19 June 2020 Morning Session Analysis

Diminishing risk appetite spurred demand for safe-haven dollar.

The dollar index which measured its value against a basket of six major currency pairs extend its bullish momentum amid unstoppable rising in new coronavirus cases globally had diminished risk appetite in the FX market, which prompting the investors to shift their portfolio toward safe-haven asset such as US Dollar. According to Reuters, a surge in new infections in several U.S. states and the imposition of movement control in Beijing to combat a new outbreak have spurred the fears upon the risks of reopening economic activity before a vaccine has been fully developed. On the U.S. economic data front, the US Dollar received further bullish momentum over the backdrop of the positive manufacturing data from the United States region. The Philadelphia Fed Manufacturing Index notched up significantly from the previous reading of -43.1 to 27.5, better than the economist forecast at -23.0, reported by Federal Reserve Bank of Philadelphia. Nonetheless, the gains experienced by the dollar index was limited following the negative job data was released. The Department of Labor from United States reported that the U.S. Initial Jobless Claims came in at 1,508K, which worse than the economist forecast at 1,300K while supporting prospect that the global economy would be facing a long and difficulty recovery from the COVID-19 recession. As of writing, the dollar index surged 0.30% to 97.35.

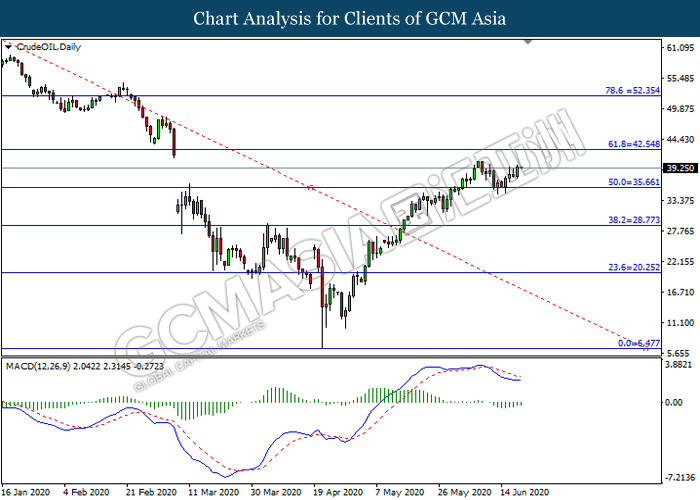

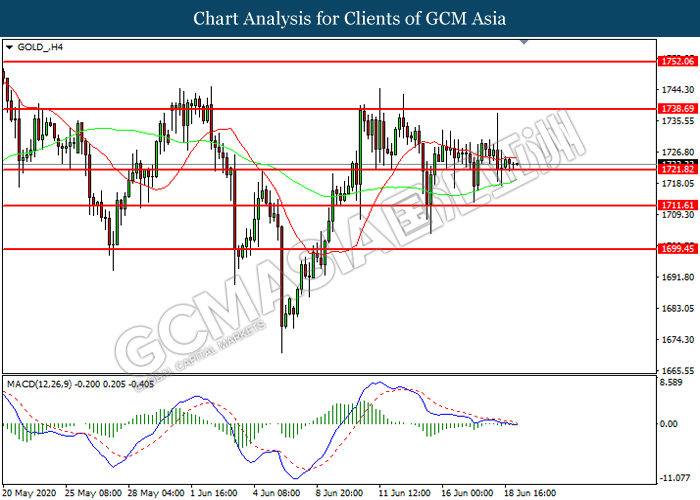

In the commodity market, the crude oil price surged 0.72% to $39.34 per barrel as of writing. The oil market edged higher following the oil producers who cheated on output cuts initially pledged to the OPEC+ alliance to extend their production cut during their video meeting on Thursday. On the other hand, the gold market surged 0.03% to $1723.53 per troy ouns as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (May) | -18.1% | 5.8% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (May) | -0.4% | -12.8% | – |

| 01:00

(20th) |

CrudeOIL – US Baker Hughes Oil Rig Count | 199 | – | – |

Technical Analysis

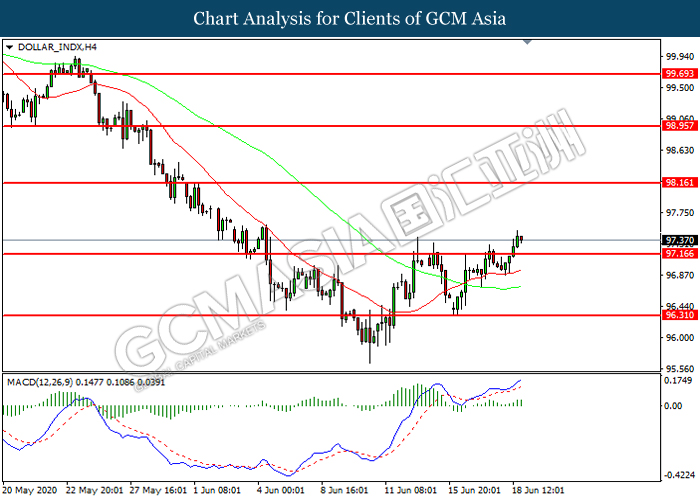

DOLLAR_INDX, H4: Dollar index was higher following prior breakout above the previous resistance level at 97.15. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 98.15.

Resistance level: 98.15, 98.95

Support level: 97.15, 96.30

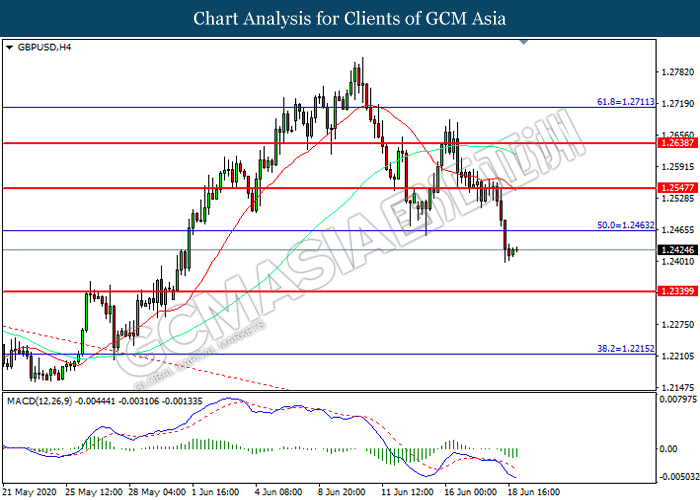

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.2465. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2545, 1.2640

Support level: 1.2340, 1.2215

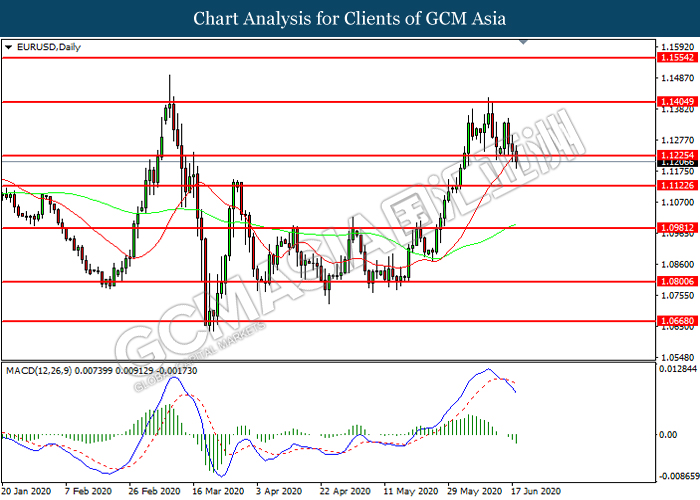

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1225. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1125.

Resistance level: 1.1225, 1.1405

Support level: 1.1125, 1.0980

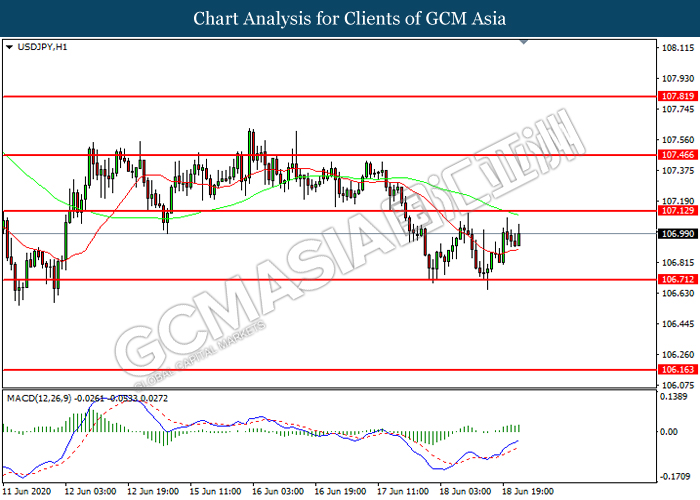

USDJPY, H1: USDJPY was traded higher while currently near the resistance level at 107.15. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.15, 107.45

Support level: 106.70, 106.15

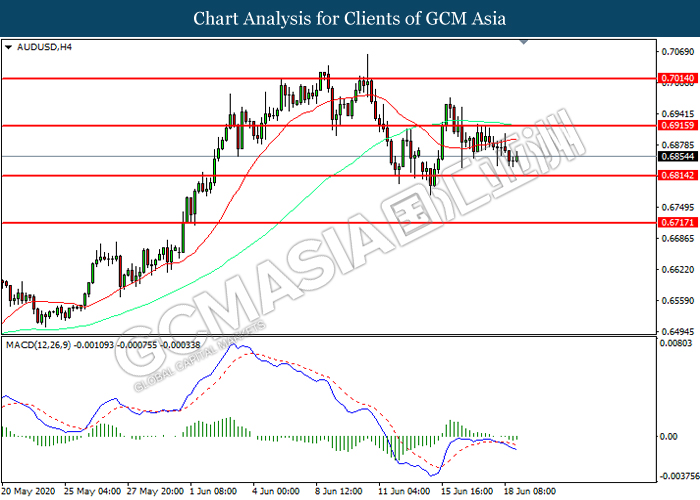

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.6915. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6915, 0.7015

Support level: 0.6815, 0.6715

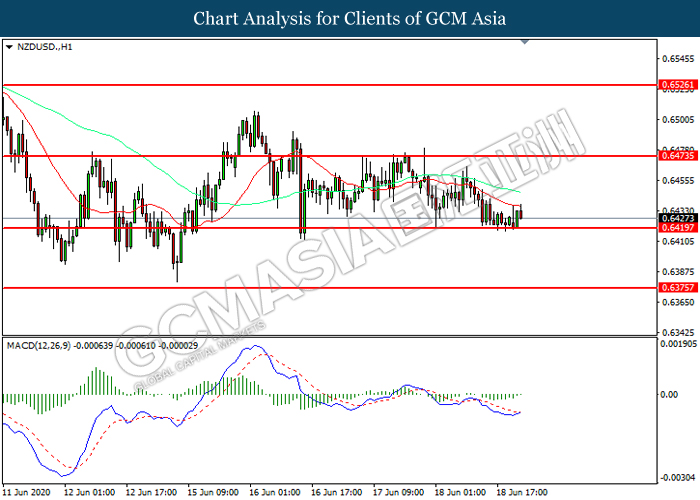

NZDUSD, H1: NZDUSD was traded lower while currently testing the support level at 0.6420. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6475, 0.6525

Support level: 0.6420, 0.6375

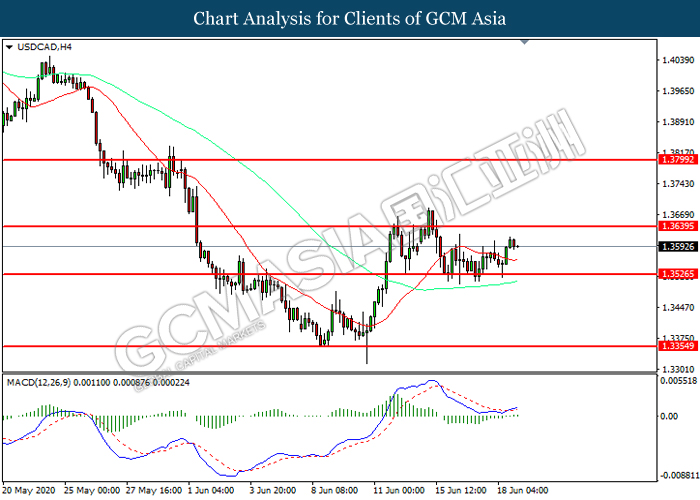

USDCAD, H4: USDCAD was higher following prior rebound from the support level at 1.3525. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3640.

Resistance level: 1.3640, 1.3800

Support level: 1.3525, 1.3355

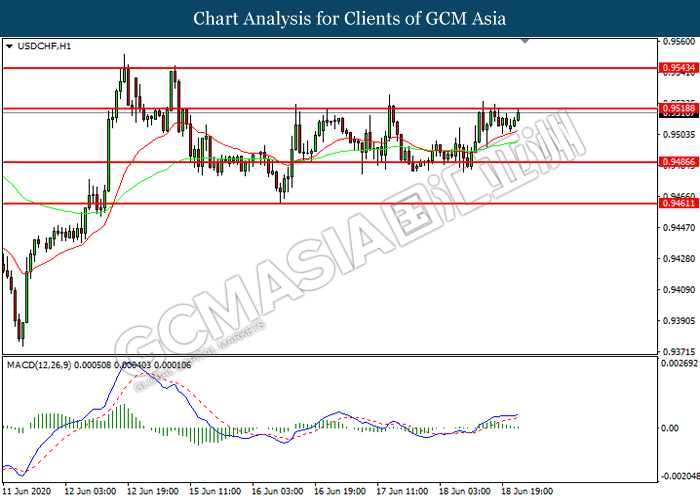

USDCHF, H1: USDCHF was traded higher while currently testing the resistance level at 0.9520. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9520, 0.9545

Support level: 0.9485, 0.9460

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 35.65. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 42.55.

Resistance level: 42.55, 52.35

Support level: 35.65, 28.75

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1721.80. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1738.70, 1752.05

Support level: 1721.80, 1711.60