20 April 2017 Daily Analysis

Cautious atmosphere as French election closes in.

Greenback was caught in a tight trading range on Thursdays, holding off from previous low as investors anxiously await this weekend’s first round of presidential election in France. The dollar index nudged up 0.1% to 99.78 as of writing. Otherwise, the euro was traded flat for the day, last seen at $1.0714. Centrist candidate Emmanuel Macron take the lead in an opinion poll although the outcome for the first round off will be too close to call for. Millions of French voters remained undecided, making it the least predictable election for decades. Such uncertainty could raise higher anxiety among investor and a potential surprise result may spread large scale turmoil in the financial market. As for other region, pound sterling was held steady at $1.2485 after touching six-months high on Tuesday following British Prime Minister Theresa May calls for an early election prior to Brexit negotiation.

Looking into the commodities market, crude oil price rebounded during early Asian trading hours following prior disappointing inventory data in the US as investors take the advantage to buy the dip. Oil prices was up 0.59% and was last quoted around $51.15 per barrel. Otherwise, gold prices were down slightly by 0.10% to $1,280.17 albeit remained supported ahead of French election this weekend.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:30 GBP BoE Gov Carney Speaks

00:30 GBP BoE Gov Carney Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 06:45 | NZD – CPI (QoQ) (Q1) | 0.4% | 0.8% | 1.0% |

| 20:30 | USD – Initial Jobless Claims | 234K | 242K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Apr) | 32.8 | 25.0 | – |

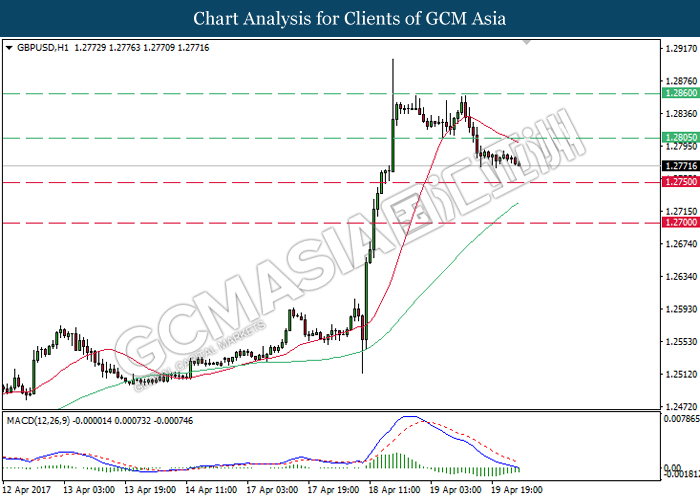

GBPUSD

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level of 1.2860 while closing below the 20-moving average line (red). As the MACD histogram illustrate moderate downward signal and momentum, GBPUSD is expected to advance further down, towards the target of support level at 1.2750.

Resistance level: 1.2805, 1.2860

Support level: 1.2750, 1.2700

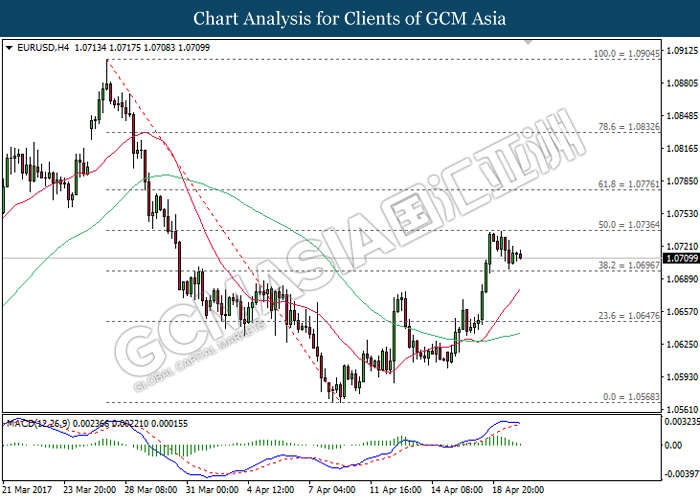

EURUSD

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level of 1.0700. However, as the upward signal in MACD histogram continues to narrow sideways while coupled with depreciation in upward momentum, EURUSD may be traded lower in short-term as technical correction. Long-term trend direction suggests EURUSD to be traded higher as both MA lines continue to expand upwards after the formation of golden cross.

Resistance level: 1.0735, 1.0775

Support level: 1.0700, 1.0650

USDJPY

USDJPY, H1: USDJPY remains traded within an ascending triangle while recently rebounded from the support level of 108.70. It is expected to be traded higher in short-term within the triangle, towards the resistance level of 109.20.

Resistance level: 109.20, 109.40

Support level: 108.95, 108.70

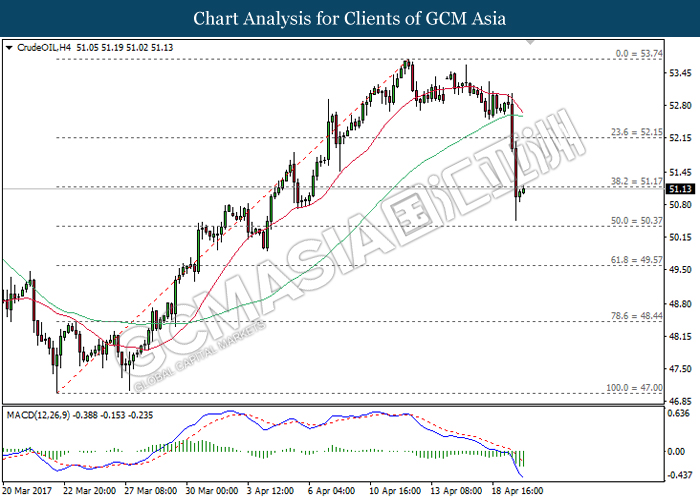

CrudeOIL

CrudeOIL, H4: Crude oil price plunged sharply while closing below both moving average line and two consecutive support levels. However, recent rebound from the support level of 50.40 suggests crude oil price to experience brief technical correction and to be traded higher in short-term. Long-term trend direction still suggests crude oil price to move further down as both moving average line continues to narrow downwards.

Resistance level: 51.20, 52.15

Support level: 50.40, 49.60

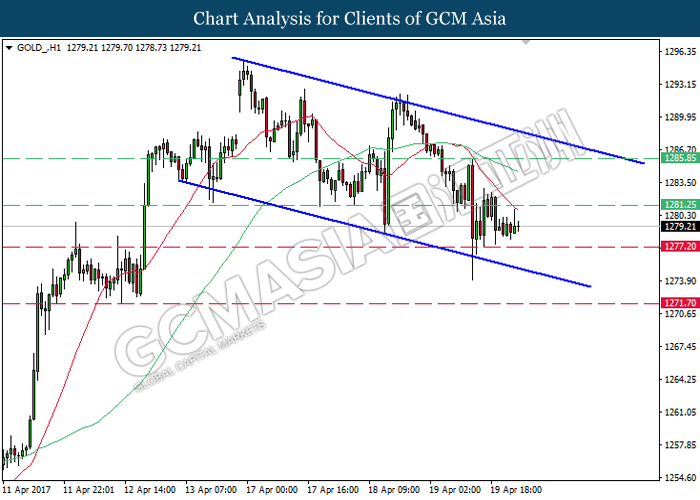

GOLD

GOLD_, H1: Gold price remains traded within a downward channel following prior retracement from the 20-moving average line (red). As both lines continue to expand downwards, gold price is expected to advance further down, towards the target of support level at 1277.20.

Resistance level: 1281.25, 1285.85

Support level: 1277.20, 1271.70