20 January 2021 Afternoon Session Analysis

Dollar plunged following comments from Yellen on COVID-19 relief.

During late Asian session, the dollar index which traded against a basket of six major currency pairs have fell following investors are digesting the recent comments from U.S Secretary of Treasury nominee Janet Yellen on big spending. During her Senate confirmation hearing on Tuesday, Janet Yellen has urged Congress to “act big” on COVID-19 relief and worry about debt later arguing that the economic benefits far outweigh the risks of a higher debt burden. Besides that, she also added that the dollar’s value should be determined by market force and U.S should oppose any attempts by other countries to manipulate the currency values. The comments have help mitigate the risk aversion tone and knocking down the appeal of the greenback as a safe-haven currency. As Joe Biden is inaugurated as U.S President later in the day, investors will now shift their focus on the event to attain any signals for the market. At the time of writing, dollar index slips 0.14% to 90.30.

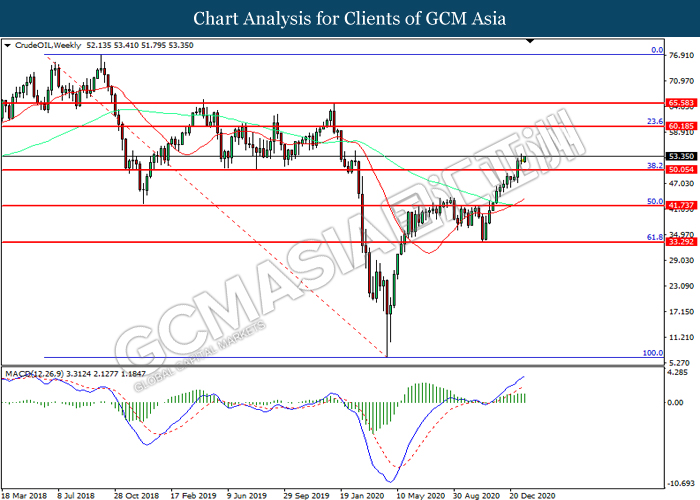

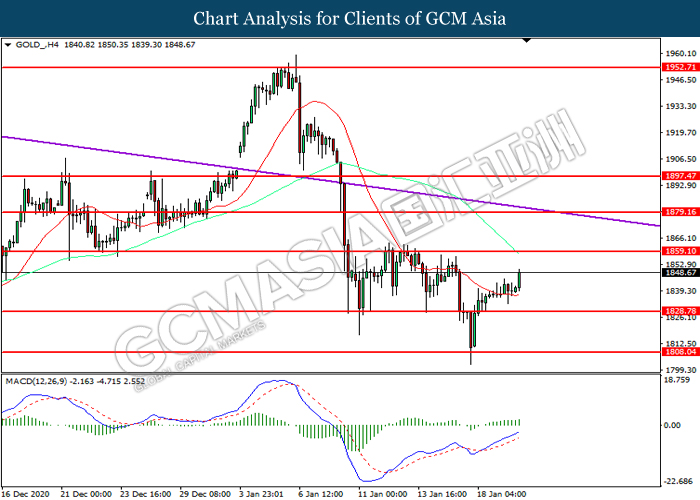

In the commodities market, crude oil price rose 0.70% to $53.34 per barrel as of writing following expectation of U.S stimulus continue to support the sentiment. Following the inauguration of Joe Biden as president and big spending comments from Janet Yellen, expectation of incoming Joe Biden administration will push through more, massive U.S. stimulus measures boosted hopes for fuel demand, thus pushing the price of the commodity. On the other hand, gold price extends gains and rose 0.49% to $1849.18 a troy ounce at the time of writing following dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Monetary Policy Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Dec) | 0.3% | 0.5% | – |

| 18:00 | EUR – CPI (YoY) (Dec) | -0.3% | -0.3% | – |

| 21:30 | CAD – Core CPI (MoM) (Dec) | 0.2% | – | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

Technical Analysis

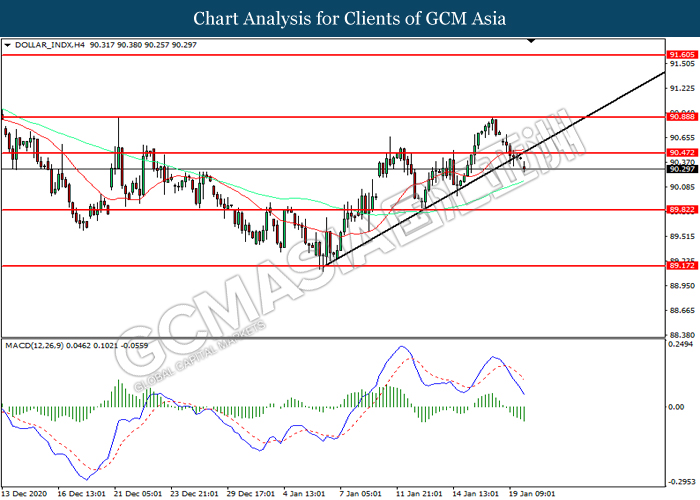

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 90.45. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 89.80.

Resistance level: 90.45, 90.90

Support level: 89.50, 89.15

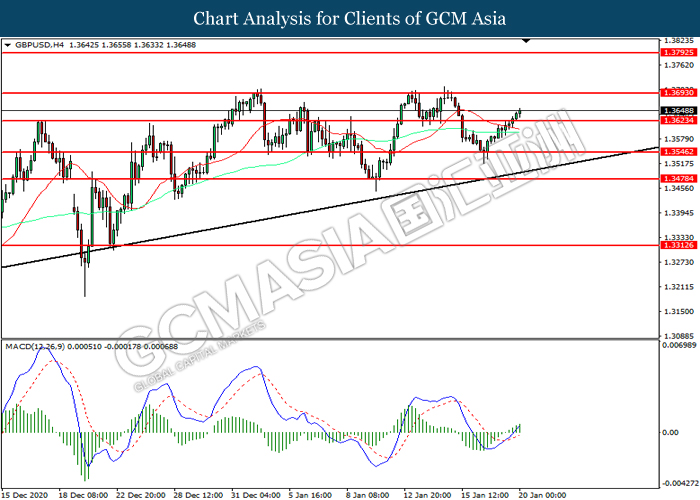

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3695.

Resistance level: 1.3695, 1.3795

Support level: 1.3625, 1.3545

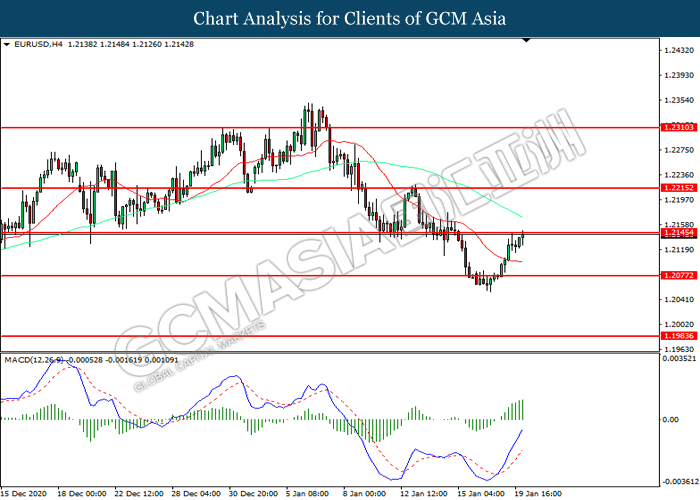

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.2145. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2145, 1.2215

Support level: 1.2075, 1.1985

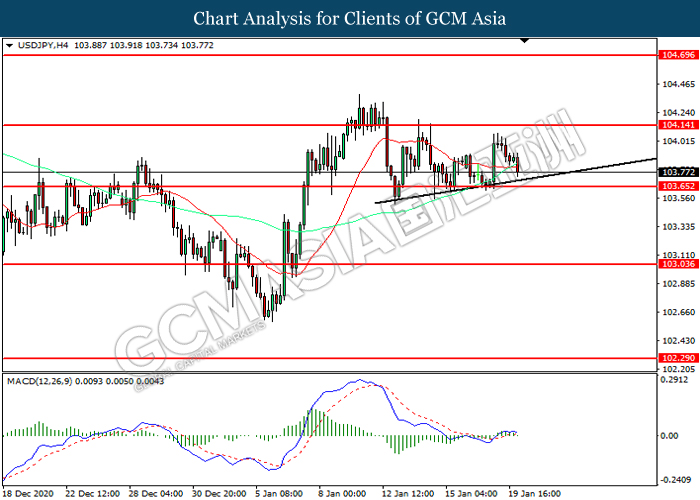

USDJPY, H4: USDJPY was traded lower while currently near the support level at 103.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 104.15, 104.70

Support level: 103.65, 103.05

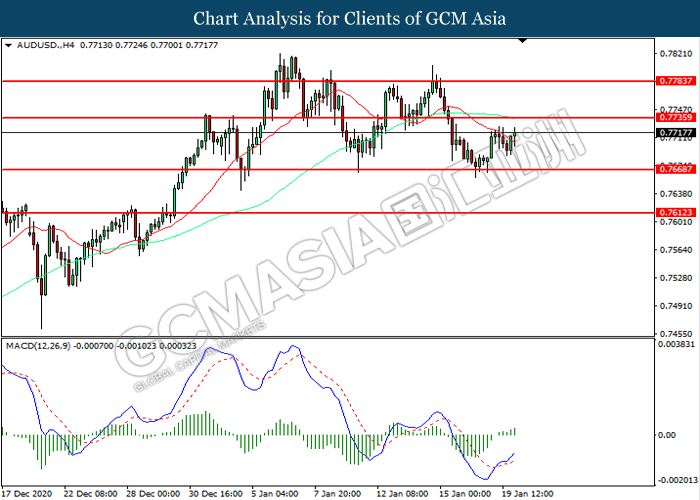

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7735. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7735, 0.7785

Support level: 0.7670, 0.7610

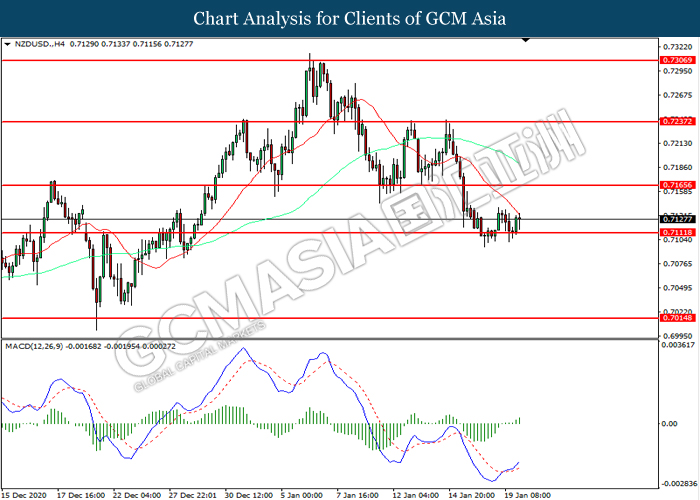

NZDUSD, H4: NZDUSD was traded within a range while currently near the support level at 0.7110. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7165, 0.7235

Support level: 0.7110, 0.7015

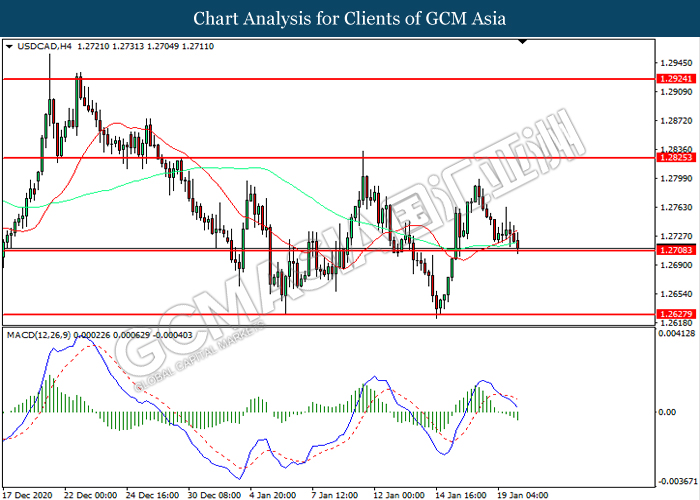

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2925

Support level: 1.2710, 1.2630

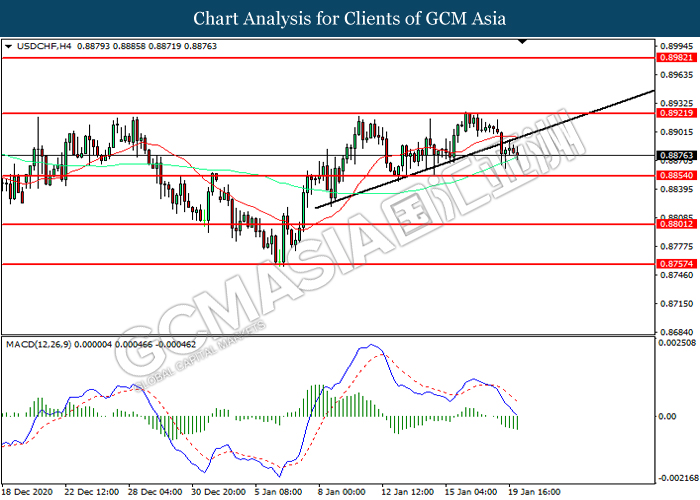

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8920. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.8855.

Resistance level: 0.8920, 0.8980

Support level: 0.8855, 0.8800

CrudeOIL, Weekly: Crude oil price was traded higher following prior breakout above the previous resistance level at 50.05. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 60.20.

Resistance level: 60.20, 65.60

Support level: 50.05, 41.75

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1828.80. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1859.10.

Resistance level: 1859.10, 1879.15

Support level: 1828.80, 1808.05