20 June 2017 Daily Analysis

Hawkish signals invigorate greenback.

Greenback hits three-weeks high against the Yen on Tuesday after an influential Federal Reserve official gave hawkish signal that has lifted market expectations for the Fed to keep its interest hike pace. Pair of USD/JPY rose 0.11% to 111.65 while the dollar index was held steady at 97.15. Sentiment surrounding the dollar was invigorated after New York Fed President William Dudley said that tightening in the labor market should help to drive up inflation. This has offset prior concerns among investors that stubbornly low inflationary pressure may prevent the Fed from raising interest rates further this year. “Inflation is a little lower than what we would like, but we think that if the labor market continues to tighten, wages will gradually pick up and with that, inflation will gradually get back to 2 percent,” William Dudley told to a local business group in New York. The rise in dollar pegged back the euro and pound as Dudley’s hawkish comment came amid the official start of Brexit negotiation between UK and EU. Likewise, the dollar continued to strengthen against the Japanese counterpart as Bank of Japan were reluctant to taper its bond purchasing stimulus.

In the commodities market, crude oil price edge up 0.20% to $44.52 while upside remains limited as investors focus on the persistent rise of crude supply which could undermined efforts done by OPEC and other producers. Similarly, gold price was last seen at $1,244.57 while remained under pressure due to hawkish signals that gives further support to US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

09:30 AUD RBA Meeting Minutes

15:30 GBP BoE Gov Carney Speaks

19:45 USD FOMC Member Rosengren Speaks

20:00 USD FOMC Member Stanley Fischer Speaks

03:00 USD FOMC Member Kaplan Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 04:30 | Crude Oil – API Weekly Crude Oil Stock | 2.750M | – | – |

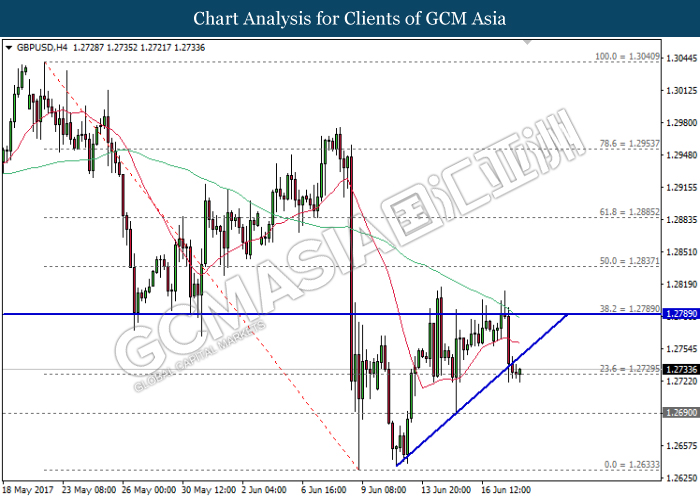

GBPUSD

GBPUSD, H4: GBPUSD has recently broke out from the bottom level of ascending triangle, signaling a change in trend direction to move further downwards. A successful closure below the support level of 1.2730 would signal further downward bias towards the next target at 1.2690.

Resistance level: 1.2790, 1.2840

Support level: 1.2730, 1.2690

EURUSD

EURUSD, H4: EURUSD remained traded within an upward channel while currently testing at the bottom level. As Stochastic Oscillator begins to illustrate rebound signal from oversold region, a successful rebound from this level would suggests EURUSD to advance towards the target of resistance level at 1.1170.

Resistance level: 1.1170, 1.1200

Support level: 1.1140, 1.1100

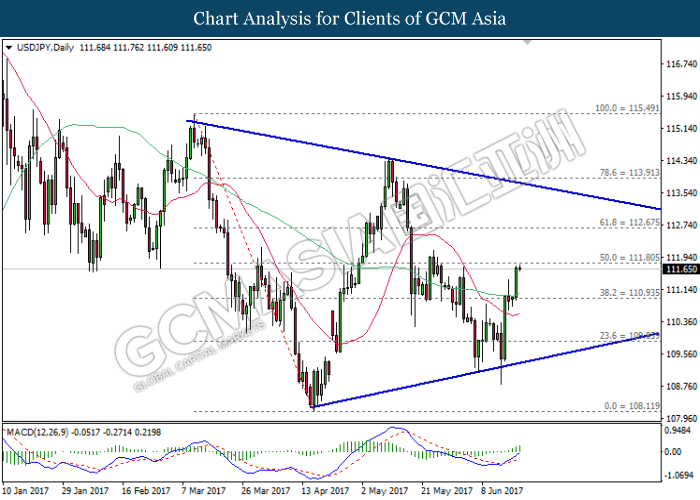

USDJPY

USDJPY, Daily: USDJPY remained traded within a narrowing triangle while currently testing at the resistance level of 111.80. MACD histogram illustrates increasing upward momentum while both MA lines begins to curve upwards suggests USDJPY to extend its upward momentum after breaking the resistance level of 111.80.

Resistance level: 111.80, 112.70

Support level: 110.95, 109.85

CrudeOIL

CrudeOIL, H4: Crude oil price remained traded within a downward channel while recently rebounded from the support level of 44.20. A closure above the 20-moving average line (red) would suggest crude oil price to move further up, towards the top level of the channel.

Resistance level: 45.30, 46.70

Support level: 44.20, 43.00

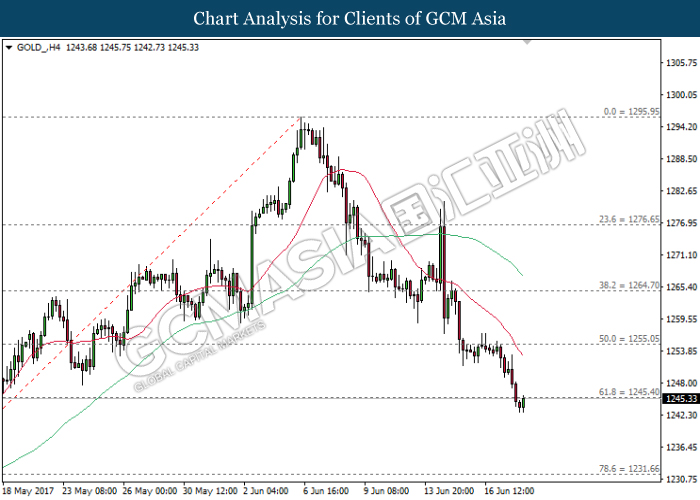

GOLD

GOLD_, H4: Gold price has extended its losses following the downward expansion of both MA lines while heading downwards. Recent closure below the support level of 1245.40 suggests further downward bias for gold price to move further down towards the next target at 1231.65.

Resistance level: 1245.40, 1255.05

Support level: 1231.65, 1214.15