20 March 2023 Afternoon Session Analysis

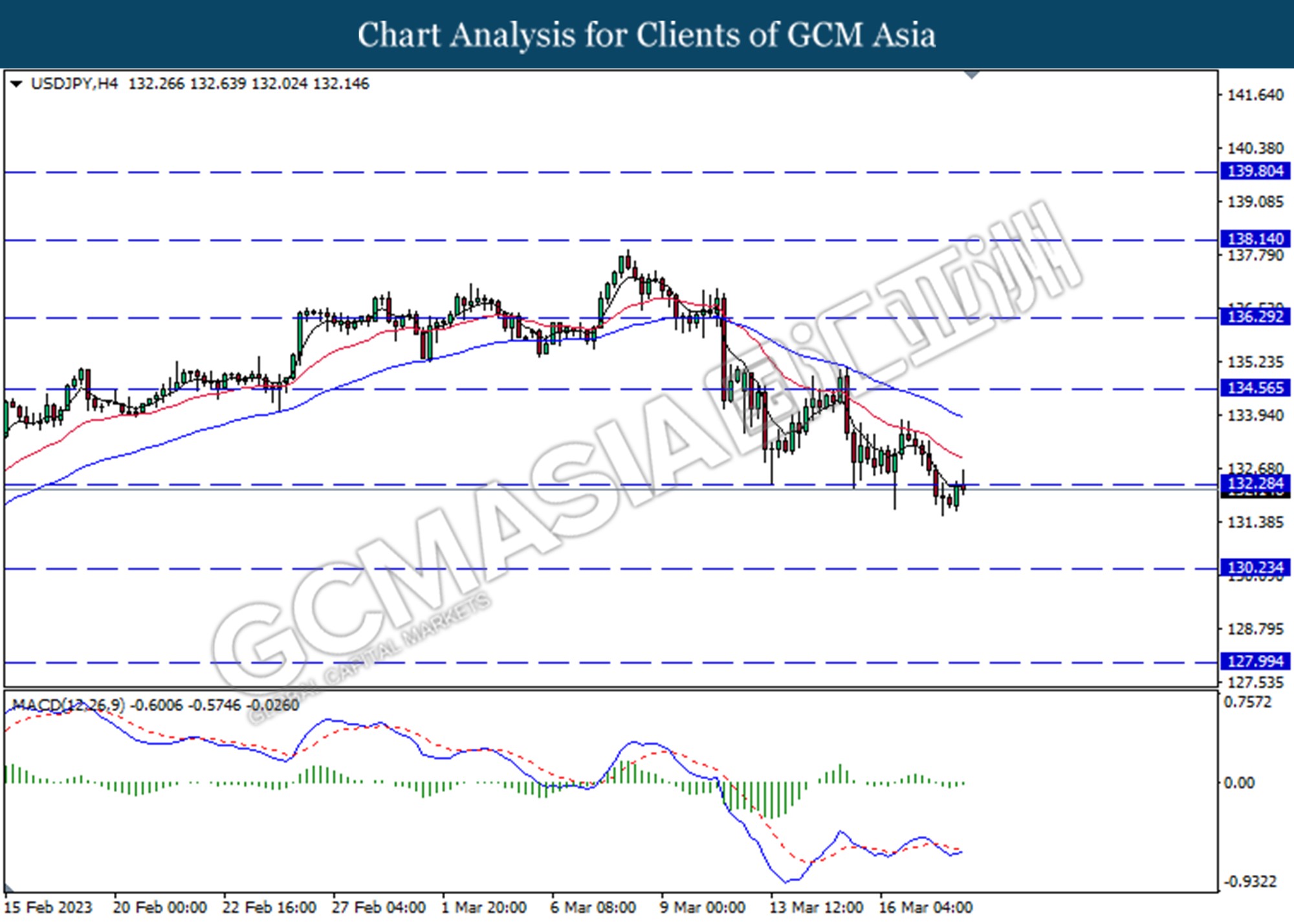

Japanese Yen nudge higher as resilient in economy

The Japanese Yen, one of the most traded currencies remains upward in its position after Japan’s economy has been resilient on the whole. According to the Bank of Japan (BoJ) monetary policy meeting statement, Firms in Japan have been optimistic about making business fixed investments and private consumption has been on a recovery trend. The fact that outlook for the long-term domestic economic growth rate has risen. Besides, investors flocked to the yen as a haven currency due to bank jitters recently. Most recently, Credit Suisse was one of the 30 banks worldwide collapsed after the main shareholder would not invest more money in the bank sparking market panic. This is the third bank, the two largest banks in the United States to fail, so the panic in the banking industry stimulated demand for the yen. However, the gains of the Japanese Yen were offset by ultra-loose monetary policy. Japanese government eyes effort worth two trillion Yen to defend the economy from slipping into a deflation zone. JPY gains are limited due to the current monetary easing. As of writing, the USD/JPY gained 0.01% to $131.80.

In the commodities market, crude oil prices traded down by -1.79% to $65.75 per barrel investors sold heavily on that the economy slows down. Besides, gold prices appreciated by 0.85% to $1990.25 per troy ounce after weakening in US dollar as market gauge Fed liquidity measures.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

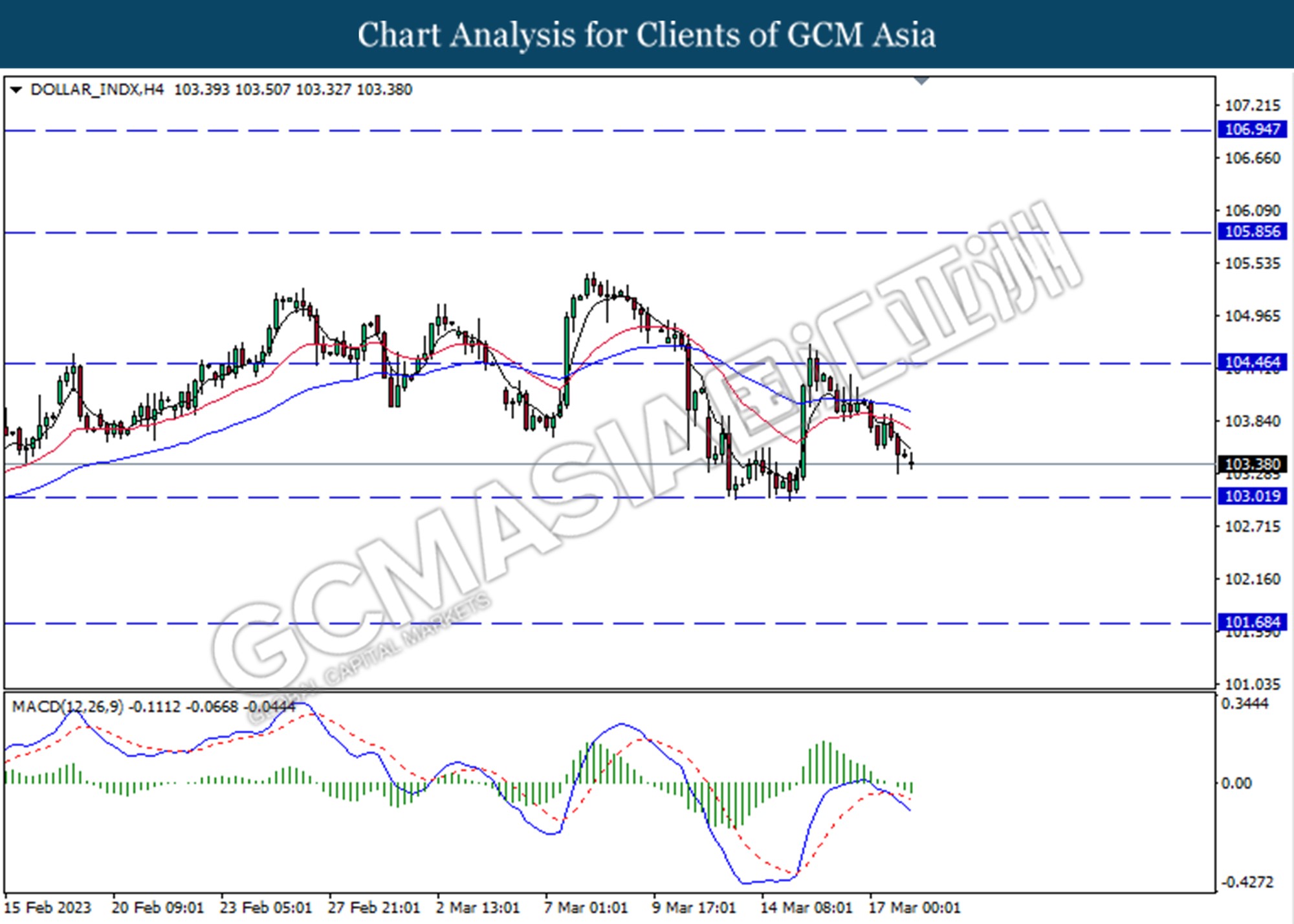

DOLLAR_INDX, H4: Dollar index was traded lower following retracement from the higher level. MACD which illustrated increasing bearish bias momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

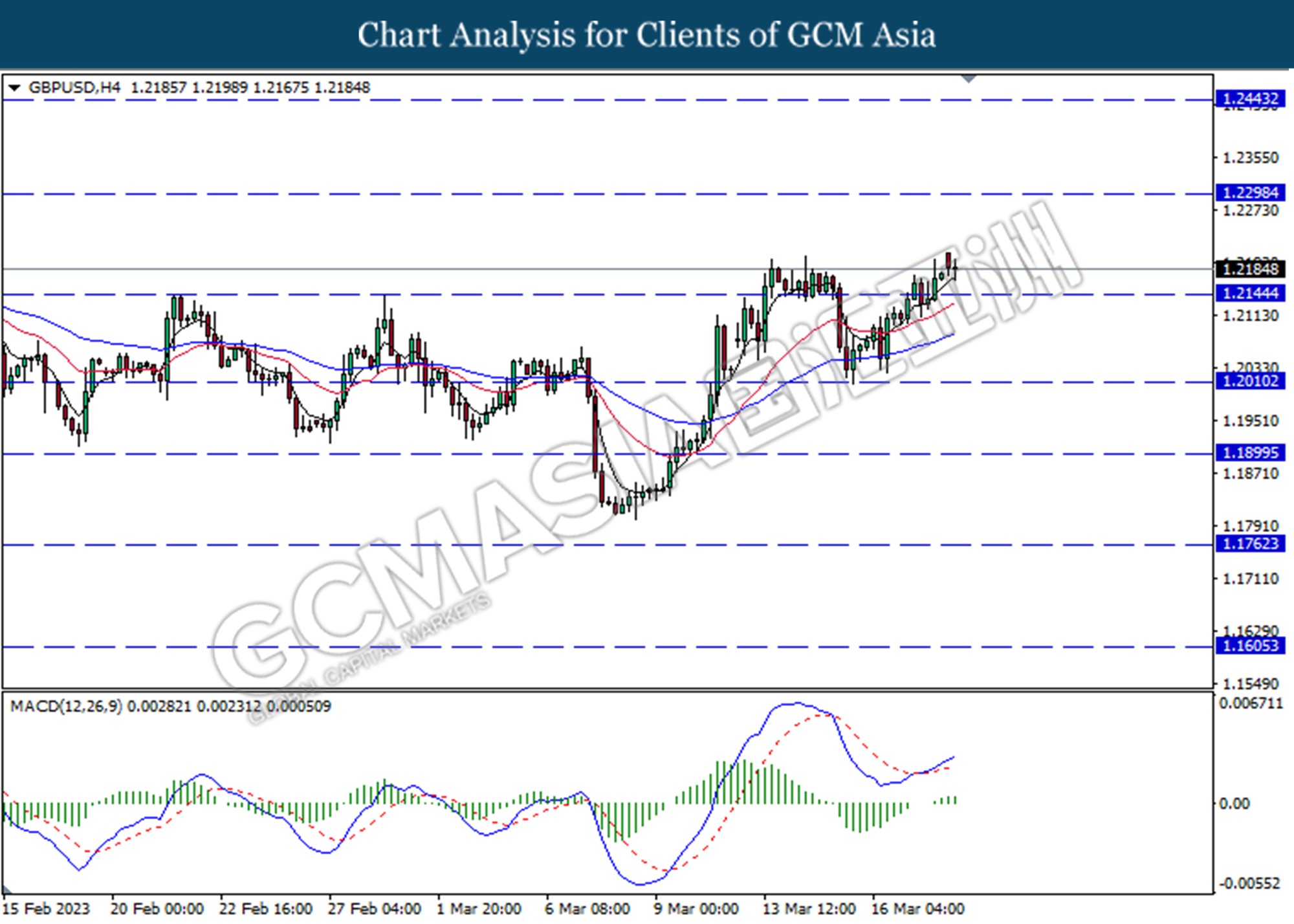

GBPUSD, H4: GBPUSD was traded lower following a retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to traded higher as technical correction.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

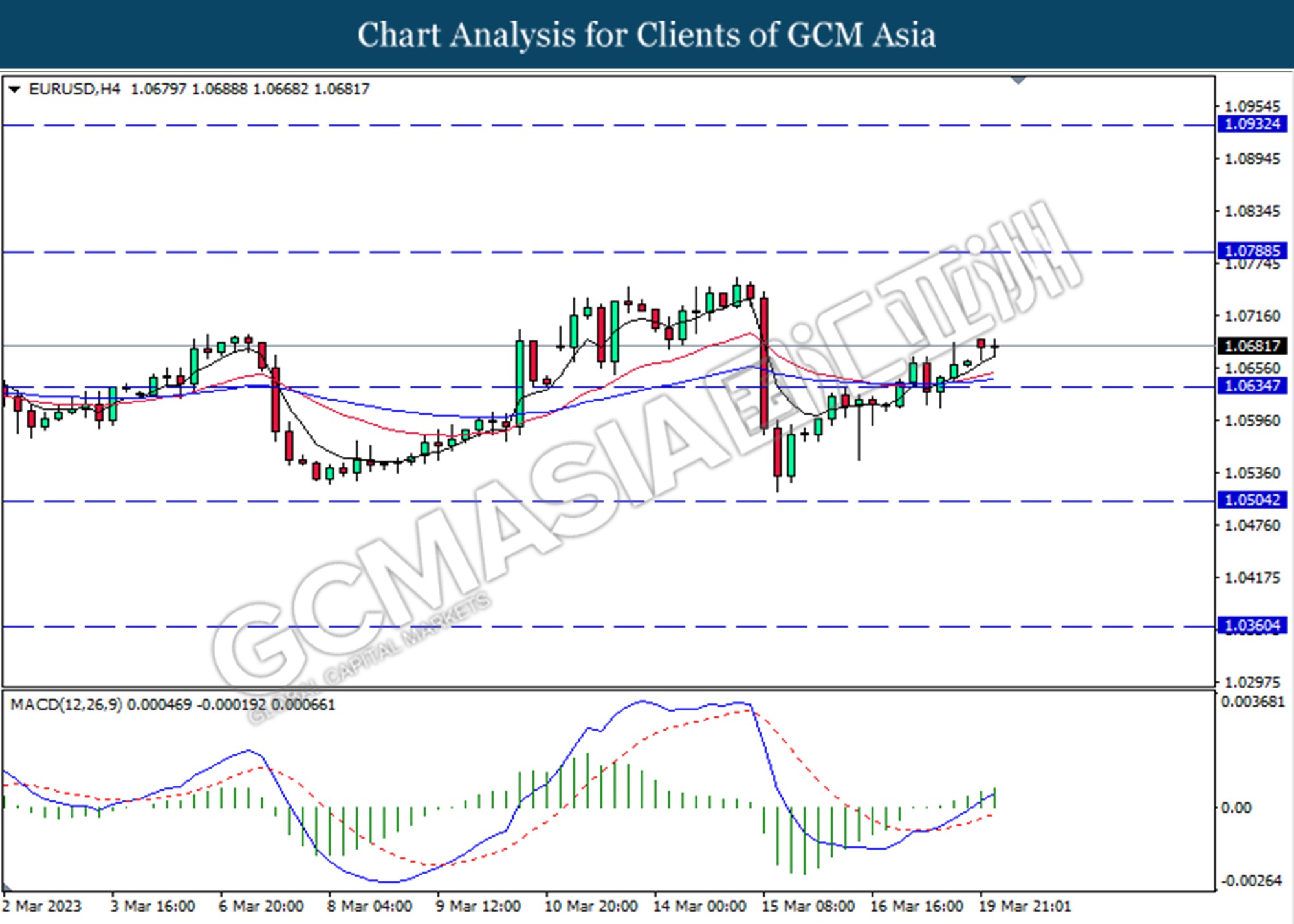

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 132.30. However, MACD which illustrated decreasing bearish momentum suggests the pair to traded higher as technical correction.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

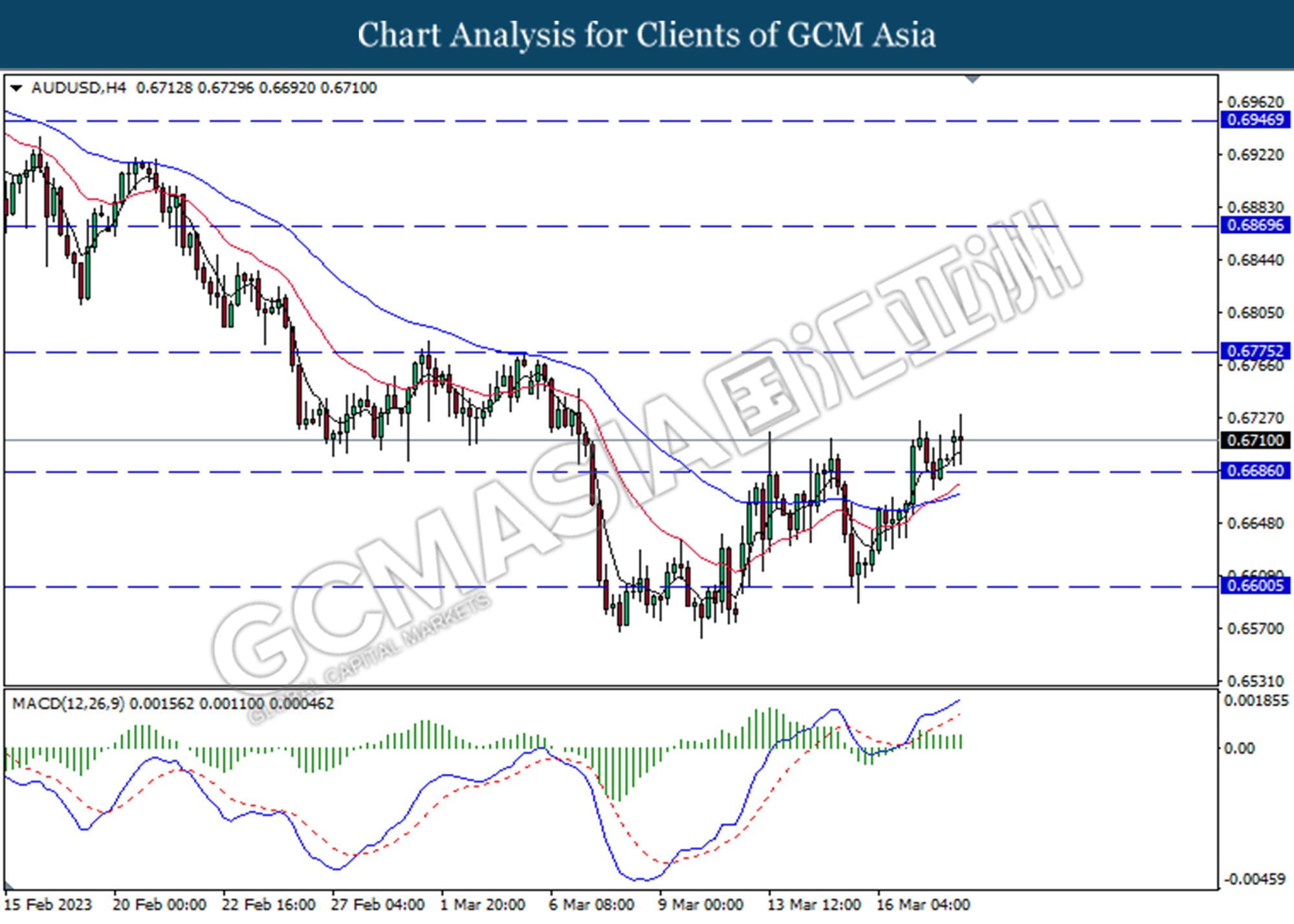

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

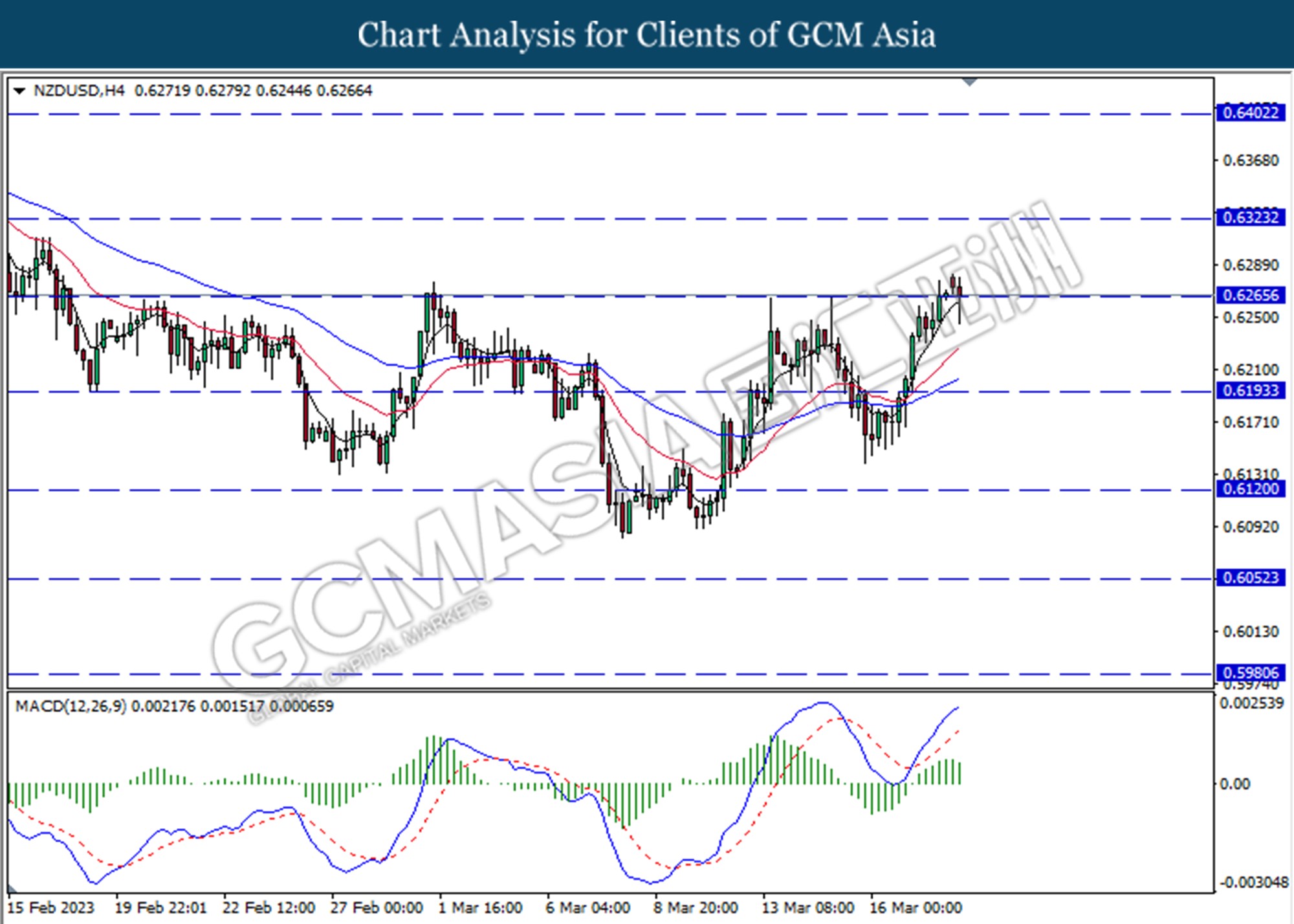

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6265. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

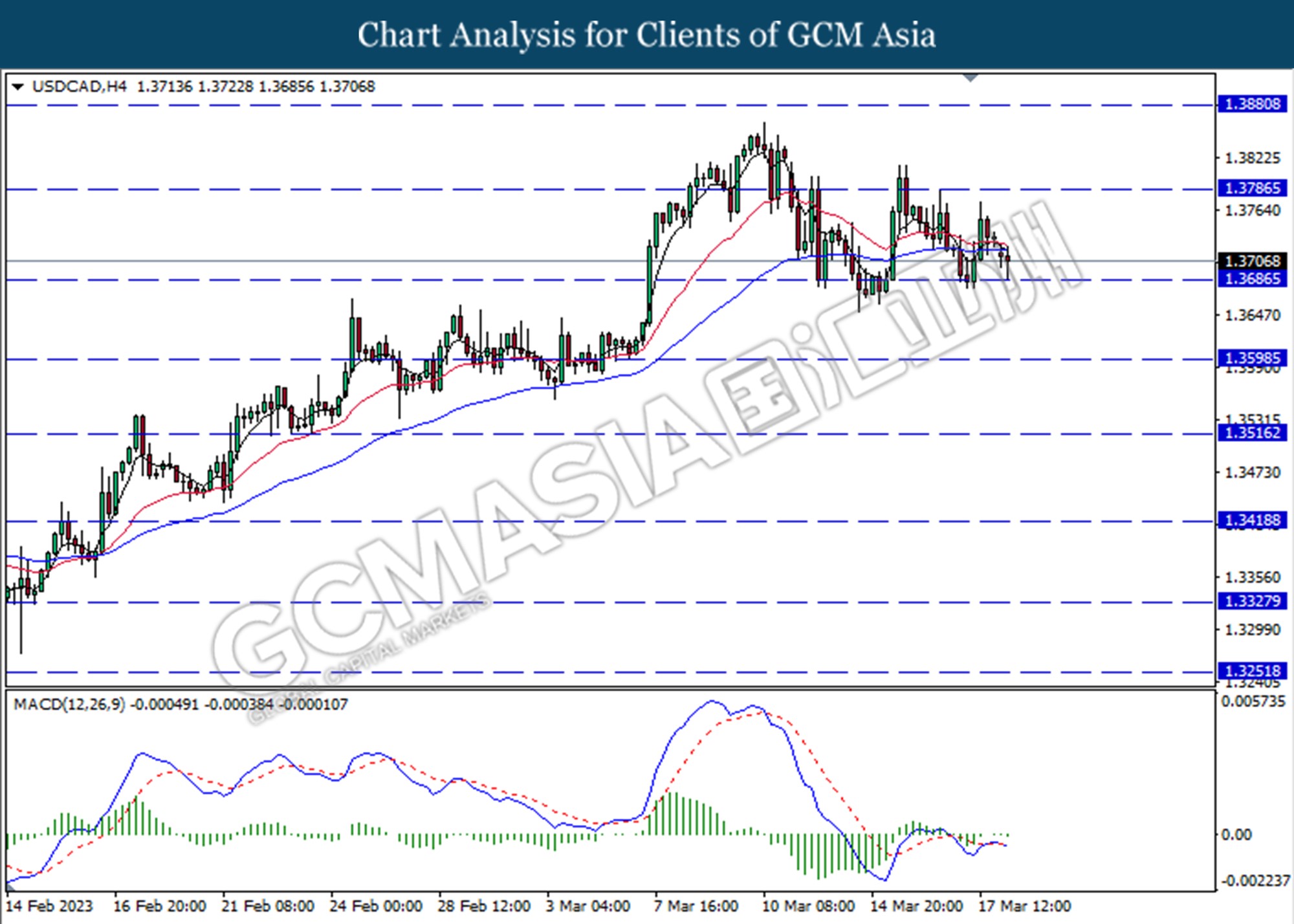

USDCAD, H4: USDCAD was traded lower while currently testing for the support level. MACD which illustrated bearish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

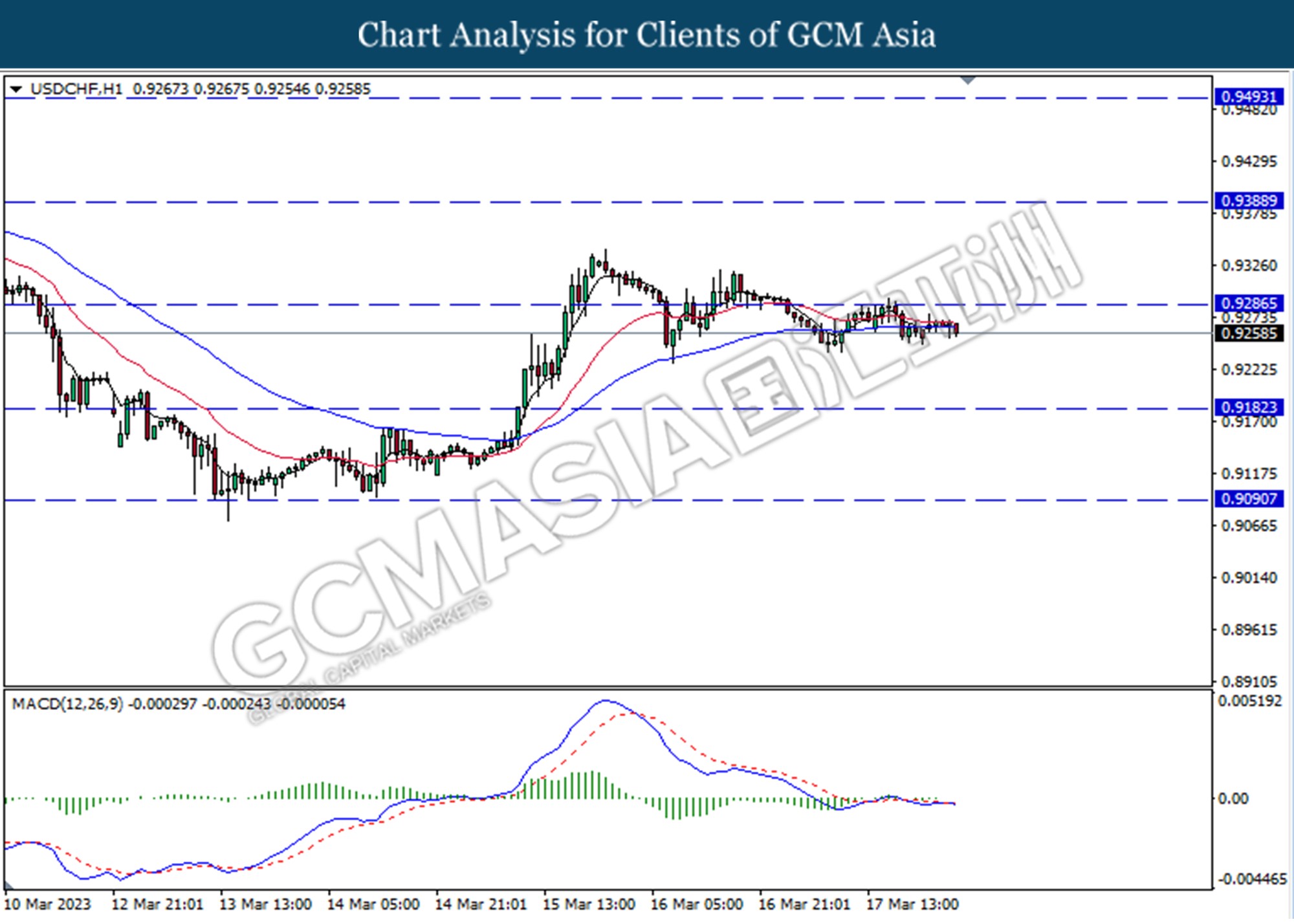

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.9180.

Resistance level: 0.9285, 0.9390

Support level: 0.9180, 0.9090

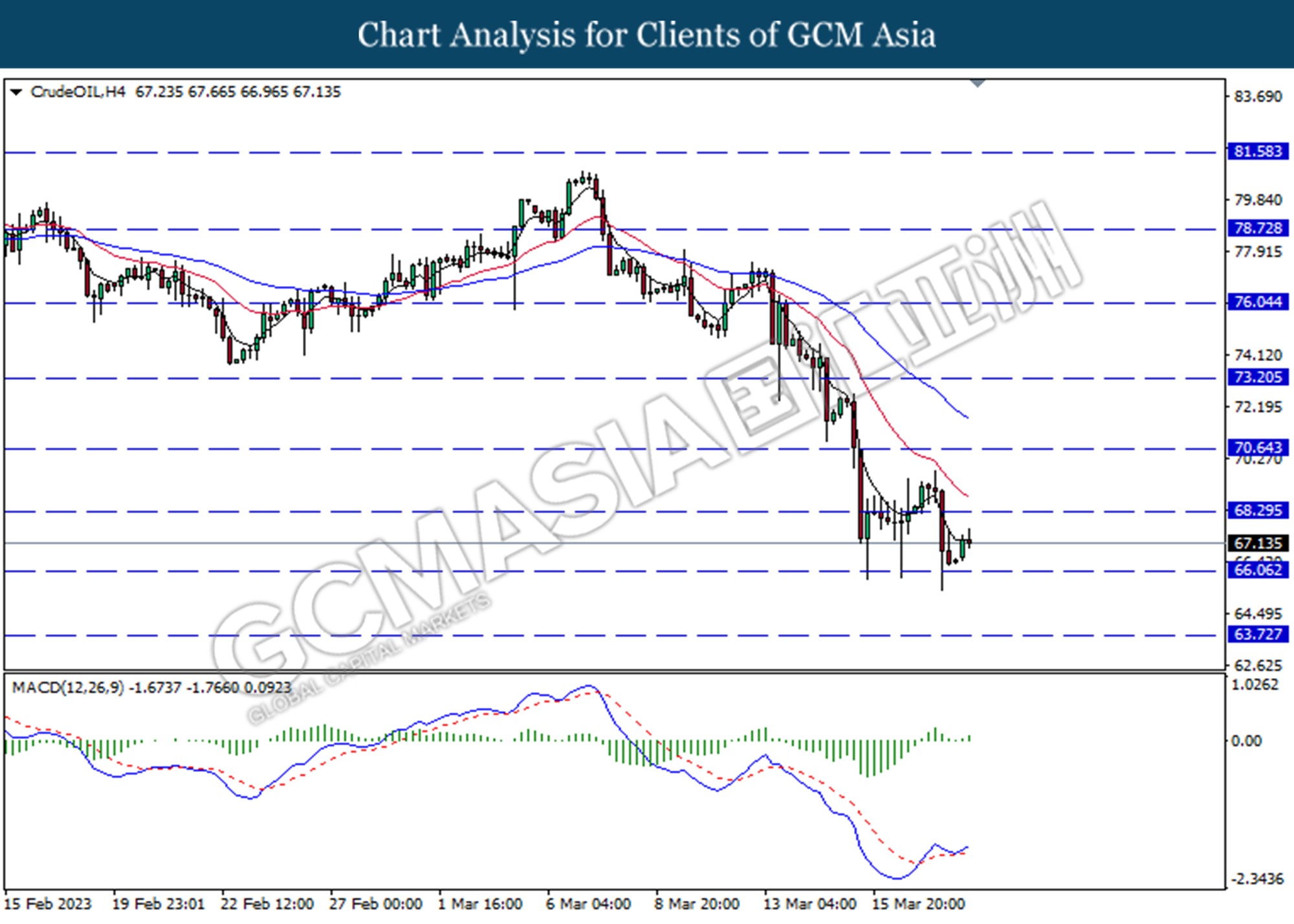

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the support level at 66.05. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level.

Resistance level: 68.30, 70.65

Support level: 66.05, 63.70

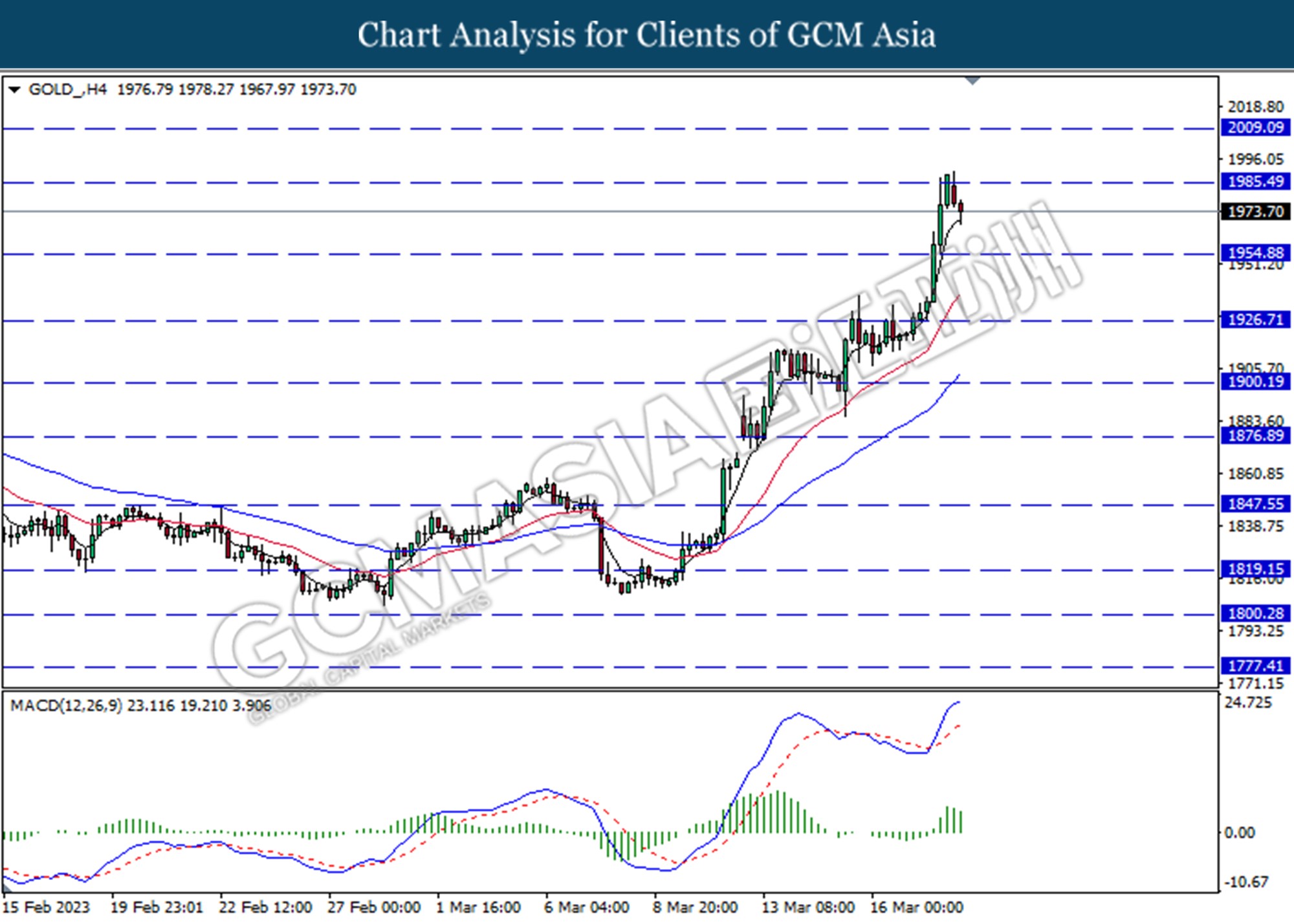

GOLD_, H4: Gold price was traded lower following retracement from the resistance level at 1985.50. MACD which illustrated decreasing bullish momentum suggests the commodity to extend losses toward the support level at 1954.90.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70