20 January 2021 Morning Session Analysis

Euro standstill after Germany extends lockdown measures.

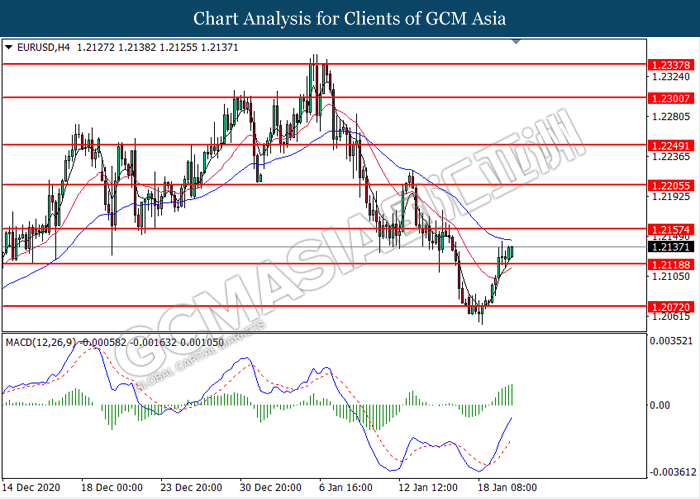

The single currency in European Union was failed to extend its gains early today amid Germany lockdown restriction which were due to expire on 31st of January has been extended for a longer period in order to rein in the pandemic of Covid-19. In the pandemic-related meeting, Germany Chancellor Angela Merkel and 16 state leaders reached a consensus where they agreed to extend measures to 14th February as the ongoing lockdown measure has been successfully bring down the number of infections obviously. Besides, they also said that the burden of hospital and healthcare unit is still at a very high level despite there was a slightly decline amid ongoing lockdown restriction. In the new lockdown measure, non-essential economy sector activities are not allowed to run, such as shops, cafes and restaurants are to remain closed. Moreover, people are restricted to wear medical mask while using local public transport and in shops under the new rules. As the economic activity were to halt for a longer period of time, investor concerns that the economy may return back into recession stage which may further pressure the value of euro currency. During Asian early trading session, the pair of EUR/USD dropped 0.01% to 1.2128.

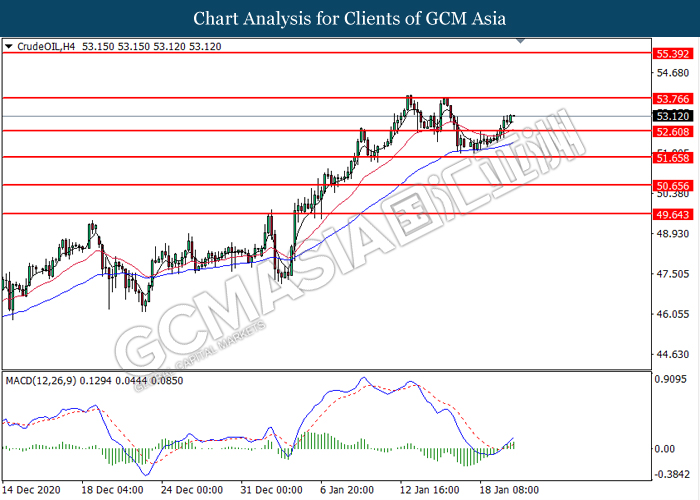

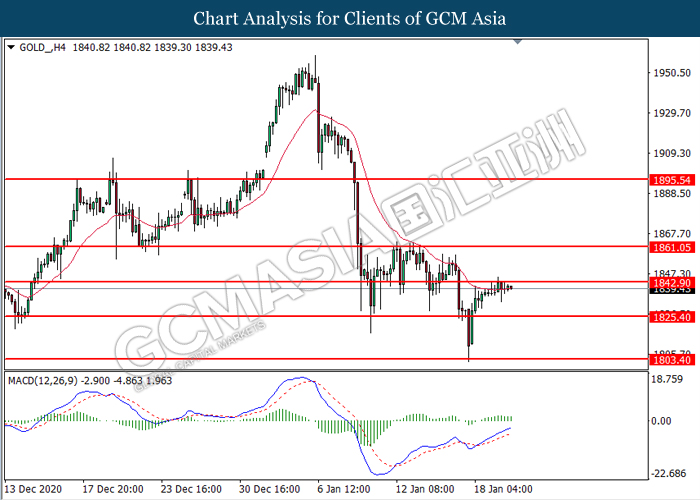

In the commodities market, the crude oil price appreciated by 0.28% to $53.10 per barrel as of writing amid heightening of expectations that US stimulus package may able to support the US economic recovery, leading to a strong recovery of demand toward this black commodity. Besides, gold price rose 0.01% to $1840.60 a troy ounce as the new variant of virus cases rose significantly and triggered investors to seek for safe-haven asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Monetary Policy Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Dec) | 0.3% | 0.5% | – |

| 18:00 | EUR – CPI (YoY) (Dec) | -0.3% | -0.3% | – |

| 21:30 | CAD – Core CPI (MoM) (Dec) | 0.2% | – | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

Technical Analysis

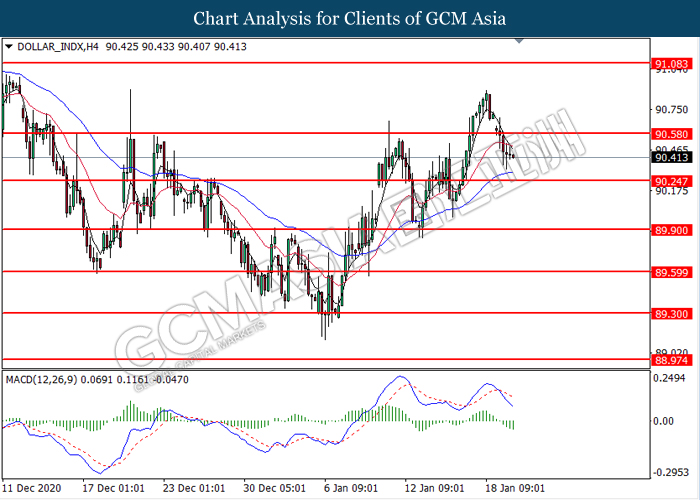

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 90.60. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 90.25.

Resistance level: 90.60, 91.10

Support level: 90.25, 89.90

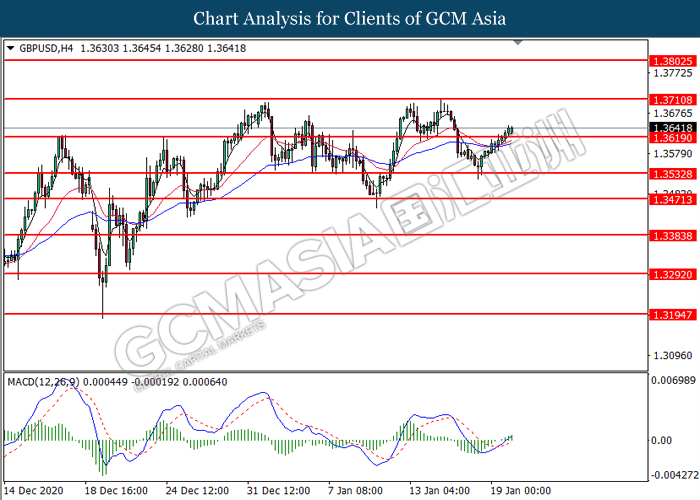

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3710.

Resistance level: 1.3710, 1.3805

Support level: 1.3620, 1.3535

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2120. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2155.

Resistance level: 1.2155, 1.2205

Support level: 1.2120, 1.2070

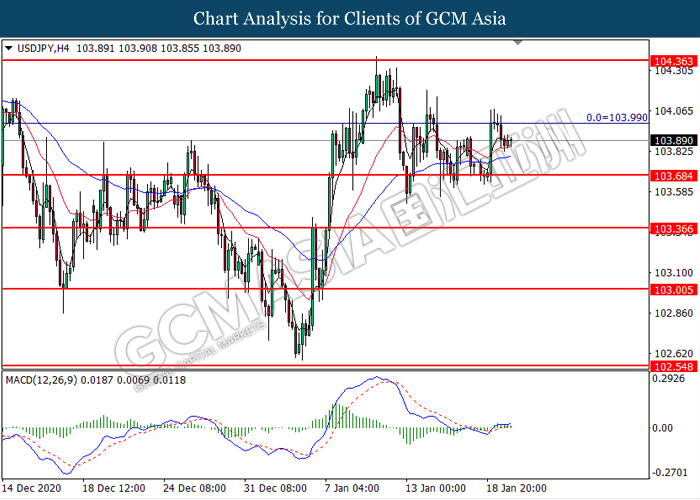

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 104.00. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the lower level.

Resistance level: 104.00, 104.35

Support level: 103.70, 103.35

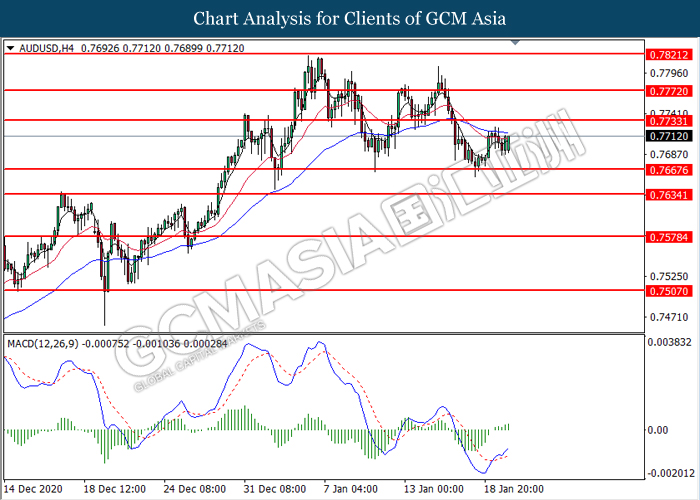

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7735.

Resistance level: 0.7735, 0.7770

Support level: 0.7670, 0.7635

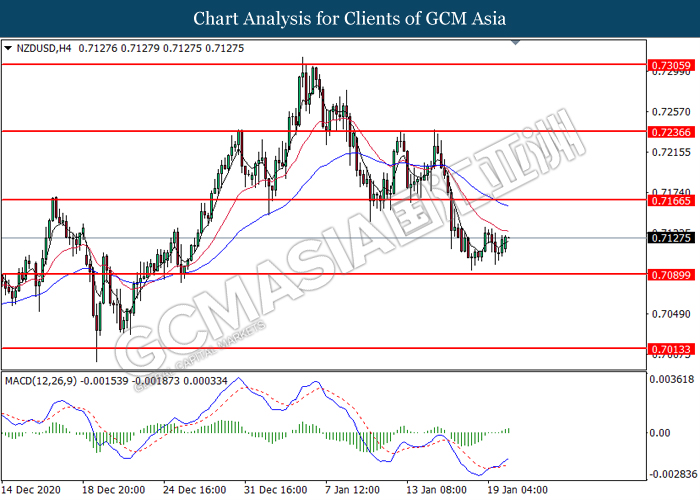

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7165.

Resistance level: 0.7165, 0.7235

Support level: 0.7090, 0.7015

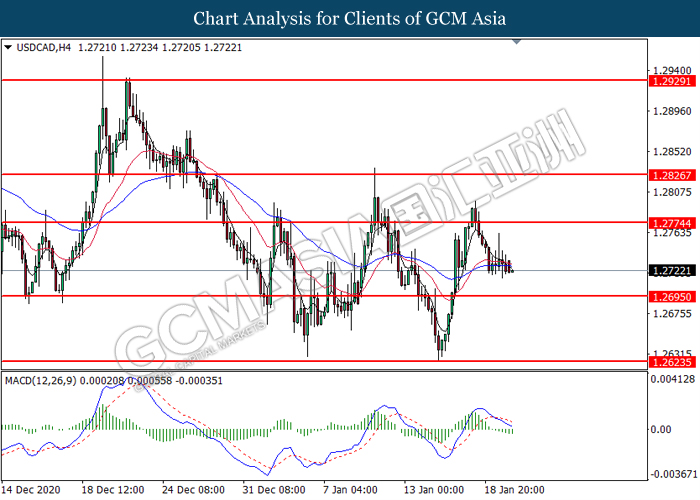

USDCAD, H4: USDCAD was traded lower following prior retracement near the resistance level at 1.2775. MACD which illustrate bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2695.

Resistance level: 1.2775, 1.2825

Support level: 1.2695, 1.2625

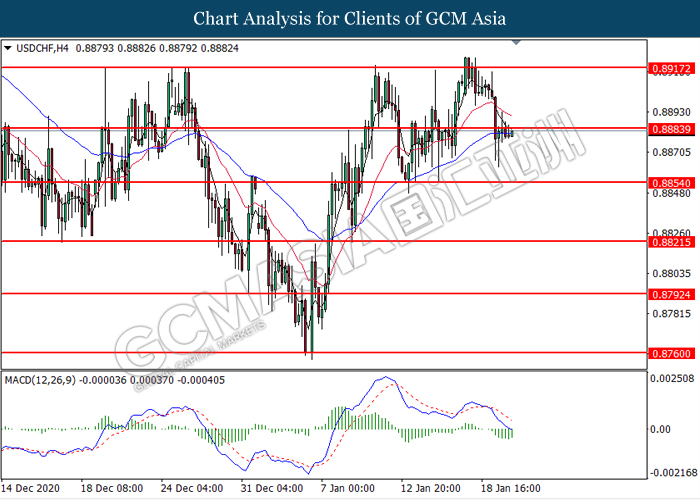

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.8885. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term toward higher level.

Resistance level: 0.8885, 0.8915

Support level: 0.8855, 0.8820

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 52.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 53.75.

Resistance level: 53.75, 55.40

Support level: 52.60, 51.65

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1842.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 1842.90.

Resistance level: 1842.90, 1861.05

Support level: 1825.40, 1803.40