20 January 2023 Morning Session Analysis

US Dollar advanced amid strong labor data.

The dollar index, which traded against a basket of mainstream currencies, managed to find its footing near the recent low level following the release of a series of upbeat economic data. According to the Department of Labor, US Initial Jobless Claims data decline sharply from the prior reading’s 205K to 190K, refreshing the record-low since April 2022. The upbeat job data showed that the US labor market is remained strong and resilient despite the heightening of recession risk. Besides, the U.S. Philadelphia Fed Manufacturing Index showed that Philadelphia business condition has improved slightly as compared to the prior month. Based on the manufacturing data from Federal Reserve Bank of Philadelphia, it printed an actual reading at -8.9, dropping from the previous month reading’s -13.7 while higher than the consensus forecast at -11.0. As a matter of fact, the state is still facing continued softness in new orders and a weak business outlook. At the same time, the US dollar market sentiment remains sour at this juncture as the majority of the investors are still foreseeing Federal Reserve will adopt a slower pace of rate hike in the upcoming meetings. As of writing, the dollar index edged down -0.29% to 102.05.

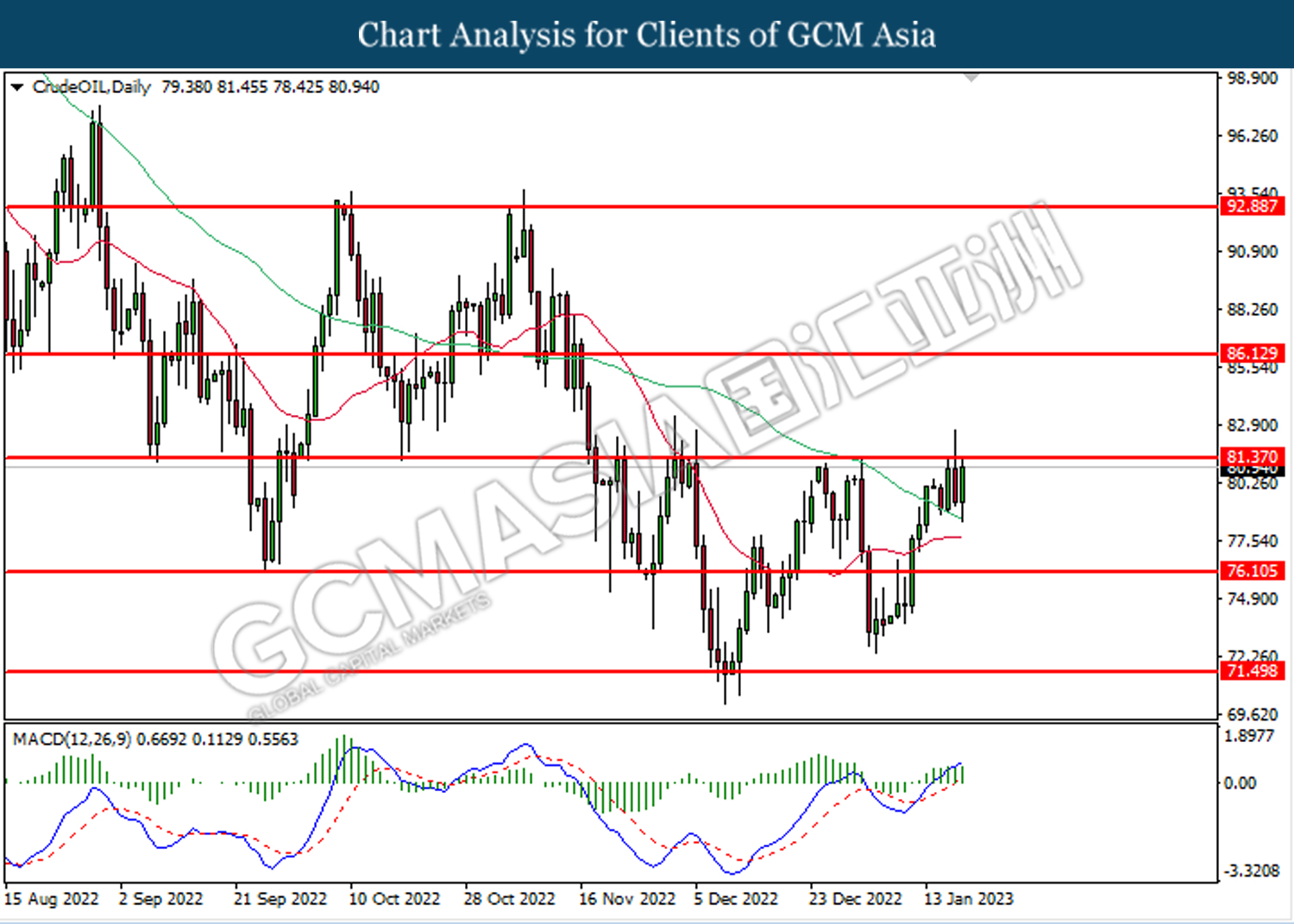

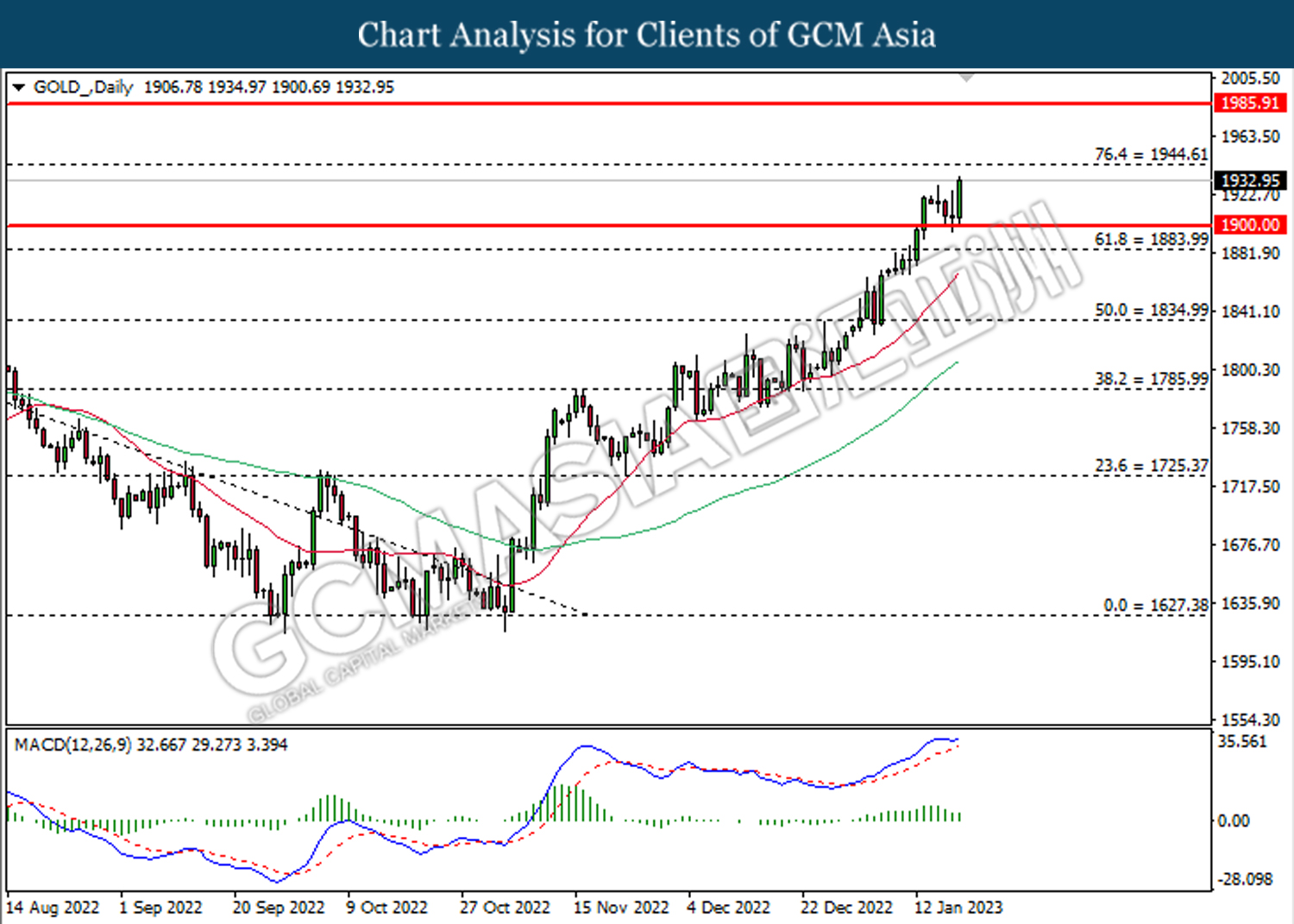

In the commodities market, crude oil price edged up by 1.51% to $80.80 per barrel amid the weakness of US dollar pushed up the demand of oil temporarily. Besides, gold prices surged by 1.45% to $1932.25 per troy ounce amid the weakening of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Dec) | -0.4% | 0.5% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Nov) | 1.7% | -0.4% | – |

| 23:00 | USD – Existing Home Sales (Dec) | 4.09M | 3.96M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

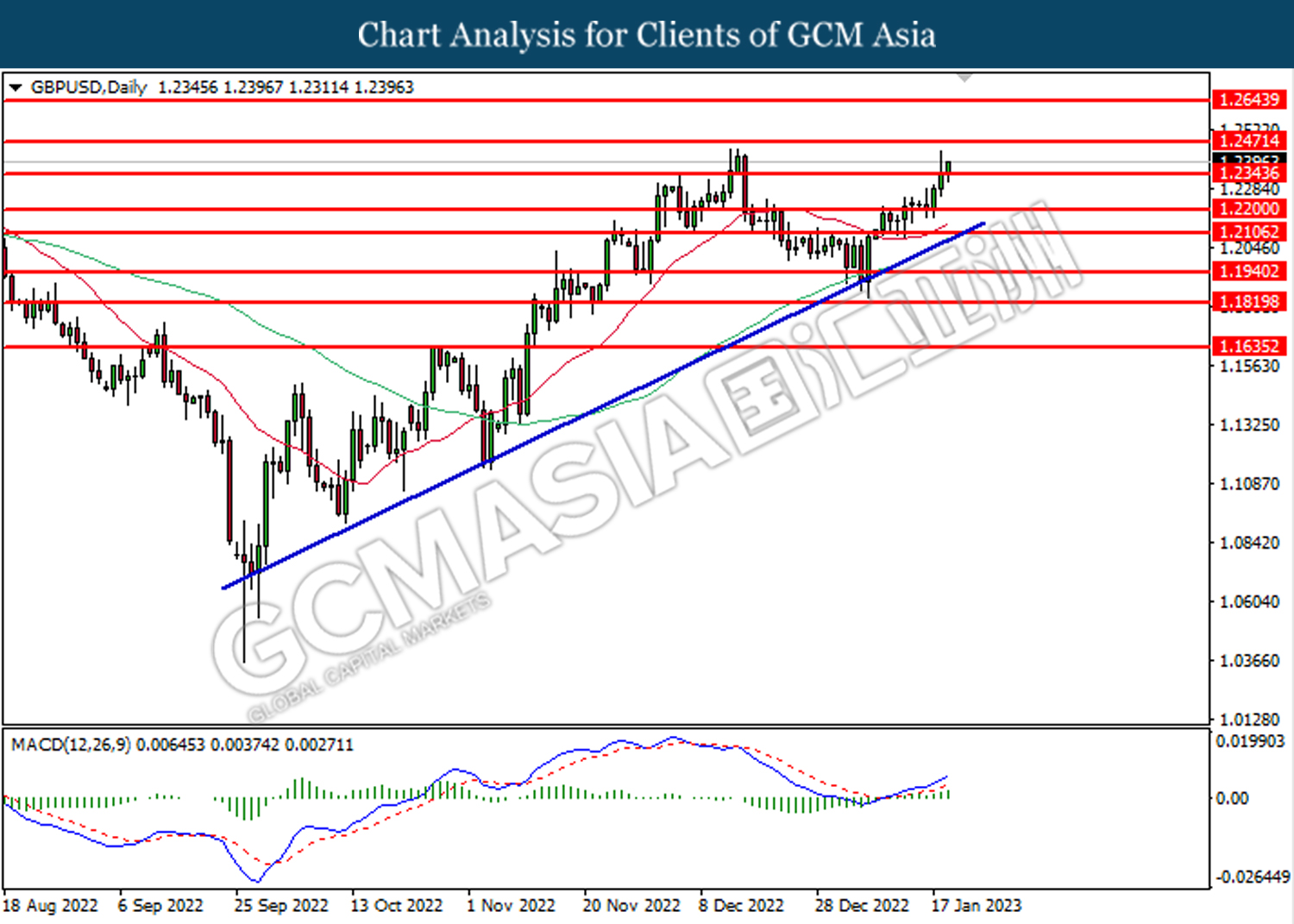

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2345. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

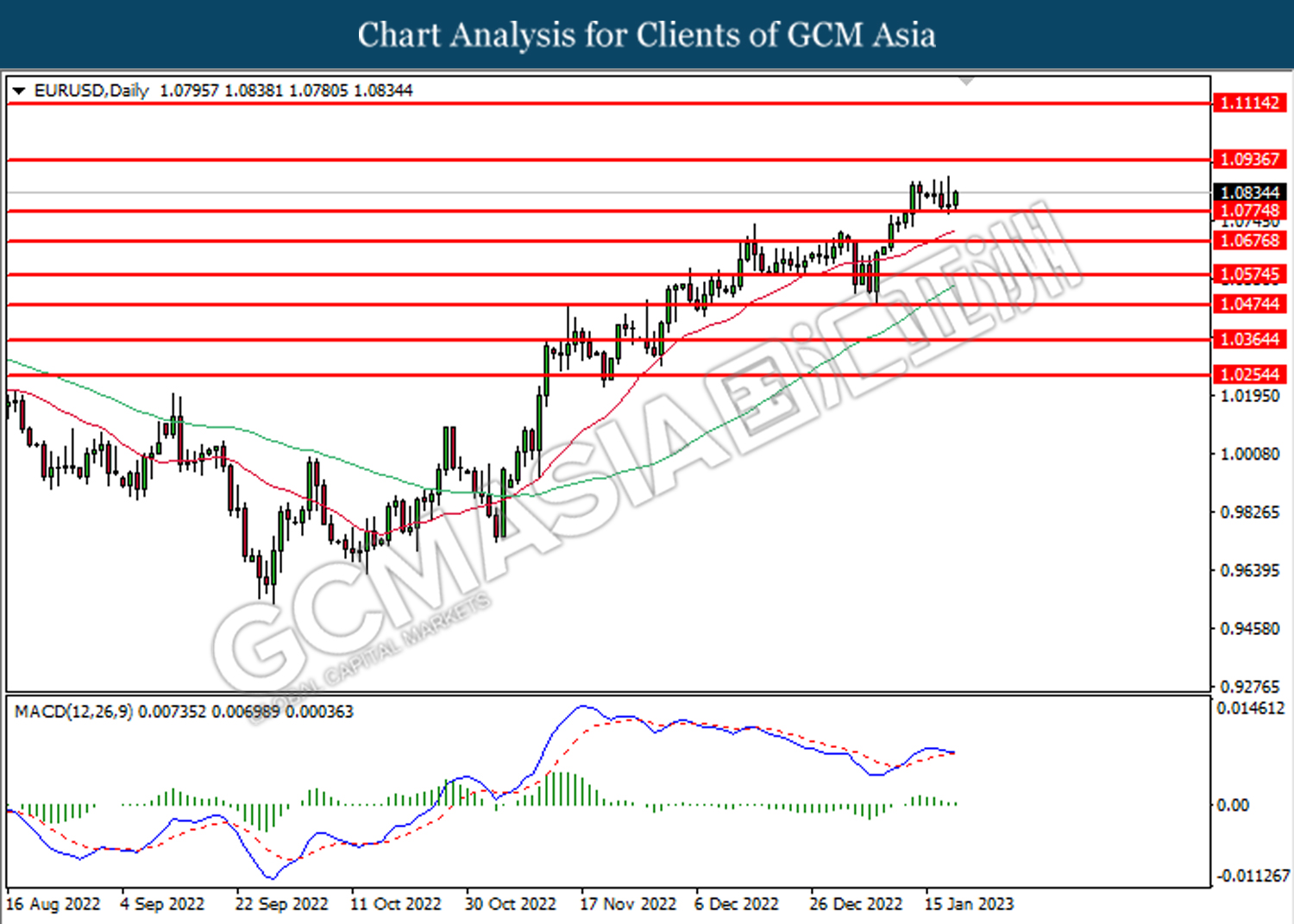

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0775. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0935.

Resistance level: 1.0935, 1.1115

Support level: 1.0775, 1.0675

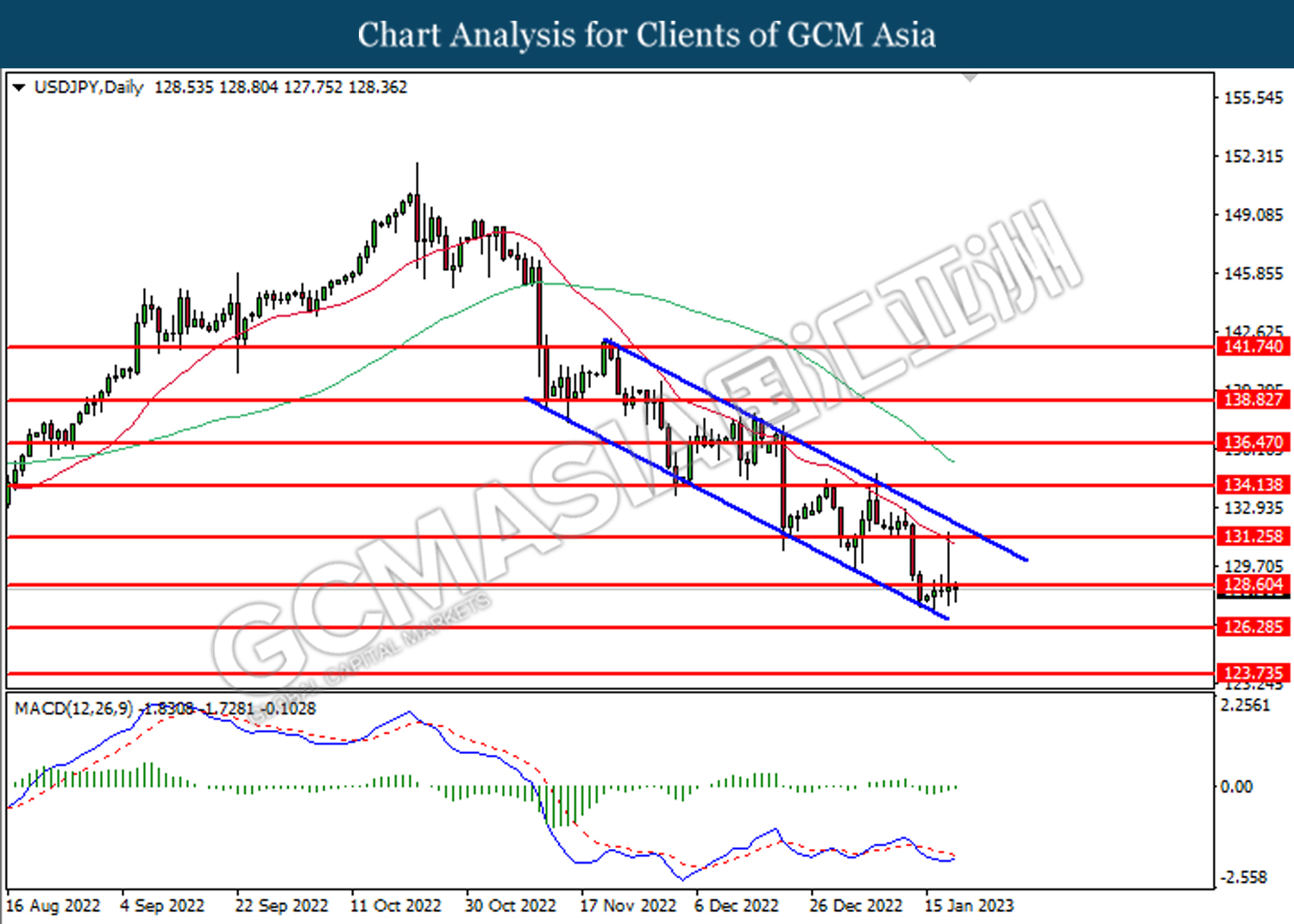

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 128.60. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 128.60.

Resistance level: 128.60, 131.25

Support level: 126.30, 123.75

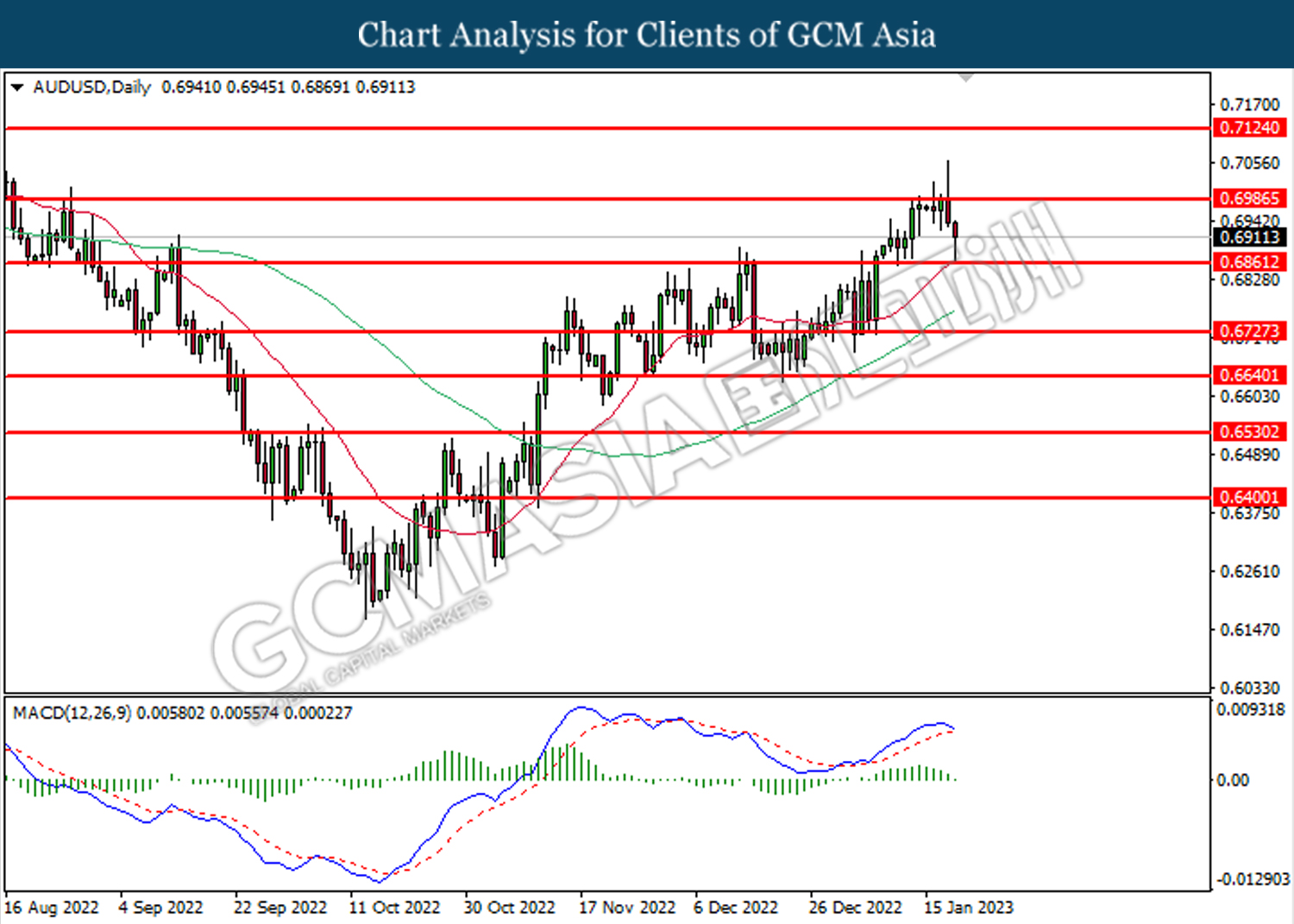

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6985. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

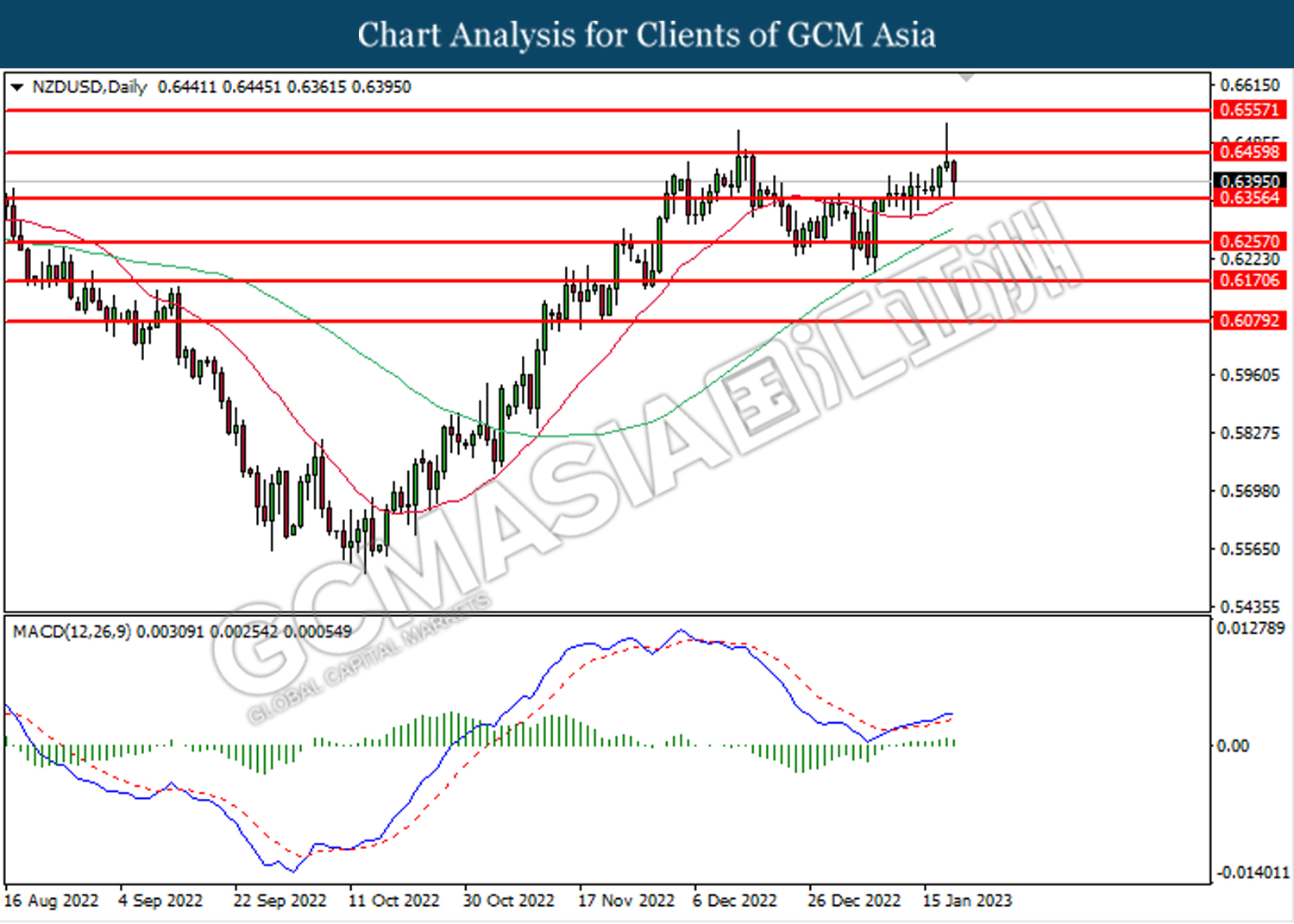

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6460. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6355.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3505. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.35. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 81.35.

Resistance level: 81.35, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1900.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00