20 July 2021 Morning Session Analysis

Rising coronavirus cases dampens market sentiment.

Pound sterling was traded lower against the US dollar over the backdrop of rising coronavirus cases in the region. On yesterday, pound sterling rebounds from its lower level following bullish signals with regards to Brexit. According to Reuters, UK is expected to request for more flexibility with regards to Northern Ireland Protocol to resolve tight custom checks issue. Earlier this year, following the official divorce of UK from EU, both countries have tightened their custom checks at Ireland borders after failing to reach a trade deal before the Brexit deadline. According to Brexit Minister David Frost, an announcement will be made with regards to latest development on the protocol later this week. Nonetheless, gains on the pound sterling were limited due to rising coronavirus cases in the region. According to statistics, UK has reported more than 39,000 new coronavirus cases last Sunday, up by 41.20% since mid of May. However, the government moved on to loosen social distancing SOP on yesterday despite calls to delay it as it may causes distress on the UK healthcare facility. As of writing, GBP/USD was down 0.03% to 1.3671.

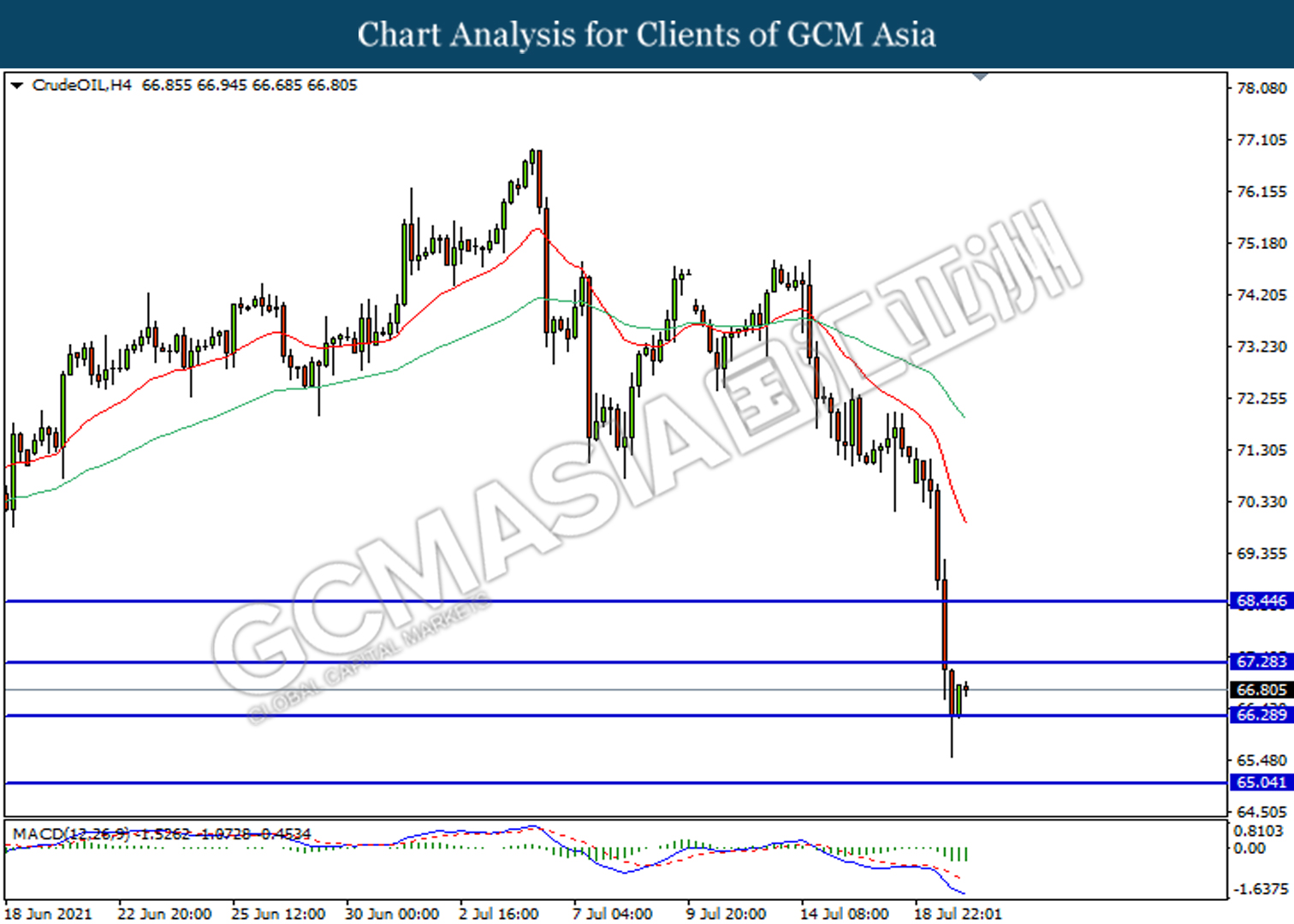

As for commodities, crude oil price rose 0.35% to $66.72 per barrel following technical correction from the lower levels. On the other hand, gold price rose 0.03% to $1,813.67 a troy ounce due to risk aversion as global coronavirus cases are on the rise.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits | – | 1.700M | 1.683M |

Technical Analysis

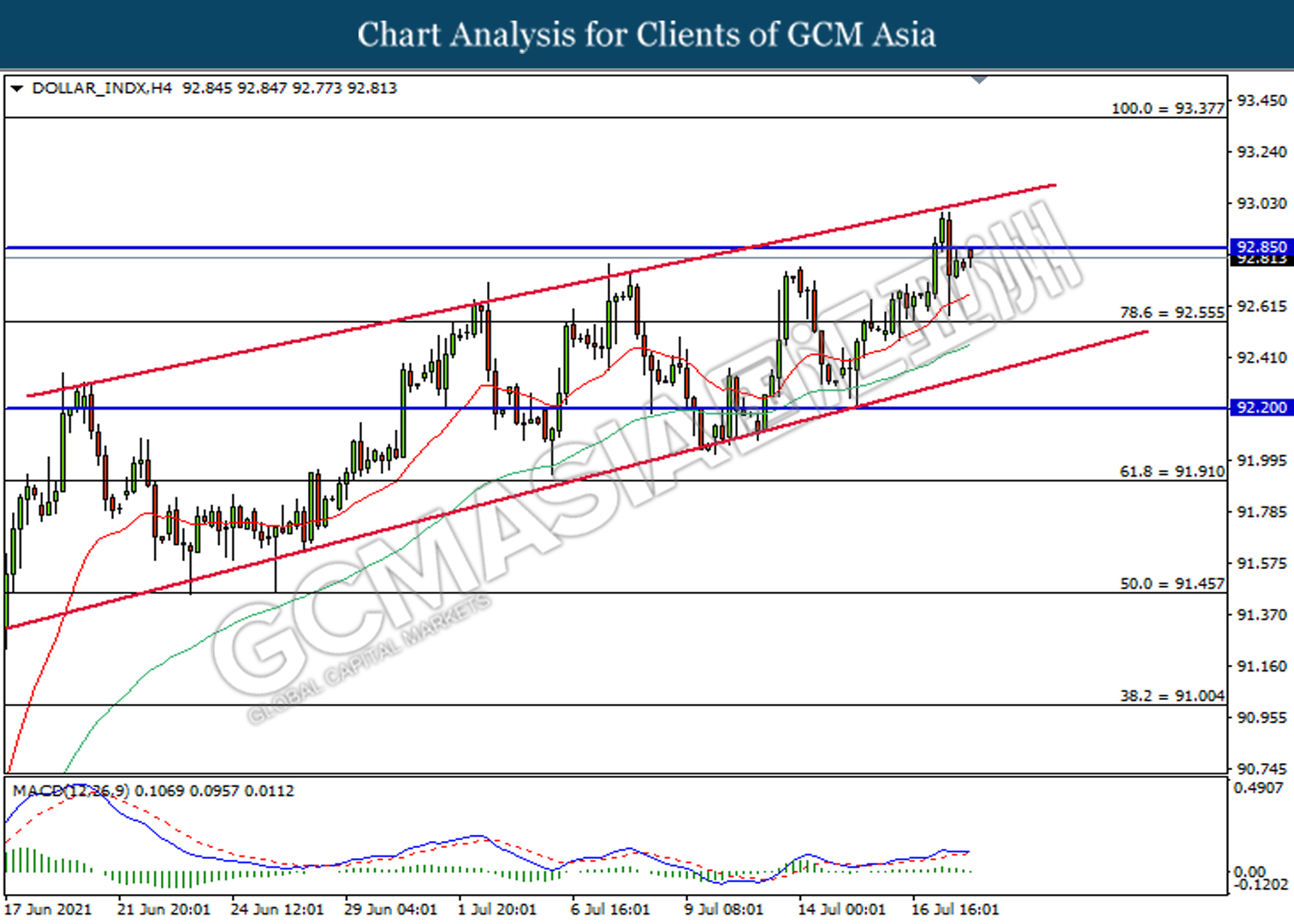

DOLLAR_INDX, H4: Dollar index was traded higher following a rebound from the lower levels. MACD which illustrated bullish momentum suggest the index to extend its gains in short-term.

Resistance level: 92.85, 93.40

Support level: 92.55, 92.20

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrated bearish momentum suggest the pair to be traded lower after breaking the support level.

Resistance level: 1.3790, 1.3885

Support level: 1.3660, 1.3565

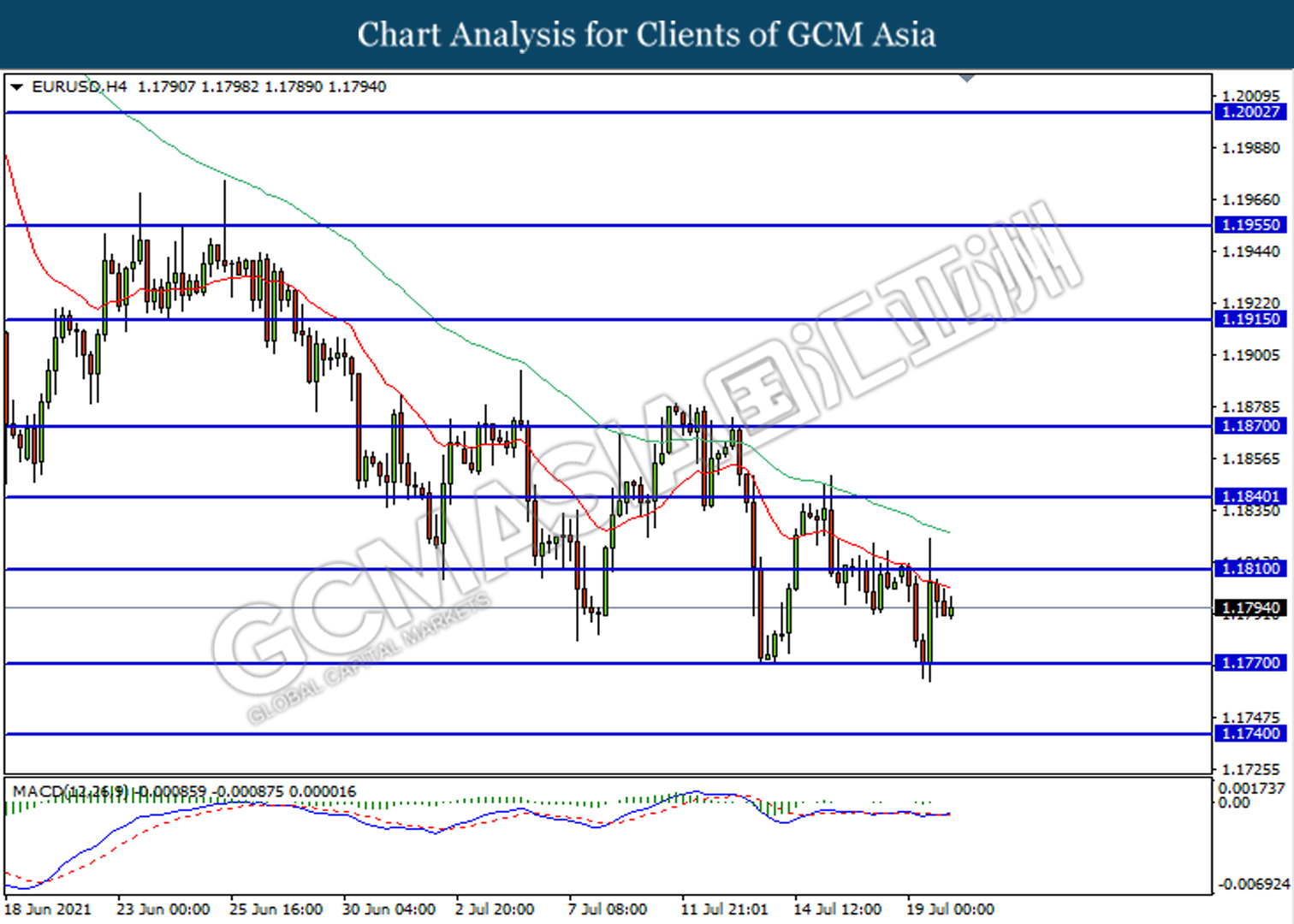

EURUSD, H4: EURUSD was traded lower following prior retrace from 1.1810. MACD which illustrated bearish momentum suggest the pair to be traded lower in short-term.

Resistance level: 1.1810, 1.1840

Support level: 1.1770, 1.1740

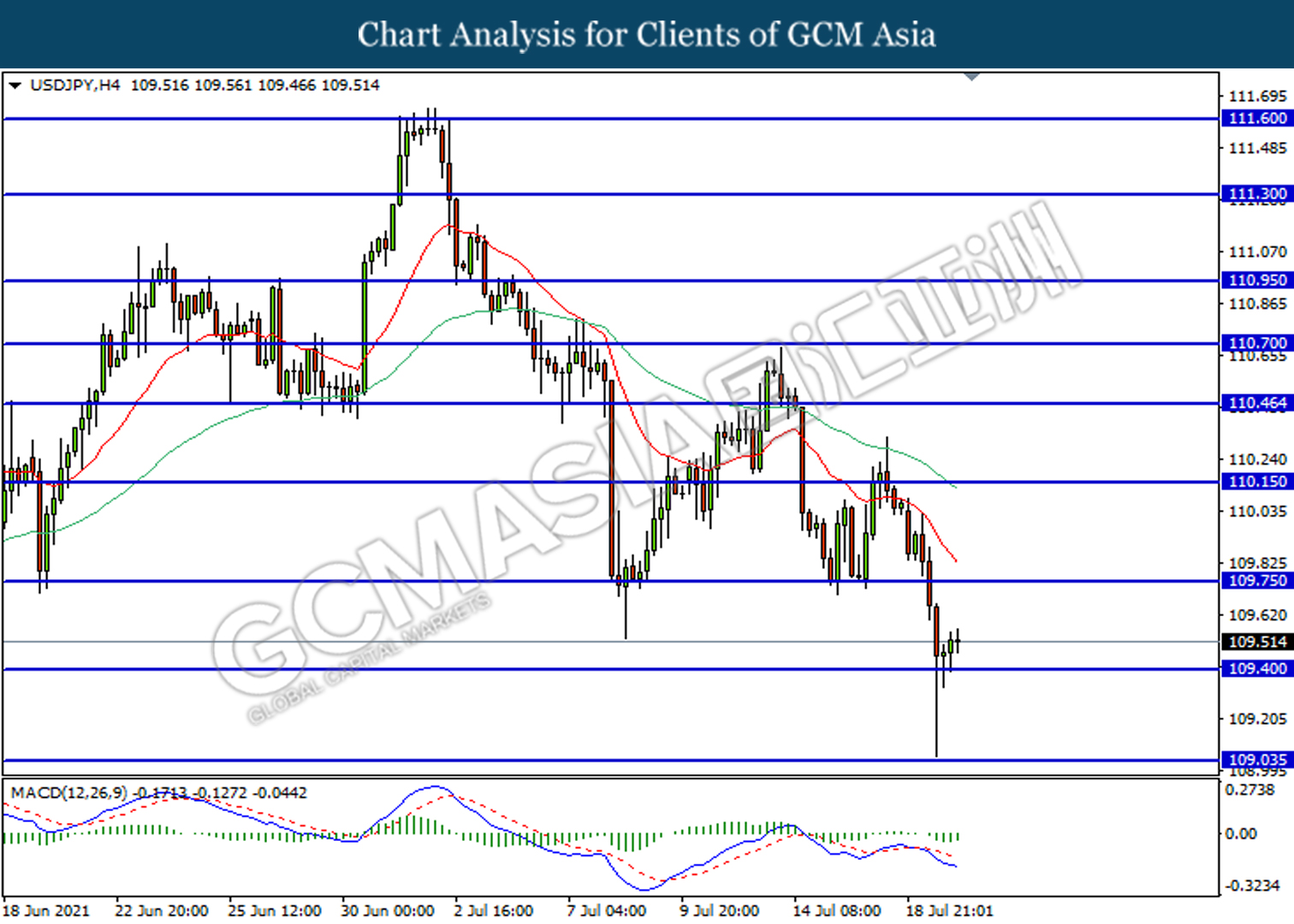

USDJPY, H4: USDJPY was traded higher following prior rebound from lower levels. MACD which illustrated diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 109.75, 110.15

Support level: 109.40, 109.05

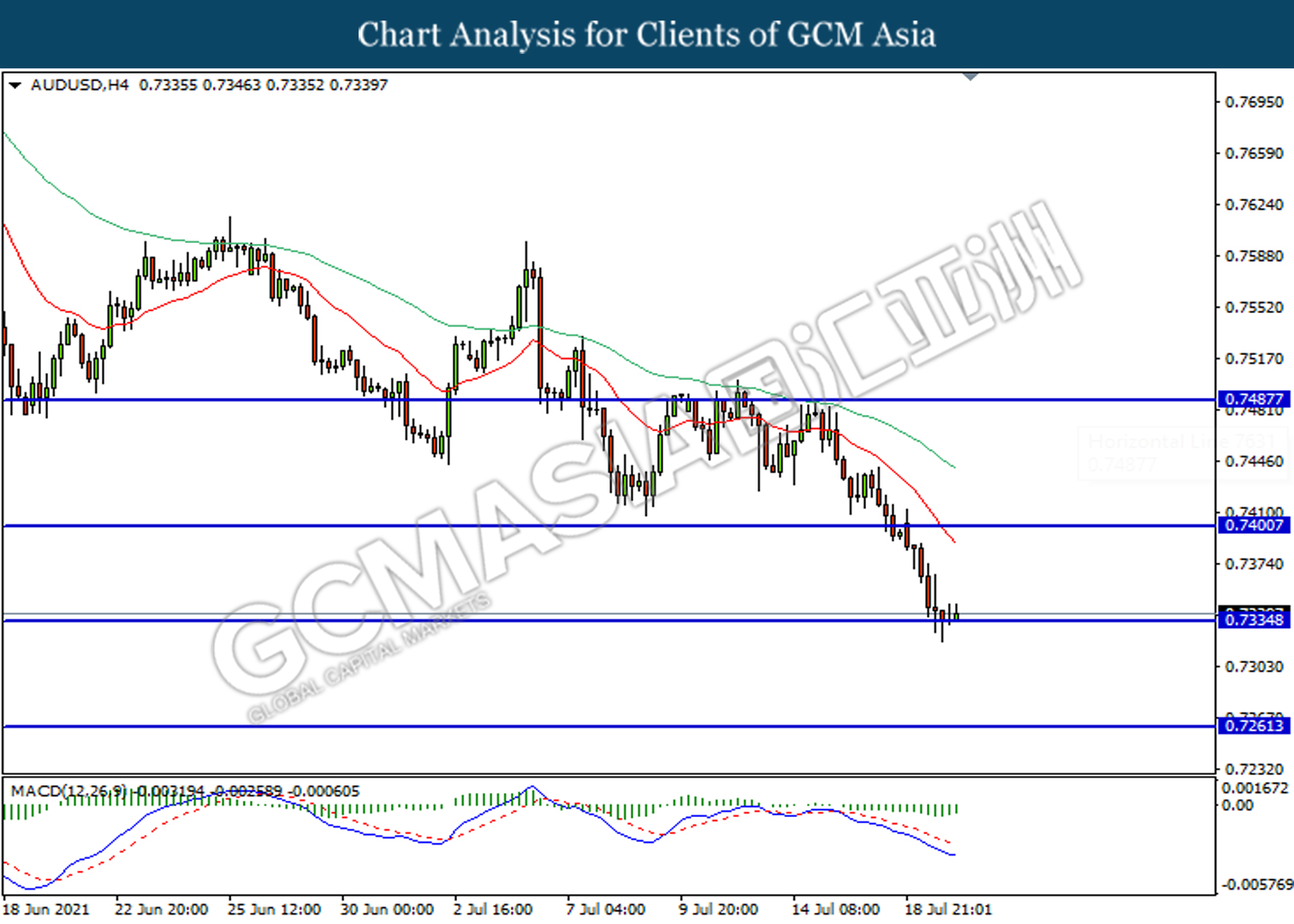

AUDUSD, H4: AUDUSD was traded lower following a retracement from higher levels. MACD which shows bearish momentum suggests the pair to extend its losses after breaking the support level.

Resistance level: 0.7400, 0.7490

Support level: 0.7335, 0.7260

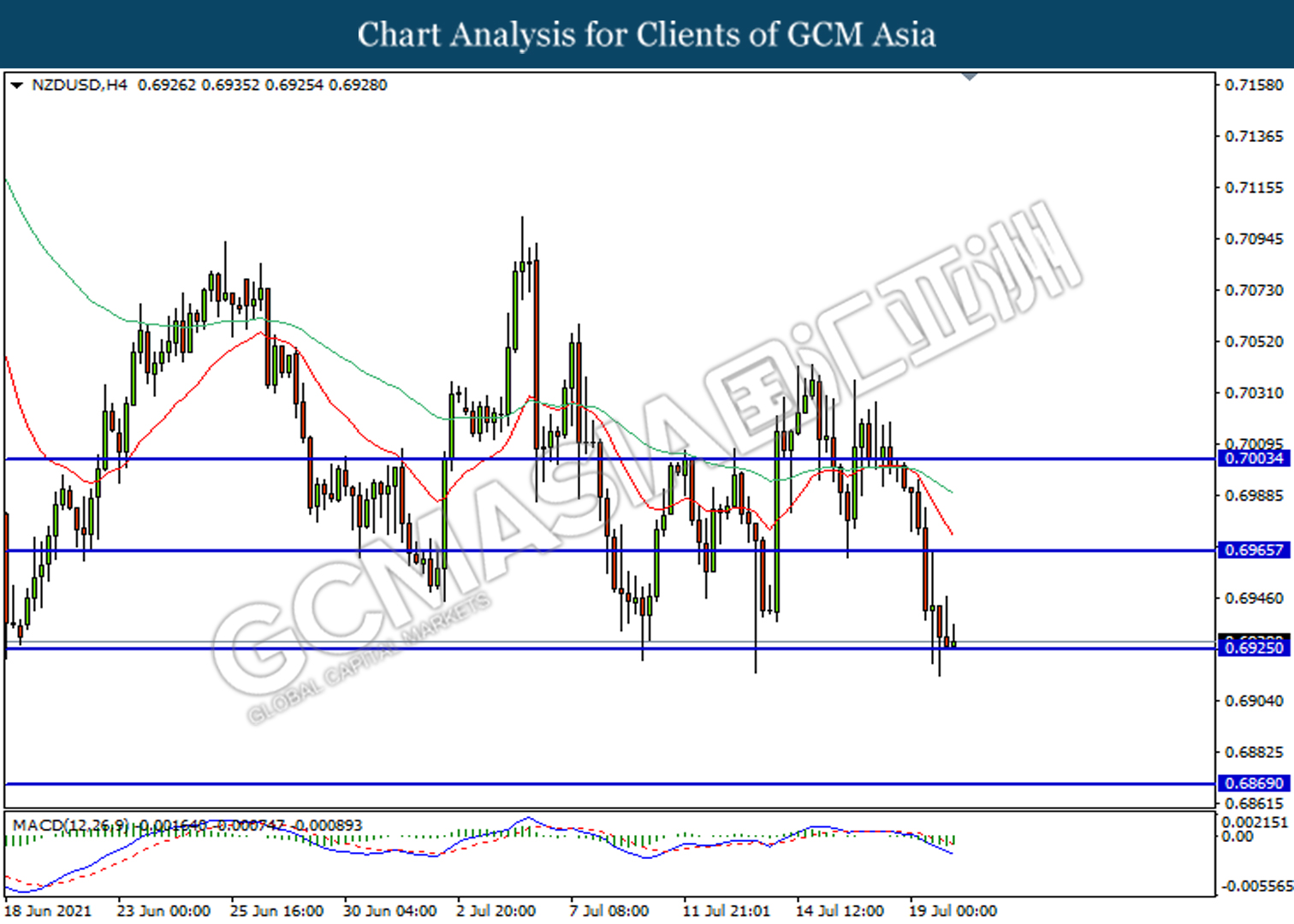

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6925. MACD which illustrate bearish momentum suggests the pair to extend its losses after closing below the support level.

Resistance level: 0.6965, 0.7000

Support level: 0.6925, 0.6870

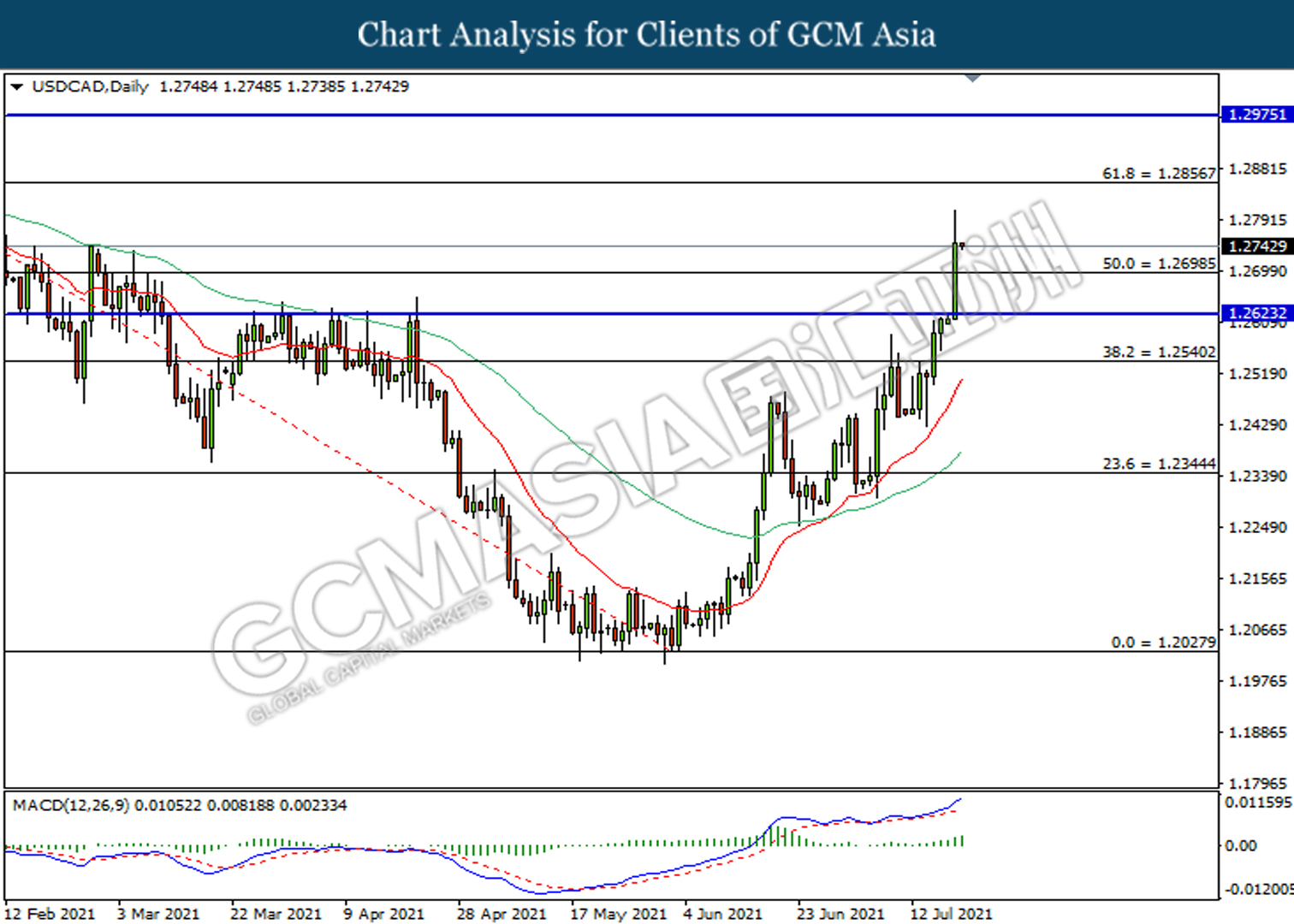

USDCAD, Daily: USDCAD was traded higher following prior rebound from the lower levels MACD which illustrated bullish momentum suggest the pair to extend its gains in mid-term.

Resistance level: 1.2855, 1.2975

Support level: 1.2700, 1.2620

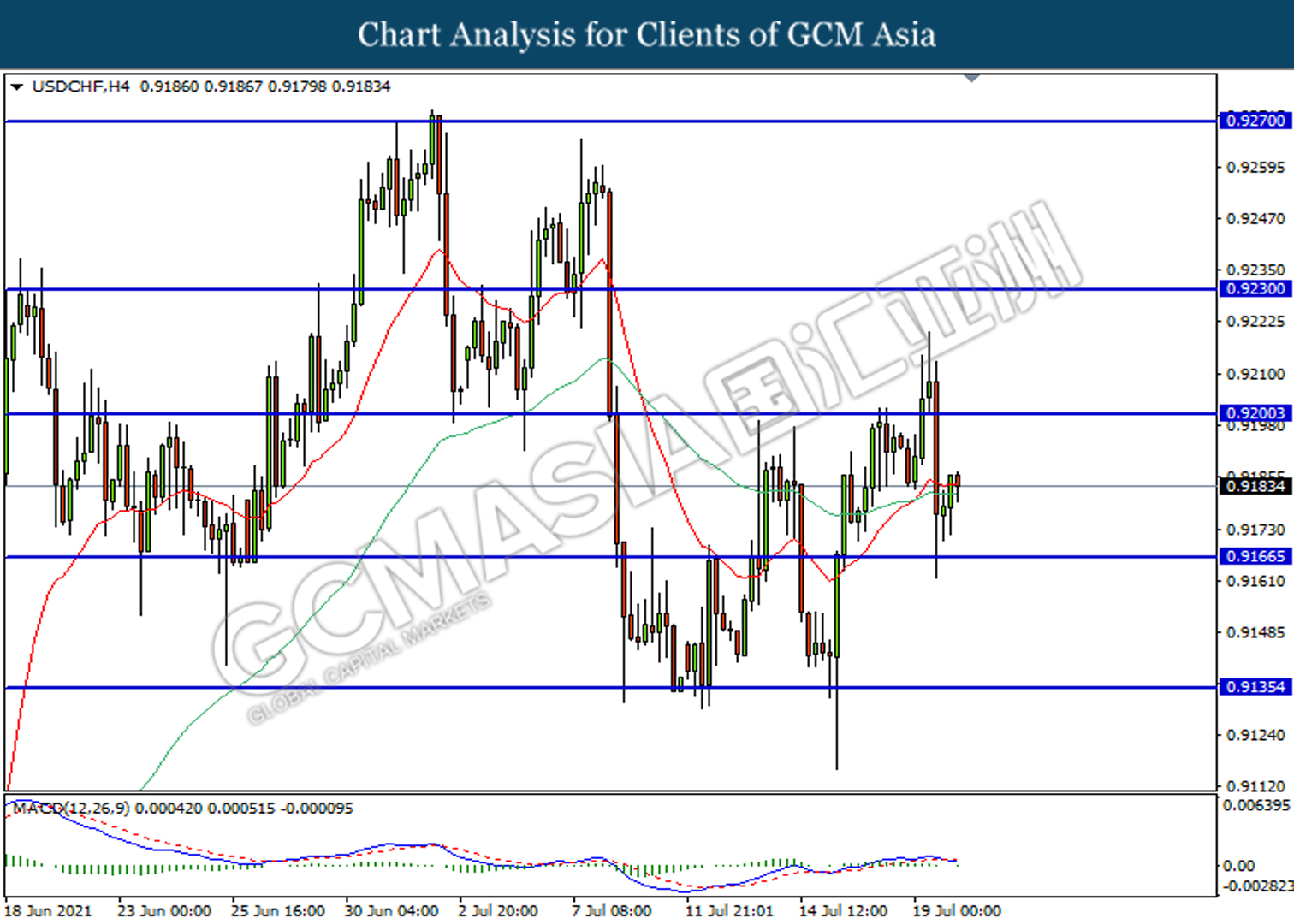

USDCHF, H4: USDCHF was traded higher following a rebound near 0.9165. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 0.9200, 0.9230

Support level: 0.9165, 0.9135

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the lower level. MACD which shows diminished bearish momentum suggests its price to be traded higher in short-term.

Resistance level: 67.30, 68.45

Support level: 66.30, 65.05

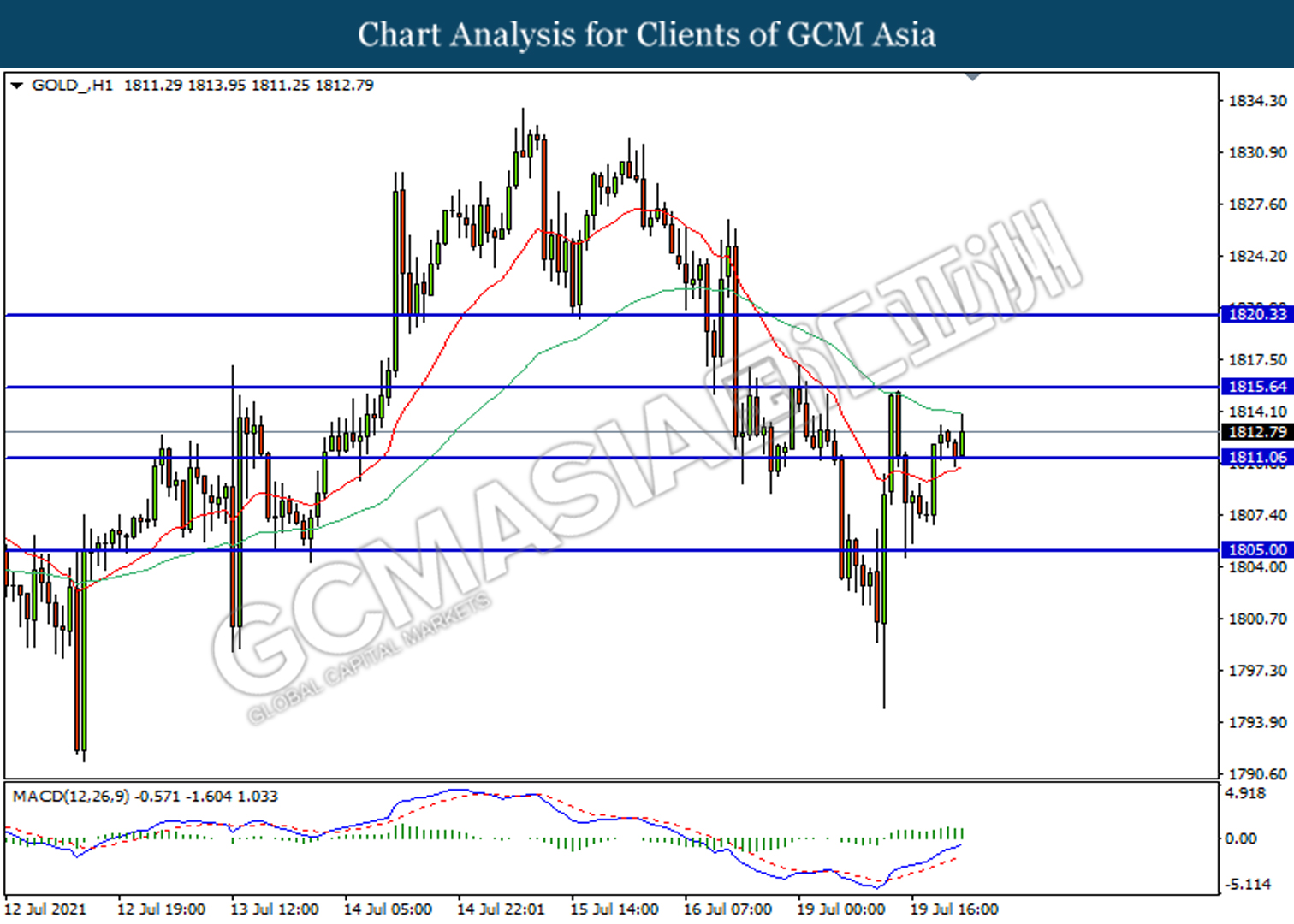

GOLD_, H4: Gold price was traded higher following prior rebound from the lower level. MACD which illustrate bullish momentum suggests its price to extend be traded higher in short-term.

Resistance level: 1815.65, 1820.35

Support level: 1811.05, 1805.00