20 January 2023 Afternoon Session Analysis

Yen edged up following rising inflation risk.

The USD/JPY, which traded widely by global investors hovered in its 8-month low on Friday after economic data has been released. According to Statistics Bureau, the Japan National Core Consumer Price Index (CPI) YoY notched up from the previous reading of 3.7% to 4.0%, while it met market expectation. With that, it might prompt Bank of Japan (BoJ) to exit its ultra-loose monetary policy as the data shown that inflationary risk in Japan heightened. Prior to that, BoJ decided to remain its interest rate in negative rate, which disappointed market participants as they used to speculate a hawkish move from it. Though, it is noteworthy that BoJ has reiterated that the goal of bringing inflation back to 2% target on its press conference. On the other hand, the EUR/USD gains was extended on yesterday over the hawkish statement from European Central Bank (ECB). Christine Largarde, the President of ECB appeared a speak on yesterday that the central bank would stay course with rate hikes as ECB was committed to curb inflation till 2%. As of writing, the USD/JPY rose by 0.26% to 128.76, as well as EUR/USD appreciated by 0.08% to 1.0836.

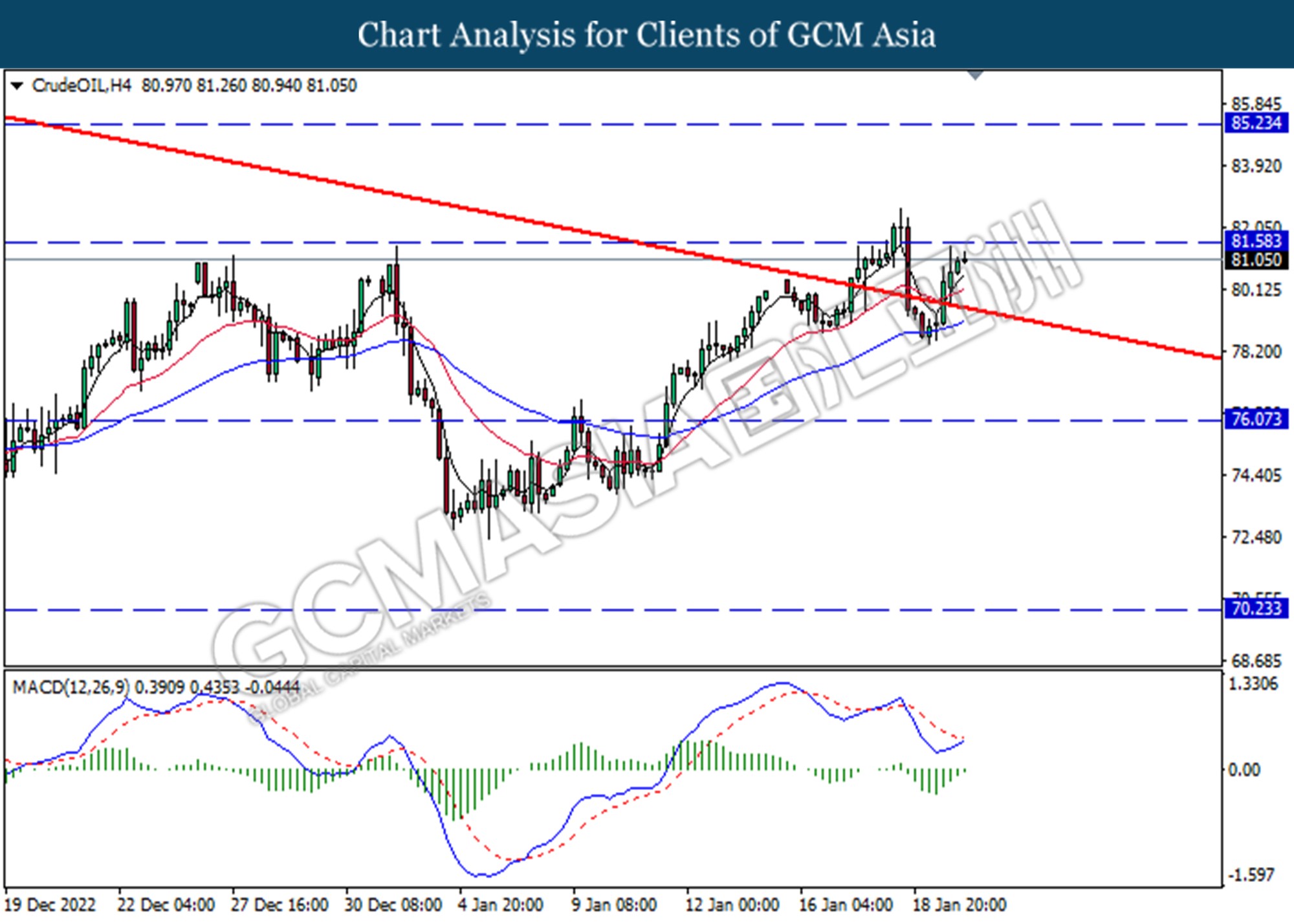

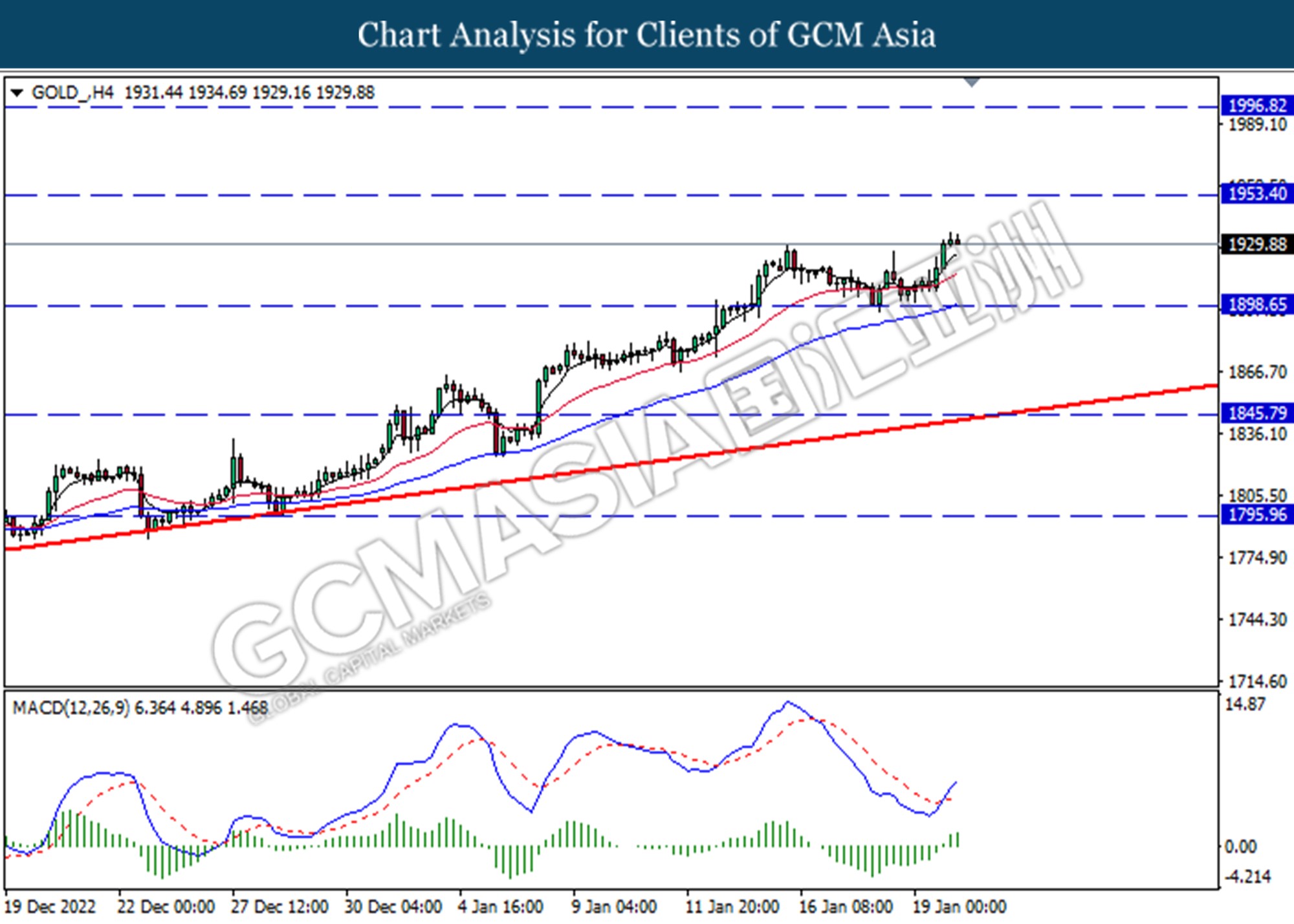

In the commodities market, the crude oil price rallied by 0.48% to $81.00 per barrel as of writing following the optimism over an eventual recovery in Chinese demand. In addition, the gold price appreciated by 0.34% to $1928.60 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Dec) | -0.4% | 0.5% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Nov) | 1.7% | -0.4% | – |

| 23:00 | USD – Existing Home Sales (Dec) | 4.09M | 3.96M | – |

Technical Analysis

DOLLAR_INDX, DAILY: Dollar index was traded lower while currently testing for the support level at 101.70. MACD which illustrated bearish momentum suggests the index to extends its losses if successfully break below the support level.

Resistance level: 103.00, 104.55

Support level: 101.70, 100.35

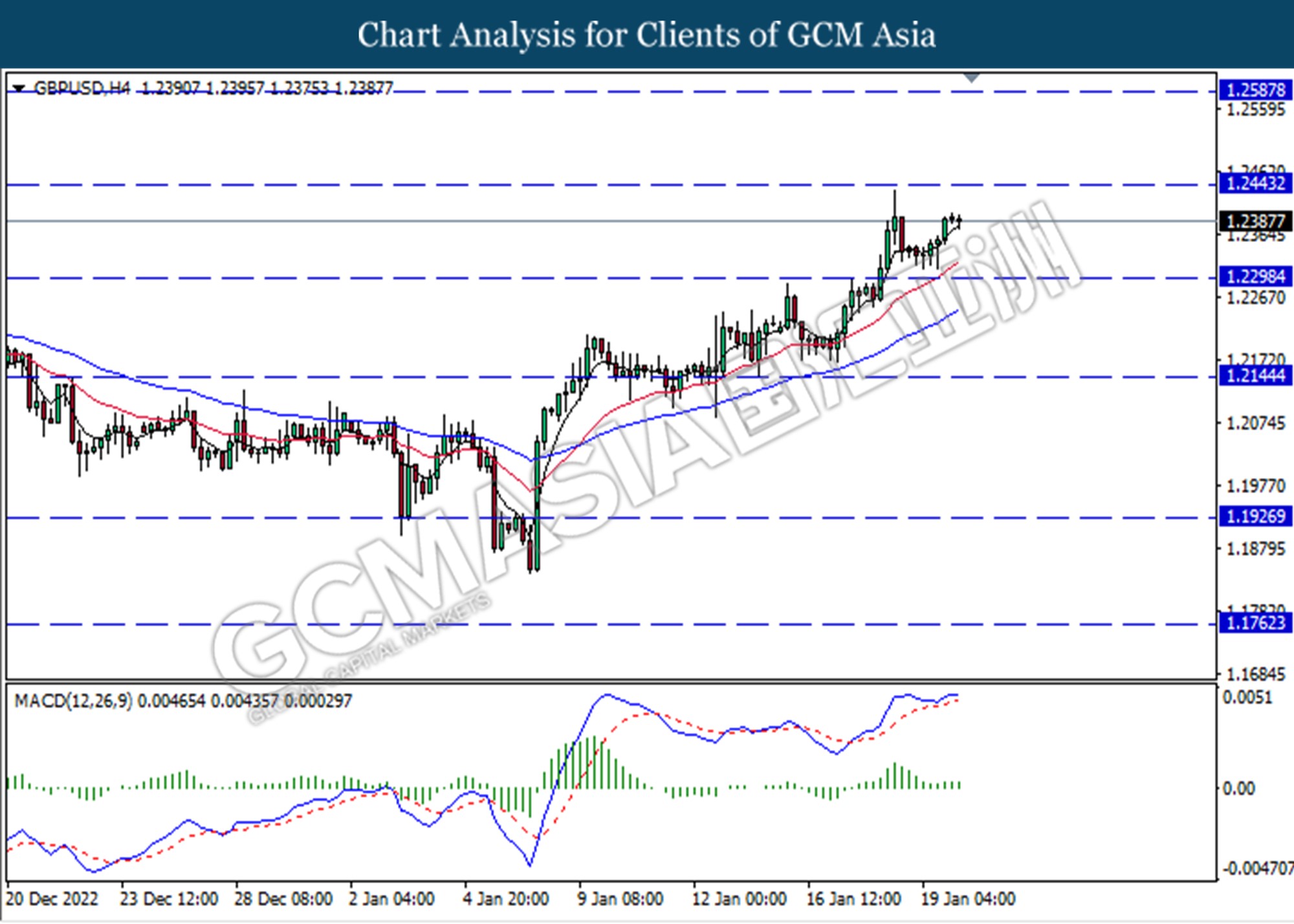

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from the higher level. MACD which illustrated bullish momentum suggests the pair to undergo technical correction in short-term.

Resistance level: 1.2450, 1.2590

Support level: 1.2300, 1.3150

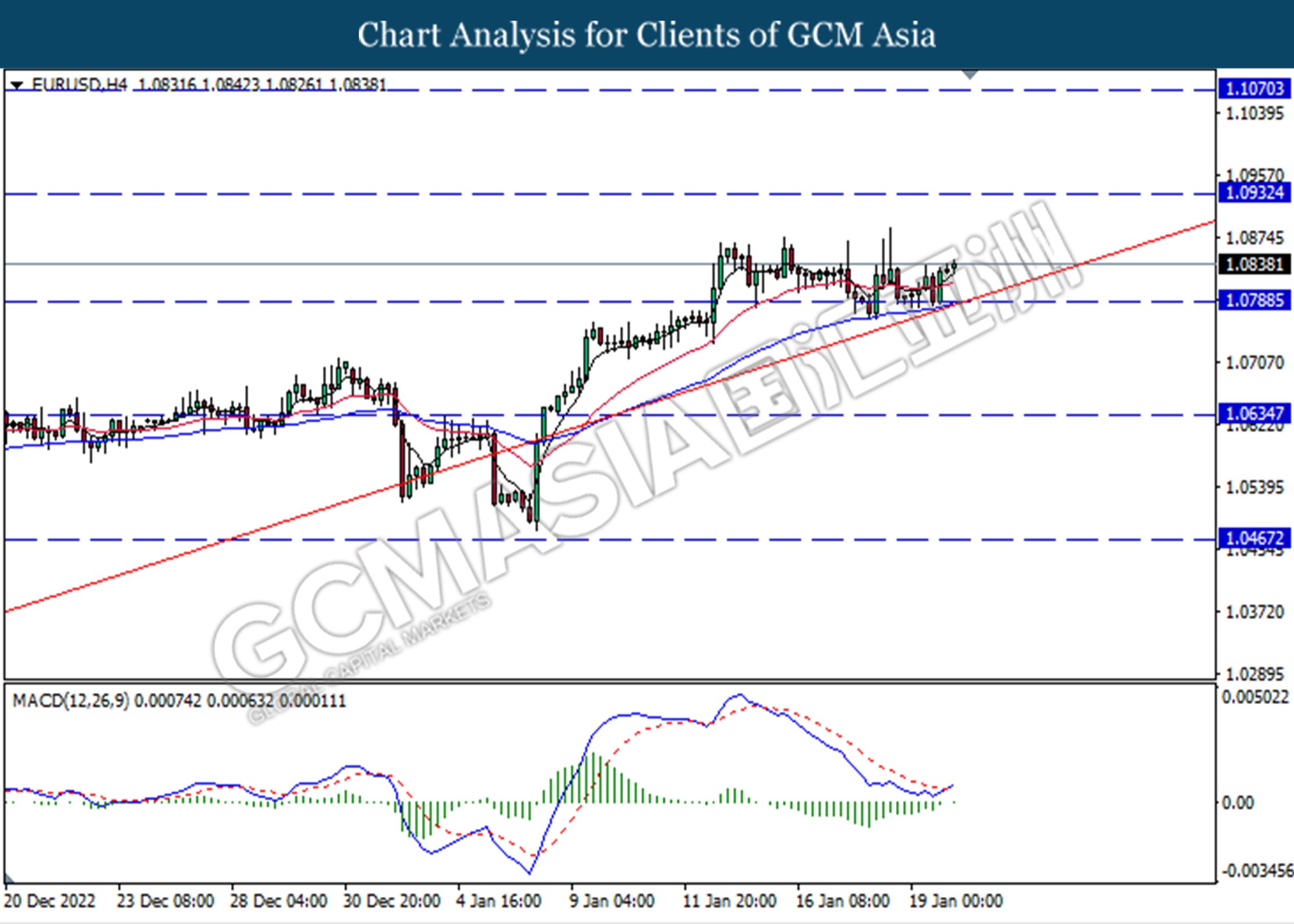

EURUSD, H4: EURUSD was traded higher following a prior rebound from the support level at 1.0790. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded higher following a prior rebound from the support level at 128.00. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 130.25, 132.30

Support level: 128.00, 126.50

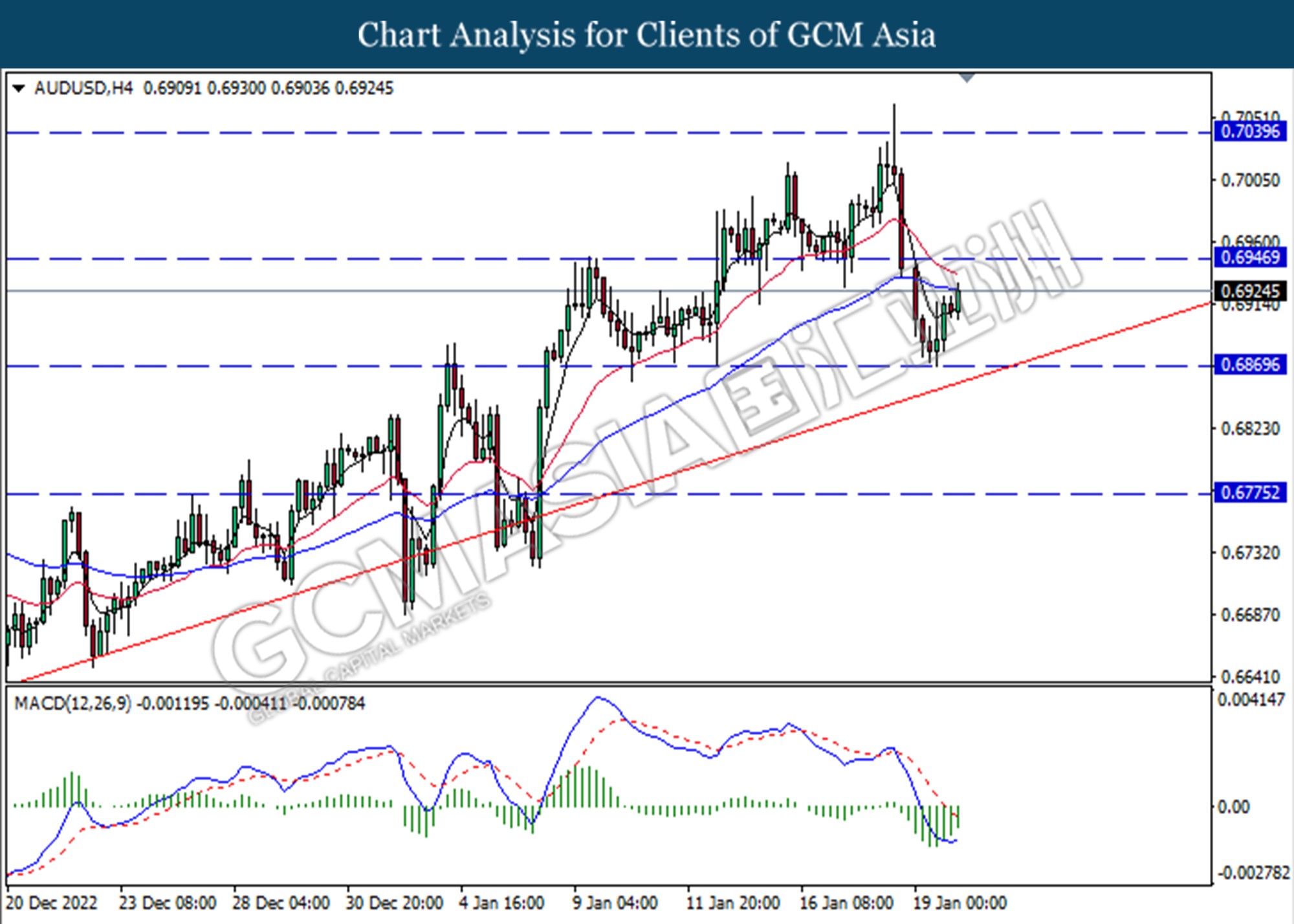

AUDUSD, H4: AUDUSD was traded higher following the rebound from the support level at 0.6870. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward resistance level at 0.6945.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

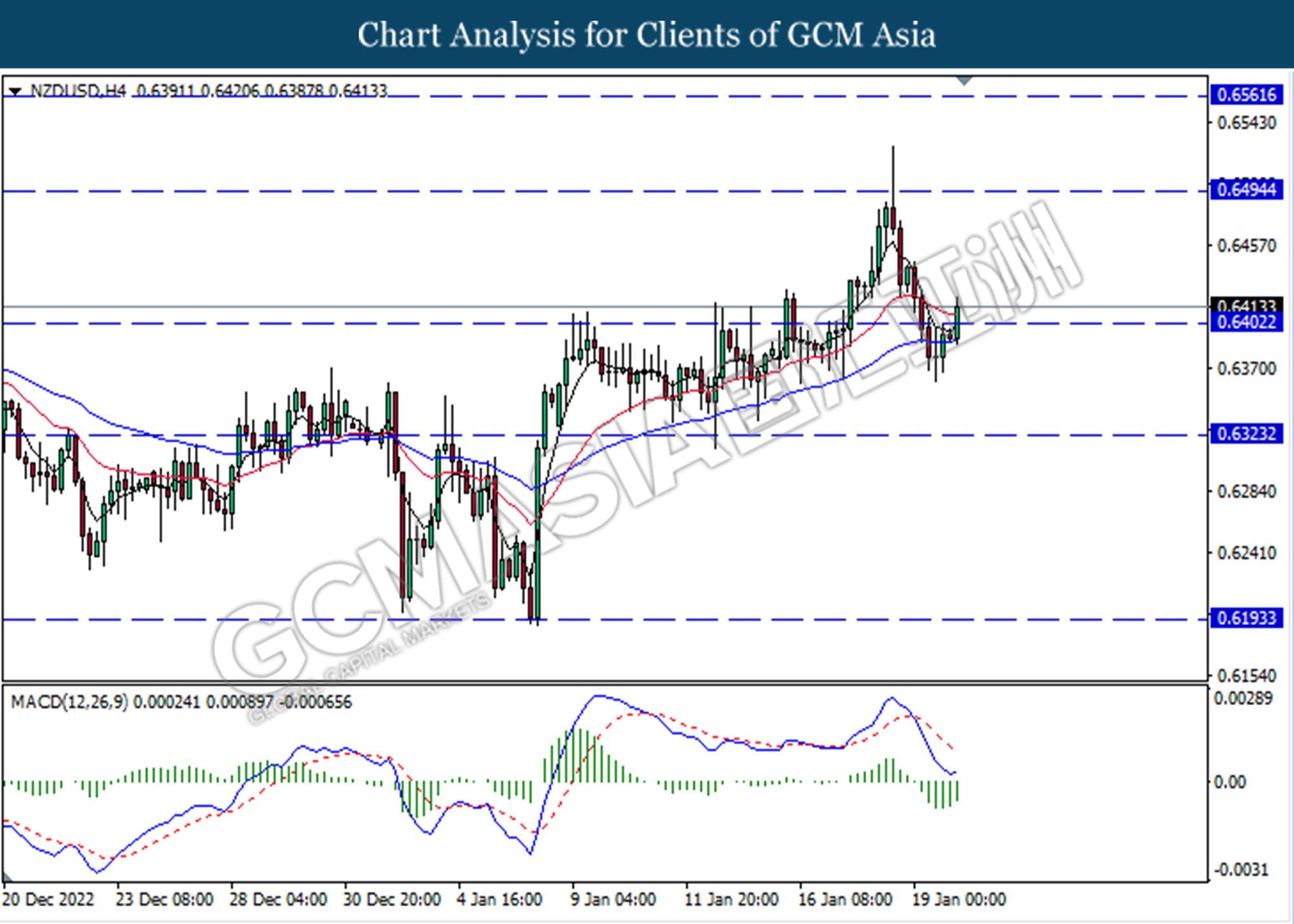

NZDUSD, H4: NZDUSD was traded higher following a prior breakout above the previous resistance level at 0.6400. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6495.

Resistance level: 0.6495, 0.6560

Support level: 0.6400, 0.6325

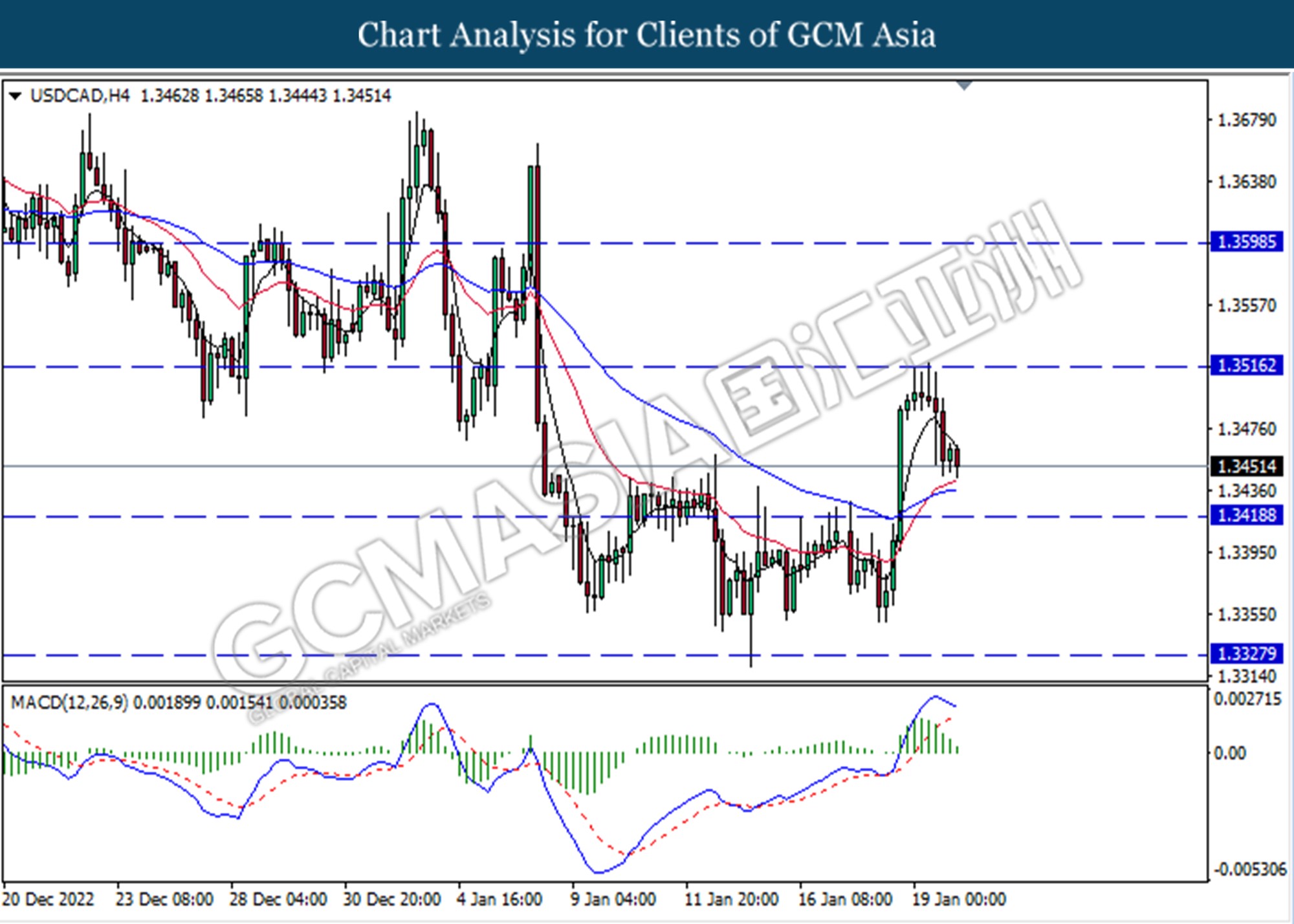

USDCAD, H4: USDCAD was traded lower following a prior retracement from the higher level at 1.3515. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses towards support level.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded higher following a prior rebound from the support level at 0.9140. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward resistance level at 0.9195.

Resistance level: 0.9195, 0.9240

Support level: 0.9140, 0.9100

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains toward resistance level at 81.60.

Resistance level: 81.60, 85.25

Support level: 76.05, 70.25

GOLD_, Daily: Gold price was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggestss the commodity to extend its gains toward the resistance level.

Resistance level: 1953.40, 1996.90

Support level: 1898.65, 1845.80