19 July 2021 Afternoon Session Analysis

Aussie plunged amid Covid woes.

The Australian dollar which traded against the dollar and other currency pair have continue to extend its losses following increasing concerns towards Covid-19 situation in the Australia. According to ABC News, while the number of daily covid cases in Australia eased from the highest since September 2020 during the weekend, total cases in Australia’s state Victoria have added another 16 new cases to 280 while New South Wales also reported new 105 new cases. Following surging cases, some of the states such as Sydney and Victoria continue to extend lockdown that may affect economic recovery. Due to the situation, Australia PM Scott Morrison’s approval rating slumped to the lowest in over a year. At the time of writing, AUD/USD fell 0.35% to 0.7375.

In the commodities market, crude oil price fell 1.05% to $70.44 per barrel as of writing after OPEC+ reach an agreement on boosting supply. On Sunday, the OPEC+ ministers have agreed to increase oil supply around 400,000 barrels per day starting from August. The agreement has sparked concerns of inventory surplus after Covid-19 infections continue to spread in many countries. On the other hand, gold price has slip 0.02% to $1812.19 a troy ounce at the time of writing amid ongoing dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

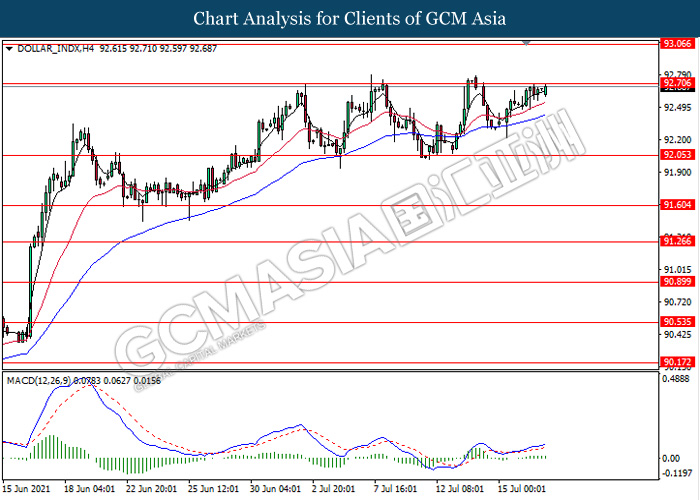

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level 92.70. MACD which ongoing illustrate bullish momentum signal with the formation of golden cross suggest the dollar to extend its gains after it breaks above the resistance level.

Resistance level: 92.70, 93.05

Support level: 92.05, 91.60

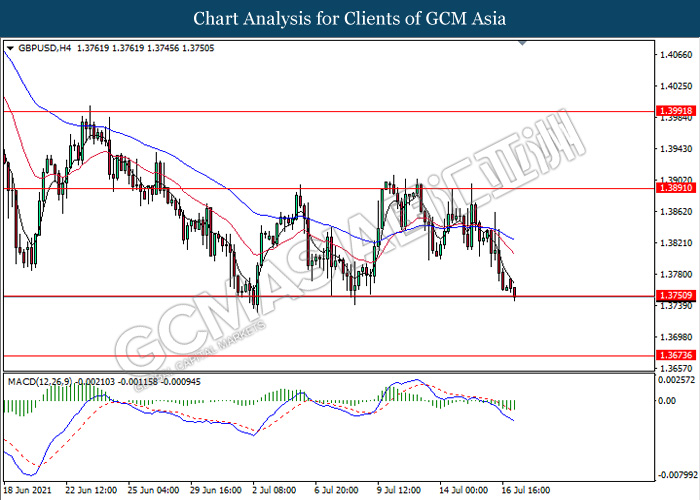

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.3750. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.3890, 1.3990

Support level: 1.3750, 1.3675

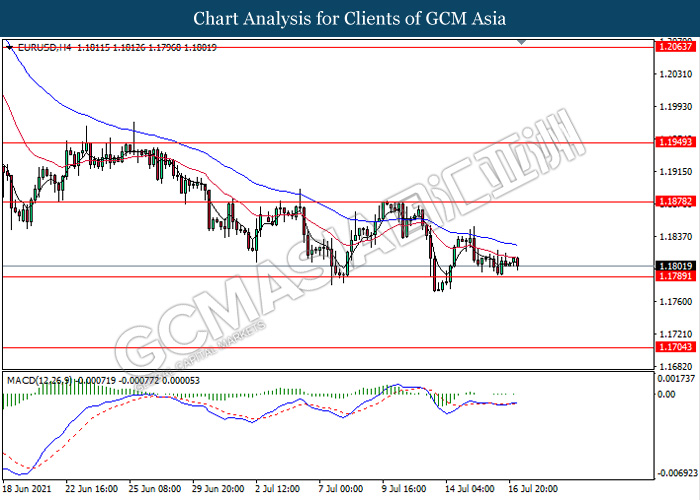

EURUSD, H4: EURUSD was traded lower while currently testing near the support level 1.1790. However, due to lack of momentum and clear direction from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 1.1880, 1.1950

Support level: 1.1790, 1.1705

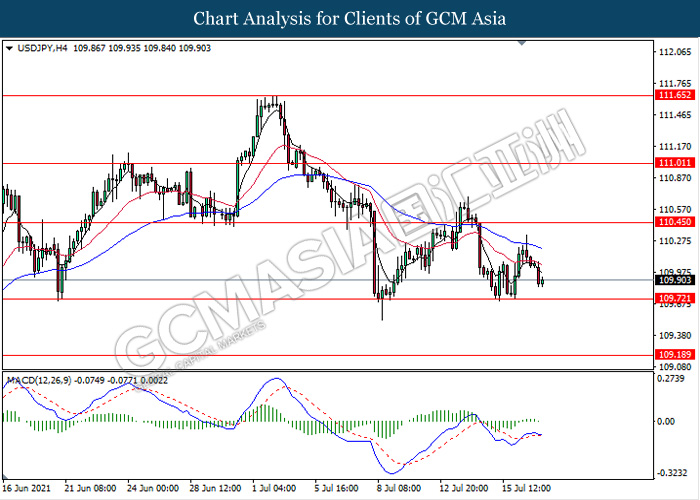

USDJPY, H4: USDJPY was traded lower while currently testing near the support level 109.70. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 110.45,111.00

Support level: 109.70, 109.20

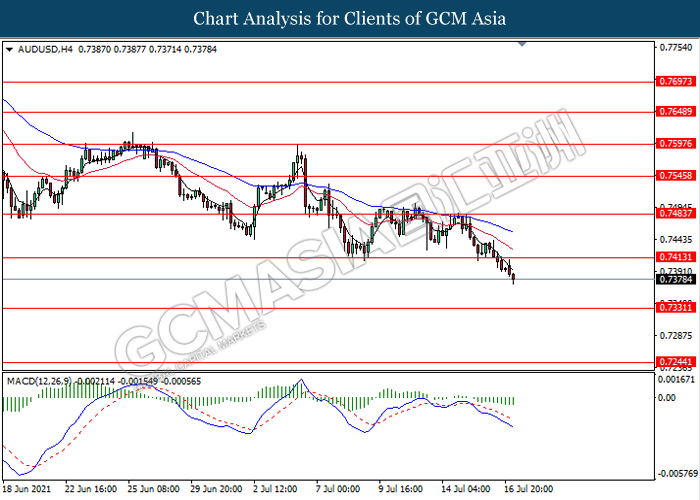

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the support level 0.7415. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses towards the support level 0.7330.

Resistance level: 0.7415, 0.7485

Support level: 0.7330, 0.7245

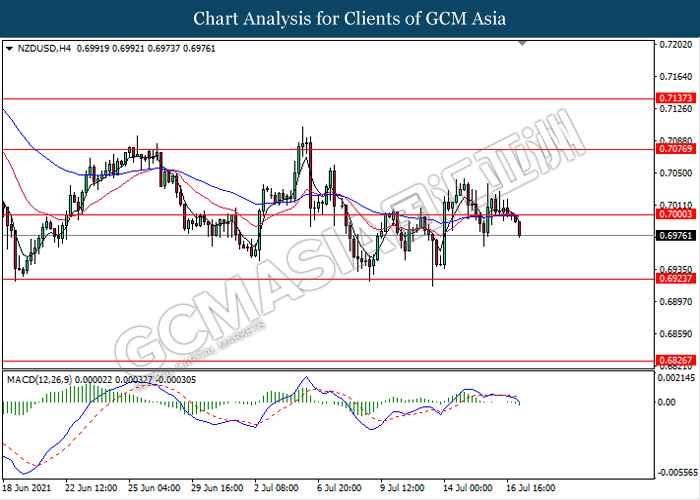

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level 0.7000. MACD which illustrate bearish momentum signals suggest the pair to extend its losses towards the support level 0.6925.

Resistance level: 0.7000, 0.7075

Support level: 0.6925, 0.6825

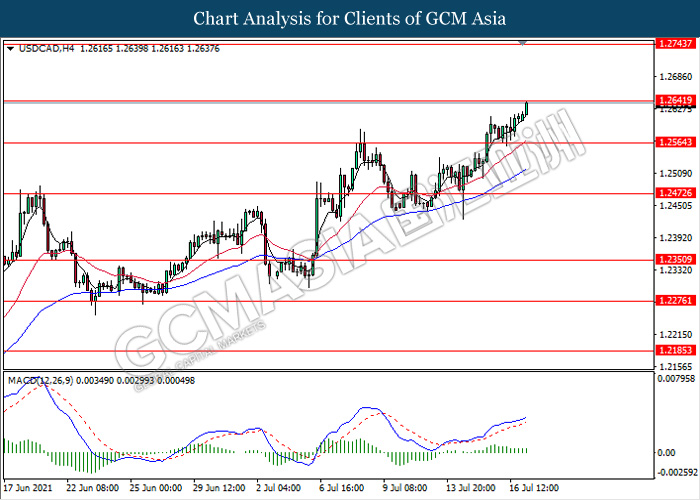

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level 1.2640. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 1.2640, 1.2745

Support level: 1.2565, 1.2470

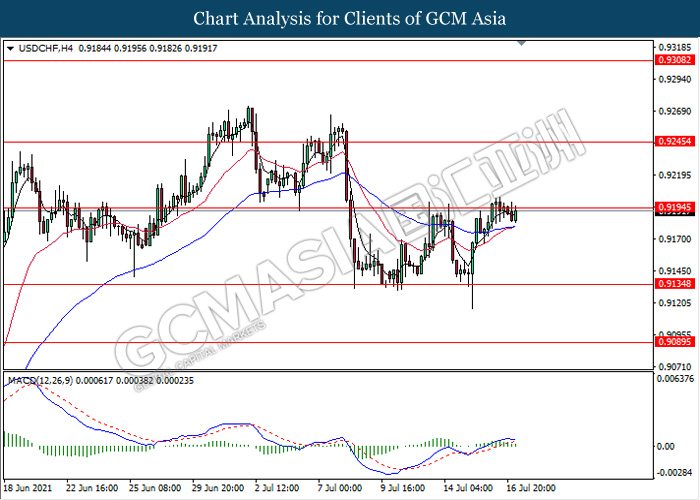

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9195. However, MACD which illustrate diminishing bullish momentum signals suggest the pair to be traded lower as a technical correction towards the support level 0.9135.

Resistance level: 0.9195, 0.9245

Support level: 0.9135, 0.9090

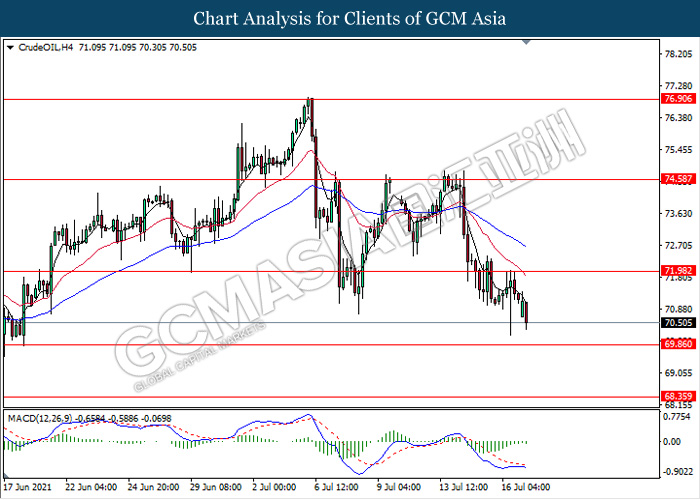

CrudeOIL, H4: Crude oil price was traded lower while currently testing the near support level 69.85. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 72.00, 74.60

Support level: 69.85, 68.35

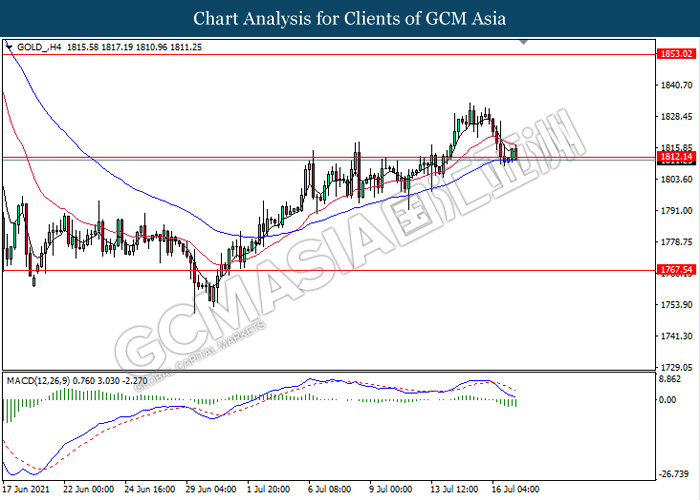

GOLD_, H4: Gold price was traded lower while currently testing the support level 1812.15. MACD which illustrate bearish bias signal suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 1853.00, 1885.35

Support level: 1812.15, 1767.55.