20 January 2022 Afternoon Session Analysis

Aussie surged amid resilient job data.

The Australia Dollar surged over the backdrop of upbeat economic data from Australia region. According to Australian Bureau of Statistics, Australia Employment Change came in at 64,800 in December, exceeding the market forecast at 43,300 and adding to November’s record jump of 366,000. Meanwhile, the unemployment rate fell from the previous reading of 4.6% to 4.2% in November, the lowest reading since August 2008. As both crucial economic data fared better than expectation, dialled up the market optimism toward the economic progression in Australia. Nonetheless, the gains experienced by the Australian Dollar was limited by the spiking numbers of Omicron variant, which spooking consumers away from shops and restaurants. As of writing, AUD/USD appreciated by 0.38% to 0.7240.

In the commodities market, the crude oil price surged 0.90% to $86.45 per barrel as of writing. The oil market touched tis highest level since October 2014 following the International Energy Agency claimed that the supply outlook for the oil industry is tighter than previously thought while the demand remained resilient amid easing symptoms of the Omicron variant. On the other hand, the gold price surged 0.10% to $1839.70 per troy ounces as of writing amid rising geopolitical tensions between Russia and Ukraine had stoked a shift in sentiment toward the safe-haven asset such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Dec) | 5.00% | 5.00% | – |

| 21:30 | USD – Initial Jobless Claims | 230K | 220K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Jan) | 15.4 | 20 | – |

| 23:00 | USD – Existing Home Sales (Dec) | 6.46M | 6.43M | – |

Technical Analysis

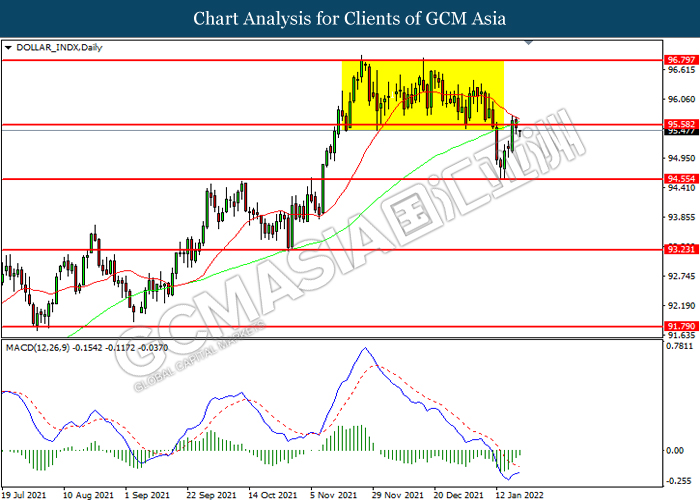

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.60. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.60, 96.80

Support level: 94.55, 93.25

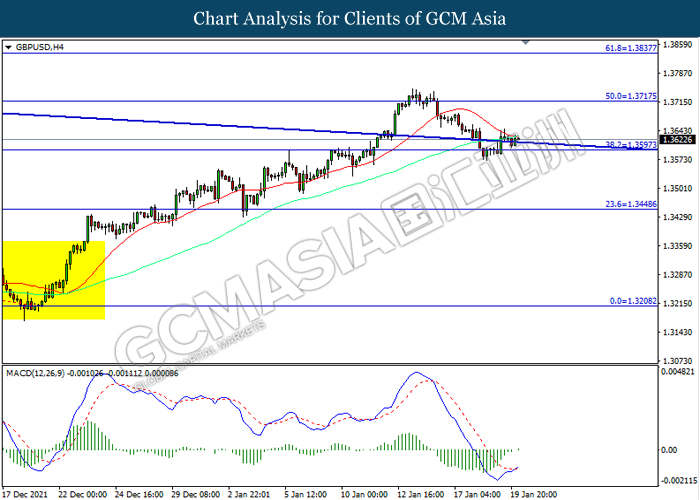

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3715, 1.3840

Support level: 1.3595, 1.3450

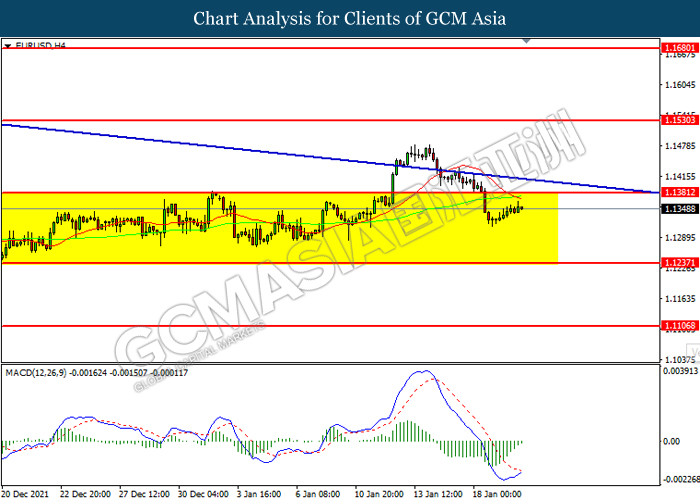

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

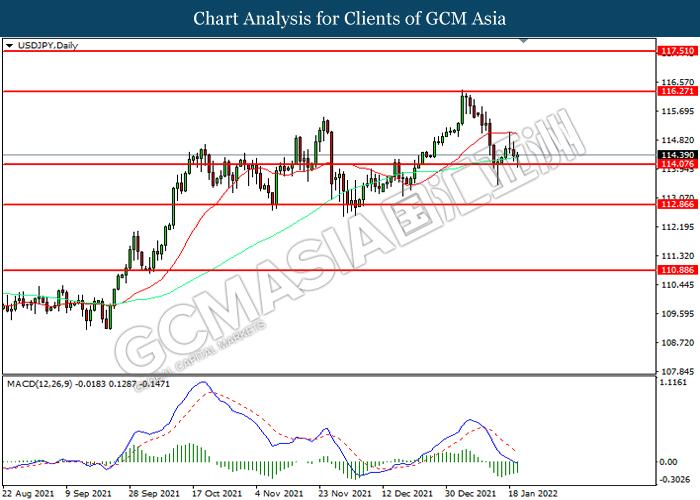

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 114.10. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 116.25, 117.50

Support level: 114.10, 112.85

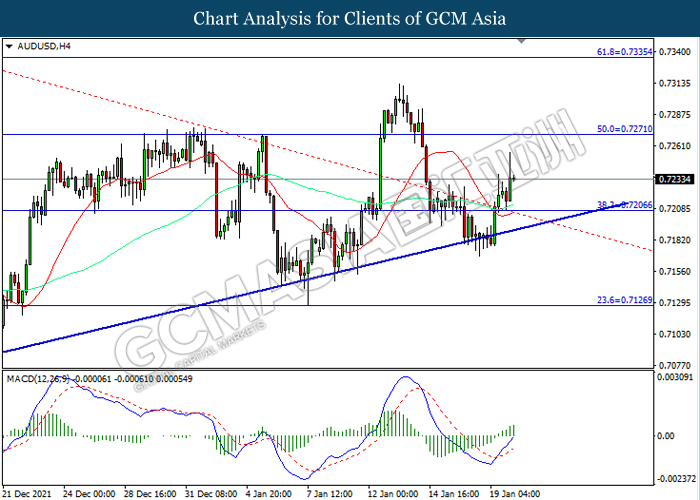

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7205. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7270.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

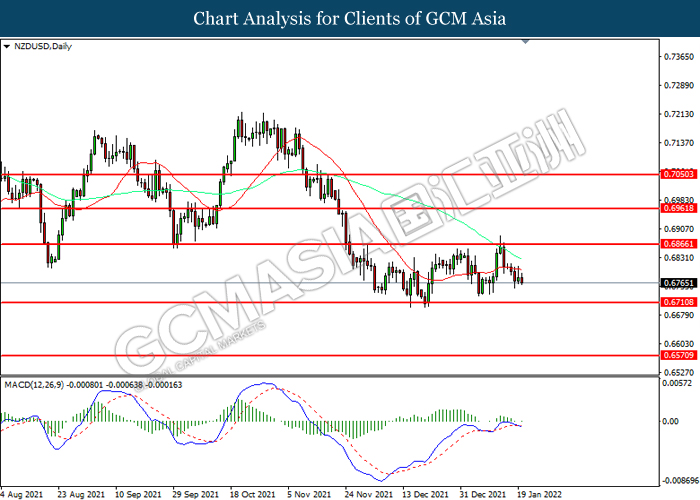

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6710.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

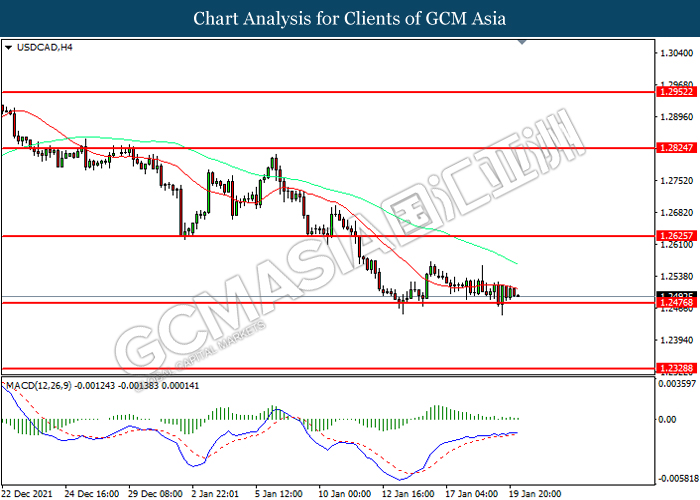

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2475. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9180. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

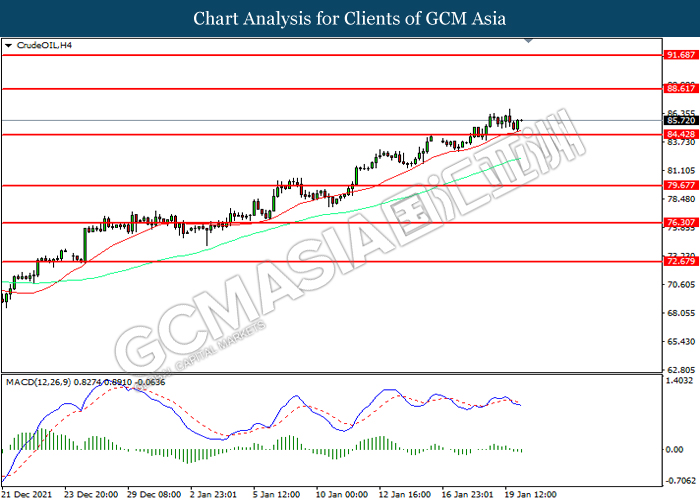

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 84.45. However, MACD which illustrated increasing baerish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 88.60, 91.70

Support level: 84.45, 79.70

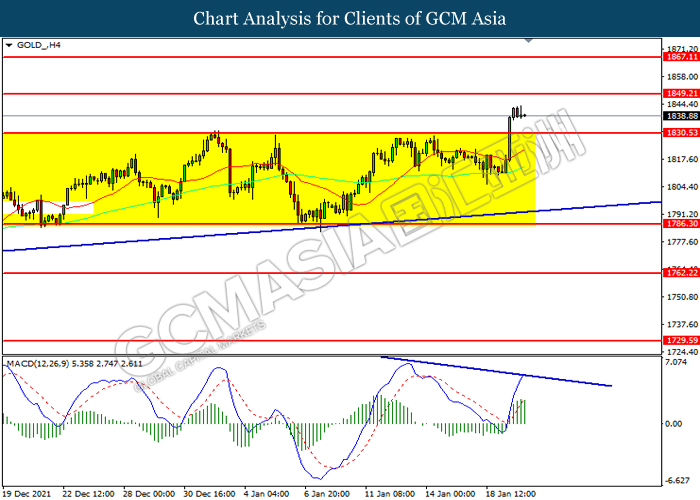

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1830.55. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1849.20.

Resistance level: 1849.20, 1867.10

Support level: 1830.55, 1786.30