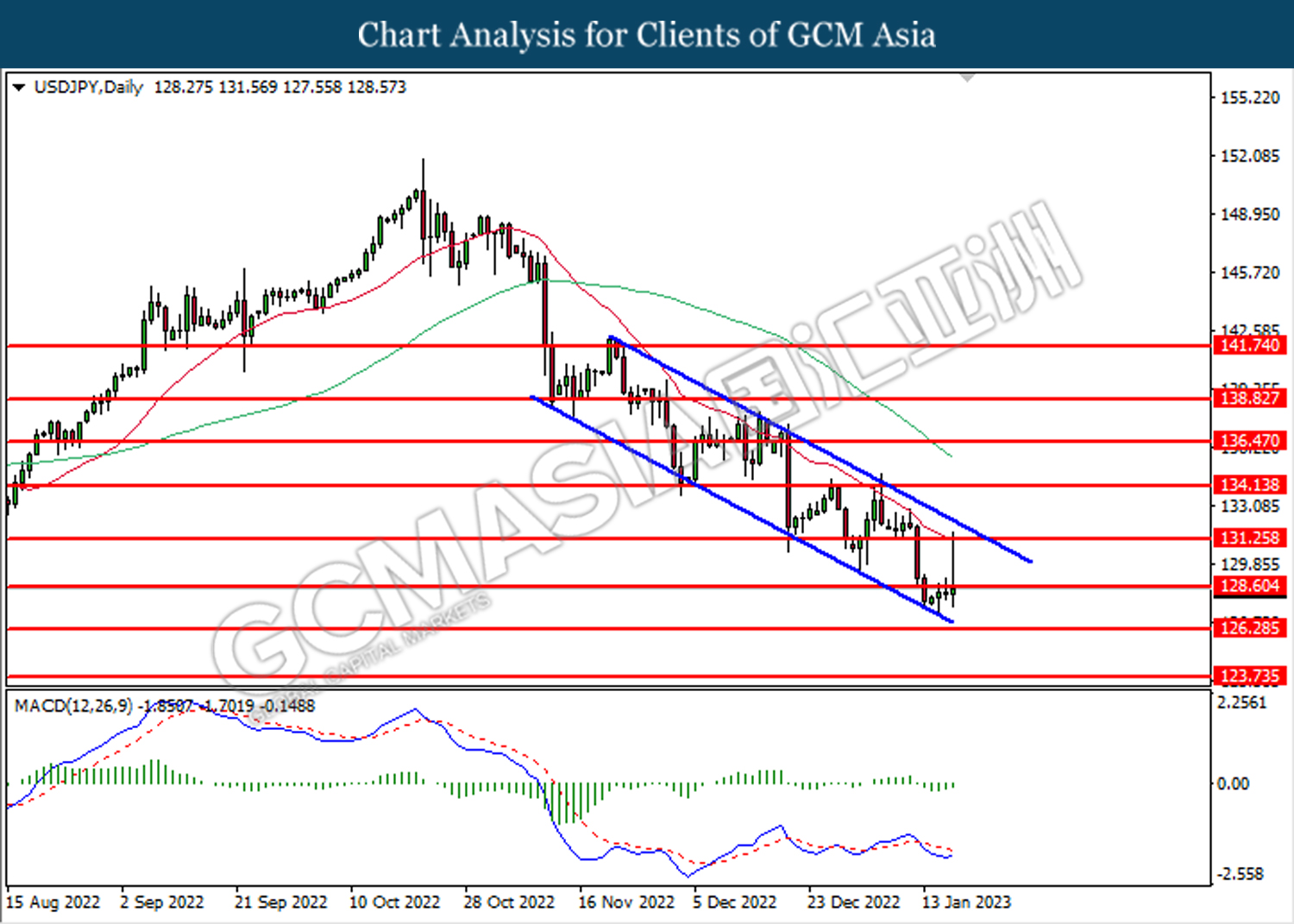

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 128.60. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 128.60.

Resistance level: 128.60, 131.25

Support level: 126.30, 123.75

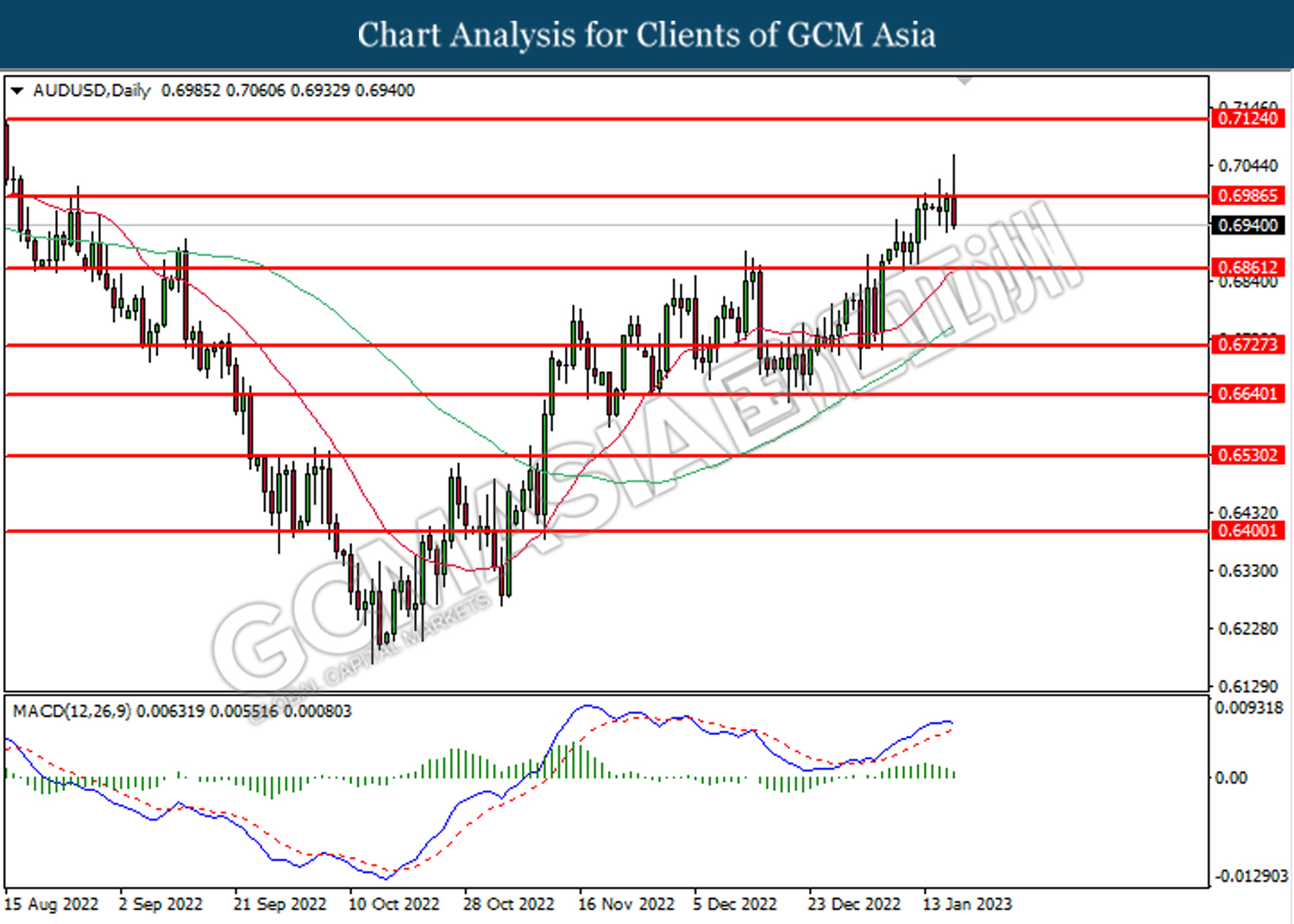

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6985. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

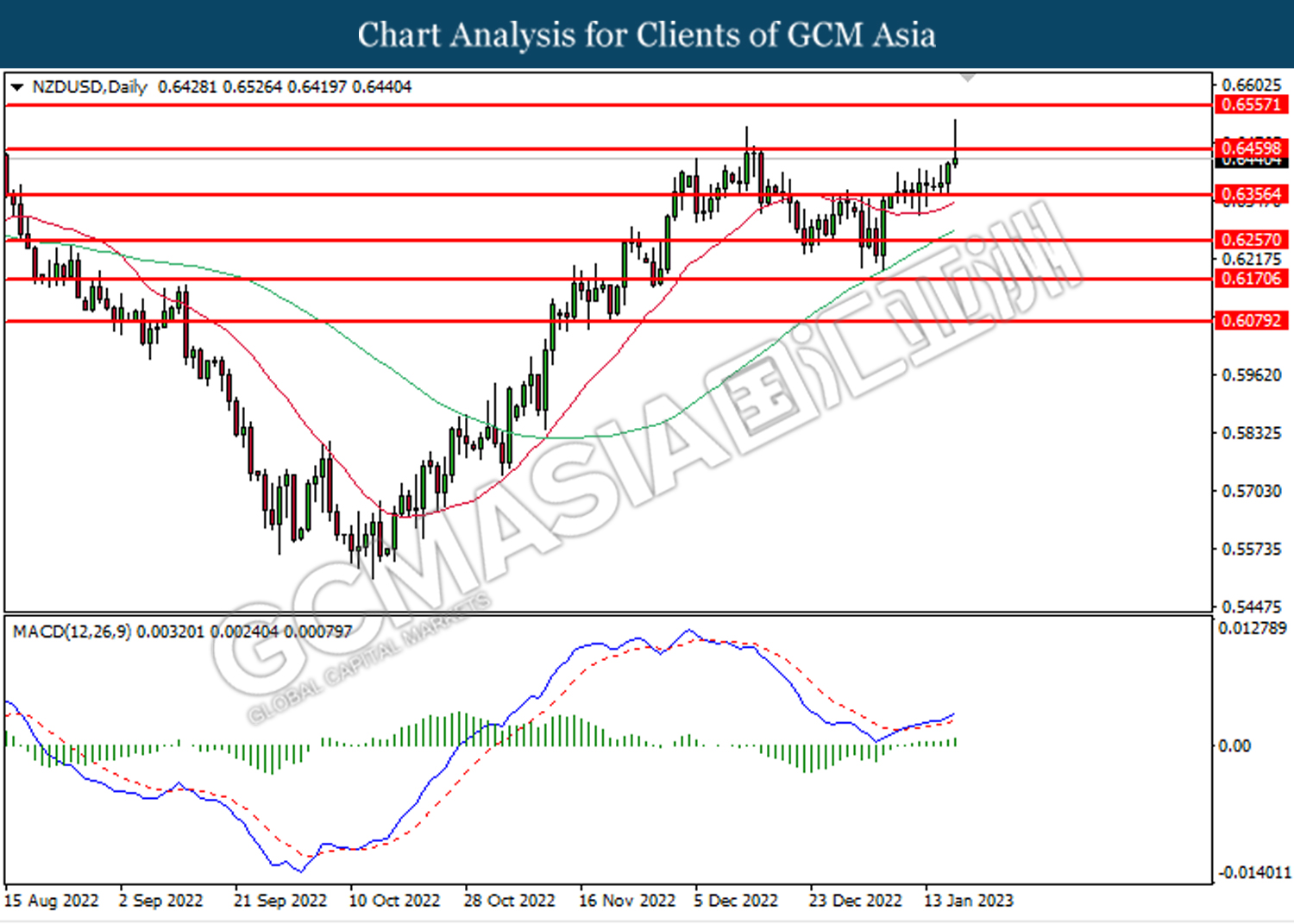

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

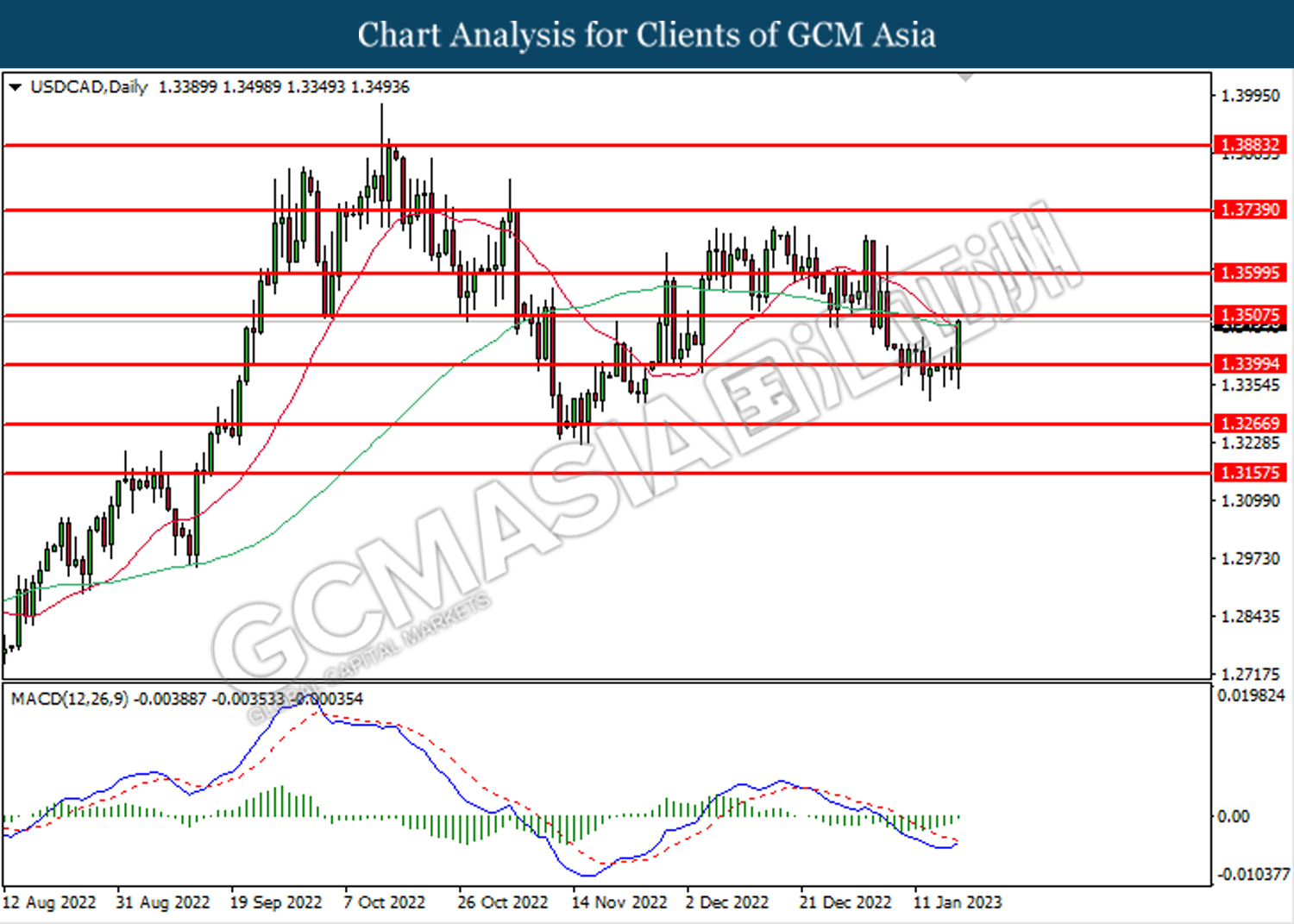

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3505. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

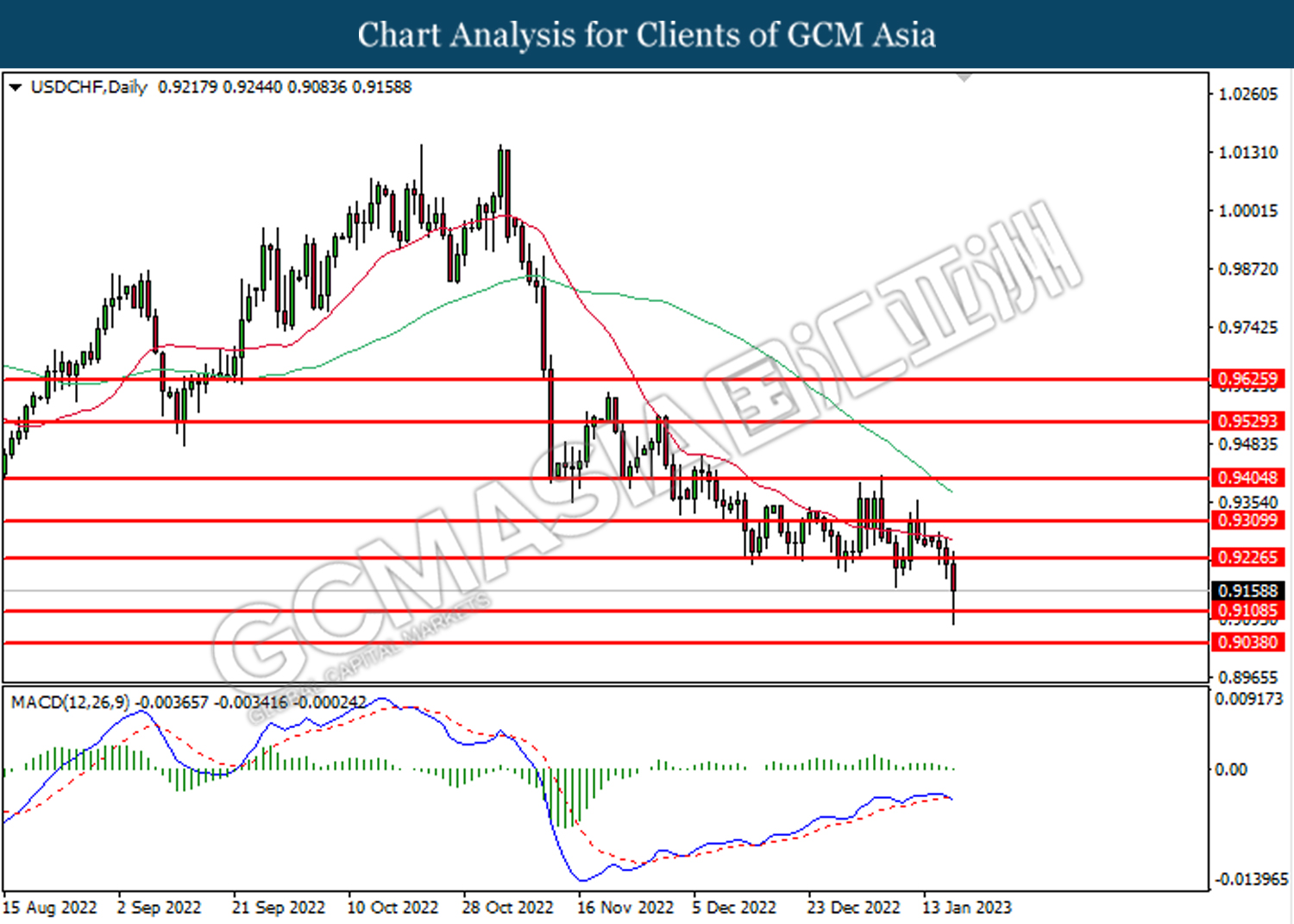

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9110. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 81.35. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 81.35, 86.15

Support level: 76.10, 71.50

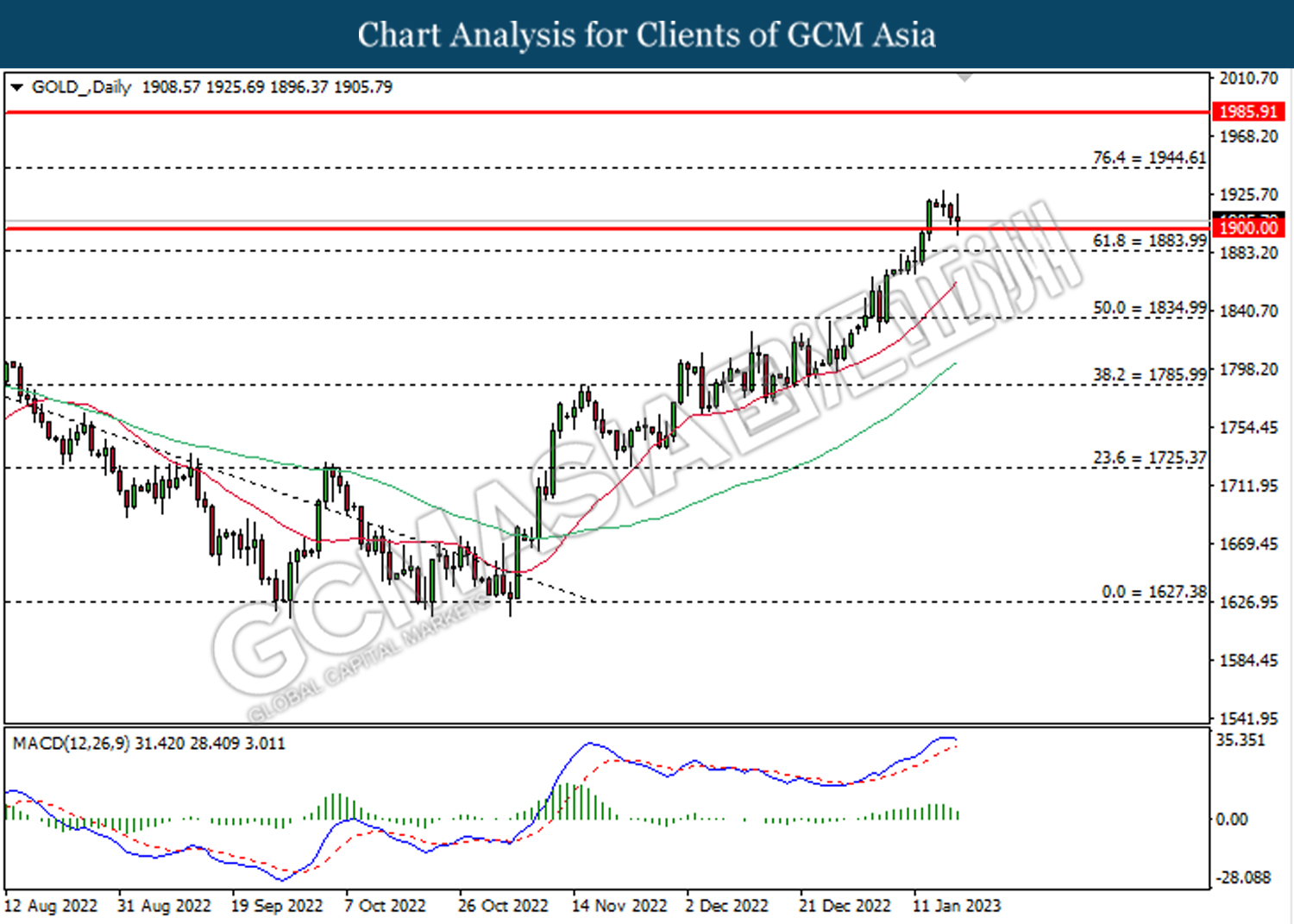

GOLD_, Daily: Gold price was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1900.00.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00