20 March 2023 Morning Session Analysis

Greenback sank amid Fed rate hikes expectation eased.

The dollar index, which traded against a basket of six major currencies, lost its ground as the recent bank jitters tumbled the possibility of the Fed’s aggressive rate hike. Last week, the fallout of SVB and Signature Bank coaxed the market participants to rush into traditional safe-haven assets, in order to avoid market uncertainty. With the purpose of safeguarding the US banking sector, the Federal Reserve has implemented a new funding facility, which will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. As a result, cash-short banks have borrowed about $300 billion from the Federal Reserve in the past week. The plan has blunted the Fed’s ongoing quantitative program and re-widened the Fed’s balance sheet massively. Besides, the banking crisis urged investors to bet on a pause in hiking interest rates by the Federal Reserve in the upcoming meeting. Against this backdrop, the US dollar is likely to remain under pressure in the foreseeable future. As of writing, the dollar index edged up 0.04% to 103.75.

In the commodities market, crude oil prices were down by -0.02% to $66.35 per barrel as the banking turmoil in Europe and the US blurred the oil demand’s prospect. Besides, gold prices ticked down by -0.59% to $1977.80 per troy ounce after skyrocketing more than 3% last Friday amid the market contagion fears.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

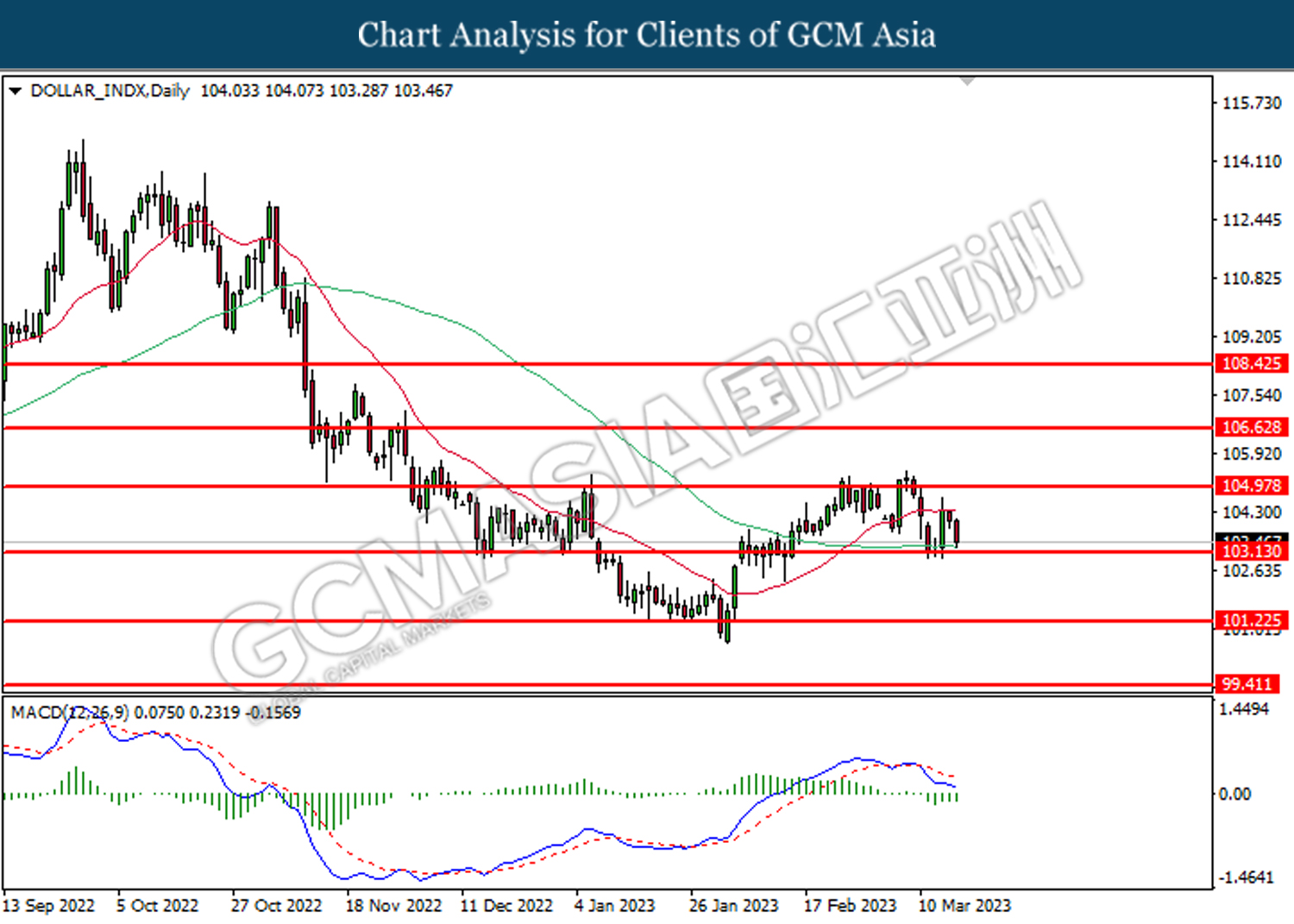

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

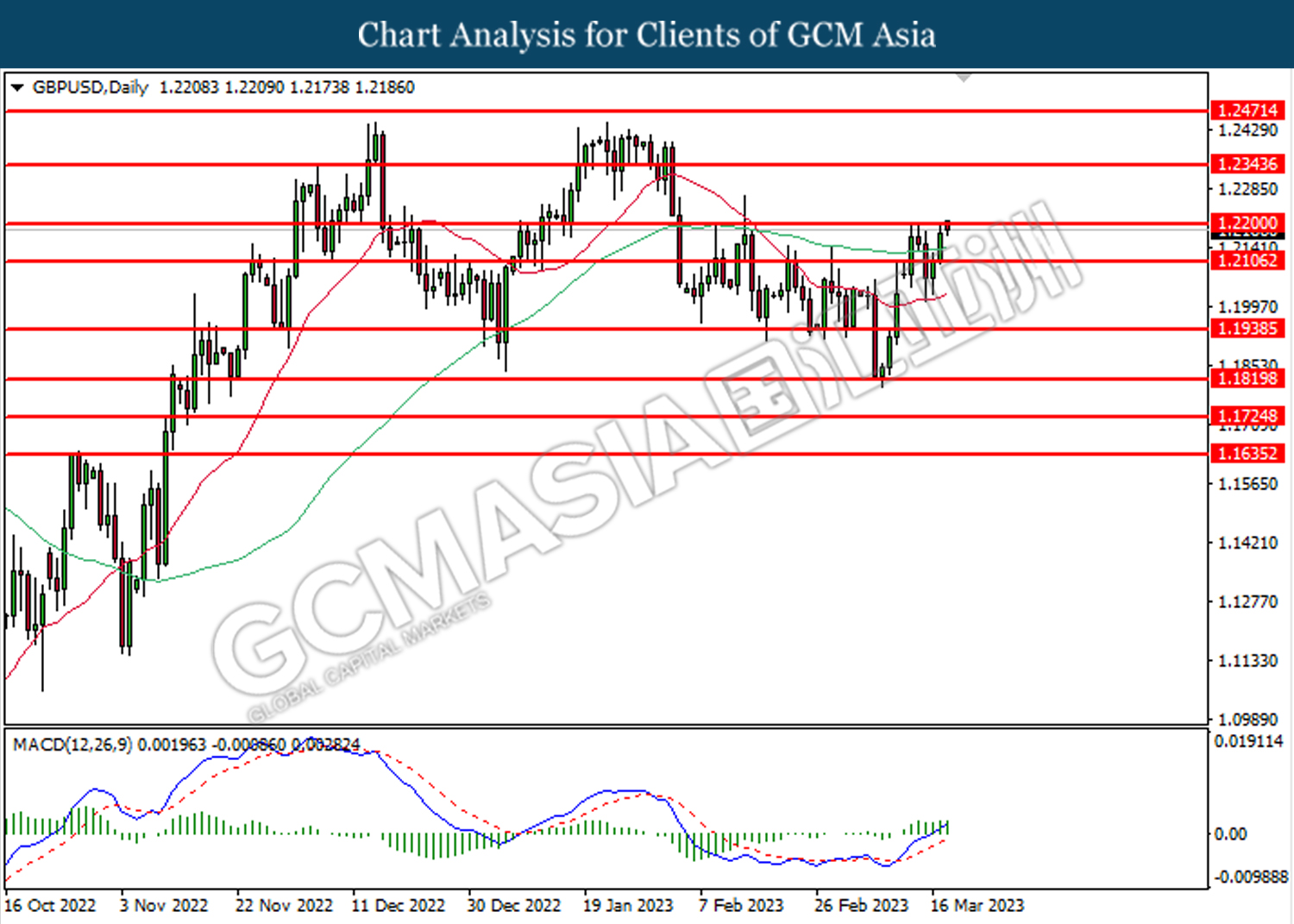

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

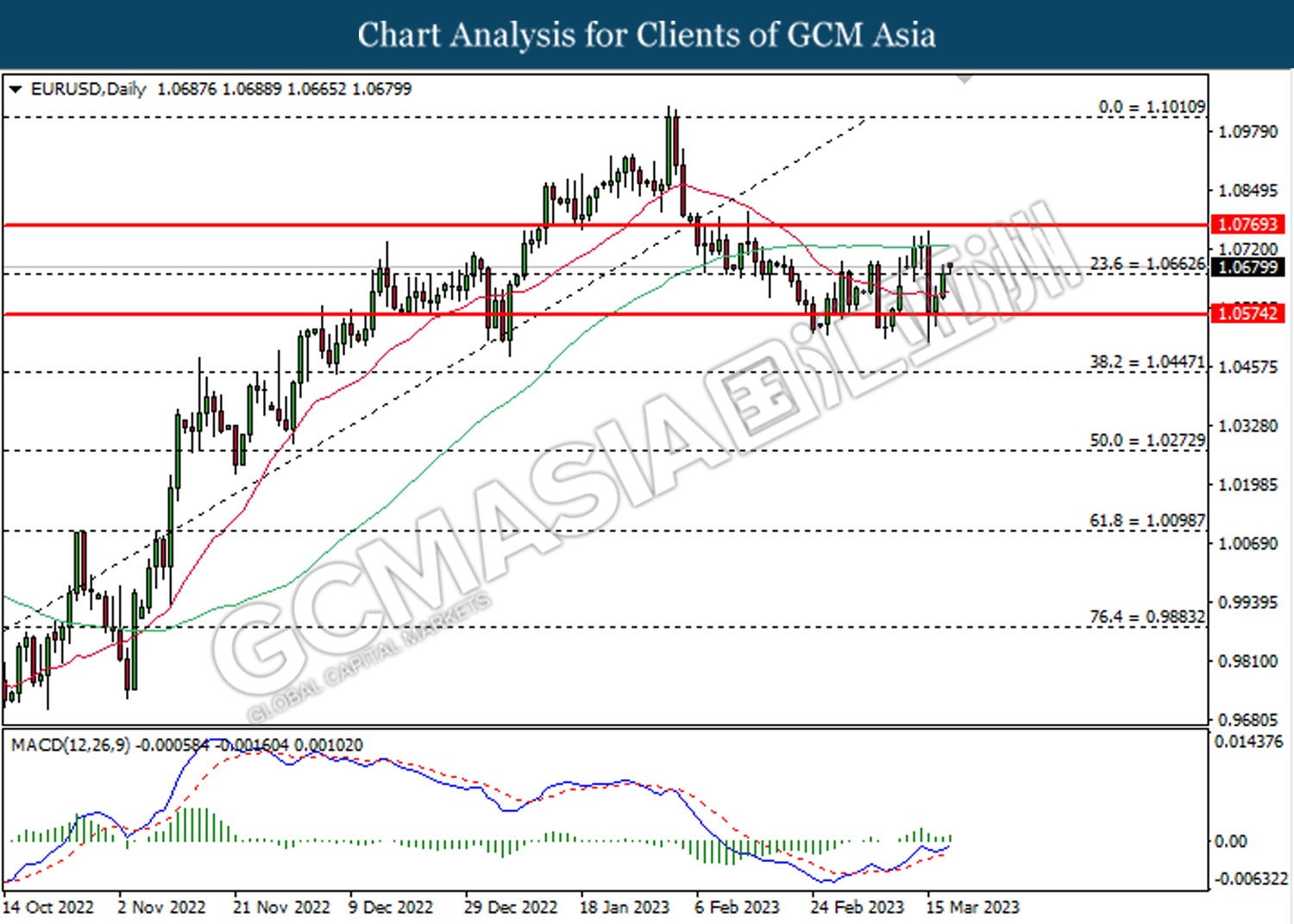

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

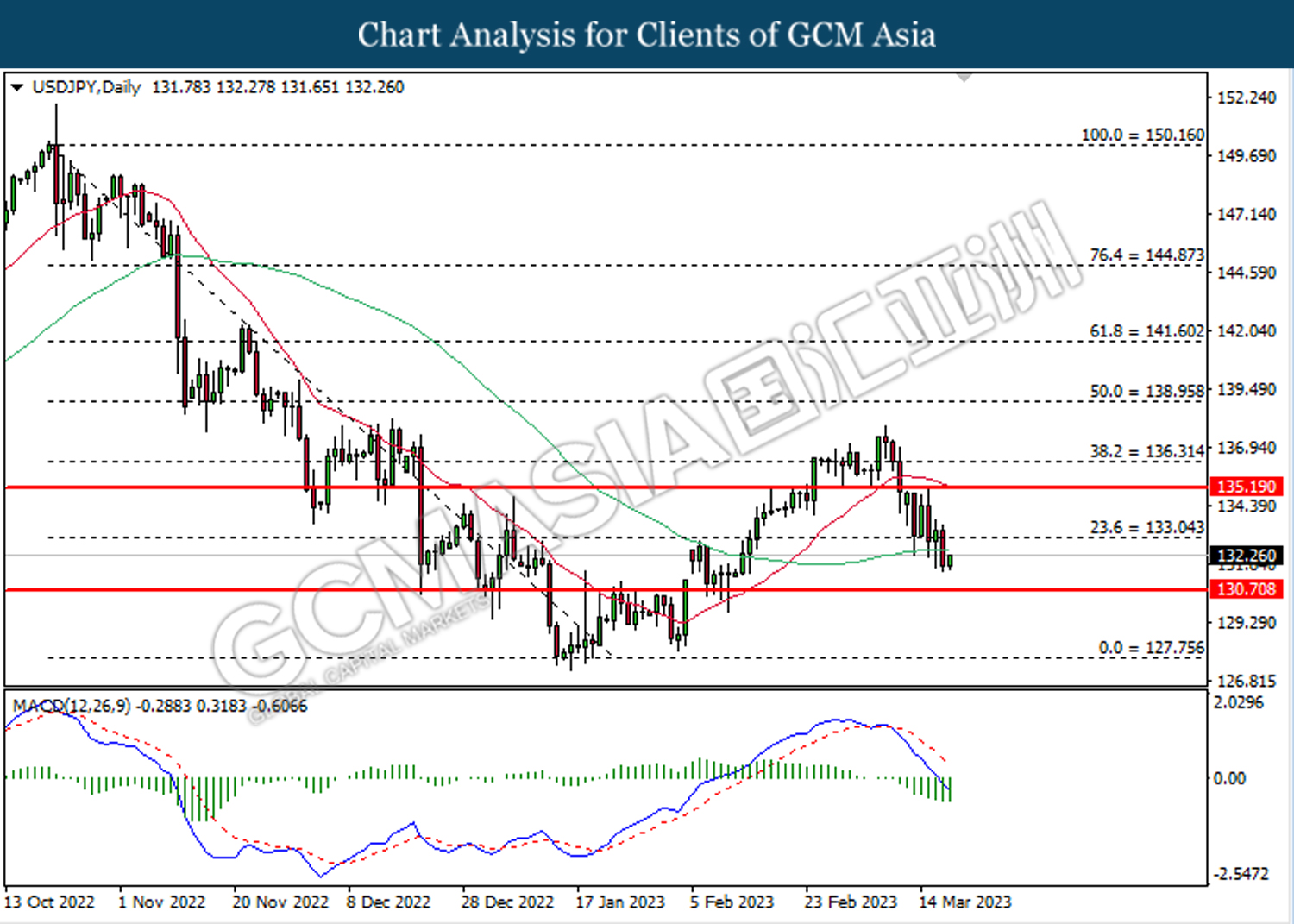

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 133.05. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 130.70.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

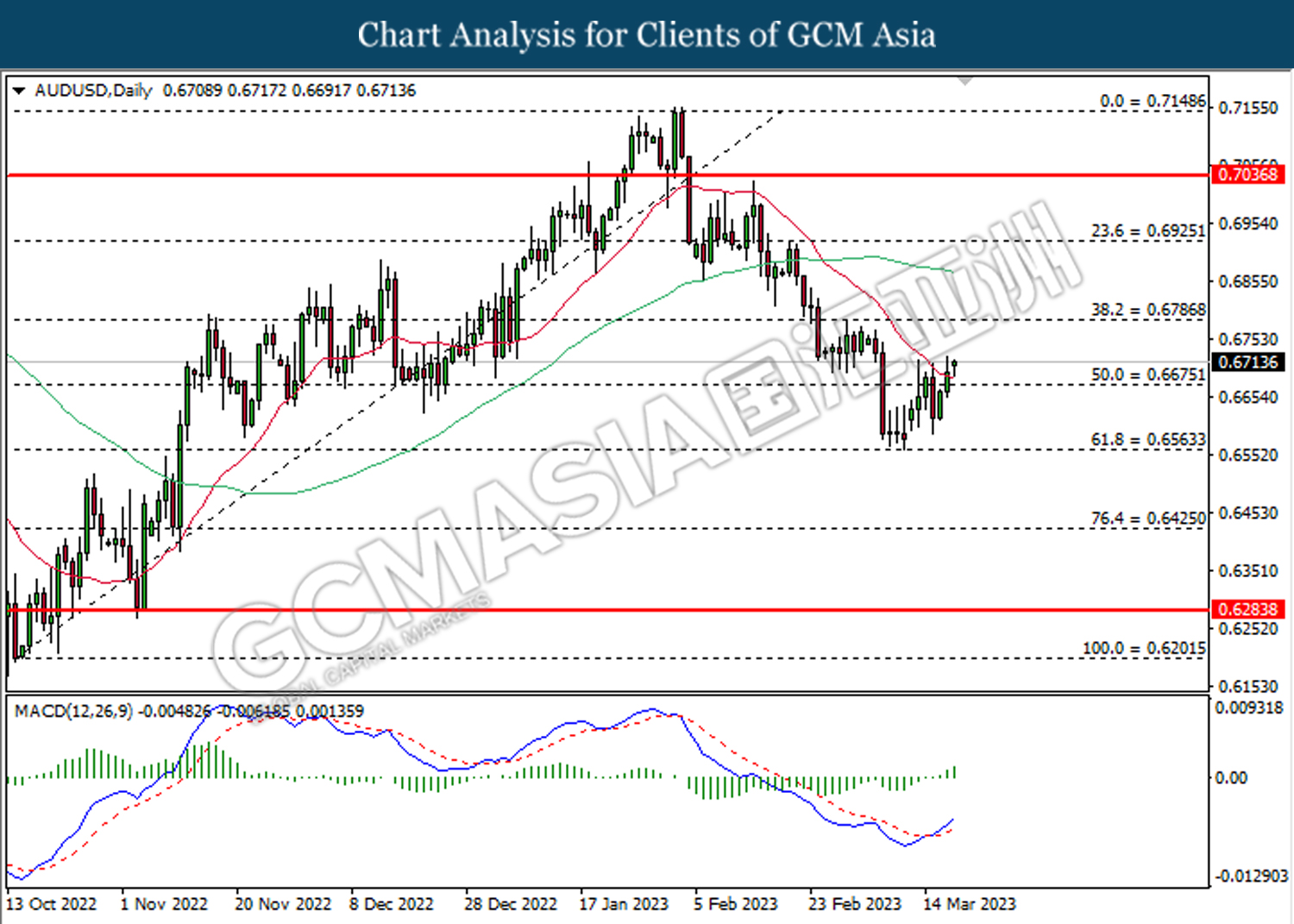

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

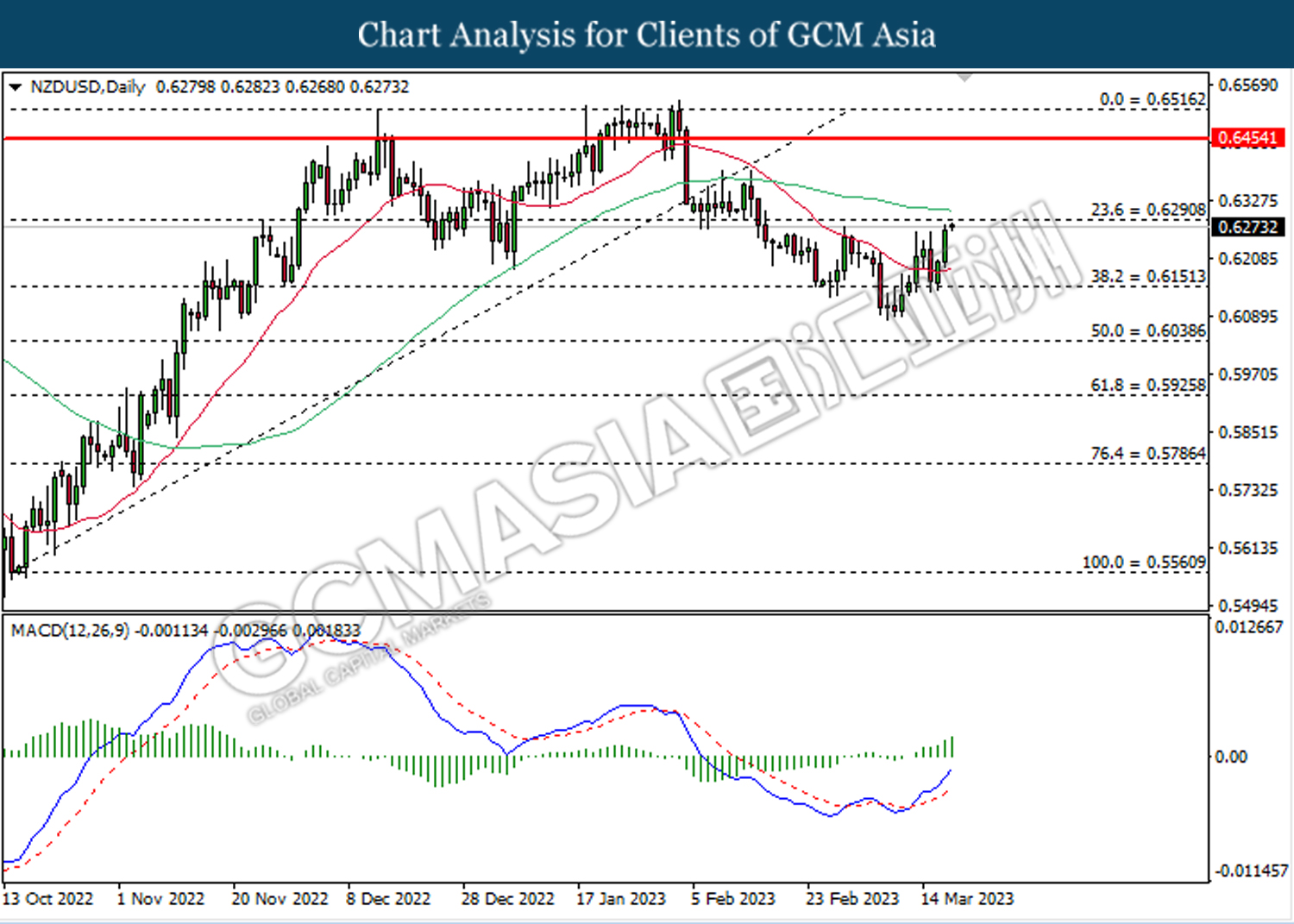

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

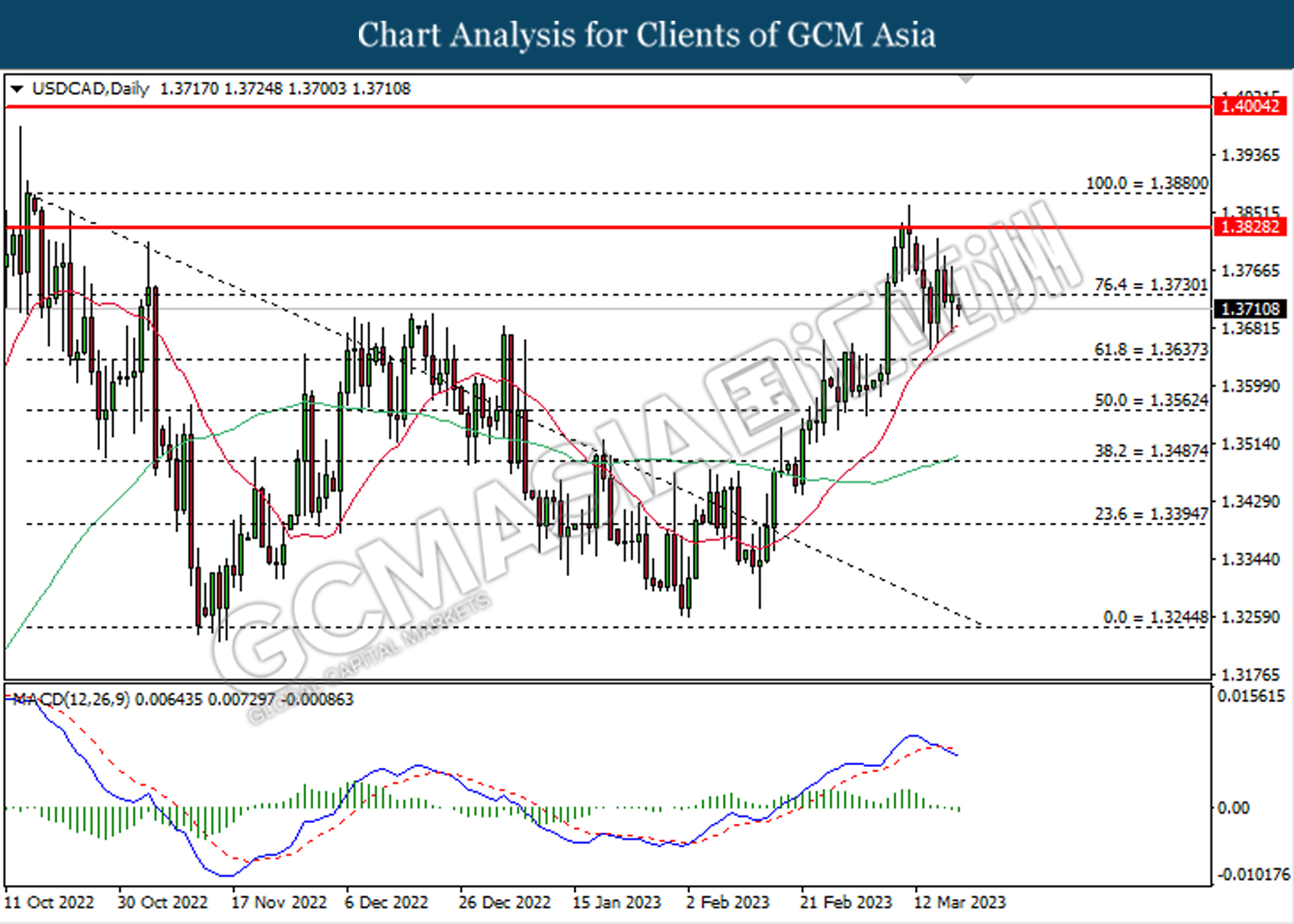

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3730. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3635.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

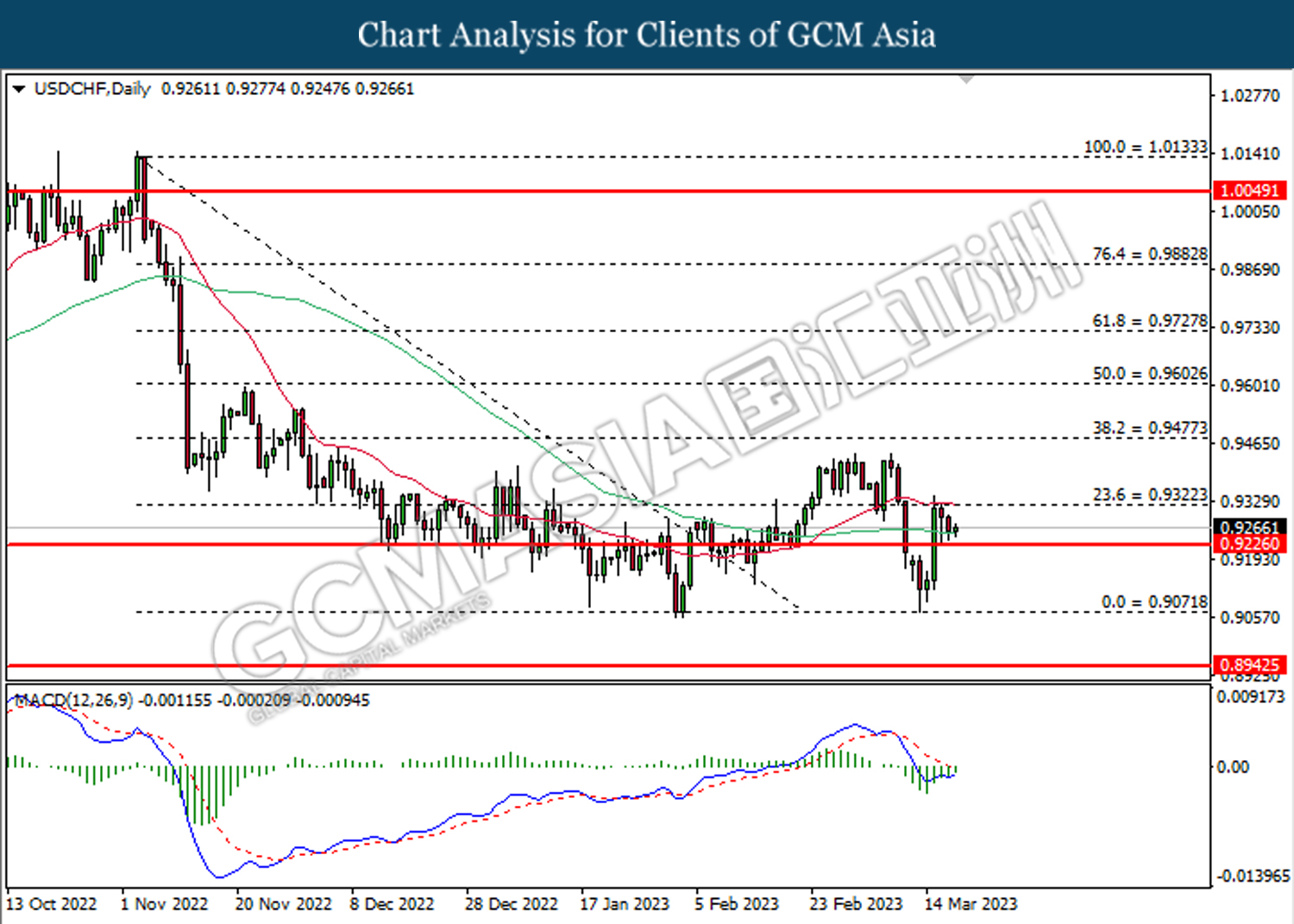

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9320. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term toward the higher level.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

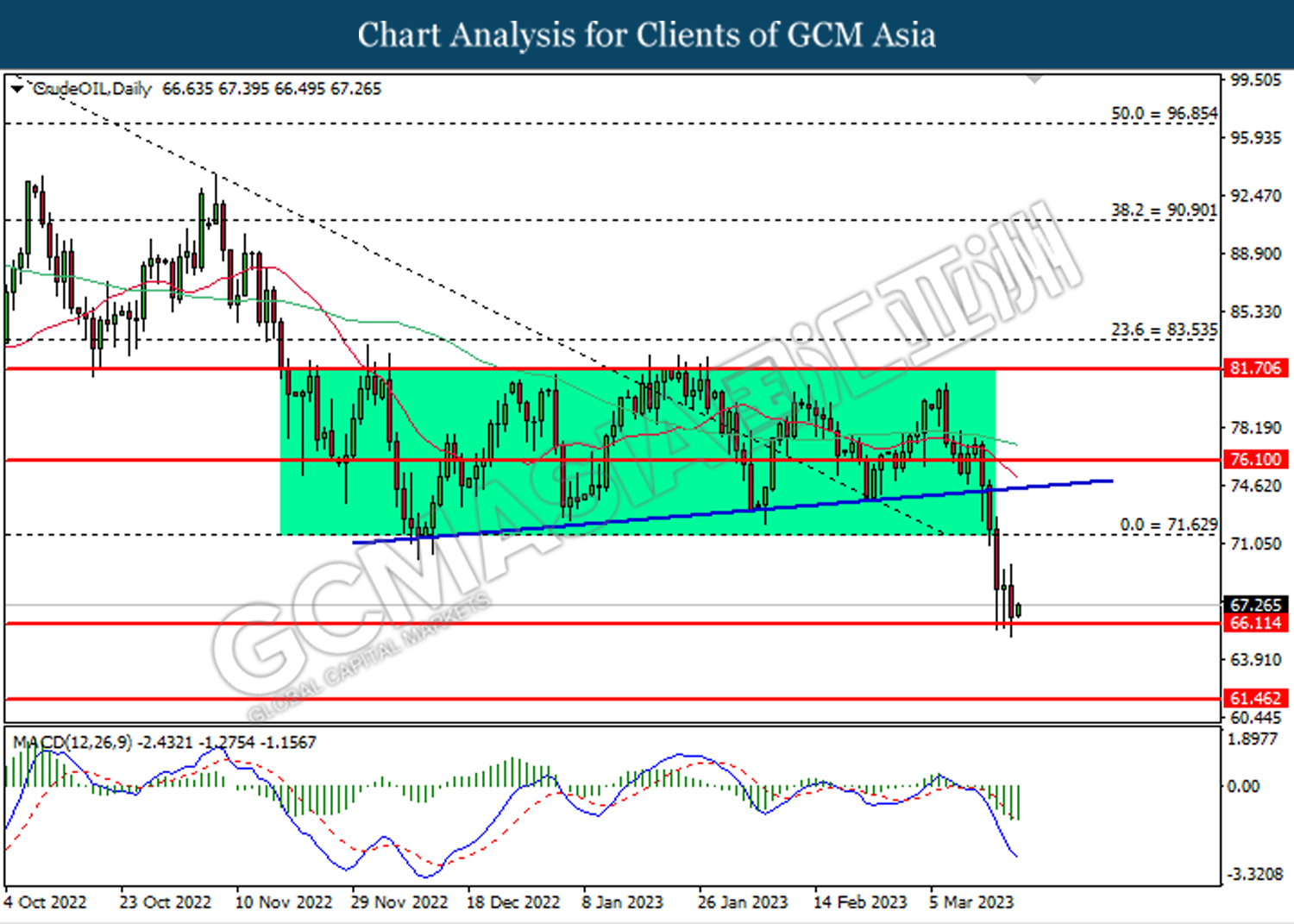

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

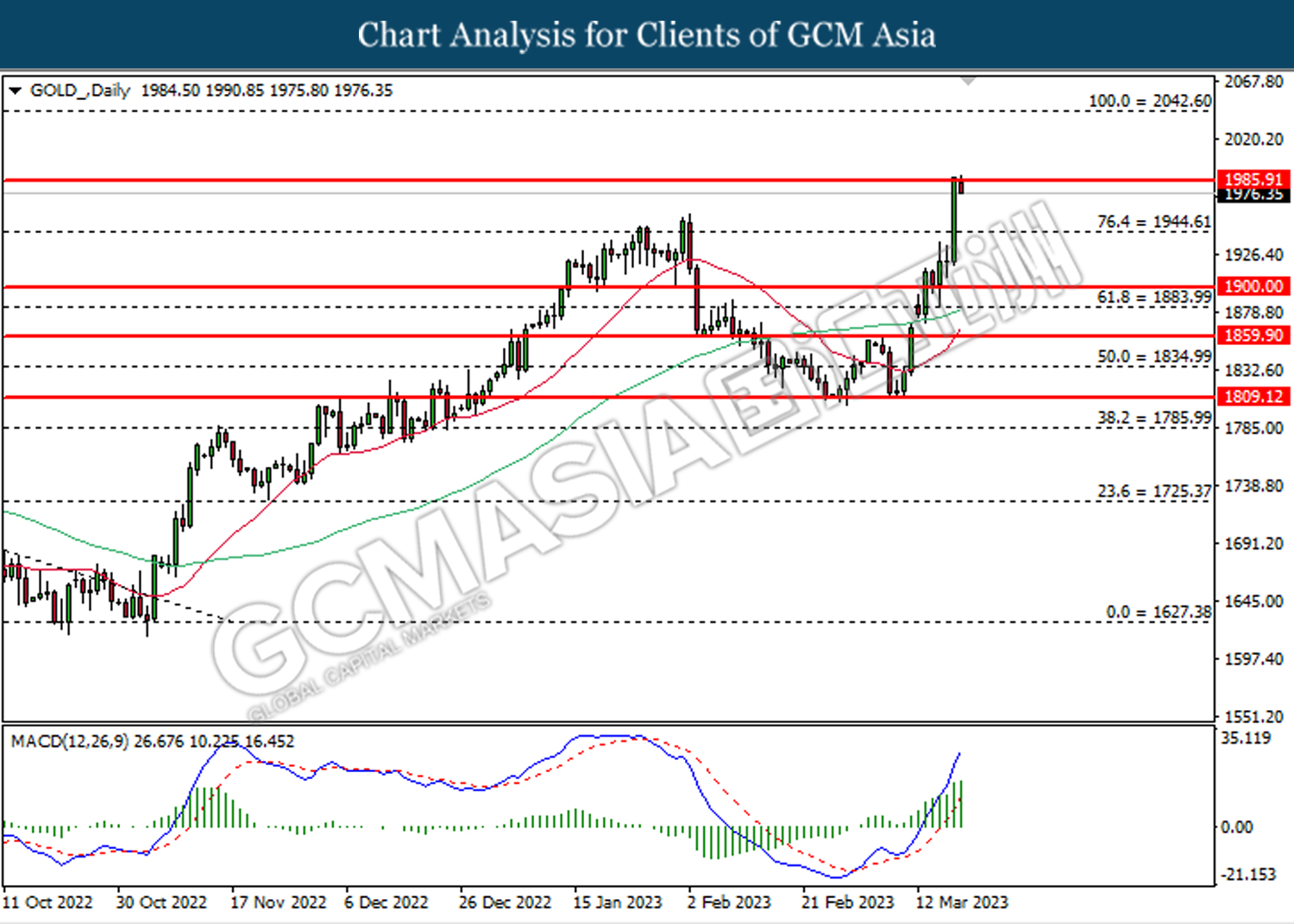

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1985.90. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1985.90, 2042.60

Support level: 1944.60, 1900.00